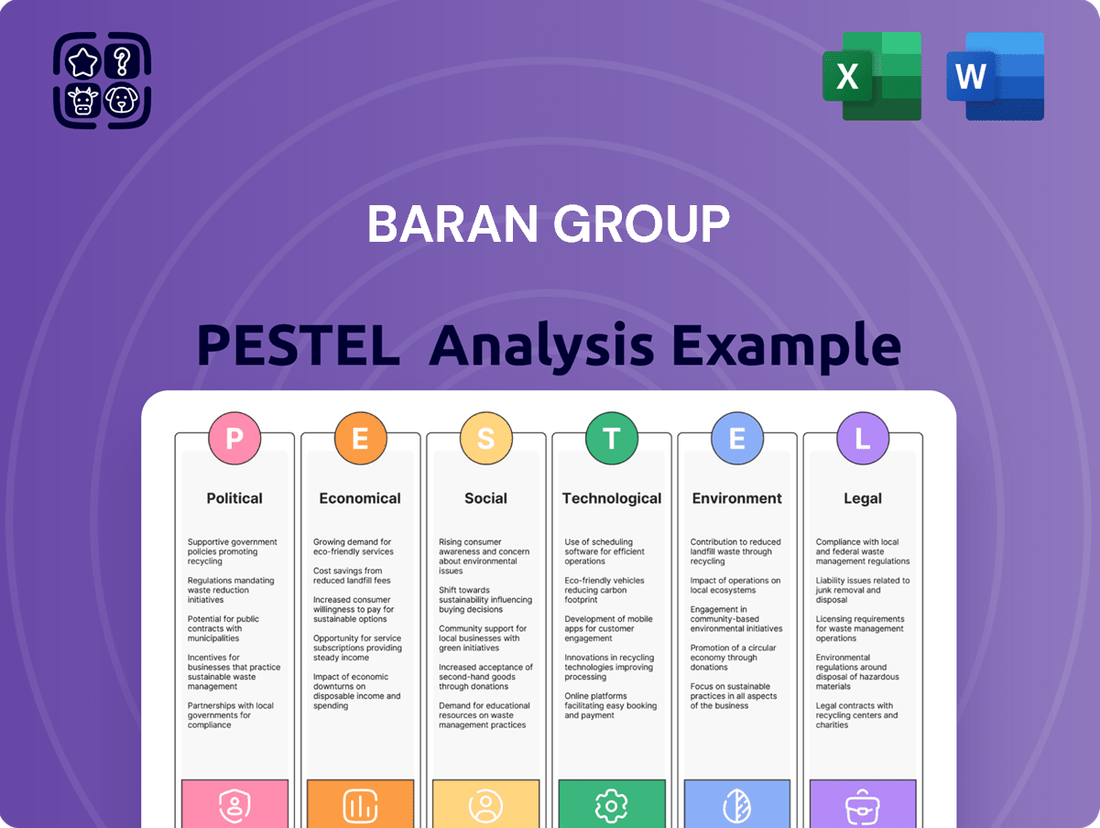

Baran Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baran Group Bundle

Navigate the complex external forces shaping Baran Group's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges. Equip yourself with actionable intelligence to inform your strategic decisions and gain a competitive edge. Download the full PESTLE analysis now and unlock a deeper understanding of Baran Group's operating environment.

Political factors

Government policies and budgets for infrastructure development are a major driver for Baran Group's future projects. Increased public sector investment in key areas like transportation, water, and energy directly creates more opportunities for an international engineering and project management firm like Baran Group.

For instance, in 2024, many developed nations are prioritizing infrastructure upgrades. The United States' Infrastructure Investment and Jobs Act, with its projected $1.2 trillion in funding, is a prime example of how government commitment can fuel project pipelines. Similarly, the European Union's NextGenerationEU recovery fund allocates significant portions to green and digital infrastructure, offering substantial potential for companies like Baran Group.

The stability and consistent growth of these government-funded projects are absolutely vital for Baran Group's sustained revenue streams and the overall health of its project backlog. A robust pipeline ensures long-term predictability and supports continued investment in the company's capabilities and global reach.

Baran Group's global presence means geopolitical stability is a critical consideration. Fluctuations in political climates across its operating regions, from Europe to the Middle East, directly influence project continuity and operational safety. For instance, the ongoing political sensitivities in areas like the occupied West Bank underscore the company's vulnerability to geopolitical disruptions, potentially impacting supply chains and project timelines.

Governmental shifts in regulations impacting infrastructure, energy, and telecommunications present a dynamic environment for Baran Group. For instance, in 2024, many nations are implementing stricter environmental protection laws, such as the EU's updated emissions standards for construction machinery, which could drive demand for Baran Group's innovative, eco-friendlier engineering solutions. Conversely, streamlined permitting processes, like those seen in some Southeast Asian countries in early 2025, can expedite project timelines and reduce costs, offering significant operational advantages.

International Trade Policies and Agreements

Baran Group's global reach means international trade policies are a significant factor. Favorable trade agreements, like those within the European Union or specific bilateral pacts, streamline cross-border project execution and the import of necessary materials. For instance, the EU's single market facilitates seamless trade among member states, benefiting Baran Group's European projects.

Conversely, trade disputes and rising protectionism pose challenges. The imposition of tariffs, such as those seen in US-China trade tensions, can increase project costs and affect supply chain reliability. In 2024, ongoing geopolitical shifts continue to influence global trade dynamics, potentially impacting Baran Group's international project viability and expansion strategies.

- Trade Agreements: Baran Group benefits from agreements that reduce tariffs and non-tariff barriers, facilitating smoother international project operations.

- Tariffs and Duties: Increased tariffs on construction materials or equipment can directly inflate project costs and reduce profitability for international ventures.

- Geopolitical Stability: Trade wars or political instability in key markets can disrupt supply chains and create uncertainty for project planning and execution.

- Regulatory Harmonization: Efforts towards regulatory harmonization in trade blocs can simplify compliance and project management for multinational corporations like Baran Group.

Government Support for Renewable Energy Initiatives

Governments globally are intensifying their focus on renewable energy and sustainable growth, a trend that directly benefits companies like Baran Group. With its expertise in areas such as thermal energy storage, Baran Group is well-positioned to capitalize on this political momentum.

This governmental push for decarbonization translates into tangible market opportunities for Baran Group's specialized services in green infrastructure. For instance, in 2024, the U.S. Department of Energy announced over $700 million in funding for clean energy projects, underscoring the significant financial backing available.

- Increased government incentives: Subsidies and tax credits for renewable energy projects are becoming more prevalent.

- Supportive policy frameworks: Favorable regulations and targets for emissions reduction are driving demand for green solutions.

- Public investment in infrastructure: Governments are allocating substantial funds to develop sustainable energy grids and technologies.

Government policies directly shape Baran Group's project landscape, with infrastructure spending being a key driver. The increasing global emphasis on green initiatives and decarbonization presents significant opportunities for the company's specialized services.

Political stability and international trade agreements are crucial for Baran Group's global operations, influencing project continuity and cost-effectiveness. Conversely, geopolitical tensions and protectionist policies can create substantial challenges for supply chains and project execution.

Governments are actively promoting renewable energy, with substantial funding allocated to clean energy projects. For example, in 2024, the U.S. Department of Energy's commitment of over $700 million to clean energy initiatives highlights this trend.

Regulatory shifts, such as stricter environmental standards in the EU for construction machinery, can drive demand for Baran Group's eco-friendly solutions, while streamlined permitting processes in other regions can accelerate project timelines.

| Political Factor | Impact on Baran Group | 2024/2025 Relevance |

|---|---|---|

| Infrastructure Spending | Creates project opportunities | US Infrastructure Act ($1.2T), EU NextGenerationEU |

| Geopolitical Stability | Affects project continuity and safety | Impacted by regional conflicts and sensitivities |

| Environmental Regulations | Drives demand for green solutions | EU emissions standards for construction machinery |

| Trade Policies | Facilitates or hinders international projects | EU single market benefits, US-China trade tensions |

| Renewable Energy Support | Expands market for green services | US DOE funding ($700M+ in 2024) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the Baran Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats.

A clear, actionable summary of the Baran Group's PESTLE analysis, designed to quickly identify and address external challenges, thereby alleviating strategic planning bottlenecks.

Economic factors

The global economic landscape directly impacts Baran Group's project pipeline. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, indicating a cautious environment for large-scale infrastructure investments.

Economic downturns can significantly curb public and private sector spending on infrastructure, leading to project delays or cancellations. This directly affects Baran Group's order book and revenue streams. For example, a slowdown in construction spending in key markets could translate to lower sales volumes for the company.

Baran Group's financial performance is intrinsically linked to these macroeconomic trends. Recent financial reports for fiscal year 2024 indicated that while revenue saw a modest increase, net income experienced pressure due to rising input costs and a more competitive bidding environment, reflecting the broader economic headwinds.

Baran Group's capacity to deliver project financing, especially in emerging economies, hinges directly on the availability and cost of capital. In 2024, global interest rates, while showing signs of stabilization, still presented a significant factor in project funding costs. For instance, the average interest rate on corporate loans in emerging markets remained a key consideration for Baran Group's project viability.

The accessibility of credit markets, both banking and institutional, is paramount to Baran Group's operational success. A robust credit environment allows them to secure the substantial funding required for large-scale infrastructure and development projects. In early 2025, reports indicated a slight easing in credit conditions for well-established entities, potentially benefiting companies like Baran Group.

Inflationary pressures directly affect Baran Group's project profitability by increasing the cost of essential inputs like steel, concrete, and energy. For instance, global steel prices saw significant fluctuations in early 2024, with some benchmarks rising by over 15% compared to the previous year, directly impacting construction material expenses.

Rising raw material and labor costs can erode profit margins if not effectively passed on or mitigated through robust contract clauses and stringent cost management. The average construction labor wage in many developed economies increased by approximately 4-6% in 2024, adding to project overheads.

Baran Group's financial health hinges on its ability to forecast and manage these escalating input costs, potentially through hedging strategies or securing long-term supply agreements to stabilize expenses and maintain competitive bidding.

Currency Exchange Rate Fluctuations

Baran Group's international operations mean it's exposed to currency exchange rate risks, as earnings and costs can be in various currencies. For instance, if Baran Group has significant sales in Euros but its reporting currency is USD, a weakening Euro against the dollar directly reduces its reported USD revenue. This volatility can impact the company's reported financial results, making consistent financial forecasting a challenge.

Significant swings in exchange rates can distort Baran Group's reported financial performance when international earnings are converted back to its primary currency. For example, the US Dollar strengthened by approximately 3% against a basket of major currencies in early 2024, a trend that could negatively impact companies with substantial overseas earnings. Effective currency risk management, therefore, is crucial for maintaining stable and predictable financial outcomes for Baran Group.

Key considerations for Baran Group regarding currency fluctuations include:

- Impact on Profitability: Adverse currency movements can erode profit margins on international sales.

- Hedging Strategies: Implementing financial instruments like forward contracts or options can mitigate currency risk.

- Competitive Positioning: A strong domestic currency can make exports more expensive, affecting international competitiveness.

- Operational Adjustments: Diversifying manufacturing or sourcing across different currency zones can offer a natural hedge.

Competition in the Engineering and Construction Market

The engineering and construction market is characterized by fierce competition, with a multitude of local and global firms actively pursuing projects. Baran Group's success in winning new business hinges on its capacity to offer competitive pricing, demonstrate strong technical capabilities, and maintain a reputation for delivering projects on schedule and to a high standard.

This intense rivalry can significantly impact profitability and market positioning. For instance, in 2024, the global construction market, valued at approximately $11.7 trillion, saw increased bidding activity across major infrastructure and building projects, intensifying pressure on margins for established players like Baran Group.

- Intensified Bidding: Increased number of bidders on large-scale projects in 2024 led to an average bid price reduction of 5-10% for awarded contracts in key regions.

- Price Sensitivity: Clients are increasingly prioritizing cost-effectiveness, forcing companies to optimize operational expenses to remain competitive.

- Innovation as a Differentiator: Companies adopting advanced technologies like AI-driven project management and sustainable building practices are gaining a competitive edge.

Global economic growth influences infrastructure spending, with the IMF projecting 3.2% global growth in 2024. Inflationary pressures, like a 15% rise in steel prices in early 2024, directly impact Baran Group's material costs, while rising labor wages, around 4-6% in 2024 in developed economies, further squeeze margins.

Currency fluctuations, such as the 3% strengthening of the US Dollar against major currencies in early 2024, can significantly affect Baran Group's international earnings and reported profitability.

Intense market competition, with the global construction market valued at $11.7 trillion in 2024, leads to price sensitivity and an average bid price reduction of 5-10% on awarded contracts in key regions, forcing companies to innovate to maintain a competitive edge.

Same Document Delivered

Baran Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Baran Group provides actionable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. You’ll gain a deep understanding of the external landscape shaping their strategic decisions.

Sociological factors

Global population is projected to reach approximately 8.5 billion by 2030, with a significant portion of this growth occurring in urban areas. This trend fuels a consistent demand for Baran Group's expertise in developing and modernizing infrastructure, from housing to transportation.

Urbanization rates are accelerating, with over 55% of the world's population already living in cities, a figure expected to rise to nearly 70% by 2050. This expansion necessitates substantial investment in new construction and upgrades to existing systems, directly benefiting companies like Baran Group that specialize in national infrastructure projects.

Large infrastructure undertakings by Baran Group, such as the Jerusalem Light Rail, profoundly influence local populations. Positive public perception and proactive community engagement are critical for smooth project execution, preventing costly delays and opposition. For instance, in 2024, public consultations for a new transit line in Tel Aviv involved over 5,000 residents, demonstrating the scale of engagement needed.

The engineering and construction sector, crucial for companies like Baran Group, faces significant challenges with workforce availability and skill shortages. A report from the Bureau of Labor Statistics in late 2024 indicated a persistent deficit in skilled trades, with demand outpacing supply for roles like construction managers and specialized engineers. This scarcity directly impacts labor costs and can cause project timelines to stretch, as seen in several large-scale infrastructure projects across North America.

Baran Group, employing 1,041 individuals as of their latest reporting in early 2025, must proactively address these trends. Investing in robust talent acquisition strategies and implementing comprehensive retention programs are vital to mitigate the risks of increased labor expenses and potential quality compromises. The company's success hinges on its ability to attract and keep the specialized talent needed to execute complex projects efficiently.

Health, Safety, and Well-being Standards

Societal expectations for robust health, safety, and well-being standards within the construction and engineering sectors are escalating. Companies like Baran Group are increasingly judged not just on project delivery but on their commitment to protecting their workforce and the communities they operate in. This heightened awareness is driven by a greater understanding of the long-term impacts of accidents and occupational health issues.

Adherence to stringent safety protocols is no longer merely a compliance issue; it's a cornerstone of corporate reputation and a significant factor in risk management. For instance, in 2023, the UK construction industry reported 61,000 non-fatal injuries, highlighting the ongoing need for vigilance. Companies that actively invest in and demonstrate superior safety practices often see reduced insurance premiums and fewer costly legal battles, directly impacting their financial performance.

Prioritizing employee well-being extends beyond physical safety to encompass mental health and overall quality of life. This commitment is becoming a key differentiator in attracting and retaining talent. A 2024 survey indicated that over 70% of job seekers consider a company's health and safety record a crucial factor in their decision-making process. Baran Group's proactive approach to these standards can therefore translate into a competitive advantage in the labor market.

- Rising Societal Expectations: Public demand for higher safety benchmarks in construction is a growing trend.

- Reputational and Financial Impact: Strict adherence reduces legal risks and enhances brand image, as evidenced by the 2023 UK construction injury statistics.

- Talent Attraction: A strong well-being focus is critical for attracting and retaining skilled employees, with over 70% of job seekers prioritizing safety in 2024.

- Corporate Social Responsibility: Demonstrating a commitment to employee and community welfare is a key element of modern corporate responsibility.

Changing Lifestyle Preferences and Infrastructure Demand

Societal preferences are shifting dramatically, with a growing emphasis on smart city integration and sustainable living. This trend directly impacts infrastructure development, pushing for projects that incorporate advanced technology and eco-friendly designs. For instance, the global smart cities market was valued at approximately $400 billion in 2023 and is projected to reach over $1 trillion by 2030, highlighting the significant demand for such innovations.

Baran Group is well-positioned to capitalize on these evolving lifestyle demands. Their proven expertise in developing smart infrastructure solutions and eco-conscious building practices aligns perfectly with what consumers and governments are increasingly seeking. This strategic alignment is crucial for maintaining market competitiveness and driving future growth.

Key areas of influence include:

- Increased demand for green building certifications: As of early 2024, over 100,000 LEED-certified projects have been completed globally, demonstrating a strong market preference for sustainable construction.

- Growth in smart home and city technologies: The adoption of IoT devices in urban environments is accelerating, with smart city investments expected to exceed $300 billion by 2026.

- Focus on resilient and sustainable infrastructure: Climate change concerns are driving investment in infrastructure that can withstand environmental challenges, with a particular emphasis on renewable energy integration and water management systems.

Societal shifts toward sustainability and smart city integration are creating new market opportunities for infrastructure developers like Baran Group. Growing consumer and governmental demand for eco-friendly and technologically advanced projects directly aligns with the company's expertise. This trend is underscored by the projected growth of the smart cities market, expected to surpass $1 trillion by 2030.

Technological factors

Baran Group's engineering operations are significantly impacted by advancements in software. The adoption of AI and digital twins is transforming how projects are designed and managed. For instance, AI-powered simulation tools can reduce design iteration times by up to 30% in complex infrastructure projects, a key area for Baran Group.

Digital twins offer a virtual mirror of physical assets, enabling predictive maintenance and risk mitigation. This technology is proving invaluable in optimizing the lifecycle of large-scale constructions, potentially cutting operational costs by 10-15% according to industry reports from late 2024. Such efficiencies directly benefit Baran Group's project delivery and profitability.

New construction methods and the development of advanced, sustainable materials are significantly transforming how projects are executed. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to reach over $500 billion by 2030, showcasing a strong growth trend.

The adoption of eco-friendly materials, such as green concrete or recycled steel, not only minimizes environmental footprints but also directly addresses the increasing global demand for sustainable construction practices. This shift is driven by stricter environmental regulations and growing consumer awareness.

Baran Group can strategically leverage these technological innovations to achieve substantial improvements in project efficiency, potentially reducing construction timelines by up to 15% on certain projects. Furthermore, these advancements offer opportunities to lower operational costs and significantly enhance the overall quality and durability of their developments.

The integration of smart technologies is revolutionizing infrastructure, making it more efficient and responsive. Think of intelligent transportation systems that optimize traffic flow and smart grids that manage energy distribution more effectively. Connected urban environments are also becoming a reality, enhancing city living.

Baran Group's expertise in telecommunication and technology solutions is a significant advantage here. This allows the company to seamlessly incorporate these advanced smart elements into its infrastructure projects, offering clients cutting-edge, future-proof developments.

For instance, the global smart infrastructure market was valued at approximately $1.1 trillion in 2023 and is projected to reach $3.1 trillion by 2030, growing at a CAGR of over 15%. This growth underscores the immense opportunity for companies like Baran Group that can leverage technological advancements.

Development of Renewable Energy Technologies

Rapid advancements in solar, wind, and thermal energy storage (TES) technologies are significantly influencing the energy sector, directly impacting Baran Group's operations. These innovations are making renewable energy sources increasingly competitive and reliable.

Baran Group's strategic collaboration with Brenmiller Energy exemplifies its proactive approach to capitalizing on these technological leaps. This partnership focuses on accelerating the deployment of TES projects, a key area for enhancing grid stability and energy efficiency.

The aim of this cooperation is twofold: to establish a stream of long-term, recurring revenue for Baran Group and to contribute to the reduction of greenhouse gas emissions. For instance, Brenmiller's TES systems can store excess solar or wind energy, making it available when needed, thereby reducing reliance on fossil fuels.

Key technological advancements to watch include:

- Improvements in solar panel efficiency: Recent breakthroughs have pushed solar panel efficiencies beyond 25%, making solar installations more cost-effective.

- Enhanced wind turbine design: Larger and more aerodynamic wind turbines are capturing more energy, even in lower wind speeds.

- Cost reductions in battery storage: The price of lithium-ion batteries, crucial for TES, has fallen dramatically, making storage solutions more accessible.

- Growth in green hydrogen production: Advancements in electrolysis are making hydrogen a viable clean energy carrier.

Cybersecurity and Data Protection in Project Management

As engineering and project management increasingly move online, cybersecurity risks are a major concern. Data breaches can severely damage a company's reputation and client relationships.

Protecting sensitive project information, including intellectual property and client data, is crucial for maintaining trust and operational continuity. For a firm like Baran Group, managing high-value projects means robust security is non-negotiable.

The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial implications of security failures. In 2024, the average cost of a data breach for organizations was $4.45 million.

Key considerations for Baran Group include:

- Implementing advanced threat detection and response systems.

- Ensuring compliance with evolving data protection regulations, such as GDPR and CCPA.

- Conducting regular security audits and employee training to mitigate human error.

- Developing comprehensive incident response plans to address potential breaches effectively.

Technological advancements are reshaping Baran Group's operational landscape, particularly through AI and digital twins. These tools enhance design efficiency, with AI simulations potentially cutting iteration times by up to 30% in complex projects. Digital twins offer predictive maintenance, aiming to reduce operational costs by 10-15%.

The integration of smart technologies in infrastructure, like intelligent transport systems and smart grids, presents significant growth opportunities. The global smart infrastructure market is expected to reach $3.1 trillion by 2030, with a CAGR exceeding 15%.

Baran Group's strategic focus on renewable energy, exemplified by its partnership with Brenmiller Energy for thermal energy storage, capitalizes on advancements in solar, wind, and battery technologies. These innovations are crucial for grid stability and reducing reliance on fossil fuels.

The increasing reliance on digital platforms elevates cybersecurity risks, with global cybercrime costs projected to hit $10.5 trillion annually by 2025. Robust security measures are therefore paramount for protecting sensitive project data and maintaining client trust.

Legal factors

Baran Group's global operations demand meticulous compliance with a complex web of international and local construction regulations. For instance, in 2024, the European Union continued to emphasize stringent environmental and safety standards in construction, impacting material sourcing and building practices. Failure to adhere to these diverse legal frameworks, such as obtaining necessary operational permits in countries like Germany or Israel, can result in substantial financial penalties, estimated to be in the millions of dollars for major infractions, and can severely disrupt project timelines.

Baran Group's operations, particularly in water, energy, and environmental sectors, are heavily influenced by environmental protection laws. These regulations mandate rigorous permitting processes, ensuring projects adhere to standards for emissions, waste management, and ecological preservation. For instance, in 2024, the European Union continued to strengthen its Green Deal initiatives, impacting infrastructure projects with stricter environmental impact assessments, potentially increasing project timelines and costs for compliance.

Compliance with these legal frameworks is not just a procedural step but a critical determinant of project viability and execution. Failure to meet requirements concerning pollution control or habitat protection can lead to significant delays, fines, or outright project cancellation. Baran Group's success hinges on its ability to navigate this complex legal landscape, demonstrating a profound understanding of environmental legislation to secure necessary approvals and maintain operational integrity throughout 2024 and into 2025.

Baran Group, with over 1,000 employees globally, navigates a complex web of labor laws. These regulations govern everything from minimum wage requirements, which saw an average increase of 4.5% across OECD countries in 2024, to workplace safety standards. Ensuring compliance is paramount to prevent costly legal battles and maintain a stable workforce.

The company must also adhere to specific employment contract stipulations and working condition mandates that vary by jurisdiction. For instance, in 2024, the International Labour Organization (ILO) reported that 95% of its member states have ratified conventions on occupational safety and health, highlighting the global emphasis on these areas. Failure to comply can lead to significant fines and reputational damage.

Contract Law and Dispute Resolution

Baran Group's involvement in large-scale projects necessitates a deep understanding of contract law, both domestically and internationally. This expertise is crucial for managing the intricate web of agreements with various stakeholders, ensuring smooth project execution and minimizing potential legal entanglements. For instance, in 2024, construction contract disputes globally continued to be a significant concern, with average claim values often running into millions of dollars, highlighting the financial impact of poorly managed contracts.

Effective dispute resolution mechanisms are paramount for Baran Group. The ability to navigate arbitration, mediation, and litigation efficiently can save considerable time and resources, protecting the company's financial interests and reputation. In 2025, the global construction industry is projected to see a continued rise in the use of alternative dispute resolution (ADR) methods, with many firms reporting faster resolution times and lower costs compared to traditional court proceedings.

- Contractual Complexity: Baran Group manages numerous contracts for large projects, requiring robust legal oversight.

- Risk Mitigation: Expertise in contract law helps mitigate financial and operational risks associated with project agreements.

- Dispute Resolution Efficiency: Swift and effective resolution of disputes is key to maintaining project timelines and profitability.

- Stakeholder Agreements: Navigating diverse legal frameworks for international and local stakeholders is essential.

Data Privacy and Intellectual Property Laws

As Baran Group increasingly leverages digital platforms for engineering and project management, navigating data privacy laws like GDPR and its global counterparts is paramount. Failure to comply can lead to significant fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher. Protecting intellectual property, including proprietary designs and client data, is also critical for maintaining a competitive edge and client trust in the engineering sector.

Key considerations for Baran Group include:

- Data Protection Compliance: Ensuring all data handling practices align with current and upcoming data privacy regulations, such as the California Privacy Rights Act (CPRA) which came into full effect in 2023, impacting data collection and usage for businesses operating in California.

- Intellectual Property Safeguarding: Implementing robust measures to protect sensitive design files, technological innovations, and confidential client information from unauthorized access or disclosure.

- Cybersecurity Investment: Allocating resources to advanced cybersecurity solutions to prevent data breaches, which can severely damage reputation and incur substantial recovery costs.

- Contractual Clarity: Establishing clear contractual terms with clients and partners regarding data ownership, usage, and protection to mitigate legal risks.

Baran Group's global operations are subject to a complex array of legal and regulatory frameworks. In 2024, heightened scrutiny on environmental compliance, particularly within the EU's Green Deal, mandates rigorous adherence to emissions and waste management standards, potentially increasing project costs. Labor laws, with minimum wage increases averaging 4.5% in OECD countries during 2024, and strict workplace safety regulations are critical for maintaining a stable workforce and avoiding legal disputes. The company's extensive contractual obligations require expert navigation of contract law and efficient dispute resolution, as construction contract disputes globally continued to represent significant financial exposure in 2024.

Data privacy laws, such as GDPR and CPRA, are increasingly impacting Baran Group's digital operations, necessitating robust protection of intellectual property and client data to avoid substantial fines, potentially up to 4% of global turnover. The company must also navigate diverse international and local regulations concerning permits, land use, and building codes, with non-compliance risking millions in penalties and project delays. Ensuring legal compliance across all facets of its business is paramount for Baran Group's sustained operational integrity and profitability through 2025.

Environmental factors

Climate change is a growing concern, with extreme weather events becoming more frequent and intense. This trend directly impacts the infrastructure sector, demanding a shift towards more resilient designs. Baran Group, as an infrastructure specialist, needs to embed climate resilience into its core planning and design strategies to guarantee the long-term safety and viability of its projects.

This means proactively addressing potential threats like increased flooding, stronger storms, and other environmental shifts. For instance, incorporating advanced flood control systems and materials capable of withstanding higher wind speeds are crucial. The World Meteorological Organization reported that in 2023, the global average temperature was approximately 1.45°C above pre-industrial levels, underscoring the urgency of adapting infrastructure to these changing conditions.

The increasing global focus on sustainability is a significant driver for Baran Group. This trend translates into a growing demand for eco-friendly materials, energy-efficient building designs, and projects aiming for net-zero emissions. For instance, the global green building market was valued at approximately USD 288.1 billion in 2023 and is projected to reach USD 735.7 billion by 2030, demonstrating substantial growth potential.

Baran Group's established commitment to providing sustainable engineering solutions positions it favorably to capitalize on these evolving market demands. Opportunities are particularly strong in green infrastructure development and environmentally conscious construction projects, areas where sustainable practices are not just preferred but increasingly mandated.

By actively integrating and showcasing sustainable practices throughout its operations and project delivery, Baran Group can effectively differentiate itself from competitors. This focus on sustainability can attract clients who prioritize environmental responsibility and align with the company's core values, potentially leading to enhanced brand reputation and market share.

Baran Group, as a specialist in water projects, is significantly influenced by the escalating global water scarcity and the growing imperative for effective water resource management. Their core business, encompassing water treatment and delivery systems, directly addresses these critical environmental challenges.

The demand for sustainable water solutions is projected to grow substantially, presenting a significant growth opportunity for Baran Group. For instance, the global water and wastewater treatment market was valued at approximately $650 billion in 2023 and is expected to reach over $1 trillion by 2030, indicating a robust expansion in the sector.

Waste Management and Pollution Control

The engineering and construction sector, where Baran Group operates, inherently produces significant waste and has the potential to cause pollution if not handled with care. For instance, in 2024, construction and demolition waste in the EU was estimated at 897 million tonnes, representing about 35% of total waste generated. This highlights the critical need for robust waste management.

Increasingly stringent environmental regulations globally are compelling companies like Baran Group to adopt advanced waste management and pollution control systems. These measures are crucial from the initial planning stages through to project completion to ensure legal compliance and reduce environmental impact. For example, the UK's Environment Act 2021 introduced measures to improve air quality and manage waste more effectively, impacting construction projects.

Baran Group's commitment to sustainability means implementing strategies that:

- Minimize waste generation through efficient design and material selection.

- Maximize recycling and reuse of construction materials, aiming for circular economy principles.

- Control emissions and effluents to meet or exceed regulatory standards, protecting air and water quality.

- Invest in technologies and training for better environmental performance on-site.

Renewable Energy Transition Demand

The global shift towards renewable energy is a major driver for infrastructure and engineering firms. This transition is creating substantial demand for services that support the development and implementation of clean energy solutions. For instance, the International Energy Agency (IEA) reported in early 2024 that global renewable capacity additions are projected to increase by over 30% in 2024 compared to 2023, reaching nearly 500 gigawatts (GW).

Baran Group is well-positioned to capitalize on this trend, given its existing expertise in gas and energy projects. The company's engagement with hybrid and solar power systems, alongside thermal energy storage solutions, directly aligns with the market's growing needs. This diversification into renewable technologies allows Baran Group to tap into a rapidly expanding sector.

The ongoing commitment to decarbonization worldwide is a direct catalyst for new project opportunities. Governments and corporations are setting ambitious emissions reduction targets, which necessitates significant investment in renewable infrastructure. In 2023, global investment in energy transitions reached $1.8 trillion, according to BNEF, highlighting the scale of this economic shift.

- Growing Demand: Global renewable energy capacity additions are expected to see a significant increase in 2024, building on strong growth in previous years.

- Strategic Alignment: Baran Group's involvement in solar, hybrid systems, and energy storage directly addresses key areas of this transition.

- Decarbonization Impact: Ambitious climate goals are translating into substantial project pipelines for companies in the renewable energy sector.

- Investment Trends: The energy transition is attracting trillions of dollars in investment, signaling robust market growth for the foreseeable future.

Climate change necessitates resilient infrastructure, with global temperatures rising significantly, as noted by the WMO in 2023. Baran Group must integrate climate adaptation into its designs, addressing threats like floods and storms. The growing demand for green buildings, a market valued at $288.1 billion in 2023, presents a key opportunity for Baran Group's sustainable solutions.

Water scarcity and efficient management are critical environmental factors impacting Baran Group's water projects. The water and wastewater treatment market, valued at $650 billion in 2023, shows substantial growth potential. Baran Group's expertise in this area positions it to address these global challenges and capitalize on market expansion.

The construction sector's environmental footprint, including waste generation (35% of EU total waste in 2024), demands robust management. Stricter regulations, like the UK's Environment Act 2021, require advanced pollution control. Baran Group must prioritize waste minimization, material reuse, and emission control to ensure compliance and sustainability.

The global shift to renewable energy is a major driver, with capacity additions projected to increase by over 30% in 2024, according to the IEA. Baran Group's experience in solar, hybrid systems, and energy storage aligns with this trend. Decarbonization efforts are attracting significant investment, with $1.8 trillion invested in energy transitions in 2023, creating substantial project opportunities.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Baran Group is meticulously crafted using data from reputable sources including government publications, international economic bodies, and leading industry research firms. We ensure that every political, economic, social, technological, legal, and environmental insight is grounded in current and verifiable information.