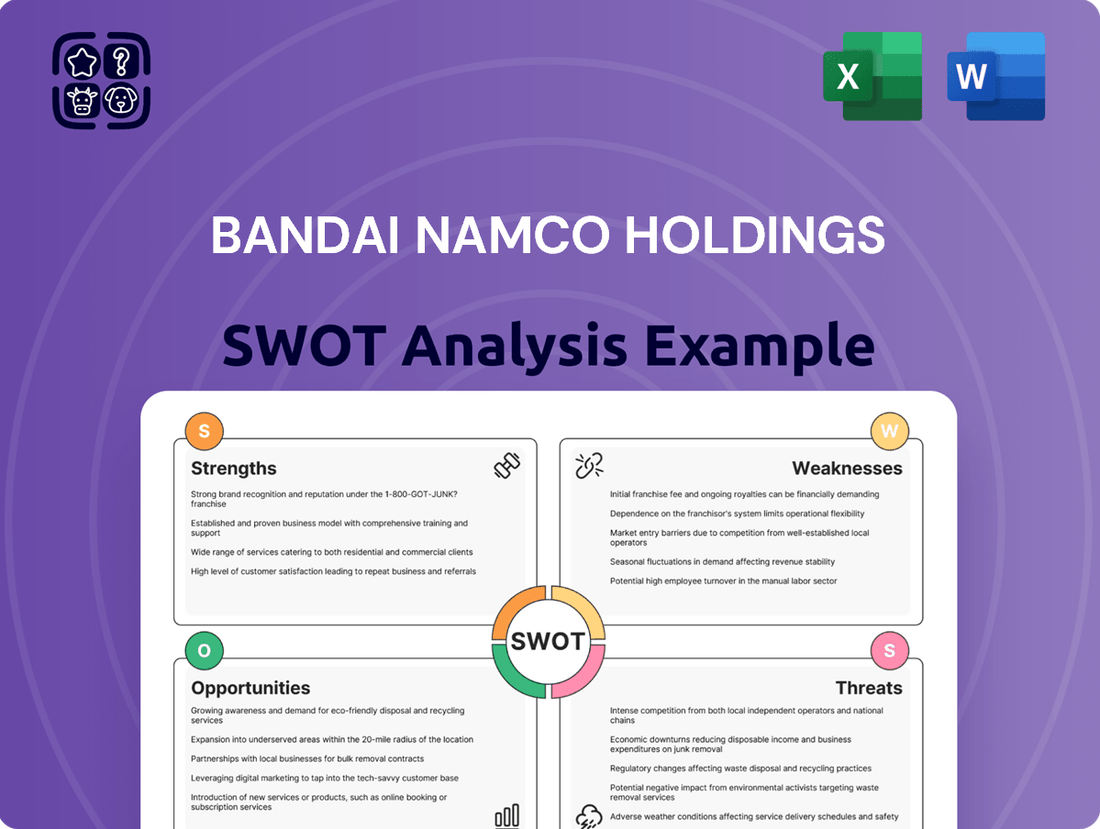

Bandai Namco Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bandai Namco Holdings Bundle

Bandai Namco Holdings boasts a powerful brand portfolio and a strong presence in both physical and digital entertainment, but faces intense competition and evolving consumer preferences. Our comprehensive SWOT analysis delves into these dynamics, revealing key opportunities for expansion and potential threats to navigate.

Want the full story behind Bandai Namco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bandai Namco Holdings possesses a remarkably diverse and robust intellectual property (IP) portfolio, featuring iconic global franchises like Pac-Man, Tekken, Gundam, and Dragon Ball. This extensive range enables the company to engage a wide spectrum of consumers across various entertainment sectors, including video games, toys, and anime. The enduring popularity and commercial success of these key IPs, such as the continued strong performance of Mobile Suit Gundam and Dragon Ball related products and media, are foundational to Bandai Namco's substantial revenue streams and dominant market standing.

Bandai Namco Holdings' integrated 'IP Axis Strategy' is a significant strength, allowing them to maximize the value of their intellectual properties by creating a synergistic ecosystem. This strategy ensures popular characters and stories are leveraged across video games, toys, merchandise, anime, and amusement facilities, fostering deeper fan engagement and diverse revenue streams from a single IP.

Bandai Namco Holdings has showcased impressive financial strength, with net sales and operating profit consistently on the rise. For the fiscal year concluding March 31, 2025, the company reported a substantial uplift in both net sales and operating profit, surpassing earlier projections. This robust financial performance not only underscores their market position but also equips them with ample resources for strategic investments and future growth initiatives.

Global Market Expansion and Digital Presence

Bandai Namco Holdings is aggressively pursuing global market expansion, with a significant emphasis on North America and Asia. This expansion is complemented by a robust focus on digital marketing and e-commerce strategies. The company is also streamlining its organizational structure to enhance worldwide marketing oversight and expedite decision-making within its digital business operations.

This strategic global push and digital enhancement allows Bandai Namco to connect with and captivate a broader international customer base. For instance, in fiscal year 2024, the company reported strong performance in its Digital Business segment, driven by its popular mobile titles and continued investment in online services. Their commitment to a digital-first approach is evident in their increasing online sales figures and engagement metrics across various platforms.

- Global Reach: Targeting key growth markets in North America and Asia.

- Digital Focus: Investing in e-commerce and digital marketing for wider audience engagement.

- Operational Efficiency: Restructuring to improve global marketing coordination and digital business agility.

Strategic Partnerships and Collaborations

Bandai Namco Holdings actively pursues strategic partnerships to amplify its intellectual property (IP) and capitalize on robust content creation and distribution capabilities. A prime example is its collaboration with Sony Group, aimed at broadening the reach of its beloved franchises and creating novel entertainment experiences for a global audience. These alliances are crucial for fostering deeper fan engagement and solidifying Bandai Namco's standing in the competitive entertainment landscape.

These strategic alliances are instrumental in Bandai Namco's growth strategy, allowing it to tap into new markets and diversify its revenue streams. For instance, its ongoing collaborations within the gaming sector, particularly with console manufacturers and other developers, have been key to launching successful titles and reaching wider player bases. Such synergistic relationships not only enhance product offerings but also provide access to cutting-edge technologies and distribution channels, crucial for staying ahead in the rapidly evolving digital entertainment industry.

- IP Expansion: Collaborations with entities like Sony Group facilitate the cross-media exploitation of Bandai Namco's extensive IP portfolio, including popular franchises in anime, gaming, and toys.

- Global Reach: Partnerships enable Bandai Namco to penetrate new geographical markets and strengthen its presence in existing ones by leveraging the local expertise and distribution networks of its partners.

- Enhanced Fan Engagement: Joint ventures and co-branded initiatives are designed to create more immersive and interactive experiences for fans, fostering loyalty and driving demand for related products and services.

- Synergistic Growth: By pooling resources and expertise, strategic partnerships allow Bandai Namco to explore innovative entertainment formats and technologies, such as advanced VR experiences or new forms of digital content distribution, thereby driving future growth.

Bandai Namco's extensive and beloved IP portfolio, featuring franchises like Gundam, Dragon Ball, and Pac-Man, is a core strength. This diverse range allows for broad consumer engagement across gaming, toys, and anime, driving consistent revenue. The company's integrated IP Axis Strategy effectively maximizes franchise value by creating a cohesive ecosystem across various entertainment sectors, fostering deep fan connections and multiple revenue streams from single IPs.

Financially, Bandai Namco Holdings demonstrates robust health, with a notable increase in net sales and operating profit reported for the fiscal year ending March 31, 2025, exceeding prior forecasts. This strong financial performance provides substantial capital for strategic investments and future expansion. The company's aggressive global market expansion, particularly in North America and Asia, coupled with a strong digital marketing and e-commerce focus, is enhancing its international reach and operational agility.

| Metric | FY2024 (Ending Mar 31, 2024) | FY2025 (Projected/Actual Ending Mar 31, 2025) |

|---|---|---|

| Net Sales (JPY billion) | 1,066.4 | 1,170.0 (Target) |

| Operating Profit (JPY billion) | 101.0 | 110.0 (Target) |

What is included in the product

Delivers a strategic overview of Bandai Namco Holdings’s internal and external business factors, highlighting key strengths in its diverse IP portfolio and opportunities in digital entertainment while acknowledging weaknesses in some traditional markets and threats from evolving consumer preferences.

Offers a clear, actionable framework to navigate Bandai Namco's competitive landscape and capitalize on its diverse IP portfolio.

Weaknesses

Bandai Namco's significant revenue generation from a select few blockbuster franchises, such as Dragon Ball and Gundam, presents a notable weakness. For instance, in fiscal year 2024, the Entertainment segment, heavily driven by these IPs, accounted for a substantial portion of the company's net sales.

A downturn in the popularity or commercial performance of any of these cornerstone intellectual properties could lead to a disproportionate negative impact on Bandai Namco's overall financial health. This concentration risk highlights the need for broader IP diversification to ensure long-term stability and mitigate potential revenue volatility.

Bandai Namco has encountered significant hurdles within its mobile and online gaming divisions. The company has seen the cancellation of multiple titles and the discontinuation of certain online services, such as Blue Protocol and Tales of the Rays. This suggests potential struggles in keeping pace with the swift changes in the mobile and online gaming landscape, as well as challenges in retaining player interest over the long term.

Reports have surfaced regarding workforce reductions and alleged 'oidashi beya' tactics, a practice aimed at pressuring employees to resign. While Bandai Namco has denied employing these specific methods, such allegations can significantly damage employee morale and the company's public image. This can create challenges in attracting and retaining skilled professionals in the highly competitive gaming and entertainment sector.

Intense Competition in the Entertainment Industry

The entertainment sector, especially video games and toys, is incredibly crowded. Bandai Namco navigates a landscape filled with both seasoned giants and ambitious newcomers. This means constant pressure to create fresh, captivating content and products to stand out.

This fierce rivalry demands ongoing innovation and substantial spending on research, development, and marketing. For instance, the global video game market was projected to reach over $200 billion in 2024, highlighting the sheer scale of investment and competition Bandai Namco operates within.

- High Stakes Innovation: Competitors like Nintendo, Sony, and Microsoft, alongside mobile gaming giants such as Tencent and NetEase, consistently launch new titles and hardware, setting high benchmarks for engagement and technological advancement.

- Content Development Costs: Developing AAA video games can cost hundreds of millions of dollars, and the toy market requires significant investment in intellectual property licensing and manufacturing, making it challenging to maintain profitability amidst intense price competition.

- Evolving Consumer Preferences: Rapid shifts in entertainment trends, from the rise of esports to the popularity of user-generated content platforms, require Bandai Namco to be agile and responsive, often necessitating quick pivots in product strategy.

Production Cost and Development Period Challenges

The increasing scale and complexity of modern video games, particularly for flagship titles, are directly contributing to longer development cycles and escalating production costs. This trend can put significant pressure on Bandai Namco's financial resources and potentially delay the realization of returns on these substantial investments.

Furthermore, the animation production segment grapples with persistent animator shortages and rising operational expenses. To counter these issues, Bandai Namco must continually invest in enhancing both its in-house and outsourced production capabilities. For instance, in fiscal year 2024, the company continued to invest in strengthening its production infrastructure to meet the growing demand for high-quality animated content.

- Extended Development Timelines: AAA game development can now take 3-5 years, increasing associated costs.

- Rising Production Budgets: Budgets for blockbuster games often exceed $100 million, impacting profitability.

- Animation Resource Strain: Shortages of skilled animators and rising labor costs in the animation sector are a constant challenge.

- Return on Investment Delays: Longer development and higher costs mean a longer wait before a game or animation project becomes profitable.

Bandai Namco's reliance on a few major franchises, like Dragon Ball and Gundam, is a significant weakness. In fiscal year 2024, the Entertainment segment, heavily driven by these IPs, represented a large portion of net sales, making the company vulnerable to fluctuations in their performance.

Challenges in mobile and online gaming are also apparent, with several titles and services being canceled. This indicates potential difficulties in adapting to the fast-paced mobile and online gaming market and maintaining player engagement.

The company faces intense competition in the crowded entertainment sector, requiring continuous investment in R&D and marketing to stand out. The global video game market was projected to exceed $200 billion in 2024, underscoring the high level of competition.

Rising development costs for major video games and operational expenses in animation production, including animator shortages, strain resources. For instance, AAA game development can take 3-5 years with budgets often exceeding $100 million, delaying profitability.

Same Document Delivered

Bandai Namco Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality, detailing Bandai Namco Holdings' Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get, offering a glimpse into the strategic insights for Bandai Namco Holdings. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete Bandai Namco Holdings SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing for immediate application of its strategic recommendations.

Opportunities

Bandai Namco has a significant opportunity to grow by entering and expanding in emerging markets. Regions like South America and India show increasing demand for both console and mobile gaming experiences, presenting a fertile ground for new ventures.

By developing local leadership and adapting strategies to specific regional tastes and economic conditions, Bandai Namco can tap into substantial growth potential. For instance, the mobile gaming market in India alone was projected to reach $1.5 billion in 2023 and is expected to continue its upward trajectory, offering a massive user base.

Bandai Namco's extensive catalog of beloved classic Intellectual Properties (IPs), including titles like Ridge Racer and Soul Calibur, presents a significant opportunity for revival. These dormant franchises can be reimagined through new game releases, engaging merchandise, and diverse entertainment formats, tapping into existing fan nostalgia and attracting new audiences.

The company's strategic focus on bolstering its licensing business, evidenced by the potential establishment of a dedicated licensing division, is crucial. This move will empower third-party developers and merchandisers to creatively develop new products and experiences based on these valuable IPs, expanding their reach and revenue streams. For instance, in the fiscal year ending March 2024, Bandai Namco reported strong performance in its IP Creation segment, indicating a healthy market for its established brands.

The escalating demand for digital content and services offers a significant avenue for Bandai Namco. With the global digital games market projected to reach $229 billion in 2024, the company is well-positioned to capitalize on this trend.

Bandai Namco can leverage the continued growth of online streaming and digital distribution to expand its digital offerings. This includes bolstering its network content, optimizing e-commerce platforms, and intensifying global digital marketing efforts to connect with a wider customer base.

Synergies from Cross-Segment Collaboration

Bandai Namco Holdings can unlock significant opportunities by fostering deeper collaboration across its diverse business segments. For instance, integrating the Digital Business with the Toys and Hobby Business can lead to innovative product development and enhanced fan engagement.

By sharing expertise and creating unified experiences, such as co-branded official stores or interactive events, the company can generate substantial added value. This cross-segment synergy not only strengthens the overall operational framework but also cultivates a more robust connection with its fanbase.

- Digital and Toys Integration: Combining digital platforms with physical toy releases can create immersive fan experiences.

- Shared Know-How: Transferring best practices between business units, like marketing strategies from gaming to merchandise, can boost sales.

- Integrated Fan Experiences: Events that blend virtual and physical elements, such as anime conventions featuring exclusive merchandise and playable game demos, draw larger audiences.

- Cross-Promotional Opportunities: Leveraging popular intellectual properties (IPs) across different segments, for example, a new anime series driving sales of related toys and video games, amplifies reach and revenue.

Technological Advancements and Experiential Entertainment

Bandai Namco is actively exploring investments in emerging technologies to craft novel experiential entertainment. This strategic focus includes potential joint development efforts, such as collaborations with partners like Sony, to pioneer new forms of interactive content. These initiatives aim to deliver unique fan experiences, a crucial differentiator in the competitive entertainment landscape.

The company is also prioritizing technical collaboration on next-generation entertainment formats. This forward-thinking approach is designed to enhance fan engagement and solidify Bandai Namco's market position. For instance, the gaming sector, a core area for Bandai Namco, saw global revenue projections for 2024 reach approximately $200 billion, highlighting the significant potential for innovative digital experiences.

Key opportunities stemming from technological advancements include:

- Development of immersive VR/AR entertainment: Leveraging advanced hardware and software to create deeply engaging virtual and augmented reality experiences.

- Integration of AI in gameplay and content creation: Utilizing artificial intelligence to personalize player experiences and streamline the production of new entertainment content.

- Expansion into metaverse platforms: Establishing a presence and offering unique interactive content within burgeoning metaverse ecosystems.

- Exploration of blockchain for digital ownership: Investigating the use of blockchain technology to offer verifiable ownership of in-game assets and digital collectibles.

Bandai Namco's extensive IP portfolio presents a significant opportunity for revival and expansion. By reimagining classic franchises like Tekken and Elden Ring through new game releases, merchandise, and diverse entertainment formats, the company can tap into existing fan nostalgia and attract new audiences. For example, the fiscal year ending March 2024 saw Bandai Namco's IP Creation segment report robust performance, underscoring the market's appetite for its established brands.

The company can also leverage the growing demand for digital content and services, with the global digital games market projected to reach $229 billion in 2024. Expanding digital offerings, optimizing e-commerce, and intensifying global digital marketing are key strategies to capitalize on this trend.

Furthermore, strategic investments in emerging technologies like VR/AR and AI offer avenues for novel experiential entertainment. Collaborations with partners, such as those with Sony, can pioneer new forms of interactive content, enhancing fan engagement and solidifying market position. The gaming sector's projected global revenue of approximately $200 billion for 2024 highlights the potential for innovative digital experiences.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| IP Revival & Expansion | Reimagining classic franchises for new games, merchandise, and entertainment. | Strong performance in IP Creation segment (FY ending March 2024). |

| Digital Content Growth | Expanding digital offerings, e-commerce, and digital marketing. | Global digital games market projected at $229 billion in 2024. |

| Emerging Technologies | Investing in VR/AR, AI for novel entertainment experiences. | Gaming sector projected global revenue of ~$200 billion in 2024. |

| Emerging Market Entry | Expanding into regions like South America and India for console/mobile gaming. | India's mobile gaming market projected at $1.5 billion in 2023. |

Threats

The entertainment sector, including gaming, toys, and anime, is fiercely competitive. Bandai Namco faces a crowded marketplace with numerous companies vying for consumer attention, making it difficult to launch new intellectual properties and capture significant market share. For instance, the global video game market was projected to reach $229 billion in 2024, highlighting the intense battle for players' time and money.

Economic downturns pose a significant threat, directly impacting consumer discretionary spending on entertainment. Inflationary pressures and potential economic slowdowns in 2024 and 2025 could reduce household budgets available for video games and toys, Bandai Namco's core offerings.

Bandai Namco has already experienced the consequences of shifting consumer engagement. A notable decline in smartphone and online game participation, a key revenue driver, has necessitated workforce adjustments and led to the cancellation of certain game projects, highlighting the vulnerability to these market shifts.

Bandai Namco Holdings’ reliance on its established intellectual properties (IPs) like Gundam and Dragon Ball presents a potential threat. IP fatigue can set in if these franchises are overexposed or if new installments lack significant innovation, potentially alienating consumers. For instance, while the Gundam franchise continues to be a revenue driver, with the Gundam franchise's global merchandise sales reaching approximately ¥500 billion (around $3.4 billion USD) in 2023, a slowdown in new content or a perceived lack of fresh appeal could impact future earnings.

Challenges in Game Development and Release Schedules

The sheer complexity and ambition of modern game development are stretching production timelines and escalating budgets. This trend makes managing these vast projects a significant hurdle. For instance, many AAA titles now require hundreds of developers and budgets exceeding $200 million, pushing release dates further out and increasing financial risk.

Furthermore, the gaming market is incredibly saturated, with a constant influx of new titles vying for consumer attention. This crowded release calendar presents a substantial threat, as launching a game too close to a major competitor's highly anticipated release can significantly cannibalize sales, leading to underperformance against projections. In 2024, the industry saw a record number of game releases, intensifying this competitive pressure.

- Extended Production Cycles: Development for major titles can now take five years or more, increasing the risk of market shifts or technological obsolescence.

- Rising Development Costs: Budgets for AAA games frequently surpass $200 million, demanding meticulous financial oversight.

- Competitive Release Windows: A crowded market means games can easily be overshadowed if released alongside major, highly anticipated titles.

- Market Saturation: The sheer volume of game releases in 2024 alone highlights the difficulty in capturing significant market share.

Talent Shortages and Rising Production Costs in Content Creation

Bandai Namco's IP Production Unit, especially in animation, is grappling with a significant shortage of skilled animators. This scarcity makes it challenging to scale operations and meet demand effectively. For instance, the global animation industry has seen a surge in demand, yet the supply of experienced talent hasn't kept pace, leading to increased competition for skilled professionals.

Rising production costs are another major threat, directly impacting the profitability of visual works and music. Factors like increased labor costs for animators, higher material expenses, and the growing complexity of animation techniques contribute to this upward trend. Reports from late 2024 indicated that animation studio overheads, including software licenses and studio space, have seen a notable increase, potentially adding 5-10% to project budgets.

- Talent Scarcity: Difficulty in securing enough experienced animators to maintain consistent output.

- Increased Labor Costs: Higher wages and benefits required to attract and retain animation talent.

- Operational Expenses: Rising costs for animation software, equipment, and studio overheads.

- Schedule Adjustments: Production delays and difficulties in meeting release deadlines due to talent and cost constraints.

Bandai Namco operates in a highly competitive entertainment landscape, facing intense pressure from rivals across gaming, toys, and anime. The global video game market's projected $229 billion valuation for 2024 underscores the fierce battle for consumer engagement and market share. Furthermore, economic instability and inflation in 2024 and 2025 could significantly curb discretionary spending on entertainment, directly impacting the company's core revenue streams.

The company's reliance on established intellectual properties like Gundam and Dragon Ball carries the risk of IP fatigue; while Gundam merchandise sales reached approximately ¥500 billion (around $3.4 billion USD) in 2023, a lack of fresh innovation could dampen future earnings. Additionally, the escalating costs and extended production cycles for AAA games, with budgets often exceeding $200 million and development times of five years or more, introduce substantial financial risks and potential market obsolescence.

A critical threat is the growing shortage of skilled animators, hindering Bandai Namco's IP Production Unit's ability to scale and meet demand, exacerbated by a surge in global animation industry demand not matched by talent supply. Rising production costs, including increased labor for animators and higher overheads for software and studio space, are also squeezing profit margins, with late 2024 reports indicating a 5-10% increase in animation project budgets.

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Bandai Namco's official financial reports, comprehensive market research on the gaming and entertainment sectors, and expert commentary from industry analysts.