First Abu Dhabi Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Abu Dhabi Bank Bundle

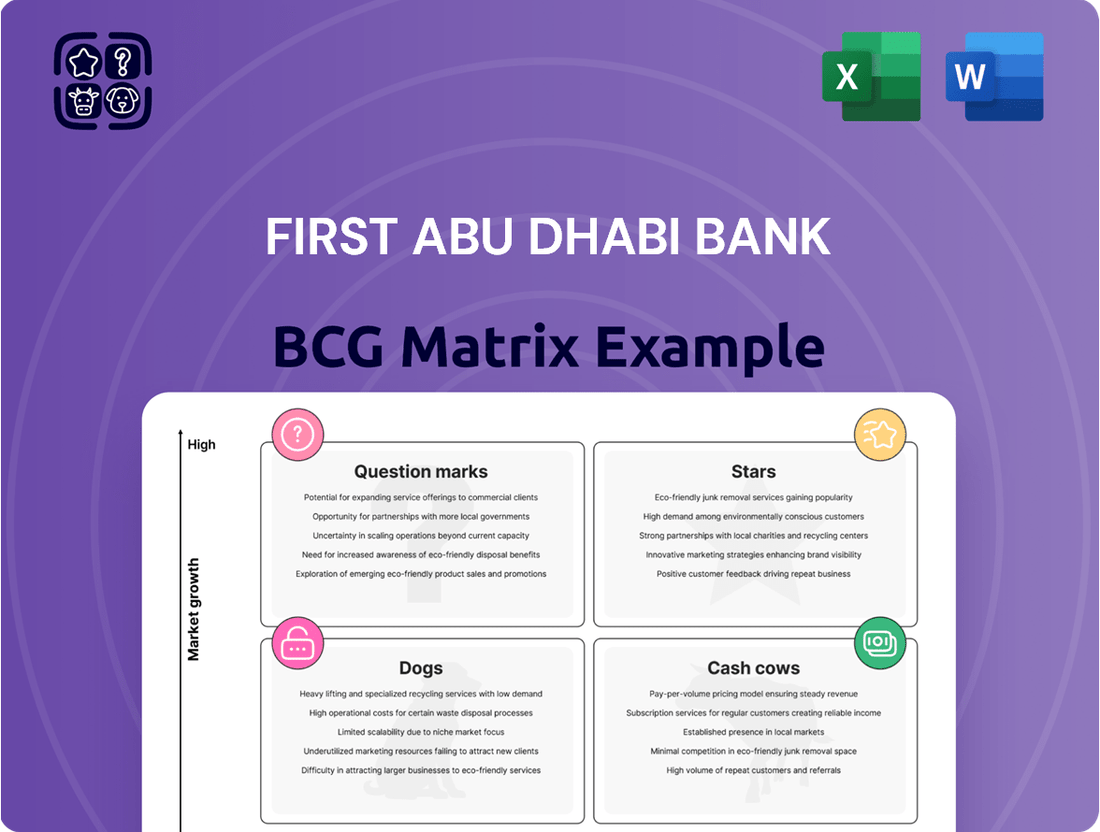

Curious about First Abu Dhabi Bank's product portfolio performance? Our BCG Matrix preview highlights key areas, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Gain the strategic clarity you need to make informed investment decisions and optimize resource allocation.

Don't miss out on the complete picture! Purchase the full First Abu Dhabi Bank BCG Matrix to receive detailed quadrant placements, actionable insights, and a strategic roadmap for navigating the competitive financial landscape. Elevate your understanding and drive impactful business growth.

Stars

First Abu Dhabi Bank (FAB) is aggressively pursuing digital transformation, pouring significant resources into areas like artificial intelligence integration. This strategic focus aligns with the banking sector's rapid evolution towards digital-first solutions, identifying these as key drivers for future expansion.

FAB's commitment is evident in initiatives like its AI Innovation Hub and the adoption of advanced platforms such as Microsoft Azure AI services. These investments are designed to elevate FAB's standing in digital banking, promising substantial gains in efficiency and fostering robust future growth.

By embracing cutting-edge technology, FAB aims to significantly improve customer experiences, streamline internal operations through automation, and pioneer innovative digital banking services. This forward-thinking approach is crucial for maintaining a competitive edge in the dynamic financial landscape.

First Abu Dhabi Bank (FAB) is demonstrating significant leadership in sustainable finance, a critical component of its strategic positioning. The bank has committed to investing and facilitating over AED 500 billion, approximately USD 136 billion, by 2030. This represents a substantial 80% increase from their earlier target.

This ambitious goal firmly places FAB at the forefront of the burgeoning green economy and reflects a keen alignment with global sustainability imperatives. Their proactive engagement in green finance instruments, such as green bonds, along with a strong Environmental, Social, and Governance (ESG) rating, is a magnet for investors prioritizing environmental responsibility. This strategic focus not only enhances their reputation but also unlocks promising new business opportunities within the sustainable finance sector.

First Abu Dhabi Bank (FAB) is strategically expanding its international presence, targeting high-growth markets across 20 countries. This includes key regions like the UK, France, Switzerland, and Saudi Arabia, alongside its recent direct involvement in China's CIPS. This diversification is crucial for accessing new customer segments and revenue opportunities beyond its core domestic market.

FAB's international operations are demonstrating robust growth, with revenues increasing by 32% year-on-year in 2024. These overseas activities now account for a significant 23% of the Group's total operating income, highlighting their increasing importance to FAB's overall financial performance and strategic objectives.

Investment Banking & Global Markets Growth

First Abu Dhabi Bank's (FAB) Investment Banking and Global Markets divisions are demonstrating robust growth, positioning them as significant contributors to the bank's overall performance. In 2024, investment banking revenue saw a substantial increase of 19% year-on-year, while Global Markets revenue grew by 18% over the same period. This upward trajectory is a direct result of heightened client engagement and the successful expansion of FAB's revenue sources beyond traditional offerings.

These strong results underscore FAB's strategic focus on these high-growth areas. The bank's consistent presence and top rankings in Middle East and North Africa (MENA) Investment Banking league tables further validate its market leadership and competitive edge.

- Investment Banking Revenue Growth: 19% year-on-year increase in 2024.

- Global Markets Revenue Growth: 18% year-on-year increase in 2024.

- Key Drivers: Increased client activity and successful diversification of income streams.

- Market Position: Maintained top rankings in MENA IB league tables.

Personal and Private Banking Segment Expansion

The personal and private banking segments for First Abu Dhabi Bank (FAB) are experiencing robust expansion, positioning them as potential stars in the BCG matrix. Retail banking saw a significant 20% increase in new customers, demonstrating strong market penetration.

Private banking assets under management surged by an impressive 75% year-on-year, highlighting the bank's success in attracting and retaining high-net-worth individuals. This growth is driven by a strategic focus on enhancing the private banking client experience and tailoring product offerings to meet the diverse needs of both retail and wealth management customers.

- Retail Banking Customer Growth: 20% increase in new customers.

- Private Banking AUM Growth: 75% year-on-year increase.

- Strategic Focus: Enhancing private banking offerings and retail product relevance.

The personal and private banking segments for First Abu Dhabi Bank (FAB) are demonstrating strong growth, indicating their potential to be classified as Stars in the BCG matrix. Retail banking experienced a notable 20% increase in new customers in 2024, signifying effective market penetration and customer acquisition.

Private banking assets under management saw an impressive 75% year-on-year surge, underscoring FAB's success in attracting and retaining high-net-worth clients. This expansion is fueled by a strategic emphasis on elevating the private banking client experience and customizing product suites to cater to the varied requirements of both retail and wealth management segments.

These segments exhibit high market growth and strong relative market share for FAB, aligning with the characteristics of Stars. The bank's focused strategies in these areas are yielding significant customer acquisition and asset growth, positioning them for continued success and market leadership.

| Business Segment | 2024 Performance Metric | Growth Rate | BCG Classification Potential |

|---|---|---|---|

| Personal Banking (Retail) | New Customers | +20% | Star |

| Private Banking | Assets Under Management (AUM) | +75% YoY | Star |

What is included in the product

FAB's BCG Matrix offers a strategic overview of its business units, guiding investment decisions.

It highlights which units to invest in, hold, or divest based on market growth and share.

The First Abu Dhabi Bank BCG Matrix offers a clear, one-page overview, relieving the pain of analyzing diverse business units.

Cash Cows

First Abu Dhabi Bank (FAB) commands a dominant position in the UAE, evidenced by its status as the largest bank by assets. As of the first quarter of 2024, FAB reported total assets of AED 1.1 trillion (approximately USD 300 billion), underscoring its significant market share and entrenched presence.

This robust domestic foothold translates into a stable and consistent revenue stream, making its UAE operations a clear cash cow. The bank's deep integration into the fabric of the UAE economy, supported by the nation's continued economic expansion, provides a solid foundation for sustained strong performance from its core banking activities.

First Abu Dhabi Bank (FAB) actively pursues a strategy of diversifying its revenue sources, moving beyond just traditional interest income. This diversification is crucial for maintaining resilience, especially in more mature markets.

Non-interest income plays a substantial role in FAB's overall financial performance. For instance, in the first quarter of 2025, non-interest income accounted for 43% of total revenue, and this figure rose to 46% by the first half of 2025.

This balanced revenue model, incorporating income from fees, commissions, and trading activities, contributes to stable and high profit margins. The consistent growth observed in non-interest income underscores the effectiveness of FAB's diversification efforts.

First Abu Dhabi Bank (FAB) exhibits characteristics of a Cash Cow within the BCG Matrix, primarily due to its robust financial performance and a strong, stable balance sheet. The bank achieved a net profit of AED 17.1 billion in 2024, demonstrating consistent profitability. This financial health is further evidenced by a Return on Tangible Equity (RoTE) that surpassed its medium-term target of 16%, indicating efficient capital utilization.

The bank's balance sheet is exceptionally strong, with total assets exceeding AED 1.3 trillion. Coupled with robust capital adequacy ratios and healthy liquidity positions, these factors ensure a consistent and reliable generation of cash flow. This sustained cash generation capability is a hallmark of a Cash Cow, allowing for stable operations and shareholder returns.

FAB's financial resilience, as shown by its H1 2025 net profit of AED 10.63 billion, underpins its capacity to provide consistent dividends to its investors. The bank's ability to maintain such strong financial metrics in a dynamic market solidifies its position as a mature, high-performing asset that generates significant surplus cash.

Established Corporate and Commercial Banking

First Abu Dhabi Bank's (FAB) Established Corporate and Commercial Banking division is a cornerstone of its business, acting as a reliable cash cow. This segment consistently generates substantial revenue by catering to a broad spectrum of clients, from burgeoning SMEs to major corporations and governmental bodies. Its maturity is underscored by deep-rooted client relationships and predictable transaction volumes.

The division's strength lies in its ability to maintain strong market share through consistent service and strategic digital enhancements. For instance, the Commercial Banking Service Accelerator aims to streamline operations and elevate the customer experience, ensuring continued loyalty and business flow.

- Market Position: FAB is a leading corporate and commercial bank in the UAE, leveraging its extensive network and reputation.

- Revenue Contribution: This segment typically represents a significant portion of FAB's overall net interest income and fee income. In 2023, FAB reported a net profit of AED 13.9 billion, with corporate and investment banking contributing substantially.

- Client Base: The division serves over 100,000 corporate and SME clients, demonstrating its wide reach.

- Digital Initiatives: Investments in digital platforms are enhancing operational efficiency and client engagement, supporting its cash cow status.

Prudent Risk Management and Asset Quality

First Abu Dhabi Bank's (FAB) Cash Cows are underpinned by a steadfast commitment to prudent risk management and superior asset quality. This strategic focus ensures the stability and reliability of its revenue streams, crucial for maintaining its position as a market leader.

FAB consistently demonstrates strong asset quality. As of June 2025, the bank reported a non-performing loan (NPL) ratio of 2.8%, a figure that reflects a declining trend and effective credit oversight. This is further bolstered by robust provision coverage, reaching 100% in the first half of 2025, which significantly mitigates potential financial shocks.

- Asset Quality: NPL ratio at 2.8% (June 2025).

- Provision Coverage: 100% in H1 2025.

- Risk Profile: Validated by strong credit ratings from major agencies.

- Impact: Minimizes potential losses and ensures earnings stability.

First Abu Dhabi Bank's (FAB) established UAE retail banking operations function as a quintessential cash cow within its business portfolio. This segment benefits from a substantial and loyal customer base, generating consistent fee and interest income. The bank's extensive branch network and digital offerings ensure continued market penetration, solidifying its stable revenue generation.

The bank's retail segment consistently demonstrates strong performance, evidenced by its significant contribution to overall profitability. In 2024, FAB’s net profit stood at AED 17.1 billion, with retail banking playing a pivotal role in this achievement through its broad customer reach and diverse product suite.

FAB's commitment to enhancing the retail customer experience through digital innovation further solidifies this segment's cash cow status. Initiatives like the FAB Mobile app, which saw a 20% increase in active users by mid-2025, contribute to operational efficiency and customer retention, ensuring sustained cash flow.

FAB's retail banking operations are characterized by their maturity, strong market share, and consistent profitability, making them a core cash cow. The bank's focus on customer acquisition and retention, coupled with a diversified product portfolio, ensures a reliable and substantial inflow of funds.

| Segment | Key Characteristics | Contribution to FAB (Illustrative) |

|---|---|---|

| UAE Retail Banking | Mature market, loyal customer base, extensive network, digital focus | Consistent net interest income, significant fee income |

| Corporate & Commercial Banking | Dominant market share, deep client relationships, strong transaction volumes | Major contributor to net profit and fee income |

Full Transparency, Always

First Abu Dhabi Bank BCG Matrix

The First Abu Dhabi Bank BCG Matrix preview you're examining is precisely the comprehensive document you will receive upon purchase, offering a complete, unwatermarked analysis of FAB's business units. This ensures you get the fully formatted, ready-to-use strategic report designed for immediate application in your business planning and competitive analysis. What you see is the actual BCG Matrix file, providing an in-depth look at FAB's portfolio without any demo content or hidden surprises. Once purchased, this professionally designed, analysis-ready file will be instantly downloadable, allowing you to leverage its insights without delay. This preview represents the final, polished version, meticulously crafted to deliver strategic clarity and actionable insights for First Abu Dhabi Bank.

Dogs

First Abu Dhabi Bank (FAB) is actively consolidating its IT infrastructure, with plans to decommission legacy data centers. Two such facilities are slated for closure in January 2025, signaling a strategic move away from older, less efficient systems. This initiative aligns with the bank's efforts to streamline operations and reduce costs associated with maintaining outdated technology.

These legacy systems can be viewed as representing a low-growth, low-market-share segment within FAB's overall business. As they are being phased out, their contribution to future strategic growth is minimal, while they continue to consume valuable resources for maintenance. This positions them as potential candidates for the 'Dogs' quadrant in a BCG Matrix analysis, reflecting their declining relevance and limited future potential.

Prior to its comprehensive digital overhaul, First Abu Dhabi Bank (FAB) likely grappled with a significant number of manual processes. These legacy systems, characterized by their reliance on paper-based workflows and human intervention, would have been a clear indicator of a 'Dog' in the BCG matrix of its operational efficiency. Such processes typically yield low returns on investment due to their inherent slowness and susceptibility to errors, while simultaneously incurring high operational costs through labor and resource expenditure.

For instance, manual account opening or loan processing, common in traditional banking, could take days and involve multiple physical document checks. In 2023, the global banking sector continued to invest heavily in automation, with many institutions reporting significant cost savings. For example, a study by Celent indicated that automation of customer onboarding could reduce processing time by up to 80% and cut costs by 50%.

FAB's strategic focus on digital transformation, including investments in AI and robotic process automation, directly addresses these outdated manual processes. The objective is to streamline operations, minimize human error, and ultimately improve the customer experience, thereby moving these inefficient functions out of the 'Dog' quadrant and towards greater profitability and market share.

For First Abu Dhabi Bank (FAB), hypothetical underperforming niche products would fall into the 'Dogs' category of the BCG Matrix. These might include specialized legacy investment products with declining investor uptake or niche corporate banking services facing intense competition from fintech disruptors.

For instance, consider a hypothetical scenario where a particular structured product, once popular, now holds a negligible market share in the UAE due to evolving investor preferences and the rise of more accessible alternatives. In 2024, such a product might represent less than 0.1% of the bank's total fee and commission income, with a negative growth rate year-over-year.

Non-Strategic Geographic Presences (Hypothetical)

First Abu Dhabi Bank (FAB) is actively pursuing international expansion, but some smaller, less strategic overseas offices might fall into the Dogs category. These could be operations in mature or stagnant markets where growth potential is limited and their market share is considerably lower than in FAB's core or high-growth regions.

These less strategic presences, potentially in markets with subdued economic activity or intense competition, may not be contributing significantly to overall profitability or strategic objectives. For instance, if FAB has a presence in a European market with a GDP growth rate projected to be below 1.5% for 2024 and 2025, and its market share there is minimal, it could be a candidate for review.

- Limited Growth Potential: Operations in markets with projected GDP growth below the global average might represent a Dog.

- Low Market Share: A small footprint in competitive, established markets indicates a potential Dog.

- Resource Allocation: These units might consume resources without generating commensurate returns, making them candidates for divestment or scaling back.

- Strategic Review: FAB may periodically assess these presences to determine if they align with its long-term international strategy.

Inefficient Internal IT Systems (Pre-Transformation)

Before its major digital overhaul, First Abu Dhabi Bank (FAB) likely grappled with internal IT systems that were not performing optimally. These systems, while functional, could have been a drag on efficiency, leading to challenges like an increased number of critical incidents (P1 cases) and operational slowdowns. For instance, a bank of FAB's scale might have seen a significant portion of its IT budget allocated to maintaining these older, less agile systems, potentially exceeding 30% of the IT operational expenditure in some legacy environments.

These legacy IT systems, characterized by their low relative market share in terms of digital service delivery and low growth prospects for their outdated functionalities, would have fit the profile of a 'Dog' in a BCG matrix analysis. They demanded substantial resources for upkeep and support without offering significant competitive advantages or driving new business opportunities. This situation is common in large financial institutions where the cost of replacing deeply embedded systems can be prohibitive, even if their performance is suboptimal.

- Low Efficiency: Legacy systems often lack automation and integration capabilities, leading to manual workarounds and increased error rates.

- High Support Costs: Older technologies require specialized skills and frequent maintenance, driving up operational expenses.

- Operational Bottlenecks: Inefficient systems can slow down critical processes, impacting customer service and internal workflows.

- Limited Scalability: These systems may struggle to adapt to growing data volumes or new business demands, hindering innovation.

Within First Abu Dhabi Bank's (FAB) strategic framework, 'Dogs' represent business units or products with low market share and low growth potential. These are often legacy products or services that are no longer competitive or in demand, consuming resources without generating significant returns.

For instance, a hypothetical niche investment fund with declining assets under management and limited investor interest would be classified as a Dog. In 2024, such a product might see its market share shrink to below 0.5% of FAB's total investment product offerings, with a negative annual growth rate.

FAB's ongoing digital transformation and IT infrastructure consolidation efforts aim to phase out these 'Dog' segments. By decommissioning legacy systems and streamlining operations, the bank seeks to reallocate resources towards more promising growth areas.

Question Marks

First Abu Dhabi Bank (FAB) is actively pursuing early-stage fintech partnerships and ventures, aligning with its broader digital transformation strategy. For example, its collaboration with Gilded to offer a physical gold investment product taps into the growing demand for accessible alternative investments. These initiatives, while positioned in high-growth sectors like fintech and AI-driven banking solutions, represent nascent market positions with potential for significant future expansion.

New geographic market entries with low initial share at First Abu Dhabi Bank (FAB) would be classified as Question Marks within the BCG Matrix. These are markets where FAB is investing for future growth, recognizing their high potential but currently holding a small piece of the pie.

For instance, FAB's engagement with China's CIPS (Cross-Border Interbank Payment System) exemplifies this. While China represents a massive, high-growth financial market, FAB's direct penetration and established client base there are still developing. This strategic move aims to capture future opportunities in a rapidly expanding economy.

First Abu Dhabi Bank (FAB) is actively exploring cutting-edge AI and machine learning applications, such as the Board AI Observer and Voice Concierge. These initiatives represent significant investments in innovation, positioning FAB to potentially capture future market leadership.

While these advanced AI tools are in a rapidly evolving technological sector, their current market penetration and direct revenue generation may still be nascent. However, substantial investment in these areas could see them mature into Stars within FAB's portfolio, driving substantial growth in the coming years.

Sustainable and Transition Financing for Hard-to-Abate Industries

First Abu Dhabi Bank (FAB) is strategically broadening its sustainable finance offerings to encompass transition financing for challenging sectors like heavy industry and resource extraction, alongside nascent climate technologies such as hydrogen. This move acknowledges the significant growth potential fueled by worldwide decarbonization initiatives.

While this market presents a substantial opportunity, FAB's current market share within these specialized and developing niches is likely to be modest. Capturing a larger share will necessitate considerable investment in expertise and infrastructure to scale operations effectively.

The global sustainable finance market is experiencing robust expansion. For instance, the sustainable debt market reached over $1.5 trillion in issuance in 2023, with a growing portion dedicated to transition-linked instruments. Specifically, green hydrogen projects are attracting significant attention, with projected global investment in the sector to exceed $500 billion by 2030, according to various industry analyses.

- Market Expansion: FAB's inclusion of transition finance for hard-to-abate sectors and emerging climate solutions like hydrogen aligns with global decarbonization trends.

- Growth Potential: The demand for sustainable and transition financing in these industries is projected to rise significantly in the coming years.

- Investment Needs: Scaling presence in these specific sub-segments will require substantial capital allocation and specialized knowledge.

- Competitive Landscape: FAB will face competition from established and emerging financial institutions also targeting this high-growth market.

Open Finance Regulation Platforms (Upcoming)

First Abu Dhabi Bank (FAB) is strategically positioning itself for the upcoming open finance regulations, with plans to accelerate cloud-native architecture adoption starting in 2025. This move is crucial for building platforms that will support the Central Bank of UAE's open finance framework.

While open finance represents a significant growth opportunity within financial services, FAB's dedicated platforms in this domain are still in their early stages. Capturing future market share in this rapidly evolving sector will necessitate substantial investment.

These initiatives are designed to leverage new market opportunities presented by open finance. For instance, by 2024, the global open banking market was projected to reach over $40 billion, highlighting the potential scale of FAB's future endeavors.

- Cloud-Native Acceleration: FAB aims to enhance its technological infrastructure with cloud-native architectures by 2025.

- Regulatory Compliance: The bank is developing platforms to meet the Central Bank of UAE's open finance regulations.

- Market Potential: Open finance is a high-growth area, with the global market expected to expand significantly.

- Investment Focus: Substantial investment is required to build and scale FAB's open finance platforms effectively.

Question Marks in FAB's BCG Matrix represent emerging ventures with high growth potential but currently low market share. These are areas where FAB is strategically investing, anticipating future market leadership. Examples include new geographic entries, advanced AI applications, and sustainable finance niches.

These initiatives, while nascent, are crucial for FAB's long-term growth strategy in a dynamic financial landscape. The bank's commitment to these areas underscores its forward-looking approach to innovation and market expansion.

For instance, FAB's expansion into China via CIPS, a high-growth market, positions it to capture future opportunities despite its current limited share. Similarly, investments in AI and sustainable finance, like hydrogen projects, tap into burgeoning sectors with significant upside potential.

FAB's proactive stance on open finance, with cloud-native architecture development by 2025, is another key Question Mark. This move anticipates regulatory shifts and aims to establish a strong market position in a sector projected for substantial growth, with the global open banking market already exceeding $40 billion by 2024.

| Venture Area | Current Market Share | Growth Potential | FAB's Strategy | Key Considerations |

|---|---|---|---|---|

| China Market Entry (CIPS) | Low | High | Investment in penetration and client base development | Navigating a large, complex market |

| AI/ML Applications (Voice Concierge) | Low | High | Significant investment in innovation and R&D | Rapid technological evolution, market adoption |

| Sustainable Finance (Hydrogen) | Modest | High | Building expertise and infrastructure for scaling | Specialized niche, significant capital needs |

| Open Finance Platforms | Early Stage | High | Accelerating cloud-native architecture by 2025 | Regulatory compliance, platform development |

BCG Matrix Data Sources

Our First Abu Dhabi Bank BCG Matrix leverages comprehensive data from internal financial reports, extensive market research, and competitor performance analysis to accurately position business units.