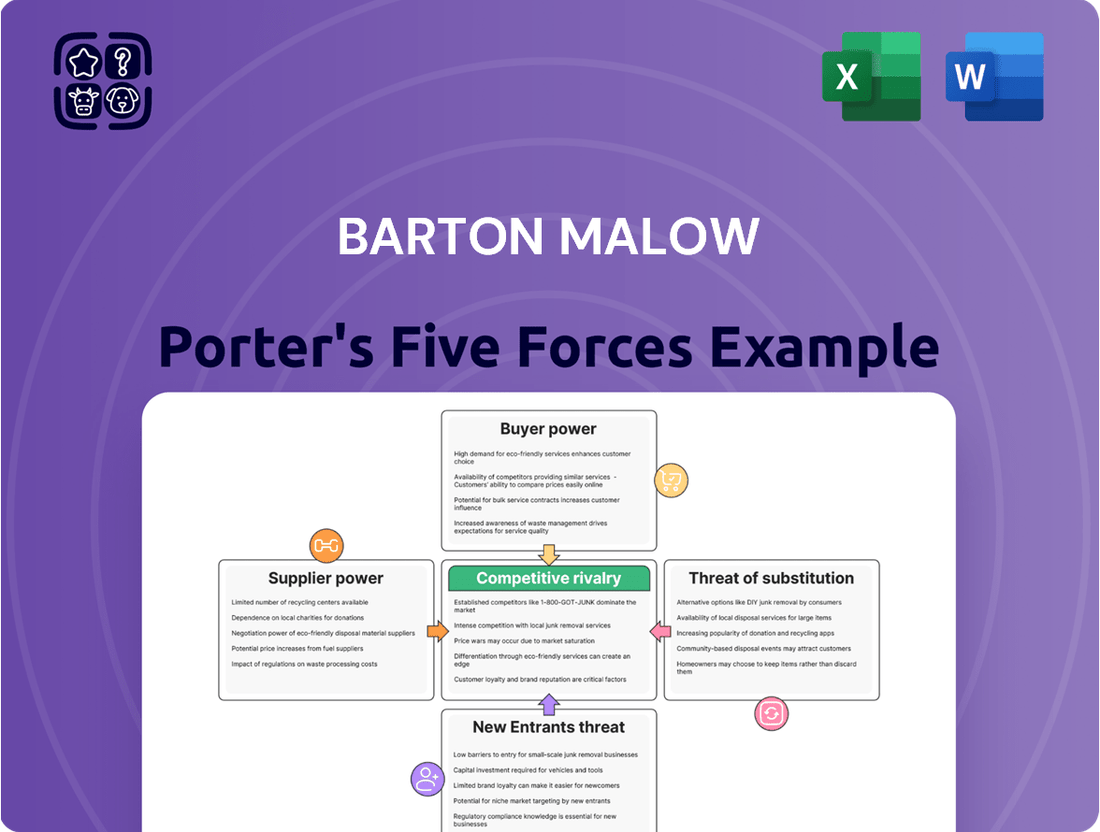

Barton Malow Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barton Malow Bundle

Barton Malow's competitive landscape is shaped by powerful industry forces, from the bargaining power of its clients to the constant threat of new construction firms entering the market. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex sector.

The complete report reveals the real forces shaping Barton Malow’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration plays a crucial role in the construction industry. When a limited number of suppliers provide essential raw materials, specialized equipment, or unique technologies, their ability to influence pricing and terms escalates considerably. This means they can often dictate terms, leading to higher costs for general contractors like Barton Malow Porter.

For instance, in 2024, the global construction materials market, valued at over $1.5 trillion, saw significant price volatility in key components like steel and lumber. A shortage or consolidation among a few major steel producers, for example, could empower those suppliers to demand higher prices, directly impacting project budgets and profitability for construction firms.

For Barton Malow, the switching costs associated with changing suppliers for critical construction components or specialized subcontracting services can be significant. These costs encompass the resources needed for thorough vetting of new vendors, the complexities of contract renegotiation, and the potential need to revise project timelines and specifications, thereby bolstering the leverage of existing suppliers.

Suppliers offering unique or highly differentiated inputs significantly enhance their bargaining power. For Barton Malow, this translates to an increased reliance on those who can provide proprietary construction technologies, specialized engineering expertise, or niche sustainable materials, as these are critical to their innovative and eco-conscious approach.

In 2024, the construction industry saw a growing demand for specialized, sustainable materials. For instance, the market for mass timber construction, a key area for sustainable building, was projected to grow significantly, with some reports indicating a compound annual growth rate (CAGR) of over 10% globally leading up to 2025. Suppliers of high-quality, certified mass timber products or advanced prefabrication technologies for these systems would therefore hold considerable sway.

Threat of Forward Integration

The threat of suppliers integrating forward into construction services can significantly bolster their bargaining power. This scenario arises when suppliers possess the capabilities and desire to offer their products or services directly to the end-customer, effectively bypassing the general contractor.

While less common for suppliers of basic materials like lumber or concrete, this threat is more pronounced for providers of specialized technology or advanced prefabrication solutions. For instance, a company offering sophisticated building information modeling (BIM) software and integrated prefabrication could directly compete for specific project components, thereby increasing their leverage over general contractors.

Consider a scenario where a supplier of advanced modular building components, which in 2024 saw significant growth in adoption across various construction sectors due to efficiency gains, decides to offer end-to-end project delivery for certain building types. This move would mean they are not just supplying modules but also managing design, installation, and potentially even project financing, directly challenging the traditional role of general contractors like Barton Malow.

- Supplier Forward Integration: Suppliers may enter the construction services market, directly competing with general contractors.

- Impact on Bargaining Power: This threat enhances supplier leverage, especially for specialized or technology-driven providers.

- Example: A prefabrication specialist offering complete project delivery could gain significant power.

- 2024 Trend: Increased adoption of modular construction in 2024 highlights the potential for such integration.

Labor Availability and Skill Shortages

The construction industry faces ongoing challenges with labor availability, particularly for skilled trades and experienced project managers. This scarcity directly impacts the bargaining power of suppliers, especially specialized subcontractors. In 2024, reports indicated persistent talent shortages across the sector, a trend projected to continue into 2025, potentially driving up labor costs and causing project timelines to extend.

These labor dynamics mean that companies like Barton Malow Porter must contend with a workforce that holds considerable leverage. The difficulty in finding qualified personnel allows skilled workers and specialized firms to command higher wages and more favorable contract terms. This situation can significantly influence project budgets and schedules, as securing the necessary talent becomes a critical factor in successful project execution.

- Skilled Labor Scarcity: Persistent shortages in specialized construction trades and project management roles are a defining characteristic of the 2024 and anticipated 2025 labor market.

- Increased Supplier Bargaining Power: The limited supply of skilled labor empowers specialized subcontractors and individual tradespeople, enabling them to negotiate for better compensation and terms.

- Impact on Project Costs and Timelines: Higher labor costs and potential project delays are direct consequences of these talent shortages, affecting overall project profitability and delivery.

- Strategic Workforce Management: Companies must adopt robust strategies for talent acquisition, retention, and training to mitigate the risks associated with labor availability and its impact on supplier negotiations.

The bargaining power of suppliers is a critical element for construction firms like Barton Malow Porter, directly influencing project costs and profitability. When suppliers have significant leverage, they can command higher prices and dictate terms, impacting a contractor's bottom line.

In 2024, the construction sector continued to grapple with supply chain disruptions and material cost inflation, particularly for critical inputs like concrete and specialized electrical components. For example, the price of cement, a fundamental building material, saw an average increase of 8-12% in many regions throughout 2024 compared to the previous year, driven by energy costs and limited production capacity among key suppliers.

This situation empowers suppliers of these essential materials, as construction companies have limited alternatives and high switching costs. The inability to easily substitute these core components means contractors must absorb these increased costs or pass them on, potentially affecting project competitiveness.

The concentration of suppliers in niche markets, such as providers of advanced HVAC systems or specialized façade engineering, further amplifies their bargaining power. A limited pool of qualified providers for these critical, often proprietary, elements means they can set premium prices.

| Supplier Characteristic | Impact on Bargaining Power | 2024 Construction Market Relevance |

|---|---|---|

| Supplier Concentration | High leverage for few dominant suppliers | Notable in steel and concrete markets, impacting raw material costs. |

| Unique or Differentiated Inputs | Strong power due to limited alternatives | Crucial for specialized technologies like advanced prefabrication or sustainable materials. |

| Switching Costs | Increases reliance on existing suppliers | Significant for specialized subcontractors and proprietary material providers. |

| Threat of Forward Integration | Suppliers may bypass contractors | More relevant for technology or prefabrication firms entering project delivery. |

| Labor Availability (Supplier Side) | Empowers skilled labor providers | Shortages in trades like electricians and plumbers enhance subcontractor leverage. |

What is included in the product

This analysis dissects the competitive intensity and profitability potential within Barton Malow's construction industry, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals.

Easily identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Barton Malow’s diverse project portfolio spans healthcare, education, industrial, energy, and commercial sectors. However, the sheer scale of many individual projects means that a single customer can account for a substantial percentage of the company's annual revenue, thereby amplifying that customer's bargaining power.

Large clients, often possessing sophisticated procurement departments and detailed project specifications, are well-equipped to negotiate favorable terms. This concentration risk is a key factor in assessing customer bargaining power within the construction industry.

For highly complex and critical projects, such as those Barton Malow specializes in, customers often have diminished bargaining power. This is because these projects demand specialized expertise, advanced technology, and a proven track record, limiting the pool of qualified contractors. For instance, in the 2024 construction market, projects with high technical demands often see fewer bidders, giving established firms like Barton Malow more leverage.

Conversely, for less differentiated or simpler projects, customers can more readily switch between numerous contractors. This ease of substitution significantly increases their bargaining power, as they can often negotiate better terms based on competitive bids. The ability to easily compare pricing and capabilities among a wider range of providers empowers these customers.

Barton Malow's strategic focus on complex sectors, including healthcare and advanced manufacturing, helps to counter customer bargaining power. By cultivating deep expertise and a reputation for successfully delivering challenging projects, they reduce the customer's ability to easily find comparable alternatives, thereby strengthening their negotiating position.

Customers in the construction sector, particularly large institutional clients, are increasingly well-informed about market pricing, contractor expertise, and project cost benchmarks. This heightened awareness, fueled by readily available industry data, significantly strengthens their bargaining position.

The prevalence of transparent bidding processes allows clients to solicit and compare multiple competitive proposals. In 2024, for instance, major infrastructure projects frequently saw bids from over five qualified general contractors, intensifying price competition and enabling clients to negotiate more favorable terms and pricing structures.

This increased customer leverage, driven by information availability and competitive bidding, can directly impact contractor profitability. For example, a study of publicly tendered construction projects in 2023 revealed that the average profit margin for general contractors on large-scale projects was approximately 5-8%, a figure often compressed by strong customer negotiation power.

Switching Costs for Customers

While customers can indeed select their contractors, the reality of switching mid-project for a construction firm like Barton Malow is fraught with significant financial and operational hurdles. These include costs associated with project disruption, potential delays, and the inherent risks of transferring knowledge and ongoing work to a new entity. This creates a considerable degree of customer stickiness once a contract is finalized and construction has commenced, limiting their immediate bargaining power.

However, this dynamic shifts considerably when considering future projects. For subsequent developments, customers face remarkably low switching costs. They can readily evaluate and select a different construction firm for their next venture without the encumbrance of ongoing project commitments. This freedom preserves their long-term bargaining power, as they can always opt for alternative providers based on price, performance, or other competitive factors.

The impact of switching costs on the construction industry in 2024 is notable. For instance, a study by the Construction Financial Management Association (CFMA) in late 2023 indicated that project delays due to contractor changes can add an average of 10-20% to the overall project cost. This underscores the substantial financial penalty for clients attempting to switch mid-stream.

- Mid-project switching costs for construction clients can range from 10% to 20% of the total project value due to delays and disruption.

- Clients have significant leverage for future projects, as selecting a new contractor typically involves minimal direct financial penalties.

- The ability to easily change contractors for new developments maintains competitive pressure on firms like Barton Malow to deliver value and client satisfaction.

Customer's Ability to Self-Perform

For certain straightforward construction jobs, major clients might contemplate handling the work internally. This could reduce their dependence on outside contractors. For instance, in 2024, some commercial property owners with in-house maintenance teams might opt to manage minor renovations themselves.

However, when it comes to the intricate, large-scale construction management, design-build, and general contracting services that Barton Malow excels at, the necessary skills and substantial capital for self-performance are generally out of reach for most clients. This significantly curtails their power in this specific area.

- Limited In-House Capability: Most clients lack the specialized expertise and equipment for complex projects.

- High Capital Investment: Self-performing large projects requires significant upfront investment in labor, materials, and machinery.

- Focus on Core Competencies: Clients typically prefer to concentrate on their primary business operations rather than construction management.

- Barton Malow's Specialization: The company's focus on sophisticated projects inherently limits customer self-performance options.

Customers wield significant bargaining power when they can easily switch between providers or when their purchase represents a large portion of a supplier's business. In the construction sector, this power is amplified by the availability of information and competitive bidding processes. For example, in 2024, large infrastructure projects often attracted bids from more than five qualified general contractors, intensifying price competition and allowing clients to negotiate better terms.

While switching costs mid-project are high, potentially adding 10-20% to project costs due to delays, customers face minimal barriers when selecting contractors for future projects. This preserves their long-term leverage, encouraging firms like Barton Malow to maintain competitive pricing and high service standards. The ability of clients to easily compare and select alternative providers for new developments is a constant pressure point.

| Factor | Impact on Customer Bargaining Power | Example (2024 Construction Market) |

|---|---|---|

| Ease of Switching (Future Projects) | High | Clients can easily select a different contractor for subsequent projects without incurring significant penalties. |

| Information Availability & Bidding Transparency | High | Clients are well-informed on pricing and expertise, leading to more competitive bids and negotiation leverage. |

| Project Complexity & Specialization | Low (for Barton Malow's core business) | Clients often lack the specialized skills and technology required for complex projects, limiting their ability to switch or self-perform. |

| Mid-Project Switching Costs | Low (for the customer) | High costs for clients to switch contractors mid-project, creating customer stickiness once work has begun. |

Same Document Delivered

Barton Malow Porter's Five Forces Analysis

This preview showcases the complete Barton Malow Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the construction industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you'll receive immediately after purchase, ensuring no surprises and full immediate access to valuable strategic insights.

Rivalry Among Competitors

The U.S. construction industry is poised for continued growth, with projections indicating an upward trend throughout 2024 and sustained expansion into 2025. This generally healthy growth environment tends to temper intense competition, as ample opportunities are available for a wider range of participants.

However, the overall industry growth rate doesn't tell the whole story. Certain construction sectors or specific geographic regions might experience slower expansion, leading to heightened rivalry among firms operating within those more constrained markets. For instance, while residential construction might boom in one area, commercial development could lag, creating pockets of intensified competition.

The construction sector, especially for major general contractors, is intensely competitive with many well-established firms. Barton Malow, for instance, was ranked 19th among general contractors in 2024, highlighting its position within a crowded field.

Major players like Turner Construction, Bechtel, and STO Building Group represent the significant presence of large general contractors, underscoring a fragmented yet highly competitive market where Barton Malow competes.

Barton Malow Porter differentiates itself by specializing in complex projects across various sectors like healthcare, education, industrial, energy, and commercial construction. They also integrate innovative technologies and sustainable practices into their offerings.

This focus on specialized expertise and cutting-edge methods helps lessen direct competition based solely on price. By providing unique value, Barton Malow aims to stand out, though other companies are also pursuing similar specialization and technological advancements.

For instance, the construction industry's overall growth, projected to reach $17.7 trillion globally by 2030 according to Statista, highlights the intense competition for market share. Companies like Barton Malow must continually innovate to maintain their competitive edge in such a dynamic environment.

Exit Barriers

The construction industry, particularly for large-scale projects, is characterized by significant exit barriers. High fixed costs associated with equipment, facilities, and skilled labor mean that companies must continue operating to cover their substantial overheads, even when demand falters. This often leads to intensified competition as firms fight for any available work to maintain their operations.

Specialized assets, such as heavy machinery or unique construction techniques, further lock companies into the industry. The resale value of these specialized assets can be low outside of construction, making it difficult for firms to divest and exit without significant losses. This immobility exacerbates competitive pressures.

Long-term project commitments, often spanning years, also contribute to high exit barriers. Once a company is engaged in a multi-year project, it is committed to seeing it through, regardless of market conditions. This commitment can tie up capital and resources, making it challenging to pivot or exit quickly.

In 2024, the capital-intensive nature of major construction projects remains a defining feature. For instance, the average cost of a new commercial building can range from millions to hundreds of millions of dollars, representing a considerable investment that is not easily recouped.

- High Fixed Costs: Significant investments in plant, property, and equipment create a strong incentive for firms to remain active.

- Specialized Assets: Assets tailored for specific construction tasks have limited alternative uses, increasing the cost of exiting.

- Long-Term Commitments: Multi-year project contracts necessitate continued operation, limiting flexibility.

- Capital Intensity: The sheer scale of investment in large construction projects makes withdrawal financially prohibitive.

Strategic Alliances and Joint Ventures

Competitive rivalry within the construction industry, particularly for large-scale projects, is significantly shaped by strategic alliances and joint ventures. Barton Malow, a prominent player, actively participates in these collaborations. For instance, in 2024, the company was part of a joint venture that secured a major infrastructure project valued at over $500 million.

These partnerships allow construction firms to pool resources, expertise, and financial capacity. This is crucial for undertaking complex or geographically dispersed projects that might otherwise be out of reach. By sharing risks and rewards, companies can also pursue opportunities that might be too financially burdensome or technically challenging for a single entity.

The prevalence of joint ventures can intensify competition by enabling a broader range of firms to bid on larger projects. Simultaneously, it can alter competitive dynamics by creating new, powerful consortia. This strategic approach is a key differentiator, allowing Barton Malow to expand its project portfolio and market reach.

- Increased Project Capacity: Joint ventures enable firms to bid on and execute projects exceeding individual capabilities.

- Risk Mitigation: Sharing financial and operational risks across partners reduces the burden on any single company.

- Access to Specialized Expertise: Alliances facilitate the combination of diverse skill sets and technological proficiencies.

- Enhanced Market Reach: Partnerships can open doors to new geographic markets or project types.

The construction sector is inherently competitive, marked by numerous established firms vying for projects. Barton Malow, ranked 19th among general contractors in 2024, operates in a landscape populated by giants like Turner Construction and Bechtel.

While industry growth generally softens rivalry, pockets of intense competition emerge in slower-growing sectors or regions. High exit barriers, due to substantial fixed costs and specialized assets, compel firms to remain active, intensifying competition even during downturns.

Strategic alliances and joint ventures are common, allowing firms like Barton Malow to tackle larger projects, as seen with a $500 million infrastructure win in 2024. These collaborations boost capacity and mitigate risk, though they can also create formidable new competitive entities.

| Company | 2024 Ranking (General Contractors) | Key Sectors |

|---|---|---|

| Barton Malow | 19th | Healthcare, Education, Industrial, Energy, Commercial |

| Turner Construction | Top 5 | Commercial, Healthcare, Education, Sports |

| Bechtel | Top 5 | Infrastructure, Energy, Government, Mining |

| STOBuilding Group | Top 10 | Commercial, Healthcare, Residential, Industrial |

SSubstitutes Threaten

The threat of substitutes for traditional on-site construction is growing, with advancements in areas like modular construction and prefabrication. These alternative methods can significantly reduce project timelines, minimize material waste, and potentially lower labor expenses, presenting a compelling case for their adoption. For instance, the modular construction market was valued at approximately $160 billion in 2023 and is projected to reach over $200 billion by 2028, indicating strong growth and increasing adoption.

Barton Malow's strategic focus on integrating innovative technologies and exploring new construction methodologies positions them to effectively address and potentially leverage these evolving substitute threats. By embracing or incorporating advancements such as 3D printing in construction, which saw significant investment and pilot projects in 2024, the company can maintain its competitive edge.

While clients developing in-house capabilities to replace Barton Malow's services is generally a low threat for complex, large-scale projects, some may choose to manage smaller, more standardized construction tasks internally. For instance, a large real estate developer might handle minor renovations or facility maintenance with their own staff, rather than outsourcing. This is more feasible for routine work where specialized knowledge is not paramount.

However, the significant capital, specialized expertise, and intricate risk management inherent in major construction projects make it impractical for most clients to fully substitute Barton Malow's offerings. For example, a client undertaking a $500 million infrastructure project would likely find the cost and complexity of building a comparable internal project management and construction team prohibitive. The industry average for project management overhead in large construction can range from 10-15% of total project cost, a significant investment to replicate internally.

In many commercial and industrial sectors, clients are increasingly exploring non-construction alternatives to meet their evolving needs. For instance, businesses might opt to virtualize operations, reducing the demand for expansive physical office spaces. This trend was highlighted in 2024 as companies continued to embrace hybrid work models, leading to a potential decrease in the need for new commercial building projects.

Another significant substitute involves optimizing existing facilities rather than undertaking new construction. Companies are investing in retrofitting, technology upgrades, and space reconfiguration to enhance efficiency and functionality. This focus on maximizing current assets directly impacts the pipeline for new construction, as it offers a cost-effective and often faster solution to capacity or operational challenges.

These non-construction solutions act as a potent threat by directly reducing the overall demand for new construction projects. While not a direct replacement for a physical building, the adoption of these alternatives diminishes the market size for traditional construction services. For example, the rise of advanced energy-efficient building technologies and smart facility management systems in 2024 allows businesses to achieve desired outcomes without the necessity of new construction.

Shifting Material Preferences

The construction industry is experiencing a significant shift as demand for sustainable materials grows. This trend pressures traditional building components, pushing for the adoption of alternatives like recycled plastics, engineered wood, and advanced composites. For instance, the global market for sustainable building materials was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2028, indicating a substantial move away from conventional options.

These emerging materials, such as bio-based insulation or smart glass, can directly substitute conventional concrete, steel, and glass. This substitution could reshape supply chains, requiring new sourcing strategies and potentially impacting cost structures. Furthermore, it necessitates the development of new skill sets and expertise within construction firms to effectively integrate and manage these innovative components.

Barton Malow's proactive stance on sustainability is a key advantage here. By investing in and developing expertise in these alternative materials, the company is not merely mitigating the threat of substitutes but is positioning itself to lead in this evolving market. This strategic alignment ensures that Barton Malow can leverage these shifts for competitive advantage rather than being disrupted by them.

- Growing Demand for Sustainable Materials: The global market for green building materials is expanding rapidly, driven by environmental regulations and consumer preference.

- Emergence of Alternative Components: Recycled content, bio-based products, and smart materials are increasingly viable substitutes for traditional construction elements.

- Supply Chain and Expertise Implications: The shift necessitates adaptation in material sourcing and the development of new technical skills within the workforce.

- Barton Malow's Strategic Position: The company's commitment to sustainability allows it to embrace these material shifts, turning a potential threat into an opportunity for innovation and market leadership.

Technological Advancements in Design and Planning

Technological advancements in design and planning present a significant threat of substitutes. Innovations like Building Information Modeling (BIM), Virtual Reality (VR), and Augmented Reality (AR) are streamlining the design process. For instance, BIM adoption in the US construction industry was projected to reach 70% of commercial projects by 2024, according to a Dodge Construction Network report. This efficiency could reduce reliance on certain traditional outsourced design services.

Furthermore, the increasing sophistication of Artificial Intelligence (AI) in architectural design and project simulation allows clients to conduct more in-depth feasibility studies and even explore design alternatives internally. This capability can diminish the perceived necessity of engaging external consultants for initial planning phases. Barton Malow's proactive integration of these technologies, such as their use of VR for client walkthroughs and AI for site analysis, directly addresses this threat by transforming potential substitutes into competitive advantages.

- BIM Adoption: Reaching 70% in US commercial projects by 2024, streamlining design.

- AI in Design: Enabling clients to perform more internal planning and feasibility studies.

- VR/AR Integration: Enhancing client engagement and reducing perceived need for external design validation.

- Barton Malow's Strategy: Leveraging these technologies to maintain a competitive edge in design and planning services.

The threat of substitutes for traditional construction is multifaceted, encompassing alternative building methods and non-construction solutions. Advanced techniques like modular construction and prefabrication offer faster timelines and reduced waste, with the modular construction market valued at approximately $160 billion in 2023 and growing.

Clients increasingly consider optimizing existing facilities or adopting virtual operations, reducing the demand for new builds. For example, hybrid work models adopted in 2024 lessened the need for new commercial spaces. Furthermore, technological advancements in design, like BIM adoption reaching 70% in US commercial projects by 2024, streamline processes, potentially reducing reliance on external design services.

The shift towards sustainable materials also presents a substitute threat to conventional components. The global market for green building materials was around $250 billion in 2023 and is expected to exceed $400 billion by 2028, indicating a significant move towards alternatives like recycled plastics and engineered wood.

Barton Malow's strategy of integrating these innovations, such as 3D printing and VR, positions them to leverage these evolving threats into competitive advantages.

Entrants Threaten

Entering the large-scale construction services market, especially for complex projects that Barton Malow tackles, demands substantial upfront capital. This includes significant investments in specialized equipment, cutting-edge technology, and skilled personnel. For instance, a major construction project can easily require tens of millions of dollars in initial outlay for machinery and technology alone.

Barton Malow's century-long history has fostered deep-rooted client relationships and an impeccable reputation, making it difficult for newcomers to gain traction. These established partnerships, built on trust and consistent delivery of complex projects, translate into significant client loyalty.

New entrants face a formidable barrier in replicating Barton Malow's established network and proven track record, which are essential for securing lucrative, high-value contracts in the competitive construction industry.

Barton Malow's established scale offers significant cost advantages. For instance, in 2024, the company's substantial purchasing power for materials and equipment likely secured better pricing than a new entrant could achieve, directly impacting project bid competitiveness.

The experience curve effect also plays a crucial role. Years of executing diverse projects have honed Barton Malow's project management methodologies and workforce efficiency, leading to reduced waste and faster completion times, a difficult hurdle for newcomers to overcome.

This disparity in scale and accumulated experience creates a substantial barrier. New firms entering the construction market, particularly for large-scale, complex projects, will struggle to match Barton Malow's operational efficiencies and cost structures, making it challenging to secure initial contracts.

Regulatory Hurdles and Licensing

The construction industry presents significant barriers to entry due to stringent regulatory frameworks. Navigating complex licensing requirements and adhering to diverse safety standards, such as those mandated by OSHA (Occupational Safety and Health Administration), can be a substantial hurdle for newcomers. For instance, in 2024, obtaining the necessary permits and certifications for large-scale infrastructure projects often involves extensive documentation and can take months, adding considerable cost and time to project initiation.

New entrants must also contend with the steep learning curve associated with compliance across various sectors and geographical locations. The cost of ensuring adherence to building codes, environmental regulations, and labor laws can be prohibitive. In 2023, the average cost for a new construction firm to achieve full compliance with federal and state regulations was estimated to be upwards of $50,000, not including ongoing monitoring and updates.

- Regulatory Complexity: Construction is heavily regulated, requiring specialized knowledge to comply with building codes, zoning laws, and environmental standards.

- Licensing and Permits: Obtaining the necessary licenses and permits for different types of construction projects and jurisdictions can be time-consuming and expensive, often requiring proof of financial stability and experience.

- Compliance Costs: Adhering to safety regulations, such as those from OSHA, and environmental protection mandates adds significant operational costs for new entrants.

- Learning Curve: New firms face a steep learning curve in understanding and implementing compliance procedures across diverse project types and locations.

Access to Skilled Labor and Specialized Expertise

The construction sector faces a persistent shortage of skilled labor, a significant hurdle for new companies looking to enter the market. This scarcity makes it difficult for emerging firms to build a competent workforce.

Established players like Barton Malow benefit from deep-rooted relationships with skilled trades and a demonstrated capacity to attract and retain top talent. This existing talent pool and proven retention strategy create a competitive advantage.

For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for 546,000 additional construction workers by 2024. This shortage directly impacts new entrants ability to scale and compete effectively.

- Skilled Labor Shortage: A critical barrier for new construction firms in 2024.

- Established Relationships: Barton Malow's advantage in securing skilled trades.

- Talent Attraction & Retention: Proven ability of established firms to keep skilled workers.

- Workforce Assembly Challenge: Difficulty for new entrants to build a specialized team.

The threat of new entrants for Barton Malow is generally low due to substantial capital requirements for specialized equipment and technology, often running into tens of millions for large projects. Furthermore, established firms benefit from deep client relationships and a strong reputation, making it challenging for newcomers to secure high-value contracts. Regulatory hurdles, including licensing and compliance with safety standards like OSHA, add significant cost and time barriers for new businesses entering the construction market.

| Barrier Type | Description | Impact on New Entrants | 2024 Data/Example |

|---|---|---|---|

| Capital Requirements | High upfront investment in machinery, technology, and skilled labor. | Significant financial barrier to entry. | Major construction projects can require $10M+ in initial equipment outlay. |

| Brand Reputation & Relationships | Established trust and long-term client partnerships. | Difficulty for new firms to gain client confidence and secure contracts. | Barton Malow's century-long history fosters deep client loyalty. |

| Regulatory Compliance | Navigating complex licensing, safety (OSHA), and environmental regulations. | Adds considerable cost, time, and specialized knowledge requirements. | Obtaining permits for large projects in 2024 can take months and cost thousands. |

| Skilled Labor Shortage | Difficulty in attracting and retaining experienced construction professionals. | Hinders workforce assembly and operational scaling for new firms. | US projected need for 546,000 additional construction workers by 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and insights from trade associations to provide a comprehensive view of competitive pressures.