First Abu Dhabi Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Abu Dhabi Bank Bundle

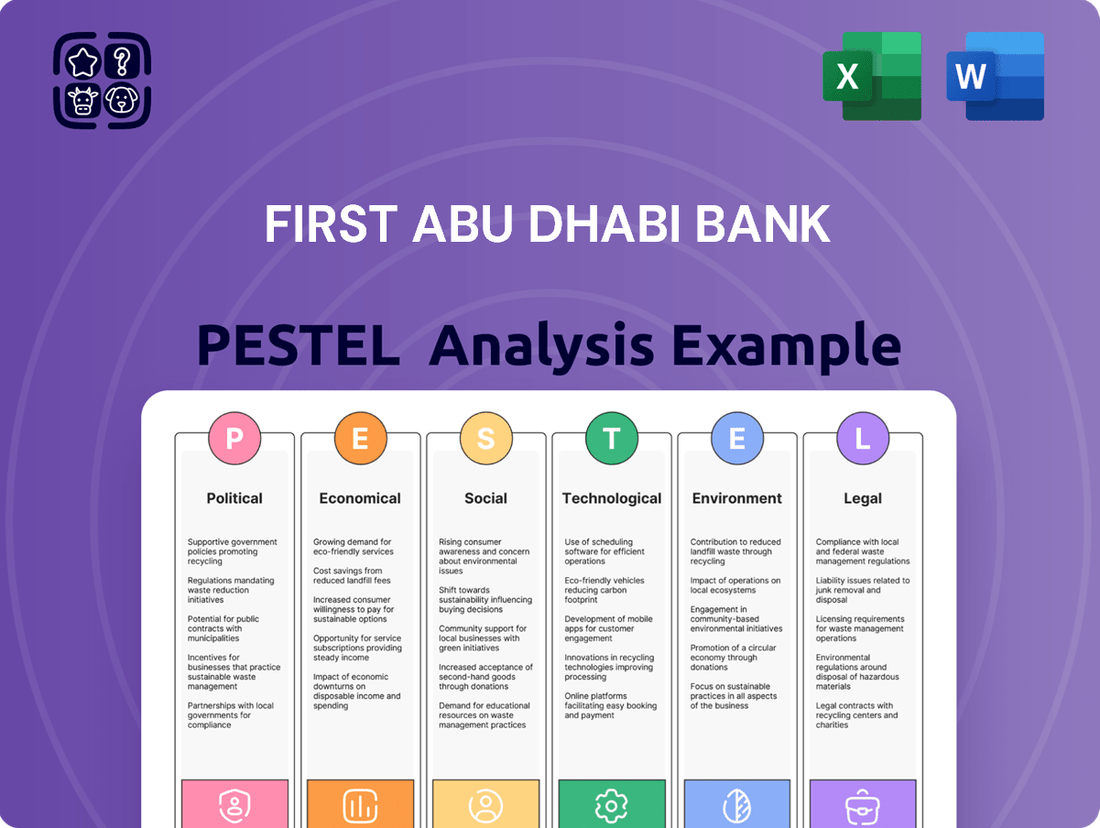

Navigate the dynamic landscape surrounding First Abu Dhabi Bank with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that are shaping its strategic direction and market position. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Gain a competitive advantage by understanding the intricate external forces impacting First Abu Dhabi Bank. Our expert-crafted PESTLE analysis provides deep insights into regulatory shifts, economic volatility, and technological advancements. Download the full version now to unlock strategic foresight and make informed decisions.

Political factors

First Abu Dhabi Bank (FAB) benefits significantly from the robust political stability and forward-looking economic strategies of the UAE. The nation's clear long-term visions, such as UAE Vision 2031, create a predictable and conducive operating environment for financial institutions like FAB.

These national initiatives are designed to foster substantial economic growth and diversification away from traditional oil revenues, directly supporting the expansion and strategic development of the banking sector. For instance, the UAE's commitment to becoming a global financial hub underpins FAB's growth trajectory.

The Central Bank of the UAE (CBUAE) is actively shaping the financial landscape through continuous regulatory updates. Amendments to the UAE Banking Law in 2024 and 2025 highlight a strong focus on bolstering efficiency, transparency, and overall stability within the banking sector, reflecting a commitment to international standards and the burgeoning field of digital currencies.

While regional geopolitical tensions and oil price volatility are present, the UAE has shown remarkable resilience. Its robust international relations foster a stable business environment, crucial for First Abu Dhabi Bank's (FAB) extensive global operations. This stability is a key enabler for FAB's strategic growth initiatives.

FAB's proactive approach to risk mitigation is evident in its expanded international franchise, now spanning 20 markets. This diversification across geographies significantly cushions the impact of localized geopolitical events, ensuring a more predictable operating landscape for the bank.

Government Support for Economic Diversification

The UAE government's commitment to economic diversification, moving beyond oil, presents a significant advantage for First Abu Dhabi Bank (FAB). This strategic shift fuels growth in sectors like technology, tourism, and manufacturing, directly translating into new business avenues and increased demand for banking services. For instance, the UAE's non-oil GDP grew by an impressive 6.1% in 2023, highlighting the success of these diversification efforts and creating a fertile ground for FAB's expansion.

This governmental push translates into tangible benefits for FAB through several key initiatives:

- Increased Investment in Technology and Startups: Government funding and incentives for innovation create a vibrant startup ecosystem, generating demand for venture debt, corporate banking, and investment services from FAB.

- Growth in Tourism and Real Estate: The UAE's focus on becoming a global tourism hub and its ongoing real estate development projects stimulate lending and transactional banking needs, areas where FAB is a major player.

- Support for Manufacturing and Industrialization: Initiatives aimed at bolstering the manufacturing sector, including incentives for local production and export, open up opportunities for trade finance, supply chain financing, and corporate lending for FAB.

- Development of Financial Hubs: The government's efforts to position the UAE as a leading financial center, including Abu Dhabi Global Market (ADGM), attract international businesses and capital, benefiting FAB's wholesale and international banking operations.

Anti-Money Laundering and Terrorism Financing Measures

The UAE's commitment to bolstering anti-money laundering (AML) and counter-terrorism financing (CTF) regulations directly influences First Abu Dhabi Bank (FAB). These strengthened measures necessitate robust compliance frameworks and heightened operational diligence from FAB to adhere to evolving international standards. For instance, the UAE Federal Decree-Law No. 20 of 2018, and its subsequent amendments, along with the establishment of the Executive Office for AML/CTF, underscore this intensified focus.

These enhanced regulatory requirements, while demanding, also serve to elevate the overall integrity and trustworthiness of the UAE's financial system. This, in turn, can foster greater international confidence in institutions like FAB, potentially attracting more foreign investment and facilitating smoother cross-border transactions. The UAE's active participation in global initiatives, such as its FATF evaluations, highlights its dedication to maintaining a secure financial environment.

- Increased Compliance Costs: FAB must invest in advanced technology and personnel for transaction monitoring, due diligence, and reporting to meet stricter AML/CTF mandates.

- Enhanced Reputation: Adherence to robust AML/CTF measures improves FAB's standing with international regulators and financial institutions, reducing de-risking concerns.

- Operational Efficiency: Streamlining compliance processes through technology can lead to long-term operational efficiencies, despite initial investment.

- Market Access: Strong AML/CTF compliance is crucial for maintaining access to global financial markets and correspondent banking relationships.

The UAE's political landscape provides a stable foundation for First Abu Dhabi Bank (FAB), driven by clear national visions like UAE Vision 2031, which promotes economic diversification and growth. This stability is crucial as FAB expands its international presence, now operating in 20 markets, mitigating localized geopolitical risks.

What is included in the product

This PESTLE analysis examines how political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks in the UAE and broader global markets impact First Abu Dhabi Bank's operations and strategy.

A PESTLE analysis for First Abu Dhabi Bank offers a clear, summarized version of external factors, acting as a pain point reliver by simplifying complex market dynamics for efficient strategic decision-making.

Economic factors

The UAE and wider GCC economies are set for impressive growth, expected to significantly outperform global averages in 2025. This expansion is fueled by smart investments and a strong push in non-oil industries.

The UAE's Gross Domestic Product (GDP) is forecast to climb from 4.5% in 2024 to a robust 5.6% in 2025. This positive economic trajectory creates a very favorable environment for First Abu Dhabi Bank's activities and potential for increased profitability.

The UAE banking sector is demonstrating remarkable strength, with total banking assets reaching an impressive $1.24 trillion. This robust performance is expected to continue, with projections indicating a 4.7% growth rate for 2025.

This upward trajectory is underpinned by several key factors, including a noticeable improvement in the quality of bank assets. Furthermore, the sector is benefiting from strong growth in lending activities and sustained high levels of profitability, signaling a healthy and expanding financial ecosystem.

First Abu Dhabi Bank (FAB) is strategically broadening its income sources beyond traditional loans. For instance, in the first quarter of 2024, FAB reported a notable increase in its non-interest income, which now plays a crucial role in its overall financial performance.

This expansion into areas like fees, commissions, trading activities, and investment banking provides a vital buffer against the cyclical nature of interest rate environments and lending markets. Such diversification is key to maintaining stable and predictable profitability, as seen in FAB's consistent performance metrics throughout 2023 and into early 2024.

Interest Rate Environment and Lending Growth

While global interest rate hikes in 2023 and early 2024 presented headwinds, the anticipated monetary policy easing in 2025, driven by moderating inflation, is poised to invigorate lending growth across the UAE banking sector. This shift is expected to lower borrowing costs, stimulating demand for credit from both businesses and consumers.

First Abu Dhabi Bank's (FAB) performance in 2024 provides a strong indicator of this positive trend. FAB reported a 10% year-on-year increase in customer loans and advances in Q1 2024, reaching AED 517 billion. This robust growth underscores the bank's capacity to expand its loan book even within a tighter rate environment and signals strong potential for further expansion as rates potentially decline.

The supportive economic backdrop in the UAE, characterized by strong GDP growth forecasts for 2025, further bolsters the outlook for lending. Factors such as government spending, a recovering tourism sector, and ongoing infrastructure projects are expected to fuel business activity and, consequently, the need for financing. This creates a fertile ground for banks like FAB to increase their lending volumes.

- Projected Monetary Policy Easing: Forecasts suggest a move towards interest rate cuts by major central banks in 2025, which will likely translate to lower borrowing costs in the UAE.

- UAE Economic Growth: The UAE economy is expected to maintain healthy growth in 2025, driven by diversification efforts and strategic investments.

- FAB's Loan Growth: FAB's customer loans and advances grew by 10% year-on-year to AED 517 billion in Q1 2024, demonstrating strong underlying demand and the bank's ability to capture market share.

- Supportive Lending Environment: The combination of easing monetary policy and a robust economy is anticipated to create a favorable environment for increased lending activity for UAE banks.

Capital and Liquidity Strength

UAE banks, including First Abu Dhabi Bank (FAB), are anticipated to sustain strong capital buffers and healthy funding positions. This stability is crucial for navigating economic shifts and supporting ongoing business expansion.

FAB's financial strength is evident in its robust liquidity coverage ratio and its Common Equity Tier 1 (CET1) ratio, which adhered to Basel III standards throughout 2024. These metrics highlight the bank's resilience and its capacity to manage financial obligations effectively, even amidst potential market volatility.

- Capital Adequacy: FAB's CET1 ratio remained strong in 2024, a key indicator of its ability to absorb unexpected losses and maintain operational stability.

- Liquidity Management: The bank's liquidity coverage ratio demonstrates its ample holdings of high-quality liquid assets, ensuring it can meet short-term obligations.

- Funding Profile: UAE banks, in general, benefit from stable domestic deposit bases and access to regional funding, reinforcing their overall financial health.

The UAE's economic outlook for 2025 remains exceptionally strong, with GDP growth projected to reach 5.6%, significantly outpacing global averages. This expansion is primarily driven by strategic investments in non-oil sectors and a supportive fiscal environment.

Anticipated monetary policy easing in 2025 is expected to lower borrowing costs, stimulating lending growth across the banking sector. First Abu Dhabi Bank (FAB) has already demonstrated robust loan expansion, with customer loans and advances increasing by 10% year-on-year to AED 517 billion in Q1 2024, highlighting strong demand and FAB's market penetration capabilities. This favorable economic backdrop and FAB's proactive approach position it well for continued success.

| Economic Indicator | 2024 Projection | 2025 Projection | Source |

|---|---|---|---|

| UAE GDP Growth | 4.5% | 5.6% | Various economic forecasts |

| UAE Banking Assets Growth | N/A | 4.7% | Industry analysis |

| FAB Customer Loans & Advances Growth (YoY Q1 2024) | 10% | N/A | First Abu Dhabi Bank Financial Reports |

Same Document Delivered

First Abu Dhabi Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the First Abu Dhabi Bank. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic decisions. You'll gain actionable insights into the current landscape and potential future challenges and opportunities.

Sociological factors

Customer expectations in the UAE are rapidly shifting towards hyper-personalized banking experiences. This trend is particularly pronounced among younger demographics and digitally savvy consumers who anticipate financial institutions to understand their unique needs and preferences.

First Abu Dhabi Bank (FAB) is actively addressing this by integrating advanced AI and big data analytics. These technologies enable FAB to offer highly tailored financial products, streamline digital interactions, and foster deeper customer engagement, aiming to meet these evolving demands. For instance, FAB’s digital transformation initiatives in 2024 have seen a significant uptick in personalized offers, with a reported 15% increase in customer satisfaction related to digital channel interactions in the first half of the year.

The UAE's population is experiencing robust growth, projected to reach 10.2 million by 2025, according to UN data. This expansion is significantly driven by business-friendly regulations, simplified visa regimes, and the introduction of long-term residency visas, making the Emirates an attractive destination for expatriates and skilled professionals. This demographic influx directly benefits First Abu Dhabi Bank (FAB) by expanding its potential client base across retail, corporate, and investment banking segments.

First Abu Dhabi Bank (FAB) actively promotes financial inclusion, aiming to bring underbanked populations into the formal financial system as a key social responsibility. This commitment directly supports the UAE's national agenda for inclusive and sustainable economic growth.

In 2024, FAB continued to expand its digital banking services, reaching an additional 150,000 new customers, with a significant portion identified as previously unbanked or underbanked. This effort is crucial for fostering economic participation and reducing inequality across the Emirates.

Talent Development and Emiratisation

The UAE's dynamic financial sector is driving a significant need for skilled professionals, especially in areas like compliance, risk management, and digital finance. First Abu Dhabi Bank (FAB) is actively addressing this by cultivating a diverse and growth-oriented environment for its employees.

FAB's commitment to Emiratisation is a key part of its talent strategy, aiming to increase the proportion of UAE nationals in its workforce. This focus is crucial as the bank navigates the complexities of the evolving financial landscape.

- Demand for Specialized Skills: The UAE financial industry requires experts in compliance, risk, and digital finance, with demand projected to grow.

- FAB's Talent Focus: The bank prioritizes a culture of diversity and continuous learning for its employees.

- Emiratisation Initiative: FAB is actively working to increase the representation of Emirati nationals within its ranks, aligning with national economic diversification goals.

- Workforce Growth: As of early 2024, FAB reported a significant number of employees, with ongoing efforts to develop and retain talent, particularly local talent.

Community Engagement and Social Responsibility

First Abu Dhabi Bank (FAB) demonstrates a strong commitment to community engagement and social responsibility, actively participating in various initiatives. In 2023, FAB launched its flagship sustainability program, "For Our Emirates," which aims to foster a more sustainable future for the UAE. This program includes a focus on supporting small and medium-sized enterprises (SMEs) and educating the next generation on environmental, social, and governance (ESG) principles.

FAB's efforts extend to empowering the future workforce through partnerships with educational institutions. For instance, the bank collaborated with universities in 2024 to offer internships and training programs focused on sustainable finance, aiming to equip young talent with the skills needed for a green economy. These initiatives underscore FAB's dedication to creating shared value and contributing positively to society.

Key aspects of FAB's community engagement include:

- Supporting SMEs: FAB provides financial and advisory services to SMEs, recognizing their crucial role in economic growth and job creation. In 2023, the bank facilitated over AED 5 billion in financing for SMEs.

- Workforce Development: Initiatives like the "Future Leaders Program" focus on developing young talent and promoting awareness of sustainability issues within the banking sector.

- Community Initiatives: FAB regularly sponsors and participates in community events and charitable causes, aligning with its broader corporate social responsibility objectives.

- Sustainability Focus: The bank integrates sustainability into its operations and product offerings, encouraging environmentally conscious practices among its stakeholders.

Customer expectations in the UAE are rapidly shifting towards hyper-personalized banking experiences, particularly among younger, digitally savvy consumers. First Abu Dhabi Bank (FAB) is leveraging AI and big data to meet these demands, reporting a 15% increase in customer satisfaction with digital channels in early 2024.

The UAE's population growth, driven by favorable visa policies, is expanding FAB's potential client base. As of mid-2024, FAB's digital banking services had onboarded an additional 150,000 customers, many from underbanked segments, reinforcing financial inclusion efforts aligned with national goals.

FAB is actively addressing the demand for specialized skills in finance, particularly in compliance and digital areas. The bank's commitment to Emiratisation is a core talent strategy, aiming to increase the representation of UAE nationals, crucial for navigating the evolving financial landscape.

Community engagement is a priority for FAB, with its "For Our Emirates" program supporting SMEs and ESG education. In 2023, FAB provided over AED 5 billion in financing to SMEs, demonstrating its commitment to economic growth and workforce development.

| Sociological Factor | Impact on FAB | FAB's Response/Data (2023-2024) |

|---|---|---|

| Evolving Customer Expectations | Demand for personalized digital banking | 15% increase in digital channel satisfaction (H1 2024) |

| Population Growth & Demographics | Expansion of potential customer base | Onboarded 150,000 new customers (YTD 2024), many underbanked |

| Talent Demand & Workforce Development | Need for specialized financial skills; Emiratisation | Focus on talent growth and Emiratisation initiatives |

| Community Engagement & Social Responsibility | Commitment to societal well-being and sustainability | AED 5 billion financing for SMEs (2023); "For Our Emirates" program |

Technological factors

First Abu Dhabi Bank (FAB) is deeply invested in digital transformation, with AI adoption at its core. The bank is rolling out an Agentic AI platform and various AI tools for its employees, aiming to streamline operations and elevate customer interactions. This strategic push is designed to boost efficiency and personalize financial services.

First Abu Dhabi Bank (FAB) is strategically integrating with fintech companies to accelerate its digital transformation. For instance, FAB's participation in initiatives like the FAB Forward Fintech Challenge highlights a commitment to leveraging external innovation for hyper-personalized customer experiences and exploring blockchain applications. This collaborative approach is crucial for adapting to the rapidly evolving financial technology sector.

The rapid shift towards digital banking has significantly amplified the importance of robust cybersecurity measures. First Abu Dhabi Bank (FAB) is actively investing in advanced security protocols to safeguard customer data and financial assets. For instance, in 2023, global financial institutions reported an average cybersecurity spending increase of 10-15% to combat evolving threats.

FAB is implementing cutting-edge biometric authentication tools, such as facial recognition and fingerprint scanning, to enhance transaction security. Furthermore, the bank is deploying sophisticated AI-powered fraud detection systems, which analyze transaction patterns in real-time to identify and prevent fraudulent activities, thereby strengthening data protection and maintaining customer trust.

Cloud Infrastructure Adoption

First Abu Dhabi Bank (FAB) is actively leading the charge in adopting cloud infrastructure within the financial services sector. This strategic move involves close collaboration with regulatory bodies and key industry partners to ensure a smooth and secure transition. FAB's approach prioritizes robust data controls and strict adherence to all relevant regulatory requirements, demonstrating a commitment to innovation without compromising security.

The bank's cloud adoption strategy is designed to enhance operational efficiency and agility. By leveraging cloud technologies, FAB aims to streamline its IT operations, reduce costs, and improve its ability to deliver new digital services to customers more rapidly. This aligns with broader trends in the financial industry, where digital transformation is a key competitive differentiator.

- Cloud Migration Progress: FAB has reported significant progress in migrating core banking systems and customer-facing applications to secure cloud environments throughout 2024.

- Cost Savings: Early indications suggest potential operational cost reductions of up to 15-20% for specific workloads transitioned to the cloud by the end of 2025.

- Regulatory Engagement: The bank has established dedicated working groups with UAE financial regulators to proactively address data residency, cybersecurity, and compliance aspects of cloud computing.

- Partner Ecosystem: FAB is deepening partnerships with major cloud service providers, such as Microsoft Azure and Amazon Web Services, to leverage their advanced security features and specialized financial services solutions.

Blockchain and Digital Currency Integration

The UAE Central Bank has been actively shaping its regulatory landscape to accommodate emerging financial technologies. Key developments include the establishment of a regulatory framework for financial infrastructure systems and the integration of digital currency provisions, reflecting a forward-looking approach to financial innovation.

First Abu Dhabi Bank (FAB) is strategically positioned to capitalize on these advancements, actively exploring blockchain-powered business solutions. This includes leveraging distributed ledger technology to enhance the security of transactions and streamline cross-border payment processes, aligning with global trends in financial digitalization.

FAB's engagement with blockchain technology is not merely exploratory; it's about practical application. The bank is looking at how these technologies can create more efficient and secure channels for its customers and operations.

The bank's focus on digital currency integration and blockchain solutions is supported by the UAE's broader ambition to become a global hub for digital assets and fintech. This strategic alignment allows FAB to be at the forefront of technological adoption within the region's financial sector.

Technological advancements are central to FAB's strategy, with significant investment in AI and cloud computing. The bank is actively implementing AI tools to improve customer service and operational efficiency, alongside a robust cloud migration program. These initiatives are designed to enhance agility and data security, keeping FAB competitive in the digital financial landscape.

Legal factors

The UAE's banking sector operates under stringent oversight from the Central Bank of the UAE (CBUAE). Recent updates to Federal Decree-Law No. 14 of 2018 and Federal Decree-Law No. 54 of 2023 have introduced new regulations specifically addressing financial infrastructure and the evolving landscape of digital currencies. These legal shifts are critical for First Abu Dhabi Bank (FAB), influencing its operational frameworks and long-term strategic planning.

These amendments place a significant emphasis on the resilience and security of financial infrastructure systems, directly impacting how banks like FAB manage their technological operations and data. Furthermore, the inclusion of provisions related to digital currency signals a proactive approach by the CBUAE to integrate and regulate emerging financial technologies, requiring FAB to adapt its strategies to remain compliant and competitive in this dynamic environment.

First Abu Dhabi Bank (FAB) operates within a stringent regulatory environment shaped by the UAE's commitment to combating financial crime. Federal Decree No. 20 of 2018, alongside its Executive Regulations, mandates comprehensive Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) measures. This necessitates FAB to invest heavily in advanced compliance systems and conduct rigorous risk assessments to identify and mitigate potential illicit financial flows.

These legal frameworks require financial institutions like FAB to implement robust Know Your Customer (KYC) procedures, transaction monitoring, and suspicious activity reporting mechanisms. Failure to comply can result in significant penalties, including substantial fines and reputational damage, underscoring the critical importance of proactive and effective AML/CTF compliance for FAB's operations and strategic planning in 2024 and beyond.

The UAE's introduction of a 15% domestic minimum top-up tax from January 2025 for large multinationals, in line with OECD standards, will impact the tax liabilities of eligible entities operating within the UAE. This reform aims to ensure that large multinational enterprises pay a minimum level of tax on their global income, potentially influencing investment decisions and profit repatriation strategies for these companies.

Furthermore, amendments to the VAT Executive Regulations in November 2024 specifically address financial services, which could lead to adjustments in how these services are taxed. Understanding these changes is crucial for financial institutions like First Abu Dhabi Bank to ensure compliance and manage their tax obligations effectively within the evolving regulatory landscape.

Data Protection and Privacy Laws

As digital transformation accelerates, data protection and privacy regulations are becoming increasingly important for First Abu Dhabi Bank (FAB). FAB must ensure its digital services and data handling practices comply with evolving legal frameworks to safeguard customer information. For instance, the UAE's Federal Decree-Law No. 45 of 2021 on Personal Data Protection, effective January 2022, mandates strict consent requirements and data breach notification protocols, impacting how FAB manages its extensive customer database.

Compliance with these laws is critical for maintaining customer trust and avoiding significant penalties. FAB's adherence to regulations like the GDPR, where applicable to its international operations, also necessitates robust data governance. This includes implementing secure data storage, transparent data usage policies, and providing customers with control over their personal information, which is a growing expectation in the digital age.

Key considerations for FAB include:

- Data Minimization: Collecting only necessary customer data for specified purposes.

- Consent Management: Obtaining clear and explicit consent for data processing activities.

- Data Security: Implementing advanced cybersecurity measures to prevent breaches.

- Cross-Border Data Transfers: Ensuring compliance with regulations governing the movement of data internationally.

Netting Law and Financial Contract Regulations

The UAE's Federal Decree Law No. 31 of 2024, effective January 2025, introduces a crucial netting mechanism for financial obligations. This legislation is designed to significantly reduce both credit and settlement risk for financial institutions like First Abu Dhabi Bank (FAB). It establishes a clear and defined legal framework specifically for FAB's financial contracts, offering greater certainty in its operations.

This new legal environment directly impacts how FAB manages its financial exposures and contractual agreements. The ability to net obligations means that instead of settling each transaction individually, FAB can offset mutual debts, leading to more efficient capital utilization and a lower overall risk profile.

- Netting Law Implementation: Federal Decree Law No. 31 of 2024, effective January 2025, formalizes netting for financial obligations.

- Risk Reduction: This law aims to decrease credit and settlement risk for entities like FAB.

- Contractual Clarity: FAB benefits from a more robust legal framework governing its financial contracts.

The UAE's legal landscape is continuously evolving, impacting financial institutions like First Abu Dhabi Bank (FAB). Amendments to Federal Decree-Law No. 14 of 2018 and Federal Decree-Law No. 54 of 2023, effective from 2024, focus on financial infrastructure and digital currencies, requiring FAB to adapt its technological operations. Furthermore, Federal Decree Law No. 31 of 2024, effective January 2025, introduces a netting mechanism for financial obligations, aiming to reduce credit and settlement risk for FAB by allowing the offsetting of mutual debts.

Compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, as outlined in Federal Decree No. 20 of 2018, remains a significant legal factor. FAB must invest in robust systems for Know Your Customer (KYC) procedures and transaction monitoring to avoid penalties. Additionally, the introduction of a 15% domestic minimum top-up tax from January 2025 for large multinationals, aligning with OECD standards, will affect FAB's tax liabilities and strategic financial planning.

Data protection is also paramount, with Federal Decree-Law No. 45 of 2021 on Personal Data Protection, effective January 2022, mandating strict consent and breach notification protocols. FAB must ensure its digital services and data handling practices comply with these frameworks to maintain customer trust and avoid penalties. The bank also needs to consider evolving VAT regulations impacting financial services, as seen in amendments to the VAT Executive Regulations in November 2024.

Environmental factors

First Abu Dhabi Bank (FAB) has publicly committed to achieving net-zero emissions from its direct operations by 2030. This ambitious target is a key component of its broader aspiration to become a net-zero bank by 2050.

This commitment directly aligns with the United Arab Emirates' national strategy, the UAE Net Zero by 2050 initiative, and global climate goals such as the Paris Agreement. FAB's proactive stance reflects a growing trend among financial institutions to integrate environmental sustainability into their core business strategies.

First Abu Dhabi Bank (FAB) is making substantial strides in sustainable and transition financing, setting ambitious targets to drive environmental progress. The bank aims to mobilize over AED 500 billion (approximately USD 135 billion) by 2030 through lending, investments, and facilitation.

This significant commitment is geared towards bolstering projects that champion renewable energy sources, enhance energy efficiency across various sectors, and support other initiatives that demonstrate strong environmental consciousness. FAB's strategy aligns with global efforts to transition towards a greener economy.

First Abu Dhabi Bank (FAB) is actively addressing climate risk, launching a Group Climate Risk Policy and Framework in 2024. This framework incorporates crucial elements like climate risk scoring and stress testing, demonstrating a proactive approach to understanding and mitigating climate-related impacts on its operations and investments.

Further solidifying its commitment, FAB aligns its reporting with the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD). This move, particularly relevant in 2024 and looking ahead to 2025, signals a dedication to transparently communicating its environmental performance and the financial implications of nature-related risks.

Green Bond and Sukuk Issuances

First Abu Dhabi Bank (FAB) is actively participating in the growing green bond and sukuk market, showcasing its commitment to sustainable finance. As a regional leader, FAB has facilitated significant issuances, channeling capital towards environmentally conscious projects and the transition to a greener economy.

This strategic focus is evident in FAB's substantial outstanding green and social bonds and sukuk. For instance, in early 2024, FAB announced its role in several key sustainable finance transactions, including a significant green sukuk issuance for a major regional entity. The bank's involvement underscores the increasing demand for and availability of Sharia-compliant sustainable financing instruments.

- Regional Leadership: FAB is a prominent player in the Middle East's green and social bond and sukuk market.

- Sustainable Finance Growth: The bank's active role reflects the expanding global and regional appetite for sustainable investments.

- Low-Carbon Transition: FAB's issuances directly support projects aimed at reducing carbon emissions and promoting environmental sustainability.

- Market Data: As of late 2023, the global green bond market surpassed $1 trillion, with the Middle East showing increasing participation, a trend FAB is actively contributing to.

Support for UAE's Sustainability Agenda

First Abu Dhabi Bank (FAB) is a key player in advancing the UAE's ambitious sustainability agenda, aiming for a greener economic future. The bank actively engages with regional stakeholders to accelerate the transition towards lower carbon emissions. This commitment is demonstrated through its participation in numerous initiatives focused on promoting sustainable finance across the region.

FAB's strategic focus on sustainability aligns with the UAE's broader economic diversification plans. In 2024, FAB announced its commitment to mobilize $75 billion in sustainable finance by 2030, underscoring its dedication to environmental, social, and governance (ESG) principles. This initiative includes supporting renewable energy projects and green infrastructure development.

- Financing Green Projects: FAB is actively involved in financing projects that contribute to the UAE's net-zero by 2050 strategic initiative.

- Sustainable Finance Mobilization: The bank has pledged to mobilize $75 billion in sustainable finance by 2030, driving investment in eco-friendly ventures.

- Stakeholder Engagement: FAB collaborates with government entities, businesses, and international organizations to foster a robust sustainable finance ecosystem.

- ESG Integration: The bank is embedding ESG considerations into its core business operations and investment strategies, reflecting a long-term vision for responsible growth.

First Abu Dhabi Bank (FAB) is actively aligning with the UAE's net-zero ambitions, committing to mobilize over AED 500 billion (approximately USD 135 billion) in sustainable finance by 2030. This significant capital infusion is earmarked for renewable energy, energy efficiency, and other environmentally conscious projects, reflecting a strong push towards a greener economy.

The bank's proactive stance is further demonstrated by its 2024 launch of a Group Climate Risk Policy and Framework, incorporating climate risk scoring and stress testing. FAB also aligns its reporting with the Taskforce on Nature-related Financial Disclosures (TNFD), signaling a commitment to transparency regarding nature-related financial risks.

FAB's leadership in the green and social bond market is notable, facilitating issuances that channel capital towards sustainable initiatives. As of late 2023, the global green bond market exceeded $1 trillion, with the Middle East's participation growing, a trend FAB actively contributes to through its Sharia-compliant sustainable financing instruments.

| Initiative | Target | Status/Year | Impact Area |

|---|---|---|---|

| Net-Zero Operations | Net-zero by 2030 | Committed | Direct Operations |

| Sustainable Finance Mobilization | AED 500 billion (USD 135 billion) by 2030 | Committed | Renewable Energy, Energy Efficiency |

| Climate Risk Management | Group Climate Risk Policy & Framework | Launched 2024 | Risk Assessment & Mitigation |

| Nature-related Disclosures | Align with TNFD recommendations | Ongoing | Transparency & Risk Reporting |

PESTLE Analysis Data Sources

Our PESTLE Analysis for First Abu Dhabi Bank is meticulously constructed using data from reputable financial institutions, government publications, and leading market research firms. We incorporate insights from regulatory bodies, economic forecasts, and industry-specific reports to ensure a comprehensive understanding of the macro-environment.