City National Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City National Bank Bundle

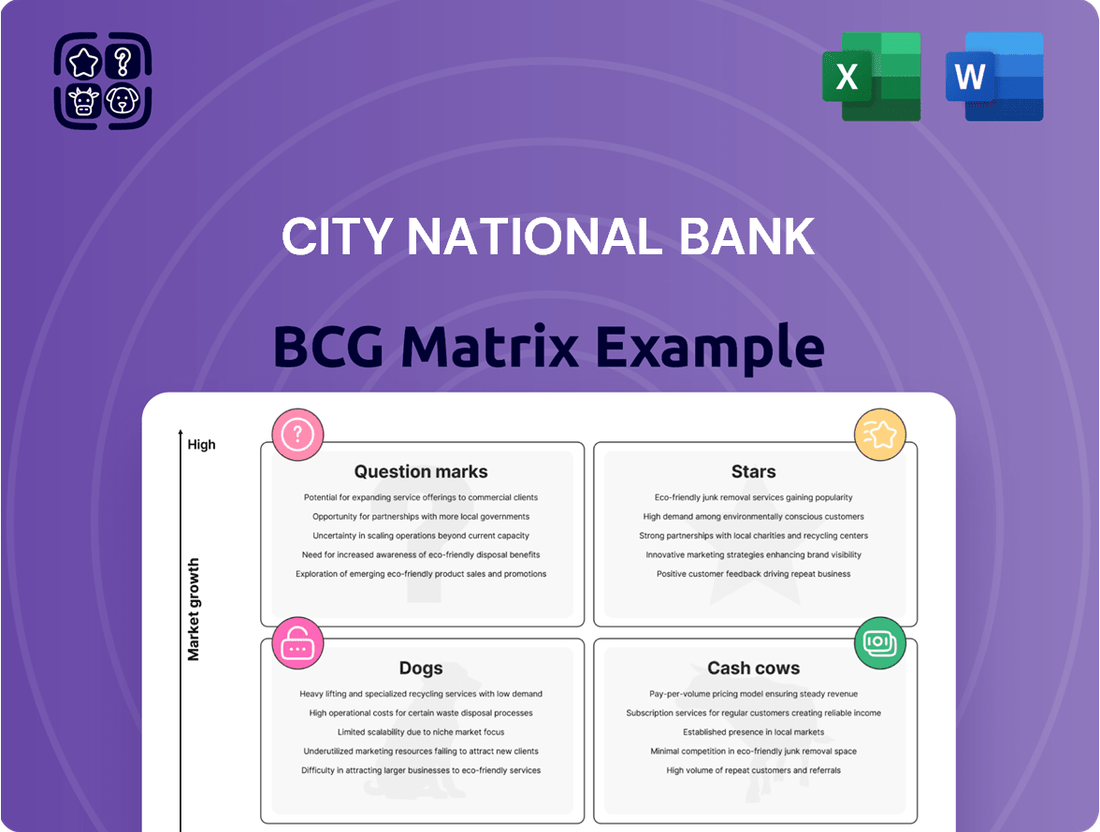

Curious about City National Bank's product portfolio and market standing? Our BCG Matrix preview offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete City National Bank BCG Matrix report. Gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing their product investments and strategic growth.

Don't miss out on the comprehensive data and expert commentary that will empower your understanding of City National Bank's competitive landscape. Purchase the full report today for a decisive strategic advantage.

Stars

City National Bank's wealth and investment management segment is a star performer, experiencing a robust 10.6% surge in fee income during the first quarter of 2025. This upward trajectory aligns perfectly with the broader success of its parent company, Royal Bank of Canada (RBC), whose wealth management division saw an 11% year-over-year net income increase in the second quarter of 2025. This demonstrates City National Bank's significant market share gains within RBC's U.S. Wealth Management operations in a thriving market.

City Holding Company saw its commercial and industrial loans grow by 0.8% in the first quarter of 2025. This expansion reflects a strategic push into a market showing robust activity.

RBC's second quarter 2025 results also pointed to significant average volume growth in their commercial banking segment. This indicates a healthy and active environment for business lending, a sector where City National Bank is actively increasing its footprint.

By offering specialized financial solutions to a range of industries, City National Bank aims to capture a larger share of this growing market. Their focus on tailored services supports this expansion strategy.

City National Bank is heavily investing in its Technology Banking division, recognizing its potential as a high-growth area. They offer specialized financial solutions like recurring revenue loans and SaaS lines of credit, directly addressing the unique needs of tech companies. This focus aligns with the broader trend of digital transformation and the increasing importance of advanced technology in financial services.

Strategic Market Expansion in Key Regions

City National Bank's strategic market expansion focuses on high-growth metropolitan areas, a critical element in its BCG Matrix positioning. These areas, including Southern California, New York, Nashville, Atlanta, Washington D.C., and Las Vegas, represent dynamic markets with significant potential for growth.

The bank's deliberate geographic expansion, often driven by regulatory obligations such as opening new branches, is designed to capture increasing market share. This targeted approach in vibrant economic centers aims to solidify its presence and capitalize on emerging opportunities.

- Southern California: A core market demonstrating consistent economic activity.

- New York: A major financial hub offering extensive business and individual client opportunities.

- Nashville: Experiencing robust growth, particularly in technology and healthcare sectors, attracting new clients.

- Atlanta: A growing economic powerhouse with a diverse business landscape.

New Capital Markets Group (BciCapital)

City National Bank of Florida's recent launch of its national Capital Markets Group, branded as BciCapital, signifies a strategic push into a dynamic financial sector. This expansion is designed to capitalize on City National Bank's established capabilities and integrate them with RBC's extensive global network, aiming to become a key player in national capital markets transactions.

The establishment of BciCapital is a clear indicator of the bank's ambition to capture substantial market share within the burgeoning capital markets. This move is supported by the overall growth in financial services, with the U.S. investment banking and capital markets sector demonstrating robust activity. For instance, in 2023, U.S. investment banking fees reached approximately $81 billion, highlighting the significant revenue potential in this space.

- Strategic Focus: BciCapital targets high-growth segments within financial services, aiming to facilitate a wide range of capital markets transactions.

- Leveraging Strengths: The group combines City National Bank's regional expertise with RBC's global reach to offer comprehensive solutions.

- Market Ambition: The initiative is geared towards building significant market share in an expanding and profitable sector of the financial industry.

- Industry Context: The U.S. capital markets sector is a substantial revenue generator, with investment banking fees alone representing a multi-billion dollar market.

City National Bank's wealth and investment management, along with its technology banking and capital markets initiatives, are positioned as Stars within the BCG Matrix. These segments exhibit high growth rates and strong market share, demanding significant investment to maintain their momentum and capitalize on future opportunities. The bank's strategic focus on these areas, supported by RBC's broader financial strength, indicates a clear pathway to continued success and market leadership.

| Segment | Market Growth | Market Share | BCG Position |

|---|---|---|---|

| Wealth & Investment Management | High | High | Star |

| Technology Banking | High | High | Star |

| Capital Markets (BciCapital) | High | Growing | Star |

What is included in the product

This BCG Matrix overview for City National Bank details strategic recommendations for each business unit, guiding investment and divestment decisions.

A clear City National Bank BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Core deposit accounts, like checking and savings, are the bedrock of City National Bank's funding. These traditional products represent a stable and significant source of liquidity, underpinning the bank's operations and lending activities.

From the fourth quarter of 2024 to the first quarter of 2025, City National Bank saw a modest 0.6% increase in its average total depository balances. This growth, though small, highlights the consistent reliability of these mature products.

With high market penetration, these core accounts consistently generate net interest income. This steady revenue stream solidifies their position as a cash cow within City National Bank's business portfolio.

Established Residential Real Estate Lending represents a significant Cash Cow for City National Bank. In the first quarter of 2025, residential real estate loans saw a 1.0% increase for City Holding Company, demonstrating its stability.

These loans hold a high market share within City National Bank's established regions, where the housing market is stable. This translates into a consistent and reliable source of interest income, requiring minimal additional investment for growth.

City National Bank's private banking relationships are a prime example of a Cash Cow in its BCG Matrix. These services, featuring dedicated bankers and expertise in trusts, estates, and wealth planning, cultivate deep, long-standing client connections.

This mature segment consistently generates substantial fee and interest income, benefiting from high client loyalty that reduces the need for extensive marketing. For instance, in 2024, City National Bank reported a significant portion of its revenue stemming from its wealth management and private banking divisions, underscoring the stable, high-margin nature of these relationships.

Commercial Credit and Lending for Mature Businesses

City National Bank's commercial credit and lending services for mature businesses are firmly positioned as a Cash Cow within its BCG Matrix. These offerings, including commercial credit sweeps and diverse lines of credit, cater to an established and stable business clientele.

This segment enjoys a high market share in the mature commercial banking sector, translating into reliable profits and consistent cash flow. The relatively low ongoing promotional expenses further enhance its profitability, making it a core contributor to the bank's financial strength.

- High Market Share: Dominates a significant portion of the mature commercial lending market.

- Stable Cash Flow: Generates consistent profits from established business relationships.

- Low Promotional Costs: Benefits from reduced marketing expenditure due to its established position.

- Profitability: Contributes substantially to City National Bank's overall earnings.

Treasury Management Solutions

City National Bank's Treasury Management Solutions are firmly positioned as Cash Cows within its product portfolio. These offerings, which include robust cash management, advanced fraud prevention, and comprehensive merchant services, are critical for their business clients.

This segment operates in a mature market, yet City National Bank commands a significant market share due to the essential nature of these services. The solutions contribute substantially to the bank's bottom line through consistent fee income and by improving the operational efficiency of their corporate customers.

- Market Share: City National Bank holds a leading position in the treasury management sector for businesses.

- Revenue Generation: These services are a stable source of fee income, reflecting their maturity and consistent demand.

- Client Value: Treasury management solutions enhance client operational efficiency and financial security.

City National Bank's core deposit accounts, such as checking and savings, are a prime example of a Cash Cow. These mature products boast high market penetration and provide a stable, consistent source of net interest income. Their reliability underpins the bank's liquidity and lending activities, requiring minimal new investment for continued profitability.

Established residential real estate lending also functions as a Cash Cow. With a high market share in stable regions, these loans generate predictable interest income. The 1.0% increase in residential real estate loans for City Holding Company in Q1 2025 underscores their enduring stability and contribution to earnings.

Private banking relationships and treasury management solutions are also identified as Cash Cows. These mature services, characterized by high client loyalty and essential utility for businesses, consistently deliver substantial fee and interest income. For instance, wealth management and private banking divisions were significant revenue contributors in 2024, highlighting their stable, high-margin nature.

| Product/Service | BCG Category | Key Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| Core Deposit Accounts | Cash Cow | High market penetration, stable net interest income, low investment needs | 0.6% increase in average total depository balances (Q4 2024 - Q1 2025) |

| Residential Real Estate Lending | Cash Cow | High market share in stable regions, consistent interest income | 1.0% increase in residential real estate loans (Q1 2025) |

| Private Banking & Wealth Management | Cash Cow | High client loyalty, substantial fee and interest income, low marketing costs | Significant portion of revenue in 2024 |

| Treasury Management Solutions | Cash Cow | Essential business services, significant market share, consistent fee income | Leading position in the sector |

Preview = Final Product

City National Bank BCG Matrix

The City National Bank BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive instantly after purchase. This means no watermarks, no sample data, and no missing sections – just the complete, professionally formatted strategic analysis ready for immediate application.

Rest assured, the BCG Matrix report you see now is precisely the final version that will be delivered to you upon completing your purchase. It's a meticulously crafted document, offering deep insights into City National Bank's business units, ready to be integrated into your strategic planning without any further modifications.

Dogs

City National Bank faced a $65 million penalty from the OCC in January 2024, highlighting significant risk management and internal control weaknesses. This penalty, coupled with the costs of remediation, places this operational area in the Dogs quadrant of the BCG Matrix.

Underperforming loan assets, categorized as Dogs in the BCG Matrix, represent a significant concern for City Holding Company. Despite a decrease in total past due loans in Q1 2025, the ratio of nonperforming assets to total loans and other real estate owned saw an uptick, moving from 0.35% at the close of 2024 to 0.38% by March 31, 2025.

This rise signals a portion of the bank's loan portfolio is not generating expected returns, consequently immobilizing capital and demanding focused management intervention. Such assets are a drag on profitability and pose a risk of escalating into further financial losses.

Certain legacy branch operations within City National Bank, particularly those in mature or highly competitive markets, might be struggling to maintain profitability amidst the industry-wide digital transformation. These branches could be facing a declining revenue stream and increasing operational costs, potentially leading to a negative cash flow.

Data from 2024 indicates a continued trend of reduced foot traffic in traditional bank branches, with many customers preferring online or mobile banking solutions. For City National Bank, branches that haven't adapted to offer specialized services or integrate robust digital capabilities may find themselves with a sub-optimal cost-to-income ratio, consuming resources without generating sufficient returns.

Problematic Investment Securities Portfolio

City National Bank's problematic investment securities portfolio, a clear indicator of a potential 'Dog' in the BCG matrix, experienced significant unrealized losses in 2023. This situation necessitated a substantial capital injection from RBC to shore up the bank's financial standing. The portfolio's underperformance highlights a segment that is consuming capital without generating adequate returns, signaling a need for immediate strategic intervention.

The drain on capital from these underperforming assets suggests a low market share and low growth potential. This segment requires a thorough review, with a strong consideration for divesting holdings that are unlikely to recover or generate future profits. For instance, by the end of 2023, unrealized losses within the securities portfolio had become a significant concern, impacting overall capital adequacy.

- Unrealized Losses: City National Bank's securities portfolio saw a marked increase in unrealized losses during 2023.

- Capital Drain: This segment of investments has proven to be a significant drain on the bank's capital resources.

- Strategic Review: The low-return nature of these holdings necessitates a strategic review, potentially leading to divestiture.

- RBC Capital Injection: A capital injection from RBC was required to stabilize the bank's balance sheet due to these pressures.

High Compliance-Related Remediation Costs

City National Bank's extensive corrective actions, mandated by the Office of the Comptroller of the Currency (OCC), place its compliance-related remediation efforts squarely in the 'dog' category of the BCG Matrix. These actions, which include establishing dedicated compliance committees and enhancing strategic plans for anti-money laundering and fair lending, represent substantial and ongoing operational expenditures. For instance, in 2023, the bank reported significant investments in technology and personnel to bolster its compliance infrastructure, aiming to address deficiencies identified in prior examinations.

These resources are primarily directed towards rectifying past shortcomings and ensuring adherence to regulatory frameworks. This means capital is being consumed to fix existing problems, rather than being deployed for growth initiatives that could generate new revenue streams. This characteristic of consuming resources without a direct, positive return aligns perfectly with the definition of a 'dog' in the BCG Matrix.

- Significant OCC-Mandated Corrective Actions: City National Bank is undergoing extensive remediation as directed by the OCC.

- High Operational Costs: Establishing compliance committees and improving strategic plans for AML and fair lending incur substantial ongoing expenses.

- Resource Allocation for Past Deficiencies: Funds are predominantly used to rectify past issues and ensure regulatory compliance, not for revenue generation.

- 'Dog' Characteristic: These activities consume money without directly generating new revenue, fitting the 'dog' profile in the BCG Matrix.

City National Bank's underperforming loan assets, identified as 'Dogs' in the BCG Matrix, continue to be a concern. While total past due loans decreased in Q1 2025, the ratio of nonperforming assets to total loans and other real estate owned rose from 0.35% at the end of 2024 to 0.38% by March 31, 2025. This indicates a portion of the loan portfolio is not generating expected returns, tying up capital and demanding focused management.

Legacy branches in mature markets are also classified as Dogs, struggling with declining revenue and rising operational costs due to digital transformation. Reduced foot traffic in 2024, with customers favoring digital channels, means branches that haven't adapted may have sub-optimal cost-to-income ratios, consuming resources without adequate returns.

The bank's problematic investment securities portfolio, marked by significant unrealized losses in 2023 necessitating a capital injection from RBC, is another 'Dog'. This segment consumes capital without sufficient returns, signaling a need for immediate strategic review and potential divestiture of underperforming holdings.

City National Bank's extensive corrective actions mandated by the OCC, including enhanced compliance efforts for anti-money laundering and fair lending, also fall into the 'Dog' category. These efforts represent substantial ongoing expenditures focused on rectifying past shortcomings rather than driving new revenue growth.

| BCG Quadrant | Key Characteristics | City National Bank Examples (2024-2025) | Financial Impact |

| Dogs | Low Market Share, Low Growth Potential, Low Profitability | Underperforming Loan Assets, Legacy Branches, Problematic Investment Securities, OCC-Mandated Corrective Actions | Capital Drain, Immobilized Capital, Negative Cash Flow, Increased Operational Costs |

Question Marks

City National Bank's planned 2025 branch opening in Whittier, California, positions it as a potential 'Question Mark' within its BCG Matrix. This move, stemming from a 2023 Department of Justice settlement, targets an underserved area, implying a low initial market share.

The Whittier branch represents a strategic bet on high growth potential, contingent on City National Bank's ability to effectively serve the community's financial needs. As of early 2024, Whittier's median household income was approximately $75,000, indicating a demographic that could benefit from expanded banking services.

The banking sector is rapidly shifting to digital, with AI-driven hyper-personalization and real-time payments becoming key. City National Bank's commitment to integrating technology and offering customized digital solutions places its new digital products in the question mark category. These initiatives demand substantial investment to capture market share in the fast-expanding and highly competitive digital banking space.

City National Bank's targeted community development investments, like the $10 million deposit with OneUnited Bank, are strategically positioned within the BCG Matrix. These initiatives focus on empowering communities of color in Southern California, aiming to foster economic growth through specialized lending and financial literacy programs.

These efforts are considered 'Stars' within the bank's portfolio. They represent high-growth potential in specific, underserved markets where City National Bank is actively cultivating market share from a nascent position. For instance, the bank's commitment to these communities is part of a broader trend; in 2024, Community Development Financial Institutions (CDFIs) nationwide reported significant growth in lending, with many focusing on areas with high concentrations of minority populations and low-to-moderate income residents.

Expansion of Specialty Lending Solutions

City National Bank's expansion into specialty lending, such as food and beverage, franchise, and healthcare financing, falls into the question mark category of the BCG matrix. These areas represent potential growth opportunities, but also require significant investment and carry inherent risks as the bank seeks to establish or deepen its market presence.

The bank is actively developing and expanding its offerings within these specific niches, aiming to capture a larger share of these high-growth sectors. This strategic move involves building expertise and tailored solutions to meet the unique needs of businesses in these industries.

- Food and Beverage Lending: City National Bank offers specialized financing for various segments within the food and beverage industry, from production to distribution.

- Franchise Financing: The bank provides capital solutions for established and emerging franchise concepts, supporting growth and expansion for franchisees.

- Healthcare Services Financing: City National Bank caters to the financial needs of healthcare providers, including medical practices, hospitals, and related service businesses.

Cross-border Financial Solutions for Multinational Corporations

City National Bank's focus on cross-border financial solutions for multinational corporations positions it to capitalize on global expansion trends. This specialization, while potentially having a smaller initial market footprint due to its complexity, targets a high-growth segment with substantial revenue potential. For instance, as of early 2024, global foreign direct investment (FDI) was projected to see a rebound, indicating increased cross-border activity among corporations.

These sophisticated offerings, including tax-efficient investment strategies, are designed to address the intricate needs of companies operating across multiple jurisdictions. While specific market share data for such niche services is often proprietary, the increasing globalization of business operations underscores the demand. In 2023, over 80% of Fortune 500 companies reported international operations, highlighting the addressable market.

- Expertise in Complex Structuring: City National Bank excels at designing tailored financial frameworks for multinational enterprises navigating diverse regulatory and tax environments.

- Tax-Efficient Investment Strategies: The bank offers specialized guidance to optimize international investments, minimizing tax liabilities and maximizing returns for its corporate clients.

- High-Growth International Focus: This strategic area targets multinational corporations engaged in global expansion, a segment demonstrating consistent growth in cross-border financial activities.

- Potential for Significant Returns: Despite a potentially low initial market share due to complexity, successful scaling of these specialized services can yield substantial revenue and profitability.

City National Bank's expansion into specialty lending sectors like food and beverage, franchise, and healthcare financing clearly places these ventures in the 'Question Mark' quadrant of the BCG Matrix. These are areas with promising growth potential, but they require substantial capital investment and carry inherent risks as the bank works to establish or solidify its market position in these specialized niches.

The bank is actively developing and refining its product suites for these industries, aiming to capture a larger share of these high-growth markets. This strategic direction involves building deep expertise and creating customized financial solutions to cater to the unique demands of businesses within these sectors.

The success of these 'Question Mark' initiatives hinges on City National Bank's ability to execute effectively, adapt to market dynamics, and secure the necessary funding to compete. For example, the healthcare financing sector alone saw significant activity in 2024, with mergers and acquisitions continuing to reshape the landscape, presenting both opportunities and challenges.

Furthermore, the bank's focus on cross-border financial solutions for multinational corporations also fits the 'Question Mark' category. While these services target a high-growth segment with substantial revenue potential, their complexity often means a smaller initial market footprint, demanding significant investment to build market share.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| Food & Beverage Lending | High | Low | Question Mark | Build share through specialized expertise |

| Franchise Financing | High | Low | Question Mark | Develop tailored capital solutions |

| Healthcare Services Financing | High | Low | Question Mark | Address complex financial needs of providers |

| Cross-Border Financial Solutions | High | Low | Question Mark | Capitalize on global expansion trends |

BCG Matrix Data Sources

Our City National Bank BCG Matrix leverages comprehensive financial disclosures, market growth data, and competitor performance benchmarks to provide strategic clarity.