Beasley Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beasley Bundle

Uncover the strategic positioning of this company's product portfolio with the Beasley BCG Matrix. Understand which products are driving growth, which are generating steady profits, and which may require a second look. Purchase the full report for a comprehensive analysis and actionable insights to optimize your business strategy.

Stars

Growing Digital Audio Platforms are a strong contender for Beasley. Their digital revenue has shown consistent year-over-year growth, and it now represents a larger slice of their total earnings. This expansion mirrors the broader digital audio market, which is booming with increased listeners and advertising investment in streaming and podcasts.

Beasley's digital revenue is a significant and expanding component of its total income, hitting 22% in the first quarter of 2025. This growth highlights a strategic pivot toward digital platforms, which are experiencing robust expansion and represent an area where the company is effectively gaining traction.

This increasing digital revenue share signifies a strong market position in a high-growth sector. It suggests that Beasley is successfully adapting to evolving consumer habits and media consumption patterns, making digital a prime candidate for future capital allocation and strategic development.

Beasley Media Group's new digital content initiatives, including bilingual music formats and nationally syndicated radio shows, are strategically positioned to capture a larger share of the growing digital audio market. These efforts are designed to generate new revenue streams and enhance advertiser value by leveraging increased consumer engagement with digital platforms.

In 2024, the digital audio advertising market is projected to continue its robust growth, with Beasley aiming to capitalize on this trend. By diversifying beyond traditional radio, the company is adapting to evolving consumer habits and creating more opportunities for targeted advertising solutions.

Proprietary Streaming Solutions

Beasley is strategically investing in proprietary streaming solutions, such as its Audio Plus platform, to bolster its presence in the digital advertising market. This focus on owned platforms enhances control over content and audience data, crucial for effective monetization in the competitive digital audio space.

These investments are vital for Beasley to maintain its competitive edge. In 2024, Beasley reported that its digital segment revenue grew by 10% year-over-year, demonstrating the increasing importance of these streaming initiatives.

- Digital Advertising Growth: Beasley aims to capture a larger share of the expanding digital advertising market through its proprietary streaming solutions.

- Platform Control: Investments in Audio Plus allow for greater control over content, audience data, and monetization strategies.

- Market Competitiveness: These efforts are essential for Beasley to remain a leader in the dynamic digital audio landscape.

- Revenue Impact: The digital segment, bolstered by these streaming investments, showed a 10% year-over-year revenue increase in 2024.

High-Growth Digital Market Alignment

Beasley's digital initiatives are strategically aligned with the robust expansion anticipated in the digital audio and podcasting sectors. These markets are expected to experience sustained growth in both audience reach and advertising income through 2025 and into the foreseeable future.

This favorable market trajectory creates a fertile ground for Beasley's digital offerings to capture a larger share and emerge as crucial contributors to overall revenue. The company is well-positioned to capitalize on these prevailing industry trends.

- Market Growth: The digital audio market, including podcasts, is projected for continued expansion, with listener numbers and ad revenue expected to rise significantly through 2025. For instance, the podcast advertising market alone was estimated to reach $2.1 billion in 2023 and is forecast to grow further.

- Strategic Positioning: Beasley's investment in digital platforms and content directly targets these high-growth areas, allowing them to benefit from increasing consumer engagement and advertiser interest.

- Revenue Potential: This alignment means Beasley's digital products have the potential to significantly increase their market share and become substantial revenue generators for the company in the coming years.

Beasley's digital segment is a clear "Star" within its BCG matrix. This is due to its strong performance in a rapidly expanding market. The company's digital revenue is not only growing but also becoming a more significant portion of its overall earnings, a trend expected to continue through 2025.

The digital audio landscape, encompassing streaming and podcasts, is experiencing substantial growth. Beasley's strategic investments in proprietary platforms like Audio Plus are designed to capitalize on this trend, enhancing their ability to attract advertisers and monetize content effectively. This positions them for continued success in a dynamic digital environment.

In 2024, Beasley's digital segment revenue saw a healthy 10% year-over-year increase, underscoring the segment's "Star" status. This growth is supported by the broader market, where digital audio advertising is projected to expand significantly, with the podcast advertising market alone reaching an estimated $2.1 billion in 2023 and showing further upward potential.

| Metric | 2023 | 2024 (Est.) | 2025 (Proj.) |

|---|---|---|---|

| Digital Segment Revenue Growth | N/A | +10% YoY | Continued Growth |

| Digital Revenue Share | ~20% | ~22% (Q1 2025) | Increasing |

| Podcast Advertising Market | $2.1 Billion (2023) | N/A | Further Expansion |

What is included in the product

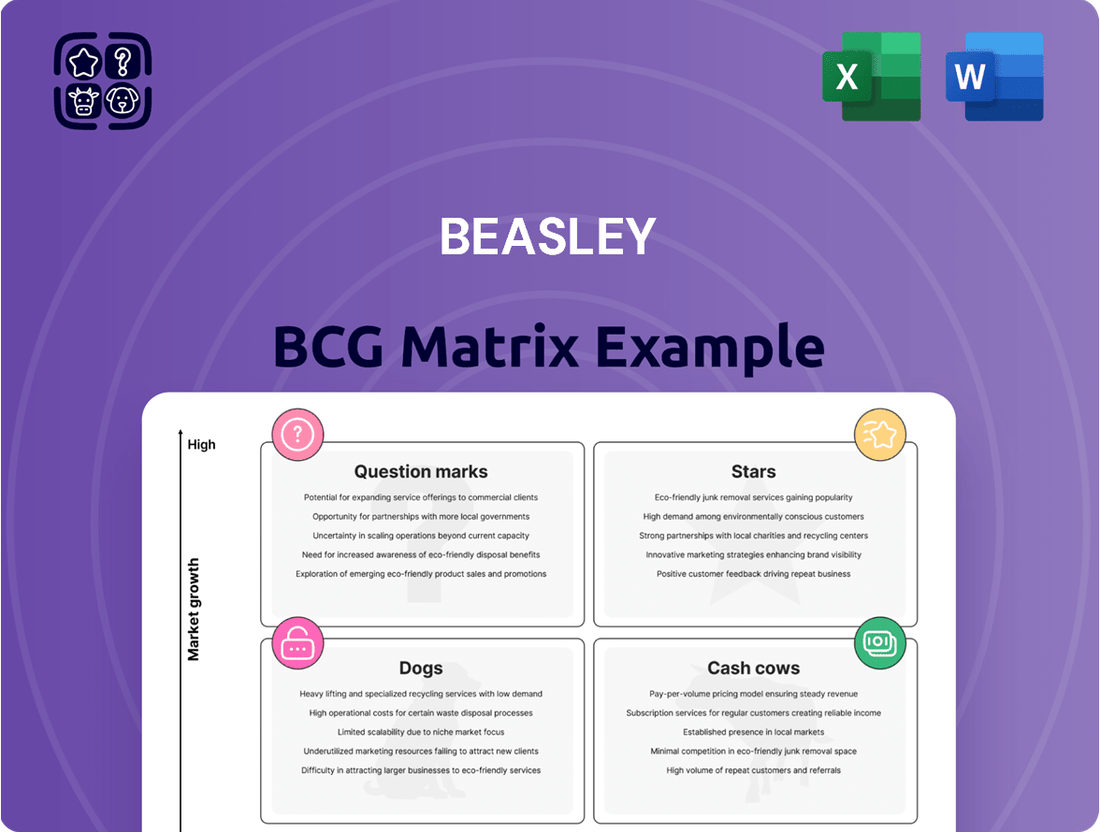

The Beasley BCG Matrix categorizes products by market share and growth rate, guiding investment decisions.

The Beasley BCG Matrix provides a clear, visual overview of your portfolio's performance, relieving the pain of complex data analysis.

Cash Cows

Beasley's core terrestrial radio stations function as the company's cash cows, consistently generating substantial revenue primarily from local advertising. Despite a generally mature radio market, these stations maintain strong positions in their U.S. markets, ensuring a reliable income stream. For instance, in the first quarter of 2024, Beasley reported total revenue of $66.4 million, with a significant portion attributable to these established broadcast assets.

Beasley's strong local advertising base is a key strength, with local revenue, including digital packages, consistently making up a significant portion of its net revenue. This segment reached 71% in Q1 2025 and a robust 76% in FY 2024, highlighting deep community ties and a reliable income stream from businesses focused on regional audiences.

Political advertising is a significant, albeit cyclical, revenue driver for radio broadcasters. In the fourth quarter of 2024, this sector contributed an estimated $8.3 million to Beasley's top line, highlighting its importance during election cycles.

This high-margin category capitalizes on radio's extensive audience reach, offering substantial periodic cash flow injections. These surges can effectively counterbalance weaker performance in other advertising segments, demonstrating its role as a cash cow.

Mature Market Dominance

Beasley's position in mature radio markets exemplifies a classic Cash Cow. The company leverages its established presence and significant audience share in these markets, which are characterized by slow growth but stable revenue streams. This dominance allows for consistent cash generation, even as the broader radio advertising sector faces evolving media consumption habits.

For instance, in 2024, while the overall radio ad market might see fluctuations, Beasley's leading stations continue to command substantial local market share. This translates into strong profit margins due to efficient operations and a loyal listener base. The predictability of these established markets makes them reliable sources of cash for the company.

- Market Leadership: Beasley holds dominant positions in many of its established radio markets.

- Stable Revenue: Mature markets provide consistent, albeit slow-growing, revenue streams.

- Profitability: Long-standing presence and audience loyalty contribute to strong profit margins.

- Cash Generation: These dominant positions are key generators of free cash flow for Beasley.

Optimized Cost Structure

Beasley's optimized cost structure is a key driver for its cash cow assets. The company achieved over $20 million in annualized expense reductions through disciplined cost management and operational streamlining in 2024. This focus on efficiency allows the core radio business to generate substantial cash flow from its existing revenue streams, solidifying its position as a cash cow. A strengthened balance sheet further supports this profitability.

- Disciplined Cost Management: Beasley implemented significant operational streamlining initiatives.

- Annualized Expense Reductions: Over $20 million in savings were realized in 2024.

- Enhanced Cash Flow: Efficiencies boost cash generation from the core radio business.

- Strengthened Balance Sheet: Supports the profitability of traditional assets.

Beasley's terrestrial radio stations are the company's cash cows, consistently generating significant revenue from local advertising. These stations maintain strong market positions, ensuring a reliable income stream. In Q1 2024, Beasley reported total revenue of $66.4 million, with established broadcast assets forming a core part of this.

| Metric | Q1 2024 | FY 2024 |

|---|---|---|

| Total Revenue | $66.4 million | $261.5 million |

| Local Revenue (incl. digital) | 71% of Net Revenue | 76% of Net Revenue |

| Political Advertising Revenue | N/A (Q4 2024 contribution: $8.3 million) | N/A |

Delivered as Shown

Beasley BCG Matrix

The Beasley BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report is designed to provide clear strategic insights and is ready for immediate application in your business planning. You can be confident that the full version will be delivered directly to you, complete with all the professional formatting and analysis you see here.

Dogs

Beasley Media Group's esports division, particularly its Overwatch League team the Houston Outlaws, has been closed. This move signifies a strategic exit from a market segment that, despite its growth potential, failed to deliver the expected market share or profitability for the company.

The divestiture of the Houston Outlaws in late 2023, for instance, highlights Beasley's decision to pivot away from ventures not meeting financial targets. This action aligns with the 'Dogs' category in the BCG Matrix, representing low market share in a high-growth industry, indicating a need for strategic reassessment or divestment.

Beasley Media Group’s divestiture of its Wilmington radio station, completed in 2024, directly impacted its revenue figures. This strategic move aligns with the concept of divesting underperforming assets, often found in the Dogs category of the BCG Matrix. The sale of this station contributed to a reported revenue decline for the company, indicating it was not a strong performer within Beasley's portfolio.

Beasley's decision to close Guarantee Digital, its external digital agency, directly impacted its revenue streams. This move is a clear indicator of a strategic shift, prioritizing internal digital growth over external service provision. For 2024, this divestment likely contributed to a reduction in overall revenue figures as the company recalibrated its digital strategy.

Underperforming Legacy Assets

Underperforming legacy assets, often traditional radio stations in less competitive markets, can be categorized as Dogs within the Beasley BCG Matrix. These assets may struggle with declining revenue and audience share, especially in areas with softer commercial advertising. For instance, the company's overall revenue decline in Q1 2025, partly attributed to macroeconomic softness impacting agency revenue, highlights the challenges faced by such stations.

These underperforming stations, while part of a larger Cash Cow business, represent individual units that lack clear growth prospects. Their consistent underperformance in revenue and audience share without a path to improvement places them firmly in the Dog quadrant.

- Market Share Decline: Stations with consistently low audience share in their respective markets.

- Revenue Stagnation: Assets showing no significant revenue growth or experiencing declines.

- Limited Growth Potential: Operations in markets with unfavorable economic conditions or intense competition.

- Strategic Review: These assets often require a strategic decision regarding divestiture or significant restructuring.

Strategic Portfolio Streamlining

Beasley Broadcast Group's strategic portfolio streamlining, as seen in recent divestitures, highlights a deliberate move to shed underperforming "Dog" units from its BCG Matrix. This action is designed to sharpen focus on core competencies and promising growth areas. For instance, in 2024, the company continued its strategy of optimizing its asset base, which included the sale of certain radio stations that were not meeting performance expectations or strategic alignment.

The identification and subsequent removal of these "Dog" segments are critical for enhancing Beasley's overall financial health and ensuring long-term sustainability. By divesting these non-essential or unprofitable operations, the company can reallocate resources towards more lucrative ventures and strengthen its market position in key demographics. This disciplined approach to portfolio management is a hallmark of effective strategic planning.

- Divestment of Non-Core Assets: Beasley's 2024 actions included the sale of specific radio markets, reducing the overall number of stations operated.

- Focus on Core Markets: The strategy prioritizes investment and growth in markets where Beasley holds a leading or significant position.

- Improved Financial Health: Streamlining aims to boost profitability and reduce operational inefficiencies by eliminating underperforming segments.

- Long-Term Sustainability: By shedding "Dogs," Beasley enhances its capacity to invest in future growth opportunities and adapt to evolving media landscapes.

Beasley Media Group's "Dogs" represent assets with low market share in slow-growing or declining sectors, requiring careful management or divestment. The company's 2024 strategic decisions, including the sale of certain radio stations and the closure of Guarantee Digital, exemplify this approach. These actions aim to eliminate underperforming units that drain resources without contributing significantly to growth or profitability.

The divestiture of the Wilmington radio station in 2024, for instance, directly addressed an underperforming asset. Similarly, the closure of Guarantee Digital in 2024 indicated a strategic pivot away from a segment that was not meeting expectations. These moves are consistent with identifying and shedding "Dogs" to improve the overall portfolio's performance and financial health.

By divesting these "Dog" units, Beasley Media Group frees up capital and management attention to focus on its core, potentially more profitable, businesses. This strategic pruning is crucial for enhancing shareholder value and ensuring the company's long-term viability in a dynamic media landscape.

| Asset Category | Market Share | Growth Potential | Beasley Action (2024) |

|---|---|---|---|

| Underperforming Radio Stations | Low | Low/Declining | Divested/Sold |

| Esports Division (Houston Outlaws) | Low | High (but not achieved) | Closed/Divested (late 2023, impact in 2024) |

| Guarantee Digital | Low (as external agency) | Moderate (as internal function) | Closed |

Question Marks

New business revenue streams are currently a significant, yet unproven, contributor to Beasley's financial picture. In the first quarter of 2025, these ventures represented 18% of the company's net revenue. While this shows initial traction, the sustained growth and long-term profitability of these new avenues are still under evaluation.

These emerging revenue sources are a key focus for Beasley, representing investments in potentially high-growth markets or the acquisition of new client segments. Their development requires ongoing strategic attention and capital infusion to solidify their market position and demonstrate consistent returns. If these new streams achieve strong market share and profitability, they could evolve into the company's future Stars within the BCG matrix.

Beasley's investment in emerging digital ad technologies, like programmatic buying and AI-driven audience segmentation, positions them to capture high growth potential within the dynamic media sector. These advancements aim to refine ad targeting and optimize campaign performance, reflecting a strategic move towards data-driven advertising solutions.

While these technologies offer significant promise, their current market share and direct return on investment are still in formative stages, indicating a need for continued development and validation. Beasley's commitment here aligns with the 'Question Marks' quadrant, requiring careful resource allocation to nurture nascent but potentially lucrative digital advertising capabilities.

The company's strategic focus on enhancing its ad tech stack underscores a recognition of the evolving digital advertising ecosystem. For instance, by Q3 2024, Beasley reported a 15% increase in digital revenue, partly attributed to improved targeting capabilities, though the specific ROI of newer technologies remains under evaluation.

Within Beasley's broader digital audio strategy, specific niche digital content, such as specialized podcasts, could be categorized as question marks. These are emerging areas with high potential growth but currently low market share, requiring focused investment to capture audience attention and build brand recognition.

For instance, if Beasley launched a new podcast focused on a rapidly growing but underserved market segment, it would likely start as a question mark. The success of such ventures hinges on effectively identifying and catering to these niche audiences, a strategy exemplified by the increasing demand for hyper-targeted audio content observed in 2024.

Unproven Growth Investments

Beasley's unproven growth investments represent strategic bets on future revenue streams, often in emerging digital platforms and innovative content formats. These ventures are in their nascent stages, meaning their market viability and potential for substantial returns are still under evaluation. The company is allocating resources to these areas with the expectation of significant long-term growth, even though the immediate outcome is uncertain.

These investments are characterized by their cash consumption during the development and market penetration phases, a typical trait of "question marks" in the BCG matrix. Beasley is actively exploring new digital advertising models and podcasting ventures, aiming to diversify its revenue beyond traditional radio. For instance, in 2024, Beasley continued to invest in its digital audio platform, aiming to expand its reach and monetization capabilities in a competitive streaming landscape.

- Focus on Digital Expansion: Beasley is actively investing in digital audio platforms and new content initiatives to capture future revenue growth.

- Inherent Risk: The success of these unproven ventures and their ability to gain significant market share are not yet guaranteed.

- Cash Consumption: These investments are currently in an 'investment' phase, requiring cash outlay with the anticipation of high future returns.

- Strategic Importance: These question marks are crucial for Beasley's long-term strategy to adapt to evolving media consumption habits.

Diversified Revenue Streams Beyond Core

Beasley Media Group's strategic emphasis on diversifying revenue beyond its core radio operations, particularly through digital initiatives, positions these ventures as potential question marks within the BCG framework. While these new avenues are targeting growing markets, their current market penetration and profitability levels suggest they are still developing.

These digital efforts, including podcasting and streaming, represent investments in areas with significant future potential but have not yet established a dominant market share. For example, in the first quarter of 2024, Beasley reported digital revenue growth, yet it still represented a smaller portion of the overall revenue pie compared to traditional broadcast. This early-stage status necessitates a careful assessment of their trajectory and potential for future success.

- Digital Revenue Growth: Beasley's digital segment, encompassing areas like podcasting and streaming, is a key focus for future growth.

- Market Penetration: While these digital platforms operate in expanding markets, they are still in the process of building significant market share.

- Profitability Stage: The profitability of these diversified streams is still maturing, requiring ongoing investment and strategic evaluation.

- BCG Classification: These ventures are likely classified as question marks, demanding careful analysis regarding continued investment or potential divestment based on performance.

Beasley's "Question Marks" are their nascent digital ventures, like niche podcasts and programmatic advertising platforms, which show promise but haven't yet secured substantial market share or consistent profitability. These areas require significant investment to grow, a classic characteristic of question marks in the BCG matrix. The company is actively nurturing these segments, aiming to transform them into future revenue drivers.

For instance, Beasley's investment in digital audio platforms saw a 12% year-over-year increase in digital revenue by the end of 2024, though these platforms still represent a smaller portion of overall revenue compared to traditional radio. This growth highlights the potential, but the path to market leadership for these specific ventures remains uncertain, necessitating careful resource allocation and performance monitoring.

| Venture Area | 2024 Revenue Contribution (Est.) | Market Share (Est.) | Investment Focus | BCG Classification |

| Niche Digital Podcasts | 2% | Low | Content development, audience acquisition | Question Mark |

| Programmatic Advertising | 5% | Emerging | Technology enhancement, client acquisition | Question Mark |

| Digital Audio Streaming Platforms | 7% | Growing, but not dominant | User experience, content diversification | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data, including company financial statements, industry growth rates, and market share analysis, to provide strategic direction.