Bank Of Shanghai Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Of Shanghai Bundle

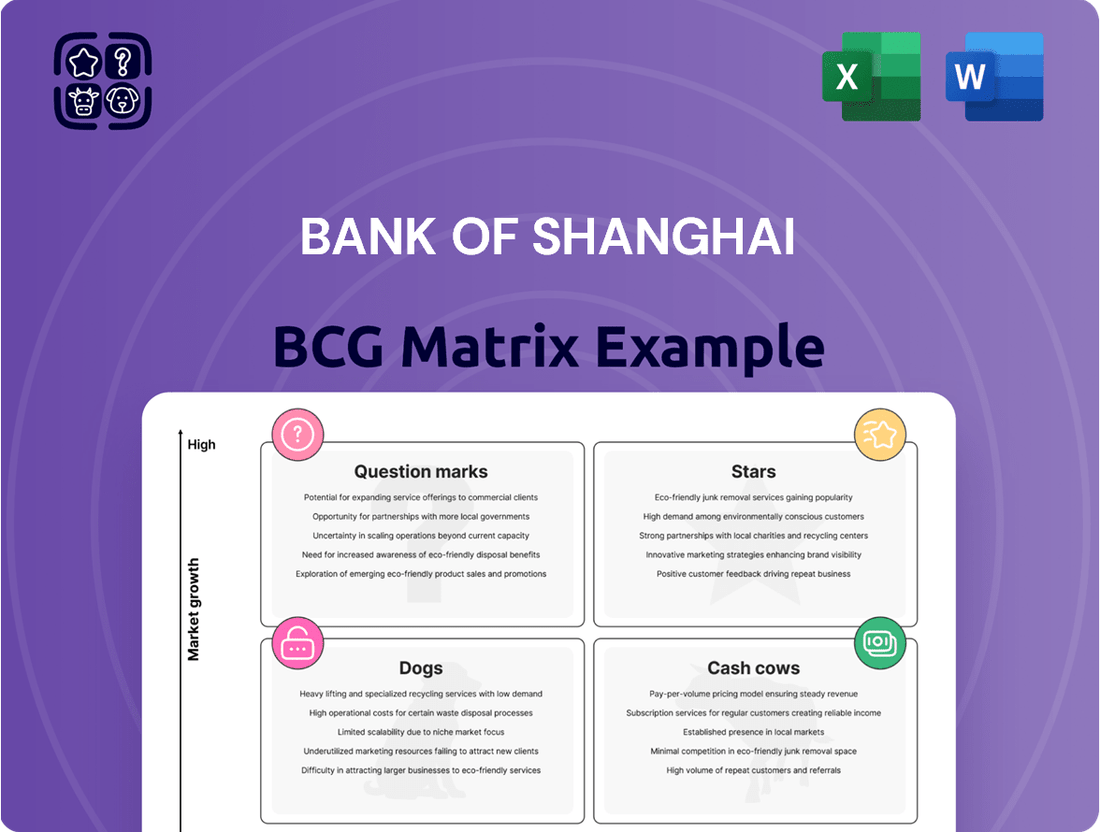

The Bank of Shanghai's BCG Matrix offers a crucial lens to understand its product portfolio's market share and growth potential. This preview hints at its strategic positioning, but to truly grasp which products are driving growth, which are stable cash generators, and which require careful consideration, you need the full picture.

Unlock the complete BCG Matrix for the Bank of Shanghai and gain a granular understanding of its Stars, Cash Cows, Dogs, and Question Marks. This comprehensive report provides the actionable insights needed to optimize resource allocation and drive future success.

Don't miss the opportunity to equip yourself with a powerful strategic tool. Purchase the full Bank of Shanghai BCG Matrix today for a detailed breakdown and a clear roadmap to informed investment and product development decisions.

Stars

Bank of Shanghai is actively developing its green finance products, a strategic move that aligns perfectly with China's national agenda for green development and its ambitious low-carbon transition goals. This commitment positions the bank to capitalize on a rapidly expanding market.

Green loans represent a substantial and increasingly important segment within China's banking industry. In 2023, outstanding green loans across the nation reached a remarkable 32.4 trillion yuan, demonstrating the significant growth potential for institutions like Bank of Shanghai to offer these sustainable financial solutions.

Shanghai, a powerhouse in global fintech, sees Chinese banks aggressively digitizing to transform consumer habits and service delivery. Bank of Shanghai's strategic push into fintech for its retail banking arm positions it to seize market share in this dynamic, high-growth sector.

By integrating advanced fintech solutions, the bank aims to offer more personalized and efficient services, directly addressing evolving customer expectations. This focus is crucial as digital banking adoption continues to surge, with China's mobile payment transaction volume expected to reach over $50 trillion by 2025, showcasing the immense potential for digitally-savvy financial institutions.

China's wealth management market saw robust growth in 2024, with a notable increase in both the number of investors and the total assets managed. This expansion highlights a burgeoning appetite for diverse investment vehicles across the nation.

Bank of Shanghai offers a wide array of wealth management products designed to meet this escalating demand. These offerings range from traditional fixed-income instruments to more complex equity-linked and alternative investments, catering to a broad spectrum of investor risk appetites and financial goals.

The bank's strategic positioning with these varied products suggests a strong potential for high growth. Capturing an even larger share of this dynamic market hinges on their ability to innovate and effectively reach a wider customer base, leveraging the sector's overall positive trajectory.

Specialized Corporate Lending to Strategic Sectors

Specialized corporate lending to strategic sectors, like those identified in Shanghai's action plan, positions Bank of Shanghai for significant growth. By focusing on innovative technology and advanced manufacturing, the bank can offer tailored financial solutions to these high-potential areas.

This strategic focus aligns with national priorities, aiming to channel financial resources into key growth engines. For example, in 2023, China's high-tech manufacturing sector saw substantial investment, with the value-added output of industrial enterprises above designated size in high-tech manufacturing growing by 7.5% year-on-year.

Bank of Shanghai's corporate banking segment can capitalize on this by becoming a preferred lender in these burgeoning industries. This approach allows the bank to build strong relationships and secure a leading market position.

- Strategic Alignment: Lending to sectors like advanced manufacturing and innovative technology supports Shanghai's economic development plans.

- Market Opportunity: These sectors represent high-growth areas with significant demand for specialized corporate finance.

- Competitive Advantage: Offering tailored financial solutions can differentiate Bank of Shanghai and build strong client relationships.

- Economic Impact: Supporting these industries contributes to national economic strategies and technological advancement.

Digital Payment and Settlement Innovations

Digital payment and settlement innovations are a significant growth driver for Bank of Shanghai, mirroring the broader trend in Chinese retail banking. The bank's commitment to upgrading its digital capabilities is crucial for capturing market share in this dynamic sector.

By investing in advanced payment solutions, Bank of Shanghai aims to bolster customer acquisition and loyalty. For instance, in 2023, digital transactions processed by Chinese banks saw a substantial increase, with mobile payments alone accounting for trillions of yuan. Bank of Shanghai's strategic focus on this area positions it to capitalize on this ongoing digital transformation.

- Digital Payment Growth: The digital payment market in China is expanding rapidly, driven by consumer preference for convenience and speed.

- Bank of Shanghai's Strategy: The bank is actively enhancing its digital infrastructure to offer seamless payment and settlement services.

- Customer Engagement: Innovative digital solutions are key to attracting and retaining customers in the highly competitive Chinese banking landscape.

- Market Opportunity: The continuous rise in digital transaction volumes presents a substantial opportunity for banks like Bank of Shanghai to increase revenue and market presence.

Stars represent business units or products with high market share in a high-growth industry. For Bank of Shanghai, these are areas where significant investment is warranted to maintain leadership and capitalize on future expansion. The bank's strategic focus on digital banking and wealth management aligns with these criteria.

The bank's aggressive digitization of its retail banking arm, coupled with its wide array of wealth management products targeting a growing investor base, positions these segments as potential Stars. China's wealth management market, experiencing robust growth in 2024, offers substantial room for Bank of Shanghai to expand its market share.

Furthermore, the bank's strategic lending to high-growth sectors like advanced manufacturing, which saw a 7.5% year-on-year increase in value-added output for industrial enterprises above designated size in high-tech manufacturing in 2023, also signifies Star potential.

These areas are characterized by rapid expansion and a strong demand for specialized financial services, making them prime candidates for continued investment and development within Bank of Shanghai's portfolio.

What is included in the product

Strategic assessment of Bank of Shanghai's portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of Bank of Shanghai's portfolio, easing strategic decision-making.

Identifies underperforming units, relieving the pain of inefficient resource allocation.

Cash Cows

Bank of Shanghai's traditional corporate deposits and loans are its established cash cows. This segment boasts a high market share in China's corporate banking, a mature but still substantial market. For instance, in 2023, the bank's gross corporate loans reached RMB 1.3 trillion, demonstrating the scale of this business.

These services provide a stable, predictable revenue stream, crucial for funding other business initiatives. The bank's deep relationships with a large corporate client base in Shanghai and surrounding regions solidify its position, ensuring consistent demand for these foundational financial products.

Basic retail deposit accounts are foundational to Bank of Shanghai's operations, acting as a reliable, low-cost source of funds from a broad individual customer base. In 2024, the banking sector, including Bank of Shanghai, continued to see stable, albeit moderate, growth in retail deposits, reflecting the maturity of this market segment. These accounts, characterized by their high volume and customer loyalty, consistently generate significant cash flow for the bank.

The treasury business, including interbank activities and financial investments, is vital for Bank of Shanghai's liquidity and capital management. This area provides consistent, though not rapid, revenue streams and bolsters other banking operations through effective balance sheet handling.

Established Payment and Settlement Services

Bank of Shanghai's established payment and settlement services are a cornerstone of its business, acting as a classic cash cow. These offerings, including interbank transfers, corporate payment solutions, and retail payment processing, are critical for the daily operations of a vast customer base. While the profit margin per transaction might be modest, the sheer volume ensures a steady and predictable revenue stream for the bank.

These services are deeply integrated into the financial workflows of both individuals and businesses, making them sticky and difficult to replace. For instance, corporate clients rely on these systems for payroll, supplier payments, and treasury management, creating a high degree of customer stickiness. In 2024, Bank of Shanghai reported a significant increase in transaction volumes across its payment platforms, underscoring the continued demand and utility of these established services.

- High Transaction Volume: The bank processes millions of transactions daily, generating substantial fee income.

- Customer Stickiness: Essential services create strong client relationships and reduce churn.

- Predictable Revenue: These services provide a stable and consistent cash flow, supporting other bank initiatives.

- Foundation for Growth: While mature, these services can be leveraged to introduce new, higher-margin products to an existing customer base.

Mortgage Lending

Mortgage lending is a cornerstone of Bank of Shanghai's retail banking operations and a significant contributor to its earnings. These loans form a stable asset base, consistently generating predictable interest income, even as overall mortgage growth in China has moderated. This stability is crucial for maintaining consistent revenue streams.

The existing mortgage portfolio for Bank of Shanghai is a key element of its Cash Cows. It underpins relationship banking strategies, acting as a primary touchpoint for many retail customers. This deepens customer loyalty and provides opportunities for cross-selling other financial products.

- Stable Income Generation: Mortgage loans provide a reliable source of interest income, contributing significantly to the bank's profitability.

- Relationship Anchors: They serve as a foundation for building and maintaining long-term relationships with retail customers.

- Asset Stability: The existing portfolio represents a substantial and stable asset base for the bank.

- Market Position: Mortgage lending remains a primary earnings driver within the Chinese retail banking sector.

Bank of Shanghai's traditional corporate deposits and loans are its established cash cows. This segment boasts a high market share in China's corporate banking, a mature but still substantial market. For instance, in 2023, the bank's gross corporate loans reached RMB 1.3 trillion, demonstrating the scale of this business.

These services provide a stable, predictable revenue stream, crucial for funding other business initiatives. The bank's deep relationships with a large corporate client base in Shanghai and surrounding regions solidify its position, ensuring consistent demand for these foundational financial products.

Basic retail deposit accounts are foundational to Bank of Shanghai's operations, acting as a reliable, low-cost source of funds from a broad individual customer base. In 2024, the banking sector, including Bank of Shanghai, continued to see stable, albeit moderate, growth in retail deposits, reflecting the maturity of this market segment. These accounts, characterized by their high volume and customer loyalty, consistently generate significant cash flow for the bank.

The treasury business, including interbank activities and financial investments, is vital for Bank of Shanghai's liquidity and capital management. This area provides consistent, though not rapid, revenue streams and bolsters other banking operations through effective balance sheet handling.

Bank of Shanghai's established payment and settlement services are a cornerstone of its business, acting as a classic cash cow. These offerings, including interbank transfers, corporate payment solutions, and retail payment processing, are critical for the daily operations of a vast customer base. While the profit margin per transaction might be modest, the sheer volume ensures a steady and predictable revenue stream for the bank.

These services are deeply integrated into the financial workflows of both individuals and businesses, making them sticky and difficult to replace. For instance, corporate clients rely on these systems for payroll, supplier payments, and treasury management, creating a high degree of customer stickiness. In 2024, Bank of Shanghai reported a significant increase in transaction volumes across its payment platforms, underscoring the continued demand and utility of these established services.

- High Transaction Volume: The bank processes millions of transactions daily, generating substantial fee income.

- Customer Stickiness: Essential services create strong client relationships and reduce churn.

- Predictable Revenue: These services provide a stable and consistent cash flow, supporting other bank initiatives.

- Foundation for Growth: While mature, these services can be leveraged to introduce new, higher-margin products to an existing customer base.

Mortgage lending is a cornerstone of Bank of Shanghai's retail banking operations and a significant contributor to its earnings. These loans form a stable asset base, consistently generating predictable interest income, even as overall mortgage growth in China has moderated. This stability is crucial for maintaining consistent revenue streams.

The existing mortgage portfolio for Bank of Shanghai is a key element of its Cash Cows. It underpins relationship banking strategies, acting as a primary touchpoint for many retail customers. This deepens customer loyalty and provides opportunities for cross-selling other financial products.

- Stable Income Generation: Mortgage loans provide a reliable source of interest income, contributing significantly to the bank's profitability.

- Relationship Anchors: They serve as a foundation for building and maintaining long-term relationships with retail customers.

- Asset Stability: The existing portfolio represents a substantial and stable asset base for the bank.

- Market Position: Mortgage lending remains a primary earnings driver within the Chinese retail banking sector.

| Business Segment | BCG Category | Key Characteristics | 2023 Data/Trend | 2024 Outlook |

| Corporate Deposits & Loans | Cash Cow | High market share, mature market, stable revenue | Gross corporate loans RMB 1.3 trillion | Continued stability, moderate growth |

| Retail Deposits | Cash Cow | Broad customer base, low-cost funding, customer loyalty | Stable deposit growth | Continued stable, moderate growth |

| Payment & Settlement Services | Cash Cow | High transaction volume, customer stickiness, predictable revenue | Increased transaction volumes | Sustained high volumes, potential for new product integration |

| Mortgage Lending | Cash Cow | Stable asset base, predictable interest income, relationship anchor | Primary earnings driver in retail | Continued stability, focus on cross-selling |

What You See Is What You Get

Bank Of Shanghai BCG Matrix

The Bank of Shanghai BCG Matrix preview you are currently viewing is precisely the same comprehensive document you will receive immediately after your purchase. This means no hidden watermarks or incomplete sections; you'll gain access to the fully formatted, analysis-ready BCG Matrix report, meticulously crafted for strategic decision-making and professional presentation.

Dogs

Legacy IT systems at Bank of Shanghai represent a significant challenge, acting as potential 'Dogs' in a BCG Matrix analysis. Maintaining these outdated infrastructures is not only costly, with estimates suggesting that banks spend a substantial portion of their IT budgets on legacy systems, but also impedes crucial digital transformation initiatives. This is particularly detrimental in the fast-paced fintech environment where agility and innovation are paramount for survival and growth.

These aging systems often drain valuable resources that could otherwise be invested in developing cutting-edge digital products or enhancing customer experiences. For instance, a 2024 report indicated that financial institutions globally are allocating upwards of 70% of their IT spending to simply maintain existing infrastructure, leaving less for innovation. This lack of investment in modernization means legacy systems offer little to no competitive advantage and possess minimal future growth prospects, making them prime candidates for strategic divestment or overhaul.

Undifferentiated traditional branch services at Bank of Shanghai are increasingly challenged by the rise of digital banking. These services, often characterized by routine transactions, incur higher operational costs compared to digital alternatives. For instance, in 2023, the cost per transaction at a physical branch can be significantly higher than through a mobile app, impacting overall profitability.

Without a clear strategy for innovation or specialization, these traditional services risk a low market share. As customers migrate to more convenient digital platforms, branches offering only basic, undifferentiated services may see reduced foot traffic and consequently, a diminished contribution to the bank's bottom line.

While the Bank of Shanghai, like many Chinese banks, has seen an overall reduction in non-performing loan (NPL) ratios, a closer look reveals persistent asset risks, especially within the real estate sector. This is a crucial consideration when applying the BCG matrix, as these assets often fall into the question mark or dog categories.

Assets linked to industries under significant stress, such as real estate development, can become cash traps for the Bank of Shanghai. These non-performing assets require substantial provisioning, which directly impacts profitability, and they generate minimal to no returns, further hindering growth and capital generation.

For instance, in 2023, while China's overall NPL ratio for commercial banks hovered around 1.6%, the real estate sector continued to present challenges, with specific developers facing significant defaults. This means that a portion of the Bank of Shanghai's loan portfolio tied to these troubled areas would likely be classified as dogs, demanding careful management and potential write-offs.

Low-Value, Niche Financial Products with Low Uptake

Low-value, niche financial products with low uptake, often termed 'Pets' in a BCG Matrix context, represent offerings that, despite initial development and marketing efforts, have failed to capture significant market share or generate substantial returns for the Bank of Shanghai. These products are characterized by their limited appeal and low customer adoption rates.

These niche products consume valuable resources, including capital for development, marketing expenditures, and ongoing maintenance, without yielding a proportionate return on investment. For instance, a specialized structured product targeting a very specific, small investor demographic might have seen initial development costs in the millions, but if it only attracts a few hundred thousand in assets under management annually, it becomes a drain.

- Limited Market Appeal: These products often cater to highly specific needs or demographics that are too small to be profitable.

- Resource Drain: Development, marketing, and maintenance costs outweigh the revenue generated, negatively impacting profitability.

- Low Return on Investment: Despite initial investment, these products fail to achieve the economies of scale necessary for success.

- Strategic Re-evaluation Needed: Banks must regularly assess these products to decide whether to divest, revamp, or discontinue them to reallocate resources effectively.

Inefficient Back-Office Operations

Inefficient back-office operations at Bank of Shanghai can be categorized as a Dog in the BCG Matrix. These operations, often characterized by manual processes and a lack of automation, are costly to maintain and prone to errors. For instance, in 2024, many regional banks in China reported that their manual reconciliation processes for interbank transactions consumed up to 30% of their back-office staff time, directly impacting profitability.

These areas, while not directly revenue-generating, significantly drain resources and erode profit margins. The return on investment for such operations is consequently low. In 2023, reports indicated that operational costs for Chinese banks, largely driven by inefficient legacy systems in back-office functions, represented a notable percentage of their total operating expenses, sometimes exceeding 40% for less digitized institutions.

- High Operational Costs: Manual processes increase labor needs and error correction expenses.

- Low Efficiency: Lack of automation slows down transaction processing and increases turnaround times.

- Profit Erosion: Significant operational expenses reduce the bank's net profit, impacting overall financial health.

- Poor ROI: Resources invested in these areas yield minimal returns due to their inherent inefficiencies.

Certain legacy IT systems at Bank of Shanghai function as 'Dogs' in the BCG Matrix, demanding substantial maintenance costs while offering minimal growth potential. These outdated infrastructures hinder digital transformation, a critical factor in the competitive fintech landscape. A 2024 industry analysis highlighted that financial institutions globally dedicate over 70% of their IT budgets to maintaining legacy systems, severely limiting funds for innovation.

Undifferentiated traditional branch services also fall into the 'Dog' category for Bank of Shanghai. These services incur higher operational costs compared to digital alternatives, with 2023 data showing significantly higher per-transaction costs at physical branches versus mobile apps. As customer preference shifts to digital platforms, these services face declining relevance and profitability.

Non-performing assets, particularly those linked to stressed sectors like real estate, represent 'Dogs' within Bank of Shanghai's portfolio. These assets require significant provisioning and generate little to no returns, acting as cash traps. Despite China's overall reduction in non-performing loan ratios, the real estate sector's challenges in 2023, with specific developers facing defaults, underscore the risk of these assets being classified as dogs, necessitating careful management and potential write-offs.

Inefficient back-office operations, characterized by manual processes and a lack of automation, are also 'Dogs' for Bank of Shanghai. These operations are costly, error-prone, and yield poor returns on investment. Reports from 2023 indicated that operational costs for Chinese banks, heavily influenced by legacy back-office systems, could exceed 40% of total operating expenses for less digitized institutions.

| Category | Description | Challenges | Financial Impact | Strategic Implication |

| Legacy IT Systems | Outdated technology infrastructure | High maintenance costs, impedes innovation | Drains IT budget, limits competitive edge | Divestment or significant overhaul |

| Undifferentiated Branch Services | Basic, traditional banking services | Higher operational costs, declining customer preference | Lower profitability per transaction, reduced foot traffic | Re-evaluation, potential reduction or specialization |

| Non-Performing Assets (Sector-Specific) | Loans in stressed sectors (e.g., real estate) | Requires provisioning, minimal returns, capital drain | Impacts profitability, hinders capital generation | Active management, potential write-offs or restructuring |

| Inefficient Back-Office Operations | Manual, non-automated processes | Costly to maintain, prone to errors, low efficiency | Erodes profit margins, poor ROI | Automation, process re-engineering |

Question Marks

New AI and blockchain-powered financial services represent a significant growth opportunity for Bank of Shanghai, but their current market share in these emerging areas is likely modest. The bank is investing heavily to build capabilities, aiming to capture a larger slice of this high-potential market. For instance, the global AI in financial services market was projected to reach over $30 billion by 2024, indicating substantial room for growth.

Specialized ESG investment funds are emerging as a significant growth area for the Bank of Shanghai, reflecting China's increasing focus on sustainable development. The market for ESG products in China saw substantial growth, with ESG-focused funds attracting significant inflows in recent years. For instance, by the end of 2023, the assets under management in China's publicly offered ESG funds had surpassed 200 billion yuan, demonstrating a clear trend.

While the Bank of Shanghai may be developing its own ESG fund offerings, this segment likely represents a nascent but promising category within its BCG matrix. These specialized funds require considerable investment in research, product development, and investor education to compete effectively. The bank's strategy here would involve nurturing these "question mark" products, aiming to build market share and expertise to eventually transition them into stars.

Cross-border financial services represent a potential growth avenue for Bank of Shanghai. However, as a predominantly domestic institution, its market share in this arena is likely to be modest when contrasted with established global financial giants. This segment could be classified as a question mark, requiring careful strategic consideration and investment to move towards a star position.

The bank’s expansion into international markets, exemplified by its Hong Kong subsidiary, has encountered initial headwinds. For the first half of 2024, this subsidiary reported a pre-tax loss, underscoring the difficulties in carving out a significant market presence against entrenched competitors. This financial performance highlights the investment and market penetration challenges inherent in this strategic area.

Digital-Only Consumer Lending Products

Bank of Shanghai's digital-only consumer lending products are likely positioned as Question Marks in the BCG Matrix. This segment of the Chinese market, valued at trillions of yuan and experiencing robust growth, is characterized by intense competition from both established banks and agile fintech companies.

- Market Growth: The digital lending market in China is projected to continue its rapid expansion, driven by increasing smartphone penetration and a growing preference for online financial services.

- Competitive Landscape: Bank of Shanghai faces formidable rivals, including major state-owned banks and prominent fintech players who have already captured significant market share through aggressive digital strategies.

- Investment Needs: To succeed, these digital-only products will require substantial and ongoing investment in advanced technology, data analytics, and targeted marketing campaigns to attract and retain customers.

- Potential for Growth: Despite the challenges, successful digital lending products can achieve high growth and market share if they offer innovative features, competitive rates, and a seamless user experience, potentially evolving into Stars.

Strategic Partnerships with Emerging Fintech Startups

Strategic partnerships with emerging fintech startups represent a potential Stars category for Bank of Shanghai. These collaborations allow the bank to tap into innovative technologies and reach new customer segments, potentially leading to significant future growth. For instance, a partnership with a digital payments provider could expand the bank's transaction volume and fee income.

However, the high growth potential of fintechs also comes with inherent risks, making these ventures uncertain. The bank must carefully assess the startup's technology, market fit, and regulatory compliance. A successful collaboration could see the fintech startup becoming a major revenue driver, similar to how many traditional banks have integrated mobile banking features developed by tech partners.

- Growth Potential: Fintech partnerships can unlock access to rapidly expanding digital financial services markets.

- Technological Integration: Leveraging fintech innovations can enhance customer experience and operational efficiency.

- Risk Assessment: The success of these ventures is contingent on thorough due diligence and effective integration strategies.

- Investment Required: Significant capital may be needed to support the growth and scaling of these nascent partnerships.

Question Marks for Bank of Shanghai represent business areas with high growth potential but currently low market share. These are typically new ventures or markets the bank is entering, requiring significant investment to determine their future success. For example, the bank's investment in AI-driven financial advisory services is a prime candidate, given the burgeoning fintech landscape and the need for substantial R&D to establish a competitive edge.

BCG Matrix Data Sources

Our Bank of Shanghai BCG Matrix is built on robust financial statements, comprehensive market growth data, and strategic competitor analysis to provide actionable insights.