Bank of Greece Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Greece Bundle

The Bank of Greece operates within a complex financial landscape, where the bargaining power of buyers and the threat of substitutes significantly influence its strategic positioning. Understanding these forces is crucial for navigating the competitive environment effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bank of Greece’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Bank of Greece's bargaining power with its suppliers is significantly constrained by the Eurosystem's overarching regulatory framework. Its monetary policy instruments and supervisory mandates are largely determined by the European Central Bank (ECB) and EU law, leaving little room for negotiation on core operational terms.

For instance, the ECB's decisions on interest rates and liquidity management directly shape the Bank of Greece's operational environment. This supranational control means the Bank of Greece cannot independently dictate terms with suppliers providing services tied to these core functions, as the parameters are set at a higher level.

The Bank of Greece, as a central bank, operates outside the conventional capital markets. Its access to capital and liquidity is fundamentally tied to its role in monetary policy and ensuring financial stability within the Eurozone. This means it doesn't face the same pressures or dynamics as commercial entities when securing funds.

The Bank of Greece's ability to manage its balance sheet and provide liquidity to the Greek banking sector is a core function, not a market transaction. These actions are dictated by monetary policy objectives and the need to maintain systemic stability, rather than by the need to attract external capital from suppliers.

While the Bank of Greece's financial health, including its profitability and capital adequacy, is indirectly influenced by the Greek economy and overarching Eurosystem policies, it does not engage in sourcing capital from suppliers in the traditional sense. Its liquidity is managed through its own operational capacity and its position within the Eurosystem framework.

The Bank of Greece heavily depends on its highly skilled workforce, comprising economists, financial analysts, and IT specialists, to execute its diverse responsibilities. The scarcity of certain specialized skills, such as those in cybersecurity and sophisticated data analytics for financial oversight, can grant these professionals significant supplier power.

Retaining these critical human resources amidst competition from private firms and global institutions is paramount for the Bank's continued operational success. For instance, in 2024, the demand for cybersecurity experts in the financial sector remained exceptionally high, with average salaries for senior roles often exceeding €70,000 annually in Greece, highlighting the competitive landscape for specialized IT talent.

Technology and Infrastructure Providers

The Bank of Greece relies on external technology and infrastructure providers for its core operations, including IT systems, payment processing, and data management. While the bank can leverage competitive tendering processes, the highly specialized nature of financial technology and secure infrastructure required for central banking can grant certain providers a degree of bargaining power. This is particularly true for vendors offering bespoke solutions that meet the stringent security and operational demands of institutions like the Bank of Greece.

The critical nature of these services means that disruptions or failures are unacceptable, giving providers of essential infrastructure a stronger negotiating position. For instance, the Bank of Greece's ongoing investments in modernizing its payment systems, as evidenced by recent tender announcements for specialized hardware and software upgrades, underscore this dependence. These tenders often specify unique technical capabilities that limit the pool of potential suppliers.

- Specialized Needs: Central banks require highly specific IT and infrastructure solutions, often custom-built, which narrows the supplier market.

- Criticality of Services: The essential nature of payment systems and data management for financial stability enhances supplier leverage.

- Tender Activity: Recent tenders for system upgrades and specialized equipment highlight the Bank of Greece's reliance on external tech providers.

- Limited Alternatives: The scarcity of providers capable of meeting stringent security and performance requirements can increase supplier bargaining power.

Government as an Operational Partner

The Greek government, by providing the Bank of Greece with its legal mandate and shaping the political landscape, exerts significant influence. This governmental role as an operational partner is crucial, as it sets the framework within which the central bank functions.

While the Bank of Greece serves as the government's banker and treasury agent, the government's fiscal policies and debt management strategies directly impact the central bank's operational environment. These fiscal decisions, though separate from monetary policy, create financial stability considerations that the Bank of Greece must navigate.

- Governmental Mandate: The Bank of Greece operates under laws enacted by the Greek Parliament, defining its powers and responsibilities.

- Fiscal Policy Influence: Government spending and taxation decisions affect the overall economic conditions, which in turn influence monetary policy effectiveness.

- Debt Management: The government's issuance and management of public debt can impact interest rates and liquidity in the financial system, areas of concern for the central bank.

- Political Context: The broader political stability and government reforms can create opportunities or challenges for the Bank of Greece's operational independence and effectiveness.

The Bank of Greece faces limited bargaining power with its suppliers due to the Eurosystem's regulatory framework, which dictates many of its operational parameters. While it relies on skilled professionals and specialized technology providers, the scarcity of certain expertise, particularly in cybersecurity, can empower those suppliers. For instance, in 2024, the demand for cybersecurity experts in Greece saw average salaries for senior roles reaching over €70,000 annually, reflecting a competitive market for these critical skills.

The Bank of Greece's dependence on specialized IT and infrastructure providers, especially for bespoke solutions meeting stringent security demands, grants these vendors some leverage. Recent tenders for payment system modernization in 2024 highlight this reliance, with specific technical requirements narrowing the supplier pool. The essential nature of these services for financial stability further strengthens the negotiating position of providers.

| Supplier Category | Factors Affecting Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Skilled Workforce (e.g., Cybersecurity Experts) | Scarcity of specialized skills, high demand from private sector | Average senior cybersecurity salaries in Greece exceeding €70,000. |

| Technology & Infrastructure Providers | Need for bespoke, highly secure solutions; criticality of services for financial stability | Tenders for payment system modernization requiring unique technical capabilities. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the Bank of Greece's unique position within the Hellenic financial system.

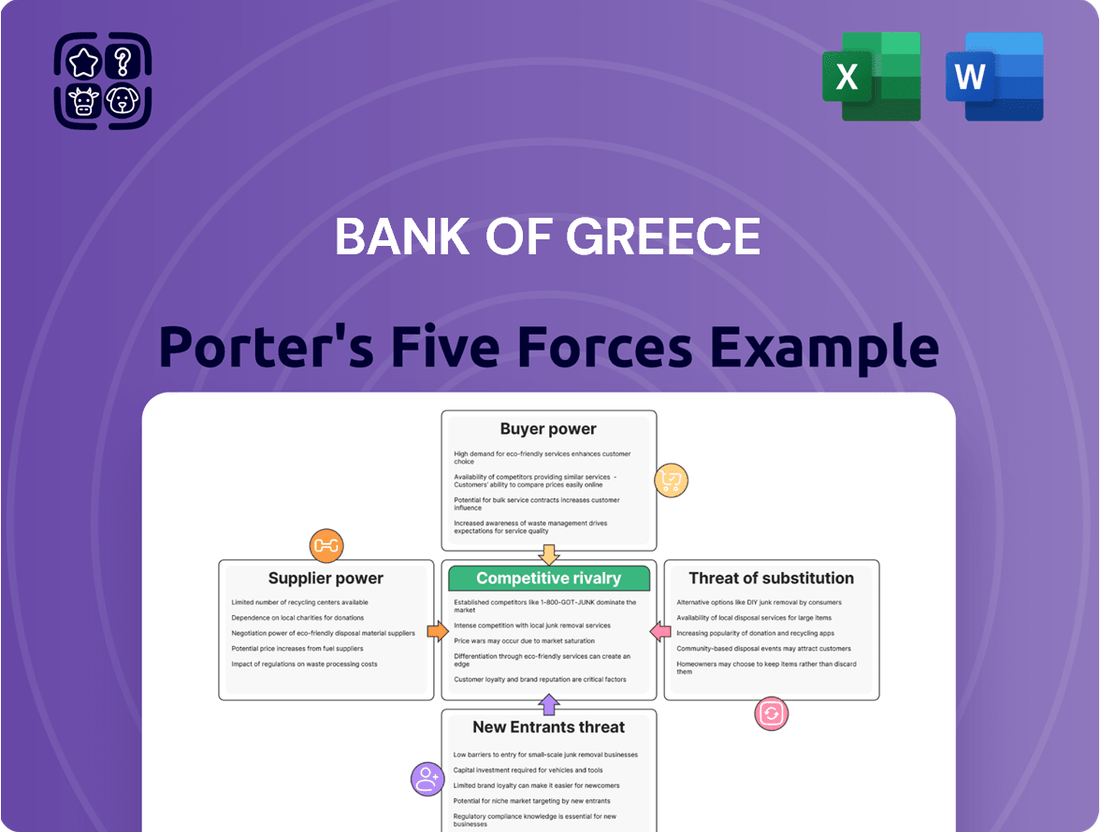

Instantly gauge competitive intensity and identify strategic vulnerabilities with a visual representation of the Bank of Greece's Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Commercial banks in Greece, as supervised entities, hold a unique position regarding the Bank of Greece. While they are subject to stringent regulations, the central bank's mandate to ensure financial stability means it must consider the operational viability and health of these institutions. This symbiotic relationship means banks, in a sense, have a voice in how supervisory and liquidity policies are shaped, as their collective well-being is paramount for the Greek financial system.

The Bank of Greece's prudential supervision and resolution functions directly influence Greek credit institutions by dictating capital adequacy ratios, risk management practices, and operational standards. For instance, in 2023, Greek banks continued to strengthen their balance sheets, with the aggregate Common Equity Tier 1 (CET1) ratio for the Greek banking system standing at a robust 15.8% as of the third quarter of 2023, indicating a generally healthy capital position that allows banks to absorb potential shocks.

The Greek government acts as a significant customer for the Bank of Greece, particularly concerning treasury services, debt management, and financial advisory. The government’s substantial fiscal requirements and its approach to issuing debt directly shape the demand for these central bank services.

The Bank of Greece's mandated role in managing state accounts and serving as the treasury's agent inherently grants the government considerable leverage. This implicit power influences the terms and scope of the services the central bank provides to the state.

In 2023, Greece's public debt stood at approximately 161.9% of its GDP, highlighting the scale of the government's debt management needs and its reliance on the Bank of Greece for these critical functions.

The European Central Bank (ECB) exerts significant customer power over the Bank of Greece. As a member of the Eurosystem, the Bank of Greece implements monetary policy decisions made by the ECB's Governing Council. This means the ECB dictates key interest rates and policy stances, which the Bank of Greece must adhere to, effectively limiting its autonomy in these areas.

Financial Markets and Investors

Financial markets and investors, while not direct purchasers of the Bank of Greece's services, exert significant indirect influence. Their reactions to policy signals, such as interest rate announcements or supervisory reports, directly impact economic variables. For instance, in early 2024, investor sentiment towards Greek government bonds, influenced by the Bank of Greece's stability pronouncements, saw yields on 10-year bonds fluctuate around the 3.5% mark, reflecting market confidence.

The Bank of Greece's credibility in maintaining price stability and ensuring financial system integrity is paramount. Investor confidence directly shapes capital flows into Greece and influences the cost of borrowing for the government and businesses. A strong signal of stability from the Bank can attract foreign investment, while perceived weakness might lead to capital flight, impacting the exchange rate and overall economic health.

Effective communication and transparency are therefore vital tools for the Bank of Greece in managing market expectations. By clearly articulating its policy objectives and economic outlook, the Bank can foster a more predictable environment for investors. This proactive approach helps mitigate volatility and reinforces the Bank's authority in steering the Greek economy.

- Investor Reaction: Markets react to Bank of Greece policy, affecting bond yields and exchange rates.

- Confidence Impact: Investor belief in price stability and financial integrity influences capital flows.

- Communication is Key: Transparency in policy signals helps manage market expectations and maintain credibility.

- Economic Indicator: Investor sentiment towards Greek assets is a barometer of perceived economic stability.

The Public (Citizens and Businesses)

The public, encompassing citizens and businesses, are the ultimate beneficiaries of the Bank of Greece's core mandates: maintaining price stability and ensuring the soundness of the financial system. While they don't directly negotiate prices or terms, their collective trust and confidence in the Greek drachma and the banking sector are crucial. For instance, if inflation were to surge, perhaps exceeding the European Central Bank's target of 2% significantly, public confidence could wane, indirectly pressuring the Bank of Greece to adjust its monetary policies.

This indirect influence is substantial. A loss of public faith can manifest in various ways, such as increased demand for foreign currency or a shift away from domestic financial institutions. The Bank of Greece's ability to manage inflation effectively, as demonstrated by its role in the broader Eurozone's inflation control efforts, directly impacts this trust. For example, in 2023, Eurozone inflation averaged 5.4%, a figure the Bank of Greece, as part of the ECB system, actively worked to bring down.

- Public Trust as an Implicit Bargaining Tool: Citizens and businesses hold sway through their confidence in the currency and financial institutions.

- Impact of Inflation: High inflation erodes purchasing power and public trust, indirectly pressuring the central bank's policy decisions.

- Financial Stability Link: A stable banking system, overseen by the Bank of Greece, is essential for public confidence and economic activity.

The bargaining power of customers for the Bank of Greece is largely indirect, stemming from entities that rely on its services or are influenced by its policies. The Greek government, as a major user of treasury and debt management services, holds significant leverage. Similarly, the European Central Bank (ECB) dictates monetary policy, effectively acting as a powerful customer by setting the operational parameters for the Bank of Greece.

Financial markets and the general public also exert influence, not through direct negotiation, but by responding to the Bank of Greece's actions. Investor confidence, for instance, impacts capital flows and borrowing costs, while public trust in price stability is crucial for the effectiveness of monetary policy. A decline in public confidence, perhaps due to persistent inflation, could indirectly pressure the Bank to alter its strategies.

In 2023, the Greek banking system's aggregate Common Equity Tier 1 (CET1) ratio was 15.8%, indicating a strong capital base that allows banks to absorb shocks, a factor that influences their interaction with supervisory authorities. Furthermore, Eurozone inflation averaged 5.4% in 2023, a key metric the Bank of Greece, as part of the Eurosystem, works to manage, directly impacting public trust.

| Customer Type | Nature of Influence | Key Data Point (2023/Early 2024) |

|---|---|---|

| Greek Government | Demand for treasury and debt management services | Public debt at ~161.9% of GDP |

| European Central Bank (ECB) | Monetary policy directives | ECB target inflation of 2% |

| Financial Markets/Investors | Sentiment impacting capital flows and yields | 10-year Greek bond yields around 3.5% (early 2024) |

| Public (Citizens & Businesses) | Confidence in currency and financial stability | Eurozone inflation averaged 5.4% (2023) |

Full Version Awaits

Bank of Greece Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis of the Bank of Greece, offering a detailed examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing you with actionable insights without any surprises.

Rivalry Among Competitors

The Bank of Greece, as part of the Eurosystem, collaborates with 19 other national central banks and the European Central Bank (ECB). This collaboration, while essential for monetary policy, can lead to differing national economic priorities and policy implementation nuances. For instance, during periods of economic stress, member states might advocate for distinct approaches to fiscal stimulus or banking sector support, creating internal debates within the Eurosystem.

The Bank of Greece navigates a complex supervisory environment, sharing oversight of major Greek banks with the European Central Bank (ECB). This dual supervision, alongside other national bodies for specific financial areas, necessitates robust coordination to prevent conflicting regulations.

While not direct competition, divergences in supervisory interpretation or focus between the Bank of Greece and the ECB can create challenges for financial institutions. For instance, during 2024, the ECB's Single Supervisory Mechanism (SSM) continued to set a high bar for capital requirements and risk management across the Eurozone, influencing the Bank of Greece's approach.

The Bank of Greece's pursuit of its monetary policy objectives, such as price stability, can be complicated by the fiscal policies enacted by the Greek government. While the Bank of Greece operates with a degree of independence, effective macroeconomic management necessitates a degree of coordination with fiscal authorities.

For instance, if the Greek government were to pursue an expansionary fiscal policy, perhaps through increased public spending or tax cuts, this could potentially create inflationary pressures that counteract the Bank of Greece's efforts to keep inflation in check. In 2023, Greece's fiscal deficit was projected to be around 3.2% of GDP, a figure that requires careful monitoring alongside monetary policy to ensure overall economic health.

International Financial Institutions and Bodies

Global financial institutions like the IMF and BIS play a significant role in shaping international financial governance and setting standards. Their research and policy recommendations can indirectly influence national central bank strategies and operations.

While not direct competitors, these bodies' surveillance and pronouncements can create a framework that national central banks must consider, potentially challenging existing approaches. For instance, the IMF’s Article IV consultations provide an external assessment of a country's economic policies, including those of its central bank.

- IMF Surveillance: The IMF conducts regular consultations with member countries, offering policy advice.

- BIS Standards: The Bank for International Settlements develops global banking standards, like Basel Accords, influencing capital requirements.

- Global Financial Stability: These bodies aim to promote stability, which can impact how central banks manage their domestic economies.

- Policy Influence: Recommendations from these institutions can indirectly pressure central banks to align with international best practices.

Technological Disruption in Payments

The payments landscape is undergoing significant transformation due to technological advancements. New digital payment methods, including private cryptocurrencies and stablecoins, are emerging as indirect competitors to traditional central bank money. This shift challenges the established role of central banks in facilitating transactions.

The Bank of Greece, in collaboration with the Eurosystem, is actively investigating the potential of a digital euro. This initiative aims to preserve the relevance of central bank money in an increasingly digital economy and safeguard monetary sovereignty. For instance, by mid-2024, the European Central Bank continued its extensive research and development phase for the digital euro, exploring various design and distribution models to ensure its future viability.

- Emergence of Digital Currencies: Private cryptocurrencies and stablecoins offer alternative payment rails, potentially bypassing traditional banking systems.

- Central Bank Response: The Bank of Greece, as part of the Eurosystem, is exploring a digital euro to maintain central bank money's relevance and monetary sovereignty.

- Indirect Rivalry: These new technologies represent an indirect competitive force against the established payment functions of central bank money.

Competitive rivalry within the Greek banking sector is intense, with several large domestic banks vying for market share. These institutions, such as National Bank of Greece, Piraeus Bank, Alpha Bank, and Eurobank, frequently compete on pricing for loans and deposits, as well as on the quality of their digital services. The ongoing efforts to strengthen the banking sector, including capital increases and NPL reduction strategies, further shape this competitive landscape.

SSubstitutes Threaten

The increasing popularity of private digital currencies, like cryptocurrencies and stablecoins, presents a potential alternative to traditional money for digital payments. While these don't directly replace the Bank of Greece's primary roles, their wider use could decrease reliance on conventional payment systems and potentially impact the central bank's monetary oversight.

For instance, global cryptocurrency market capitalization reached over $2.5 trillion in early 2024, indicating significant user adoption. This trend highlights a growing demand for digital payment alternatives that could, over time, influence the velocity and volume of central bank money circulation within the Greek economy.

In response, the Eurosystem, including the Bank of Greece, is actively exploring a digital euro. This initiative aims to provide a safe, regulated digital currency that can compete with private offerings, thereby safeguarding financial stability and maintaining the effectiveness of monetary policy in an increasingly digital financial environment.

Fintech disruptors and Big Tech firms are increasingly offering payment services, presenting a significant threat of substitution to traditional bank-led payment systems. These new players often provide streamlined, user-friendly digital wallets and payment gateways, attracting consumers and businesses seeking faster, cheaper transactions. For instance, global digital payment transaction volume was projected to reach over $13 trillion in 2024, a substantial portion of which is handled by non-bank entities.

This shift away from bank-intermediated payments can diminish the central role of commercial banks in the financial ecosystem and consequently, the Bank of Greece's direct oversight on a growing segment of payment flows. The Bank of Greece actively monitors this evolving landscape, assessing potential risks to financial stability and ensuring robust consumer protection measures are in place even as payment innovation accelerates.

While large corporations theoretically could bypass traditional banking for financing, such as through direct bond issuance, the Greek market's structure and regulatory environment make this a limited threat to the Bank of Greece. For instance, in 2023, Greek corporate bond issuance remained a fraction of total financing, with banks playing a dominant role.

The government's reliance on the Bank of Greece as its treasury agent further solidifies this relationship, making direct market financing a less viable substitute for sovereign needs. In 2024, the Greek government continued to utilize the Bank of Greece for managing its debt issuance and operations.

Shadow Banking System

The expanding shadow banking sector, encompassing financial entities operating outside traditional regulatory oversight, presents a significant threat of substitution for conventional banking services. This growth can divert capital and customer flows, impacting the market share and profitability of regulated institutions. For instance, by mid-2024, money market funds, a key component of shadow banking, saw substantial inflows, indicating a shift in investor preference for these less regulated alternatives.

This proliferation of shadow banking activities poses systemic risks that are more challenging for the Bank of Greece to monitor and manage effectively. Such entities may engage in activities with higher leverage or lower liquidity, potentially creating vulnerabilities that could spill over into the broader financial system. The Bank of Greece, therefore, actively works to identify and mitigate these emerging risks to safeguard financial stability.

The Bank of Greece's efforts to address the threat of substitutes from shadow banking include enhanced data collection and analysis of non-bank financial intermediaries.

- Increased Competition: Shadow banks offer alternative lending and investment products, directly competing with traditional banks for customers and capital.

- Regulatory Arbitrage: Less stringent regulations in the shadow banking sector can allow for more competitive pricing and product offerings, attracting business away from regulated entities.

- Systemic Risk: The interconnectedness and opacity of shadow banking can amplify financial shocks, posing a threat to the stability of the entire financial system, which the Bank of Greece must oversee.

Alternative Investment Vehicles

Alternative investment vehicles pose a significant threat to traditional banking services. For households and businesses, options like mutual funds, bonds, and real estate offer attractive alternatives to bank deposits, particularly when interest rates are low. This can divert liquidity away from the banking system.

The availability of these substitutes can diminish the effectiveness of monetary policy. For instance, during periods of low interest rates, savers might shift their funds to higher-yielding alternative investments. In Greece, this trend has been observed, impacting the transmission of monetary policy and the overall stability of bank funding.

- Mutual Funds: Offer diversification and professional management, attracting investors seeking returns beyond traditional savings accounts.

- Bonds: Provide fixed income streams and are perceived as less volatile than equities, appealing to risk-averse investors.

- Real Estate: Remains a tangible asset class, often seen as a hedge against inflation and a store of value, drawing significant household and business capital.

- Impact on Banks: Reduced deposit base can lead to higher funding costs and potentially limit lending capacity for banks.

The rise of private digital currencies and fintech payment services presents a notable threat of substitution by offering alternative ways to transact. Global digital payment transaction volume was projected to exceed $13 trillion in 2024, with a significant portion handled by non-bank entities, diverting activity from traditional channels. This trend necessitates the Bank of Greece's active monitoring to ensure financial stability and consumer protection amidst rapid payment innovation.

Alternative investment vehicles like mutual funds, bonds, and real estate also substitute for traditional bank deposits, especially during low-interest-rate environments. This can reduce the banking system's liquidity and impact monetary policy transmission. For instance, by mid-2024, money market funds saw substantial inflows, signaling a shift in investor preference towards less regulated alternatives.

| Substitute Type | Description | Market Indicator (2024 Data) | Impact on Bank of Greece |

|---|---|---|---|

| Private Digital Currencies | Cryptocurrencies and stablecoins for payments | Global market cap over $2.5 trillion (early 2024) | Potential decrease in reliance on traditional payment systems, impacting monetary oversight |

| Fintech Payment Services | Digital wallets, payment gateways by non-banks | Digital payment transaction volume projected > $13 trillion | Diminished role of commercial banks, reduced direct oversight on payment flows |

| Shadow Banking | Entities outside traditional regulation (e.g., money market funds) | Substantial inflows into money market funds (mid-2024) | Diverts capital, poses systemic risks harder to monitor |

| Alternative Investments | Mutual funds, bonds, real estate | Shift in investor preference to higher-yielding alternatives | Reduced bank deposit base, impacts monetary policy transmission |

Entrants Threaten

The threat of new entrants for the Bank of Greece, specifically concerning new Eurozone national central banks, is virtually non-existent. The Eurosystem's structure is defined by EU treaties, meaning any future member states will integrate their existing central banks rather than introduce new competitive entities. The Bank of Greece’s role is legally established within this framework, precluding any disruptive market entry from similar institutions.

The emergence of powerful supranational regulatory bodies with expanded mandates presents a unique threat, akin to new entrants, for institutions like the Bank of Greece. These bodies could centralize authority, potentially overshadowing national central banks' operational autonomy and specific policy-making roles within the EU framework.

The threat of large-scale fintech or Big Tech firms entering core banking infrastructure is a growing concern for central banks like the Bank of Greece. These tech giants possess vast resources and technological expertise, enabling them to potentially develop and deploy alternative financial infrastructures that could rival or even disrupt traditional banking services. For instance, in 2024, major tech companies continued to expand their financial service offerings, from payment processing to lending, demonstrating a clear intent to capture market share in the financial sector.

The potential for these entities to operate at a scale that could impact financial stability or payment systems necessitates a proactive regulatory response. Central banks are increasingly exploring frameworks to manage the risks associated with Big Tech’s growing influence in finance, recognizing that a significant shift in infrastructure could alter the landscape of monetary policy transmission and financial oversight. This global challenge requires careful consideration of how to foster innovation while safeguarding the integrity of the financial system.

Emergence of Private Sector Digital Currency Ecosystems

The rise of private sector digital currency ecosystems, particularly widely adopted stablecoins from major corporations, presents a long-term threat by potentially establishing parallel monetary systems. This could significantly challenge a central bank's monetary sovereignty and its capacity to effectively manage monetary policy. For instance, the potential for these private currencies to facilitate large-scale transactions outside traditional banking channels could reduce the central bank's control over liquidity and interest rates.

The Bank of Greece, like other central banks, views the development of a digital euro as a proactive measure to counter such threats. By offering a central bank digital currency (CBDC), the aim is to provide a safe and stable digital alternative that maintains the primacy of central bank money in the evolving financial landscape. This preemptive strategy seeks to ensure the continued effectiveness of monetary policy transmission mechanisms.

- Potential for Parallel Monetary Systems: Private digital currencies could create alternative payment and store-of-value systems, bypassing traditional financial infrastructure.

- Erosion of Monetary Sovereignty: Widespread adoption of private digital currencies could diminish a central bank's ability to control the money supply and set interest rates.

- Impact on Monetary Policy Transmission: The effectiveness of monetary policy tools, such as open market operations, might be weakened if a significant portion of economic activity occurs outside the central bank's direct influence.

- Digital Euro as a Countermeasure: The development of a digital euro is intended to provide a secure, central bank-backed digital currency, thereby preserving monetary control and stability.

Global Payment Network Disruptors

The threat of new entrants in the payment network space is significant, particularly with the rise of distributed ledger technology (DLT). These new global payment networks could bypass established national and international infrastructures, directly challenging the Bank of Greece and the broader Eurosystem.

If these DLT-based networks achieve widespread adoption, they could fundamentally alter how payments are settled and overseen. This necessitates a proactive approach from the Bank of Greece and the Eurosystem to adapt their strategies and potentially integrate with these emerging systems to maintain relevance and control.

- Global Fintech Investment: In 2023, global fintech investment reached $147.4 billion, with a notable portion directed towards payment solutions and blockchain technology, indicating substantial capital flowing into potential disruptors.

- Central Bank Digital Currency (CBDC) Exploration: As of early 2024, over 130 central banks were exploring or developing CBDCs, a direct response to the potential disruption posed by private digital currencies and payment networks.

- Cross-Border Payment Innovations: The average cost of sending $200 internationally remains high, around $12.70 as of Q4 2023, highlighting a clear market opportunity for more efficient and cheaper DLT-based payment solutions.

The threat of new entrants for the Bank of Greece primarily stems from non-traditional players like Big Tech and fintech firms, particularly in the payment systems arena. These entities possess significant technological capabilities and financial resources, enabling them to develop and deploy innovative solutions that could challenge existing financial infrastructures.

The rise of distributed ledger technology (DLT) presents a direct challenge, with new global payment networks potentially bypassing traditional settlement systems. For instance, global fintech investment in 2023 reached $147.4 billion, with a significant portion allocated to payment solutions and blockchain, underscoring the competitive landscape.

| Disruptor Type | Key Threat | Example/Data Point (2023-2024) |

|---|---|---|

| Big Tech/Fintech | Challenging payment infrastructure, offering alternative financial services | Continued expansion of financial services by major tech companies in 2024 |

| DLT-based Payment Networks | Bypassing traditional payment settlement, offering efficiency | Global fintech investment of $147.4 billion in 2023, with focus on payments/blockchain |

| Private Digital Currencies (e.g., Stablecoins) | Creating parallel monetary systems, eroding monetary sovereignty | Over 130 central banks exploring CBDCs by early 2024 to counter private digital currency influence |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Bank of Greece is built upon a foundation of official publications from the Bank itself, including its annual reports and statistical bulletins. This is supplemented by data from the Hellenic Statistical Authority (ELSTAT) and Eurostat for macroeconomic context and industry-wide trends.