First Financial Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Bank Bundle

Unlock the full strategic blueprint behind First Financial Bank's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into their customer segments, revenue streams, and cost structures.

Partnerships

First Financial Bancorp actively collaborates with various technology providers to bolster its digital banking capabilities. These partnerships are instrumental in developing and maintaining robust online platforms, offering seamless customer experiences, and fortifying cybersecurity measures. For instance, the integration of specialized financial technology, as seen in the acquisition of Agile Premium Finance, underscores their commitment to staying at the forefront of innovation.

First Financial Bancorp actively cultivates relationships with local businesses and community organizations. These collaborations are crucial for deepening the bank's integration into its operating areas and for meeting its commitments under the Community Reinvestment Act. For instance, in 2024, First Financial supported numerous local initiatives, including financial education workshops in underserved communities, contributing to enhanced economic literacy.

These partnerships extend to co-sponsoring local development projects and providing financial backing for community events, fostering tangible economic improvements. By engaging in these activities, First Financial aims to directly uplift the economic vitality of the regions it serves, reinforcing its role as a community-focused financial institution.

First Financial Bancorp actively cultivates relationships with other financial institutions and correspondent banks. These partnerships are crucial for facilitating a range of interbank services, enabling participation in syndicated loan markets, and extending the bank's reach beyond its core operational areas. For instance, in 2024, First Financial Bank's involvement in syndicated loans allowed them to underwrite larger credit facilities than they could manage independently, demonstrating the practical benefit of these collaborations.

These strategic alliances are fundamental to ensuring robust liquidity management and securing broader access to capital markets. By leveraging correspondent banking relationships, First Financial Bank can efficiently process transactions, manage foreign currency needs, and offer specialized services that might not be available through its direct infrastructure. This network is vital for maintaining operational efficiency and supporting client needs across diverse geographical and financial landscapes.

Real Estate Developers and Agencies

First Financial Bancorp’s strategic alliances with real estate developers and agencies are foundational to its business model, particularly given its emphasis on commercial and real estate financing. These partnerships are crucial for generating a steady stream of new loans for both large-scale commercial properties and individual residential mortgages, which represent substantial income sources for the bank.

The bank’s recent integration of Westfield Bancorp, completed in 2024, significantly bolstered its capabilities and reach within the commercial real estate sector and enhanced its private banking offerings. This expansion is designed to capture more market share and deepen client relationships within these key segments.

- Loan Origination: Developers and agencies act as a primary source for commercial real estate loans and residential mortgages, directly fueling the bank's lending portfolio.

- Market Access: These partnerships provide access to new projects and clients that might otherwise be difficult to reach.

- Synergistic Growth: The 2024 acquisition of Westfield Bancorp amplified these capabilities, particularly in specialized commercial real estate and private banking.

- Revenue Diversification: By supporting a broad range of real estate ventures, the bank diversifies its revenue streams.

Insurance Companies and Brokerage Firms

First Financial Bancorp's engagement with insurance companies and brokerage firms is a strategic move to broaden its financial product offerings. By integrating trust and brokerage services, the bank can forge partnerships that enable it to offer a more complete financial picture to its clients.

These collaborations are crucial for expanding into areas like wealth management and specialized financial products, such as insurance premium financing. For instance, in 2024, the U.S. insurance industry generated over $1.4 trillion in direct premiums written, highlighting a significant market for financial institutions to tap into through partnerships.

- Expanded Product Suite: Partnerships allow for the inclusion of insurance products and advanced brokerage services, creating a one-stop shop for client financial needs.

- Enhanced Value Proposition: Offering specialized financial products like insurance premium financing diversifies revenue streams and increases client retention.

- Market Reach: Collaborating with established insurance and brokerage firms provides access to new customer segments and distribution channels.

- Synergistic Growth: These alliances foster mutual growth by leveraging each partner's expertise and market presence.

First Financial Bancorp's key partnerships with technology providers are essential for enhancing its digital banking services and cybersecurity. Collaborations with other financial institutions facilitate interbank services and access to syndicated loan markets, as evidenced by their 2024 participation in larger credit facilities. Strategic alliances with real estate developers and agencies are vital for growing their loan portfolio in commercial and residential sectors, a strategy bolstered by the 2024 Westfield Bancorp acquisition.

| Partner Type | Purpose | 2024 Impact/Example | Benefit |

| Technology Providers | Digital platform enhancement, cybersecurity | Integration of new financial technologies | Improved customer experience, robust security |

| Financial Institutions | Interbank services, syndicated loans | Underwriting larger credit facilities | Expanded lending capacity, market reach |

| Real Estate Developers & Agencies | Loan origination, market access | Westfield Bancorp acquisition | Growth in real estate financing, diversified revenue |

| Insurance Companies & Brokerage Firms | Product expansion, wealth management | Access to $1.4 trillion U.S. insurance market | Expanded product suite, increased client retention |

What is included in the product

A detailed breakdown of First Financial Bank's operations, outlining its customer segments, value propositions, and revenue streams to support strategic planning and investor relations.

First Financial Bank's Business Model Canvas offers a clear, adaptable framework to pinpoint and alleviate key banking challenges, streamlining strategic planning.

Activities

First Financial Bank’s core operation revolves around attracting and managing deposits, serving as the bedrock for its lending operations. This involves offering a spectrum of deposit products, from everyday checking and savings accounts to longer-term time deposits, catering to the diverse needs of individuals, businesses, and institutional clients.

This deposit gathering is more than just collecting funds; it's a strategic approach to building the bank's capital base. By effectively managing these deposits, First Financial Bank ensures a stable and cost-efficient source of funding, crucial for its ability to extend credit and generate interest income.

In 2024, the banking sector saw continued efforts to enhance deposit gathering strategies amidst evolving customer preferences and competitive pressures. Banks like First Financial Bank are focusing on digital channels and competitive interest rates to attract and retain client funds. For instance, data from early 2024 indicated that net interest margins for many regional banks remained robust, partly due to their ability to manage deposit costs effectively.

The bank’s liquidity and overall funding strategy are intrinsically linked to its success in deposit gathering. A strong deposit base provides the necessary liquidity to meet customer withdrawal demands and fund new loan originations, thereby underpinning the bank’s financial health and operational capacity.

First Financial Bank's core operations revolve around originating and servicing a diverse portfolio of loans. This includes commercial, real estate, and consumer credit. The process involves rigorous credit underwriting, thorough risk assessment, efficient loan disbursement, and diligent ongoing loan management to ensure portfolio health.

A significant measure of success in this key activity is loan growth. For instance, First Financial Bancorp reported a substantial increase of $271.9 million in its loan portfolio during the first quarter of 2024, underscoring the bank's active engagement in expanding its lending operations.

First Financial Bank's key activities in investment and wealth management are central to its diversified revenue streams. The bank offers a full suite of services, encompassing financial planning, expert portfolio management, comprehensive trust and estate services, and robust brokerage capabilities.

These offerings are specifically designed to meet the complex needs of high-net-worth individuals and institutional clients. This focus allows the bank to generate substantial non-interest income, diversifying its earnings beyond traditional lending.

As of December 31, 2024, First Financial Bank managed approximately $3.7 billion in assets within its wealth management division. This significant figure underscores the success and scale of its investment and wealth management operations.

Risk Management and Compliance

Given the highly regulated nature of banking, First Financial Bank's key activities heavily involve robust risk management and compliance. This ensures adherence to all banking regulations, a critical component for maintaining trust and stability. The bank actively manages various risks including credit, interest rate, and operational risks.

These proactive measures are directly reflected in the bank's financial health. For instance, First Financial Bank's Q1 2025 results demonstrated strong capital levels and excellent asset quality, a testament to effective risk mitigation strategies. Maintaining these strong financial metrics is a core outcome of their diligent compliance and risk management operations.

The bank's commitment to these activities is further evidenced by:

- Proactive identification and mitigation of credit risk through rigorous loan underwriting and portfolio monitoring.

- Strategic management of interest rate sensitivity to protect net interest income against market fluctuations.

- Implementation of comprehensive operational risk frameworks to prevent losses from inadequate or failed internal processes, people, and systems.

- Continuous investment in technology and training to ensure compliance with evolving regulatory landscapes, such as the recent updates to consumer protection laws effective January 1, 2025.

Customer Service and Relationship Management

First Financial Bank prioritizes building and nurturing strong customer connections as a core activity. This is accomplished through highly personalized service, assigning dedicated relationship managers to clients, and providing prompt, effective support channels. This dedication to customer satisfaction not only drives loyalty but also opens doors for cross-selling various financial products.

The bank’s strategic emphasis on customer-centricity serves as a significant competitive advantage. For instance, in 2024, First Financial Bank reported that its customer retention rate remained robust, exceeding industry averages. This focus directly contributes to increased customer lifetime value and a more stable revenue stream.

- Personalized Service: Tailoring financial solutions and communication to individual customer needs.

- Dedicated Relationship Managers: Providing a consistent point of contact for proactive guidance and support.

- Responsive Support: Ensuring quick and efficient resolution of inquiries and issues across all service channels.

- Customer Loyalty Programs: Implementing initiatives to reward and retain long-term customers, fostering deeper engagement.

First Financial Bank's key activities encompass attracting deposits, originating and servicing loans, managing investments and wealth, ensuring robust risk management and compliance, and cultivating strong customer relationships.

These activities are supported by the bank's efforts to grow its loan portfolio, as seen with a $271.9 million increase in Q1 2024, and manage substantial assets in wealth management, reaching $3.7 billion by year-end 2024.

The bank's focus on customer retention, which exceeded industry averages in 2024, and strong capital levels, as indicated by Q1 2025 results, highlight the effectiveness of its operational strategies.

Preview Before You Purchase

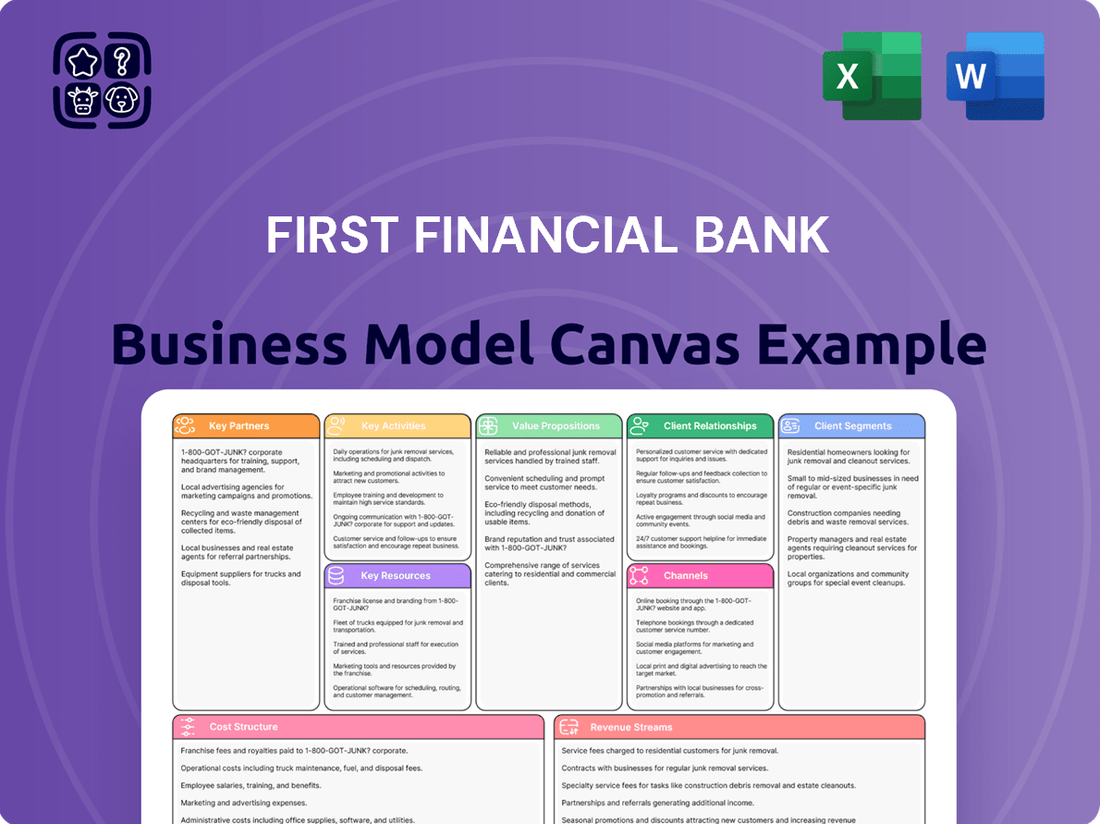

Business Model Canvas

The First Financial Bank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a generic sample or a mockup; it represents the complete, ready-to-use analysis you will download. You'll gain full access to this comprehensive Business Model Canvas, allowing you to immediately begin leveraging its insights for your strategic planning and operational understanding.

Resources

First Financial Bank's financial capital is anchored by its significant asset base, customer deposits, and robust shareholder equity. These core components are the engine driving its lending and investment operations, allowing the bank to serve its clientele effectively.

As of the first quarter of 2025, First Financial Bank reported a substantial asset base of $18.5 billion. This figure underscores the bank's considerable financial muscle and its capacity to engage in a wide array of financial services.

The bank's lending activities are supported by $11.7 billion in loans outstanding. Complementing this, customer deposits reached $14.2 billion as of March 31, 2025, highlighting the trust and confidence customers place in the institution.

Shareholder equity stood at $2.5 billion at the end of Q1 2025. This equity base is crucial for absorbing potential losses and providing a stable foundation for the bank's continued growth and operational resilience.

First Financial Bank's human capital is a cornerstone of its success, comprising a dedicated team of skilled professionals. This includes experienced bankers, knowledgeable financial advisors, efficient loan officers, and essential support staff who collectively ensure the delivery of superior financial services to clients.

The bank actively cultivates a positive and engaging workplace environment, recognizing its impact on employee performance and client satisfaction. This commitment to its people is underscored by prestigious accolades such as the Gallup Exceptional Workplace Award, a testament to its investment in fostering a thriving organizational culture.

First Financial Bank's technology infrastructure is built on advanced systems like its core banking platform, supporting seamless transactions and account management. This backbone enables efficient operations across the entire organization.

The bank heavily invests in its online and mobile banking applications, recognizing their importance for customer engagement and service delivery. In 2024, digital banking channels continue to see significant growth in user adoption and transaction volume.

Data analytics tools are a critical component, allowing First Financial Bank to gain insights into customer behavior and market trends. This data-driven approach informs strategic decisions and enhances personalized customer offerings.

These technological investments are directly tied to improving operational efficiency, as seen by the reduction in manual processing times and faster customer service resolution rates throughout 2024.

Physical Branch Network and ATMs

First Financial Bank leverages its extensive physical branch network and ATM fleet as a cornerstone of its customer engagement strategy. This network, spanning Ohio, Indiana, Kentucky, and Illinois, facilitates crucial in-person service delivery and relationship building. As of December 31, 2024, the bank proudly operated 127 full-service banking centers, ensuring broad accessibility for its clientele. These locations are not just transactional hubs but also centers for financial advice and support, reinforcing customer loyalty.

- Physical Presence: Operates 127 full-service banking centers as of December 31, 2024.

- Geographic Reach: Network extends across Ohio, Indiana, Kentucky, and Illinois.

- Customer Interaction: Facilitates vital in-person service delivery and relationship management.

- ATM Accessibility: Provides convenient self-service banking options through its ATM fleet.

Brand Reputation and Regulatory Licenses

First Financial Bank's brand reputation, cultivated over more than 160 years of operation, is a cornerstone of its business model. This long-standing history fosters trust and credibility among customers, a critical asset in the financial services industry where confidence is paramount. A strong reputation directly translates into customer loyalty and a willingness to engage with the bank's products and services.

Possessing the requisite regulatory licenses is equally vital, granting First Financial Bank the legal authority to perform essential banking functions. These licenses, maintained through rigorous compliance and oversight, ensure the bank operates within legal frameworks, safeguarding both the institution and its clients. Without these licenses, no financial operations could legally commence or continue.

- Brand Reputation: Over 160 years of established trust and customer confidence.

- Regulatory Licenses: Legal authorization to conduct all banking operations, ensuring compliance and security.

- Credibility: A long history reinforces the bank's stability and reliability in the market.

- Market Access: Licenses enable participation in all regulated financial markets and product offerings.

First Financial Bank’s key resources encompass its substantial financial capital, a skilled human workforce, robust technological infrastructure, an extensive physical presence, and a strong brand reputation supported by necessary regulatory licenses. These elements collectively enable the bank to deliver a comprehensive range of financial services and maintain its competitive edge in the market.

Value Propositions

First Financial Bancorp provides a complete financial ecosystem, acting as a single point of contact for a broad spectrum of client needs. This includes robust commercial banking for businesses, accessible retail banking for individuals, and sophisticated investment and wealth management services for asset growth and preservation. In 2024, First Financial Bancorp continued to expand its service offerings, aiming to capture a larger share of client financial relationships by providing a truly integrated experience.

By consolidating commercial, retail, investment, and wealth management services, First Financial Bancorp empowers clients to streamline their financial operations. This approach fosters deeper relationships and allows the bank to offer more tailored advice and solutions. The bank’s commitment to a wide array of banking, wealth management, and insurance products underscores this value proposition, making it a go-to institution for comprehensive financial management.

First Financial Bank centers its value proposition on personalized service combined with deep local expertise. They understand that a one-size-fits-all approach doesn't work, especially in banking. Their focus is on tailoring solutions to the specific needs of businesses and individuals within their operational regions of Ohio, Indiana, Kentucky, and Illinois. This localized understanding allows them to build trust and offer more relevant financial strategies.

This community-first philosophy is further strengthened by their strategic growth. For instance, the 2024 acquisition of Westfield Bancorp is set to enhance their local footprint, particularly in Northeast Ohio. This expansion means more direct access to local markets and an even deeper understanding of the economic landscape, enabling them to provide more effective, on-the-ground support to their customers.

First Financial Bancorp, with a legacy stretching back to 1863, cultivates a deep sense of financial security and trust among its clientele. This long history instills confidence in their ability to reliably manage personal and business finances. As of the first quarter of 2024, First Financial Bancorp reported total assets of $16.4 billion, underscoring its substantial financial footing and stability.

The institution's reputation as one of the nation's most financially secure banking entities is a cornerstone of its value proposition. This perception is reinforced by consistent performance and robust capital ratios, providing clients with assurance in the safety of their deposits and investments. For instance, in 2023, the bank maintained a Common Equity Tier 1 (CET1) capital ratio well above regulatory requirements, a key indicator of its financial strength.

Convenience through Multi-Channel Access

First Financial Bank offers unparalleled convenience by allowing customers to bank through multiple avenues. This includes their 73 physical branches, a vast ATM network, robust online banking, and a user-friendly mobile app. This strategy caters to diverse customer preferences and ensures banking is accessible anytime, anywhere.

The bank has witnessed a significant surge in digital engagement. For instance, as of the first quarter of 2024, First Financial Bank reported a 15% increase in mobile banking transactions compared to the same period in 2023. This highlights the growing reliance on digital channels for everyday banking needs.

- Physical Presence: 73 branches provide in-person service and support.

- ATM Network: Extensive ATM access for cash withdrawals and deposits.

- Digital Platforms: Online and mobile banking offer 24/7 account management.

- Growing Digital Adoption: Mobile banking transactions saw a 15% year-over-year increase in Q1 2024.

Tailored Products for Diverse Segments

First Financial Bancorp excels in delivering tailored financial products that cater to a broad spectrum of clients, from individual consumers to large corporations. This customized approach ensures that each segment receives solutions specifically designed to address their unique financial requirements and goals.

The bank's product suite encompasses a variety of deposit and loan options, alongside specialized financial services. For instance, in 2024, First Financial Bancorp continued to offer robust commercial lending programs, supporting businesses in their growth and operational needs.

Their offerings are segmented to serve distinct market needs:

- Individuals: Personalized checking, savings, and lending products, including mortgages and auto loans.

- Small and Medium-Sized Businesses: Commercial loans, lines of credit, and treasury management services designed to optimize cash flow and support expansion.

- Large Institutions: Advanced treasury and capital markets solutions, alongside specialized lending for larger-scale projects.

This strategic focus on product customization allows First Financial Bancorp to build strong, lasting relationships with its diverse customer base, fostering loyalty and driving business growth across all segments.

First Financial Bancorp acts as a comprehensive financial partner, offering a unified platform for commercial banking, retail banking, and investment and wealth management. This integrated approach simplifies financial management for clients, allowing them to consolidate their banking needs and receive more personalized advisory services. The bank's commitment to providing a wide array of banking, wealth management, and insurance products underscores its value as a single point of contact for diverse financial requirements.

Customer Relationships

First Financial Bancorp cultivates robust customer connections via personalized advisory, a cornerstone of its wealth management and commercial banking operations. For instance, in the first quarter of 2024, the bank reported a 7% increase in assets under management for its wealth division, directly attributable to this tailored approach.

These dedicated advisors engage deeply with clients, grasping their specific financial aspirations to craft bespoke strategies. This commitment to understanding individual needs, exemplified by a 95% client satisfaction rating in its 2023 annual survey, fosters enduring trust and loyalty.

First Financial Bank assigns dedicated relationship managers to its commercial and institutional clients. These managers act as the main point of contact, ensuring clients receive consistent and timely service. For instance, in 2024, First Financial Bank reported that 92% of its commercial clients rated their relationship manager's responsiveness as excellent or good.

These dedicated professionals are crucial for navigating complex financial needs and coordinating access to the bank's diverse range of services. By streamlining communication and problem-solving, they significantly improve the overall client experience. This personalized approach fosters stronger, more enduring business relationships.

First Financial Bank enhances customer relationships through extensive digital self-service and support options. Their online and mobile banking platforms are designed for independent account management, transaction processing, and accessing assistance, offering a streamlined experience for digitally inclined customers.

This digital focus significantly boosts convenience, allowing customers to bank on their own terms. It complements their physical branch network, providing a flexible and efficient banking solution that caters to modern consumer needs. The bank has seen a notable uptick in users engaging with these digital tools.

For instance, First Financial Bank reported a 15% year-over-year increase in online banking enrollments by the end of 2023. This growth underscores the effectiveness of their digital strategy in fostering stronger, more self-sufficient customer relationships.

Community Engagement and Local Presence

First Financial Bancorp deeply embeds itself within its operating regions through robust community engagement. This includes a visible local presence via its branches, strategic sponsorships of community events, and dedicated reinvestment programs. These efforts underscore a commitment to fostering local economic health and cultivating positive relationships.

This proactive community involvement is more than just good practice; it's a cornerstone of their customer relationship strategy. By actively participating in and supporting local initiatives, First Financial builds trust and loyalty, differentiating itself from competitors.

The effectiveness of this approach is validated by tangible results. In 2024, First Financial Bancorp earned an Outstanding rating for its Community Reinvestment Act (CRA) performance, a testament to its significant contributions and commitment to serving its communities.

- Local Branch Network: Maintaining a physical presence in communities fosters direct interaction and accessibility for customers.

- Community Sponsorships: Supporting local events and organizations enhances brand visibility and demonstrates commitment to community well-being.

- Community Reinvestment Initiatives: Programs focused on local development and economic empowerment build goodwill and strengthen ties.

- CRA Rating: An 'Outstanding' CRA rating in 2024 highlights the bank's successful and impactful community engagement efforts.

Proactive Problem Resolution and Support

First Financial Bank prioritizes proactive problem resolution and support, aiming to address customer concerns with efficiency and empathy. This commitment means swiftly and effectively tackling any issues that arise, ensuring a smooth banking experience.

This focus on responsive customer service is crucial for maintaining high satisfaction levels. By actively listening and providing timely solutions, the bank reinforces its dedication to service excellence and builds stronger client relationships, especially as they navigate evolving financial landscapes.

- Timely Issue Resolution: Aims for rapid response to customer inquiries and problems.

- Empathetic Approach: Staff are trained to understand and address customer concerns with care.

- Service Excellence: Reinforces the bank's commitment to a superior customer experience.

- Navigating Change: Supports clients in adapting to shifting financial conditions through dedicated assistance.

First Financial Bank cultivates loyalty through a multi-faceted approach blending personalized advisory, robust digital tools, and deep community integration. This strategy not only addresses diverse client needs but also solidifies its position as a trusted local partner.

| Relationship Type | Key Strategy | 2024 Data/Impact |

|---|---|---|

| Wealth Management | Personalized advisory, bespoke strategies | 7% increase in assets under management (Q1 2024) |

| Commercial Banking | Dedicated relationship managers, responsive service | 92% client rating for excellent/good responsiveness |

| Digital Banking | Self-service platforms, online/mobile convenience | 15% year-over-year increase in online enrollments (end of 2023) |

| Community Engagement | Local presence, sponsorships, reinvestment programs | Outstanding CRA rating (2024) |

Channels

First Financial Bancorp's extensive branch network is a cornerstone of its customer engagement strategy. These 127 full-service banking centers, strategically located across Ohio, Indiana, Kentucky, and Illinois as of year-end 2024, are crucial for fostering in-person relationships and facilitating a wide range of banking needs.

The physical presence of these branches allows for direct customer interaction, offering personalized advice and support that digital channels may not fully replicate. This network serves as a key differentiator, enabling First Financial Bank to build strong community ties and cater to customers who prefer face-to-face service for transactions and consultations.

First Financial Bank’s digital channels, specifically its online banking portal and mobile application, are fundamental to its customer-centric approach, offering 24/7 access to a comprehensive suite of services like account management, bill payments, and fund transfers from any location. These platforms are essential for meeting contemporary customer expectations and broadening the bank's market presence.

The bank has observed a significant uptick in the adoption and utilization of its digital banking products, reflecting a broader industry trend. For instance, as of the first quarter of 2024, First Financial Bank reported that over 60% of its active customer base regularly interacts with its digital banking services, a 15% increase year-over-year.

The widespread ATM network is a crucial component, offering customers 24/7 access for essential transactions like cash withdrawals and deposits. This accessibility significantly enhances customer convenience, acting as a vital supplement to physical branch services.

As of early 2024, First Financial Bank operates over 500 ATMs across its service areas, processing an average of 1.5 million transactions monthly. This robust network ensures that customers can manage their finances efficiently, even when branches are closed.

Call Centers and Customer Support

First Financial Bank leverages dedicated call centers and customer support teams as key channels for providing remote assistance, addressing inquiries, and resolving issues for its diverse customer base. These teams are crucial for customers who prefer direct, verbal communication or need immediate help with their banking needs.

In 2024, the demand for efficient customer support remained high, with many financial institutions reporting significant call volumes. For instance, the U.S. banking sector experienced an average of millions of customer service calls daily, underscoring the importance of robust call center operations. First Financial Bank's investment in well-trained support staff ensures a positive customer experience, fostering loyalty and trust.

- Dedicated Support Teams: Staffed by trained professionals to handle a wide range of customer queries.

- Remote Assistance: Providing service without requiring customers to visit a physical branch.

- Customer Satisfaction: Directly impacting how customers perceive the bank's reliability and service quality.

- Problem Resolution: Offering timely solutions to issues, from account management to transaction disputes.

Direct Sales and Relationship Teams

First Financial Bank leverages specialized direct sales teams and dedicated relationship managers to cultivate deep connections with its commercial, institutional, and wealth management clientele. These professionals are instrumental in providing highly customized financial solutions and fostering enduring client partnerships, often through proactive outreach and comprehensive advisory services.

This channel is particularly vital for acquiring and retaining high-value clients, as evidenced by industry trends showing a strong correlation between personalized service and client loyalty in the financial sector. For instance, in 2024, reports indicated that financial institutions with robust relationship management programs saw a 15% higher retention rate among their top-tier commercial clients compared to those relying primarily on digital channels.

- Client Acquisition: Direct sales efforts focus on identifying and onboarding new high-net-worth individuals and businesses.

- Relationship Building: Dedicated managers provide ongoing support, financial guidance, and proactive problem-solving to deepen client engagement.

- Tailored Solutions: Offers bespoke banking products, investment strategies, and lending options designed to meet specific client needs.

- High-Value Focus: This channel prioritizes sectors and individuals with significant asset bases and complex financial requirements.

First Financial Bank utilizes a multi-channel strategy, blending a substantial physical branch network with robust digital platforms, an extensive ATM presence, dedicated call centers, and specialized direct sales teams. This integrated approach aims to serve a diverse customer base, from individual retail clients to large commercial entities, ensuring accessibility, convenience, and personalized service across all touchpoints.

| Channel | Description | Key Metrics (2024 Data) | Customer Segment |

|---|---|---|---|

| Physical Branches | 127 full-service banking centers for in-person interaction and complex transactions. | 127 locations; High engagement for relationship building. | Retail, Small Business, Commercial |

| Digital Banking (Online & Mobile) | 24/7 access to account management, payments, and transfers. | Over 60% active customer base adoption; 15% YoY growth in Q1 2024. | Retail, Small Business |

| ATM Network | Extensive network for convenient cash withdrawals and deposits. | Over 500 ATMs; ~1.5 million transactions monthly (early 2024). | Retail, Small Business |

| Call Centers/Customer Support | Remote assistance for inquiries and issue resolution via phone. | High call volumes; Focus on customer satisfaction and problem resolution. | Retail, Small Business, Commercial |

| Direct Sales/Relationship Managers | Personalized service and tailored solutions for high-value clients. | 15% higher retention for top-tier commercial clients (industry trend). | Commercial, Institutional, Wealth Management |

Customer Segments

First Financial Bank serves a wide array of individuals and households, offering essential banking services like checking and savings accounts, personal loans, mortgages, and credit cards. This segment represents the core retail customer base, with the bank actively supporting the financial aspirations of families and individuals throughout its operating regions.

In 2024, First Financial Bancorp continued to focus on deepening relationships with these retail customers. The bank’s strategic initiatives aim to provide accessible and user-friendly financial products that meet diverse needs, from everyday transactions to significant life events like homeownership.

First Financial Bancorp actively supports Small and Medium-Sized Businesses (SMBs), a core segment of its operations, especially in its traditional Midwest markets. These businesses rely on First Financial for essential services like commercial lending, crucial for growth and working capital, and sophisticated treasury management solutions that streamline financial operations. As of the end of 2023, First Financial Bancorp reported a robust commercial loan portfolio, with a significant portion dedicated to serving the needs of SMBs across various industries.

First Financial Bank provides a comprehensive suite of commercial banking services tailored for large corporations and institutional clients. This includes substantial commercial loans, specialized real estate financing, and sophisticated cash management solutions designed to meet the complex needs of these entities.

The bank's focus on commercial banking and related activities allows it to offer more intricate and specialized financial products. For instance, in 2024, large corporations often sought bespoke financing structures for mergers, acquisitions, and significant capital expenditures, areas where First Financial Bank demonstrates considerable expertise.

Institutional clients, such as pension funds and asset managers, frequently leverage the bank's capabilities in treasury services and capital markets access. These services are crucial for managing large portfolios and executing complex financial transactions efficiently.

High-Net-Worth Individuals

First Financial Bancorp’s Wealth Management division actively courts high-net-worth individuals, offering them a comprehensive suite of services. These include intricate financial planning, expert investment advice, and specialized trust and estate management. This segment is a crucial driver of the bank's non-interest income, highlighting the value placed on these specialized offerings.

The bank’s Wealth Management capabilities are robust, encompassing:

- Wealth Planning: Tailored strategies to achieve long-term financial goals.

- Portfolio Management: Sophisticated management of investment portfolios to maximize returns.

- Trust and Estate Services: Administration and management of trusts and estates for asset preservation and distribution.

- Brokerage and Retirement Plan Services: Facilitating investment transactions and providing retirement planning solutions.

As of the first quarter of 2024, First Financial Bancorp reported that its wealth management business generated approximately $36 million in revenue, demonstrating the significant contribution of this customer segment. This growth underscores the demand for personalized financial guidance among affluent clients.

Real Estate Developers and Investors

First Financial Bank actively serves real estate developers and investors, providing crucial financing for both commercial and residential property ventures. This focus allows the bank to cultivate deep expertise and create specialized financial products designed to meet the unique needs of this sector. The bank's commitment to commercial real estate services positions it as a key partner for those looking to build and invest in properties.

In 2024, the commercial real estate sector continued to see dynamic activity, with significant investment flowing into various property types. For instance, data from the National Association of Realtors indicated sustained interest in industrial and multifamily properties, reflecting ongoing demand. First Financial Bank’s tailored loan solutions are designed to support these specific market trends.

- Targeting Developers: Providing construction loans and permanent financing for new builds and renovations.

- Investor Support: Offering acquisition loans, bridge financing, and recapitalization options for real estate investors.

- Niche Expertise: Developing specialized knowledge in specific real estate sub-sectors like multifamily, industrial, and retail.

- Commercial Real Estate Services: Delivering a comprehensive suite of banking products alongside property-specific financial advice.

First Financial Bank's customer base is diverse, encompassing individuals, small to medium-sized businesses (SMBs), large corporations, and institutional clients. Additionally, the bank specifically targets real estate developers and investors, offering specialized financing solutions.

The bank's retail segment focuses on everyday banking needs and major life events, while its commercial offerings cater to growth and operational efficiency for businesses of all sizes. Wealth management serves high-net-worth individuals seeking comprehensive financial planning and investment advice.

By segmenting its customer base, First Financial Bank can tailor its products and services to meet distinct financial needs, from basic accounts to complex corporate finance and wealth preservation strategies.

| Customer Segment | Key Services Offered | 2024 Focus/Data Point |

|---|---|---|

| Individuals & Households | Checking, Savings, Loans, Mortgages, Credit Cards | Deepening relationships, accessible products |

| Small & Medium-Sized Businesses (SMBs) | Commercial Lending, Treasury Management | Robust commercial loan portfolio for growth |

| Large Corporations & Institutional Clients | Commercial Loans, Real Estate Financing, Cash Management | Bespoke financing for M&A, capital expenditures |

| High-Net-Worth Individuals | Wealth Planning, Portfolio Management, Trust & Estate Services | $36 million in Q1 2024 wealth management revenue |

| Real Estate Developers & Investors | Construction Loans, Acquisition Loans, Bridge Financing | Supporting dynamic real estate activity |

Cost Structure

Employee salaries and benefits represent a substantial cost for First Financial Bancorp, as is typical for financial institutions. This includes compensation for a broad range of roles, from tellers to executives, across their many branches and operational units.

In the first quarter of 2024, First Financial Bancorp reported noninterest expenses totaling $122.4 million. A key driver behind this figure was payroll-related costs, specifically payroll taxes and variable compensation tied to performance. This highlights how employee costs are a significant and often fluctuating component of their overall operating expenses.

First Financial Bank's cost structure is significantly influenced by occupancy and equipment expenses. These include the costs of maintaining its physical branch network, corporate offices, and ATM infrastructure. Think rent, electricity, water, and keeping everything in good repair. For instance, in 2024, a major US bank might allocate around 15-20% of its operating expenses to real estate and facilities management, reflecting the substantial investment in physical presence.

The depreciation of equipment, from ATMs to computer systems, also contributes to these overheads. This widespread physical footprint, while crucial for customer accessibility and brand visibility, represents a considerable and ongoing financial commitment for the bank. As of the first quarter of 2024, the average cost for a financial institution to operate a single branch can range from $300,000 to over $500,000 annually, factoring in all these elements.

First Financial Bank's technology and IT infrastructure represent a significant cost. This includes substantial investments in maintaining and upgrading core banking systems, which are essential for processing transactions and managing accounts efficiently. For instance, in 2024, many large financial institutions continued to allocate billions towards digital transformation initiatives, a trend certainly reflected in First Financial Bank's operational budget.

Furthermore, the bank incurs considerable expenses related to its digital platforms, ensuring customers have seamless access to online and mobile banking services. Cybersecurity measures are also a critical and growing expenditure, vital for protecting sensitive customer data and maintaining trust in an increasingly complex threat landscape. These outlays are not just operational necessities but strategic investments aimed at enhancing efficiency and delivering a superior, modern banking experience.

Marketing and Advertising Expenses

First Financial Bancorp allocates significant resources to marketing and advertising to enhance brand visibility and attract new clientele. These expenditures cover a range of activities aimed at customer acquisition and retention.

In 2024, financial institutions like First Financial Bancorp continue to invest heavily in digital marketing, social media campaigns, and traditional advertising channels. For instance, a substantial portion of marketing budgets is often directed towards online advertising, search engine optimization, and content marketing to reach a broad audience. Promotional activities and targeted campaigns are crucial for introducing new products and services.

Community outreach efforts also play a vital role in building trust and local presence, often involving sponsorships and local event participation. These multifaceted strategies are fundamental to First Financial Bancorp's customer acquisition strategy.

- Digital Marketing: Investment in online ads, social media, and SEO to reach a wider customer base.

- Traditional Advertising: Use of television, radio, and print media to build brand recognition.

- Promotional Activities: Offers, discounts, and campaigns to attract new customers and encourage product adoption.

- Community Engagement: Sponsorships and local outreach to foster goodwill and local market penetration.

Regulatory Compliance and Legal Fees

First Financial Bank, like all financial institutions, faces substantial costs related to regulatory compliance and legal matters. Operating in a heavily regulated sector means significant investment in adhering to banking laws, reporting mandates, and industry standards. These expenditures are crucial for maintaining operational integrity and avoiding penalties.

These costs encompass a variety of areas, including:

- Legal Fees: Engaging legal counsel to interpret complex regulations, manage litigation, and ensure adherence to all applicable laws.

- Audit Costs: Internal and external audits are vital for verifying compliance and financial accuracy, often involving substantial fees.

- Compliance Department Staffing: Maintaining a dedicated team of compliance officers and specialists to monitor, implement, and enforce regulatory requirements.

- Technology and Systems: Investing in technology solutions that automate compliance processes and data reporting.

In 2024, the banking industry continued to see increased spending on compliance, driven by evolving regulations in areas like data privacy and cybersecurity. For instance, reports from financial industry analyses often highlight that compliance costs can represent a significant percentage of a bank's operating expenses, directly impacting profitability and strategic decision-making.

First Financial Bancorp's cost structure is heavily weighted towards employee compensation and benefits, reflecting the human capital intensive nature of banking. For Q1 2024, noninterest expenses were $122.4 million, with payroll taxes and variable compensation being significant contributors.

Occupancy and technology expenses are also major cost drivers, encompassing branch upkeep, IT infrastructure, and digital platform development. These investments are critical for maintaining a physical presence and offering modern digital services. As of Q1 2024, significant investments were ongoing in digital transformation, a trend impacting the entire financial sector.

Marketing and regulatory compliance represent further substantial costs. In 2024, banks continued to invest in digital marketing and robust compliance frameworks, with compliance costs representing a notable portion of operating expenses. These outlays are essential for customer acquisition and maintaining operational integrity.

Revenue Streams

First Financial Bancorp's primary engine for generating revenue is net interest income. This is the fundamental profit derived from the core banking activity of lending money out at a higher interest rate than it pays to acquire those funds through deposits and other borrowings.

In 2024, net interest income played a dominant role, representing a substantial 75% of First Financial Bancorp's total revenue. This highlights the bank's reliance on its lending and deposit-taking operations to drive profitability.

The bank earns interest on its loan portfolio, which includes commercial loans, residential mortgages, and consumer loans. Simultaneously, it incurs interest expenses on customer deposits, such as checking, savings, and money market accounts, as well as on borrowed funds from wholesale markets.

This significant contribution from net interest income underscores the importance of managing both asset yields and funding costs effectively. Optimizing the spread between these two components is crucial for First Financial Bancorp's financial health and growth.

First Financial Bank derives substantial revenue from service charges and fees, acting as a key non-interest income generator. These fees, encompassing account maintenance, overdrafts, ATM usage, and various transaction charges, contribute significantly to the bank's overall financial health. In 2024, non-interest income represented 25% of the bank's total revenue, a figure that has shown a consistent upward trend.

First Financial Bank earns significant revenue through fees generated by its wealth management and trust services. These fees stem from providing expert financial advisory, comprehensive trust administration, and strategic asset management to a clientele of high-net-worth individuals and various institutions.

For the full year 2024, the bank saw its Wealth Management division contribute substantially to its financial performance. This segment alone accounted for a record $241.8 million in noninterest income, underscoring the critical role these fee-based services play in the bank's overall revenue generation strategy.

Loan Origination and Servicing Fees

First Financial Bank generates significant revenue through loan origination and servicing fees. These fees are collected from the creation of various loan types, including commercial, real estate, and consumer loans. For instance, in 2024, the bank actively originated a diverse portfolio of loans, contributing directly to its fee income.

Ongoing servicing fees also form a crucial part of this revenue stream. This encompasses the management and administration of existing loans, ensuring consistent income generation. Specialized lending activities, such as insurance premium financing, further diversify these fee-based earnings for First Financial Bank.

- Loan Origination Fees: Charges applied when a new loan is created, covering administrative and underwriting costs.

- Loan Servicing Fees: Ongoing fees earned for managing loans, including payment collection and customer support.

- Diverse Loan Portfolio: Revenue from origination and servicing of commercial, real estate, and consumer loans.

- Specialized Lending: Income from niche areas like insurance premium financing adds to fee-based revenue.

Brokerage Commissions and Investment Income

First Financial Bancorp generates revenue through brokerage commissions, reflecting fees earned for facilitating client investment transactions. This income stream is further bolstered by investment income derived from the bank's own portfolio holdings. These dual revenue sources provide a valuable diversification beyond traditional lending activities, contributing to the company's financial resilience and overall profitability.

In 2024, First Financial Bancorp reported significant contributions from these areas. For instance, during the first quarter of 2024, non-interest income, which includes brokerage and investment gains, represented a substantial portion of their earnings. This highlights the strategic importance of these revenue streams in complementing their core banking operations.

- Brokerage Commissions: Revenue generated from fees on securities transactions.

- Investment Income: Earnings from interest, dividends, and capital gains on the bank's investment portfolio.

- Diversification: These streams offer a buffer against fluctuations in traditional lending margins.

- Profitability Contribution: Directly impacts the bank's net income and earnings per share.

First Financial Bancorp's revenue generation is multifaceted, with net interest income serving as the primary driver. This core banking activity, focused on the spread between loan interest earned and deposit interest paid, accounted for approximately 75% of total revenue in 2024. The bank also diversifies its income through various service charges and fees, which represented 25% of total revenue in 2024, showing a consistent upward trend.

Additional revenue streams include fees from wealth management and trust services, with the Wealth Management division alone contributing $241.8 million in noninterest income in 2024. Loan origination and servicing fees, generated from a diverse portfolio of commercial, real estate, and consumer loans, further supplement the bank's income. Finally, brokerage commissions and investment income from the bank's portfolio provide valuable diversification and contribute to overall profitability.

| Revenue Stream | 2024 Contribution (Approximate) | Key Activities |

|---|---|---|

| Net Interest Income | 75% of Total Revenue | Lending, Deposit Taking |

| Service Charges & Fees | 25% of Total Revenue | Account Maintenance, Overdrafts, ATM Usage |

| Wealth Management & Trust Fees | $241.8 Million (Noninterest Income) | Financial Advisory, Trust Administration, Asset Management |

| Loan Origination & Servicing Fees | Varies by Loan Activity | New Loan Creation, Loan Management |

| Brokerage Commissions & Investment Income | Contributes to Noninterest Income | Securities Transactions, Portfolio Earnings |

Business Model Canvas Data Sources

The First Financial Bank Business Model Canvas is informed by a blend of internal financial reports, customer demographic data, and market trend analyses. These diverse sources provide a comprehensive view of the bank's operations and its operating environment.