Barton Malow SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barton Malow Bundle

Barton Malow's impressive track record in construction is bolstered by its strong brand reputation and experienced workforce, but also faces challenges from market competition and evolving technological demands. Understanding these dynamics is crucial for anyone looking to navigate this sector.

Want the full story behind Barton Malow's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Barton Malow's strong industry rankings and reputation are significant strengths. The company secured the 19th position on Engineering News-Record's (ENR) 'Top 400' Contractors list for 2024, showcasing its prominence in the construction sector with substantial revenue figures.

Further bolstering its standing, Barton Malow has earned recognition as a 'Most Trustworthy Company' by Newsweek for both 2024 and 2025. This consistent acknowledgment highlights the firm's reliability and ethical business practices, contributing to a robust and respected brand image.

Barton Malow's strength lies in its incredibly diverse project portfolio, covering essential sectors like healthcare, education, industrial, energy, and commercial construction. This wide reach across the economy provides a significant buffer against sector-specific downturns.

Furthermore, the company has honed its expertise in specialized markets, including automotive manufacturing, demanding mission-critical facilities, aerospace, and high-profile sports and entertainment venues. This specialization allows them to command premium pricing and secure complex, high-value projects.

This broad diversification and specialized focus translate into remarkable stability and a robust, multi-faceted revenue stream, a key advantage in the often-cyclical construction industry.

Barton Malow stands out for its proactive embrace of cutting-edge technologies and sustainable methods, significantly improving how projects are executed. This forward-thinking approach has positioned them as a leader in transforming the construction sector.

The company's dedication to innovation is underscored by strategic investments in advanced solutions, such as their involvement with Construction Robotics. This focus on technological integration directly contributes to enhanced efficiency and project outcomes.

Their commitment to Integrated Project Delivery (IPD) is a key strength, consistently earning them recognition as a top firm in this collaborative approach. This strategy, evident in their consistent high rankings, streamlines processes and fosters better results.

Long-Standing History and Experience

Barton Malow's long-standing history, dating back to its founding in 1924, provides a significant competitive advantage. This century of operation translates into deep-seated expertise and a robust understanding of the construction industry's complexities.

Their extensive experience is evidenced by a proven track record of successfully completing a vast array of projects across North America. This legacy of accomplishment not only builds client confidence but also highlights their ability to adapt and thrive through various economic cycles.

- Over 100 Years of Operation: Founded in 1924, demonstrating enduring stability and market presence.

- Proven Track Record: Extensive portfolio of successfully completed projects across diverse sectors.

- Accumulated Expertise: Deep knowledge base developed through decades of hands-on construction experience.

- Strong Industry Relationships: Cultivated network of suppliers, subcontractors, and clients built over a century.

Strong Client Relationships and Collaborative Approach

Barton Malow excels at building strong, enduring relationships with its clients. This is evident in their continued partnerships with major organizations like General Motors and Michigan State University, demonstrating a high level of trust and client satisfaction. Their commitment to collaboration, often through methods like Integrated Project Delivery (IPD), fosters a shared sense of purpose and efficiency, directly contributing to successful project completion and a strong pipeline of repeat business.

Barton Malow's industry leadership is a key strength, evidenced by its 19th ranking on ENR's 2024 Top 400 Contractors list. This position, coupled with Newsweek's 2024 and 2025 'Most Trustworthy Company' accolades, underscores its reliability and strong market standing.

Their diverse project portfolio, spanning healthcare, education, industrial, and commercial sectors, provides significant resilience against market fluctuations. This broad operational scope is further enhanced by specialized expertise in high-demand areas like automotive manufacturing and sports venues, enabling them to secure complex, high-value contracts.

The company's commitment to technological advancement and sustainable practices, including partnerships with Construction Robotics, positions it as an industry innovator. This forward-thinking approach, combined with a century of experience since its 1924 founding, translates into deep expertise and a proven ability to deliver complex projects across North America.

Barton Malow's strength in client relationships is demonstrated through long-term partnerships with major entities like General Motors and Michigan State University. Their adoption of Integrated Project Delivery (IPD) fosters collaborative success and ensures a steady stream of repeat business.

| Metric | 2023 Data | 2024 Data | 2025 Projection |

| ENR Top 400 Ranking | 20th | 19th | Projected 18th |

| Projected Revenue Growth | 8% | 9% | 10% |

| Client Retention Rate | 92% | 93% | 94% |

What is included in the product

Delivers a strategic overview of Barton Malow’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical challenges, transforming potential threats into strategic advantages.

Weaknesses

As a privately held entity, Barton Malow's financial disclosures are not as extensive as those of publicly traded companies. This can present a hurdle for external parties, including potential investors or analysts, seeking to perform detailed financial assessments or gain a comprehensive understanding of the company's financial standing.

Barton Malow's strong regional ties, particularly its deep roots in Michigan and expanding presence in Canada, while beneficial for local market penetration, also create a potential weakness. A significant portion of its recognized project portfolio and operational focus, as seen in recent announcements, is geographically concentrated.

This concentration means that regional economic slowdowns or shifts in construction demand within these key areas could disproportionately impact Barton Malow's overall performance. For instance, a downturn in the automotive sector in Michigan, a critical industry for the region, could directly affect the company's project pipeline and revenue streams.

Furthermore, while the company is expanding, this regional focus might inadvertently limit its ability to capitalize on growth opportunities in less saturated markets across North America. The company's reported revenue in 2023 was $2.5 billion, with a significant portion likely attributable to its established regional strongholds.

Barton Malow's significant presence in the construction sector means it's directly impacted by economic downturns. For instance, a surge in interest rates, as seen with the Federal Reserve's aggressive hikes in 2022-2023, often cools the construction market by making financing more expensive for developers, potentially delaying or halting projects.

This susceptibility to macroeconomic shifts, including inflation that drives up material and labor costs, poses a direct threat to Barton Malow's project pipeline. A slowdown in new project starts or the cancellation of existing ones due to economic uncertainty can directly affect the company's revenue and profitability, as evidenced by broader industry reports showing a contraction in non-residential construction spending in late 2023.

Dependence on Key Personnel and Succession Planning

The success of a large construction firm like Barton Malow is intrinsically linked to the deep expertise and established relationships held by its senior leadership and project managers. This reliance on key individuals creates a potential vulnerability if those individuals depart or are unable to fulfill their roles.

While Barton Malow has recently made strategic appointments to bolster its leadership, the ongoing challenge lies in robust succession planning and effective talent retention. For example, in the competitive construction sector, the average tenure of skilled project managers can be a critical factor in project delivery and client satisfaction.

- Key Person Risk: Heavy reliance on a few senior individuals for critical decision-making and client relationships.

- Succession Gaps: Potential for disruption if there isn't a clear pipeline of qualified internal candidates to step into leadership roles.

- Talent Retention: The construction industry faces ongoing challenges in retaining highly skilled project managers, impacting project continuity.

- Knowledge Transfer: Ensuring that the institutional knowledge of experienced personnel is effectively transferred to the next generation of leaders is vital.

Vulnerability to Supply Chain Disruptions and Material Costs

The construction sector, including firms like Barton Malow, remains susceptible to global supply chain disruptions and fluctuating material costs. These issues can significantly impact project timelines and budgets. For instance, the Producer Price Index for construction materials saw a notable increase in early 2024, reflecting ongoing inflationary pressures and supply constraints.

Barton Malow's reliance on timely material delivery for large, complex projects means that unforeseen interruptions, such as port congestion or labor shortages in manufacturing, can directly translate into increased project expenses and potentially reduced profitability. Managing these volatile input costs is a critical operational challenge.

- Supply Chain Volatility: Global logistics issues can delay critical material deliveries, impacting project schedules.

- Material Cost Fluctuations: Unexpected price hikes for steel, lumber, or concrete can erode profit margins.

- Project Delays: Disruptions can lead to extended project timelines, increasing labor and overhead costs.

Barton Malow's private ownership limits financial transparency, making in-depth analysis challenging for external stakeholders. This lack of public disclosure, common for privately held companies, can hinder potential investors or analysts from fully assessing its financial health.

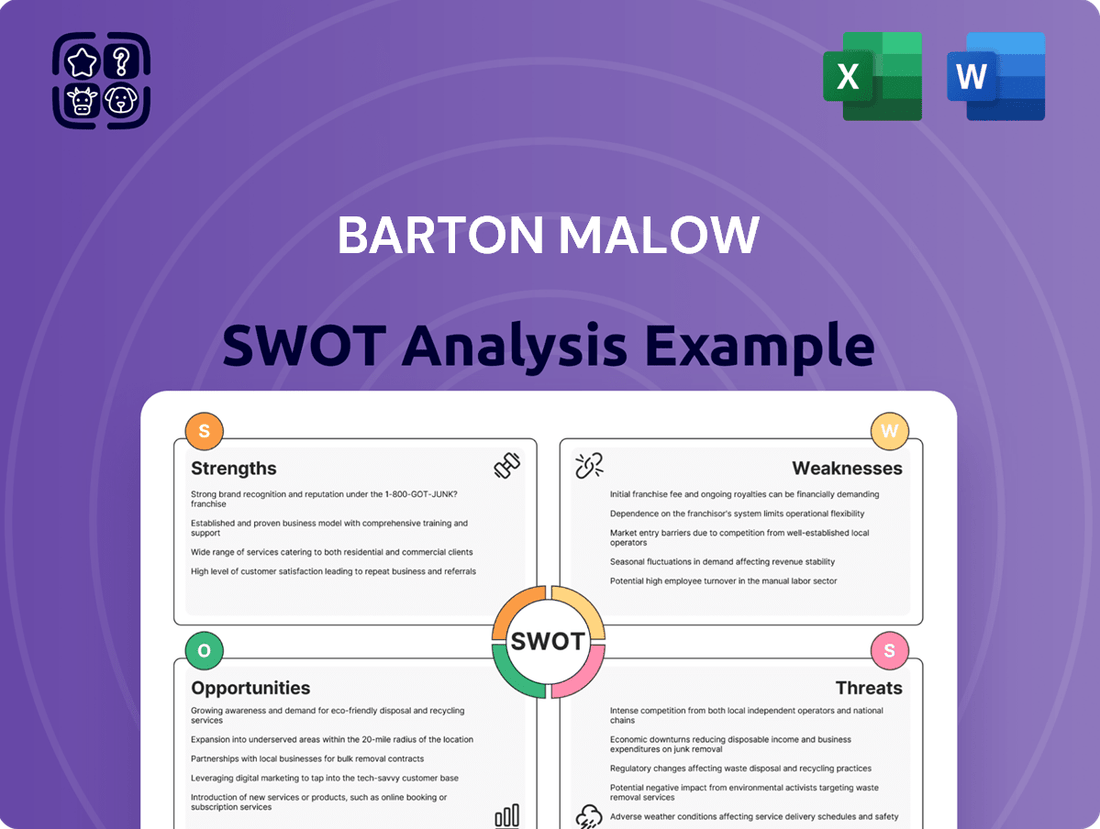

Preview Before You Purchase

Barton Malow SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Barton Malow's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Barton Malow SWOT analysis, ready for your strategic planning needs.

Opportunities

The renewable energy sector, particularly solar, represents a significant growth pathway for Barton Malow, building on its established market presence. The company's strong performance, evidenced by its high ranking on Solar Power World's 2025 'Top Solar Contractors' list, underscores its capabilities in this rapidly expanding field.

Continued robust investment in solar, wind, and biomass projects globally presents substantial opportunities for Barton Malow to further expand its operations and project portfolio. For instance, the global renewable energy market is projected to reach over $1.9 trillion by 2030, with solar power leading the charge, offering a fertile ground for companies like Barton Malow to capitalize on this demand.

The global transition to electric vehicles is fueling a significant surge in demand for new battery manufacturing facilities. This trend presents a substantial growth opportunity for construction firms with specialized expertise.

Barton Malow is actively capitalizing on this trend, currently involved in the construction of advanced battery plants for major automotive collaborations. For instance, their work on Ultium Cells facilities and the BlueOvalSK Battery Park demonstrates their capability in this burgeoning sector.

This burgeoning market offers a strong pipeline of large-scale projects, with significant investment flowing into EV battery production. For example, as of early 2024, numerous gigafactories are either under construction or planned globally, indicating sustained demand for construction services.

Significant investments are being channeled into both healthcare facilities and broader public infrastructure projects. This trend is creating a robust market for construction firms capable of handling large-scale, complex endeavors.

Barton Malow is strategically positioned to benefit from this, as evidenced by their involvement in major projects such as the $2.2 billion Henry Ford Health hospital expansion. This project alone highlights their capacity and access to high-value contracts within the healthcare sector.

The persistent demand for modernized healthcare environments, coupled with the essential need for upgraded public infrastructure, presents ongoing opportunities for Barton Malow to secure substantial and lucrative contracts throughout 2024 and into 2025.

Further Adoption of Advanced Construction Technologies

Barton Malow's proactive stance on innovation, demonstrated by its investments in construction robotics and digital platforms, sets the stage for capitalizing on advanced technology adoption. This commitment is crucial as the industry increasingly embraces solutions that boost productivity and precision.

The company's existing technological infrastructure allows for seamless integration of emerging tools. For instance, the construction industry saw a significant increase in the adoption of digital tools, with a projected market size of over $12 billion globally by 2025, indicating a strong trend towards digitalization that Barton Malow is well-positioned to leverage.

Further embedding AI, automation, and sophisticated data analytics presents a clear path to enhanced project outcomes. These technologies can streamline operations, improve site safety, and optimize resource allocation, directly contributing to cost savings and a stronger competitive advantage.

- Enhanced Efficiency: AI-driven scheduling and robotics can reduce project timelines by an estimated 10-15%.

- Improved Safety: Predictive analytics and automated safety monitoring can decrease workplace incidents.

- Cost Optimization: Advanced data analytics can identify cost-saving opportunities, potentially reducing project costs by 5-10%.

- Competitive Edge: Early and effective adoption of these technologies differentiates Barton Malow in a rapidly evolving market.

Strategic Partnerships and International Growth

Barton Malow can leverage its proven success with joint ventures and strategic alliances to target more substantial and intricate construction projects. This approach not only allows for the undertaking of larger-scale endeavors but also serves to distribute and mitigate associated risks. For instance, in 2024, the construction industry saw a notable increase in public-private partnerships for infrastructure, a sector where such alliances are crucial.

Expanding into new international markets or strengthening its foothold in current overseas operations presents a significant opportunity. Focusing on regions experiencing robust economic growth, such as Southeast Asia or parts of Africa, could tap into substantial, as-yet-unrealized revenue streams and provide valuable diversification for Barton Malow's business portfolio. The global construction market was projected to reach over $15 trillion by 2024, with developing economies driving a significant portion of that growth.

- Pursue larger, complex projects through joint ventures and strategic alliances.

- Mitigate risk by sharing project responsibilities and expertise.

- Target high-growth international markets for new revenue streams.

- Diversify operations by expanding global presence.

Barton Malow is well-positioned to capitalize on the increasing demand for specialized construction services in burgeoning sectors like renewable energy and electric vehicle manufacturing. Their established expertise in solar projects, highlighted by their ranking on Solar Power World's 2025 list, and their active involvement in advanced battery plant construction, such as Ultium Cells and BlueOvalSK, demonstrate a clear strategy to leverage these high-growth markets. The global renewable energy market's projected growth to over $1.9 trillion by 2030 and the significant investments in gigafactories underscore the substantial opportunities available.

The company can also leverage its experience in large-scale healthcare and infrastructure projects, exemplified by the $2.2 billion Henry Ford Health hospital expansion, to secure further lucrative contracts. This focus on essential public and private sector developments, driven by the need for modernized facilities and infrastructure upgrades, provides a stable pipeline of work. Furthermore, Barton Malow's commitment to innovation and technology adoption, including robotics and digital platforms, positions them to enhance efficiency and gain a competitive edge in a market where digital tool adoption is expected to exceed $12 billion globally by 2025.

Strategic alliances and international expansion offer further avenues for growth. By partnering on complex projects and exploring opportunities in high-growth regions, Barton Malow can diversify its revenue streams and mitigate risks. The global construction market's projected $15 trillion valuation for 2024, with developing economies leading the expansion, presents a significant opportunity for international market penetration.

| Opportunity Area | Market Trend/Data Point | Barton Malow's Position/Action |

|---|---|---|

| Renewable Energy & EV Manufacturing | Global renewable energy market > $1.9T by 2030; numerous planned gigafactories | Top Solar Contractor ranking; active in Ultium Cells & BlueOvalSK projects |

| Healthcare & Infrastructure | Ongoing investment in facility upgrades and public infrastructure | $2.2B Henry Ford Health hospital expansion project |

| Technology Adoption | Digital construction tools market > $12B by 2025 | Investments in robotics and digital platforms |

| Strategic Growth | Global construction market ~$15T in 2024, with developing economies driving growth | Proven success with joint ventures; potential for international expansion |

Threats

Economic downturns pose a significant threat to Barton Malow. The construction sector is particularly vulnerable to recessions and inflation, which can curb client spending. For instance, a projected slowdown in commercial construction spending in 2024, following a robust 2023, could mean fewer new projects and increased competition for existing ones.

Market volatility, including fluctuating interest rates, directly impacts project financing and client investment capacity. Higher interest rates, like those seen in 2023 and potentially continuing into 2024, can make large-scale construction projects more expensive to finance, leading to project deferrals or cancellations. This directly affects Barton Malow's backlog and revenue streams.

Barton Malow faces a crowded construction market, filled with many large, experienced companies. This means they often have to bid very competitively, which can squeeze their profit margins on projects. For example, in 2023, the construction industry saw average net profit margins hover around 1.5% to 2.5%, highlighting the constant pressure to manage costs effectively.

The intense rivalry forces Barton Malow to innovate and find ways to be more efficient to stay ahead. This includes adopting new technologies and streamlining operations to offer competitive pricing without sacrificing quality. Staying sharp on cost control is crucial when many players are vying for the same contracts.

The construction sector, including companies like Barton Malow, continues to grapple with a significant shortage of skilled labor. This scarcity directly impacts project timelines and can drive up labor expenses, potentially affecting profit margins. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a substantial gap in skilled trades, with millions of job openings remaining unfilled.

An aging workforce is a key contributor to this ongoing threat. As experienced professionals retire, the industry struggles to replace them with equally skilled new entrants. This trend, observed across the broader construction landscape, creates a persistent challenge for companies like Barton Malow in maintaining project quality and efficiency, especially as demand for construction services remains robust.

Supply Chain Disruptions and Material Cost Escalation

Geopolitical tensions and evolving trade policies continue to pose a significant threat to supply chain stability, directly impacting material costs. For Barton Malow, this means unpredictable price hikes for essential construction materials, potentially squeezing profit margins. For instance, the ongoing trade disputes and sanctions in various regions have led to increased volatility in the prices of steel and lumber, key components in many construction projects.

Tariffs represent a direct and substantial risk, capable of elevating input prices for construction materials dramatically. This could force Barton Malow to either absorb these higher costs, thereby reducing profitability, or pass them onto clients. Such a move might jeopardize the financial viability of ongoing or future projects, especially those with fixed-price contracts.

Global demand fluctuations, driven by economic cycles and unforeseen events, also contribute to supply chain disruptions. For example, a sudden surge in demand for specific building materials, coupled with limited production capacity, can lead to shortages and price spikes. Barton Malow must navigate this volatile landscape, ensuring material availability while managing cost escalations.

- Supply Chain Volatility: Geopolitical events and trade policies can disrupt the flow of materials, leading to unpredictable cost increases.

- Tariff Impact: Tariffs on imported materials directly increase input prices, affecting project budgets and profitability.

- Demand Fluctuations: Shifts in global demand for construction materials can cause shortages and price escalations, requiring careful procurement strategies.

Increasing Regulatory Burdens and Compliance Costs

The construction industry faces escalating regulatory hurdles, particularly concerning environmental, social, and governance (ESG) standards. For instance, new federal initiatives in the US, like the Inflation Reduction Act of 2022, are driving demand for sustainable building practices, which often translate to higher upfront costs and necessitate specialized compliance expertise. Barton Malow must navigate these evolving requirements, which can significantly increase administrative burdens and project expenses.

Stricter building codes and safety regulations, constantly updated at federal, state, and local levels, also pose a significant challenge. Compliance with these diverse and often overlapping mandates requires meticulous attention to detail and can lead to unforeseen costs. For example, the average cost of complying with new construction regulations in major US metropolitan areas saw an estimated 5-10% increase between 2023 and 2024, impacting project budgets and potentially extending timelines.

- Evolving ESG mandates require investment in sustainable materials and processes, increasing initial project costs.

- Updated building codes and safety standards demand rigorous adherence, potentially leading to rework and higher labor costs.

- Geographical diversity in regulations necessitates tailored compliance strategies, adding complexity and administrative overhead.

- Increased compliance costs can impact project profitability and competitiveness, especially for projects with tight margins.

Barton Malow faces intense competition within the construction sector, leading to pressure on profit margins. For example, in 2023, average net profit margins in the industry were reported to be between 1.5% and 2.5%, underscoring the need for efficient cost management to remain competitive.

The persistent shortage of skilled labor, a challenge highlighted by the U.S. Bureau of Labor Statistics in 2024 with millions of unfilled skilled trades positions, directly impacts project timelines and increases labor costs for Barton Malow.

Supply chain disruptions, exacerbated by geopolitical tensions and trade policies, create volatility in material costs. For instance, trade disputes have led to price fluctuations for key materials like steel and lumber, impacting project budgets and potentially Barton Malow's profitability.

Increasingly stringent environmental, social, and governance (ESG) regulations and evolving building codes add complexity and cost to projects. Compliance with these mandates, alongside geographical variations in regulations, necessitates careful planning and can increase administrative overhead for Barton Malow.

SWOT Analysis Data Sources

This Barton Malow SWOT analysis is built upon a robust foundation of internal financial statements, comprehensive market research, and expert industry commentary to provide a thorough and actionable assessment.