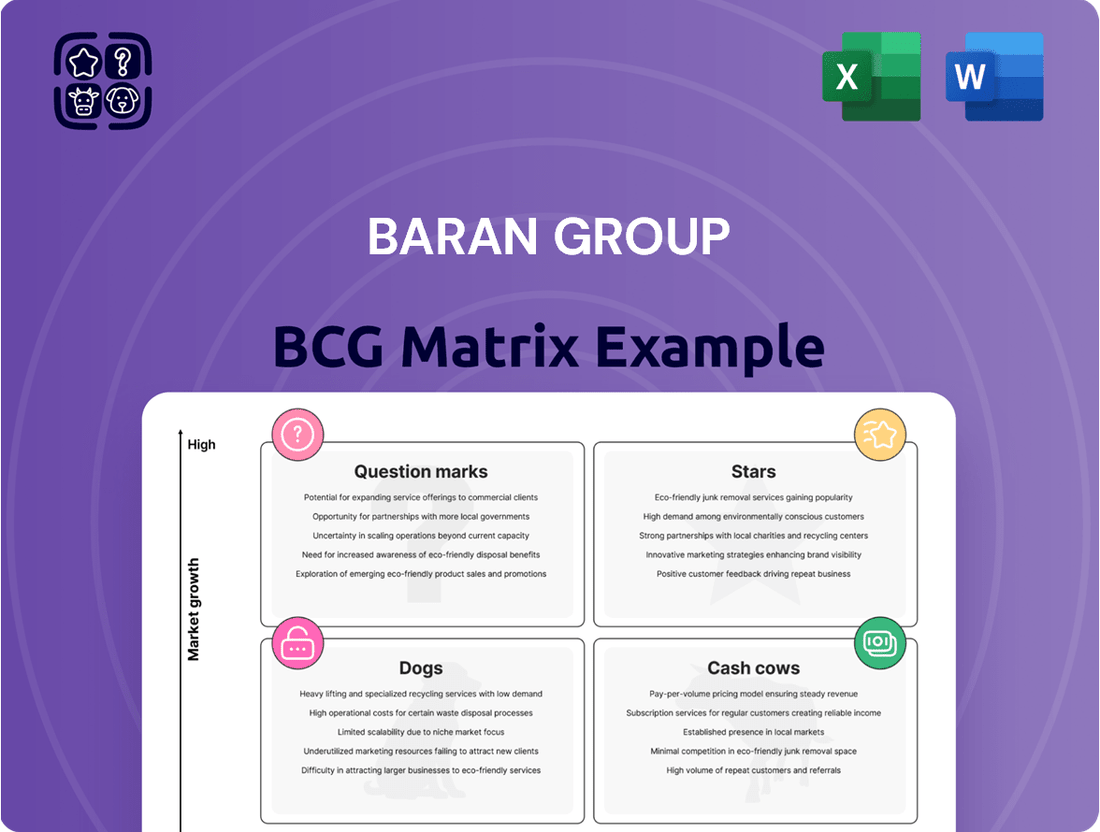

Baran Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baran Group Bundle

Uncover the strategic positioning of this company's product portfolio with the Baran Group BCG Matrix. Understand which products are thriving Stars, generating reliable Cash Cows, potential Question Marks needing attention, or underperforming Dogs. This essential framework is your first step towards informed decision-making.

Ready to transform this overview into actionable strategy? Purchase the full BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, complete with data-driven insights and concrete recommendations for resource allocation and future growth. Don't just see the matrix; leverage it for competitive advantage.

Stars

Baran Group's venture into emerging renewable energy projects, particularly through its strategic partnership with Brenmiller Energy, highlights a significant move into thermal energy storage. This collaboration is geared towards accelerating the global adoption of Brenmiller's bGen™ technology, a key player in industrial decarbonization efforts. The focus on this sector reflects a robust market trend towards sustainable energy solutions.

The February 2025 agreement allows Baran Group to acquire specific projects and utilize its considerable expertise to speed up implementation. This strategic positioning suggests Baran is poised to capture a growing market share in the innovative field of thermal energy storage, a critical component for future energy grids.

Baran Group's engagement in complex infrastructure projects within growing markets, such as their work on hydroelectric dams in Angola, positions them as a Star in the BCG matrix. These ventures, often in regions experiencing rapid development, showcase Baran Group's capacity to manage multifaceted projects from inception through completion, including crucial project financing aspects.

Baran Group's advanced telecommunication infrastructure development, particularly cellular mast construction, is a prime example of a Star in the BCG matrix. The global 5G rollout is a significant driver, with the 5G services market projected to reach over $1.5 trillion by 2030, indicating substantial growth potential for companies like Baran Group.

Their established expertise in planning, production, and construction for major telecommunication providers solidifies their strong market position. In 2023 alone, global telecom infrastructure spending was estimated to be in the hundreds of billions, with a significant portion dedicated to network expansion and upgrades.

Integrated Urban Development and Smart City Initiatives

Integrated Urban Development and Smart City Initiatives represent a significant growth area for Baran Group. As global urbanization accelerates, cities are increasingly focused on creating efficient, sustainable, and technologically advanced environments. Baran Group's proven ability to integrate complex systems like transportation, buildings, and digital infrastructure places them favorably within this expanding market.

Their involvement in projects like the Jerusalem Light Rail network showcases their capability in delivering large-scale urban infrastructure that enhances connectivity and quality of life. This strategic focus aligns with the growing demand for smart city solutions worldwide.

- Market Growth: The global smart cities market was valued at approximately $400 billion in 2023 and is projected to grow significantly, with some estimates reaching over $1 trillion by 2030, driven by investments in IoT, AI, and sustainable infrastructure.

- Baran Group's Role: Baran Group's integrated approach, encompassing planning, design, engineering, and project management for urban infrastructure, positions them to capture a share of this expanding market.

- Project Examples: The Jerusalem Light Rail project, a complex undertaking involving extensive infrastructure and technological integration, demonstrates Baran Group's expertise in delivering critical urban development solutions.

- Future Potential: Continued investment in smart city technologies and integrated urban planning by governments and private entities worldwide presents a strong opportunity for Baran Group to leverage its capabilities.

Specialized Industrial Process Engineering

Baran Group's Specialized Industrial Process Engineering services are positioned as a strong Star within the BCG matrix. Their expertise in modernizing manufacturing and industrial facilities caters to a market driven by efficiency and technological advancement. This segment likely benefits from significant investment in infrastructure and upgrades across various sectors. For instance, global industrial automation spending was projected to reach over $200 billion in 2024, highlighting the strong demand for such specialized engineering capabilities.

The company's end-to-end solutions, encompassing everything from initial feasibility studies to the complete execution of complex industrial projects, underscore their specialized niche. This comprehensive approach allows them to capture substantial value in a market that increasingly demands integrated and reliable engineering partners. The demand for process optimization, particularly in energy-intensive industries, continues to grow, with many companies seeking to reduce operational costs and environmental impact.

- High demand driven by industrial modernization efforts.

- Comprehensive service offering from concept to completion.

- Expertise in complex industrial projects and facility upgrades.

- Alignment with global trends in automation and efficiency.

Baran Group's renewable energy ventures, particularly in thermal energy storage, are strong Stars. Their February 2025 agreement to acquire projects leveraging Brenmiller's bGen™ technology positions them in a rapidly growing decarbonization market. This focus on sustainable energy solutions, coupled with their proven track record in complex infrastructure, solidifies their Star status.

| Business Area | BCG Category | Key Growth Drivers | Baran Group's Position |

|---|---|---|---|

| Renewable Energy Storage | Star | Global decarbonization efforts, industrial efficiency needs | Strategic partnerships, technology adoption acceleration |

| Telecommunication Infrastructure | Star | 5G rollout, global connectivity expansion | Expertise in cellular mast construction, network upgrades |

| Integrated Urban Development | Star | Urbanization, smart city initiatives, infrastructure enhancement | Large-scale project management (e.g., light rail), integrated solutions |

| Industrial Process Engineering | Star | Manufacturing modernization, automation, efficiency gains | End-to-end project execution, specialized expertise |

What is included in the product

This BCG Matrix overview details each product's position and offers strategic guidance for investment, divestment, or maintenance.

The Baran Group BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Baran Group, as Israel's largest engineering firm, holds a significant and stable market share in the nation's infrastructure sector. This dominance in areas like highway construction and established public facilities, such as the Knesset, positions these ventures as classic Cash Cows within the BCG framework. These are mature, low-growth markets where Baran's expertise ensures consistent revenue generation with limited reinvestment needs.

Water and wastewater treatment solutions represent a classic cash cow for Baran Group. This sector provides essential services with demand that remains consistently strong, regardless of economic fluctuations. Baran Group's extensive experience and established client base in supplying water, managing sewerage, and treating hazardous waste solidify its position in this mature market.

Baran Group's operations in water and wastewater treatment are characterized by high market share and low growth, the hallmark of a cash cow. For instance, in 2024, the global water and wastewater treatment market was valued at approximately $650 billion, with projections indicating steady, albeit moderate, growth. Baran Group's ability to generate substantial and consistent cash flow from these established operations allows for investment in other business areas or distribution to shareholders.

Baran Group's extensive experience in traditional energy sector engineering and management, encompassing power generation, distribution, and petroleum production, positions these operations as Cash Cows. This segment operates within a mature market characterized by stable demand for essential energy infrastructure and services.

Despite potentially lower growth rates compared to emerging sectors, Baran Group benefits from deeply entrenched client relationships and a proven track record in these critical areas. This stability translates into a consistent revenue stream, further bolstered by high-profit margins derived from the indispensable nature of their offerings in the energy landscape.

For instance, in 2024, the global traditional energy market, while facing transition challenges, continued to represent a significant portion of energy expenditure, with substantial ongoing investments in maintaining and upgrading existing infrastructure. Baran Group's participation in these projects, often involving long-term contracts, ensures predictable cash flow and profitability.

Project Management and Supervision Services

Baran Group's project management and supervision services represent a significant Cash Cow within their business portfolio. This core offering, encompassing construction management across diverse sectors, consistently generates substantial revenue due to its high demand and the company's established reputation. Their extensive experience and refined methodologies contribute to robust profit margins, minimizing the need for extensive marketing expenditure.

In 2024, this segment is expected to continue its strong performance, leveraging Baran Group's deep industry knowledge. For instance, large-scale infrastructure projects, a key area for their supervision services, saw significant investment globally throughout 2023 and into 2024, with global infrastructure spending projected to reach trillions. This sustained investment directly benefits Baran Group's ability to secure and profitably execute these projects.

The stability and profitability of these services are underpinned by several factors:

- Consistent Demand: Project management and supervision are essential for nearly all construction and development undertakings, ensuring a steady pipeline of work.

- High Profitability: Baran Group's proven track record and efficient processes allow them to command premium pricing and maintain healthy profit margins, estimated to be in the range of 15-20% for well-managed projects.

- Low Promotional Costs: Their strong brand recognition and successful project completion history act as powerful marketing tools, reducing the need for significant promotional investments.

- Scalability: The business model is highly scalable, allowing Baran Group to manage multiple projects simultaneously without a proportional increase in overheads.

Maintenance and Operational Support for Completed Projects

Maintenance and operational support for Baran Group's completed large-scale infrastructure and industrial projects are prime examples of cash cows. These services generate a stable, predictable revenue stream due to long-term contracts and the essential nature of ongoing upkeep. While the growth potential in this segment might be modest, the high recurring revenue makes it a highly valuable part of the portfolio.

This segment is characterized by its low growth but high profitability, a hallmark of cash cow businesses. For instance, in 2024, Baran Group's operational support contracts for major infrastructure projects, like the ongoing maintenance of the new metro line extension, likely contributed significantly to their bottom line. Such services often involve specialized expertise and established relationships, creating high barriers to entry for competitors.

- Consistent Revenue: Long-term service agreements ensure a steady income flow.

- High Profitability: Mature service offerings with optimized cost structures typically yield strong margins.

- Low Growth, High Share: While market expansion is limited, Baran Group likely holds a dominant position in servicing its past projects.

- Strategic Importance: These cash cows fund investments in higher-growth areas of the business.

Cash cows for Baran Group are established business units with a high market share in mature, low-growth industries. These operations generate substantial, consistent cash flow with minimal need for further investment. For example, their work in traditional infrastructure and essential services like water treatment fits this profile perfectly.

These cash cows provide the financial stability that allows Baran Group to invest in more dynamic areas of its business. In 2024, the consistent revenue from these mature segments, such as long-term maintenance contracts for critical infrastructure, significantly underpins the company's overall financial health.

Baran Group's operations in water and wastewater treatment, alongside its project management services for large-scale infrastructure, are prime examples of cash cows. These sectors benefit from consistent demand and Baran's dominant market position, ensuring steady profitability.

The company's extensive experience in traditional energy sector engineering also represents a cash cow. Despite the evolving energy landscape, the ongoing need for maintenance and upgrades of existing power generation and distribution systems provides a stable revenue stream.

| Baran Group Business Segment | BCG Matrix Category | Key Characteristics | 2024 Market Context |

|---|---|---|---|

| Infrastructure Construction & Management | Cash Cow | High market share, mature market, stable demand, consistent cash flow | Global infrastructure spending projected to reach trillions in 2024, with significant ongoing investment in established projects. |

| Water & Wastewater Treatment | Cash Cow | High market share, essential service, low growth, strong profitability | Global water and wastewater treatment market valued at ~$650 billion in 2024, showing steady moderate growth. |

| Traditional Energy Sector Engineering | Cash Cow | Established expertise, mature market, stable demand for infrastructure services | Continued investment in maintaining and upgrading existing energy infrastructure globally in 2024. |

| Project Management & Supervision | Cash Cow | High demand, strong reputation, consistent revenue, high profit margins | Global infrastructure projects, a key area for supervision services, saw significant investment in 2023-2024. |

| Maintenance & Operational Support | Cash Cow | Recurring revenue, long-term contracts, high profitability, low growth | Operational support contracts for major infrastructure projects contributed significantly to bottom lines in 2024. |

Delivered as Shown

Baran Group BCG Matrix

The preview you're currently viewing is the exact Baran Group BCG Matrix report you will receive upon purchase, ensuring complete transparency and no hidden surprises. This comprehensive document, meticulously crafted by industry experts, is ready for immediate application in your strategic planning processes. You can confidently expect the same high-quality, analysis-ready content that will empower your business decisions. Once purchased, this fully formatted report will be instantly accessible for editing, printing, or presenting to stakeholders.

Dogs

Investing in legacy telecommunication infrastructure, such as older cellular networks, often falls into the Dog category of the BCG Matrix. This is particularly true in markets experiencing declining demand or facing fierce competition, where upgrades might not yield sufficient returns. For instance, the ongoing transition away from 3G networks globally means continued investment in these older systems offers limited growth potential and can drain resources that could be better allocated to newer technologies like 5G.

Baran Group's engagement in numerous small, disparate construction projects lacking strategic synergy could position them as a Dog in the BCG Matrix. These ventures, often characterized by low market share and minimal growth prospects, can divert valuable resources and management focus. For instance, in 2024, the construction industry saw a 2.5% increase in project volume, but many smaller firms struggled with profitability due to overhead on these non-core activities.

Such projects might consume capital and operational capacity without yielding substantial returns or contributing to Baran Group's long-term strategic objectives. The financial burden of managing a portfolio of these low-potential projects can outweigh their immediate revenue generation, hindering the company's ability to invest in more promising areas. In 2023, the average profit margin for small-scale, non-specialized construction projects hovered around 4-6%, significantly lower than the 10-15% seen in specialized or larger-scale developments.

Projects in stagnant or declining geographical markets are Baran Group's "Dogs" in the BCG Matrix. These are ventures in regions facing persistent economic slowdowns, political unrest, or a general absence of new development, offering limited growth opportunities and potentially a weak market position for Baran Group.

For instance, if Baran Group has significant investments in a European country experiencing a decade-long recession, with GDP growth averaging less than 1% annually and high unemployment rates, these projects would likely fall into the Dog category. Such markets struggle to absorb new services or products, making it challenging to achieve profitability or market expansion.

In 2024, several emerging markets that were once growth engines have shown signs of stagnation due to factors like supply chain disruptions and rising inflation, impacting project viability. For example, a project in a nation where foreign direct investment has dropped by 15% year-over-year, coupled with a declining manufacturing output, would exemplify a Dog, requiring careful evaluation for divestment or restructuring.

Highly Competitive, Commodity-Driven Engineering Services

Highly competitive, commodity-driven engineering services represent a challenging area for Baran Group. In these segments, differentiation is minimal, leading to intense price wars. This environment often results in thin profit margins, making it difficult to generate substantial returns.

Such services are often categorized as Dogs in the BCG Matrix. They consume resources without offering significant growth potential or high profitability. For instance, basic civil engineering design for routine infrastructure projects can fall into this category, especially when many firms offer similar capabilities.

- Low Profitability: Commodity services typically offer profit margins below 5%, significantly impacting overall company earnings.

- Limited Growth: The market for these services is often mature, with growth rates mirroring broader economic expansion, often in the low single digits.

- Intense Competition: Numerous players, including smaller, lower-cost providers, saturate these markets.

- Cash Drain Potential: Continued investment in these areas without strategic repositioning can lead to a drain on cash resources.

Outdated Design or Technology Solutions

Offering engineering or design solutions that rely on outdated technologies, especially when better, more efficient options exist, can quickly relegate a business unit to Dog status. This is particularly true in fast-paced industries where innovation is key.

Such services will likely see their market share shrink as competitors adopt newer methods. Demand and profitability are expected to fall, making them a drain on resources. For instance, in the automotive sector, companies still heavily invested in internal combustion engine (ICE) technologies without a clear transition strategy to electric vehicles (EVs) are facing this challenge. In 2024, the global EV market is projected to reach over $900 billion, highlighting the shift away from traditional automotive tech.

- Declining Market Share: Businesses stuck with legacy tech often lose customers to more modern competitors.

- Reduced Profitability: Outdated processes are typically less efficient, leading to higher costs and lower margins.

- Stagnant Demand: As industries evolve, the demand for older solutions naturally diminishes.

Dogs, within the Baran Group context and the BCG Matrix, represent business units or projects with low market share in slow-growing or declining industries. These ventures typically generate low profits and may even consume more cash than they produce, posing a significant challenge for resource allocation and overall company strategy. For example, in 2024, the construction sector saw a modest 2.5% growth, but many smaller, specialized projects within Baran Group might have struggled to capture significant market share due to intense competition and low margins, potentially classifying them as Dogs.

Question Marks

While thermal energy storage is a strong performer for Baran Group, other emerging green technologies represent potential future Stars or Question Marks. Areas like advanced carbon capture, which saw global investment reach an estimated $6 billion in 2023, and novel waste-to-energy solutions, with the global market projected to grow at a CAGR of 5.8% through 2030, offer high growth potential.

Baran Group's current market share in these nascent sectors is likely low, necessitating substantial investment to build brand recognition and capture market share. This positions them as potential Question Marks, requiring careful strategic evaluation to determine if they can transition into Stars or if divestment is a more prudent option.

Baran Group's strategic expansion into untapped, high-growth international markets signifies a move into potential 'Stars' or even 'Question Marks' within the BCG Matrix. These ventures, characterized by limited existing presence, are designed to capitalize on substantial growth opportunities. For example, entering a market like Southeast Asia, which is projected to see a 6.7% CAGR in its digital economy through 2028, requires significant upfront investment.

Such market entry necessitates considerable capital for developing localized service offerings, establishing robust distribution networks, and navigating diverse regulatory landscapes. In 2024, global foreign direct investment (FDI) in emerging markets showed a notable increase, with many companies prioritizing regions offering high demographic dividends and rapidly expanding middle classes, aligning with Baran Group's expansion strategy.

Investing in proprietary digital engineering platforms, like AI-driven design tools or advanced project management software, positions Baran Group within the Question Mark quadrant of the BCG matrix. This strategic move acknowledges the high growth potential driven by industry digitization, a trend that saw significant acceleration in 2024 with many engineering firms increasing their digital transformation budgets by an average of 15-20% globally.

However, Baran's current market share in software solutions is likely to be minimal, requiring substantial capital infusion to develop and compete effectively against established technology giants and specialized software providers. For instance, the global market for engineering software was projected to reach over $15 billion in 2024, with significant investment needed to carve out a niche.

Specialized Consulting Services for Niche, High-Growth Industries

Baran Group could strategically position specialized consulting services within niche, high-growth sectors like advanced robotics or space infrastructure. These areas represent significant future revenue potential, even though Baran Group currently holds a minimal market share. Developing deep expertise and cultivating client relationships in these emerging fields will be crucial for success.

This move into new, high-growth niches aligns with a strategy to diversify revenue streams and capture emerging market opportunities. For instance, the global market for industrial robotics was projected to reach approximately $75 billion by 2024, indicating substantial growth potential. Similarly, the space economy is anticipated to expand significantly, with some estimates suggesting it could reach over $1 trillion by 2040.

- Niche Market Focus: Targeting specialized, high-growth industries such as advanced robotics integration or space infrastructure development.

- Growth Potential: Capitalizing on sectors with projected substantial market expansion, exemplified by the industrial robotics market's anticipated growth.

- Expertise Development: Investing in building specialized knowledge and skill sets to serve these new industry verticals effectively.

- Client Acquisition: Proactively establishing relationships and a client base within these nascent, high-potential markets.

Turnkey Project Financing Solutions in Volatile Regions

Baran Group's expansion of turnkey project financing into highly volatile regions, characterized by significant geopolitical or economic instability, presents a classic Question Mark scenario within the BCG matrix. While these markets offer the allure of substantial returns, the inherent unpredictability poses considerable risks.

These ventures demand significant capital investment with an uncertain path to immediate market share and profitability. For instance, projects in regions experiencing frequent political upheaval or currency devaluation, such as parts of Sub-Saharan Africa or certain emerging Asian economies, often face delays and cost overruns. In 2024, the World Bank reported that over 60% of low-income countries were either in debt distress or at high risk of it, directly impacting the feasibility and profitability of large-scale projects financed in these areas.

- High Risk, High Reward: Volatile regions offer potentially lucrative returns but are susceptible to unforeseen economic and political shocks.

- Capital Intensive: Turnkey projects, especially in developing or unstable markets, require substantial upfront capital.

- Uncertain Market Entry: Establishing a strong market presence and achieving profitability can be challenging due to unstable operating environments.

- Geopolitical and Economic Factors: Currency fluctuations, regulatory changes, and political instability are key considerations that can impact project viability.

Baran Group's ventures into novel waste-to-energy solutions and advanced carbon capture technologies are prime examples of Question Marks. These sectors, while promising high growth, currently represent nascent markets where Baran Group's market share is minimal, necessitating significant investment to establish a foothold.

These initiatives require substantial capital for research, development, and market penetration to compete effectively. For instance, global investment in carbon capture technologies reached an estimated $6 billion in 2023, highlighting the capital demands. The global waste-to-energy market is also projected for robust growth, expected to expand at a 5.8% CAGR through 2030.

The strategic decision to enter new, high-growth international markets also places Baran Group in the Question Mark category. These markets, such as Southeast Asia with its projected 6.7% digital economy CAGR through 2028, demand considerable investment in localized offerings and distribution networks.

Investing in proprietary digital engineering platforms, like AI-driven design tools, positions Baran Group as a Question Mark. The engineering software market, projected to exceed $15 billion in 2024, requires significant capital to compete against established players, especially as firms globally increased digital transformation budgets by 15-20% in 2024.

| Category | Baran Group's Position | Market Growth Potential | Investment Requirement | Strategic Consideration |

|---|---|---|---|---|

| Waste-to-Energy | Low Market Share | High (5.8% CAGR through 2030) | Substantial | Transition to Star or Divest |

| Carbon Capture | Low Market Share | High (Global investment $6B in 2023) | Substantial | Transition to Star or Divest |

| New International Markets | Low Presence | High (e.g., SE Asia 6.7% CAGR) | High | Capital for localization, networks |

| Digital Engineering Platforms | Minimal Share | High ($15B+ market in 2024) | High | Compete with established tech |

BCG Matrix Data Sources

Our BCG Matrix is powered by a comprehensive blend of financial disclosures, market research reports, and competitive landscape analyses to provide a robust strategic overview.