First Financial Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Bank Bundle

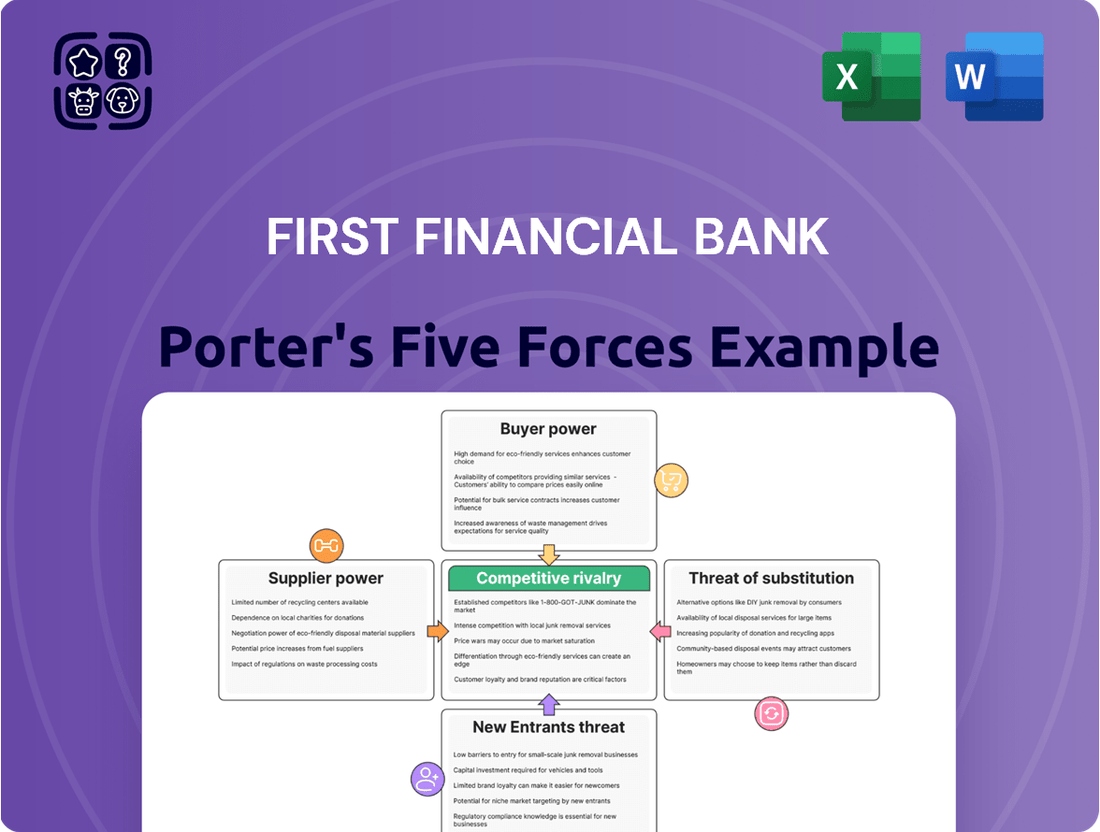

First Financial Bank operates within a dynamic financial landscape, where understanding the competitive forces at play is crucial for sustained success. Our analysis reveals the intricate interplay of buyer power, supplier leverage, and the threat of new entrants, all of which significantly influence the bank's strategic decisions.

We've identified key areas where First Financial Bank faces intense rivalry and potential disruptions, particularly concerning the availability of substitutes and the bargaining power of existing customers. These forces shape the profitability and growth potential within the sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore First Financial Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

For First Financial Bank, depositors are the primary suppliers of capital. Their bargaining power is significant, especially when other financial institutions offer more appealing interest rates or more flexible access to funds. In the first quarter of 2024, the average interest rate on savings accounts across the U.S. hovered around 0.46%, but competitive banks were offering rates well over 4% for high-yield savings accounts, directly impacting First Financial Bank's cost of funds.

Technology and software providers wield significant bargaining power over banks like First Financial Bank, especially for specialized core banking systems, advanced cybersecurity solutions, and sophisticated data analytics platforms. These providers often possess proprietary technology, and the complex integration required for their systems can create substantial switching costs, making it difficult and expensive for banks to change vendors. This reliance is amplified as the financial industry continues its digital transformation, increasing the leverage these tech suppliers hold.

Skilled employees, especially those with expertise in financial technology, risk management, and compliance, are vital for First Financial Bancorp's success. A scarcity of these specialized workers can significantly boost their leverage, compelling the bank to offer higher salaries and incur greater recruitment expenses. In 2024, the competition for top financial talent remained intense, directly affecting First Financial's capacity to both draw in and keep essential employees.

Information and Data Providers

Information and data providers, such as credit bureaus and financial data aggregators, hold considerable bargaining power over First Financial Bank. Their ability to furnish essential data for lending decisions and risk management makes their services indispensable. For instance, the accuracy and comprehensiveness of credit scoring data directly impact the bank's ability to assess loan applicant risk, influencing profitability. In 2024, financial institutions heavily rely on these providers, with the global market for financial data services projected to continue its robust growth, underscoring the critical nature of these inputs.

The proprietary nature of the data these suppliers possess, coupled with the significant investment required for banks to replicate such information, amplifies their leverage. First Financial Bank, like many others, depends on these specialized datasets to maintain a competitive edge and ensure sound financial operations. Without access to updated market insights and reliable credit histories, the bank’s core functions would be severely hampered, giving suppliers a strong negotiating position.

- High Switching Costs: First Financial Bank faces substantial costs in switching data providers due to integration complexities and the need to re-validate data sources.

- Essential Service: Access to accurate credit scores and market data is non-negotiable for fundamental banking operations like loan origination and investment analysis.

- Limited Substitutes: The specialized and often unique datasets offered by major information providers have few, if any, direct substitutes that can offer the same depth and breadth of coverage.

- Data Concentration: A few dominant players often control significant portions of the financial data market, concentrating bargaining power among a limited number of suppliers.

Regulatory and Legal Services

The banking sector's intricate regulatory environment grants substantial leverage to suppliers of regulatory and legal services. These firms possess specialized knowledge crucial for compliance with evolving mandates, such as those concerning operational resilience and data privacy, which are increasingly critical. For instance, the expected introduction of new financial regulations in 2025 will likely amplify the demand for such expert guidance, thereby strengthening supplier power.

The bargaining power of these legal and compliance consultants is amplified by the specialized nature of their expertise. Banks often lack the in-house capacity to navigate the labyrinthine legal frameworks and anticipate upcoming regulatory shifts. This reliance means that firms providing these essential services can command higher fees and dictate terms, especially as compliance costs for financial institutions continue to rise, with industry reports from 2024 indicating a significant increase in spending on regulatory technology and services.

- Specialized Expertise: Legal and compliance firms offer unique skills essential for navigating complex banking regulations.

- Regulatory Dependence: Banks' need to adhere to evolving laws, like those anticipated for 2025, increases supplier influence.

- High Compliance Costs: Increased spending on regulatory services in 2024 highlights the financial importance and supplier leverage.

- Limited In-house Capacity: Banks often outsource these critical functions due to the lack of internal specialization.

Suppliers of specialized technology, data, and skilled labor hold considerable sway over First Financial Bank. Their unique offerings, coupled with high switching costs and limited substitutes, mean banks must often accept supplier-dictated terms. This dynamic is particularly evident in areas like core banking systems and crucial data provision, where reliance is high and alternatives are scarce.

The bargaining power of suppliers is a key consideration for First Financial Bank, influencing operational costs and strategic flexibility. Key supplier groups, including depositors, technology providers, skilled employees, and data aggregators, all exert varying degrees of influence. For instance, in Q1 2024, while average savings rates were low, competitive banks offered over 4%, demonstrating depositor power.

| Supplier Type | Key Dependencies | Example of Bargaining Power (2024 Data) | Impact on First Financial Bank |

|---|---|---|---|

| Depositors | Capital for lending | High-yield savings accounts offering >4% interest | Increases cost of funds |

| Technology Providers | Core banking systems, cybersecurity | Proprietary tech, high integration costs | Limits flexibility, increases IT expenses |

| Skilled Employees | Fintech, risk, compliance expertise | Intense competition for talent | Drives up recruitment and salary costs |

| Data Providers | Credit scores, market insights | Essential for risk assessment, limited substitutes | Affects loan quality and profitability |

What is included in the product

This analysis of First Financial Bank's competitive landscape reveals the intensity of rivalry, the power of buyers and suppliers, and barriers to entry. It also identifies potential substitutes and new entrants that could impact the bank's market share and profitability.

Quickly identify and prioritize competitive threats with a visual representation of each force, enabling focused strategic adjustments.

Customers Bargaining Power

Customers of banks like First Financial Bank often face low switching costs for many of their services. This means it’s relatively easy and inexpensive for someone to move their checking account, savings account, or even a mortgage to another institution if they find a better deal. For instance, in 2024, many neobanks and traditional banks alike offer streamlined online account opening processes, often taking just minutes, which significantly lowers the barrier to entry for a customer considering a change.

The proliferation of digital banking tools, including mobile apps for managing finances and online portals for loan applications, further reduces the effort involved in switching. A customer can compare rates for personal loans or mortgages from multiple banks online and initiate a transfer with minimal hassle. This increased accessibility and reduced friction directly contribute to the bargaining power of customers, as they are more willing and able to shop around for the best terms and services available in the market.

Customers today have unprecedented access to information, significantly boosting their bargaining power. Comparison websites and online reviews allow consumers to easily evaluate interest rates, fees, and service quality across numerous financial institutions. This transparency means customers can make well-informed choices, choosing the banks that offer the best value, which in turn puts pressure on First Financial Bank to remain competitive.

Customers of First Financial Bancorp face a market brimming with choices for financial products and services. This includes not only large national banks but also a significant number of regional competitors and credit unions, all vying for their business. As of the first quarter of 2024, the U.S. banking industry held approximately $23.5 trillion in total deposits, illustrating the vast competitive landscape First Financial operates within.

The sheer volume of alternatives available to consumers directly empowers them. This means First Financial Bancorp must consistently innovate and deliver exceptional value, whether through competitive interest rates, user-friendly digital platforms, or personalized customer service, to keep its clients engaged and prevent them from migrating to a competitor. For instance, a 2023 survey indicated that 65% of consumers consider fees and interest rates as primary factors when choosing a bank.

Sophisticated Corporate and Institutional Clients

Sophisticated corporate and institutional clients wield considerable bargaining power with banks like First Financial Bank. These entities, often possessing substantial financial resources and dedicated financial expertise, are well-equipped to negotiate better terms on services such as loans, cash management, and investment banking. Their ability to command favorable pricing and service levels stems from the significant volume of business they represent, making their retention a key priority for financial institutions.

For instance, major corporations often leverage their scale to secure lower interest rates on credit facilities or demand customized treasury solutions. This leverage is amplified by the fact that these clients can readily switch providers if their needs are not met, creating a competitive pressure on banks to offer attractive packages. In 2024, the average interest rate on commercial and industrial loans, a key service for such clients, saw fluctuations influenced by monetary policy, presenting opportunities for negotiation.

- Significant Leverage: Large corporate clients can negotiate favorable terms due to their substantial transaction volumes.

- Expert Negotiation Teams: Sophisticated financial departments within these institutions drive competitive pricing.

- Risk of Client Attrition: The potential loss of major clients compels banks to offer compelling value propositions.

- Market Dynamics: Interest rate environments and competitive pressures in 2024 influenced the bargaining power of these clients.

Growth of Digital Banking and Fintech

The rapid growth of digital banking and fintech companies significantly amplifies the bargaining power of customers. These new entrants offer specialized, user-friendly, and often more cost-effective solutions for various financial services, directly challenging traditional institutions like First Financial Bank. For instance, by mid-2024, several neobanks reported customer acquisition rates far exceeding those of established banks, driven by superior digital interfaces and lower fee structures.

Customers now have a wider array of choices, allowing them to easily switch providers for specific needs, thereby increasing their leverage. This shift forces traditional banks to enhance their digital offerings and competitive pricing to retain their customer base. By the end of 2023, the digital payments sector alone saw a 15% year-over-year growth, indicating a strong customer preference for accessible online solutions.

- Increased Choice: Digital banks and fintechs provide alternatives for payments, loans, and investments, reducing reliance on single institutions.

- Lower Costs: Many digital-first providers offer services with minimal or no fees, attracting cost-conscious consumers.

- Enhanced Expectations: Customers now expect seamless, intuitive digital experiences, putting pressure on traditional banks to upgrade their technology.

- Data-Driven Personalization: Fintechs leverage data to offer personalized products, further empowering customers with tailored options.

Customers of First Financial Bancorp possess considerable bargaining power due to low switching costs and the abundance of financial service providers. In 2024, the ease of opening accounts online and the prevalence of comparison tools empower consumers to readily seek better rates and services, putting pressure on banks to remain competitive in pricing and digital experience. This environment highlights the need for First Financial to offer compelling value to retain its client base.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Switching Costs | Low | Streamlined online account opening processes are common. |

| Availability of Alternatives | High | U.S. banking industry held ~$23.5 trillion in total deposits in Q1 2024. |

| Information Access | High | Comparison websites and online reviews are widely used. |

| Digital Banking Growth | High | Digital payments sector grew 15% YoY by end of 2023. |

| Customer Priorities | Rates and Fees are Key | 65% of consumers cite fees/rates as primary factors (2023 survey). |

Preview Before You Purchase

First Financial Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for First Financial Bank, providing an in-depth examination of competitive forces within its industry. The document you see is the exact, professionally formatted analysis you will receive instantly upon purchase, with no alterations or omissions. It details the intensity of rivalry among existing competitors, the bargaining power of suppliers, the threat of new entrants, the bargaining power of buyers, and the threat of substitute products or services. This complete, ready-to-use file offers valuable strategic insights into First Financial Bank's competitive landscape.

Rivalry Among Competitors

First Financial Bancorp, operating across Ohio, Indiana, Kentucky, and Illinois, encounters significant competitive pressure. The landscape is populated by a substantial number of regional and community banks, alongside the local branches of larger national institutions. This dense competitive environment means banks are constantly vying for the same pool of customers within their operational areas.

The sheer volume of competitors in these regional markets intensifies the rivalry. For instance, in Ohio alone, as of the first quarter of 2024, there were over 200 FDIC-insured institutions. This high number forces banks like First Financial to work harder to attract and retain customers, often through competitive pricing on loans and deposits, or by offering specialized services.

The core banking services offered by many traditional financial institutions, including checking accounts, savings accounts, and basic loans, are remarkably similar. This lack of differentiation means that banks like First Financial Bank often find themselves competing primarily on price, offering slightly better interest rates or lower fees to attract customers.

This intense price competition significantly heightens the rivalry within the sector. For instance, in 2024, the average interest rate on a 30-year fixed-rate mortgage hovered around 7%, a figure that banks actively adjust to remain competitive, directly impacting their profitability on such products.

When a bank like First Financial Bank offers a standard savings account, the features are so alike to those of its competitors that customers can easily switch based on a quarter-point difference in the Annual Percentage Yield (APY). This ease of switching fuels the aggressive competition.

This homogeneous nature of core offerings forces banks to differentiate through customer service, digital innovation, or niche product development, but the foundational products themselves remain a battleground for price-sensitive consumers, with fees for overdrafts or ATM usage also being key competitive points.

First Financial Bank operates in a sector acutely sensitive to interest rate fluctuations, which directly influence net interest margins. When rates are volatile or trending downward, banks often resort to aggressive pricing on both deposits and loans to protect profitability, intensifying competitive rivalry.

For instance, in early 2024, the Federal Reserve maintained a hawkish stance, keeping interest rates elevated. This environment can compress margins for banks if they cannot quickly adjust their lending rates or attract cheaper funding. Many regional banks, facing deposit outflows, had to offer higher rates on savings accounts, directly impacting their cost of funds and intensifying competition for customer balances.

Digital Transformation and Innovation Race

The competitive rivalry within the banking sector is intensifying as institutions race to embrace digital transformation. First Financial Bank, like its peers, faces pressure to invest heavily in mobile banking, online platforms, and innovative financial tools to capture and keep customers who expect seamless digital experiences. This pursuit of superior digital offerings, including the integration of artificial intelligence, is a key driver of competition for market share.

The ongoing digital innovation race means that banks are constantly striving to differentiate themselves through technology. For instance, in 2024, many leading banks are focusing on enhancing user interfaces, personalizing financial advice through AI, and expanding capabilities like instant loan approvals and sophisticated budgeting tools. This arms race in digital capabilities directly impacts customer acquisition and retention, making it a critical area of rivalry.

- Digital Investment: Banks are channeling significant capital into digital infrastructure and AI development, with industry-wide spending projected to reach hundreds of billions globally by 2024.

- Customer Expectations: A growing percentage of banking transactions, often exceeding 70% for routine activities, are now conducted digitally, highlighting the importance of robust online and mobile services.

- Competitive Differentiation: Features like advanced fraud detection powered by AI and user-friendly mobile interfaces are becoming standard competitive requirements, not just differentiators.

- Market Share Impact: Banks offering more intuitive and feature-rich digital platforms are demonstrably gaining a competitive edge in attracting younger demographics and retaining existing clients.

Consolidation and M&A Activity

The banking industry is experiencing significant consolidation, which indirectly intensifies rivalry by altering the competitive structure. As larger institutions emerge through mergers and acquisitions (M&A), they gain greater market share, enhanced economies of scale, and potentially more pricing power, putting pressure on smaller or less efficient players. For instance, in 2023, the banking sector saw notable M&A activity, with deals aimed at bolstering scale and geographic reach. First Financial Bancorp has itself been an active participant in this trend, strategically acquiring other institutions to expand its footprint and service offerings.

- Industry Consolidation: M&A activity reshapes the competitive landscape by creating larger, more formidable competitors.

- First Financial's Strategy: First Financial Bancorp has utilized acquisitions as a growth strategy to enhance its market position.

- Impact on Rivalry: Increased consolidation can lead to fewer, but larger, competitors, intensifying competitive pressures.

- 2023 Trends: The banking sector witnessed substantial M&A deals in 2023, driven by the pursuit of scale and market expansion.

First Financial Bank faces intense rivalry due to numerous regional and national competitors offering similar core products. This forces a reliance on competitive pricing for loans and deposits, as seen with the average 30-year fixed-rate mortgage around 7% in early 2024, directly impacting profit margins.

The digital transformation race further fuels this rivalry, with banks investing heavily in AI and mobile platforms to meet customer expectations for seamless experiences. Features like advanced AI fraud detection are becoming baseline requirements, not just differentiators, in the pursuit of market share.

Industry consolidation, with significant M&A activity in 2023, also heightens competitive pressure by creating larger, more powerful players. First Financial's own acquisition strategy aims to bolster its position amidst this trend, making the landscape even more dynamic.

| Factor | Description | Impact on First Financial Bank | 2024 Data Point |

|---|---|---|---|

| Number of Competitors | Dense regional and national banking presence | Intensifies competition for customers | Over 200 FDIC-insured institutions in Ohio alone (Q1 2024) |

| Product Homogeneity | Similar core banking services (accounts, loans) | Drives price-based competition | Average 30-year fixed mortgage rate around 7% |

| Digital Innovation | Investment in AI, mobile, online platforms | Pressure to enhance digital offerings for customer retention | Industry-wide digital spending in hundreds of billions globally |

| Industry Consolidation | M&A activity creating larger entities | Increases scale and potential pricing power of rivals | Significant M&A activity in 2023 |

SSubstitutes Threaten

Fintech companies present a significant threat of substitution for traditional banks like First Financial Bank by offering specialized, often more convenient and cost-effective, digital alternatives for core banking services. For instance, payment processors such as PayPal and Square handle transactions efficiently, bypassing traditional bank channels.

The rise of peer-to-peer lending platforms directly competes with banks’ lending functions, attracting borrowers with potentially lower interest rates and investors with higher returns. In 2024, the global fintech market was valued at over $1.1 trillion and is projected to grow substantially, indicating a strong customer shift towards these digital solutions.

Online investment advisors, or robo-advisors, also substitute traditional wealth management services, leveraging algorithms for portfolio management at a fraction of the cost. This accessibility and lower fee structure appeal to a broad customer base, including younger demographics less inclined towards traditional banking relationships.

The agility of fintech firms allows them to innovate rapidly, adapting to evolving customer demands for speed, seamless user experiences, and personalized services, which can be challenging for established institutions to match. This competitive pressure forces traditional banks to invest heavily in their own digital transformation to remain relevant.

Credit unions represent a significant threat of substitutes for First Financial Bank, particularly in retail banking. As not-for-profit entities, they frequently provide more attractive interest rates on savings and loans, alongside reduced fees, drawing in customers prioritizing cost savings and community engagement over traditional commercial banking. In 2023, credit unions saw substantial growth, with total assets reaching over $2.2 trillion, and membership expanding to over 135 million individuals in the U.S.

The threat of substitutes for banks in wealth management is significant, as customers increasingly turn to direct investment platforms and online brokerage firms. These platforms, like Robinhood and Charles Schwab, offer streamlined access to a vast array of investment products, often with lower fees than traditional bank offerings. In 2024, the digital brokerage market continued its robust growth, with millions of new accounts being opened, demonstrating a clear preference for self-directed investing. This trend directly bypasses the need for a bank's wealth management services, presenting a substantial substitute option for consumers seeking to grow their assets.

Non-Bank Lenders

Specialized non-bank lenders, such as mortgage companies, auto finance providers, and commercial finance firms, present a significant threat of substitution to traditional bank lending. These entities often operate with distinct regulatory frameworks and varying risk appetites, enabling them to cater to market segments that traditional banks may find less attractive or more challenging to serve.

For instance, in 2024, the non-bank mortgage origination market continued to be a substantial player, with non-bank lenders accounting for a notable percentage of total mortgage originations, sometimes exceeding 50% during periods of market flux. This demonstrates their capacity to offer competitive alternatives for consumers and businesses seeking financing.

- Mortgage Companies: Offer specialized mortgage products, often with faster processing times.

- Auto Finance Companies: Provide direct financing for vehicle purchases, competing with bank auto loans.

- Commercial Finance Firms: Focus on business lending, including equipment financing and invoice factoring, as alternatives to commercial bank loans.

- Fintech Lenders: Increasingly leverage technology to offer streamlined loan applications and quicker approvals across various credit needs.

Cryptocurrencies and Blockchain Technology

Emerging technologies like cryptocurrencies and blockchain present a growing threat of substitutes for traditional banking services. These innovations offer alternative ways to conduct transactions, send money across borders, and even access lending facilities, potentially disintermediating established financial institutions like First Financial Bank. For instance, the global remittance market, a significant revenue stream for many banks, is increasingly being eyed by crypto platforms, which aim to offer lower fees and faster transfer times. In 2024, the total value of remittances worldwide was projected to reach over $800 billion, highlighting the substantial market that could be disrupted.

While widespread adoption of cryptocurrencies for everyday banking functions is still developing, their potential as long-term disruptive substitutes cannot be ignored. Blockchain technology’s inherent security and transparency features are attractive to consumers and businesses alike, fostering trust in decentralized systems. This shift could reduce reliance on traditional financial intermediaries for services such as payments, record-keeping, and even asset management. The ongoing innovation in decentralized finance (DeFi) further amplifies this threat, with platforms offering yield-generating opportunities and lending protocols that directly compete with bank products.

- Transaction Alternatives: Cryptocurrencies offer peer-to-peer digital transactions, potentially bypassing traditional payment networks.

- Remittance Disruption: Blockchain-based remittance services aim to reduce costs and speed up international money transfers, impacting a key banking revenue source.

- Lending Competition: Decentralized Finance (DeFi) platforms provide alternative lending and borrowing opportunities, challenging traditional credit markets.

- Long-Term Threat: Despite current adoption hurdles, the underlying technology represents a persistent and evolving substitute for conventional banking infrastructure.

The threat of substitutes for First Financial Bank is substantial, with fintech companies offering specialized, cost-effective digital alternatives for core banking services. Payment processors and peer-to-peer lending platforms directly compete with traditional banking functions. In 2024, the global fintech market exceeded $1.1 trillion, highlighting a strong customer shift towards these digital solutions, which often provide lower rates and greater convenience.

Online investment advisors, or robo-advisors, also serve as significant substitutes for traditional wealth management. These platforms leverage algorithms for portfolio management at reduced costs, attracting customers who prioritize accessibility and lower fees. This trend is particularly pronounced among younger demographics, who may be less inclined towards established banking relationships.

Credit unions represent another key substitute, especially in retail banking, by offering more attractive interest rates and lower fees due to their not-for-profit status. In 2023, credit unions saw substantial growth, with total assets exceeding $2.2 trillion and a membership base of over 135 million individuals in the U.S., demonstrating their appeal to cost-conscious consumers.

Emerging technologies like cryptocurrencies and blockchain offer alternative transaction methods and remittance services, potentially disintermediating banks. The global remittance market, projected to reach over $800 billion in 2024, is a key area where crypto platforms aim to offer lower fees and faster transfers, posing a disruptive threat.

| Substitute Type | Key Offerings | Market Penetration/Growth Indicator |

| Fintech Companies | Digital payments, P2P lending, robo-advisors | Global fintech market > $1.1 trillion (2024) |

| Credit Unions | Retail banking services, competitive rates/fees | Total assets > $2.2 trillion, 135M+ members (U.S., 2023) |

| Online Investment Platforms | Self-directed investing, lower-fee wealth management | Robust growth in digital brokerage accounts (2024) |

| Cryptocurrencies & Blockchain | Alternative transactions, remittances, DeFi | Global remittance market > $800 billion (projected 2024) |

Entrants Threaten

High capital requirements present a formidable barrier to entry in the banking sector. Establishing a new bank necessitates significant upfront investment to meet regulatory capital adequacy ratios, which are crucial for ensuring financial stability. For instance, in 2024, many jurisdictions mandate that new banks maintain a Common Equity Tier 1 (CET1) ratio of at least 4.5%, with additional capital buffers often required by regulators, making it difficult for smaller or less capitalized entities to enter the market.

The banking sector is a minefield of stringent regulations, making it incredibly difficult for new players to enter. Obtaining the necessary licenses and continuously adhering to complex compliance mandates from bodies like the Federal Reserve and the Office of the Comptroller of the Currency requires substantial investment and expertise.

These regulatory hurdles translate into significant upfront and ongoing costs. For instance, in 2024, the cost of compliance for financial institutions is estimated to have risen, with smaller banks often bearing a disproportionately higher burden relative to their revenue. This financial strain acts as a powerful deterrent to potential new entrants.

Established banks like First Financial Bancorp, or FFN, leverage decades of building strong brand recognition and customer trust. This deep-seated loyalty makes it challenging for new players to attract and retain customers, as individuals often prefer the security and familiarity of institutions with proven track records. For instance, FFN's consistent customer service and community involvement over many years contribute significantly to this advantage.

Economies of Scale and Experience

Existing financial institutions, like First Financial Bank, often leverage significant economies of scale. This means they can spread their substantial investments in technology, extensive branch networks, and streamlined operational processes across a vast customer base. Consequently, they can offer services more affordably than smaller, newer competitors. For example, a large bank's investment in a sophisticated digital banking platform costs less per user when distributed across millions of accounts compared to a startup trying to build a similar system from scratch with a limited customer pool.

New entrants face a considerable hurdle in matching these established economies of scale. They typically start with smaller customer bases and less developed infrastructure, leading to higher per-unit costs for services. This cost disadvantage can make it difficult for them to compete on price or invest as heavily in customer acquisition and retention, thereby limiting their ability to quickly gain market share.

- High Capital Requirements: Establishing a banking operation demands significant upfront capital for regulatory compliance, technology, and physical infrastructure, creating a substantial barrier.

- Brand Recognition and Trust: Established banks benefit from years of building customer trust and brand loyalty, which new entrants find challenging to replicate quickly.

- Regulatory Hurdles: The banking sector is heavily regulated, requiring new entrants to navigate complex licensing and compliance procedures, adding time and cost to market entry.

- Access to Funding: While not solely an entry barrier, the ability of incumbents to access cheaper capital due to their size and track record can be a disadvantage for new players.

Access to Distribution Channels and Networks

New entrants into the banking sector face significant hurdles in establishing the necessary distribution channels to compete with established players like First Financial Bank. Building an extensive physical branch network, a hallmark of traditional banking, demands substantial capital outlay and a considerable timeframe. For instance, First Financial Bancorp, as of Q1 2024, operated over 400 banking locations, a footprint that is costly and time-consuming for newcomers to replicate.

Similarly, developing a robust and secure digital infrastructure, essential for modern banking, requires immense investment in technology, cybersecurity, and user experience. Newcomers must overcome the challenge of creating comparable digital platforms that offer seamless and secure access to services, a feat that existing banks have perfected over years of operation and ongoing investment. In 2023, the banking industry saw continued investment in digital transformation, with major banks allocating billions to enhance their online and mobile offerings, creating a high bar for new entrants.

Gaining widespread reach and customer adoption is also a formidable challenge. Established banks benefit from brand recognition, customer loyalty, and existing relationships, making it difficult for new entrants to attract and retain a significant customer base. The cost of customer acquisition in the financial services industry is notoriously high, further exacerbating the threat of new entrants in this area.

- Access to distribution channels is a key barrier for new banks.

- First Financial Bancorp's network of over 400 banking locations as of Q1 2024 represents a significant competitive advantage.

- Developing comparable digital infrastructure requires substantial and ongoing investment.

- Customer acquisition costs in banking are high, hindering new entrants' ability to gain market share.

The threat of new entrants into the banking sector is generally low, primarily due to the significant capital and regulatory barriers. New banks need substantial funding to meet capital adequacy requirements, such as the Common Equity Tier 1 ratio, which stood at a minimum of 4.5% in many regions in 2024, plus additional buffers. Navigating complex regulations and licensing processes adds considerable time and expense, with compliance costs continuing to rise. Established players like First Financial Bancorp also benefit from strong brand loyalty and existing economies of scale, making it difficult for newcomers to compete effectively on price or customer acquisition.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront investment needed for regulatory compliance and operations. For example, maintaining a CET1 ratio of at least 4.5% in 2024. | Significant deterrent due to the scale of investment required. |

| Regulatory Hurdles | Complex licensing, ongoing compliance with bodies like the Federal Reserve. | Adds considerable time, cost, and expertise demands. |

| Brand Recognition & Trust | Established banks like FFN have built long-term customer loyalty. | Challenging for new entrants to attract and retain customers. |

| Economies of Scale | Incumbents leverage scale in technology, networks, and operations. | Results in lower per-unit costs for established banks, creating a price disadvantage for new entrants. |

| Distribution Channels | Extensive physical branch networks (e.g., FFN's 400+ locations as of Q1 2024) and robust digital infrastructure. | Costly and time-consuming for new players to replicate, alongside high customer acquisition costs. |

Porter's Five Forces Analysis Data Sources

Our First Financial Bank Porter's Five Forces analysis is built upon a robust foundation of data from the bank's annual reports, SEC filings, and investor relations materials. This is supplemented by industry-specific research from reputable sources like the American Bankers Association and financial data providers such as S&P Global Market Intelligence.