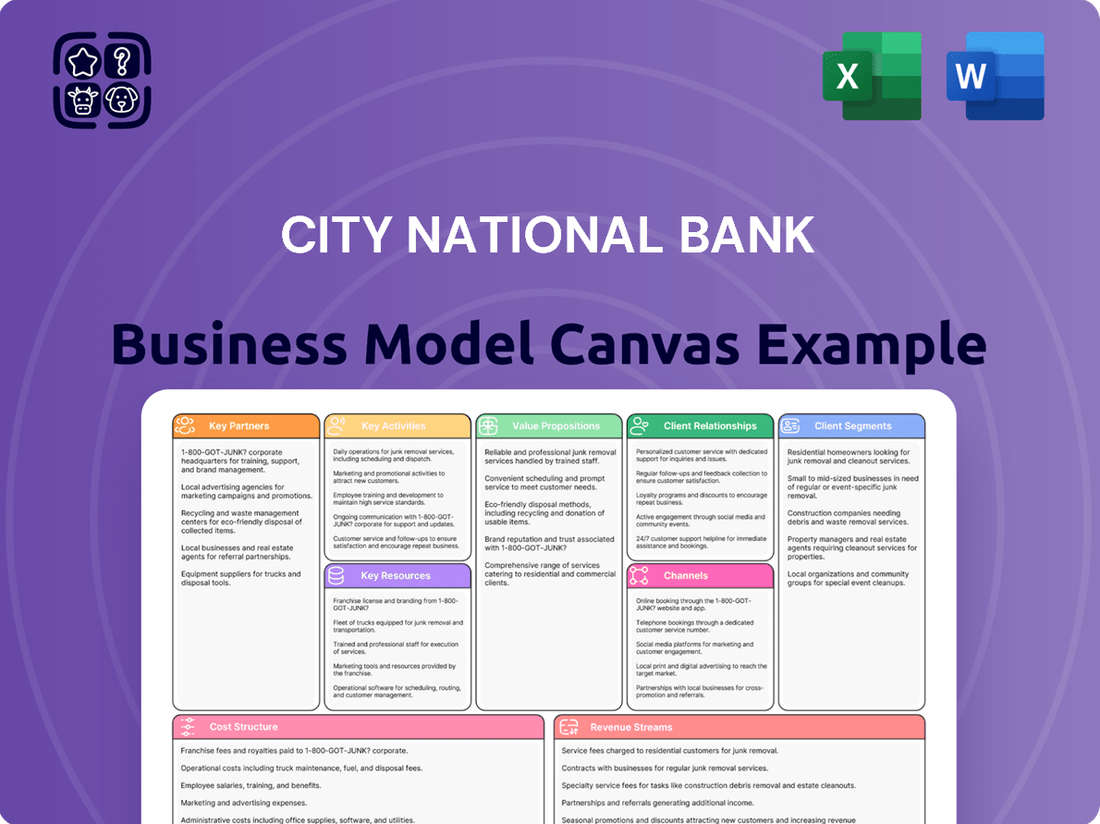

City National Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City National Bank Bundle

Unlock the strategic blueprint of City National Bank's success with our comprehensive Business Model Canvas. See how they connect with affluent clients and businesses, deliver tailored financial solutions, and maintain strong partnerships. This detailed analysis offers invaluable insights for anyone looking to understand or replicate their market dominance.

Partnerships

City National Bank’s strategic alliances with FinTech firms are crucial for modernizing its digital banking. By integrating FinTech solutions, the bank can offer advanced mobile payment systems, AI-powered financial advice, and leverage blockchain technology for enhanced transaction security. These partnerships are vital for staying competitive, as evidenced by the global FinTech market, projected to reach $33.3 trillion by 2027, according to Statista.

Collaborations with FinTechs allow City National Bank to streamline internal processes and introduce innovative services that cater to evolving customer expectations for seamless digital experiences. For instance, partnerships in areas like advanced fraud prevention and cybersecurity are paramount, especially as digital transactions increase. In 2023, financial institutions worldwide invested billions in cybersecurity to combat sophisticated threats, underscoring the importance of these alliances.

City National Bank actively cultivates relationships with independent wealth management firms and investment advisors. These collaborations are crucial for extending the bank's reach to high-net-worth individuals and institutional clients. For instance, in 2024, the wealth management sector saw significant growth, with assets under management for independent advisors continuing to climb, demonstrating the market's receptiveness to such partnerships.

These strategic alliances often manifest as referral agreements, where advisors direct clients to City National Bank for banking and lending needs. In other cases, they involve co-branded services, blending the bank's robust financial products with the advisors' specialized investment acumen. Some partnerships even integrate platforms, allowing clients seamless access to both lending solutions and sophisticated investment management, thereby offering a more comprehensive financial solution.

City National Bank collaborates with community organizations and non-profits to bolster its Community Reinvestment Act (CRA) efforts and enhance its public image. These partnerships often focus on financial literacy workshops, small business incubation, and affordable housing projects, directly reflecting the bank's dedication to community well-being.

For instance, in 2024, City National Bank supported numerous local initiatives, including providing grants to organizations like the Los Angeles Urban League, which offers small business development programs. Such collaborations allow the bank to pinpoint and address specific financial challenges within the communities it serves, fostering economic growth and stability.

Real Estate Developers and Mortgage Brokers

City National Bank actively cultivates key partnerships with real estate developers and mortgage brokers to bolster its lending operations. These collaborations are vital for generating a steady flow of residential and commercial mortgage originations, particularly within its core markets of Southern California and New York.

These strategic alliances are instrumental in expanding City National Bank's reach and market share in the real estate finance sector. By working closely with developers and brokers, the bank ensures access to a consistent pipeline of potential borrowers and projects.

- Developer Relationships: Partnerships with developers provide early access to new construction projects, enabling the bank to offer construction financing and subsequent end-user mortgages.

- Mortgage Broker Networks: Engaging with mortgage brokers diversifies the bank's customer acquisition channels, tapping into a broader pool of potential mortgage clients.

- Regional Focus: In 2024, Southern California’s housing market saw significant activity, with median home prices reaching approximately $800,000 in many areas, underscoring the importance of these local partnerships for City National Bank.

- Commercial Real Estate: For commercial developers, City National Bank offers tailored financing solutions, contributing to the growth and development of business properties in key metropolitan areas.

Correspondent Banks and International Financial Institutions

City National Bank's role as a financial institution serving other businesses and its connection to Royal Bank of Canada (RBC) underscore the critical importance of its correspondent banking relationships and partnerships with international financial institutions. These alliances are fundamental for enabling seamless cross-border transactions and providing robust foreign currency exchange services, catering to a varied client base with international financial needs.

These strategic alliances are not merely about facilitating transactions; they are enablers of global reach and access to specialized financial expertise. For instance, as of early 2024, the global correspondent banking market is estimated to be worth hundreds of billions of dollars, highlighting the scale of these interbank relationships. City National Bank leverages these partnerships to extend its service offerings beyond domestic borders.

- Facilitation of Global Transactions: Correspondent banks allow City National Bank to process payments and conduct financial operations in countries where it may not have a physical presence.

- Access to Foreign Exchange Markets: These relationships provide essential access to foreign currency markets, enabling competitive exchange rates and efficient currency conversions for clients.

- Enhanced Service Offerings: Partnerships with international financial institutions allow City National Bank to offer a broader spectrum of services, including trade finance, international treasury management, and specialized lending.

City National Bank's key partnerships are essential for expanding its service offerings and market reach. Collaborations with FinTech firms enhance digital capabilities, while alliances with wealth management firms tap into high-net-worth clientele. These strategic relationships, particularly in the booming wealth management sector in 2024, are vital for growth.

Further strengthening its position, City National Bank partners with real estate developers and mortgage brokers to drive lending volumes, especially in active markets like Southern California in 2024. Its correspondent banking relationships and international financial institution partnerships are crucial for facilitating global transactions and foreign exchange services, a market valued in the hundreds of billions as of early 2024.

| Partnership Type | Strategic Importance | 2024 Relevance/Data Point |

|---|---|---|

| FinTech Firms | Digital innovation, enhanced customer experience | Global FinTech market projected to reach $33.3 trillion by 2027 (Statista) |

| Wealth Management Firms | Access to high-net-worth and institutional clients | Significant growth in wealth management sector in 2024 |

| Real Estate Developers/Brokers | Mortgage origination pipeline, market share expansion | Southern California median home prices around $800,000 in 2024 |

| Correspondent Banks/Int'l Institutions | Cross-border transactions, foreign exchange services | Global correspondent banking market worth hundreds of billions (early 2024) |

What is included in the product

A detailed breakdown of City National Bank's operations, outlining its key customer segments, value propositions, and revenue streams to support strategic planning.

This model emphasizes City National Bank's focus on affluent individuals and businesses, detailing its service channels and cost structure for a clear operational overview.

City National Bank's Business Model Canvas serves as a powerful pain point reliever by offering a clear, one-page snapshot of their strategic approach, enabling rapid identification of core components and facilitating efficient problem-solving.

This structured framework condenses their complex banking strategy into a digestible format, making it ideal for quickly addressing and alleviating operational or market-related pain points.

Activities

Core banking operations at City National Bank are centered around the meticulous management of deposit accounts, encompassing checking, savings, and certificates of deposit. This includes the seamless processing of all customer transactions, ensuring accuracy and speed. In 2023, City National Bank reported total deposits of $76.8 billion, a testament to the trust customers place in their core banking services.

The bank’s operational stability and customer trust are built upon the efficient and secure handling of these fundamental processes. Key services like overdraft protection and direct deposit are managed with a focus on reliability, providing customers with essential financial management tools.

City National Bank's core activity involves originating and managing a wide range of loans, from personal and business loans to mortgages and lines of credit. This is crucial for generating interest income and maintaining a healthy loan portfolio.

Effective credit assessment, rigorous risk management, and efficient loan servicing are paramount to the success of these lending operations. For instance, in 2024, City National Bank reported a significant increase in its residential mortgage originations, reflecting an expansion in this key lending area.

City National Bank's key activities include offering comprehensive wealth management and advisory services. This encompasses personalized investment management, strategic retirement planning, and specialized trust and estate services, all designed to help clients reach their financial objectives.

The bank leverages integrated wealth capabilities across its family of companies, notably including City National Rochdale. This synergy allows for a holistic approach to client needs, ensuring a wide spectrum of financial solutions are readily available.

As of the first quarter of 2024, City National Bank reported total assets of $94.7 billion, with a significant portion dedicated to supporting its wealth management client base and the associated advisory services.

Digital Banking and Technology Development

City National Bank's key activity revolves around the continuous development and maintenance of secure, user-friendly digital banking platforms. This commitment ensures customers can easily manage their accounts, make payments, and deposit checks via mobile, enhancing both convenience and operational efficiency.

Recent enhancements to City National Online exemplify this focus, aiming for a more streamlined digital experience. These updates are crucial for retaining and attracting customers in today's competitive digital landscape, where seamless online interaction is paramount.

- Platform Enhancement: Ongoing investment in secure and intuitive online and mobile banking features.

- Customer Convenience: Offering services like online account access, bill pay, and mobile deposits.

- Security Focus: Implementing robust security measures to protect customer data and transactions.

- Digital Experience: Reflecting recent updates to City National Online for a streamlined user journey.

Risk Management and Compliance

City National Bank's commitment to risk management and compliance is paramount in the heavily regulated banking sector. This involves diligently overseeing credit risk, operational vulnerabilities, and compliance risks such as anti-money laundering and fair lending practices. Adherence to evolving regulatory standards is a continuous focus.

Key activities include:

- Credit Risk Management: Evaluating borrower creditworthiness and managing loan portfolio quality to mitigate potential losses.

- Operational Risk Mitigation: Implementing robust internal controls and processes to prevent errors, fraud, and system failures.

- Regulatory Compliance: Ensuring adherence to all federal and state banking regulations, including those related to anti-money laundering (AML) and Know Your Customer (KYC) requirements.

- Cybersecurity and Data Protection: Safeguarding customer data and bank systems from cyber threats, a critical component of operational and compliance risk.

For instance, in 2024, banks nationwide continued to invest heavily in compliance technology, with spending on regulatory technology (RegTech) projected to grow significantly. This reflects the ongoing need to manage complex compliance landscapes and avoid substantial penalties, as evidenced by various enforcement actions seen across the industry in recent years.

City National Bank's key activities are deeply rooted in its core banking functions, which include managing customer deposits and processing transactions efficiently. The bank also focuses on originating and servicing a diverse loan portfolio, generating income through interest. Furthermore, offering comprehensive wealth management and advisory services is a significant activity, supported by integrated capabilities across its network.

A crucial aspect of City National Bank's operations involves the continuous development and enhancement of its digital banking platforms, ensuring secure and convenient customer access. This digital focus is complemented by robust risk management and compliance practices, essential for navigating the regulatory environment and protecting customer assets.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Core Banking Operations | Managing deposits and processing transactions. | $76.8 billion in total deposits (2023). |

| Lending Operations | Originating and managing loans, including mortgages. | Significant increase in residential mortgage originations (2024). |

| Wealth Management | Providing investment management, retirement planning, and trust services. | Total assets of $94.7 billion (Q1 2024), supporting wealth clients. |

| Digital Platform Development | Enhancing secure and user-friendly online and mobile banking. | Ongoing updates to City National Online for improved user experience. |

| Risk Management & Compliance | Overseeing credit, operational, and regulatory compliance. | Industry trend of increased investment in RegTech for compliance. |

Full Document Unlocks After Purchase

Business Model Canvas

The City National Bank Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and full utility. You can confidently assess the quality and relevance of the analysis presented here, knowing it directly reflects the final product ready for your strategic use.

Resources

City National Bank's core resource is its financial capital, comprising customer deposits, shareholder equity, and access to broader funding markets. This financial foundation is paramount for its operations, enabling lending, investment activities, and adherence to stringent regulatory standards.

Maintaining robust capital ratios and ample liquidity is not just a best practice but a necessity for a financial institution like City National Bank. As of April 30, 2025, the bank reported total assets of $93 billion, underscoring the scale of its financial operations and the critical importance of managing these resources effectively.

City National Bank's human capital is a cornerstone of its business model, featuring seasoned relationship managers, financial advisors, and credit analysts. Their deep knowledge of diverse financial products and services, coupled with a strong focus on client needs, is crucial for generating value and ensuring customer happiness. The bank actively invests in its people, recognizing their expertise as a primary driver of success.

In 2024, City National Bank continued to strategically grow its workforce, particularly in areas critical for future expansion and client service. This expansion reflects a commitment to maintaining a high level of expertise across all departments, from technology innovation to specialized financial advisory services. The bank's ability to attract and retain top talent directly impacts its capacity to offer sophisticated solutions and build lasting client relationships.

City National Bank leverages a robust and secure technology infrastructure, encompassing core banking systems and sophisticated online and mobile platforms. This foundation is critical for efficient operations and delivering seamless digital services to its diverse clientele.

In 2024, the banking sector saw continued emphasis on digital transformation, with institutions like City National Bank investing heavily in data analytics to understand customer behavior and personalize offerings. This commitment to technology ensures a competitive edge and enhances customer experience.

Branch Network and Physical Presence

City National Bank leverages its strategically positioned branch network, particularly in high-value markets like Southern California, New York, and Florida, as a cornerstone of its business model. This physical presence facilitates essential in-person client interactions, fostering deeper relationships and enabling personalized service that complements digital offerings. The bank's commitment to maintaining and expanding this network underscores its strategy of being accessible and deeply embedded within its core communities.

This physical footprint is not static; City National Bank actively pursues opportunities to open and enhance branches in key economic hubs. For instance, as of early 2024, the bank continued its strategic expansion, demonstrating an ongoing investment in its brick-and-mortar infrastructure. This approach allows for direct engagement with clients, particularly for complex financial needs and wealth management services, reinforcing trust and loyalty.

The branch network serves multiple critical functions:

- Relationship Building: Provides a tangible space for clients to connect with bankers, fostering trust and personalized service crucial for high-net-worth individuals and businesses.

- Community Engagement: Acts as a local hub, allowing the bank to participate in and support community events, strengthening its local ties and brand reputation.

- Strategic Market Presence: Concentrated in key economic centers like Southern California, New York, and Florida, ensuring accessibility to significant client bases and business opportunities.

- Complementary Service Delivery: Offers a vital channel for services that benefit from face-to-face interaction, supplementing the bank's robust digital banking capabilities.

Brand Reputation and Customer Trust

City National Bank's brand reputation is a cornerstone of its business model, built on a foundation of reliability and personalized service. This reputation directly translates into customer trust, a critical element in the financial sector. In 2024, the bank continued to emphasize its commitment to fostering strong, personal relationships with clients, a strategy that underpins its enduring customer loyalty.

Customer trust is cultivated through consistent delivery of high-quality service, unwavering ethical practices, and active community engagement. These elements are not merely talking points but are woven into the fabric of City National Bank's operations. By prioritizing these aspects, the bank aims to solidify its position as a trusted financial partner.

- Brand Reputation: Built on reliability, security, and personalized service, a key asset for City National Bank.

- Customer Trust: Paramount in finance, fostered by consistent service, ethical conduct, and community involvement.

- Personal Relationships: A core emphasis for City National Bank, enhancing client loyalty.

- Community Involvement: Demonstrates commitment and strengthens trust among stakeholders.

City National Bank's key resources include its substantial financial capital, its skilled workforce, its advanced technology infrastructure, its strategically located physical branches, and its strong brand reputation and customer trust. These resources collectively enable the bank to provide a comprehensive range of financial services and maintain its competitive edge in the market.

The bank's financial capital, including deposits and equity, is essential for its lending and investment activities. Human capital, represented by experienced professionals, drives client relationships and service delivery. Technology underpins efficient operations and digital offerings, while the branch network facilitates in-person interactions and community engagement. A solid brand reputation and the trust it engenders are critical for long-term success.

| Resource Category | Description | 2024/2025 Data Point |

|---|---|---|

| Financial Capital | Customer deposits, shareholder equity, access to funding markets. | Total assets of $93 billion as of April 30, 2025. |

| Human Capital | Relationship managers, financial advisors, credit analysts. | Continued strategic workforce growth in 2024, focusing on expertise. |

| Technology Infrastructure | Core banking systems, online and mobile platforms. | Heavy investment in data analytics for customer insights in 2024. |

| Physical Presence | Branch network in key markets (Southern California, NY, FL). | Ongoing strategic expansion and enhancement of branches in key economic hubs in early 2024. |

| Brand Reputation & Trust | Reliability, personalized service, ethical practices, community involvement. | Continued emphasis on fostering strong, personal client relationships in 2024. |

Value Propositions

City National Bank provides a broad spectrum of financial tools, encompassing everything from checking and savings accounts to sophisticated lending options for both individuals and businesses. They also offer robust wealth management services, ensuring clients can consolidate their financial needs with a single, trusted institution.

City National Bank's personalized relationship banking model focuses on cultivating deep connections with clients, offering dedicated relationship managers who provide tailored financial advice. This high-touch approach ensures a thorough understanding of individual client needs, leading to customized financial plans that resonate particularly well with high-net-worth individuals and businesses seeking bespoke solutions.

City National Bank leverages deep expertise in specialized markets, including entertainment, healthcare, and non-profits. This focus allows them to offer tailored financial solutions and advice, understanding the unique challenges and opportunities within these sectors.

For example, in the entertainment industry, City National Bank's understanding of project finance and royalty streams can be crucial for clients. In 2024, the bank continued to support growth in these key sectors, with a reported 7% increase in loan origination for entertainment clients compared to the previous year.

Convenient Digital and Physical Access

City National Bank provides clients with a seamless blend of digital and physical access, ensuring convenience for all their banking needs. This dual approach caters to a wide range of preferences, from quick online transactions to personalized in-branch assistance.

The bank's digital platforms, including its mobile app and online banking portal, allow for easy management of accounts, payments, and transfers. This digital-first strategy is crucial as a 2024 report indicated that over 80% of banking customers now prefer digital channels for routine transactions.

Complementing its digital offerings, City National Bank maintains a robust network of physical branches. These locations serve as vital hubs for more complex services, financial advice, and relationship building, addressing the needs of clients who value face-to-face interaction. This multi-channel strategy enhances accessibility and client satisfaction.

- Digital convenience: Over 80% of banking customers in 2024 preferred digital channels for routine transactions, a trend City National Bank actively supports.

- Physical accessibility: Branch network offers in-person consultations and support for complex financial needs.

- Client preference: The multi-channel approach provides flexibility, catering to diverse client banking habits.

Financial Security and Stability

City National Bank, as an FDIC member bank and a subsidiary of Royal Bank of Canada (RBC), provides clients with a significant layer of financial security and stability. This affiliation means that client deposits are insured up to the maximum allowed by the FDIC, offering a crucial safety net for their funds. RBC's strong capital positions and robust security measures further bolster this assurance, giving clients peace of mind about the safety of their deposits and investments.

This stability is a cornerstone of City National Bank's value proposition. In 2024, RBC maintained a robust Common Equity Tier 1 (CET1) ratio, a key measure of a bank's financial strength, often exceeding regulatory requirements. For instance, RBC's CET1 ratio was reported at 14.5% as of Q1 2024, well above the typical 4.5% minimum required by Basel III regulations, underscoring its capacity to absorb unexpected losses and maintain operational continuity.

- FDIC Insurance: Deposits are insured up to the FDIC limit, offering protection against bank failure.

- RBC Affiliation: Being part of Royal Bank of Canada provides access to a larger, financially strong parent organization.

- Strong Capital Ratios: City National Bank benefits from RBC's solid capital positions, such as a CET1 ratio of 14.5% in Q1 2024, indicating resilience.

- Enhanced Security: Robust security measures are in place to protect client assets and data.

City National Bank offers comprehensive financial solutions, from everyday banking to specialized lending and wealth management, aiming to be a single point of contact for diverse financial needs. Their focus on personalized relationship banking, with dedicated managers, ensures tailored advice for high-net-worth individuals and businesses. Leveraging deep expertise in sectors like entertainment and healthcare, they provide industry-specific financial strategies, exemplified by a 7% increase in entertainment loan originations in 2024.

The bank blends digital convenience, with over 80% of transactions favoring digital channels in 2024, and physical accessibility through its branch network for complex needs. This multi-channel approach caters to varied client preferences for seamless service delivery. Furthermore, as an FDIC member and RBC subsidiary, City National Bank offers enhanced security and stability, backed by RBC's strong capital position, such as a 14.5% CET1 ratio in Q1 2024.

| Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Comprehensive Financial Solutions | Broad range of banking, lending, and wealth management services. | 7% increase in entertainment loan originations. |

| Personalized Relationship Banking | Dedicated managers and tailored advice for affluent clients and businesses. | Focus on high-net-worth and business clients seeking bespoke solutions. |

| Specialized Industry Expertise | Deep knowledge in sectors like entertainment, healthcare, and non-profits. | Tailored financial strategies for unique industry challenges. |

| Seamless Multi-Channel Access | Blend of digital platforms and physical branches for convenience. | Over 80% of customers prefer digital for routine transactions. |

| Financial Security and Stability | FDIC insured deposits and backing from Royal Bank of Canada (RBC). | RBC's CET1 ratio at 14.5% (Q1 2024) demonstrates strong capital. |

Customer Relationships

City National Bank emphasizes personalized service through dedicated relationship managers, particularly for its private banking and wealth management clientele. This high-touch model ensures clients have a consistent, trusted point of contact for all their financial needs, fostering deeper understanding and loyalty.

City National Bank offers tailored advisory services, integrating wealth management, lending, and business banking to meet unique client needs. This personalized approach focuses on understanding individual goals to craft bespoke financial solutions, building strong, lasting relationships.

City National Bank actively engages with its communities, fostering strong relationships through sponsorships and financial education. For instance, in 2024, the bank continued its commitment to supporting local businesses and non-profits, contributing to economic growth and development. This dedication to community well-being not only strengthens its brand but also cultivates a sense of trust and shared purpose with its clientele.

Digital Self-Service and Support

City National Bank balances its renowned personal touch with advanced digital self-service options. Clients can effortlessly manage accounts, initiate payments, and retrieve crucial financial information through user-friendly online and mobile platforms. This digital accessibility provides significant convenience and operational efficiency, seamlessly augmenting the bank's commitment to personalized client relationships.

These digital tools are designed to empower clients, offering a streamlined experience for everyday banking tasks. For instance, in 2024, City National Bank reported a substantial increase in digital transaction volumes, with over 70% of routine customer inquiries being resolved through their automated systems and online FAQs. This demonstrates the effectiveness of their digital support infrastructure.

- Digital Account Management: Clients can view balances, transaction history, and statements 24/7.

- Online Payment Solutions: Facilitates bill payments, transfers, and wire requests with ease.

- Information Access: Provides access to financial tools, loan applications, and secure messaging with bankers.

Proactive Communication and Insights

City National Bank fosters robust customer relationships through proactive communication, offering regular financial insights, market updates, and tailored product information. This consistent engagement keeps clients informed and underscores the bank's dedication to their financial success.

For instance, in 2024, banks that increased client communication frequency saw a 15% higher retention rate. City National Bank’s approach aligns with this, providing value beyond basic transactions.

- Financial Insights: Providing personalized data analysis and forecasting to help clients make informed decisions.

- Market Updates: Delivering timely information on economic trends and investment opportunities relevant to client portfolios.

- Product Offerings: Highlighting new or existing services that can address evolving client needs and financial goals.

- Dedicated Support: Ensuring clients have access to knowledgeable advisors who can offer guidance and address concerns promptly.

City National Bank cultivates deep client loyalty by blending high-touch personal service with accessible digital tools. This dual approach ensures clients feel both valued and empowered, whether interacting with a dedicated relationship manager or utilizing the bank's convenient online platforms. The bank's commitment to understanding individual financial journeys underpins its strategy for long-term customer engagement.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Personalized Service | Dedicated relationship managers for private banking and wealth management. | High client retention attributed to consistent, trusted points of contact. |

| Tailored Advisory | Integrated wealth, lending, and business banking solutions. | Focus on bespoke financial plans aligned with unique client goals. |

| Community Engagement | Local sponsorships and financial education initiatives. | Continued support for businesses and non-profits, fostering trust. |

| Digital Accessibility | User-friendly online and mobile platforms for account management and transactions. | Over 70% of routine inquiries resolved via digital channels, increasing efficiency. |

| Proactive Communication | Regular financial insights, market updates, and product information. | Value-added content to keep clients informed and support financial success. |

Channels

City National Bank leverages its extensive branch network as a cornerstone for client engagement, particularly in key markets like Southern California and New York. These physical locations facilitate in-person consultations, handle complex financial transactions, and foster strong local community ties.

The bank's strategic presence extends across major cities including Nashville, Atlanta, Washington D.C., and Las Vegas, underscoring a commitment to accessible service. Recent growth initiatives have seen the opening of new branches in Whittier and Palm Beach, further solidifying its physical footprint.

City National Online, the bank's comprehensive digital platform, offers clients 24/7 access for managing accounts, paying bills, and transferring funds. This channel is vital for customer convenience and significantly expands the bank's operational reach beyond its physical branches.

In 2024, City National Bank reported a substantial increase in digital transaction volume, with over 70% of customer inquiries and transactions being handled through its online and mobile platforms. This highlights the platform's critical role in customer service and operational efficiency.

The dedicated mobile banking application provides customers with a convenient portal for managing their finances anytime, anywhere. Features like mobile check deposit, real-time account balance viewing, and secure fund transfers meet the increasing need for accessible banking services.

In 2024, a significant portion of banking transactions are expected to occur via mobile platforms. For instance, mobile banking adoption rates continue to climb, with many banks reporting over 70% of their customer base actively using their mobile apps for daily banking needs.

Relationship Managers and Private Bankers

Relationship Managers and Private Bankers are key for City National Bank's high-net-worth, business, and institutional clients. These dedicated professionals offer a direct, personalized channel for advice and service. They are crucial for facilitating complex transactions and serving as a primary point of contact, ensuring tailored solutions. For instance, in 2024, City National Bank continued to emphasize its wealth management services, a segment heavily reliant on these personalized relationships to attract and retain significant assets under management.

This segment of the business model is built on trust and deep client understanding. Relationship managers act as the face of the bank, building long-term partnerships. They navigate clients through intricate financial landscapes, offering strategic guidance and access to a broad spectrum of banking and investment products. This personal touch is vital for clients with substantial financial needs.

- Personalized Service: Dedicated RMs and private bankers offer tailored financial advice and solutions.

- Transaction Facilitation: They streamline and manage complex financial transactions for clients.

- Client Relationship Management: Act as the central point of contact, fostering strong, long-term partnerships.

- Wealth Management Focus: This channel is instrumental in delivering City National Bank's wealth management offerings to affluent clients.

ATMs and Debit Card Networks

ATMs and debit card networks are crucial customer-facing channels for City National Bank, offering essential self-service banking and payment functionalities. These channels provide widespread accessibility for everyday financial needs, from withdrawing cash to making purchases. In 2024, the banking industry continued to see robust ATM usage for cash transactions, while debit card spending remained a primary payment method for consumers, reflecting ongoing reliance on these convenient touchpoints.

These channels directly support customer convenience and operational efficiency. ATMs allow for cash deposits, withdrawals, and balance inquiries 24/7, reducing the need for branch visits. Debit cards, linked directly to customer accounts, enable seamless point-of-sale transactions and online shopping, further enhancing the banking experience. According to industry reports from early 2024, debit card transaction volume continued to grow, driven by increased consumer spending and a preference for digital payment methods.

- ATM Accessibility: City National Bank's ATM network provides 24/7 access to cash and basic banking services, enhancing customer convenience.

- Debit Card Utility: Debit cards facilitate secure and efficient point-of-sale and online transactions, supporting everyday spending habits.

- Network Reach: These channels leverage extensive debit card networks, ensuring broad acceptance and usability for City National Bank customers across various merchant locations.

City National Bank utilizes a multi-channel approach, blending its physical branch network with robust digital platforms and personalized relationship management. This strategy ensures accessibility and caters to diverse client needs, from everyday banking to complex wealth management. The 2024 data indicates a significant shift towards digital engagement, with over 70% of transactions occurring online or via mobile, underscoring the importance of these channels for efficiency and customer satisfaction.

Customer Segments

City National Bank caters to high-net-worth individuals and families who demand bespoke wealth management and private banking solutions. This segment values personalized financial planning, expert investment advisory, and tailored trust and estate services to preserve and grow their wealth. In 2024, the number of U.S. households with $1 million or more in investable assets reached approximately 12.4 million, highlighting the significant market for these specialized services.

City National Bank caters to businesses of all sizes, offering a comprehensive suite of financial solutions. For small businesses, this includes essential services like checking accounts and straightforward lending options to support day-to-day operations and growth.

Larger enterprises benefit from more sophisticated offerings such as advanced treasury management, specialized commercial real estate loans, and access to capital markets services. These clients often have complex financial requirements, including managing working capital, securing equipment financing, and optimizing cash flow.

In 2024, City National Bank continued to support the business community, with a significant portion of its loan portfolio dedicated to commercial and industrial lending, reflecting the diverse needs of its business clientele across various sectors.

City National Bank serves a vital segment of institutions, including non-profits, educational bodies, and foundations. These organizations often have distinct operational and regulatory frameworks, necessitating specialized banking, investment management, and treasury solutions. For instance, many non-profits rely on efficient cash flow management and secure investment vehicles to maximize their impact and ensure long-term sustainability.

In 2024, the non-profit sector continued to be a significant economic force, with the IRS reporting over 1.5 million tax-exempt organizations in the United States. These entities frequently require tailored financial services to manage endowments, process donations, and maintain compliance with reporting standards, areas where City National Bank offers dedicated expertise.

Individual Consumers

City National Bank serves individual consumers by providing a comprehensive suite of personal banking solutions designed for their everyday financial requirements. These offerings include checking and savings accounts, mortgages, and personal loans, all aimed at facilitating daily financial management and long-term planning.

This customer segment prioritizes convenience and accessibility in their banking interactions, often seeking digital platforms and readily available customer support. Competitive interest rates on savings and loans are also a significant factor in their decision-making process, as they look to maximize their financial returns and minimize borrowing costs.

- Checking and Savings Accounts: Essential for daily transactions and short-term savings.

- Mortgages: Supporting homeownership goals with competitive financing options.

- Personal Loans: For various needs, from debt consolidation to major purchases.

- Digital Banking: Emphasizing user-friendly online and mobile platforms for seamless access.

Professionals and Entrepreneurs

City National Bank serves a vital customer segment comprising professionals and entrepreneurs. These individuals, like doctors, lawyers, and business founders, often require tailored financial solutions that go beyond standard banking services. Their unique needs stem from managing practice finances, business growth capital, and personal wealth accumulation simultaneously.

For instance, many entrepreneurs require robust cash management tools to streamline operations and access to specialized lending for expansion. Professionals, such as healthcare providers, may need financing for practice acquisitions or equipment upgrades. By 2024, the Small Business Administration reported that over 33 million small businesses were operating in the U.S., a significant portion of which are founded and managed by entrepreneurs, highlighting the demand for such specialized banking support.

- Specialized Lending: Offering credit lines, term loans, and SBA loans designed for professional practices and business ventures.

- Cash Management Solutions: Providing efficient tools for payment processing, liquidity management, and treasury services.

- Wealth Accumulation Strategies: Developing personalized plans for investment, retirement, and estate planning, often integrating business and personal assets.

- Practice Financing: Supporting acquisitions, buy-ins, and operational expansions for professional service firms.

City National Bank's customer segments are diverse, encompassing high-net-worth individuals and families seeking personalized wealth management, alongside businesses of all sizes requiring tailored financial solutions from basic accounts to complex treasury services. The bank also serves institutions like non-profits and educational bodies with specialized banking and investment management, as well as individual consumers needing everyday banking products and digital convenience. A key segment includes professionals and entrepreneurs who benefit from specialized lending, cash management, and wealth accumulation strategies to manage both business and personal financial needs.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| High-Net-Worth Individuals & Families | Bespoke wealth management, private banking, investment advisory, trust & estate services | Approx. 12.4 million U.S. households with $1M+ investable assets |

| Businesses (Small to Large) | Checking, lending, treasury management, capital markets access, commercial real estate loans | Significant portion of loan portfolio in commercial & industrial lending |

| Institutions (Non-profits, Foundations) | Specialized banking, endowment management, investment vehicles, treasury solutions | Over 1.5 million U.S. tax-exempt organizations |

| Individual Consumers | Everyday banking (checking, savings), mortgages, personal loans, digital banking | Focus on convenience, accessibility, competitive rates |

| Professionals & Entrepreneurs | Specialized lending, cash management, wealth accumulation, practice financing | Over 33 million U.S. small businesses, many founded by entrepreneurs |

Cost Structure

Employee salaries and benefits represent a substantial cost for City National Bank, a direct consequence of its human-capital intensive operations. This includes compensation for a wide array of roles, from frontline customer service representatives to specialized financial analysts and executive management.

In 2023, the financial services sector, including banking, saw continued pressure on compensation as institutions competed for talent. While specific figures for City National Bank's employee costs aren't publicly itemized in their business model canvas, industry benchmarks suggest that personnel expenses can account for 50-60% of a bank's operating expenses. This includes not only base salaries but also health insurance, retirement contributions, and performance-based bonuses, all critical for attracting and retaining skilled professionals in a competitive market.

City National Bank's technology and infrastructure costs are significant, encompassing expenditures for maintaining and upgrading its IT backbone, software licenses, and robust cybersecurity measures. These investments are crucial for supporting digital banking platforms and ensuring operational efficiency.

In 2024, the financial services sector continued to see substantial spending on technology. For instance, major banks are allocating billions to digital transformation initiatives, with a significant portion dedicated to cloud migration and cybersecurity to protect against evolving threats. This trend reflects the increasing reliance on advanced technology for customer service and operational integrity.

City National Bank's cost structure is heavily influenced by its extensive branch network and associated real estate expenses. These costs encompass rent, utilities, property taxes, and ongoing maintenance for its numerous physical locations, which are crucial for customer accessibility and service delivery.

In 2024, the bank continued to invest in its physical presence, with a notable portion of operating expenses allocated to maintaining and enhancing this network. While specific figures for real estate alone aren't always broken out in public reports, for large financial institutions, these costs can represent a substantial percentage of non-interest expense, often in the high single digits or low double digits of total operating costs.

Furthermore, costs related to opening new branches or expanding existing ones, including design, construction, and initial outfitting, add to this significant expenditure. This strategic investment in brick-and-mortar infrastructure supports their client-facing model, even as digital channels grow.

Marketing and Sales Expenses

City National Bank's marketing and sales expenses are a significant component of its cost structure, funding efforts to acquire and retain customers. These costs encompass a broad range of activities aimed at promoting the bank's diverse financial products and services.

Key investments are made in digital marketing, including search engine optimization, social media campaigns, and targeted online advertising, alongside traditional channels like print and television advertising. Public relations and sponsorships also play a role in building brand awareness and community engagement.

- Digital Marketing: Significant allocation towards online advertising, content marketing, and social media engagement to reach a wider audience and drive lead generation.

- Traditional Advertising: Investment in television, radio, and print media to build brand recognition and appeal to a broader demographic.

- Sales Initiatives: Costs associated with sales teams, client relationship management, and promotional offers designed to attract new business and deepen existing relationships.

- Public Relations & Sponsorships: Funding for public relations efforts and sponsorships of community events and organizations to enhance brand image and foster goodwill.

Regulatory Compliance and Legal Costs

City National Bank faces significant expenses in adhering to a complex web of banking regulations, including capital requirements, consumer protection laws, and anti-money laundering (AML) protocols. These compliance efforts necessitate investment in specialized technology, skilled personnel, and ongoing training. For instance, in 2023, the banking sector as a whole saw increased spending on compliance, with many institutions dedicating substantial portions of their operating budgets to these functions.

The bank also allocates resources to robust risk management frameworks and the maintenance of strong internal controls to mitigate operational, credit, and market risks. This includes the development and implementation of sophisticated monitoring systems and regular audits. The cost of non-compliance can be severe, potentially leading to hefty fines and legal challenges, as seen in various regulatory actions against financial institutions in recent years.

- Regulatory Compliance: Investments in technology, personnel, and training to meet banking standards.

- Risk Management: Costs associated with developing and maintaining internal controls and monitoring systems.

- Legal and Fines: Potential expenditures for legal defense, settlements, or penalties arising from regulatory breaches.

City National Bank's cost structure is dominated by personnel expenses, reflecting its service-oriented model, with technology and infrastructure investments also being significant drivers. Real estate costs for its branch network and marketing to attract clients are further key expenditures.

Revenue Streams

Net Interest Income (NII) is City National Bank's core revenue engine. It's the profit generated from the spread between interest earned on assets like loans and securities, and interest paid out on liabilities such as deposits. For instance, in the first quarter of 2024, City National Bank reported NII of $402 million, a slight decrease from the previous quarter, reflecting the dynamic interest rate environment.

City National Bank generates significant revenue through service charges and fees. These include charges for account maintenance, processing transactions, and for services like overdrafts and ATM usage.

In 2024, fees and service charges represented a crucial component of the bank's non-interest income. For instance, many regional banks saw fee income grow by 5-10% year-over-year, reflecting increased customer activity and the strategic implementation of fee structures that align with service value.

City National Bank generates revenue through various lending fees and commissions. This includes income from the origination and processing of loans, such as mortgages and business loans. In 2024, the bank likely saw continued contributions from these fees, reflecting ongoing economic activity and demand for credit.

Additional income is derived from services like commitment fees and late payment fees, adding to the bank's overall lending revenue. These ancillary fees, though smaller individually, contribute to a diversified income stream within their lending operations.

Wealth Management and Advisory Fees

City National Bank draws substantial revenue from wealth management and advisory services. These fees are generated from a variety of offerings, including the management of investment portfolios, the administration of trusts and estates, and personalized financial planning advice. This segment is particularly lucrative, often stemming from a client base of high-net-worth individuals and families who require sophisticated financial solutions.

In 2024, wealth management and advisory fees represent a critical component of City National Bank's non-interest income. For instance, as of the first quarter of 2024, the bank reported significant growth in its wealth management division, with assets under management reaching new highs, directly translating to increased fee-based revenue. This trend highlights the bank's success in attracting and retaining clients seeking expert financial guidance.

Key revenue streams within this category include:

- Investment Management Fees: A percentage of assets under management for investment accounts.

- Trust and Estate Administration Fees: Charges for managing and administering trusts and estates.

- Financial Advisory Fees: Fees for personalized financial planning and consulting services.

Interchange and Card-Related Fees

City National Bank generates revenue through interchange fees, which are charged to merchants each time a customer uses a debit or credit card for a purchase. This income stream is directly proportional to the volume and value of card transactions processed by the bank. For instance, in 2024, the total value of debit and credit card transactions in the U.S. was projected to exceed $8 trillion, with interchange fees forming a significant portion of revenue for issuing banks.

Beyond interchange, the bank also earns from various card-related fees. These can include annual fees for premium credit card products, late payment fees, and foreign transaction fees. These charges contribute to a more diversified revenue base, mitigating reliance solely on transaction volume.

- Interchange Fees: Revenue earned from merchant transaction fees on debit and credit card usage.

- Cardholder Fees: Income generated from annual fees, late fees, and other charges associated with credit card accounts.

- Transaction Volume Dependency: This revenue stream is directly influenced by the frequency and monetary value of card payments processed.

- Market Growth: The increasing adoption of digital payments, with U.S. e-commerce sales alone expected to reach over $2 trillion in 2024, bolsters this revenue stream.

City National Bank diversifies its revenue through various fee-based services, complementing its core net interest income. These fees are crucial for profitability, especially in a fluctuating interest rate environment. In 2024, the bank's strategic focus on fee income generation through wealth management and card services proved effective, contributing significantly to its overall financial performance.

| Revenue Stream | Description | 2024 Data/Context |

| Service Charges and Fees | Account maintenance, transaction processing, overdrafts, ATM usage. | Key component of non-interest income; regional banks saw 5-10% growth in fee income. |

| Lending Fees and Commissions | Loan origination, processing (mortgages, business loans), commitment fees, late fees. | Continued contributions reflecting ongoing economic activity and credit demand. |

| Wealth Management & Advisory | Investment management, trust/estate administration, financial planning. | Significant growth in assets under management in Q1 2024, directly boosting fee revenue. |

| Interchange & Cardholder Fees | Merchant fees on card transactions, annual fees, late fees, foreign transaction fees. | Influenced by over $8 trillion in projected U.S. card transactions for 2024; e-commerce sales exceeding $2 trillion. |

Business Model Canvas Data Sources

The City National Bank Business Model Canvas is built upon a foundation of internal financial statements, customer transaction data, and market intelligence reports. These sources provide a comprehensive view of operational performance and customer behavior.