First Abu Dhabi Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Abu Dhabi Bank Bundle

First Abu Dhabi Bank operates within a dynamic banking landscape, facing significant pressure from rivals and evolving customer expectations. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping First Abu Dhabi Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology providers hold significant sway over banks like First Abu Dhabi Bank (FAB). Core banking systems, essential for daily operations, are often supplied by a limited number of specialized firms. In 2024, the demand for advanced solutions like AI and cybersecurity is soaring, increasing the leverage of providers offering these critical services.

The bargaining power of tech suppliers can be moderate to high, particularly for those offering niche or cutting-edge technologies. For instance, generative AI and blockchain solutions are in high demand for digital transformation initiatives, giving these specialized providers considerable influence over pricing and contract terms for banks aiming to stay competitive through 2025.

The availability of highly skilled professionals in finance, technology, cybersecurity, and ESG significantly impacts supplier power for First Abu Dhabi Bank (FAB). A tight labor market for these specialized roles, especially in areas like artificial intelligence and digital transformation, grants employees considerable bargaining leverage regarding compensation and benefits.

First Abu Dhabi Bank (FAB), like other major banks, relies on interbank lending and wholesale funding as crucial supplier relationships. These financial institutions, acting as suppliers of capital, wield significant bargaining power. Their leverage is directly tied to prevailing market liquidity conditions and the interest rate policies enacted by the Central Bank of the UAE (CBUAE).

In 2024, the UAE's monetary policy, influenced by global trends, directly impacts the cost and accessibility of these vital funding sources for FAB. For instance, if the CBUAE raises interest rates, the cost of borrowing from other banks increases, thereby strengthening the suppliers' bargaining position. Conversely, ample liquidity in the interbank market can dilute this power.

Data and Information Providers

Data and information providers wield significant bargaining power over First Abu Dhabi Bank (FAB). Access to robust financial data, market intelligence, and sophisticated risk assessment tools is absolutely essential for FAB's strategic decision-making and effective risk management. These providers often offer proprietary services that are difficult to replicate, making FAB reliant on their offerings.

The specialized nature of these services, coupled with the critical role they play in FAB's operations, grants these suppliers leverage. For instance, in 2024, the global financial data analytics market was valued at over $25 billion, with specialized segments experiencing strong growth, indicating the high demand and value placed on such information. FAB's ability to obtain timely and accurate data directly influences its competitive edge and operational efficiency.

- Essential Reliance: FAB depends on data providers for critical market insights and risk analytics.

- Proprietary Offerings: Many data services are unique and difficult for FAB to develop in-house.

- Market Value: The global financial data analytics market's significant valuation underscores the importance and cost of these services.

- Strategic Impact: The quality and availability of data directly affect FAB's strategic planning and risk mitigation efforts.

Infrastructure and Real Estate Providers

For a bank like First Abu Dhabi Bank (FAB), which operates a significant physical network, including 63 conventional and 8 Islamic branches across the UAE as of early 2024, the suppliers of infrastructure and real estate services wield considerable bargaining power. This is especially true in the rapidly developing UAE market.

Landlords offering prime locations, construction firms undertaking branch renovations or new builds, and facility management companies providing essential maintenance services can all exert influence. Their ability to negotiate terms is amplified by the specialized nature of their services and the critical role they play in maintaining FAB's operational footprint and customer accessibility.

- High Demand for Prime Real Estate: The competitive UAE real estate market, particularly for banking locations, allows landlords to command higher rents and more favorable lease terms.

- Specialized Construction and Maintenance Needs: Banks require secure and compliant infrastructure, giving specialized construction and facility management companies leverage in pricing and contract negotiations.

- Limited Supplier Pool for Specific Services: For certain niche infrastructure or maintenance services tailored to financial institutions, the number of qualified suppliers may be limited, increasing their bargaining power.

Suppliers of specialized technology, such as AI and cybersecurity solutions, hold significant bargaining power over First Abu Dhabi Bank (FAB) in 2024. The demand for these advanced services, crucial for digital transformation, allows providers to dictate terms. Similarly, providers of essential financial data and market intelligence also possess strong leverage due to the proprietary nature and critical importance of their offerings for FAB's strategic decision-making.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on FAB |

|---|---|---|

| Technology Providers (AI, Cybersecurity) | Limited number of specialized firms, high demand for advanced solutions | Higher costs, stricter contract terms for FAB |

| Financial Data & Market Intelligence Providers | Proprietary services, critical for strategic decisions, difficult to replicate | Reliance on providers, potential for premium pricing |

| Wholesale Funding Providers | Market liquidity, central bank policies (CBUAE), interest rate environment | Fluctuating cost of capital, influence on FAB's funding strategy |

What is included in the product

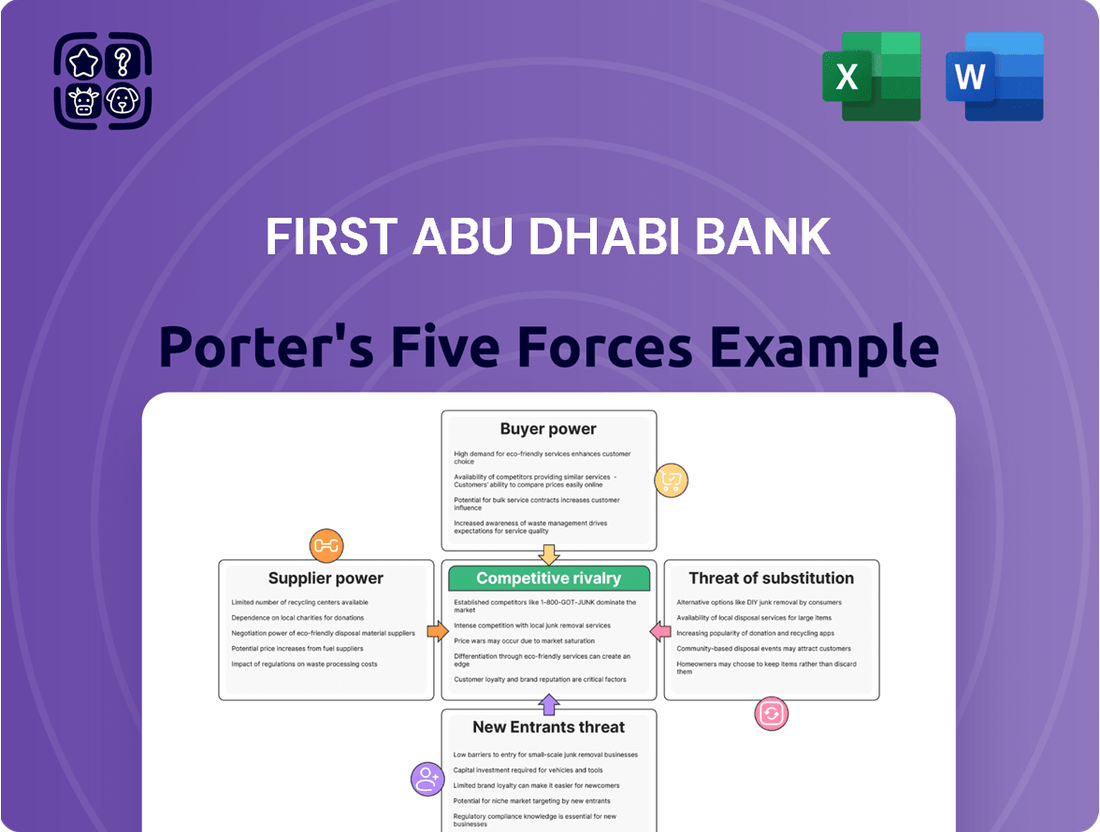

This analysis of First Abu Dhabi Bank's competitive environment examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector.

Instantly identify and address competitive threats with a visually intuitive Porter's Five Forces analysis, simplifying strategic planning for First Abu Dhabi Bank.

Customers Bargaining Power

The bargaining power of individual retail customers with First Abu Dhabi Bank (FAB) is typically quite low. This is largely because switching banks can involve significant hassle, whether it's the actual effort of moving accounts or the perception of difficulty. FAB's established presence and the convenience of having a wide range of banking services, from savings accounts to loans and investments, all in one place, also make it less appealing for customers to move elsewhere.

However, the financial landscape is evolving. The increasing prevalence of digital banking platforms and the emergence of agile fintech competitors are steadily shifting this power dynamic. These new players often offer streamlined services and competitive rates, making it easier and more attractive for customers to explore alternatives and switch providers if they find better value or a more user-friendly experience. For instance, by the end of 2024, the UAE's digital banking sector is expected to see continued growth, with a significant portion of the population actively using mobile banking apps, indicating a greater openness to digital-first financial institutions.

Small and medium-sized enterprises (SMEs) generally possess moderate bargaining power with banks like First Abu Dhabi Bank (FAB). While they are crucial clients, needing a range of financial services from loans to transaction processing, their options for banking partners can be more limited compared to large corporations. This reliance on established relationships can give them some sway.

FAB's strategic emphasis on the SME sector, evidenced by its tailored financing solutions and support programs, suggests a recognition of their importance. For instance, in 2024, FAB continued to expand its digital banking platforms aimed at simplifying processes for SMEs, potentially empowering these businesses with more information and thus a slightly stronger negotiating position.

Large corporations and government entities wield considerable bargaining power with banks like First Abu Dhabi Bank (FAB). This stems from the sheer volume of business they generate, allowing them to negotiate more favorable terms and pricing. In 2024, for instance, major corporate clients often demand bespoke financial solutions and can leverage their financial scale to secure better rates on loans and other services, directly impacting FAB's profitability.

Their ability to access international markets and alternative funding sources further amplifies their leverage. FAB's strategic emphasis on corporate and investment banking underscores the critical importance of these high-value clients; their ability to switch providers or secure financing elsewhere means FAB must continuously offer competitive and tailored services to retain them.

Availability of Information and Digital Tools

The proliferation of financial information and digital tools significantly bolsters customer bargaining power. Customers can now effortlessly compare banking services, fees, and interest rates across various institutions, thanks to increased transparency and readily available online platforms. This ease of access, coupled with streamlined digital onboarding, empowers consumers to make more informed choices and negotiate better terms.

For instance, in 2024, the widespread adoption of financial comparison websites and mobile banking apps allows customers to quickly identify the most competitive offerings. This digital empowerment means that banks like First Abu Dhabi Bank must remain competitive on pricing and service quality to retain their customer base. The ability to switch providers with minimal friction directly translates to greater leverage for the customer.

- Increased Transparency: Digital platforms provide easy access to bank product details and pricing.

- Ease of Comparison: Customers can readily compare rates, fees, and services across multiple banks.

- Digital Onboarding: Simplified online account opening reduces switching costs for customers.

- Informed Decision-Making: Access to reviews and data empowers customers to choose the best value.

Customer Deposits and Liquidity

Customer deposits form a crucial backbone for banks like First Abu Dhabi Bank (FAB), serving as a primary funding well. While a single depositor might not wield much influence, the sheer volume of these deposits grants the collective customer base considerable indirect leverage. FAB's customer deposits reached an impressive AED 782 billion by the close of 2024, highlighting the intense competition among banks to attract and retain these vital funds.

This substantial aggregate volume means that customers, by choosing where to place their money, can significantly impact a bank's liquidity and funding costs. Banks must therefore actively manage their deposit offerings and customer relationships to maintain a stable and cost-effective funding base.

- Primary Funding Source: Customer deposits are fundamental to a bank's operational funding.

- Aggregate Customer Power: The collective volume of deposits, such as FAB's AED 782 billion in 2024, grants depositors significant indirect bargaining power.

- Competitive Landscape: Banks actively compete for customer deposits, influencing interest rates and service offerings.

- Liquidity Management: The ability to attract and retain deposits is critical for a bank's liquidity and financial stability.

The bargaining power of customers with First Abu Dhabi Bank (FAB) is influenced by several factors, including the ease of switching, the availability of alternatives, and the volume of business they represent. While individual retail customers have low power due to switching costs, large corporate clients and SMEs possess moderate to significant leverage.

Digitalization has amplified customer power by increasing transparency and simplifying comparisons. FAB's substantial deposit base, reaching AED 782 billion by the end of 2024, underscores the collective influence of its depositors in shaping the bank's funding costs and service offerings.

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Retail Customers | Low | Switching costs, convenience, FAB's broad service offering |

| SMEs | Moderate | Need for tailored services, FAB's SME focus, digital platform improvements |

| Large Corporations/Govt. Entities | High | Volume of business, access to alternative funding, negotiation of bespoke solutions |

| Depositors (Collective) | Significant (Indirect) | Total deposit volume (AED 782 billion in 2024), impact on liquidity and funding costs |

Full Version Awaits

First Abu Dhabi Bank Porter's Five Forces Analysis

This preview showcases the complete First Abu Dhabi Bank Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the banking sector. The document you see here is the exact, professionally formatted report you'll receive immediately after purchase, providing actionable insights into industry rivalry, buyer and supplier power, threats of new entrants and substitutes. No placeholders or sample content, just the full, ready-to-use analysis for your strategic planning.

Rivalry Among Competitors

The UAE banking sector is crowded with numerous well-established local and international institutions, creating a fiercely competitive environment. First Abu Dhabi Bank (FAB), despite being the UAE's largest bank by assets, faces significant rivalry from these many strong players, all vying for the same customer base and market share.

UAE banks are in a fierce race to adopt digital transformation, pouring significant capital into AI and cloud technologies. This focus aims to create superior customer experiences and streamline operations, with institutions actively seeking to stand out through innovative digital offerings.

The competitive landscape is further heated by the rise of digital-only banks, forcing traditional players to innovate rapidly. For instance, by the end of 2023, UAE banks had collectively invested billions in technology, with digital channels accounting for a substantial portion of transactions, underscoring the intensity of this innovation-driven rivalry.

First Abu Dhabi Bank (FAB) operates in an environment where competitive rivalry is intensified by a strategic push towards diversification and specialization. Banks are actively broadening their revenue sources beyond traditional lending, with significant growth seen in areas like wealth management, investment banking, and digital financial services.

This diversification means competition isn't just about interest rates anymore; it's about who offers the most comprehensive suite of services. For instance, FAB's expansion into areas like sustainable finance, a rapidly growing sector, pits it against other major regional and international banks also targeting this lucrative niche.

The focus on specific customer segments, such as high-net-worth individuals for private banking or small and medium-sized enterprises (SMEs) for specialized financing, creates intense competition within these defined markets. FAB's ambition to grow its global footprint further fuels this rivalry as it goes head-to-head with established players in new territories.

Regulatory Environment and Central Bank Initiatives

The regulatory environment, particularly initiatives from the Central Bank of the UAE (CBUAE), significantly influences competitive rivalry for First Abu Dhabi Bank. Programs like Open Finance and the Financial Infrastructure Transformation (FIT) program are designed to foster innovation and increase competition within the banking sector.

These CBUAE-led efforts aim to modernize financial services, which can potentially lower entry barriers for new players and encourage the development of novel digital banking solutions. This increased competition can pressure existing institutions like First Abu Dhabi Bank to adapt and enhance their service offerings to remain competitive.

- Open Finance: Encourages data sharing, potentially enabling fintech companies to offer competing services.

- FIT Program: Aims to enhance the UAE's financial infrastructure, supporting digital transformation and new market entrants.

- Regulatory Impact: These initiatives can intensify rivalry by promoting a more dynamic and technology-driven financial ecosystem.

Economic Growth and Lending Opportunities

The United Arab Emirates' economy is showing strong signs of growth, with projections indicating continued expansion. For instance, the UAE's GDP was estimated to grow by 3.9% in 2023 and is forecast to expand by 4.2% in 2024, according to the International Monetary Fund. This robust economic climate naturally creates more opportunities for lending, as businesses and individuals have greater capacity and confidence to borrow. This increased potential for lending volumes intensifies the competition among banks, including First Abu Dhabi Bank, as they vie to capture a larger share of this expanding market.

While a growing economic pie can sometimes temper rivalry by ensuring enough business for everyone, the very strength of this growth also spurs aggressive expansion strategies. Banks are keen to leverage the favorable conditions, leading to increased efforts in marketing, product innovation, and competitive pricing for loans and other financial services. This dynamic means that even with ample opportunities, the battle for market share remains fierce.

- Projected UAE GDP Growth: 4.2% in 2024.

- Impact on Lending: Increased demand for loans and financial services.

- Competitive Response: Banks actively pursue market share through aggressive strategies.

- Result: Heightened rivalry in the banking sector.

The competitive rivalry for First Abu Dhabi Bank (FAB) is intense, driven by a crowded UAE banking sector with numerous strong local and international players. FAB, as the largest bank, faces constant pressure to innovate, especially with the rapid digital transformation and the emergence of digital-only banks. This necessitates significant investment in technology, with UAE banks collectively investing billions in digital channels by the end of 2023.

The rivalry extends beyond traditional lending to areas like wealth management and sustainable finance, as banks diversify their offerings to capture broader market segments. FAB's global expansion ambitions also place it in direct competition with established international institutions.

Regulatory initiatives from the Central Bank of the UAE, such as Open Finance and the FIT program, are designed to foster innovation and increase competition, potentially lowering barriers for new entrants and pushing existing banks like FAB to enhance their services.

The robust UAE economic growth, with a projected GDP expansion of 4.2% in 2024, fuels this rivalry by creating more lending opportunities, which banks aggressively pursue through enhanced marketing and product innovation.

| Key Competitor Type | FAB's Competitive Actions | Market Impact |

|---|---|---|

| Established UAE Banks | Digital transformation, service diversification | Intensified competition for customer base |

| International Banks | Global expansion, specialized services | Increased rivalry in niche markets and new territories |

| Fintech/Digital Banks | Innovative digital offerings, lower cost structures | Pressure on traditional players to adopt new technologies |

SSubstitutes Threaten

Fintech companies pose a significant threat of substitution to traditional banks like First Abu Dhabi Bank. These agile firms are carving out niches with specialized digital payment, remittance, and peer-to-peer lending services that often bypass conventional banking infrastructure.

These fintech solutions frequently offer superior speed, lower costs, and enhanced convenience, particularly appealing to younger, tech-oriented demographics. For instance, by July 2024, the global digital payments market was projected to reach over $2.5 trillion, showcasing the massive adoption of these alternative payment methods.

Neobanks and digital-only banks present a significant threat by offering streamlined, mobile-first banking experiences, often with lower fees and more personalized services. These agile competitors are unburdened by the legacy infrastructure that can slow down traditional institutions. For instance, by mid-2024, several neobanks in the UAE reported substantial growth in their customer bases, attracting younger demographics and small businesses seeking convenience and cost-effectiveness.

While cryptocurrencies are not yet a widespread substitute for daily banking, their potential to disrupt traditional financial services is significant. The ongoing exploration of central bank digital currencies (CBDCs) by nations like the UAE, as seen with their Project Umnia, signals a future where digital assets could fundamentally reshape payment and lending landscapes, posing a long-term threat to established models.

In-house Corporate Finance Departments

For large corporations, the presence of sophisticated in-house finance departments acts as a significant substitute. These departments can manage treasury functions, execute investments, and even arrange certain types of financing, thereby diminishing the need for external banking support for these specific activities. This internal capability directly impacts the demand for a bank's transaction and advisory services.

By handling functions like cash management and short-term lending internally, companies can reduce their reliance on banks. For instance, a substantial portion of corporate treasury operations, which might have previously been outsourced, can now be managed efficiently in-house. This trend is supported by advancements in financial technology and the increasing expertise within corporate finance teams.

- Internal Treasury Management: Large corporations increasingly manage their own cash flow, liquidity, and foreign exchange exposures, reducing the need for bank-provided treasury services.

- In-house Investment Capabilities: Sophisticated finance departments can directly manage corporate investments, bypassing traditional bank advisory or asset management services.

- Direct Financing Arrangements: Companies may arrange private debt placements or other forms of direct financing, lessening their dependence on syndicated loans or traditional corporate banking facilities.

Non-Bank Financial Institutions (NBFIs)

Non-bank financial institutions (NBFIs) present a significant threat of substitutes for First Abu Dhabi Bank (FAB). Insurance companies, investment funds, and asset management firms increasingly offer products that directly compete with traditional banking services. For instance, wealth management products from these NBFIs can be seen as alternatives to FAB's savings and investment accounts, attracting customer deposits.

Businesses also have growing access to alternative financing channels. NBFIs, through direct lending or by facilitating capital markets access, can provide funding that might otherwise be sought from conventional banks like FAB. This disintermediation reduces the reliance on traditional banking relationships for capital.

- Investment products from NBFIs offer competitive returns, drawing customer deposits away from traditional savings accounts.

- Direct financing options provided by NBFIs and capital markets offer businesses alternatives to bank loans.

- The global NBFI sector's assets under management reached an estimated $250 trillion by the end of 2023, highlighting their substantial market presence and competitive capacity.

The threat of substitutes for First Abu Dhabi Bank (FAB) is multifaceted, encompassing fintech innovations, neobanks, and even internal corporate capabilities. Fintechs offer specialized, often cheaper and faster, digital alternatives for payments and lending, with the global digital payments market projected to exceed $2.5 trillion by July 2024. Neobanks are rapidly gaining traction by providing streamlined, mobile-first experiences with lower fees, attracting younger demographics and SMEs, as evidenced by their significant growth in customer bases by mid-2024 in regions like the UAE.

Furthermore, large corporations increasingly manage treasury functions and direct financing in-house, reducing their reliance on traditional banking services. Non-bank financial institutions (NBFIs) also present a substantial competitive force, with their global assets under management estimated at $250 trillion by the end of 2023, offering competing investment products and alternative financing channels that disintermediate traditional banks.

| Substitute Category | Key Offerings | Impact on FAB | Supporting Data/Trend |

| Fintech Companies | Digital Payments, Remittances, P2P Lending | Erosion of transaction fees, customer migration | Global digital payments market projected >$2.5T by July 2024 |

| Neobanks | Mobile-first banking, lower fees, personalized service | Loss of retail and SME customers | Substantial customer base growth reported by UAE neobanks mid-2024 |

| Internal Corporate Finance | Treasury Management, Direct Financing | Reduced demand for corporate banking services | Increasing trend of in-house management of cash flow and liquidity |

| Non-Bank Financial Institutions (NBFIs) | Wealth Management, Alternative Financing | Competition for deposits, disintermediation in lending | NBFI Assets Under Management estimated $250T by end of 2023 |

Entrants Threaten

The banking sector in the UAE, including First Abu Dhabi Bank, faces high regulatory barriers to entry. The Central Bank of the UAE (CBUAE) mandates rigorous licensing procedures, substantial capital requirements, and ongoing compliance with anti-money laundering and counter-terrorism financing (AML/CTF) regulations. These stringent measures effectively deter new players from entering the market, thereby reducing the threat of new entrants.

Establishing a new bank demands immense capital. This includes setting up physical branches, investing in cutting-edge technology, and covering initial operational costs. For instance, First Abu Dhabi Bank's total assets reached AED 1.21 trillion in 2024, highlighting the colossal scale of resources needed to even begin competing.

First Abu Dhabi Bank (FAB) benefits significantly from deeply ingrained brand loyalty and customer trust, a formidable barrier for new entrants. Established financial institutions like FAB have cultivated strong relationships over decades, fostering a sense of reliability that new players struggle to replicate. For instance, in 2023, FAB reported a customer base of over 25 million, a testament to its enduring appeal and the trust placed in it by a vast number of individuals and businesses.

Technological Investment and Expertise

New entrants face significant hurdles due to the substantial technological investments required. To compete with established players like First Abu Dhabi Bank (FAB), newcomers must deploy cutting-edge banking technology, robust cybersecurity measures, and sophisticated digital platforms. For instance, in 2023, global banks allocated an estimated $300 billion to technology spending, a figure expected to grow as digital transformation accelerates.

The escalating demand for AI-driven solutions and advanced analytics further elevates the entry barrier. Entrants need to demonstrate a high degree of technological readiness and the capacity to innovate rapidly. This includes developing secure and user-friendly mobile banking applications, implementing advanced fraud detection systems, and leveraging data analytics for personalized customer experiences, all of which demand considerable upfront capital and specialized expertise.

- High Capital Expenditure: Significant investment is needed for digital infrastructure, cloud computing, and AI capabilities.

- Cybersecurity Demands: Protecting sensitive financial data requires substantial spending on advanced cybersecurity solutions and talent.

- Regulatory Compliance: New entrants must invest in technology to meet stringent financial regulations and data privacy standards.

- Talent Acquisition: Securing skilled IT professionals, data scientists, and cybersecurity experts is crucial and costly.

Incumbent Advantage and Network Effects

Existing banks like First Abu Dhabi Bank (FAB) possess a significant advantage due to their extensive physical and digital infrastructure. This includes a vast network of branches and ATMs, which are costly and time-consuming for new players to replicate. For instance, as of late 2023, FAB operated a substantial number of branches and ATMs across the UAE, providing a tangible barrier to entry.

Furthermore, established banks benefit from powerful network effects. Their deep integration with businesses, government entities, and a large customer base creates an ecosystem that is difficult for newcomers to penetrate. These existing relationships and established payment systems, like FAB's participation in the UAE's instant payment platform, create a strong incumbent advantage, making it challenging for new entrants to achieve critical mass and compete effectively.

- Extensive Branch and ATM Network: FAB's significant physical footprint provides widespread customer access and convenience, a costly infrastructure for new entrants to match.

- Established Payment Systems: Integration into national payment infrastructures and existing transaction volumes create operational efficiencies and customer loyalty.

- Deep Customer and Business Relationships: Long-standing ties with corporate clients and government bodies offer a stable revenue base and competitive moat.

- Network Effects: The value of FAB's services increases with its user base, making it harder for new, smaller entrants to attract and retain customers.

The threat of new entrants for First Abu Dhabi Bank (FAB) remains relatively low due to significant barriers. High capital requirements, stringent regulatory frameworks overseen by the Central Bank of UAE, and established brand loyalty create substantial hurdles for newcomers. For instance, FAB's total assets in 2024 were AED 1.21 trillion, underscoring the immense capital needed to enter this market.

Technological investment and cybersecurity demands further elevate entry barriers, requiring new banks to match the advanced digital infrastructure and security protocols of incumbents like FAB. The need for AI-driven solutions and robust data analytics also necessitates considerable expertise and financial outlay, making it difficult for new players to compete effectively.

| Barrier | Description | Impact on New Entrants | Example (FAB) |

| Capital Requirements | Substantial funds needed for licensing, infrastructure, and operations. | High barrier, limiting the number of potential entrants. | Total assets of AED 1.21 trillion (2024). |

| Regulation | Strict licensing, compliance, and AML/CTF rules. | Deters new players and increases operational complexity. | CBUAE mandates rigorous procedures. |

| Brand Loyalty & Trust | Established customer relationships built over time. | Difficult for new entrants to attract and retain customers. | Over 25 million customers (2023). |

| Technology Investment | Need for advanced digital platforms, AI, and cybersecurity. | Requires significant upfront capital and specialized talent. | Global banks spent ~$300 billion on tech (2023). |

Porter's Five Forces Analysis Data Sources

Our First Abu Dhabi Bank Porter's Five Forces analysis leverages data from the bank's annual reports, investor presentations, and official disclosures. We supplement this with industry-specific research from reputable financial news outlets and market intelligence providers to capture the competitive landscape.