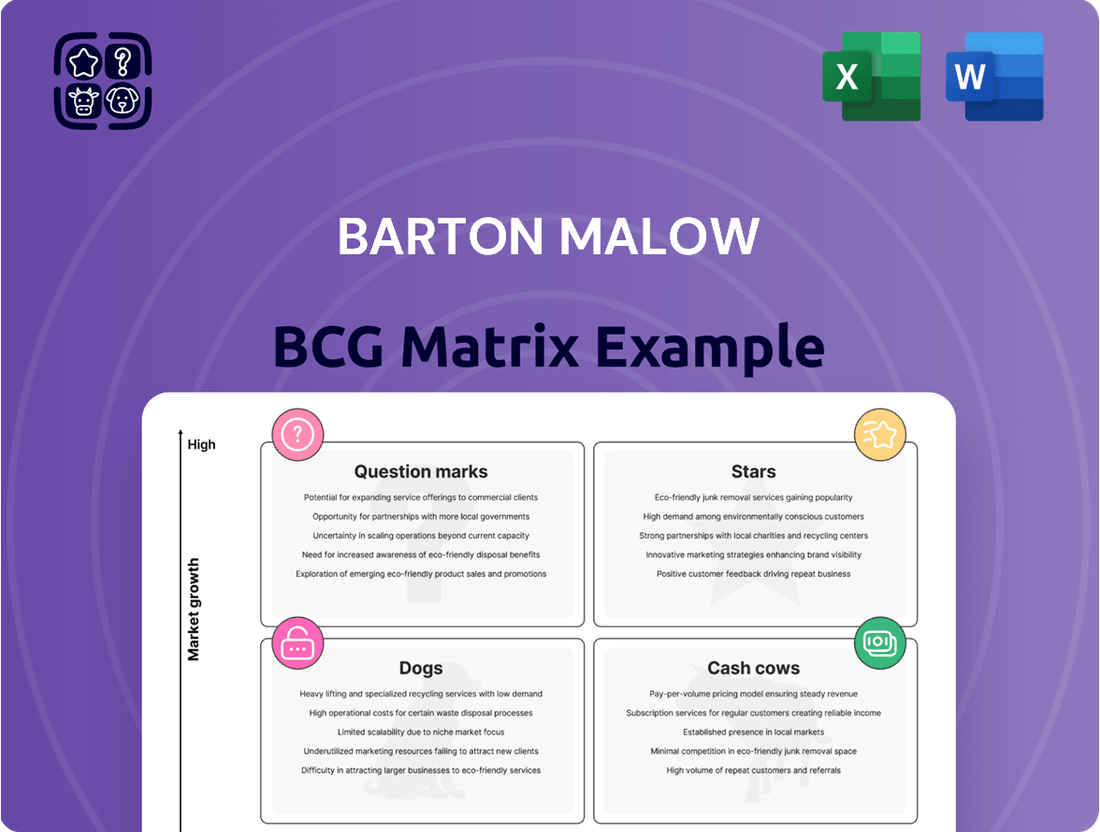

Barton Malow Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barton Malow Bundle

Curious about Barton Malow's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the complete picture; purchase the full report for actionable insights to drive your own business growth.

Stars

Barton Malow's healthcare construction segment shines as a Star within the BCG framework. This is due to the sector's projected strong growth, with an estimated compound annual growth rate (CAGR) of 4.5% to 5.5% expected through 2034. The company's significant involvement in major projects like the Intermountain Health Lutheran Hospital and the Future Roper Hospital Medical Campus underscores its high market share in this expanding area.

Barton Malow's Renewable Energy Construction segment is a clear Star in the BCG Matrix. Since 1989, they've delivered over 5.6 gigawatts of clean energy, showcasing a strong track record in a rapidly expanding sector.

The global energy and utilities construction market is set for significant growth, with forecasts indicating a 5% to 7% compound annual growth rate through 2033, largely fueled by renewable energy infrastructure development. Barton Malow's consistent placement on Solar Power World's 'Top Solar Contractors' list for 2025 underscores their dominant position in this high-demand area.

Barton Malow is a key player in the electric vehicle (EV) revolution, actively building advanced battery manufacturing plants. A prime example is their work with Ultium Cells, a joint venture between General Motors and LG Energy Solution. These facilities are crucial for meeting the surging demand for EV batteries.

This sector is experiencing rapid growth, fueled by the global automotive industry's shift towards electrification. The sheer size and technological sophistication of these battery plants highlight Barton Malow's substantial presence in this high-demand, expanding market segment. For instance, Ultium Cells' Tennessee plant, a project Barton Malow is involved with, is a massive 2.8 million square foot facility.

Advanced Manufacturing and Industrial Facilities

While the broader manufacturing construction sector might experience slight dips in 2025 and 2026, the demand for advanced, high-tech manufacturing facilities is projected to remain robust. These specialized projects, often incorporating cutting-edge processes, are critical drivers of future economic expansion.

Barton Malow's extensive experience in building these complex industrial sites, exemplified by their work on Ultium Cells plants, positions them as a leader in this high-growth segment. For instance, Ultium Cells, a joint venture between General Motors and LG Energy Solution, is investing billions in battery manufacturing facilities, with Barton Malow playing a key role in their construction. This demonstrates a significant commitment to the burgeoning electric vehicle supply chain.

- High-Tech Manufacturing Growth: Despite overall market fluctuations, the specialized construction of advanced manufacturing facilities, particularly those for semiconductors and electric vehicle components, is expected to see sustained demand through 2026.

- Barton Malow's Expertise: The company's successful delivery of complex projects like the Ultium Cells plants highlights its capability in managing large-scale, technologically advanced industrial construction.

- Economic Impact: Investment in these advanced facilities, such as the multiple Ultium Cells locations across the US, represents a substantial commitment to reshoring critical manufacturing and bolstering domestic supply chains, with billions of dollars in capital expenditure.

- Future-Oriented Projects: Barton Malow's focus on these areas aligns with national strategies to enhance technological competitiveness and secure supply chains for emerging industries.

Large-Scale Higher Education Projects

Large-scale higher education projects align with Barton Malow's strengths in the institutional facilities sector. This sector, which includes universities, is anticipated to experience robust growth, with projected gains of 6.1% in 2025 and 3.8% in 2026.

Barton Malow's ongoing collaboration with Michigan State University exemplifies this focus. The company is actively engaged in major new construction and expansion initiatives, including the upcoming Engineering + Digital Innovation Building. These substantial and intricate campus developments position Barton Malow favorably within a market that is both expanding and stable.

- Market Share: High in a growing sector.

- Growth Projection: 6.1% in 2025 for institutional facilities.

- Stability: The institutional construction market offers a stable environment.

- Key Project: Involvement in Michigan State University's Engineering + Digital Innovation Building.

Barton Malow's involvement in the Electric Vehicle (EV) battery manufacturing sector positions it firmly as a Star. The company is actively constructing advanced battery plants, such as those for Ultium Cells, a joint venture between General Motors and LG Energy Solution. These projects are critical for the burgeoning EV supply chain, with Ultium Cells investing billions in facilities like their 2.8 million square foot Tennessee plant.

| Sector | Barton Malow's Position | Market Growth | Key Data Point |

|---|---|---|---|

| EV Battery Manufacturing | Leader/Key Player | Rapidly Expanding | Ultium Cells Tennessee Plant: 2.8 million sq ft |

| Renewable Energy Construction | Leader/Top Contractor | 5%-7% CAGR (through 2033) | Delivered >5.6 GW clean energy since 1989 |

| Healthcare Construction | Significant Player | 4.5%-5.5% CAGR (through 2034) | Projects like Intermountain Health Lutheran Hospital |

| Higher Education Construction | Strong Contributor | 6.1% growth in 2025 | Michigan State University Engineering + Digital Innovation Building |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

Barton Malow's BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis.

Cash Cows

Barton Malow, a significant player in the construction industry, is positioned as a Cash Cow within the BCG Matrix due to its strong performance in established sectors. The company's ranking as No. 19 on ENR's 'Top 400' contractors for 2024, with $6.4 billion in domestic revenue, highlights its substantial market share in general contracting and construction management. These foundational services are key drivers of consistent, robust cash flow across mature markets like commercial and industrial construction.

The company's enduring legacy and solid reputation provide a distinct competitive edge in these stable, albeit low-growth, market segments. This established presence allows Barton Malow to efficiently leverage its resources and expertise, ensuring continued profitability from its core offerings.

Barton Malow's long-term client relationships, such as those with General Motors and Michigan State University, represent significant cash cows. These decades-long partnerships translate into a consistent and predictable stream of revenue, a hallmark of mature market segments where Barton Malow has established a strong foothold.

The stability derived from repeat business with these major clients minimizes the need for extensive new business development efforts. This reduced investment requirement allows these established relationships to efficiently generate substantial cash flow, reinforcing their position as key cash cows within Barton Malow's portfolio.

Barton Malow's renovation and modernization of existing infrastructure projects are clear cash cows. They leverage their deep experience to win profitable contracts for upgrading large facilities in established markets. This segment provides reliable income streams.

For instance, the company's work on the Camping World Stadium renovation and the Penn State Beaver Stadium revitalization showcases their strength in this area. These projects are less prone to the unpredictable swings of new construction, ensuring a steady flow of revenue.

By capitalizing on their existing expertise and strong client relationships, Barton Malow generates consistent cash flow from these infrastructure upgrades. This stability is a hallmark of a successful cash cow business.

Maintenance and Support Services for Industrial and Commercial Clients

Barton Malow's maintenance and support services for industrial and commercial clients likely function as a Cash Cow within its BCG Matrix. This segment thrives in a mature market, characterized by slower growth but significant potential for high market share, leveraging established client relationships and specialized skills.

These services are crucial for generating consistent revenue streams. They require less investment for expansion compared to high-growth areas, allowing them to contribute reliably to the company's profitability. In 2024, the global facility management market, which encompasses these services, was valued at approximately $1.3 trillion, indicating a substantial and stable demand.

- Steady Revenue Generation: Provides a predictable income stream from existing clientele.

- Low Investment Needs: Requires minimal capital expenditure for growth, freeing up cash.

- High Market Share Potential: Benefits from long-term contracts and specialized expertise in a mature market.

- Profitability Driver: Contributes significantly to overall company profits due to efficient operations.

Specialized Concrete and Steel Self-Perform Services

Barton Malow's specialized concrete and steel self-perform services, including civil work, concrete and rebar installation, and steel erection, are firmly positioned as Cash Cows within their BCG Matrix. These are established, mature offerings in the construction sector, meaning the market for these services is well-developed and not experiencing rapid growth.

By bringing these critical functions in-house, Barton Malow gains a significant competitive edge. This internal capability allows for greater control over project timelines, quality, and, crucially, costs. For instance, in 2024, the construction industry saw material costs for concrete and steel fluctuate, but companies with strong self-perform capabilities could better absorb these pressures, maintaining healthier profit margins.

These self-perform operations consistently generate substantial revenue and profit for Barton Malow. They are reliable income streams that fund other, more growth-oriented ventures within the company's portfolio. The efficiency gains from direct control over these labor-intensive processes contribute directly to the bottom line, solidifying their Cash Cow status.

- Competitive Advantage: Direct control over quality and scheduling in concrete and steel work.

- Cost Control: Internalizing services mitigates risks associated with subcontractor pricing and availability.

- Profitability: Mature services with established market rates allow for consistent, strong profit margins.

- Market Maturity: These are fundamental construction activities with stable demand, ensuring ongoing revenue.

Barton Malow's core general contracting and construction management services are prime examples of Cash Cows. These established offerings operate in mature markets with stable demand, allowing the company to leverage its significant market share, evidenced by its 2024 ENR Top 400 ranking at No. 19 with $6.4 billion in revenue, to generate consistent profits with relatively low investment.

The company's long-standing relationships, such as those with General Motors and Michigan State University, represent stable revenue streams. These repeat clients and ongoing projects in sectors like commercial and industrial construction provide predictable cash flow, a hallmark of successful Cash Cows.

Barton Malow's self-perform capabilities in concrete and steel work also function as Cash Cows. These in-house services offer cost control and quality assurance in mature construction segments, contributing reliably to profitability and funding other business units.

| Barton Malow Business Segment | BCG Matrix Category | Key Characteristics | Supporting Data (2024/Recent) |

| General Contracting & Construction Management | Cash Cow | High market share in mature, stable markets; consistent revenue generation. | ENR Top 400 Contractor #19 ($6.4B domestic revenue) |

| Long-term Client Relationships (e.g., GM, MSU) | Cash Cow | Predictable, recurring revenue from established clients; low new business development costs. | Decades-long partnerships |

| Self-Perform Concrete & Steel Services | Cash Cow | Mature services with stable demand; cost control and quality advantage; consistent profit margins. | Mitigates impact of fluctuating material costs |

Full Transparency, Always

Barton Malow BCG Matrix

The Barton Malow BCG Matrix preview you're seeing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no demo content, and no need for further editing – just a professionally formatted and analysis-ready strategic tool. You can confidently use this preview as a direct representation of the high-quality BCG Matrix report that will be instantly downloadable after your transaction. This ensures you get exactly what you need for informed business planning and strategic decision-making, straight from the source.

Dogs

In the realm of small, highly commoditized commercial construction projects, Barton Malow might find itself with a low market share. These segments are often characterized by intense competition and a lack of unique offerings, making it challenging to stand out. For instance, the general building construction sector in the US, which includes many such small projects, saw approximately $450 billion in revenue in 2023, with numerous smaller firms vying for a piece of that pie.

While Barton Malow embraces innovation, past technology investments that are no longer cutting-edge or don't fit their current strategic vision fall into this category. These could include legacy software systems or hardware that hinder efficiency.

The company's strategic decision to divest from FlyPaper Technologies in December 2024 exemplifies this. This move highlights Barton Malow's proactive approach to shedding assets that are no longer strategically aligned or are underperforming, freeing up resources for more impactful ventures.

Operating in geographic markets where Barton Malow has a limited presence and faces intense local competition can be a challenging strategic position. In these scenarios, the company might struggle to gain significant market share, leading to low growth potential. For instance, entering a new regional market in 2024 where established local firms already dominate construction, as seen in some smaller Midwestern cities, could mean Barton Malow only achieves a fraction of the market share compared to its more established regions. This can result in break-even performance or even resource drain without substantial strategic advantages.

Highly Price-Sensitive Public Works Contracts

Highly price-sensitive public works contracts, particularly those for straightforward infrastructure or routine maintenance, often present a challenge for construction firms like Barton Malow. These projects, while potentially offering substantial volume, are frequently characterized by intense bidding wars where price becomes the dominant factor, leading to thin profit margins. For instance, in 2024, the average profit margin for non-specialized public works construction projects across the United States hovered around 2-4%, a stark contrast to more complex or specialized projects.

If Barton Malow were to pursue these types of contracts without effectively deploying its core competencies, such as advanced project management, innovative construction techniques, or specialized engineering expertise, they could be categorized as low-growth, low-market-share segments. This scenario could result in minimal profitability, draining resources that could be better allocated to areas where the company holds a stronger competitive advantage. In 2023, the public sector infrastructure spending saw an increase, but the portion allocated to basic, low-complexity projects still faced significant price pressures.

- Low Margins: Public works contracts with high price sensitivity often yield profit margins in the low single digits, potentially 2-4% in 2024 for non-specialized projects.

- Volume vs. Profitability: While offering project volume, these contracts may not translate to significant profit if unique capabilities are not leveraged.

- Resource Allocation: Engaging in these segments without differentiation can divert resources from higher-margin, more strategic opportunities.

- Market Position: Without a clear value proposition beyond price, Barton Malow might struggle to build a dominant market share in these specific contract types.

Inefficient Legacy Operational Processes

Inefficient legacy operational processes can be considered 'Dogs' within an organization's strategic framework, much like a business unit. These processes, often deeply embedded and resistant to change, consume valuable resources without delivering proportional returns. For instance, manual data entry or outdated project management systems might require significant labor and time, hindering overall productivity and innovation.

These 'Dog' processes drain financial and human capital, diverting them from more strategic initiatives. In 2024, companies are increasingly scrutinizing operational expenditures, with a focus on automation and digital transformation to eliminate such inefficiencies. A study by McKinsey in 2023 highlighted that organizations with highly automated operations saw a 15-20% improvement in productivity compared to those relying on manual processes.

- Resource Drain: Legacy systems can lead to increased IT maintenance costs and require specialized, often scarce, personnel.

- Hindered Growth: Inability to adapt or scale due to outdated processes limits a company's competitive edge and market responsiveness.

- Sustainability Impact: Non-optimized processes can contribute to higher energy consumption and waste, conflicting with modern sustainability goals.

- Low ROI: These processes typically offer a low return on investment, often negative when factoring in the opportunity cost of resources allocated elsewhere.

Within Barton Malow's strategic portfolio, 'Dogs' represent business segments or projects with low market share and low growth potential. These are often characterized by intense competition, commoditized offerings, or operational inefficiencies that limit profitability. For instance, small, highly commoditized commercial construction projects or legacy operational processes that consume resources without significant returns fit this classification. In 2024, many construction firms, including Barton Malow, are actively reviewing their portfolios to identify and address these underperforming areas to optimize resource allocation.

| Segment Example | Market Share | Growth Potential | Profitability | Strategic Consideration |

|---|---|---|---|---|

| Small, commoditized construction projects | Low | Low | Low/Negative | Divest or minimize engagement |

| Legacy operational processes | N/A (Internal) | Low | Low/Negative | Streamline or replace |

| Price-sensitive public works contracts (non-specialized) | Low (without differentiation) | Low | Low (e.g., 2-4% in 2024) | Avoid unless core competencies are leveraged |

Question Marks

Barton Malow's Accelerator program is a clear indicator of their strategic push into emerging construction technologies. Investments in areas like solar energy technology, autonomous reality capture, and underground utility mapping in 2024 signal a focus on high-growth potential segments within the broader construction tech landscape.

The January 2024 seed round investment in KOPE, a software solutions provider, further underscores this commitment to digital innovation. While these are promising fields with significant future growth, Barton Malow's current market share in these nascent technologies is likely minimal, necessitating substantial capital infusion to achieve scale and market penetration.

Barton Malow's international market expansion into high-growth regions, such as Southeast Asia or parts of Africa, would represent a strategic move into potential 'Stars' or 'Question Marks' within a BCG-like framework. The global construction market is indeed seeing robust growth, with the Asia Pacific region projected to expand at a compound annual growth rate of 6.2%.

However, Barton Malow's current international revenue stood at $130 million in 2024, a modest figure compared to their $6.4 billion domestic revenue. This indicates a low market share in international arenas, making these expansion efforts inherently risky and requiring significant capital outlay for potentially uncertain returns.

Barton Malow's exploration into specialized, niche sustainable construction practices positions it in a high-growth potential quadrant. These advanced green methods, while not yet mainstream, offer significant future market share opportunities. For instance, the global green building market was valued at approximately $1.07 trillion in 2023 and is projected to reach $3.03 trillion by 2030, indicating substantial room for specialized innovation.

However, these cutting-edge techniques require substantial research and development investment, coupled with market education. The initial market share for such niche practices is inherently low, reflecting the early stage of adoption. This investment profile aligns with a question mark in the BCG matrix, signifying high investment needs for potentially high future returns.

New Service Offerings in Untapped or Nascent Market Segments

Barton Malow could introduce specialized services targeting emerging construction sectors like advanced life sciences labs or sustainable infrastructure projects. These nascent markets, while currently representing a small fraction of their business, offer significant future growth opportunities. For instance, the global life sciences construction market was projected to reach over $150 billion by 2024, indicating a substantial untapped potential.

Developing expertise in these niche areas, such as modular construction for healthcare facilities or bio-secure research environments, would require upfront investment in technology and talent. However, early movers in these segments can establish a strong competitive advantage. The demand for net-zero buildings is also rapidly increasing, with many regions setting ambitious targets for new construction by 2030.

- Focus on High-Growth Niches: Explore specialized construction for data centers, advanced research facilities, and sustainable infrastructure.

- Investment in Innovation: Allocate resources to develop new building approaches and technologies for nascent market segments.

- Market Penetration Strategy: Aim to capture market share in emerging areas like life sciences construction, which is experiencing robust growth.

- Alignment with Future Trends: Position Barton Malow to capitalize on increasing demand for net-zero buildings and specialized technological infrastructure.

Strategic Partnerships with Early-Stage Innovators

Barton Malow's strategic partnerships with early-stage innovators, such as those with Moog Construction and Built Robotics focusing on solar energy technology pilots, exemplify the company's approach to identifying and integrating potentially disruptive technologies.

These collaborations are designed to leverage the agility and specialized knowledge of startups to explore and implement novel solutions within Barton Malow's construction projects, particularly in rapidly expanding sectors like renewable energy.

While these ventures represent a high-potential growth area, their current market share is limited, and their long-term commercial viability and scalability remain under evaluation, positioning them as potential 'Stars' or 'Question Marks' in a BCG-like matrix.

- Focus on Solar Energy: Partnerships with Moog Construction and Built Robotics target solar energy solutions.

- High Potential, Low Share: These early-stage collaborations have high growth potential but currently low market share.

- Integration of Innovation: The aim is to embed cutting-edge technologies into construction projects.

- Scalability Under Test: Commercial success and scalability of these specific partnerships are still being determined.

Question Marks represent areas where Barton Malow is investing in high-growth, nascent markets with currently low market share. These ventures require significant capital for research, development, and market penetration. Success hinges on effectively scaling these innovative approaches and educating the market.

Barton Malow's venture into specialized sustainable construction practices, like advanced green building methods, fits this category. The global green building market's projected growth from $1.07 trillion in 2023 to $3.03 trillion by 2030 highlights the potential for specialized innovation, but initial market share for niche techniques is inherently low.

Similarly, international market expansion into regions like Southeast Asia, while offering robust growth potential (Asia Pacific CAGR of 6.2%), represents a question mark due to Barton Malow's modest international revenue of $130 million in 2024 against $6.4 billion domestic revenue. These efforts demand substantial capital for uncertain returns.

These initiatives, including partnerships with startups like KOPE for software solutions, demand substantial investment to achieve scale and market penetration, positioning them as high-risk, high-reward opportunities.

| Category | Market Growth Potential | Current Market Share | Investment Needs | Risk/Reward Profile |

| Nascent Technologies (e.g., Solar Energy Tech) | High | Low | High | High Risk, High Reward |

| International Expansion | High | Low | High | High Risk, High Reward |

| Niche Sustainable Practices | High | Low | High | High Risk, High Reward |

| Specialized Services (e.g., Life Sciences Labs) | High | Low | High | High Risk, High Reward |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial disclosures, market research reports, and internal performance metrics to provide a clear strategic overview.