City National Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City National Bank Bundle

City National Bank navigates a complex financial landscape where buyer power and the threat of substitutes significantly shape its competitive environment. Understanding these forces is crucial for strategic planning and identifying growth opportunities.

The complete report reveals the real forces shaping City National Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology providers hold considerable sway in the banking sector, given its growing dependence on digital services, artificial intelligence, and data analytics. Core banking systems, cybersecurity, and AI platforms are vital, and the specialized nature of these solutions, coupled with substantial switching costs for banks, amplifies supplier power. For instance, banks are channeling significant investment into AI for enhanced customer experiences and streamlined operations, making these technology partners indispensable.

Suppliers of financial data, payment network infrastructure, and other essential market utilities wield considerable influence. For instance, major data providers like Bloomberg and Refinitiv are critical for banks to access real-time market intelligence and execute trades. Their pricing structures and service availability directly impact a bank's operational efficiency and competitive edge.

Banks rely heavily on these services for seamless, real-time transactions, crucial market insights, and meeting stringent regulatory compliance requirements. The increasing adoption of real-time payment systems, like The Clearing House's RTP network, and the ongoing push towards open banking principles amplify the importance and potential bargaining power of these infrastructure providers.

Skilled talent, especially in fast-growing fields like cybersecurity, artificial intelligence, and digital transformation, acts as a crucial supplier for banks. A scarcity of these specialized professionals significantly bolsters their bargaining power, often translating into demands for higher salaries and more comprehensive benefits packages. For instance, in 2024, the average salary for a cybersecurity analyst in the U.S. ranged from $90,000 to $130,000, reflecting the high demand and specialized skill set required.

Regulatory Bodies and Compliance Service Providers

Regulatory bodies and the compliance service providers that help navigate their rules exert considerable bargaining power over banks like City National Bank. These entities shape the operational environment by imposing stringent requirements, particularly in areas like artificial intelligence, data privacy, and anti-money laundering. The escalating complexity of these regulations necessitates significant investment from banks to ensure adherence, thereby increasing the influence of those who define and interpret these rules.

The financial services industry saw substantial regulatory shifts in 2024, with a heightened focus on cybersecurity and consumer protection. For instance, new data breach notification laws in several key markets mandated quicker reporting and stricter data handling protocols. This increased regulatory burden directly translates to higher compliance costs for financial institutions, often exceeding 10-15% of their operating budgets, depending on the institution's size and scope of operations.

- Increased Regulatory Complexity: Evolving rules around AI ethics, data governance, and financial crime prevention grant significant leverage to regulatory bodies and their associated service providers.

- Compliance Cost Burden: Banks face substantial investments in technology and personnel to meet compliance mandates, making them more susceptible to the demands of compliance solution providers.

- Risk of Penalties: Non-compliance can result in severe financial penalties and reputational damage, compelling banks to prioritize adherence and thus strengthening the bargaining position of regulators and compliance experts.

Liquidity Providers and Funding Sources

Liquidity providers, such as depositors and wholesale funding markets, hold significant bargaining power over banks like City National Bank. In 2024, the cost of funding became a critical factor as interest rates remained elevated. This increased the leverage of those supplying capital.

When funding costs rise, it directly impacts a bank's profitability by squeezing net interest margins. For instance, if a bank's cost of funds increases by 0.50% while its lending rates cannot keep pace, its profitability will be negatively affected. This dynamic underscores the importance of maintaining diverse and stable funding sources.

- Deposits: Retail and commercial deposits are a primary, often lower-cost, funding source.

- Wholesale Funding: This includes borrowing from other financial institutions or capital markets, which can be more volatile in cost.

- Interest Rate Sensitivity: Banks with a higher proportion of short-term, variable-rate funding are more susceptible to rising interest rate environments.

- Regulatory Environment: Regulations can influence the availability and cost of certain funding types, impacting supplier power.

Technology providers are increasingly influential due to banks' reliance on digital services, AI, and data analytics. Core banking systems, cybersecurity, and AI platforms are critical, and the specialized nature of these solutions, along with high switching costs, amplifies supplier power. Banks are investing heavily in AI for customer experience and operations, making these tech partners essential.

Suppliers of financial data, payment networks, and market utilities hold significant sway. For example, providers like Bloomberg are crucial for real-time market intelligence, directly impacting a bank's efficiency and competitive edge through their pricing and service availability.

Skilled talent, particularly in cybersecurity, AI, and digital transformation, acts as a key supplier. A shortage of these professionals in 2024, with cybersecurity analyst salaries ranging from $90,000 to $130,000 in the U.S., significantly boosts their bargaining power.

Liquidity providers, including depositors and wholesale funding markets, possess considerable leverage. In 2024, elevated interest rates made funding costs a critical factor, increasing the power of capital suppliers.

What is included in the product

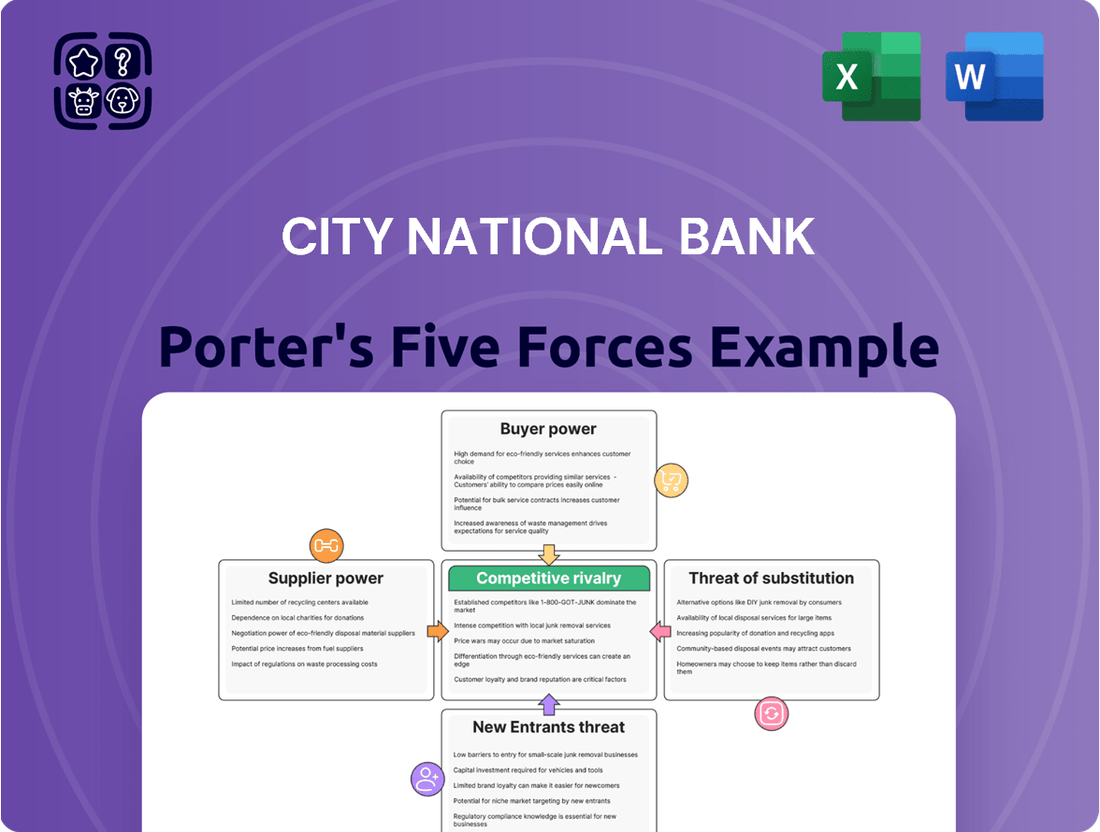

This analysis unpacks the competitive forces impacting City National Bank, examining rivalry among existing competitors, the threat of new entrants, buyer and supplier power, and the potential for substitute products or services.

Instantly identify and address competitive threats with a clear, actionable breakdown of each of Porter's Five Forces as they apply to City National Bank.

Customers Bargaining Power

City National Bank caters to a broad spectrum of clients, including individuals, businesses, and institutional investors. This diversity means customer bargaining power varies significantly across segments. For instance, large institutional clients and high-net-worth individuals often wield considerable influence due to the substantial volume of their transactions and their greater ease in moving their assets to competing financial institutions.

While individual retail customers may possess less direct bargaining power, their collective impact can be substantial. The rise of digital platforms and the ease of switching between banks empower retail customers, allowing their feedback and preferences to shape competitive offerings. In 2024, the banking sector continued to see increased customer mobility driven by digital convenience and competitive interest rates, underscoring the importance of customer retention strategies.

For many basic banking services, such as checking and savings accounts, customers face minimal hurdles when switching providers. This is particularly true as digital banking and open banking frameworks become more prevalent, making it easier for consumers to compare and move their funds. In 2024, the continued growth of fintech and neobanks offering competitive rates and enhanced digital platforms further amplifies this customer leverage.

Customers now have vast amounts of information at their fingertips, readily comparing banking products, interest rates, and fees through online tools. This transparency significantly boosts their bargaining power, as they can easily identify the best deals and negotiate for more favorable terms. For instance, a 2024 survey indicated that over 70% of consumers use online resources to research financial products before making a decision.

Demand for Personalized and Seamless Experiences

Customers, especially younger demographics, are demanding more tailored services and smooth digital interactions. They expect instant payments and a consistent experience across all touchpoints with their bank. For instance, a 2024 survey indicated that over 60% of Gen Z and Millennial consumers prioritize digital convenience and personalization when choosing a financial institution.

Banks that don't keep up with these evolving expectations face the risk of losing clients to quicker fintech companies or more tech-savvy rivals. This customer-driven need for innovation directly translates into increased bargaining power, pushing financial institutions to adapt their product and service offerings.

- Demand for Personalization: Customers increasingly seek customized banking solutions.

- Digital Experience Expectations: Seamless and intuitive digital platforms are paramount.

- Impact on Innovation: Customer demands are a key driver for new product development.

- Competitive Landscape: Banks must innovate to retain customers against agile competitors.

Alternative Financial Solutions

The rise of fintech has significantly amplified the bargaining power of City National Bank's customers. Digital wallets, peer-to-peer lending platforms, and robo-advisors offer a diverse array of alternatives, allowing customers to bypass traditional banking for specific needs or better rates. For instance, by mid-2024, the global fintech market was projected to reach over $300 billion, indicating a substantial shift in financial service provision.

This proliferation of choices means customers are less reliant on incumbent institutions like City National Bank. They can easily compare offerings and switch to providers that better meet their demands for lower fees, higher interest rates, or more convenient digital experiences. This competitive pressure compels banks to innovate and offer more attractive terms to retain their customer base.

- Fintech adoption: By the end of 2023, over 70% of consumers globally had used at least one fintech service.

- Digital payments growth: The global digital payments market is expected to grow at a compound annual growth rate of over 12% through 2027.

- Robo-advisor assets: Assets under management by robo-advisors were estimated to exceed $2 trillion by early 2024.

- Customer expectations: A significant majority of banking customers now expect seamless digital onboarding and personalized digital services.

City National Bank's customers, particularly those with substantial assets or a strong digital presence, possess significant bargaining power. This leverage is amplified by the ease of switching providers and the increasing availability of competitive alternatives from fintech companies. In 2024, the banking sector saw continued customer mobility, driven by digital convenience and attractive interest rates, forcing banks to focus on retention.

The transparency afforded by digital tools allows customers to easily compare rates and fees, empowering them to negotiate better terms. For example, a 2024 survey revealed that over 70% of consumers research financial products online before committing. This trend, coupled with a growing demand for personalized digital experiences, particularly from younger demographics, pushes banks like City National Bank to innovate and adapt their offerings to maintain market share.

| Customer Segment | Bargaining Power Drivers | 2024 Impact/Observation |

|---|---|---|

| Institutional Clients & High-Net-Worth Individuals | Transaction volume, ease of asset mobility | High leverage due to substantial funds and ability to switch easily. |

| Retail Customers | Collective impact, digital platform usage, information access | Growing power through ease of switching and comparison, influencing bank offerings. |

| Fintech-Savvy Customers | Access to alternatives (fintech, neobanks), demand for digital convenience | Significant leverage; can bypass traditional banks for specific needs or better rates. |

What You See Is What You Get

City National Bank Porter's Five Forces Analysis

This preview displays the complete City National Bank Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file. This analysis will equip you with a thorough understanding of the strategic landscape, enabling informed decision-making.

Rivalry Among Competitors

City National Bank contends with a banking sector characterized by its sheer fragmentation and diversity. Thousands of financial institutions, ranging from massive national players to nimble community banks and innovative fintech startups, vie for market share across the United States. This broad spectrum of competitors means City National Bank must constantly adapt its strategies to a dynamic and crowded marketplace.

City National Bank's competitive landscape is shaped by its significant presence in Southern California and New York, leading to fierce regional rivalry. In these concentrated markets, the bank contends with numerous established local and national financial institutions all seeking to capture a share of the same affluent customer base and businesses. This intense competition is particularly evident in high-value segments like wealth management and commercial lending, where differentiation and strong client relationships are paramount.

Most banks, including City National Bank, offer a very similar core set of products and services. Think checking and savings accounts, various types of loans, and wealth management options. This similarity means customers can easily switch between institutions, increasing the pressure on banks to stand out.

This high degree of product overlap fuels intense price competition. Banks often compete on interest rates for deposits and loans, and on fees for services. For instance, in 2024, the average interest rate on savings accounts hovered around 0.45%, with some online banks offering significantly higher yields, forcing traditional banks to adjust.

To combat this, City National Bank and its competitors focus on differentiation. This often means excelling in customer service, investing heavily in user-friendly digital platforms, and developing specialized offerings for niche markets. For example, many banks are enhancing their mobile app capabilities and offering personalized financial advice to attract and retain clients.

Digital Transformation and AI Adoption

The banking sector's intense focus on digital transformation, particularly the integration of AI and generative AI, significantly heightens competitive rivalry. Banks are pouring resources into these technologies to refine customer interactions, offer tailored financial products, and streamline internal processes. For instance, in 2024, many leading financial institutions announced substantial increases in their technology budgets, with a notable portion allocated to AI development and implementation.

Those institutions that fail to keep pace with these technological advancements risk falling behind more innovative competitors. This digital divide can lead to a loss of market share as customers gravitate towards banks offering superior digital experiences and more personalized services. The pressure to innovate is immense, as early adopters of AI are already demonstrating enhanced operational efficiencies and a stronger ability to attract and retain customers.

- AI Investment Surge: Many banks are projecting double-digit percentage increases in AI spending for 2024 compared to 2023, aiming to leverage AI for fraud detection, credit scoring, and customer service automation.

- Customer Experience Focus: Banks are leveraging AI to provide 24/7 customer support through chatbots and to offer personalized financial advice, aiming to boost customer satisfaction scores by up to 15% in the next two years.

- Operational Efficiency Gains: Adoption of AI is enabling banks to automate routine tasks, reducing operational costs by an estimated 10-20% in areas like back-office processing and compliance.

- Competitive Disruption: Fintech companies and challenger banks, often built with modern technology stacks, are using AI to offer competitive products and services, forcing traditional banks to accelerate their own digital transformation efforts.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) are significantly reshaping the banking and wealth management industries. This heightened activity is fueled by a need for consolidation, the pursuit of greater scale, and the strategic acquisition of new technologies or market reach. For instance, in 2024, the financial services sector continued to see substantial M&A deals, with reports indicating a strong pipeline of transactions aimed at achieving greater efficiency and competitive advantage.

This trend directly intensifies competitive rivalry. As larger entities emerge through mergers, they often possess greater resources, broader product offerings, and enhanced market power, presenting a more formidable challenge to existing players like City National Bank. The consolidation can lead to fewer, but larger, competitors, making it harder for smaller or mid-sized banks to compete effectively on price or service breadth.

- Increased Consolidation: The banking sector saw a notable uptick in M&A in 2024, with several multi-billion dollar deals announced, aiming to create larger, more dominant financial institutions.

- Capability Acquisition: Many banks are acquiring fintech companies or specialized wealth management firms to gain access to new technologies and customer segments, thereby increasing competitive pressure.

- Scale as a Driver: The pursuit of economies of scale remains a primary motivator for M&A, enabling larger banks to reduce costs per transaction and invest more heavily in innovation.

The competitive rivalry for City National Bank is intense due to a fragmented market with thousands of players, from large national banks to agile fintechs. This fragmentation, coupled with a high degree of product similarity across institutions, forces banks to compete fiercely on price, particularly interest rates and fees. For example, in 2024, the average savings account interest rate was around 0.45%, with online banks often offering higher yields, pressuring traditional banks to adjust their offerings.

Technological advancements, especially in AI, are further escalating this rivalry. Banks are investing heavily in AI to enhance customer experience and operational efficiency, with many projecting double-digit percentage increases in AI spending for 2024. Those that lag in digital transformation risk losing market share to more innovative competitors. This digital arms race is critical for customer retention and acquisition.

Mergers and acquisitions are also a significant factor, leading to consolidation and the emergence of larger, more resource-rich competitors. In 2024, the financial services sector saw substantial M&A activity, with banks acquiring fintechs to gain technological capabilities and market reach. This trend creates a more challenging environment for mid-sized banks like City National Bank, requiring them to constantly innovate and differentiate their services to maintain a competitive edge.

| Competitive Factor | Description | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | Thousands of financial institutions compete. | Ongoing, with continued presence of community banks and fintechs. |

| Product Homogeneity | Similar core banking products offered. | High degree of overlap; differentiation is key. |

| Price Competition | Competition on interest rates and fees. | Average savings rates around 0.45% in 2024; online banks offer higher yields. |

| Digital Transformation & AI | Investment in technology for customer experience and efficiency. | Double-digit percentage increases in AI spending projected for 2024; AI adoption for fraud detection, credit scoring, and customer service. |

| Mergers & Acquisitions | Consolidation creating larger competitors. | Substantial M&A activity in 2024; acquisition of fintechs for capabilities. |

SSubstitutes Threaten

Fintech companies and neobanks present a significant threat of substitution to traditional banks like City National Bank. These digital-first entities offer specialized services such as online payments, peer-to-peer lending, and digital wallets, often at a lower cost and with greater convenience. For instance, the global fintech market was valued at an estimated $111.7 billion in 2023 and is projected to grow substantially, indicating a strong shift in consumer preference towards these alternatives for specific financial needs.

For wealth management services, independent investment firms, brokerage houses, and increasingly sophisticated robo-advisors present significant substitutes for traditional investment management firms like those within City National Bank. These alternatives frequently compete on price, with many robo-advisors charging annual fees as low as 0.25% compared to traditional management fees that can range from 1% to 2%.

The appeal of these substitutes lies in their accessibility and cost-effectiveness. For instance, platforms like Betterment and Wealthfront offer automated investment portfolios, rebalancing, and tax-loss harvesting, often with lower minimum investment requirements than many traditional advisors. This digital-first approach attracts a growing segment of investors, particularly younger demographics, seeking convenient and affordable ways to grow their wealth.

Alternative lending platforms represent a significant threat to City National Bank's traditional lending business. These platforms, including online lenders, crowdfunding sites, and direct financing from non-bank financial institutions, offer businesses and individuals access to capital outside of conventional banking channels.

These alternatives can often provide faster approval processes and more flexible terms compared to traditional bank loans, directly competing for City National Bank's customer base. For instance, the alternative lending market saw substantial growth, with online lenders alone originating billions in loans in 2024, demonstrating their increasing market share and appeal.

Cryptocurrencies and Blockchain-based Solutions

Cryptocurrencies and blockchain technology represent a growing, albeit still developing, substitute threat to traditional financial services, particularly in areas like payments and cross-border transactions. These digital assets and their underlying distributed ledger technology offer the potential for faster, more cost-effective, and transparent financial operations compared to established banking systems.

The adoption of cryptocurrencies for payments is steadily increasing, with global transaction volumes showing significant growth. For instance, in 2024, the total value of cryptocurrency transactions processed reached trillions of dollars, indicating a tangible shift in how some individuals and businesses conduct financial exchanges.

- Growing Transaction Volumes: Global cryptocurrency transaction volumes continue to expand, signaling increasing acceptance for payments.

- Cost and Speed Advantages: Blockchain solutions can offer lower fees and quicker settlement times for cross-border payments compared to traditional methods.

- Regulatory Evolution: While still a developing landscape, evolving regulatory frameworks in 2024 are shaping the competitive dynamics for crypto-based financial services.

- Decentralization Appeal: The inherent decentralization of blockchain technology appeals to users seeking alternatives to centralized financial institutions.

In-house Corporate Treasury Functions

Larger corporations are increasingly building sophisticated in-house treasury functions, reducing their need for external banking services. For instance, a significant portion of Fortune 500 companies now manage substantial portions of their foreign exchange hedging and cash pooling internally, bypassing traditional bank channels for these specific needs. This trend is driven by advancements in treasury management software and direct market access, making internal execution more efficient and cost-effective for certain transactions.

These internal capabilities act as direct substitutes for several core offerings of corporate banks.

- Reduced Reliance on Banks: Companies can perform functions like cash concentration, payment processing, and short-term investment management internally.

- Cost Savings: By bringing treasury operations in-house, businesses can potentially reduce fees associated with bank services.

- Enhanced Control: Internal treasury functions offer greater direct control over financial assets and exposures.

- Technological Advancements: Sophisticated treasury management systems (TMS) enable companies to manage complex financial operations efficiently, diminishing the need for bank-provided platforms.

The threat of substitutes for City National Bank's services is multifaceted, encompassing fintech innovations, alternative lending, cryptocurrencies, and in-house corporate treasury functions. These substitutes often offer greater convenience, lower costs, or specialized features that appeal to specific customer segments.

Fintechs and neobanks are directly challenging traditional banking models by providing streamlined digital experiences for payments, lending, and wealth management. For instance, the global fintech market reached an estimated $111.7 billion in 2023, showcasing significant customer migration to these platforms for specific financial needs.

Alternative lending platforms, including online lenders and crowdfunding, provide faster and more flexible access to capital, directly competing with City National Bank's loan offerings. The alternative lending market saw substantial growth in 2024, with online lenders alone originating billions in loans.

Cryptocurrencies and blockchain technology are emerging substitutes, particularly for cross-border payments and transactions, offering potential cost and speed advantages. In 2024, the total value of cryptocurrency transactions processed reached trillions of dollars, indicating a growing adoption rate.

Additionally, large corporations increasingly manage treasury functions internally, reducing their reliance on banks for services like foreign exchange and cash management. This trend is driven by advanced treasury management software, enabling greater control and potential cost savings.

| Substitute Category | Key Offerings | Competitive Advantage | Market Trend/Data (2023-2024) |

|---|---|---|---|

| Fintech & Neobanks | Digital Payments, P2P Lending, Digital Wallets | Lower Costs, Greater Convenience | Global Fintech Market: $111.7B (2023) |

| Wealth Management Alternatives | Robo-Advisors, Independent Firms | Lower Fees (e.g., 0.25% vs. 1-2%), Accessibility | Robo-advisor fees often significantly lower than traditional management fees. |

| Alternative Lending | Online Lending, Crowdfunding | Faster Approval, Flexible Terms | Billions in loans originated by online lenders in 2024. |

| Cryptocurrencies & Blockchain | Cross-border Payments, Digital Transactions | Potential Cost/Speed Benefits, Decentralization | Trillions in crypto transactions processed in 2024. |

| In-house Corporate Treasury | Cash Pooling, FX Hedging, Payment Processing | Enhanced Control, Potential Cost Savings | Significant portion of Fortune 500 companies managing treasury functions internally. |

Entrants Threaten

The banking sector faces substantial hurdles for newcomers due to rigorous regulatory frameworks. These include demanding licensing procedures, stringent capital adequacy ratios, and the continuous need to adhere to evolving financial legislation. For instance, in 2024, many jurisdictions maintained or even increased capital reserve requirements for banks, making it incredibly expensive for new entities to establish a foothold and meet these essential financial obligations.

Established institutions like City National Bank leverage deep-seated brand loyalty and trust, cultivated over decades of reliable service. This existing customer base is a significant barrier, as new entrants must invest heavily in marketing and customer acquisition to even begin to erode this established goodwill. In 2024, for instance, major banks continued to report high customer retention rates, underscoring the difficulty for newcomers to gain traction.

Entering the banking sector demands immense capital for cutting-edge, secure technology. This includes everything from core processing systems to sophisticated digital customer interfaces and robust cybersecurity defenses. For instance, in 2024, major banks continued to allocate billions towards digital transformation initiatives, with estimates suggesting global banking IT spending could reach over $600 billion.

New players must either build these complex systems from scratch or acquire them, presenting a significant barrier to entry. The sheer scale of investment required for compliant and competitive technological infrastructure means only well-funded entities can realistically consider entering the market.

Fintech Expansion and Non-Traditional Players

The threat of new entrants into the banking sector, particularly for a firm like City National Bank, is amplified by the rise of fintech. While established regulatory hurdles and capital requirements remain, these are often circumvented by specialized fintech firms. These companies can focus on niche services, like payments or lending, often with a lighter regulatory touch, allowing them to enter the market more swiftly and with lower initial investment.

The landscape is further complicated by tech giants and other non-financial entities venturing into financial services through embedded finance. This strategy integrates financial products directly into non-financial platforms, effectively blurring traditional industry boundaries. For instance, a major e-commerce platform might offer point-of-sale financing, directly competing with traditional banking services without operating as a bank itself.

In 2024, the fintech sector continued its robust growth. Global fintech funding, while fluctuating, remained significant, with specific areas like digital payments and embedded finance attracting substantial investment. For example, reports indicated that payments-related fintechs continued to see strong deal activity, demonstrating the ongoing appeal of these less capital-intensive entry points into financial services.

- Fintechs bypass traditional barriers by focusing on niche services, reducing initial capital and regulatory burdens.

- Tech giants and non-financial companies are entering the financial services space via embedded finance, blurring industry lines.

- In 2024, fintech, particularly in payments and embedded finance, continued to attract significant investment, highlighting the ongoing threat of new, agile competitors.

Access to Funding and Deposit Gathering

New entrants in the banking sector face significant hurdles in accessing funding and gathering deposits. Establishing a robust and cost-effective deposit base is crucial for any financial institution's stability and growth. For instance, as of early 2024, the average interest rate on savings accounts from established banks continued to offer competitive yields, making it difficult for new players without a strong brand presence to attract similar levels of customer funds.

The ability to secure wholesale funding or access credit markets also presents a challenge. New banks often lack the established relationships and credit history that incumbent institutions possess, potentially leading to higher borrowing costs. This can directly impact their profitability and ability to offer competitive loan products.

Consider these points regarding access to funding and deposit gathering:

- Deposit Gathering Challenges: New banks must overcome the inertia of existing customer relationships and build trust to attract deposits, often requiring substantial marketing investment.

- Wholesale Funding Costs: Without a large, stable deposit base, new entrants may rely more heavily on wholesale funding, which can be more volatile and expensive, especially during periods of market stress.

- Regulatory Capital Requirements: Meeting stringent regulatory capital requirements necessitates a strong and consistent funding structure, which is harder to achieve for nascent institutions.

- Branch Network and Technology Investment: While digital-first models can reduce overhead, significant investment is still needed in technology and potentially a limited physical presence to facilitate deposit gathering and customer onboarding.

The threat of new entrants for City National Bank remains moderate but is evolving. While traditional banking faces high barriers like capital requirements and regulatory hurdles, fintech and embedded finance models offer agile pathways for new players. In 2024, continued investment in fintech, especially in payments and specialized lending, demonstrated the persistent challenge of nimble competitors bypassing established norms. Even tech giants are integrating financial services, creating new competitive fronts.

| Barrier Type | Impact on New Entrants | 2024 Context |

|---|---|---|

| Regulatory & Licensing | Very High | Stringent capital and compliance remain, with some jurisdictions tightening rules. |

| Capital Requirements | Very High | Significant investment needed for technology and operations, with global IT spending in banking exceeding $600 billion in 2024. |

| Brand Loyalty & Trust | High | Established banks maintain high customer retention rates, making acquisition costly. |

| Technology & Infrastructure | Very High | Massive investment required for secure, modern banking systems. |

| Access to Funding & Deposits | High | Attracting deposits and securing wholesale funding is difficult without an established base and trust. |

| Fintech & Embedded Finance | Moderate and Growing | Niche fintechs and embedded finance offerings lower entry barriers for specific services. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for City National Bank is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports. This approach ensures a comprehensive understanding of the competitive landscape.