Bank of Greece Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Greece Bundle

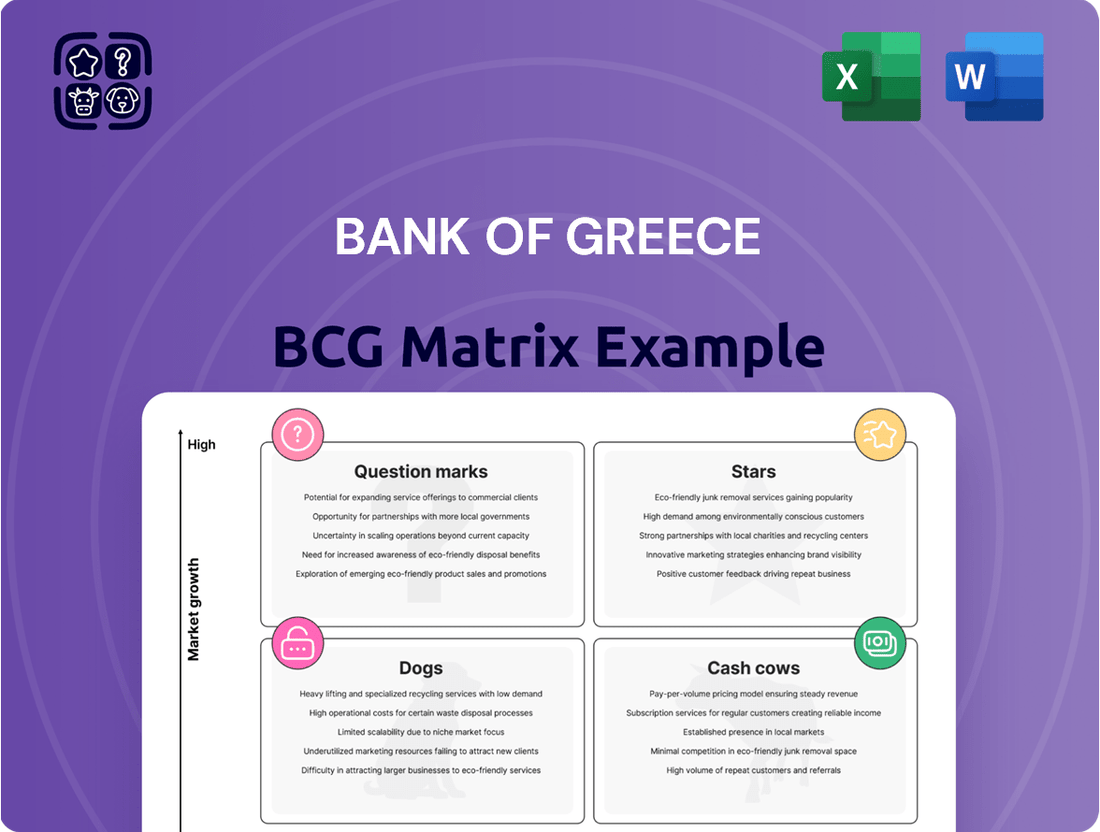

Unlock the strategic potential of the Bank of Greece with our comprehensive BCG Matrix analysis. Understand which of its services are Stars, Cash Cows, Dogs, or Question Marks, and where its future growth lies.

This preview offers a glimpse into the Bank of Greece's market positioning. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing its product portfolio and resource allocation.

Don't miss out on critical insights into the Bank of Greece's competitive landscape. Get the full BCG Matrix today to receive a detailed Word report and a high-level Excel summary, empowering you to evaluate, present, and strategize with absolute confidence.

Stars

The Bank of Greece has bolstered its macroprudential policy, setting a positive countercyclical capital buffer rate at 0.5% effective October 2025. This move is designed to safeguard the banking sector against potential systemic risks during Greece's economic recovery and periods of financial stability.

The Bank's 2024 Annual Report on Prudential Supervision and Resolution Activities underscores its dedication to transparency in these critical policy enhancements. This proactive approach aims to build a more resilient financial system, ready to navigate future economic challenges.

As a key member of the Eurosystem, the Bank of Greece is deeply involved in shaping and executing monetary policy, a field that has seen significant adjustments with the European Central Bank's recent interest rate hikes. Its contributions are vital to the broader monetary strategy for the entire eurozone.

The Bank of Greece's influence is amplified by Greece's projected economic growth, which is expected to outpace the eurozone average in both 2024 and 2025. This economic dynamism highlights the tangible impact of the monetary policies the Bank helps implement, solidifying its status as a star performer within its operational sphere.

The Bank of Greece is a key player in the Eurosystem's drive for advanced digital payment systems, including instant payment solutions. Their involvement in the preparation phase for a potential digital euro underscores their commitment to modernizing financial transactions. This strategic focus aligns with the increasing adoption of electronic payments observed in Greece and the broader Eurozone.

Supervision of a Recovering Banking Sector

The Greek banking sector has demonstrated significant resilience and improvement, with profitability reaching robust levels and non-performing loans (NPLs) falling to their lowest point since the country joined the Eurozone. This turnaround is a testament to the effectiveness of the Bank of Greece's supervisory efforts.

The Bank of Greece's enhanced supervisory framework, which includes new governance rules set to be implemented by July 2025, plays a pivotal role in steering this recovery and safeguarding financial stability. This makes banking supervision a particularly impactful and successful area of the Bank's operations.

- Profitability Surge: Greek banks have reported substantial profit growth, with aggregate net profits expected to exceed €3 billion in 2024, a sharp increase from previous years.

- NPL Reduction: The ratio of non-performing loans across the Greek banking system has fallen below 5% as of early 2024, a significant achievement from over 30% in 2017.

- Credit Rating Upgrades: Several Greek banks have seen their credit ratings upgraded by major agencies in 2024, reflecting improved financial health and the success of supervisory measures.

- New Governance Rules: The introduction of updated governance rules by July 2025 aims to further strengthen internal controls and risk management within the banking sector.

Leadership in Climate Change and Sustainable Finance

The Bank of Greece showcases significant leadership in climate change and sustainable finance. Its establishment of the Climate Change and Sustainability Centre (CCSC) underscores a dedicated approach to this critical area. For instance, in 2023, the CCSC actively contributed to research on the economic impacts of climate change in Greece, with preliminary findings suggesting potential GDP reductions of up to 7% by 2050 under certain warming scenarios.

This leadership extends to active participation in key national and international initiatives. The Bank's involvement in projects like LIFE-IP AdaptInGreece, which secured €12.7 million in EU funding for climate adaptation measures, highlights its role in mobilizing finance. Such engagement is crucial as sustainable finance markets are projected to grow substantially, with global green bond issuance expected to exceed $1 trillion in 2024.

- Climate Change and Sustainability Centre (CCSC): Dedicated research and policy development hub.

- LIFE-IP AdaptInGreece: Active participation in a major EU-funded climate adaptation project.

- Mobilizing Finance: Facilitating investment in climate-resilient infrastructure and green projects.

- Sustainable Economic Model: Contributing to a long-term economic vision that integrates environmental considerations.

The Bank of Greece's proactive monetary policy, coupled with Greece's strong economic growth forecast for 2024 and 2025, positions it as a star performer. Its leadership in digital payments and the significant improvements in the Greek banking sector, including robust profitability and reduced non-performing loans (NPLs), further solidify this status. The Bank's commitment to modernizing financial transactions and its effective supervisory efforts are key drivers of this success.

The Bank of Greece's strategic focus on digital payment systems, including instant payments and preparations for a potential digital euro, highlights its forward-thinking approach. This aligns with the increasing adoption of electronic payments across the Eurozone. The sector's improved health, with aggregate net profits exceeding €3 billion in 2024 and NPLs falling below 5% by early 2024, demonstrates the tangible impact of the Bank's policies and supervision.

The Bank of Greece's leadership in sustainable finance, exemplified by its Climate Change and Sustainability Centre and participation in EU climate adaptation projects, is another area of stellar performance. With global green bond issuance projected to surpass $1 trillion in 2024, the Bank is well-positioned to facilitate investment in a sustainable economic future for Greece.

| Area of Operation | Key Performance Indicators | Status |

|---|---|---|

| Monetary Policy & Economic Growth | Greece's projected growth outperforming Eurozone average (2024-2025) | Star |

| Banking Supervision & Stability | NPL ratio below 5% (early 2024); Aggregate net profits > €3 billion (2024) | Star |

| Digital Payments & Innovation | Active role in instant payments and digital euro preparation | Star |

| Sustainable Finance | Establishment of CCSC; Participation in EU climate projects; Growing green finance market | Star |

What is included in the product

The Bank of Greece BCG Matrix categorizes its business units based on market share and growth, offering strategic guidance.

A clear, actionable BCG Matrix visual for the Bank of Greece, simplifying complex portfolio analysis to reduce decision-making paralysis.

Cash Cows

The Bank of Greece, as a key player in the Eurosystem, fundamentally prioritizes price stability. This core function, while not a growth area, secures a high 'market share' of economic confidence and purchasing power for Greece. Its ongoing success means a stable currency environment for all economic actors.

The Bank of Greece acts as the government's banker and treasury agent, a core, mature function that underpins public finance. This role involves managing state accounts, processing payments, and offering fiscal advice, ensuring the smooth operation of government finances.

This essential service represents a high-market share, stable revenue stream for the Bank of Greece, generating consistent operational value without the need for significant new investment or market expansion. For instance, in 2024, the Greek government's debt management operations, facilitated by the Bank of Greece, continued to be a cornerstone of its fiscal activities.

The Bank of Greece's oversight of payment and settlement systems is a cornerstone of its operations, ensuring the seamless flow of money throughout the economy. This vital function is mature, contributing significantly to financial stability.

In 2023, the TARGET2 system, a key platform managed by the Bank of Greece, facilitated a substantial volume of interbank transfers, underscoring its critical role. The efficiency of these systems is paramount, requiring continuous investment in technology and security rather than expansion.

Supervision of Less Significant Credit Institutions

The Bank of Greece oversees less significant credit institutions, a crucial but stable part of the Greek financial system. This function, while not a growth engine, ensures the soundness of a considerable segment of domestic banking, contributing reliably to financial stability. For instance, as of the end of 2023, the Bank of Greece was directly supervising a significant number of these smaller institutions, ensuring their compliance with prudential requirements.

This ongoing supervisory role is vital for maintaining the overall health of the Greek banking sector. While the European Central Bank handles the largest banks, the Bank of Greece’s direct oversight of these less significant entities is a continuous and fundamental responsibility. This steady contribution, though not characterized by rapid expansion, underpins a substantial portion of the national financial infrastructure.

- Steady Revenue Generation: This supervisory function provides a consistent, albeit modest, revenue stream for the Bank of Greece through supervisory fees.

- Systemic Stability Contribution: By ensuring the prudential soundness of less significant institutions, the Bank of Greece mitigates potential risks to the broader financial system.

- Regulatory Compliance Focus: The primary objective is to ensure these institutions adhere to all relevant banking regulations and capital adequacy requirements.

- Limited Growth Potential: This area is not expected to experience significant market expansion or innovation, fitting the profile of a cash cow.

Research and Economic Analysis

The Bank of Greece's research and economic analysis arm functions as a strategic Cash Cow within its operational framework. This division consistently produces in-depth economic reports, such as annual reports and monetary policy reviews, offering crucial insights into the Greek economic landscape. For example, the Bank of Greece's 2023 Annual Report highlighted a projected GDP growth of 2.9% for the Greek economy in 2024, underscoring the relevance of its forward-looking analyses.

This output generates significant value by informing policy decisions and providing essential data for market participants. The Bank’s expertise in economic forecasting and analysis commands a high share of influence in economic discourse, even though it isn't a commercial product with direct revenue generation. The depth of information provided in their publications, like the Financial Stability Review, solidifies its position as a reliable source of economic intelligence.

- High Market Share: Dominant provider of authoritative economic data and forecasts for Greece.

- Low Growth Potential: Research output is a core function, not a commercial product with expansion goals.

- Profitability (Indirect): Contributes to informed decision-making, indirectly supporting economic stability and growth.

- Key Outputs: Annual Reports, Monetary Policy Reports, Financial Stability Reviews.

The Bank of Greece's role in managing payment and settlement systems, such as TARGET2, represents a mature business with a high market share in facilitating financial transactions. This function is essential for the smooth operation of the Greek economy, generating stable, albeit indirect, value through its critical infrastructure provision. The continued efficiency and security of these systems are paramount, necessitating ongoing investment in technology to maintain their reliability, rather than market expansion.

In 2023, the volume of transactions processed through these systems, including interbank transfers, remained robust, highlighting their indispensable nature. The Bank's commitment to maintaining these vital financial arteries ensures a predictable and consistent contribution to its overall operational stability. This steady performance aligns perfectly with the characteristics of a Cash Cow, providing reliable support without requiring significant strategic shifts.

| Function | BCG Category | Description | 2023/2024 Data Point |

|---|---|---|---|

| Payment & Settlement Systems Oversight | Cash Cow | Essential infrastructure for financial transactions, high market share in facilitating money flow. | TARGET2 system facilitated a substantial volume of interbank transfers in 2023. |

| Economic Research & Analysis | Cash Cow | Authoritative provider of economic data and forecasts, influencing policy and market understanding. | Bank of Greece's 2023 Annual Report projected 2.9% GDP growth for Greece in 2024. |

Full Transparency, Always

Bank of Greece BCG Matrix

The preview you are currently viewing is the identical, fully completed Bank of Greece BCG Matrix document you will receive upon purchase. This means you can confidently assess the quality, detail, and strategic insights contained within the report, knowing it's precisely what you'll download. The analysis presented is ready for immediate application in your business strategy, offering a clear and actionable framework for evaluating the Bank of Greece's portfolio. No further editing or modification is required; you'll receive the finalized, professionally formatted report as is.

Dogs

Despite considerable strides in tackling non-performing loans (NPLs), Greece's banking sector still grapples with a residual high NPL ratio. As of June 2024, the system-wide NPL ratio stood at 6.9%, a figure substantially above the European average of 2.3%.

This persistent segment of legacy bad loans, though diminishing, represents a low-growth area. It continues to immobilize vital capital and resources, offering minimal new revenue streams and necessitating continuous management attention.

While the situation is improving, these remaining NPLs act as a relative drag on the overall performance and growth potential of Greek banks.

Despite the rise of electronic payments, cash remains a dominant force in Greece for everyday purchases. In 2024, a substantial 54% of all transactions in Greece were still conducted using cash. This reliance on physical currency highlights a segment of the market where digital payment adoption lags behind other Eurozone nations.

This preference for cash positions it as a low-growth area within the broader payment landscape. While digital transactions are rapidly expanding, the persistent preference for cash for smaller, everyday expenses means this traditional method continues to hold significant transaction volume, even as newer, faster payment methods gain traction.

The Bank of Greece has faced past criticisms for regulatory inertia, particularly concerning its delayed response to banking scandals. This historical passivity has understandably eroded public trust and influenced perceptions of the institution's effectiveness.

While new governance frameworks have been implemented, fully shedding this legacy and restoring complete public confidence remains a gradual undertaking. This slow rebuilding process translates to minimal immediate gains in terms of enhanced influence or market share, reflecting a 'cash cow' or 'dog' quadrant in a strategic assessment.

Limited Direct Influence on Global Trade Dynamics

The Bank of Greece, while vigilant about global geopolitical risks affecting the Greek economy, possesses minimal direct leverage over international trade conditions or global policy uncertainty. This external arena represents a low-market share segment where the Bank's role is primarily reactive, adapting to rather than dictating global shifts, notwithstanding their significant impact.

For instance, while the Bank of Greece actively analyzes the ramifications of events like the ongoing supply chain disruptions impacting global trade, its capacity to alter these fundamental dynamics is negligible. The Greek economy's trade volume, while important domestically, constitutes a small fraction of the global total, limiting its influence on broader international trade policies or the resolution of global uncertainties.

- Limited Global Trade Influence: The Bank of Greece's direct impact on global trade flows and policy uncertainty is minimal, reflecting a low market share in this external environment.

- Reactive Stance: The Bank's strategy involves monitoring and adapting to global geopolitical and trade developments rather than actively shaping them.

- Economic Context: Greece's trade volume, while significant for its own economy, represents a minor component of the global trade landscape.

- Focus on Domestic Impact: The Bank's primary concern is analyzing and mitigating the impact of these external factors on the Greek economy.

Management of Legacy Public Debt Issues

The Bank of Greece, in its strategic analysis, categorizes legacy public debt issues as a 'problem' within its framework. Despite a notable reduction in Greece's public debt-to-GDP ratio, which stood at an estimated 153.8% in 2024, the substantial historical burden necessitates continuous management.

This ongoing effort is crucial for maintaining fiscal stability, even as the country achieves investment-grade status. The central bank's role here is one of diligent oversight and support for government fiscal policies, rather than a driver of new economic expansion.

- Legacy Debt Burden: In 2024, Greece's public debt remained significant at 153.8% of GDP.

- Ongoing Management: The Bank of Greece actively monitors and contributes to fiscal stability efforts concerning this legacy debt.

- Low Growth Characteristic: This category represents a 'problem' area due to its historical weight and lack of new growth potential.

- Focus on Stability: The primary objective is to manage the existing debt without creating new growth avenues.

The Bank of Greece's legacy issues, such as high residual non-performing loans (NPLs) and the persistent reliance on cash for transactions, can be viewed as 'Dogs' in the BCG matrix. These segments, despite ongoing efforts, represent low-growth, low-market share areas that require continuous management attention without significant new revenue potential.

The persistence of cash transactions, accounting for 54% of all transactions in Greece in 2024, illustrates a segment with limited growth prospects in an increasingly digital payment landscape. Similarly, the Bank's limited direct influence over global trade conditions places it in a low-market share, low-growth category.

These 'Dog' categories, characterized by their low growth and minimal market share, demand careful resource allocation to manage existing liabilities rather than to drive future expansion.

| Category | Description | 2024 Data Point | Strategic Implication |

| Non-Performing Loans (NPLs) | Residual bad loans requiring ongoing management. | System-wide NPL ratio at 6.9% (June 2024). | Low growth, requires capital and resource allocation for management. |

| Cash Transactions | Dominant payment method for everyday purchases. | 54% of all transactions in 2024. | Low growth area within the payment landscape, despite high volume. |

| Global Trade Influence | Bank's limited leverage over international trade conditions. | Greece's trade volume is a small fraction of global total. | Low market share in an external environment, primarily reactive. |

Question Marks

The Bank of Greece is actively integrating climate-related risks into its financial supervision framework. This aligns with a global trend where regulators are increasingly focusing on these emerging threats, recognizing their potential impact on financial stability. While this represents a high-growth area for regulatory development, the precise methodologies and the full extent of its impact on the Greek banking sector are still being defined, leading to some uncertainty about the ultimate outcomes.

The Bank of Greece is exploring the broader adoption of artificial intelligence, machine learning, and advanced analytics across its operations, aiming for greater efficiency and improved risk management. This move beyond traditional digital payments signifies a significant potential for growth and innovation within the central bank's functions.

While the potential is high, the Bank of Greece's current implementation level of these advanced technologies is still developing, placing it in a nascent stage. This makes its specific 'market share' or maturity in this rapidly evolving technological landscape a key area of ongoing assessment and a question mark for its BCG Matrix positioning.

The Bank of Greece emphasizes that Greece's successful absorption and utilization of Recovery and Resilience Facility (RRF) funds are critical for speeding up its green and digital transformations. This presents a significant growth avenue for the nation's economy.

While the RRF offers substantial potential, the Bank of Greece's direct influence on the precise deployment and ultimate impact of these funds is more of an advisory and oversight role rather than a direct market share. Its involvement is more about ensuring the strategic alignment and effectiveness of the program.

Developing New Financial Education and Literacy Programs

The Bank of Greece, while not a commercial entity, can play a pivotal role in bolstering national financial literacy, a strategic imperative for long-term economic health. This initiative aligns with the central bank's mandate to foster a stable financial system, offering significant societal benefits. Though likely an emerging area with currently limited direct market penetration, its potential for high impact is undeniable.

- Societal Impact: Enhancing financial literacy empowers citizens to make informed decisions, reducing vulnerability to financial shocks and promoting responsible financial behavior.

- Economic Stability: A financially educated populace contributes to a more resilient economy, fostering greater trust in financial institutions and markets.

- Emerging Initiative: While specific program details might be nascent, the Bank of Greece's commitment to this area signals a forward-looking approach to its public engagement.

- Potential for Growth: This category represents a "question mark" in the BCG matrix, indicating high growth potential but requiring significant investment to establish market presence and achieve widespread adoption.

Responding to Evolving Geopolitical Shocks and Market Volatility

The Bank of Greece recognizes that navigating increased global uncertainty, geopolitical instability, and fluctuating financial markets is a critical challenge. Developing adaptable policy tools to counter these unpredictable external shocks presents a high-growth opportunity, though the ultimate market share of success remains uncertain in the current volatile global landscape.

In 2024, the ongoing conflict in Ukraine continued to exert pressure on energy and food prices, contributing to inflation rates that, while moderating in some regions, remained a concern for economic stability. For instance, Eurozone inflation was reported at 2.4% in April 2024, down from highs seen previously but still a factor in policy considerations.

- Geopolitical Impact: Persistent geopolitical tensions, such as those in Eastern Europe and the Middle East, directly influence supply chains and commodity prices, leading to increased market volatility.

- Policy Agility: The need for central banks, including the Bank of Greece, to develop and deploy novel policy instruments that can swiftly address sudden and severe external shocks without causing unintended consequences is paramount.

- Growth Challenge: Creating effective frameworks for managing these evolving risks is a significant growth challenge, as the efficacy of new tools is tested against unpredictable and rapidly changing global conditions.

- Market Share Uncertainty: The success of any new policy approach is inherently uncertain, as its adoption and impact depend on a complex interplay of global economic factors and the responses of other international actors.

The Bank of Greece is actively developing its capacity to analyze and mitigate climate-related financial risks. This is a growing area of focus for regulators worldwide, with the potential for significant impact on financial stability.

The Bank of Greece is exploring advanced technologies like AI and machine learning to enhance its operations. While this represents a high-growth area, its current implementation level is still developing, making its market position uncertain.

The Bank of Greece's role in facilitating Greece's green and digital transitions through the Recovery and Resilience Facility (RRF) is significant. However, its direct market share in the deployment of these funds is limited, focusing more on oversight and strategic alignment.

The Bank of Greece is also prioritizing financial literacy initiatives, a strategic imperative for long-term economic health. This emerging area has high potential impact but currently limited direct market penetration.

The Bank of Greece must navigate global uncertainty and geopolitical instability by developing adaptable policy tools. This presents a high-growth opportunity, though the success of these tools in volatile markets remains uncertain.

In 2024, inflation remained a concern, with Eurozone inflation at 2.4% in April 2024. The Bank of Greece's ability to respond effectively to external shocks, like those stemming from geopolitical events, is crucial for economic stability.

| Area of Focus | Growth Potential | Current Market Position | BCG Matrix Category |

|---|---|---|---|

| Climate Risk Integration | High | Developing | Question Mark |

| AI & Advanced Analytics | High | Nascent | Question Mark |

| RRF Fund Utilization Oversight | High | Advisory/Oversight | Question Mark |

| Financial Literacy Enhancement | High | Emerging/Limited Penetration | Question Mark |

| Policy Agility for Global Shocks | High | Uncertain Success | Question Mark |

BCG Matrix Data Sources

The Bank of Greece BCG Matrix is informed by official financial statements, national economic indicators, and sector-specific industry reports to provide a comprehensive view of market positions.