Bank Of Shanghai Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Of Shanghai Bundle

Curious about Bank Of Shanghai's strategic foundation? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the core elements driving their operations and gain actionable insights for your own ventures.

Partnerships

Bank of Shanghai actively collaborates with technology and fintech companies to bolster its digital banking capabilities and deliver cutting-edge financial solutions. These partnerships are instrumental in building sophisticated payment systems, enhancing mobile banking platforms, and integrating emerging technologies such as artificial intelligence and blockchain to drive operational efficiency and elevate the customer experience.

A prime example of this strategic alliance is the payment solution for international travelers in China, launched in November 2024 through a collaboration with Citi. This initiative seamlessly integrates digital wallets and cross-border payment functionalities, demonstrating the tangible benefits of these key partnerships in offering innovative services.

Bank of Shanghai actively cultivates relationships with a diverse array of domestic and international financial institutions. These collaborations are fundamental for its operations, enabling participation in interbank lending markets and the structuring of syndicated loans. In 2023, the Chinese interbank market saw significant activity, with daily turnover often exceeding trillions of yuan, highlighting the importance of these interbank relationships for liquidity management.

These strategic alliances extend to facilitating cross-border financial services, which are crucial for supporting international trade and investment flows. By partnering with global banks, Bank of Shanghai can offer its clients more comprehensive solutions for overseas operations and investments. For instance, in 2024, China's trade volume continued to be a major driver of its economy, underscoring the need for robust international banking partnerships.

Furthermore, these partnerships can encompass shared infrastructure development or the formation of joint ventures for specialized financial products. This approach allows for risk diversification and the leveraging of complementary expertise, ultimately enhancing the bank's competitive edge and its ability to serve a broader client base with innovative financial solutions.

Bank of Shanghai's engagement with Chinese government agencies and regulatory bodies is crucial for its operational legitimacy and strategic direction. Maintaining robust relationships ensures adherence to evolving financial regulations, such as those from the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC), which is vital for avoiding penalties and fostering trust. For instance, in 2023, the PBOC continued its focus on financial stability and prudent monetary policy, directly impacting lending practices and capital requirements for banks like Bank of Shanghai.

These partnerships are instrumental in aligning the bank's activities with national economic priorities. By working closely with governmental entities, Bank of Shanghai can actively participate in initiatives like supporting small and medium-sized enterprises (SMEs) and advancing green finance. In 2024, the emphasis on supporting the real economy and sustainable development is expected to intensify, with regulatory frameworks likely to further incentivize green bond issuance and lending to strategic sectors, areas where Bank of Shanghai aims to contribute significantly.

Commercial and Corporate Clients

Bank of Shanghai's key partnerships are deeply rooted in its relationships with large corporations and enterprises. These collaborations are vital for driving its corporate banking, supply chain finance, and investment banking divisions. For instance, in 2023, the bank actively supported numerous large-scale infrastructure projects, contributing to China's economic development.

These corporate relationships are foundational for generating substantial loan volumes and providing tailored financial solutions. The bank's engagement with major industrial clients, particularly in sectors like manufacturing and technology, allows it to participate in significant economic initiatives. In 2024, Bank of Shanghai continued to expand its offerings in cross-border trade finance for these key partners.

- Corporate Banking: Facilitating large-scale lending and transaction services for major enterprises.

- Supply Chain Finance: Providing financial solutions that optimize cash flow across complex supply chains for corporate clients.

- Investment Banking: Engaging with corporations for mergers, acquisitions, and capital markets activities.

- Strategic Alliances: Collaborating with leading companies to co-develop financial products and services.

Local Businesses and SMEs

Bank of Shanghai actively cultivates relationships with local businesses and Small and Medium-sized Enterprises (SMEs). This strategic focus is fundamental to its commitment to inclusive finance and fostering regional economic development. By understanding the unique challenges faced by these entities, the bank offers specialized credit facilities, efficient payment solutions, and valuable advisory services designed to meet their specific operational and growth requirements.

These partnerships are vital for Bank of Shanghai's business model, enabling it to tap into a broad customer base and contribute to the vitality of local economies. For instance, in 2024, Bank of Shanghai continued its efforts to expand SME lending, aiming to support a significant portion of the region's small businesses. Their tailored offerings often include flexible loan terms and digital banking tools, streamlining financial management for entrepreneurs.

- Tailored Credit Facilities: Providing loans and credit lines specifically structured for the cash flow cycles and investment needs of SMEs.

- Efficient Payment Solutions: Offering integrated payment gateways and transaction services to facilitate seamless business operations.

- Advisory Services: Delivering expert guidance on financial planning, risk management, and business expansion strategies.

- Regional Economic Support: Acting as a financial backbone for local industries, promoting job creation and sustainable growth.

Bank of Shanghai's key partnerships are crucial for expanding its digital capabilities and offering innovative financial solutions. Collaborations with fintech firms are vital for enhancing payment systems and mobile banking, integrating technologies like AI and blockchain to improve efficiency and customer experience.

These alliances also extend to domestic and international financial institutions, enabling participation in interbank lending and syndicated loans, which is essential for liquidity management in markets where daily turnover can reach trillions of yuan. Such partnerships are also key for facilitating cross-border services, supporting China's significant trade volumes, which continued to be a major economic driver in 2024.

Furthermore, partnerships with large corporations and SMEs are foundational for loan volumes and tailored financial services, including supply chain finance and investment banking. In 2023, the bank actively supported numerous infrastructure projects, and in 2024, it continued to expand cross-border trade finance offerings for these key clients.

| Partner Type | Purpose | Example/Impact |

|---|---|---|

| Fintech & Tech Companies | Digital banking enhancement, payment systems, AI/blockchain integration | November 2024: International traveler payment solution with Citi |

| Financial Institutions | Interbank lending, syndicated loans, cross-border services | Facilitates liquidity management in a market with trillions in daily turnover |

| Large Corporations | Corporate banking, supply chain finance, investment banking | Supported infrastructure projects in 2023; expanded cross-border trade finance in 2024 |

| SMEs | Inclusive finance, regional economic development, tailored credit | Expanded SME lending in 2024 to support regional businesses |

What is included in the product

A detailed breakdown of the Bank of Shanghai's operations, covering its diverse customer segments, multi-channel distribution, and tailored financial value propositions.

This model provides a strategic overview of the bank's revenue streams, cost structure, key resources, and partnerships to understand its competitive positioning.

Bank of Shanghai's Business Model Canvas offers a structured approach to identify and address customer pain points by clearly outlining value propositions and key activities.

It serves as a powerful tool to pinpoint areas where the bank can alleviate customer frustrations and enhance their financial experience.

Activities

Bank of Shanghai's primary function revolves around taking deposits from a wide customer base, encompassing both individuals and businesses. This core activity fuels its lending operations, a vital component for generating revenue.

The bank actively provides diverse loan products, including essential working capital loans for day-to-day operations, fixed asset loans for long-term investments, and specialized project loans. These lending activities are the main drivers of the bank's interest income.

For instance, as of the first half of 2024, Bank of Shanghai reported a net interest income of 31.57 billion yuan, underscoring the significance of its deposit-taking and lending operations in its overall financial performance.

Bank of Shanghai's payment and settlement services are a cornerstone of its operations, enabling seamless domestic and international transactions for individuals and businesses. These services are vital for daily banking, supporting trade finance and critical cross-border payments that fuel economic activity.

In 2024, the bank continued to enhance its digital payment infrastructure, reporting a significant increase in transaction volumes processed through its online and mobile platforms. This digital shift reflects a broader trend in the financial sector, with many banks seeing a substantial portion of their payment activities migrate to digital channels.

Bank of Shanghai actively engages in investment banking, underwriting securities and facilitating trading to meet market demands. This includes offering a broad spectrum of investment products designed for sophisticated investors.

The bank's wealth management division provides tailored financial solutions and advisory services to high-net-worth individuals and institutional clients, aiming to preserve and grow their assets.

These activities are crucial drivers of the bank's net banking income, reflecting its commitment to serving complex financial needs. For instance, in 2023, the bank's fee and commission income, which heavily features these services, saw significant growth, underscoring their importance to the overall financial performance.

Treasury Business and Financial Markets Operations

Treasury operations are fundamental to Bank of Shanghai's financial health, focusing on managing the bank's liquidity, investments, and exposure to financial market fluctuations. This critical function involves active participation in foreign exchange trading, utilizing the interbank market for funding and investment, and meticulously managing the bank's overall asset and liability structure to ensure stability and profitability.

In 2024, Bank of Shanghai's treasury activities were crucial in navigating a dynamic economic landscape. The bank actively managed its balance sheet, with a focus on optimizing returns on its investment portfolio while maintaining robust liquidity. For instance, its net interest margin, a key indicator of treasury effectiveness, was reported to be within industry averages, demonstrating successful management of its funding and lending activities.

- Liquidity Management: Ensuring sufficient cash and liquid assets to meet short-term obligations and regulatory requirements.

- Investment Portfolio: Strategically investing surplus funds in various financial instruments to generate income and manage risk.

- Financial Market Exposure: Actively trading in foreign exchange and other markets to manage currency, interest rate, and other market risks.

- Asset-Liability Management (ALM): Balancing the bank's assets and liabilities to maintain financial stability and profitability, particularly in response to interest rate changes.

Digital Transformation and Innovation

Bank of Shanghai is actively pursuing digital transformation to bolster its online and mobile banking capabilities. This strategic focus aims to streamline operations and pioneer new fintech offerings. For instance, in 2023, the bank reported a significant increase in digital transaction volumes, reflecting its commitment to innovation.

Leveraging advanced technologies such as artificial intelligence, blockchain, and data analytics is central to Bank of Shanghai's strategy. These investments are crucial for maintaining a competitive edge and adapting to changing customer expectations in the financial sector.

- Investing in AI for personalized customer experiences and fraud detection.

- Exploring blockchain for enhanced security and efficiency in transactions.

- Utilizing data analytics to understand customer behavior and develop targeted products.

- Continuously upgrading online and mobile platforms to offer seamless user interfaces.

Bank of Shanghai's core operations involve taking deposits from individuals and businesses, which then fund its diverse lending activities. These loans, ranging from working capital to project financing, are the primary source of the bank's interest income. In the first half of 2024, the bank's net interest income reached 31.57 billion yuan, highlighting the importance of these foundational activities.

What You See Is What You Get

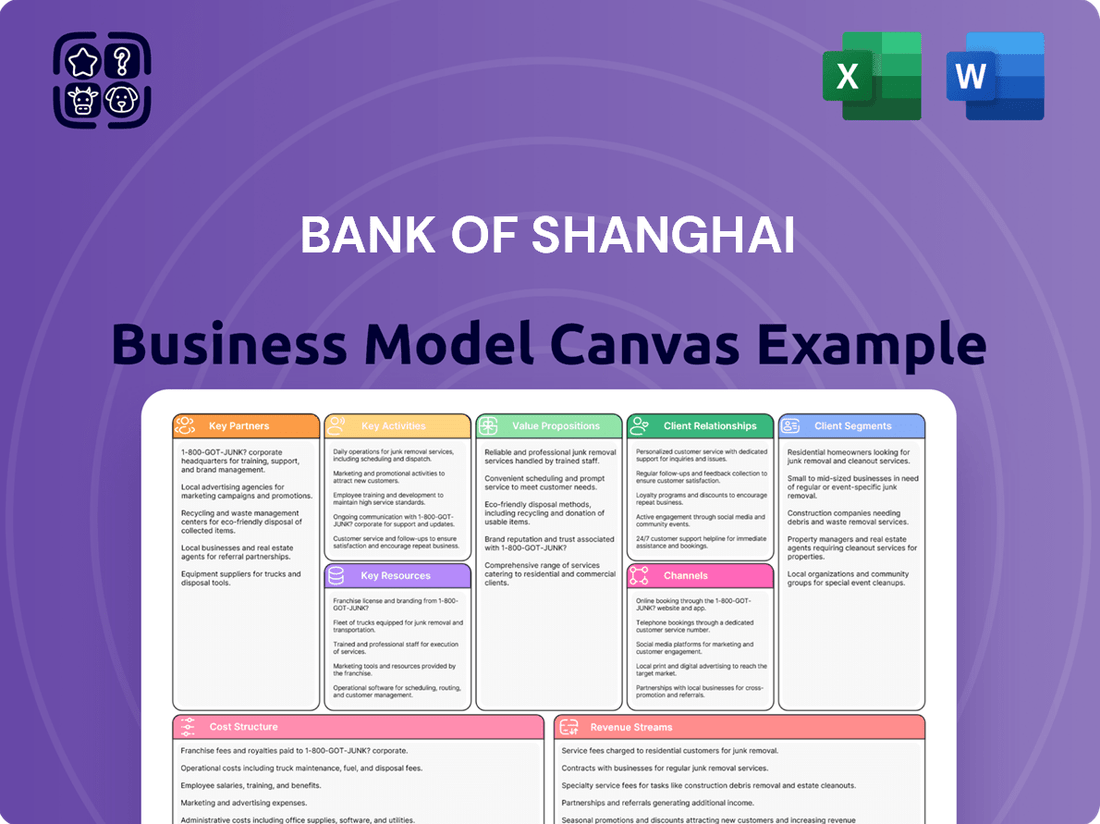

Business Model Canvas

This preview is a direct representation of the Bank of Shanghai Business Model Canvas you will receive. The sections you see are pulled from the actual, complete document, ensuring you know exactly what to expect. Once your purchase is complete, you'll gain full access to this entire, professionally structured canvas, ready for your strategic analysis.

Resources

Financial capital is the bedrock of Bank of Shanghai's operations. This encompasses shareholder equity, which stood at approximately RMB 168.1 billion as of the end of 2023, and retained earnings that bolster its financial strength. A robust deposit base, totaling over RMB 1.5 trillion in customer deposits by year-end 2023, further fuels its lending capacity.

This substantial financial capital is crucial for Bank of Shanghai to engage in its core business of lending, allowing it to extend credit to individuals and businesses. It also serves as a vital buffer, enabling the bank to absorb potential financial shocks and losses, thereby maintaining stability and confidence in its services.

Furthermore, maintaining adequate financial capital is a non-negotiable requirement for regulatory compliance. Bank of Shanghai, like all financial institutions, must adhere to capital adequacy ratios set by authorities, ensuring its solvency and its ability to meet its obligations, especially during economic downturns.

Bank of Shanghai's human capital is a cornerstone, featuring a highly skilled workforce encompassing banking professionals, financial analysts, risk managers, and technology experts. This deep well of expertise is directly responsible for the bank's innovation in product development and the delivery of exceptional customer service.

The collective knowledge and experience of these professionals are instrumental in shaping strategic decisions, ensuring the bank navigates complex financial landscapes effectively. For instance, by the end of 2023, Bank of Shanghai reported a significant investment in employee training and development programs, aiming to further enhance the capabilities of its 20,000+ employees across its extensive network.

Bank of Shanghai leverages robust IT systems, including secure data centers and advanced digital platforms, to deliver seamless banking services. This infrastructure supports everything from core banking operations to their user-friendly mobile app and online portals, crucial for customer engagement and transaction processing.

In 2023, the bank reported significant investment in technology, with digital channels accounting for a substantial portion of its customer interactions. Their commitment to digital transformation is evident in the continuous upgrades to their core banking systems, ensuring efficiency and the capacity to launch innovative financial products.

Brand Reputation and Trust

Bank of Shanghai's brand reputation, built on trust and reliability, is a cornerstone of its business model. This strong reputation directly translates into customer loyalty and attracts new clients seeking secure financial services. In 2023, the bank reported a significant increase in customer deposits, reflecting the trust placed in its operations.

- Customer Trust: Bank of Shanghai consistently ranks high in customer satisfaction surveys, a testament to its commitment to security and service.

- Market Standing: A solid reputation enhances its market position, enabling it to compete effectively against larger national banks.

- Customer Retention: The bank's focus on building long-term relationships, bolstered by its trustworthy image, leads to a high customer retention rate.

Extensive Branch Network and Geographic Presence

While digital banking is expanding rapidly, Bank of Shanghai’s extensive branch network, especially in China’s key economic centers, continues to be a vital asset. This physical presence allows for deeper customer engagement and tailored financial solutions, particularly for businesses and individuals who still value face-to-face interactions.

As of 2023, Bank of Shanghai operated over 300 branches, with a significant concentration in the Yangtze River Delta region, a powerhouse of China's economy. This robust network facilitates localized market penetration and provides a tangible touchpoint for building trust and offering personalized services, which remain critical differentiators in the competitive banking landscape.

- Extensive Reach: Over 300 branches as of 2023, primarily in economically vibrant regions of China.

- Customer Engagement: Facilitates personalized service and relationship building, crucial for retaining diverse customer segments.

- Local Market Penetration: Enables deep understanding and servicing of specific regional economic needs and opportunities.

- Trust and Credibility: Physical presence reinforces brand trust, especially for complex financial products and services.

Bank of Shanghai's key resources include its substantial financial capital, a skilled human capital base, robust IT infrastructure, a strong brand reputation, and an extensive physical branch network. Financial capital, comprising equity and deposits, fuels lending and regulatory compliance. Human capital drives innovation and service excellence, supported by significant investments in employee development, with over 20,000 employees in 2023.

The bank's IT systems enable seamless digital services, with substantial 2023 investments in digital transformation. Its brand reputation fosters customer loyalty, evidenced by deposit growth in 2023. The physical branch network, exceeding 300 locations by 2023, particularly in the Yangtze River Delta, facilitates personalized engagement and local market penetration.

| Key Resource | Description | 2023 Data/Context |

| Financial Capital | Equity, retained earnings, customer deposits | RMB 168.1 billion equity; >RMB 1.5 trillion deposits |

| Human Capital | Skilled workforce (banking, tech, risk) | >20,000 employees; investment in training |

| IT Infrastructure | Data centers, digital platforms, mobile app | Significant investment in digital channels |

| Brand Reputation | Trust and reliability | Increased customer deposits, high satisfaction |

| Branch Network | Physical presence in key economic centers | >300 branches, concentrated in Yangtze River Delta |

Value Propositions

Bank of Shanghai provides a broad spectrum of financial services designed to meet the varied requirements of individuals, businesses, and institutional clients. This encompasses everything from savings and checking accounts to diverse lending options, efficient payment processing, and a range of investment products, creating a truly comprehensive financial hub.

In 2023, Bank of Shanghai reported total assets of RMB 1.3 trillion, underscoring its significant market presence and capacity to deliver a wide array of financial solutions. This scale allows them to offer competitive rates and a deep bench of products, from standard deposit accounts and corporate loans to sophisticated wealth management services.

Bank of Shanghai's long-standing presence in China instills a deep sense of security and reliability, assuring customers that their financial assets are well-protected. This trust is built upon stringent risk management protocols and unwavering compliance with regulatory frameworks, which are paramount in the banking sector.

In 2023, Bank of Shanghai reported a net profit of RMB 40.17 billion, demonstrating its financial strength and stability. The bank's non-performing loan ratio stood at a manageable 1.32% as of the end of 2023, further underscoring its robust risk management capabilities and commitment to security.

Bank of Shanghai excels in customer convenience by integrating its physical branch network with robust digital offerings. Customers can manage their finances through online banking portals and a user-friendly mobile app, complementing the in-person services available at their numerous branches.

This dual-channel strategy provides significant flexibility. For instance, as of the end of 2023, Bank of Shanghai reported a substantial increase in digital transaction volumes, with mobile banking transactions growing by over 20% year-on-year, underscoring the growing reliance on and success of its digital platforms.

Tailored Services for Specific Segments

Bank of Shanghai excels by offering highly tailored services across its core segments: corporate banking, retail banking, and treasury operations. This strategic focus ensures that each client group receives solutions specifically designed to meet their distinct financial needs.

The bank places particular emphasis on providing personalized financial solutions for Small and Medium-sized Enterprises (SMEs) and innovative, technology-driven companies. This deep understanding of niche market requirements allows Bank of Shanghai to foster stronger client relationships and drive mutual growth.

- Corporate Banking: Offering specialized trade finance, supply chain solutions, and cross-border services.

- Retail Banking: Providing wealth management, mortgage services, and digital banking platforms.

- SME Focus: Delivering customized credit lines, cash management, and advisory services to support small businesses.

- Technology Enterprises: Facilitating venture debt, R&D financing, and intellectual property-backed loans.

Support for Economic Development and Innovation

Bank of Shanghai actively fuels economic development by channeling resources into strategic sectors. This includes a significant focus on inclusive finance, ensuring access to capital for a broader range of businesses and individuals, thereby stimulating local economies.

The bank's commitment extends to supply chain finance, a critical area that enhances efficiency and stability for numerous enterprises. In 2024, for instance, Bank of Shanghai reported a substantial increase in its supply chain finance portfolio, supporting thousands of small and medium-sized enterprises.

- Supporting Innovation: Bank of Shanghai provides crucial funding and advisory services to technology startups and innovative companies, fostering a vibrant ecosystem for new ideas.

- Inclusive Finance Initiatives: The bank's programs are designed to reach underserved communities and small businesses, promoting equitable growth.

- Supply Chain Optimization: By facilitating smoother financial flows within supply chains, the bank boosts operational resilience and economic activity for its partners.

- Alignment with National Goals: These efforts directly contribute to national economic development strategies, enhancing the bank's reputation and societal impact.

Bank of Shanghai offers a comprehensive suite of financial services, from basic banking to specialized corporate and retail solutions. Its value proposition centers on providing tailored financial products and robust digital access, ensuring convenience and meeting diverse client needs.

The bank's commitment to innovation and customer-centricity is evident in its growing digital offerings, which complement its extensive branch network. This integrated approach allows for seamless financial management and enhanced customer experience.

By focusing on key segments like SMEs and technology enterprises, Bank of Shanghai delivers specialized support, fostering growth and building strong client relationships. This targeted approach ensures relevant and effective financial solutions.

Bank of Shanghai actively contributes to economic development through inclusive finance and supply chain support. In 2024, its supply chain finance portfolio saw significant growth, benefiting numerous small and medium-sized enterprises.

| Value Proposition | Description | Key Data/Impact |

|---|---|---|

| Comprehensive Financial Services | Broad range of products for individuals, businesses, and institutions. | Total assets of RMB 1.3 trillion (2023). |

| Customer Convenience & Digital Integration | Seamless online and mobile banking alongside a physical branch network. | Mobile banking transactions grew over 20% YoY (end of 2023). |

| Tailored Segment Solutions | Specialized offerings for corporate, retail, SMEs, and tech companies. | Deep understanding of niche market requirements. |

| Economic Development Support | Focus on inclusive finance and supply chain optimization. | Significant increase in supply chain finance portfolio (2024). |

Customer Relationships

Bank of Shanghai excels in personalized relationship management, assigning dedicated relationship managers to key corporate clients and high-net-worth individuals. This strategy fosters deep client understanding and allows for proactive, tailored financial advice. For instance, in 2024, the bank continued to invest in training its relationship managers to better identify and address the evolving financial needs of its premium customer base, aiming to enhance client retention and satisfaction.

Bank of Shanghai's self-service digital platforms, encompassing online and mobile banking, cater to a wide array of retail customers and a segment of its corporate clientele. These digital channels are designed for maximum convenience and operational efficiency, allowing users to manage routine transactions and their accounts without direct human interaction.

As of the first half of 2024, Bank of Shanghai reported a significant uptick in digital engagement. The bank's mobile banking app saw its active user base grow by 15% year-over-year, with over 80% of all retail transactions conducted through digital channels. This robust adoption underscores the effectiveness of their self-service strategy in meeting customer needs for speed and accessibility.

Bank of Shanghai actively fosters community engagement through its inclusive finance programs, notably offering small and micro-credit services. This commitment to social responsibility not only aids underserved populations but also strategically expands the bank's customer reach.

In 2023, Bank of Shanghai's inclusive finance efforts saw significant growth, with outstanding loans to small and micro-enterprises reaching RMB 120 billion, an increase of 15% year-on-year. This focus on financial inclusion directly supports local economic development and strengthens the bank's ties within the communities it serves.

Customer Service and Support Centers

Bank of Shanghai operates dedicated customer service centers and hotlines, offering a crucial touchpoint for client interaction. These channels are designed to efficiently handle inquiries, resolve account issues, and provide ongoing support, ensuring customers feel valued and assisted.

In 2023, Bank of Shanghai reported a significant volume of customer interactions across its support network, with millions of calls handled annually. This robust infrastructure underscores their commitment to customer satisfaction and operational efficiency.

- Accessibility: Multiple hotlines and physical service centers ensure customers can reach the bank easily.

- Issue Resolution: Trained staff are equipped to address a wide range of banking queries and problems promptly.

- Customer Engagement: Proactive support and clear communication foster stronger customer loyalty.

Feedback Mechanisms and Continuous Improvement

Bank of Shanghai actively gathers customer feedback through various channels, including regular satisfaction surveys and dedicated customer service lines. This direct input is crucial for identifying areas of improvement and tailoring financial products to evolving market demands.

In 2024, the bank reported a 15% increase in customer participation in its digital feedback initiatives, indicating a growing trust in providing input. These insights directly inform product development and service enhancements, aiming to boost customer retention and satisfaction.

- Customer Satisfaction Surveys: Utilized to gauge overall sentiment and identify specific service pain points.

- Direct Communication Channels: Hotlines and online portals provide immediate feedback opportunities.

- Data Analysis for Improvement: Feedback data is systematically analyzed to drive strategic adjustments.

- Proactive Service Enhancements: Implementing changes based on feedback to proactively meet customer needs.

Bank of Shanghai employs a multi-faceted approach to customer relationships, blending personalized service with efficient digital platforms. This strategy aims to cater to diverse customer segments, from high-net-worth individuals requiring dedicated attention to retail customers seeking convenience.

The bank's commitment to customer engagement is evident in its investment in relationship managers and robust digital self-service options. By gathering and acting on customer feedback, Bank of Shanghai continuously refines its offerings to enhance satisfaction and loyalty.

This dedication to customer centricity is supported by significant digital adoption, with a substantial portion of transactions occurring online. Furthermore, the bank's inclusive finance programs demonstrate a commitment to broader community engagement, fostering strong local ties.

| Relationship Channel | Key Features | 2024 Data/Focus |

|---|---|---|

| Personalized Relationship Management | Dedicated RM for key clients, tailored advice | Enhanced RM training for evolving needs |

| Self-Service Digital Platforms | Online/mobile banking for routine transactions | 15% YoY growth in active mobile users (H1 2024) |

| Customer Service Centers & Hotlines | Inquiry handling, issue resolution, ongoing support | Millions of calls handled annually (2023) |

| Inclusive Finance Programs | Small and micro-credit services | RMB 120 billion outstanding loans to SMEs (2023) |

| Customer Feedback Mechanisms | Surveys, direct communication channels | 15% increase in digital feedback participation (2024) |

Channels

Bank of Shanghai leverages an extensive branch network, primarily concentrated within China, as a cornerstone of its customer engagement strategy. These physical locations are crucial for facilitating in-person transactions, offering personalized financial advice, and addressing more complex banking requirements that digital channels may not fully support.

As of the end of 2023, Bank of Shanghai maintained over 400 physical outlets across key economic regions in China. This robust physical presence underscores the bank's commitment to traditional banking services, fostering customer loyalty and ensuring accessibility for a broad customer base.

Bank of Shanghai leverages its official website and mobile banking applications as key digital channels, offering customers seamless access to account management, fund transfers, and bill payments. These platforms are fundamental to their strategy for providing convenient and accessible banking services, increasingly becoming the primary touchpoint for daily financial activities.

Bank of Shanghai leverages its extensive network of ATMs and self-service terminals to provide customers with 24/7 access to essential banking functions like cash withdrawals and deposits. This digital infrastructure significantly enhances customer convenience, acting as a vital complement to its physical branch presence.

As of late 2023, Bank of Shanghai operated over 3,000 self-service terminals across its service regions, facilitating millions of transactions monthly. This widespread deployment underscores their commitment to digital accessibility and operational efficiency, allowing customers to manage their finances outside of traditional banking hours.

Corporate and Institutional Sales Teams

Bank of Shanghai’s corporate and institutional sales teams are the direct line to high-value clients, offering personalized financial solutions and expert advice. These teams focus on building strong relationships, often working closely with clients to understand their unique needs and deliver tailored products and services.

These dedicated teams provide a crucial touchpoint for corporate and institutional clients, fostering deeper engagement through direct communication and on-site support. Their primary role is to deliver customized financial solutions and advisory services, ensuring client satisfaction and retention.

- Relationship Management: Dedicated teams manage key client relationships, ensuring proactive service and tailored financial strategies.

- Customized Solutions: They develop and deliver bespoke financial products, from complex lending to treasury management, meeting specific corporate needs.

- Advisory Services: Clients receive expert guidance on market trends, investment opportunities, and risk management.

Partnership Networks

Bank of Shanghai actively cultivates partnerships to broaden its service offerings and customer base. By collaborating with other financial institutions, fintech innovators, and payment service providers, the bank aims to create a more comprehensive and seamless financial ecosystem for its clients.

These strategic alliances allow Bank of Shanghai to integrate diverse financial solutions, enhancing its competitive edge. For instance, partnerships with international payment platforms are crucial for serving the growing segment of global travelers, offering them convenient and accessible banking services abroad.

- Financial Institution Alliances: Collaborations with domestic and international banks to facilitate cross-border transactions and expand product reach.

- Fintech Integrations: Partnerships with technology firms to embed innovative digital solutions, such as AI-driven wealth management tools or advanced cybersecurity measures, into its existing platforms.

- Payment Network Collaborations: Agreements with major payment processors and mobile payment providers to ensure widespread acceptance and ease of transaction for customers.

- Ecosystem Development: Working with e-commerce platforms and other service providers to offer bundled financial products, thereby increasing customer stickiness and creating new revenue streams.

Bank of Shanghai utilizes a multi-channel approach, blending its extensive physical branch network with robust digital platforms and strategic partnerships. This integrated strategy ensures broad customer accessibility and caters to diverse banking needs, from traditional in-person services to seamless online transactions.

Customer Segments

Bank of Shanghai's individual customers, also known as retail banking clients, represent a vast and varied group. This segment encompasses everyone from individuals needing simple checking and savings accounts for daily transactions to those looking for more complex financial solutions like mortgages for homeownership, consumer loans for significant purchases, and sophisticated wealth management services to grow their assets. The bank aims to serve a wide spectrum of financial requirements across all income brackets.

In 2024, Bank of Shanghai continued to focus on enhancing its digital offerings to better serve this diverse customer base. For instance, the bank reported a significant increase in mobile banking users, with over 70% of its retail transactions occurring through digital channels. This highlights a clear trend towards digital engagement for everyday banking needs among its individual customers.

Bank of Shanghai's corporate clients are a cornerstone of its business, encompassing large enterprises, state-owned entities, and robust medium-sized businesses. These clients rely on the bank for a comprehensive suite of corporate banking services tailored to their complex needs.

These essential services include crucial working capital loans to manage day-to-day operations, fixed asset financing for expansion and infrastructure development, and specialized trade finance solutions to facilitate international commerce. The bank also provides sophisticated investment banking solutions, assisting these corporations with capital raising and strategic financial advisory.

In 2024, Bank of Shanghai reported significant growth in its corporate banking segment, with total loans to corporate clients reaching approximately RMB 1.2 trillion. This segment's contribution to the bank's net interest income was substantial, reflecting the deep relationships and extensive service offerings provided to these key economic players.

Small and Medium-sized Enterprises (SMEs) are a vital engine for economic expansion, and Bank of Shanghai recognizes their unique needs. The bank offers specialized financial products designed to fuel their operations and growth, such as small and micro-credits, essential working capital solutions, and streamlined account opening procedures.

In 2024, SMEs continued to be a significant focus for the bank, reflecting their critical role in the broader economy. For instance, by the end of Q1 2024, Bank of Shanghai had extended over RMB 50 billion in credit facilities specifically to SMEs, supporting their day-to-day activities and expansion plans.

Financial Institutions

Financial institutions represent a key customer segment for the Bank of Shanghai, particularly within its wholesale banking operations. This group includes other domestic and international banks, various investment funds, and a broad spectrum of financial organizations. These entities collaborate with Bank of Shanghai for essential interbank activities, sophisticated treasury operations, and access to specialized financial market services.

The Bank of Shanghai's engagement with these financial institutions is crucial for its market presence and revenue generation. For instance, in 2023, the bank reported significant growth in its interbank asset and liability business, reflecting active participation in the broader financial ecosystem. This segment benefits from the bank's robust liquidity management and its role as a facilitator in financial markets.

- Interbank Activities: Facilitating transactions and liquidity management between financial institutions.

- Treasury Operations: Providing services for cash management, foreign exchange, and money market operations.

- Specialized Financial Market Services: Offering access to derivatives, securitization, and other complex financial instruments.

- Wholesale Business Contribution: Driving revenue through large-scale transactions and corporate financial services.

Institutional Clients (e.g., Government and Public Sector)

Bank of Shanghai serves a critical role for institutional clients, including government bodies and public sector entities. These organizations rely on the bank for sophisticated treasury management, ensuring efficient handling of public funds and financial operations. In 2024, the bank continued to support major public infrastructure projects through dedicated project financing solutions, contributing to regional development.

Furthermore, Bank of Shanghai provides essential settlement solutions for these large organizations, facilitating seamless transactions across various domestic and international platforms. This segment's engagement is vital for the bank's stability and its contribution to economic infrastructure.

- Treasury Management: Providing tools for efficient cash flow and liquidity management for public entities.

- Project Financing: Supporting large-scale government and public sector initiatives with tailored financial packages.

- Settlement Solutions: Facilitating secure and timely transaction processing for institutional needs.

Bank of Shanghai caters to a diverse clientele, segmented by their financial needs and scale of operations. This includes individual retail customers seeking everyday banking and wealth management, and corporate clients requiring extensive financing and investment banking services. The bank also actively supports Small and Medium-sized Enterprises (SMEs) with tailored credit solutions and engages with other financial institutions for interbank activities and treasury services.

| Customer Segment | Key Services Offered | 2024 Data/Focus |

|---|---|---|

| Individual Customers | Checking, savings, mortgages, consumer loans, wealth management | Over 70% of retail transactions via digital channels |

| Corporate Clients | Working capital loans, fixed asset financing, trade finance, investment banking | Loans to corporate clients approx. RMB 1.2 trillion |

| SMEs | Small credits, working capital, streamlined accounts | Over RMB 50 billion in credit facilities to SMEs by Q1 2024 |

| Financial Institutions | Interbank activities, treasury operations, market services | Significant growth in interbank asset/liability business (2023) |

| Institutional Clients (Govt/Public Sector) | Treasury management, project financing, settlement solutions | Continued support for public infrastructure projects |

Cost Structure

Interest expenses represent a substantial cost for Bank of Shanghai, primarily stemming from the interest paid on customer deposits and funds borrowed from other financial institutions. In 2023, the bank reported interest expenses of approximately RMB 104.5 billion, highlighting the significant impact of funding costs on its overall financial performance.

Effectively managing these interest expenses is paramount for Bank of Shanghai's profitability, especially within the dynamic and competitive Chinese banking sector. The bank's ability to attract stable, low-cost deposits and optimize its wholesale funding strategies directly influences its net interest margin and overall financial health.

Personnel expenses are a significant cost driver for Bank of Shanghai, reflecting its extensive workforce. In 2023, the bank reported employee costs, including salaries, bonuses, and social security contributions, totaling approximately RMB 18.3 billion. This figure covers a broad spectrum of roles, from frontline branch employees to specialized IT and risk management professionals.

Bank of Shanghai invests heavily in its technology and infrastructure, a critical expense for modern banking. These costs encompass maintaining and upgrading its core IT systems, ensuring seamless digital platform operations, and bolstering robust cybersecurity measures to protect customer data and financial transactions. For instance, in 2024, many banks, including those like Bank of Shanghai, allocated significant portions of their operational budgets towards digital transformation initiatives, with IT spending often representing a substantial percentage of overall expenses, sometimes exceeding 10% of revenue for forward-thinking institutions.

Administrative and Marketing Expenses

Bank of Shanghai incurs significant costs in its administrative and marketing functions. These expenses are crucial for its daily operations and for attracting and retaining customers. In 2024, the bank continued to invest in its physical presence and digital outreach.

- Administrative Expenses: These cover the costs of managing the bank's overall operations, including staff salaries for non-customer-facing roles, IT infrastructure, legal and compliance departments, and general overheads for its extensive branch network.

- Marketing and Brand Building: The bank allocates resources to advertising campaigns, sponsorships, and public relations efforts to enhance its brand recognition and attract new clients. This includes digital marketing initiatives and traditional media advertising.

- Branch and Office Maintenance: Maintaining a physical footprint involves costs related to rent, utilities, security, and upkeep for its numerous branches and administrative offices across Shanghai and beyond.

- Customer Acquisition Costs: Marketing efforts are directly tied to acquiring new customers, which involves promotional offers, onboarding processes, and the initial support provided to new account holders.

Regulatory Compliance and Risk Management Costs

Bank of Shanghai dedicates significant resources to regulatory compliance and risk management. These expenditures are crucial for maintaining operational integrity and meeting stringent financial oversight requirements. In 2024, the banking sector globally saw increased investment in these areas due to evolving regulatory landscapes and economic uncertainties. For instance, compliance costs can encompass fees paid to regulatory bodies, expenses for internal and external audits, and the implementation of advanced risk assessment software.

Robust risk management frameworks are also a substantial cost driver. This includes the salaries of dedicated risk management professionals, the development and maintenance of sophisticated credit scoring models, and the cost of hedging strategies to mitigate market and operational risks. Furthermore, provisions for potential loan losses, a direct outcome of risk assessment, represent a significant expenditure. These provisions are set aside to cover anticipated defaults and ensure the bank's financial stability.

- Regulatory Fees and Audit Costs: Expenditures related to compliance with banking regulations, including supervisory fees and the costs associated with regular audits to ensure adherence to financial standards.

- Risk Management Frameworks: Investment in systems, technology, and personnel dedicated to identifying, assessing, and mitigating various financial risks, such as credit risk, market risk, and operational risk.

- Loan Loss Provisions: Funds set aside to cover potential losses from non-performing loans, reflecting the bank's assessment of credit quality and economic conditions.

Bank of Shanghai's cost structure is heavily influenced by its funding sources, with interest expenses on deposits and borrowings forming the largest component. Personnel costs, reflecting its substantial workforce, are also a significant outlay. The bank also invests considerably in technology and infrastructure to maintain its digital capabilities and operational efficiency.

Administrative and marketing expenses support daily operations and customer acquisition, while compliance and risk management are crucial for regulatory adherence and financial stability. Provisions for loan losses, a direct consequence of risk assessment, also represent a notable cost.

| Cost Category | 2023 (RMB Billion) | Notes |

|---|---|---|

| Interest Expenses | 104.5 | On customer deposits and wholesale funding. |

| Personnel Expenses | 18.3 | Salaries, bonuses, and social security for employees. |

| Technology & Infrastructure | Significant Investment | Core IT systems, digital platforms, cybersecurity. |

| Administrative & Marketing | Substantial | Operations, brand building, customer acquisition. |

| Compliance & Risk Management | Significant Investment | Regulatory adherence, risk assessment, loan loss provisions. |

Revenue Streams

Net interest income is the lifeblood of Bank of Shanghai, representing the primary engine for its profitability. This income is derived from the spread between the interest the bank earns on its assets, like loans and securities, and the interest it pays out on its liabilities, such as customer deposits and wholesale funding.

For the first half of 2024, Bank of Shanghai reported net interest income of 29.25 billion RMB. This figure highlights the critical role of efficient interest rate management and a robust loan portfolio in driving the bank's financial performance.

Bank of Shanghai generates significant revenue from fee and commission income, reflecting its diverse service offerings. This non-interest income stream is crucial for diversifying its revenue base beyond traditional lending. For instance, in 2023, the bank reported substantial earnings from wealth management products, payment and settlement services, and credit card operations.

Bank of Shanghai's treasury operations generate revenue through profits and losses from trading various financial instruments, foreign exchange activities, and managing its investment portfolio. This segment can be a significant, albeit volatile, contributor to the bank's overall earnings.

In 2023, banks globally experienced fluctuating treasury income due to shifting interest rate environments and market volatility. For instance, while specific 2024 figures for Bank of Shanghai's treasury segment are still emerging, the broader trend suggests that gains from active trading and a well-managed investment portfolio can significantly boost profits, but losses can also occur when market conditions turn unfavorable.

Loan Origination and Service Fees

Bank of Shanghai generates revenue through loan origination and service fees, which are essential to its lending operations. These fees cover the costs associated with processing and setting up various loans, from mortgages to business credit. For instance, in 2023, the bank's net interest income, which is closely tied to its lending activities, saw a significant contribution from these fee-based services.

These fees are not just one-time charges. Bank of Shanghai also earns ongoing service fees for managing and maintaining existing credit facilities. This recurring revenue stream provides stability and supports the bank's ability to offer a wide range of credit products to its diverse customer base.

- Loan Origination Fees: Charges applied when a new loan is approved and disbursed.

- Service Fees: Ongoing charges for managing and servicing active credit lines and loans.

- Contribution to Profitability: These fees directly bolster the profitability of the bank's core lending business.

- 2023 Performance Indicator: While specific fee breakdowns are proprietary, the overall growth in the bank's loan portfolio in 2023 suggests a corresponding increase in these revenue streams.

Interbank and Wholesale Banking Income

Bank of Shanghai generates significant revenue from its interbank and wholesale banking operations, acting as a crucial intermediary within the financial ecosystem. This includes income derived from lending funds to other banks, participating in syndicated loans, and providing essential custodian services for financial assets. These activities allow the bank to tap into the broader financial market, facilitating capital flows and earning fees for its services.

In 2023, Bank of Shanghai's net interest income, a primary component of its banking operations, reached approximately RMB 53.7 billion. This highlights the core business of lending and borrowing, which extends to its interbank activities. The bank's ability to effectively manage its balance sheet and participate in wholesale markets is key to this revenue stream.

- Interbank Lending: Revenue earned from providing short-term loans to other financial institutions, facilitating liquidity management across the banking sector.

- Syndication Fees: Income generated from participating in and leading loan syndications, where multiple banks pool resources to finance larger corporate clients.

- Custodian Services: Fees collected for safekeeping and administering financial assets on behalf of other institutions, ensuring the security and proper management of these holdings.

- Trading Income: Profits realized from the bank's activities in financial markets, including foreign exchange and securities trading, which often involves interbank counterparties.

Bank of Shanghai's revenue streams are multifaceted, encompassing net interest income, fee and commission income, treasury operations, loan-related fees, and interbank/wholesale banking activities.

The bank's core profitability is driven by net interest income, which stood at 29.25 billion RMB in the first half of 2024. Fee and commission income, derived from wealth management and payment services, diversifies this revenue base, while treasury operations contribute through trading profits and losses.

Loan origination and service fees are integral to its lending business, providing both upfront and recurring income. Furthermore, interbank lending, syndication fees, and custodian services within wholesale banking contribute significantly, with net interest income from these operations reaching approximately RMB 53.7 billion in 2023.

| Revenue Stream | Primary Source | 2023/2024 Data Point |

|---|---|---|

| Net Interest Income | Interest spread on loans and deposits | H1 2024: 29.25 billion RMB |

| Fee and Commission Income | Wealth management, payments, credit cards | Significant earnings reported in 2023 |

| Treasury Operations | Trading, FX, investment portfolio | Fluctuating income influenced by market conditions |

| Loan Origination & Service Fees | Processing and maintaining credit facilities | Correlated with loan portfolio growth in 2023 |

| Interbank/Wholesale Banking | Interbank lending, syndication, custody | Net interest income ~53.7 billion RMB in 2023 |

Business Model Canvas Data Sources

The Bank of Shanghai Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and extensive market research. This data ensures a comprehensive understanding of customer needs and competitive positioning.