Bank of Greece PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Greece Bundle

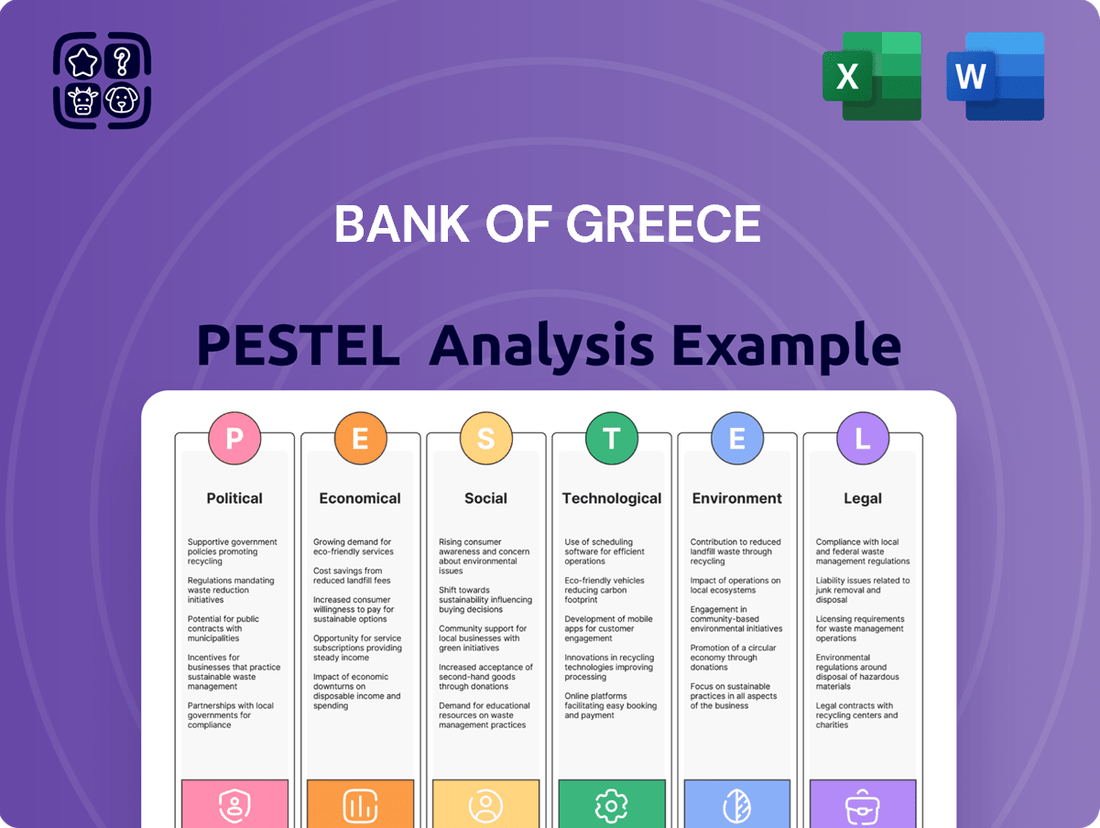

Navigate the complex external forces shaping the Bank of Greece's future with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors influencing its operations and strategic direction. Gain a competitive edge by leveraging these expert insights to inform your own market strategy.

Ready to make informed decisions about the Bank of Greece? Our detailed PESTLE analysis provides the actionable intelligence you need to anticipate challenges and identify opportunities. Download the full version now and equip yourself with the foresight to succeed.

Political factors

The political stability of Greece is a crucial element impacting the Bank of Greece's operations and its policy implementation. A stable government fosters a predictable environment for monetary and fiscal policy, allowing the Bank to focus on its mandate of price stability. Conversely, frequent governmental changes or significant ideological shifts can introduce uncertainty, potentially altering economic priorities and the regulatory framework for financial institutions.

As a member of the Eurosystem, the Bank of Greece's monetary policy is primarily dictated by the European Central Bank (ECB). This means decisions on interest rates and other crucial economic levers align with broader Eurozone objectives, impacting Greece's economic landscape.

Political currents within the European Union and the Eurozone, such as intergovernmental negotiations and policy divergences, can significantly influence the operational environment for the Bank of Greece. These dynamics can affect its policy-making flexibility and the tools available to it.

The Bank of Greece must strictly adhere to EU treaties and ECB directives, ensuring its operations remain compliant with the overarching legal and regulatory framework governing the monetary union. For instance, the ECB's target inflation rate of 2% for the medium term guides its policy stance.

Regional and global geopolitical events significantly impact the Greek economy. For instance, the ongoing conflict in Ukraine, which began in early 2022, has continued to affect energy prices and supply chains throughout 2024, contributing to inflationary pressures that the Bank of Greece must manage.

Shifts in international alliances and trade disputes also play a crucial role. The European Union's ongoing efforts to strengthen economic ties and manage external trade relations, alongside potential disruptions from trade tensions elsewhere, influence investor confidence and capital flows into Greece. These external dynamics are closely monitored by the Bank of Greece for their potential risks to financial stability and its price stability mandate.

Regulatory landscape changes

Political decisions, both within Greece and at the European Union level, are a primary driver of regulatory shifts impacting the Bank of Greece. These changes directly influence the supervisory framework, demanding constant adaptation to ensure the stability and compliance of the Greek banking sector. For instance, the European Central Bank's (ECB) ongoing review of capital requirements, as seen in its 2024 stress test methodologies, necessitates adjustments in how the Bank of Greece oversees its supervised entities.

These legislative adjustments can manifest in various forms, affecting everything from capital adequacy ratios to enhanced consumer protection measures. The Bank of Greece must remain agile, integrating new directives into its operational procedures. For example, the implementation of the Digital Operational Resilience Act (DORA) across the EU, effective from January 2025, imposes new ICT risk management requirements on financial institutions, which the Bank of Greece will be responsible for enforcing.

- Capital Requirements Directive (CRD VI) implementation: Expected to be fully transposed by member states, including Greece, in 2024-2025, introducing new prudential rules.

- European Banking Authority (EBA) Guidelines: Ongoing updates to guidelines on areas like internal governance and risk management require continuous monitoring and adaptation by the Bank of Greece.

- Consumer Protection Legislation: New or amended laws focused on fair lending practices and transparent product information directly affect bank operations and supervisory focus.

Fiscal policy coordination

The Bank of Greece's pursuit of price stability and financial well-being hinges significantly on the Greek government's fiscal policy. Political dedication to fiscal discipline, effective debt management, and implementing structural reforms directly impacts market confidence and the broader economic landscape.

Close alignment between fiscal and monetary authorities is paramount for fostering sustainable economic growth and stability. For instance, Greece's commitment to fiscal consolidation, as evidenced by its efforts to reduce its budget deficit, is a key factor in maintaining investor trust. In 2023, Greece's primary surplus reached 3.1% of GDP, a testament to fiscal prudence.

- Fiscal Discipline: Adherence to budgetary targets supports the Bank of Greece's inflation control objectives.

- Debt Management: Prudent management of public debt reduces borrowing costs and enhances financial stability.

- Structural Reforms: Reforms aimed at improving competitiveness and productivity create a more resilient economy.

- Coordination: Joint efforts between the government and the Bank of Greece are vital for navigating economic challenges effectively.

Political stability within Greece is fundamental to the Bank of Greece's effectiveness, influencing its ability to implement monetary policy and maintain financial stability. A stable political environment supports predictable economic management, allowing the Bank to focus on its mandate, such as controlling inflation. For instance, Greece's successful navigation through its post-bailout period, marked by a stable government in 2023 and 2024, has bolstered investor confidence.

The Bank of Greece operates within the broader EU framework, meaning its policies are significantly shaped by ECB decisions and EU directives. This integration means that political developments at the EU level, such as the ongoing implementation of the Capital Requirements Directive VI (CRD VI) in 2024-2025, directly impact the Bank's supervisory responsibilities and the Greek banking sector's regulatory landscape.

Geopolitical events, like the continued impact of the conflict in Ukraine, influence economic conditions such as energy prices and supply chains, creating inflationary pressures that the Bank of Greece must manage. Furthermore, international trade relations and EU-wide regulations, such as the Digital Operational Resilience Act (DORA) effective January 2025, necessitate continuous adaptation by the Bank in its oversight of financial institutions.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting the Bank of Greece across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting key trends and their implications for the Bank.

A concise PESTLE analysis of the Bank of Greece, presented in a clear, summarized format, serves as a crucial pain point reliever by enabling quick referencing and discussion of external factors during strategic planning.

Economic factors

The Bank of Greece, as part of the Eurosystem, prioritizes price stability. In May 2024, Greece's Harmonised Index of Consumer Prices (HICP) inflation stood at 2.4%, a decrease from 3.2% in April 2024, reflecting a broader Eurozone trend towards moderating price pressures.

These inflation trends are paramount for the Bank of Greece to gauge the efficacy of its monetary policy. For instance, the European Central Bank's (ECB) target is 2% inflation over the medium term, and deviations, whether upward or downward, trigger adjustments in interest rates and other policy tools to protect the euro's purchasing power.

Greece's economic health, as indicated by GDP growth, employment, and investment, directly influences banking sector stability. For instance, in the first quarter of 2024, Greece's GDP grew by 2.1% year-on-year, showcasing a positive growth trajectory. This robust expansion generally supports healthier bank balance sheets by increasing loan demand and reducing the likelihood of defaults.

Conversely, economic downturns pose significant risks to banks. High unemployment rates, which stood at 10.8% in April 2024, can lead to increased non-performing loans (NPLs) as borrowers struggle to meet their obligations. The Bank of Greece closely watches these macroeconomic indicators to identify and mitigate potential systemic risks within the financial system, adjusting its supervisory approach accordingly.

The European Central Bank's (ECB) monetary policy, particularly its key interest rates, significantly shapes the Greek economic landscape. For instance, as of early 2024, the ECB's deposit facility rate stood at 3.00%, a level that directly impacts borrowing costs for businesses and consumers in Greece. This policy environment influences the profitability of Greek banks, as it affects their net interest margins and the demand for credit.

Higher interest rates, like those seen in recent ECB tightening cycles, tend to dampen investment and consumption by making loans more expensive. Conversely, lower rates can stimulate economic activity. The Bank of Greece diligently monitors these ECB decisions and their transmission mechanisms within the Greek financial system, providing crucial analysis on their implications for domestic credit conditions and overall growth prospects.

Public Debt and Fiscal Health

Greece's public debt remains a critical factor for the Bank of Greece, impacting its role as the nation's banker. High debt levels can erode investor confidence and elevate the cost of government borrowing, directly influencing the Bank's operational environment. The Bank of Greece actively monitors these fiscal indicators, advocating for policies that ensure long-term debt sustainability and financial stability.

As of the first quarter of 2024, Greece's gross public debt stood at approximately €339.5 billion, representing about 161.9% of its GDP. This substantial debt burden necessitates careful fiscal management to maintain market confidence and control borrowing costs. The Bank of Greece plays a crucial role in advising on and implementing fiscal strategies to navigate these challenges.

- Public Debt to GDP Ratio: Greece's debt-to-GDP ratio was around 161.9% in Q1 2024, a significant figure that influences borrowing costs and investor sentiment.

- Fiscal Deficit Management: The government's ability to manage its fiscal deficit is key to controlling the growth of public debt and ensuring fiscal health.

- Banking Sector Exposure: The Bank of Greece is vigilant about potential spillover effects of public debt on the banking sector, as government bonds are often held by domestic banks.

- Borrowing Costs: Higher public debt can lead to increased interest rates on government bonds, raising the cost of financing for the state and potentially for the private sector.

Banking Sector Performance and NPLs

The Bank of Greece closely monitors the financial performance, capital adequacy, and asset quality of Greek commercial banks. A key focus is the level of non-performing loans (NPLs), which directly impacts the sector's stability and the effectiveness of the Bank's supervisory role.

The Bank of Greece actively assesses the banking system's resilience to economic shocks, implementing measures to ensure adequate capital buffers and provisions. This proactive approach is vital for maintaining financial stability.

Significant progress has been made in reducing NPLs, a crucial indicator of the sector's health. For instance, by the end of 2023, the NPL ratio for Greek banks had fallen to approximately 5.7%, a notable improvement from previous years.

- NPL Ratio: Greek banks' NPL ratio stood at around 5.7% by the close of 2023.

- Capital Adequacy: The Common Equity Tier 1 (CET1) ratio for the Greek banking system remained robust, averaging above 15% in early 2024, indicating strong capital buffers.

- Profitability: Net profits for Greek banks saw a substantial increase in 2023, driven by higher interest income and improved loan loss provisions.

- Supervisory Focus: The Bank of Greece continues to emphasize the need for further NPL reduction and enhanced risk management practices.

Economic factors significantly influence the Bank of Greece's operational mandate, particularly concerning inflation and economic growth. Greece's inflation rate, measured by the HICP, was 2.4% in May 2024, aligning with the ECB's medium-term target and indicating moderating price pressures. This economic backdrop directly informs the Bank's monetary policy assessments and supervisory activities.

The nation's GDP growth, which stood at 2.1% year-on-year in Q1 2024, provides a positive signal for the banking sector's health by potentially boosting loan demand and reducing default risks. Conversely, the unemployment rate at 10.8% in April 2024 highlights persistent challenges that could lead to increased non-performing loans, a key concern for the Bank of Greece.

The ECB's monetary policy, including the deposit facility rate at 3.00% in early 2024, directly impacts Greek banks' profitability and credit conditions. Greece's substantial public debt, approximately 161.9% of GDP in Q1 2024, also presents a critical factor that the Bank of Greece monitors for its implications on borrowing costs and financial stability.

Full Version Awaits

Bank of Greece PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bank of Greece PESTLE analysis covers all key political, economic, social, technological, legal, and environmental factors impacting the institution.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed examination of the external forces shaping the Bank of Greece's operations and strategic decisions.

The content and structure shown in the preview is the same document you’ll download after payment. This includes in-depth insights into the regulatory landscape, market trends, and societal influences relevant to the Bank of Greece.

Sociological factors

Public trust in Greece's banking system and the Bank of Greece is a critical sociological element. High confidence fuels deposits, smooth transactions, and overall economic stability, which is vital for the Bank of Greece's mandate.

Data from the European Commission's Eurobarometer surveys consistently shows varying levels of trust across member states. For instance, in late 2023, while overall confidence in the EU banking sector saw some recovery, specific national sentiments can differ significantly. A strong public belief in the integrity and stability of Greek banks directly translates to greater financial participation and a more resilient economy, bolstering the Bank of Greece's efforts to manage monetary policy and ensure financial soundness.

Greece is experiencing significant demographic shifts, notably an aging population. In 2023, the median age was 45.8 years, an increase from previous years, directly impacting labor force participation and increasing pressure on social security systems. Declining birth rates, with a total fertility rate of approximately 1.3 children per woman in recent years, further exacerbate these trends, suggesting a shrinking future workforce and potential long-term implications for economic growth and savings rates.

The general level of financial literacy in Greece is a key sociological factor. While specific recent comprehensive data for 2024/2025 is still emerging, previous surveys indicated a need for improvement. For instance, a 2021 OECD report highlighted that a significant portion of Greeks struggled with basic financial concepts, impacting their decision-making.

Financial inclusion, or access to banking services, is also crucial. The Bank of Greece has been actively working to enhance this. By promoting digital banking and accessible financial products, the aim is to ensure more citizens can participate effectively in the economy, a trend likely to continue its focus through 2024 and 2025.

Initiatives by the Bank of Greece to boost financial education are vital. These efforts aim to equip individuals with the knowledge to make sound financial choices, thereby fostering a more stable and resilient financial ecosystem for Greece.

Consumer behavior and spending patterns

Consumer behavior is a dynamic force shaping the financial landscape. Evolving habits, such as a growing preference for digital transactions and altered saving and borrowing approaches, directly influence the banking sector. For instance, in Greece, the adoption of digital payments has seen significant growth, with card transactions increasing by approximately 15% year-on-year in early 2024, reflecting a tangible shift in consumer preferences.

The Bank of Greece closely analyzes these shifts to gauge their impact on monetary policy effectiveness and credit demand. Understanding how consumers manage their finances, whether through increased savings or changes in borrowing patterns, is vital for predicting economic trends and ensuring the stability of the financial system. This adaptability is key for banks to maintain their relevance and operational efficiency in the face of changing consumer needs.

- Digital Payment Growth: Greek consumers increasingly favor digital payment methods, with card usage rising significantly in recent periods.

- Shifting Saving Habits: Consumers are adapting their approaches to saving, influenced by economic conditions and future outlooks.

- Borrowing Patterns: Changes in consumer confidence and interest rates are altering borrowing behaviors, impacting credit markets.

Social stability and inequality

High levels of social inequality and potential periods of social unrest can significantly disrupt economic stability and the investment climate in Greece. These factors can indirectly influence the Bank of Greece's considerations regarding financial stability, as persistent social issues can breed economic vulnerabilities. For instance, the Gini coefficient, a measure of income inequality, stood at 31.5 in Greece in 2023, indicating a notable disparity.

While the Bank of Greece's primary mandate is monetary policy, it must acknowledge how social friction can impact the broader economic landscape, affecting investor confidence and the overall operating environment for financial institutions. Addressing underlying social vulnerabilities, even indirectly, can contribute to a more resilient economic foundation for the country.

- Income Inequality: Greece's Gini coefficient was 31.5 in 2023, reflecting a moderate level of income disparity.

- Social Unrest Impact: Periods of significant social unrest can deter foreign direct investment and hinder domestic economic activity.

- Financial Stability Link: Persistent social issues can create economic vulnerabilities that the Bank of Greece considers in its financial stability assessments.

- Economic Resilience: Mitigating social inequalities can foster a more stable and predictable environment for the financial sector and the broader economy.

Public trust in the Greek banking system is a cornerstone for the Bank of Greece's stability mandate. High confidence directly correlates with increased deposits and smoother financial transactions, vital for economic resilience. Recent Eurobarometer data from late 2023 indicated varying trust levels across the EU, with national sentiments playing a crucial role in Greece's financial participation.

Demographic shifts, particularly an aging population and declining birth rates, present long-term economic challenges. In 2023, Greece's median age was 45.8 years, with a fertility rate around 1.3 children per woman, impacting the future workforce and savings potential.

Financial literacy remains an area for development, as noted in a 2021 OECD report, influencing consumer decision-making. The Bank of Greece's focus on financial inclusion and education aims to empower citizens, promoting greater economic participation through initiatives like digital banking access.

Consumer behavior is evolving, with a notable increase in digital payment adoption. Card transactions in Greece saw an approximate 15% year-on-year rise in early 2024, reflecting a significant shift towards digital financial habits. This trend necessitates adaptation from financial institutions to meet changing consumer preferences.

Social inequality, measured by a Gini coefficient of 31.5 in Greece in 2023, can impact economic stability and investor confidence. While not a direct mandate, the Bank of Greece considers how social friction might create broader economic vulnerabilities, influencing its assessments of financial system resilience.

| Sociological Factor | 2023/2024 Data Point | Implication for Bank of Greece |

|---|---|---|

| Public Trust in Banking | Varies by member state (Eurobarometer late 2023) | Impacts deposits, transactions, and economic stability |

| Median Age | 45.8 years (2023) | Affects labor force, social security, and savings rates |

| Fertility Rate | ~1.3 children per woman (recent years) | Indicates shrinking future workforce and long-term economic growth potential |

| Digital Payment Growth | ~15% YoY increase in card transactions (early 2024) | Signals evolving consumer behavior and need for digital financial services |

| Income Inequality (Gini Coefficient) | 31.5 (2023) | Can influence investor confidence and economic vulnerabilities |

Technological factors

The rapid digitalization of banking services, with growing adoption of online and mobile platforms, is fundamentally reshaping how commercial banks operate. By the end of 2024, it's projected that over 75% of banking transactions in many developed economies will occur digitally, a significant jump from previous years.

The Bank of Greece faces the crucial task of updating its supervisory approaches to effectively govern these evolving digital channels. Ensuring robust security measures, comprehensive consumer protection, and overall systemic stability are paramount in this increasingly digital financial environment.

This digital shift directly impacts payment systems, with innovations like real-time payment networks gaining traction, and fundamentally alters customer engagement models, pushing banks to prioritize seamless digital user experiences.

Cybersecurity threats are a growing concern for Greece's financial system, with attacks becoming more sophisticated and frequent. The Bank of Greece actively works to ensure supervised institutions implement strong defenses to safeguard sensitive data and ensure uninterrupted operations. For instance, in 2024, the European Central Bank, of which the Bank of Greece is a part, reported a significant increase in cyber incidents targeting financial sector entities across the Eurozone, underscoring the urgency of these measures.

Blockchain and Distributed Ledger Technology (DLT) are rapidly evolving, presenting a dual-edged sword for the financial sector. The Bank of Greece is actively tracking these advancements, particularly the potential of central bank digital currencies (CBDCs) and tokenized assets. These innovations could significantly alter monetary policy transmission, the very infrastructure of financial markets, and the existing regulatory landscape. For instance, by mid-2024, several countries were actively piloting CBDCs, with Greece and the Eurozone exploring their implications for cross-border payments and financial inclusion.

Data analytics and AI

The Bank of Greece is increasingly leveraging data analytics and artificial intelligence to bolster its financial surveillance and risk assessment capabilities. For instance, the European Central Bank, in its 2024 outlook, highlighted the growing adoption of AI and machine learning by national central banks for tasks like fraud detection and macroeconomic forecasting. This allows for more agile identification of emerging threats within the Greek financial system.

These advancements enable more sophisticated policy modeling, allowing the Bank to simulate the impact of various economic scenarios with greater precision. In 2024, a significant portion of central banks globally reported an increase in their investment in advanced data analytics tools, aiming to improve the accuracy of their economic predictions and policy recommendations. This data-driven approach is crucial for navigating complex economic landscapes.

However, the integration of these technologies presents challenges. Key concerns revolve around ensuring data privacy, mitigating algorithmic bias that could lead to unfair outcomes, and establishing robust ethical frameworks for AI deployment. The Bank must carefully manage these aspects to maintain public trust and ensure equitable application of its supervisory and policy functions.

- Enhanced Surveillance: AI-powered tools can process vast datasets to detect anomalies and potential risks in real-time, improving the Bank's oversight of financial institutions.

- Improved Risk Assessment: Advanced analytics allow for more granular and predictive risk modeling, helping the Bank to anticipate and address vulnerabilities proactively.

- Data-Driven Policy: AI and big data analytics enable more informed and evidence-based decision-making in monetary policy and financial stability operations.

- Ethical Considerations: The Bank must address data privacy concerns and potential biases in AI algorithms to ensure fair and responsible use of these technologies.

FinTech innovation and competition

The financial technology (FinTech) sector is rapidly expanding, presenting both novel competitive pressures and significant innovation opportunities for traditional financial institutions like those overseen by the Bank of Greece. These agile FinTech firms are introducing new services and business models that can disrupt established banking practices.

The Bank of Greece is actively monitoring the evolving FinTech landscape to understand its implications for market dynamics and overall financial stability. This involves assessing the impact of new entrants on competition and identifying potential systemic risks.

To navigate this changing environment, the Bank of Greece is considering adaptive regulatory approaches. This includes exploring initiatives such as regulatory sandboxes, which allow for controlled testing of innovative financial products and services, and ensuring that regulations promote a fair competitive environment for both traditional banks and FinTech companies.

In 2024, FinTech investment globally continued to be robust, with particular growth in areas like digital payments and embedded finance, indicating the ongoing disruption to traditional banking models. For instance, the European FinTech market saw significant funding rounds in early 2024, highlighting the competitive drive.

- FinTech investment: Global FinTech funding reached over $100 billion in 2023, with projections for continued growth into 2024, particularly in digital banking and payment solutions.

- Market disruption: New FinTech entrants are increasingly offering services such as peer-to-peer lending and digital wallets, directly competing with established banks.

- Regulatory adaptation: The Bank of Greece is actively engaging with the European Banking Authority (EBA) on developing frameworks to address FinTech risks and opportunities, aiming for a balanced regulatory approach.

- Innovation focus: Initiatives like regulatory sandboxes are being explored to facilitate the testing of new technologies, such as blockchain applications in finance, within a supervised environment.

Technological advancements are fundamentally altering the banking landscape, with a significant shift towards digital platforms. By the end of 2024, it's estimated that over 75% of banking transactions in many developed nations will be digital, necessitating updated supervisory approaches from the Bank of Greece to manage security and consumer protection in this evolving environment.

Cybersecurity remains a critical concern, with increasingly sophisticated threats targeting financial institutions. The Bank of Greece, in alignment with the European Central Bank, is prioritizing robust defenses against these attacks, as evidenced by a reported rise in cyber incidents across the Eurozone in 2024.

Emerging technologies like blockchain and DLT are being closely monitored by the Bank of Greece, particularly regarding central bank digital currencies and tokenized assets, which could reshape monetary policy and financial market infrastructure. By mid-2024, several nations were piloting CBDCs, with the Eurozone exploring their potential for payments and financial inclusion.

The Bank of Greece is increasingly adopting data analytics and artificial intelligence to enhance its oversight and risk assessment capabilities, mirroring a global trend among central banks in 2024 to invest in these tools for improved forecasting and fraud detection.

Legal factors

As a member of the Eurosystem, the Bank of Greece is bound by the extensive legal framework of the European Union and the European Central Bank's (ECB) statutes. This legal structure governs its core functions, including monetary policy implementation and the prudential supervision of financial institutions. For instance, the ECB's Guideline (EU) 2024/xxxx on the implementation of monetary policy operations, which came into effect on January 1, 2024, directly shapes the Bank of Greece's operational procedures.

Adherence to EU directives and regulations, such as those concerning anti-money laundering (AML) and capital requirements for banks, is a legal imperative for the Bank of Greece. The latest report from the European Banking Authority (EBA) in Q1 2024 indicated that Greek banks met the regulatory capital requirements, with an average Common Equity Tier 1 (CET1) ratio of 15.2%, demonstrating compliance with these binding EU standards.

Greek national laws, including those governing the banking sector and financial markets, directly shape the Bank of Greece's supervisory authority. These statutes dictate requirements for bank licensing, capital adequacy, and corporate governance, as well as anti-money laundering protocols.

The Bank of Greece actively enforces these legal frameworks to safeguard the stability and integrity of the nation's financial system. For instance, as of early 2024, the Bank continues to oversee adherence to the latest EU-driven capital requirements for Greek banks, ensuring they maintain robust financial health.

The Bank of Greece operates under stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) legislation, a core legal mandate. This framework requires rigorous oversight of financial institutions to prevent illicit financial flows and safeguard the integrity of the banking system.

In 2024, the Bank of Greece continued its proactive supervision, with a focus on enhancing reporting requirements and strengthening due diligence processes for regulated entities. This commitment is crucial in combating financial crime and aligning with European Union directives on AML/CTF.

Data protection regulations

The Bank of Greece must strictly adhere to data protection regulations, most notably the General Data Protection Regulation (GDPR) within the European Union. These laws dictate the Bank's responsibilities concerning the collection, processing, storage, and sharing of sensitive personal and financial information. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to €20 million or 4% of the company's annual global turnover, whichever is higher. Maintaining robust data security and privacy practices is therefore paramount for preserving stakeholder trust and operational integrity.

Key aspects of data protection compliance for the Bank of Greece include:

- Data Minimization: Collecting only the data that is absolutely necessary for specified purposes.

- Consent Management: Ensuring clear and informed consent is obtained for data processing activities.

- Data Subject Rights: Facilitating individuals' rights to access, rectify, erase, and port their data.

- Security Measures: Implementing appropriate technical and organizational safeguards to protect data against unauthorized access or breaches.

Financial crisis management and resolution frameworks

The Bank of Greece operates within a robust legal framework for financial crisis management and resolution, heavily influenced by European Union directives. These laws, including those governing deposit guarantee schemes and bank recovery and resolution, empower the Bank to act decisively during financial distress. For instance, the Hellenic Deposit and Investment Guarantee Fund (TECL) ensures depositor protection, a critical element in maintaining financial stability.

These legal structures provide the Bank of Greece with the necessary authority to implement interventions such as recapitalizing struggling institutions, facilitating restructuring, or, if necessary, managing the orderly liquidation of failing banks. The primary objective is always to mitigate broader economic repercussions and safeguard taxpayer interests. The Bank's role is particularly crucial in coordinating these actions with the Single Resolution Board (SRB) and other European supervisory bodies, ensuring a unified approach to systemic risk.

Key legal provisions impacting the Bank of Greece's crisis management include:

- Bank Recovery and Resolution Directive (BRRD): This EU directive, transposed into national law, establishes a comprehensive framework for preventing and managing bank failures, including resolution planning and the use of resolution tools.

- Deposit Guarantee Schemes Directive (DGSD): This directive sets out the minimum coverage levels for eligible deposits and the procedures for compensating depositors in the event of a bank failure, with the TECL acting as the national deposit guarantee scheme.

- Single Resolution Mechanism (SRM): The Bank of Greece actively participates in the SRM, working closely with the SRB to ensure the orderly resolution of significant banks operating within the Eurozone, thereby enhancing cross-border financial stability.

The Bank of Greece is deeply integrated into the EU's legal framework, necessitating strict adherence to directives on monetary policy, banking supervision, and financial stability. This includes compliance with ECB regulations and national Greek legislation governing financial institutions, ensuring robust prudential standards and operational integrity.

In 2024, Greek banks maintained strong capital positions, with an average Common Equity Tier 1 (CET1) ratio of 15.2% as of Q1, exceeding the regulatory requirements set by the European Banking Authority. This reflects the effectiveness of EU directives on capital adequacy and the Bank of Greece's supervisory role in enforcing them.

Legal mandates for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) are critical. The Bank of Greece's 2024 supervisory focus on enhanced reporting and due diligence aims to combat financial crime and align with EU standards, reinforcing the integrity of the financial system.

Data protection, governed by GDPR, is paramount. Penalties for non-compliance can be severe, up to 4% of global annual turnover, underscoring the Bank's commitment to safeguarding sensitive financial and personal information through robust security and privacy practices.

Environmental factors

The Bank of Greece acknowledges that climate change presents substantial threats to financial stability. These threats are categorized into physical risks, such as damage to assets from extreme weather, and transition risks, stemming from shifts in policy and markets as economies decarbonize.

These climate-related risks can manifest as devaluations in assets, a rise in loan defaults, and broader systemic vulnerabilities within the financial system. For instance, the European Central Bank's 2022 climate stress test indicated that a severe climate scenario could lead to significant losses for banks, highlighting the urgency of assessment and mitigation strategies.

The Bank of Greece is actively involved in shaping and implementing sustainable finance regulations, aligning with the European Union's ambitious green agenda. This focus is critical as global and European investment flows increasingly prioritize environmentally responsible practices.

In 2024, the European Central Bank's (ECB) climate stress tests highlighted the need for banks to integrate climate-related risks into their operations, a directive the Bank of Greece actively promotes among Greek financial institutions. This push encourages Greek banks to embed ESG factors into their lending and investment strategies, aiming to foster a more sustainable financial sector.

The Greek government has also launched various green initiatives, such as the National Recovery and Resilience Plan, which allocates significant funding towards green transition projects. The Bank of Greece plays a role in ensuring that the banking sector supports these initiatives through environmentally conscious financing, thereby channeling capital towards sustainable economic development.

Financial institutions in Greece, like elsewhere in the EU, are facing a growing wave of new reporting and disclosure mandates concerning climate-related risks. These requirements are designed to bring greater transparency to how banks assess and manage their exposure to physical and transitional climate impacts.

The Bank of Greece is actively involved in the implementation and supervision of these evolving standards for Greek banks. This includes ensuring that institutions are transparent about their climate-related financial disclosures and their resilience to environmental shifts, aligning with broader European Banking Authority (EBA) guidelines.

For instance, the EBA's 2024 data collection on climate-related and environmental risks, which Greek banks participate in, highlights the increasing focus on quantifying these exposures. This initiative aims to build a robust dataset for supervisory assessment and the development of further regulatory measures.

Impact of environmental policies on economic sectors

Government environmental policies, including carbon pricing and renewable energy mandates, are reshaping Greece's economic landscape. For instance, the EU's Fit for 55 package, aimed at reducing greenhouse gas emissions by at least 55% by 2030, directly influences sectors like energy, transport, and industry. The Bank of Greece monitors how these evolving regulations impact corporate profitability and the financial stability of Greek businesses.

These policies can create both challenges and opportunities for various economic sectors. Industries heavily reliant on fossil fuels may face increased operational costs due to carbon taxes, potentially affecting their long-term viability and increasing credit risk for lenders. Conversely, sectors focused on green technologies and renewable energy are likely to experience growth and enhanced investment prospects.

The Bank of Greece's analysis highlights the critical need to understand the economic implications of environmental goals. For 2024, Greece aims to significantly increase its renewable energy sources, targeting a 45% share in gross final energy consumption by 2030, a move that requires substantial investment and adaptation across the energy sector.

- Carbon Pricing Impact: Increased operational costs for energy-intensive industries due to carbon pricing mechanisms.

- Renewable Energy Targets: Growth opportunities for businesses in solar, wind, and other green energy sectors.

- Regulatory Compliance: Potential for increased investment in pollution control technologies and sustainable practices.

- Economic Growth Link: The interplay between environmental policy implementation and overall GDP growth projections for Greece.

Reputational risks associated with environmental performance

The Bank of Greece, along with the financial institutions it oversees, faces considerable reputational risks tied to their environmental performance and policies. As public and investor attention on climate change intensifies, banks that neglect environmental concerns risk damaging their public image, potentially leading to divestment campaigns and restricted access to funding. For instance, a 2024 report by the European Central Bank highlighted that 70% of euro area banks identified climate-related risks as a material concern impacting their reputation.

The Bank of Greece actively promotes proactive engagement with environmental stewardship among supervised entities. This includes encouraging the development of robust environmental risk management frameworks and transparent reporting on sustainability metrics. In 2025, the Bank is expected to release updated guidelines for stress-testing climate-related scenarios, aiming to bolster the resilience and environmental accountability of the Greek banking sector.

- Reputational Impact: Failure to address environmental issues can lead to negative public perception and loss of investor confidence.

- Investor Scrutiny: Growing demand for sustainable investments means banks with poor environmental records may struggle to attract capital.

- Regulatory Pressure: Increased focus on ESG (Environmental, Social, and Governance) factors by regulators like the ECB is driving greater accountability.

- Proactive Engagement: The Bank of Greece's encouragement of environmental stewardship aims to mitigate these risks and foster a more sustainable financial system.

Environmental factors significantly shape the Greek financial landscape, with climate change posing tangible risks. The Bank of Greece acknowledges that extreme weather events can damage assets, while the transition to a greener economy introduces policy and market shifts impacting financial stability. For instance, the ECB's 2024 climate stress tests underscored the potential for substantial losses for banks under severe climate scenarios, emphasizing the need for robust risk management.

Greece's commitment to environmental goals, such as increasing renewable energy sources to a 45% share by 2030, necessitates significant financial adaptation. This transition creates opportunities for green finance but also challenges for carbon-intensive industries facing higher operational costs due to policies like the EU's Fit for 55 package. The Bank of Greece monitors these dynamics to ensure the banking sector supports sustainable economic development.

The Bank of Greece is actively promoting sustainable finance, aligning with EU directives and encouraging Greek banks to embed ESG factors into their strategies. This includes implementing new reporting mandates for climate-related risks, as seen in the EBA's 2024 data collection, to enhance transparency and resilience within the financial sector.

Reputational risks are also a growing concern, with a 2024 ECB report indicating that 70% of euro area banks view climate risks as material to their reputation. The Bank of Greece's proactive approach to environmental stewardship aims to mitigate these risks, with updated stress-testing guidelines expected in 2025 to bolster the sector's environmental accountability.

| Environmental Factor | Impact on Greek Financial Sector | Key Initiatives/Data (2024-2025) |

|---|---|---|

| Climate Change Risks | Physical damage to assets, loan defaults, systemic vulnerabilities | ECB 2024 Climate Stress Tests highlight potential bank losses; Bank of Greece promotes climate risk integration. |

| Green Transition Policies | Opportunities in renewables, increased costs for fossil fuel industries | Greece targets 45% renewable energy by 2030; EU Fit for 55 package influences sectors. |

| Regulatory & Disclosure Mandates | Increased transparency on climate risks, ESG integration | EBA 2024 data collection on climate risks; Bank of Greece supervises evolving standards. |

| Reputational Risk | Loss of investor confidence, restricted access to funding | ECB report (2024): 70% of euro area banks see climate risks as material to reputation; Bank of Greece to release updated stress-testing guidelines in 2025. |

PESTLE Analysis Data Sources

Our Bank of Greece PESTLE Analysis is built on a robust foundation of data from official Greek government publications, European Union directives, and leading international financial institutions. We meticulously gather insights from economic reports, legislative updates, and demographic surveys to ensure comprehensive coverage.