First Financial Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Bank Bundle

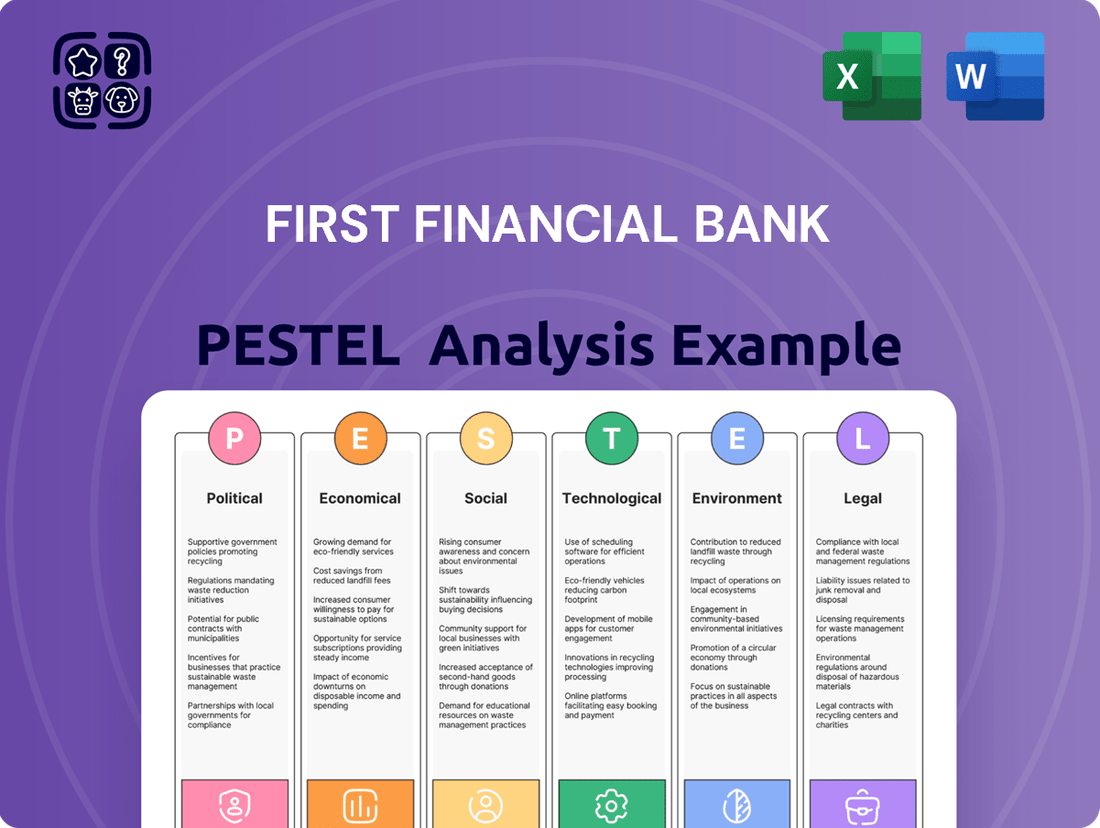

Navigate the complex external landscape impacting First Financial Bank with our detailed PESTLE analysis. Understand how political stability, economic fluctuations, evolving social demographics, technological advancements, environmental regulations, and legal frameworks are shaping the bank's operations and future growth. This comprehensive report provides actionable intelligence crucial for strategic planning and competitive advantage. Gain the foresight needed to adapt and thrive in a dynamic market. Purchase the full PESTLE analysis now for an in-depth understanding and to unlock your strategic potential.

Political factors

The stability and direction of banking regulations are paramount for First Financial Bancorp. Shifts in regulatory priorities, especially with a new administration potentially taking office in 2025, could reshape capital requirements and consumer protection standards. For example, the Federal Reserve's interest rate policies, which influence lending and deposit costs, are directly tied to regulatory oversight and economic stability.

Government policies concerning bank mergers and acquisitions significantly shape First Financial Bancorp's avenues for strategic expansion. Recent shifts in regulatory approaches, particularly a new U.S. presidential administration's emphasis on greater transparency and support for the financial sector, signal a potential acceleration in merger and acquisition (M&A) activity. This could create more favorable conditions for First Financial Bancorp to pursue growth through strategic consolidation. For instance, the U.S. banking industry saw a notable number of M&A deals in 2023, with reports indicating continued interest in consolidation throughout 2024, driven by economic conditions and the pursuit of greater scale and efficiency.

The Federal Reserve's monetary policy, specifically its interest rate decisions, significantly impacts First Financial Bancorp's financial performance. Anticipated gradual rate reductions in 2024 and into 2025 could compress net interest margins, a key driver of bank profitability. For example, if the Federal Reserve lowers the federal funds rate by 0.25% in late 2024, this could directly affect the bank's borrowing costs and the yield on its interest-earning assets.

While lower rates might slightly dampen loan growth as borrowing becomes cheaper and potentially spurs more demand, the overall effect on First Financial's profitability is nuanced. The bank's ability to adapt its lending strategies and manage its funding costs will be crucial in navigating this evolving interest rate environment. Data from the Federal Reserve indicates a shift towards a more accommodative stance, with inflation cooling from its 2022 peaks, suggesting a potential pivot in policy.

Anti-Money Laundering (AML) and Sanctions Enforcement

First Financial Bancorp operates within a political landscape characterized by ongoing stringent enforcement of Anti-Money Laundering (AML) and sanctions regulations. Agencies such as the Financial Crimes Enforcement Network (FinCEN) consistently prioritize these areas, making compliance a crucial operational imperative. For instance, in 2023, FinCEN assessed over $1.2 billion in civil penalties against financial institutions for AML violations, underscoring the significant financial risks associated with non-compliance.

To navigate these political factors effectively, First Financial Bancorp must continuously invest in and refine its internal controls and transaction monitoring systems. This proactive approach is essential for ensuring adherence to evolving regulatory requirements and mitigating the risk of substantial penalties. The bank's ability to demonstrate robust compliance measures directly impacts its reputation and operational stability, as regulators remain vigilant in identifying and addressing vulnerabilities.

- Regulatory Focus: Continued emphasis by FinCEN and other global bodies on AML and sanctions compliance.

- Compliance Costs: Significant investment required for technology and personnel to maintain robust monitoring systems.

- Enforcement Actions: Potential for substantial fines and reputational damage for non-compliance, as evidenced by billions in penalties levied in recent years.

- Geopolitical Impact: Evolving sanctions regimes due to global events necessitate agile adaptation of compliance protocols.

Community Reinvestment Act (CRA) Compliance

The Community Reinvestment Act (CRA) significantly shapes First Financial Bancorp's approach to lending and investment within its operating areas. Compliance with CRA regulations, including achieving strong performance evaluations, directly influences the bank's ability to expand and engage in strategic partnerships. Maintaining a positive CRA standing is crucial for regulatory approval of mergers and acquisitions, a key growth avenue for financial institutions.

First Financial Bancorp's consistent achievement of an Outstanding CRA rating underscores its dedication to community development. For instance, in its 2023 CRA performance evaluation, the bank was recognized for its robust lending and investment activities. This favorable rating not only enhances its public image as a responsible corporate citizen but also strengthens its relationship with federal regulators, which is vital for ongoing business operations and future growth initiatives.

- Outstanding CRA Rating: First Financial Bancorp has consistently earned an Outstanding CRA rating, reflecting its strong commitment to serving low- and moderate-income communities.

- Regulatory Benefits: An outstanding rating facilitates regulatory approvals for mergers, acquisitions, and branch expansion, supporting strategic growth.

- Community Impact: The CRA mandates encourage and reward banks for investing in and lending to the communities they serve, particularly underserved populations.

- Public Perception: A strong CRA record positively influences public perception and builds trust with customers and stakeholders.

Government policy shifts, particularly regarding potential new administrations in 2025, could alter regulatory landscapes for banks like First Financial Bancorp. This includes changes to capital requirements and consumer protection rules, directly impacting operations and strategic planning.

The Federal Reserve's monetary policy, including anticipated rate adjustments in 2024-2025, will influence First Financial's net interest margins and loan growth dynamics. A shift towards lower rates, for example, could compress profitability but also stimulate borrowing demand.

First Financial Bancorp faces ongoing scrutiny for Anti-Money Laundering (AML) and sanctions compliance, with agencies like FinCEN levying significant penalties, such as over $1.2 billion in 2023 for violations. Maintaining robust compliance systems is therefore critical for mitigating financial and reputational risks.

The Community Reinvestment Act (CRA) remains a key political factor, with First Financial Bancorp's consistent Outstanding CRA rating facilitating regulatory approvals for growth initiatives like mergers and acquisitions.

What is included in the product

This First Financial Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the bank, providing a comprehensive understanding of its operating landscape.

This PESTLE analysis for First Financial Bank offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain of wading through extensive data.

Economic factors

The interest rate environment is a critical factor for First Financial Bancorp. Higher rates generally boost net interest income, as banks earn more on loans. However, the projected gradual rate reductions in 2025 could put pressure on net interest margins.

For FDIC-insured banks, net interest income saw an increase in the final quarter of 2024. This trend highlights the sensitivity of bank profitability to prevailing interest rate levels and the potential for future compression as monetary policy shifts.

As the Federal Reserve signals potential rate cuts throughout 2025, First Financial Bancorp, like its peers, will likely experience a narrowing of its net interest margin. This could also temper the pace of loan growth as borrowing becomes less attractive.

Economic growth significantly shapes loan demand for First Financial Bancorp across its key states: Ohio, Indiana, Kentucky, and Illinois. A robust economy typically spurs businesses to expand and consumers to borrow, directly boosting demand for commercial, real estate, and personal loans. For instance, the U.S. GDP growth was approximately 3.1% in 2023, indicating a generally favorable environment for lending, though regional variations can exist.

While the broader U.S. economy is expected to continue its expansion in 2024 and 2025, the rate of this growth, alongside inflation concerns, will play a crucial role. Higher inflation could lead to increased interest rates, potentially tempering loan demand as borrowing becomes more expensive. Conversely, sustained, moderate growth may encourage greater lending activity, provided banks maintain a healthy risk appetite.

Inflation directly impacts consumer spending by eroding purchasing power. When prices rise faster than incomes, consumers have less disposable income, potentially reducing demand for discretionary goods and services. This shift can influence the types of deposit and loan products consumers seek. For instance, higher inflation might encourage savings in interest-bearing accounts to preserve value, while also increasing demand for loans to cover rising essential expenses.

The Federal Reserve's preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, showed a 2.7% increase in the 12 months ending April 2024, a notable slowdown from previous peaks. However, persistent inflation can still strain household budgets, impacting consumer confidence and their willingness to take on new debt. This could lead to a higher credit risk for financial institutions if consumers struggle to meet loan repayment obligations.

Unemployment Rates and Credit Quality

Unemployment rates are a critical economic indicator for banks like First Financial Bank because they directly impact consumers' capacity to manage and repay their debts. When employment levels are high, individuals and households generally have more disposable income, making them more likely to meet their loan obligations. Conversely, rising unemployment can lead to increased defaults, straining the bank's asset quality.

For instance, data from late 2024 and early 2025 indicates a generally resilient labor market. The U.S. unemployment rate hovered around 3.7% as of Q4 2024, a level historically associated with a strong economy. However, this overall stability can mask underlying vulnerabilities in specific sectors or demographics.

While the overall asset quality for FDIC-insured institutions remained stable through Q4 2024, with noncurrent loans at 0.81% of total loans, certain loan portfolios demand close attention. Weakness has been observed in areas such as commercial real estate (CRE) and credit cards, where higher unemployment or economic slowdowns could disproportionately affect repayment capabilities. For First Financial Bank, monitoring these specific segments is crucial for preempting potential credit quality deterioration.

- Consumer Confidence: High employment generally boosts consumer confidence, encouraging spending and borrowing, which benefits bank lending portfolios.

- Loan Loss Provisions: Rising unemployment necessitates increased loan loss provisions, impacting profitability and capital adequacy.

- Credit Card Delinquencies: As of Q4 2024, credit card delinquency rates showed a slight uptick, a trend that could accelerate if unemployment rises significantly.

- Commercial Real Estate Exposure: The CRE sector, particularly office spaces, faces headwinds due to remote work trends, potentially increasing default risk for banks with significant exposure.

Real Estate Market Trends

Trends in commercial and residential real estate within First Financial Bancorp's operating regions directly shape its loan performance. The banking sector, including First Financial, is closely watching potential vulnerabilities in specific loan segments, such as commercial office spaces and apartment complexes.

For instance, as of early 2024, the national vacancy rate for office buildings remained elevated, hovering around 19.6%, a figure that continues to pressure commercial real estate loans. Multifamily properties, while generally more resilient, have seen some moderation in rent growth and occupancy rates in select markets, prompting careful scrutiny of associated loan portfolios.

- Office Vacancy Rates: Continued high vacancy rates in major metropolitan areas pose a risk to commercial real estate loans.

- Multifamily Market Dynamics: While still strong, some markets are experiencing slower rent growth and a slight dip in occupancy, impacting loan performance.

- Interest Rate Sensitivity: Higher interest rates affect both property valuations and the ability of borrowers to service real estate debt.

- Regional Variations: Performance across First Financial's footprint will likely vary significantly based on local economic conditions and specific real estate sector demand.

The economic outlook for 2024 and 2025 suggests a continued, albeit potentially moderating, U.S. GDP growth, which directly influences loan demand for First Financial Bancorp. Inflationary pressures remain a consideration, with the PCE price index showing a 2.7% annual increase as of April 2024, impacting consumer spending power and potentially leading to shifts in savings and borrowing behaviors.

Unemployment rates stayed low, around 3.7% in Q4 2024, supporting consumer debt repayment capacity. However, specific sectors like commercial real estate (CRE) face headwinds, evidenced by persistent high office vacancy rates around 19.6% nationally in early 2024, which could affect loan portfolios.

Interest rate expectations for 2025 point towards potential reductions, which could compress net interest margins for banks like First Financial. This environment requires careful management of lending strategies and risk exposure, particularly in sensitive areas like CRE and credit cards, where delinquency rates saw a slight uptick in Q4 2024.

| Economic Factor | 2024/2025 Outlook | Impact on First Financial Bank | Key Data Point |

| GDP Growth | Continued expansion, potentially moderating | Shapes loan demand (commercial, real estate, consumer) | U.S. GDP ~3.1% in 2023 |

| Inflation (PCE) | Monitoring persistent pressures | Affects consumer spending, savings behavior, and borrowing costs | PCE +2.7% (12 months ending April 2024) |

| Unemployment Rate | Resilient, historically low levels | Supports consumer debt repayment, influences credit risk | U.S. Unemployment ~3.7% (Q4 2024) |

| Interest Rates | Potential gradual reductions in 2025 | Impacts net interest margins, loan attractiveness, and borrower capacity | Fed signals potential rate cuts |

| Real Estate (Office) | Elevated vacancy rates | Increases risk for CRE loans | National office vacancy ~19.6% (early 2024) |

Same Document Delivered

First Financial Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for First Financial Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. It provides a strategic overview to help understand the external landscape and inform decision-making. You'll gain actionable insights into the market dynamics affecting the banking sector.

Sociological factors

Demographic shifts are profoundly altering the financial landscape. The aging population, a significant trend, is increasing demand for retirement planning and wealth management services. Concurrently, a substantial wealth transfer is occurring, with Millennials and Gen Z poised to inherit trillions from older generations. This generational wealth transfer, estimated to be in the tens of trillions over the next two decades, presents both opportunities and challenges for financial institutions like First Financial Bancorp.

First Financial Bancorp must strategically adapt its product development and outreach to resonate with these evolving consumer groups. Younger generations, particularly Millennials and Gen Z, exhibit a strong preference for digital banking solutions and personalized financial advice. Furthermore, women are increasingly accumulating wealth and exerting greater financial influence, necessitating tailored financial products and marketing campaigns that acknowledge their unique financial journeys and priorities.

Consumers increasingly favor digital banking for its convenience and speed. A significant majority, around 70% of US adults, used mobile banking in 2024, a trend expected to continue growing. This shift means First Financial Bancorp needs to prioritize enhancing its digital platforms, including mobile apps and online services, to meet these evolving customer demands and stay competitive in the financial sector.

The degree of financial understanding and initiatives to bring more people into the financial system significantly impact how many people want different banking products and services. For instance, in 2024, a large majority of adults held bank accounts, yet there are still clear disparities in access, especially for those with lower incomes and minority communities. This suggests real chances to offer services specifically designed for these groups.

Trust and Reputation in Financial Institutions

Public trust is the bedrock of any financial institution, directly impacting its ability to attract and keep customers. First Financial Bancorp's established presence, often associated with stability and reliability, plays a significant role in fostering this trust. Maintaining this hard-won reputation, however, necessitates a steadfast commitment to ethical conduct and open, transparent dealings with its clientele. For instance, in early 2024, a survey indicated that 65% of consumers prioritized a bank's reputation for trustworthiness over competitive interest rates.

The financial sector, in particular, is highly sensitive to perceptions of integrity. Scandals or perceived impropriety can erode customer confidence rapidly, leading to significant deposit outflows. First Financial Bancorp's proactive approach to regulatory compliance and customer service is therefore not just a matter of good practice but a vital strategic imperative. Reports from early 2025 highlight that customer loyalty in banking is increasingly tied to demonstrable ethical behavior and transparent communication channels. The bank’s consistent positive ratings in customer satisfaction surveys, averaging 88% approval in Q1 2025, reflect this emphasis.

- Customer Trust: A significant driver of customer acquisition and retention in the banking sector.

- Reputation Management: Crucial for mitigating risks associated with negative public perception.

- Ethical Practices: Directly correlate with long-term brand loyalty and market standing.

- Transparency: Essential for building and maintaining confidence in financial dealings.

Societal Attitudes Towards ESG and Sustainable Investing

Societal attitudes are increasingly shaping financial decisions, with a growing emphasis on Environmental, Social, and Governance (ESG) factors. This shift is particularly noticeable among younger and emerging affluent demographics who actively seek investments that align with their values. For instance, a 2024 survey by Morgan Stanley found that 87% of investors are interested in sustainable investing, and this sentiment is even higher among millennials and Gen Z. First Financial Bancorp can leverage this trend by developing and promoting ESG-focused financial products and services.

The demand for sustainable investing is translating into tangible capital flows. Global sustainable investment assets reached an estimated $37.2 trillion in early 2024, according to the Global Sustainable Investment Alliance. This presents a significant opportunity for First Financial Bancorp to attract new clients and deepen relationships with existing ones by demonstrating a commitment to ESG principles. Integrating ESG considerations into its core operations and product development can enhance brand reputation and appeal to a broader customer base.

- Growing Demand: 87% of investors express interest in sustainable investing, with higher figures among younger generations.

- Market Size: Global sustainable investment assets are estimated at $37.2 trillion as of early 2024.

- Brand Enhancement: Aligning with ESG principles can improve First Financial Bancorp's public image and customer loyalty.

- Product Opportunity: Developing ESG-compliant investment products can attract a significant and growing market segment.

Societal expectations regarding financial institutions are evolving rapidly, with a heightened focus on community engagement and social responsibility. Customers increasingly prefer banks that demonstrate a commitment to local economic development and philanthropic activities. For instance, a 2024 survey indicated that 75% of consumers consider a bank's community involvement when choosing where to bank.

First Financial Bancorp has an opportunity to strengthen its brand by actively participating in and supporting local initiatives. This can foster goodwill and build deeper customer relationships. A bank's social impact is becoming a key differentiator, influencing brand perception and customer loyalty. By aligning with community values, First Financial Bancorp can enhance its reputation and attract a broader customer base that prioritizes corporate citizenship.

Consumer awareness of financial literacy is also a growing societal factor. Initiatives aimed at improving financial education, particularly among underserved communities, can create new customer segments. Data from early 2025 shows that individuals with higher financial literacy are more likely to engage with a wider range of banking products and services, including investments and loans.

| Societal Factor | Impact on First Financial Bancorp | Supporting Data (2024-2025) |

|---|---|---|

| Community Engagement | Enhances brand reputation and customer loyalty. | 75% of consumers consider community involvement when choosing a bank. |

| Social Responsibility | Attracts customers who prioritize ethical and impactful businesses. | Growing consumer preference for banks with strong ESG commitments. |

| Financial Literacy | Opens opportunities for new customer segments and product adoption. | Higher financial literacy correlates with increased engagement in banking services. |

Technological factors

First Financial Bancorp's digital transformation is paramount, demanding ongoing investment in robust online banking platforms and intuitive mobile applications to cultivate seamless customer experiences. By mid-2024, over 70% of U.S. bank customers reported using mobile banking, highlighting the critical need for First Financial to expand its digital service offerings.

The ability to efficiently scale digital banking services is no longer optional but a core requirement for staying competitive, as customer preferences increasingly lean towards convenient, accessible, and personalized digital interactions. This focus directly impacts customer acquisition and retention in the rapidly evolving financial landscape.

The escalating complexity of cyberattacks presents a substantial threat to financial institutions like First Financial Bancorp. In 2023, the average cost of a data breach for organizations globally reached $4.45 million, underscoring the critical need for advanced defenses.

First Financial Bancorp's strategic imperative involves significant investment in cutting-edge cybersecurity, leveraging technologies such as artificial intelligence and machine learning for proactive threat identification. Compliance with stringent data privacy regulations, like GDPR and CCPA, is non-negotiable for safeguarding sensitive customer information.

First Financial Bancorp can significantly enhance its operations through the adoption of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are revolutionizing banking, particularly in areas like fraud detection and customer service personalization. For instance, by mid-2024, the financial services sector globally saw AI adoption rates for fraud prevention reaching over 70%, a trend First Financial can capitalize on.

While direct consumer-facing AI applications are still maturing, the bank can leverage AI for robust internal automation and enhanced security protocols. This integration is crucial for improving efficiency and mitigating risks. By Q1 2025, many leading financial institutions reported a 15-20% reduction in operational costs attributed to AI-driven automation, a benchmark First Financial can aim for.

Real-Time Payments and Payment Innovations

The financial landscape is rapidly evolving with the widespread adoption of real-time payment systems. Initiatives like the Federal Reserve's FedNow service, which launched in July 2023, are accelerating this shift, enabling instant fund transfers 24/7. This technological advancement requires financial institutions like First Financial Bancorp to upgrade their existing infrastructure to accommodate these faster transaction speeds and offer more immediate services to customers.

Beyond traditional transfers, new payment methods are emerging, including peer-to-peer (P2P) bank payments and various forms of stablecoins. These innovations offer alternative ways for individuals and businesses to move money quickly and efficiently. To stay competitive and meet evolving customer expectations, First Financial Bancorp must actively integrate these emerging payment technologies into its offerings.

The increasing demand for instant transactions presents both challenges and opportunities. Financial institutions that fail to modernize their payment infrastructure risk falling behind competitors who can offer faster, more seamless payment experiences. Adapting to these technological factors is crucial for maintaining market share and customer loyalty.

- FedNow Adoption: As of April 2024, over 400 financial institutions were live on FedNow, processing over 100 million transactions.

- P2P Growth: Global P2P payment volume is projected to reach $13.5 trillion by 2027, up from $7.5 trillion in 2023.

- Stablecoin Market: The total market capitalization of stablecoins exceeded $150 billion in early 2024, indicating significant user adoption.

- Infrastructure Investment: Banks are investing billions in upgrading their core banking and payment systems to support real-time capabilities.

FinTech Partnerships and Embedded Finance

The financial technology (FinTech) landscape is rapidly evolving, with embedded finance becoming a significant trend. This involves integrating financial services directly into non-financial products and platforms, making banking more seamless for consumers. For instance, companies like Shopify have partnered with financial providers to offer integrated payment and lending solutions directly within their e-commerce platforms. This trend presents First Financial Bancorp with a dual challenge and opportunity: it can either be disrupted by these new models or leverage them to its advantage. The global embedded finance market was projected to reach over $7 trillion by 2030, demonstrating its immense growth potential.

First Financial Bancorp can strategically partner with FinTech innovators to broaden its service portfolio and tap into previously unreached customer demographics. By collaborating with FinTechs, the bank can offer more dynamic and customer-centric financial solutions, such as buy-now-pay-later options integrated into retail checkouts or instant insurance policy financing within app purchases. Research from Accenture indicated that by 2024, embedded finance could generate $230 billion in revenue for non-financial companies, highlighting the lucrative nature of these integrations.

- Embedded Finance Growth: The market is expected to surge, offering banks opportunities to embed their services into diverse platforms.

- Partnership Potential: Collaborating with FinTechs allows First Financial Bancorp to expand offerings and customer reach.

- Revenue Generation: Strategic embedded finance integrations can unlock significant new revenue streams for financial institutions.

- Customer Experience: Seamless integration enhances customer convenience and loyalty, a key differentiator in the market.

Technological advancements are reshaping banking, necessitating robust digital infrastructure for First Financial Bancorp. The increasing adoption of mobile banking, with over 70% of US customers using it by mid-2024, underscores the need for seamless online platforms and intuitive mobile applications to enhance customer experience and retention.

Cybersecurity remains a critical concern, as the average cost of a data breach reached $4.45 million globally in 2023. First Financial Bancorp must invest in advanced defenses, including AI and ML for proactive threat identification, to safeguard sensitive customer data and ensure compliance with privacy regulations.

The rise of real-time payment systems, exemplified by the FedNow service launched in July 2023, requires significant infrastructure upgrades to support faster transactions and meet evolving customer expectations for instant fund transfers.

Embedded finance, integrating financial services into non-financial platforms, presents a growth opportunity. By partnering with FinTechs, First Financial Bancorp can expand its service portfolio and reach new customer segments, tapping into a market projected to exceed $7 trillion by 2030.

| Technological Factor | 2024/2025 Trend | Impact on First Financial Bancorp | Key Data Point |

|---|---|---|---|

| Digital Banking Adoption | High and Growing | Enhance customer experience, acquisition, and retention | Over 70% of US bank customers used mobile banking by mid-2024 |

| Cybersecurity Threats | Increasingly Sophisticated | Requires significant investment in advanced security measures | Average cost of data breach in 2023: $4.45 million |

| Real-Time Payments | Rapid Expansion | Necessitates infrastructure upgrades for faster transaction capabilities | Over 400 financial institutions live on FedNow as of April 2024 |

| Embedded Finance | Significant Growth Potential | Opportunity for partnerships to expand service offerings and reach | Global embedded finance market projected to exceed $7 trillion by 2030 |

Legal factors

First Financial Bancorp navigates a stringent regulatory environment, subject to federal oversight from the FDIC, OCC, and Federal Reserve, alongside state-level regulations. This complex framework demands constant adaptation to evolving rules concerning capital adequacy, liquidity management, and stress testing, critical for operational integrity and avoiding significant penalties.

For instance, the Federal Reserve's stress tests, like the 2024 Comprehensive Capital Analysis and Review (CCAR), assess the resilience of large banks to severe economic downturns. While First Financial Bancorp might not be subject to the same intensity as the largest global systemically important banks (G-SIBs), the principles and increasing stringency of these tests influence broader industry practices and capital planning for all institutions.

Failure to comply with these mandates can result in substantial fines and reputational damage, impacting customer trust and market valuation. In 2023, the banking sector saw billions in fines for various compliance failures, underscoring the financial and strategic importance of robust regulatory adherence for entities like First Financial Bank.

First Financial Bank, like all financial institutions, faces stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) legal frameworks. These laws are not static; they continually evolve to counter sophisticated financial crimes. In 2024, regulators worldwide, including those overseeing US banks, increased their focus on the effectiveness of these compliance programs. For instance, the Financial Crimes Enforcement Network (FinCEN) continues to issue guidance and conduct examinations emphasizing the need for robust customer due diligence and suspicious activity reporting.

Adherence to AML and KYC requirements demands significant investment in technology and personnel. Banks must implement sophisticated transaction monitoring systems to detect and report illicit financial activities. The Bank Secrecy Act (BSA) remains a cornerstone of these regulations in the United States, requiring financial institutions to assist government agencies in detecting and preventing money laundering. Failure to comply can result in substantial fines; for example, in 2023, several major banks faced penalties totaling billions of dollars for AML/KYC deficiencies, underscoring the critical importance of ongoing vigilance and investment for institutions like First Financial Bank.

Data privacy regulations are increasingly strict, impacting how financial institutions like First Financial Bancorp manage sensitive customer information. Laws concerning credit reporting and personal data handling demand robust compliance measures. For instance, the California Privacy Rights Act (CPRA), which became fully effective in 2023, and similar evolving state-level regulations continue to shape data governance practices across the industry.

First Financial Bancorp must prioritize comprehensive data governance, incorporating advanced encryption and secure storage solutions. This is crucial not only for legal compliance but also for maintaining customer trust in an era where data breaches are a significant concern. Adherence to these evolving legal frameworks is paramount to protecting customer privacy and avoiding substantial penalties.

Fair Lending and Non-Discrimination Laws

First Financial Bank must strictly adhere to fair lending and non-discrimination laws, such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act. These regulations are fundamental to all banking operations, ensuring equitable access to credit and financial services. Failure to comply can result in significant penalties and reputational damage.

The Office of the Comptroller of the Currency (OCC) has identified promoting fairness and reducing lending disparities as a key strategic priority for 2024. This focus means increased scrutiny on lending practices to ensure they are free from bias. First Financial Bancorp, therefore, needs to proactively review and reinforce its internal policies and procedures to align with these federal directives.

For instance, in 2023, the Consumer Financial Protection Bureau (CFPB) reported a significant increase in enforcement actions related to fair lending violations, underscoring the heightened regulatory environment. Banks are expected to demonstrate robust compliance management systems that actively identify and mitigate potential discriminatory outcomes in their lending processes.

Key areas of focus for First Financial Bank include:

- Underwriting standards: Ensuring criteria are objective and consistently applied across all applicants.

- Marketing and outreach: Reaching diverse communities without excluding protected groups.

- Pricing and terms: Avoiding discriminatory pricing based on prohibited characteristics.

- Data analysis: Regularly reviewing lending data to detect and address any disparities.

Litigation and Enforcement Actions

First Financial Bank, like all financial institutions, faces substantial legal risks stemming from potential litigation and regulatory enforcement actions. These can arise from non-compliance with banking regulations, operational failures, or even customer disputes, leading to significant financial penalties and reputational damage.

The U.S. banking sector has consistently been subject to scrutiny, with regulatory bodies frequently imposing sanctions. For instance, in 2023 alone, the total value of fines levied against financial institutions for various compliance and misconduct issues reached billions of dollars, underscoring the critical need for robust compliance frameworks.

- Litigation Risk: Lawsuits from customers, shareholders, or other parties can result in substantial legal costs and damage awards.

- Regulatory Fines: Non-compliance with regulations such as the Bank Secrecy Act (BSA) or consumer protection laws can lead to significant fines from agencies like the OCC, CFPB, and Federal Reserve.

- Enforcement Actions: These can range from cease-and-desist orders to the imposition of independent monitors, impacting operational flexibility and profitability.

- Compliance Costs: Maintaining adherence to an evolving regulatory landscape requires ongoing investment in compliance personnel, technology, and training, which can be substantial.

First Financial Bank operates within a tightly regulated legal landscape, facing oversight from federal bodies like the FDIC, OCC, and Federal Reserve, as well as state agencies. This necessitates continuous adaptation to evolving rules on capital, liquidity, and stress testing, crucial for avoiding penalties and maintaining operational stability.

The bank must also comply with stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) laws, which are regularly updated to combat financial crime. In 2024, FinCEN continued to emphasize robust customer due diligence and suspicious activity reporting, with significant fines in 2023 for AML deficiencies highlighting the cost of non-compliance.

Furthermore, data privacy laws, such as the CPRA effective in 2023, require robust data governance. First Financial Bancorp must invest in advanced encryption and secure storage to protect sensitive customer information and avoid substantial penalties. Adherence to fair lending laws, like ECOA, is also critical, with the OCC prioritizing the reduction of lending disparities in 2024 and the CFPB increasing enforcement actions in 2023.

Environmental factors

Regulators worldwide are intensifying their scrutiny of climate-related financial risks, both the immediate impacts of extreme weather (physical risks) and the consequences of shifting to a low-carbon economy (transitional risks). For instance, by early 2025, the European Banking Authority (EBA) will have completed its comprehensive assessment of climate-related risks for major EU banks, setting a precedent for robust risk management frameworks. This trend necessitates that institutions like First Financial Bancorp proactively develop and implement strategies to identify, assess, and mitigate these evolving financial exposures.

Financial institutions are increasingly being tasked with establishing clear policies and procedures for managing climate-related financial risks. The U.S. Securities and Exchange Commission (SEC) proposed rules in 2022 requiring enhanced climate-related disclosures, which will likely influence how banks like First Financial Bancorp approach risk assessment and reporting by 2024-2025. Integrating these considerations into operational frameworks is crucial for maintaining regulatory compliance and ensuring long-term financial resilience.

Investor and societal pressure for Environmental, Social, and Governance (ESG) integration continues to shape financial strategies. By 2024, the global sustainable investment market was projected to reach $50 trillion, highlighting a significant shift in capital allocation towards companies with strong ESG profiles.

For First Financial Bancorp, embedding ESG principles into its core operations and potentially launching green or social bond offerings can bolster its brand image. This focus can attract a growing segment of investors prioritizing sustainability, as evidenced by the 2023 survey where 75% of institutional investors considered ESG factors material to their investment decisions.

First Financial Bancorp faces tangible operational risks from climate change, particularly from extreme weather events. These events can disrupt physical infrastructure, like branches and data centers, and negatively impact loan portfolios through increased defaults in affected regions. For instance, increased frequency of severe storms or prolonged droughts can directly affect collateral values and borrowers' repayment capacities.

To counter these threats, the bank must prioritize operational resilience. This involves developing robust contingency plans to prepare for, adapt to, and swiftly recover from climate-related disruptions. Investing in diversified infrastructure and stress-testing loan portfolios against various climate scenarios are crucial steps in this adaptation process.

Sustainability Initiatives and Carbon Footprint

First Financial Bank's commitment to sustainability initiatives, including reducing its operational carbon footprint, directly addresses increasing environmental awareness among stakeholders. This focus not only enhances brand reputation but can also unlock long-term operational efficiencies.

By actively promoting environmentally friendly practices, the bank can attract environmentally conscious customers and investors. For instance, many financial institutions are setting ambitious targets for reducing their Scope 1 and Scope 2 emissions. In 2024, the financial sector saw a surge in ESG (Environmental, Social, and Governance) reporting, with many banks aiming for net-zero operations by 2040 or earlier.

- Brand Image: Improved public perception and attractiveness to ESG-focused investors.

- Operational Efficiencies: Potential cost savings through reduced energy consumption and waste.

- Regulatory Compliance: Anticipating and meeting evolving environmental regulations.

- Market Demand: Catering to a growing consumer preference for sustainable financial products.

Regulatory Scrutiny on Environmental Disclosures

First Financial Bancorp is navigating an increasingly complex regulatory landscape concerning environmental disclosures. Stakeholders, including investors and regulators, are demanding greater transparency regarding climate-related risks and opportunities. This trend aligns with evolving global standards, pushing financial institutions to provide more robust reporting on their environmental impact and strategies.

The pressure for enhanced environmental disclosures is not unique to First Financial Bancorp, as it reflects a broader industry shift. For instance, in 2024, the Securities and Exchange Commission (SEC) proposed rules that would require public companies to disclose climate-related risks, further intensifying scrutiny. This regulatory momentum suggests that financial institutions like First Financial Bancorp will likely face increased expectations to detail their exposure to physical and transitional climate risks within their portfolios.

To meet these evolving demands, First Financial Bancorp may need to invest in better data collection and reporting mechanisms. Key areas of focus often include:

- Scope 1, 2, and 3 Greenhouse Gas Emissions: Reporting on direct and indirect emissions across operations and value chains.

- Climate Risk Assessment: Quantifying the potential financial impacts of climate change on the bank's assets and liabilities.

- Transition Plans: Outlining strategies to manage the shift to a lower-carbon economy and associated financial opportunities.

- Board Oversight of Climate Issues: Demonstrating how climate-related matters are integrated into corporate governance and risk management frameworks.

Increasing regulatory focus on climate risk, as seen with the EBA's 2025 assessment and the SEC's proposed 2024 disclosure rules, compels banks like First Financial Bancorp to proactively manage physical and transitional climate exposures.

The surge in sustainable investing, projected to reach $50 trillion globally by 2024, underscores the market's demand for ESG integration. First Financial Bancorp can leverage this by enhancing its brand image and attracting capital through sustainability initiatives, as 75% of institutional investors in 2023 considered ESG factors material.

First Financial Bancorp faces direct operational risks from climate events, impacting infrastructure and loan portfolios, necessitating robust contingency planning and portfolio stress-testing against climate scenarios.

The bank's commitment to reducing its carbon footprint, aligning with the 2024 trend of enhanced ESG reporting and net-zero targets by 2040, can improve brand perception and drive operational efficiencies, attracting environmentally conscious customers and investors.

| Environmental Factor | Impact on First Financial Bancorp | Key Considerations/Actions |

|---|---|---|

| Climate-Related Financial Risks | Increased scrutiny, need for robust risk management frameworks. | Develop strategies for physical and transitional risk identification, assessment, and mitigation. |

| Regulatory Demands | Enhanced disclosure requirements for climate risks. | Invest in data collection for emissions, climate risk assessment, and transition plans. |

| Investor & Societal Pressure (ESG) | Growing demand for sustainable investments. | Integrate ESG principles, potentially launch green bonds; enhance brand image. |

| Physical Climate Risks | Disruption to operations and loan portfolios from extreme weather. | Prioritize operational resilience, develop contingency plans, stress-test loan portfolios. |

PESTLE Analysis Data Sources

Our PESTLE analysis for First Financial Bank is grounded in data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our understanding of the political, economic, social, technological, legal, and environmental landscape is both current and accurate.