Bandai Namco Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bandai Namco Holdings Bundle

Bandai Namco Holdings' gaming division likely boasts several "Stars" with its popular franchises, while its toy segment might represent "Cash Cows" generating consistent revenue. Understanding the nuances of their entire product portfolio is crucial for strategic growth.

Unlock a comprehensive understanding of Bandai Namco's market position by purchasing the full BCG Matrix report. Gain actionable insights into their "Dogs" and "Question Marks," and discover where to strategically invest for future success.

Stars

Elden Ring, especially with the recent launch of its Shadow of the Erdtree DLC, has become a powerhouse for Bandai Namco. The game's continued success, evidenced by the DLC selling over 5 million units in just its first three days, highlights its strong market position.

This title consistently generates robust repeat sales, making it a key contributor to Bandai Namco's digital entertainment sector. Elden Ring's performance underscores its high market share within the expanding console gaming market.

The Dragon Ball franchise, a cornerstone for Bandai Namco, consistently demonstrates robust performance. Games like *Dragon Ball: Sparking! Zero* have achieved remarkable sales, reaching 5.4 million copies, underscoring the franchise's enduring appeal and commercial viability.

This intellectual property holds a significant market share across diverse entertainment sectors, most notably in video games. Its ability to attract new audiences globally, as evidenced by the continued success of titles like the mobile game *Dragon Ball Z Dokkan Battle*, points to substantial ongoing growth potential and a strong position within Bandai Namco's portfolio.

The Mobile Suit Gundam franchise is a cornerstone of Bandai Namco's revenue, especially within its toys and hobby division. This enduring IP consistently drives sales through its popular plastic model kits, often referred to as Gunpla, which appeal to a dedicated and mature fan base.

Gundam boasts a commanding position in the Japanese plastic character model market and is experiencing robust global expansion. This growth trajectory, coupled with its established market leadership, firmly places it as a star product for Bandai Namco.

In fiscal year 2023, Bandai Namco reported that its Hobby segment, heavily influenced by Gundam model kits, saw significant growth. While specific IP-level revenue isn't always broken out, the overall segment performance indicates the franchise's substantial contribution, with sales continuing to climb as it captures new international markets.

One Piece Franchise

The One Piece franchise is a significant asset for Bandai Namco, demonstrating robust revenue growth, particularly in 2024. This expansion is fueled by its diverse media presence, including the highly successful Netflix live-action series and ongoing mobile game revenue streams.

The broad, global appeal of One Piece, coupled with its consistent expansion across various entertainment platforms, solidifies its position as a high-growth, high-market-share property within Bandai Namco's portfolio.

- Revenue Growth: Driven by the Netflix series and mobile games, One Piece saw substantial revenue increases in the fiscal year ending March 2024.

- Market Share: Its widespread popularity across anime, manga, games, and now live-action, secures a dominant market share for Bandai Namco.

- Growth Prospects: Continued content releases and merchandise expansion indicate strong future growth potential.

- IP Strength: The franchise's enduring appeal and adaptability across different media platforms underscore its status as a star performer.

Toys and Hobby Business (Adult-Oriented Products)

Bandai Namco's Toys and Hobby division, particularly its adult-oriented products like Gundam model kits and trading card games, has been a standout performer. This segment has demonstrated robust revenue and profit growth, reflecting strong consumer demand.

The company holds a significant market share in this niche, especially within its domestic Japanese market. However, its international expansion efforts are actively increasing its global footprint, signaling a high-growth trajectory for Bandai Namco.

- Strong Revenue Growth: The adult-oriented toy and hobby segment has consistently shown impressive revenue increases. For example, in fiscal year 2024, this segment contributed significantly to the company's overall financial health.

- High Market Share: Bandai Namco commands a dominant position in key markets for products like plastic models and trading cards, leveraging established intellectual property.

- International Expansion: The company is actively investing in expanding its presence in overseas markets, targeting regions with growing demand for collector-focused hobby products.

- Profitability: This segment consistently delivers strong profit margins, driven by premium pricing and high-quality product lines that appeal to dedicated fanbases.

Elden Ring, with its Shadow of the Erdtree DLC exceeding 5 million units sold in its initial three days, continues to be a star performer for Bandai Namco. Its sustained sales and broad appeal solidify its high market share in the console gaming sector.

The Dragon Ball franchise, exemplified by *Dragon Ball: Sparking! Zero*'s 5.4 million copies sold, remains a commercial powerhouse. Its consistent success across games and mobile platforms like *Dragon Ball Z Dokkan Battle* demonstrates its strong market position and ongoing growth potential.

Mobile Suit Gundam's plastic model kits (Gunpla) are a significant revenue driver, particularly in the Toys and Hobby segment. Its established leadership in Japan and expanding global presence confirm its star status.

One Piece's 2024 performance, boosted by the Netflix series and mobile games, shows robust revenue growth and a dominant market share. Its adaptability across media ensures strong future prospects.

| Product/Franchise | Market Position | Growth Indicator | Key Data Point (2024/Latest) |

|---|---|---|---|

| Elden Ring | High Market Share (Console Gaming) | Sustained Sales, DLC Success | Shadow of the Erdtree DLC: 5M+ units in 3 days |

| Dragon Ball | High Market Share (Games, Mobile) | Consistent Performance, Broad Appeal | Sparking! Zero: 5.4M copies sold |

| Mobile Suit Gundam | Market Leader (Hobby/Models) | Domestic Dominance, Global Expansion | Strong contribution to Toys and Hobby segment |

| One Piece | High Market Share (Multi-Platform) | Robust Revenue Growth, Cross-Media Success | Significant revenue increase in FY ending March 2024 |

What is included in the product

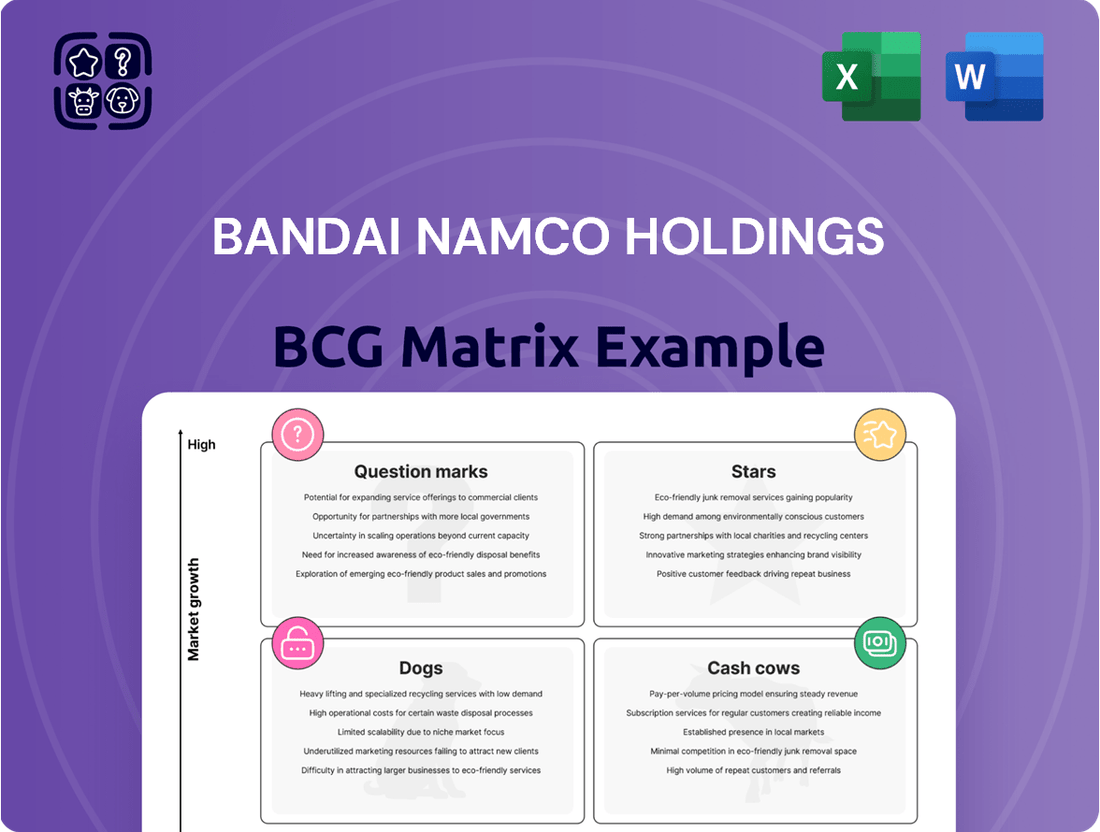

Bandai Namco's BCG Matrix analysis categorizes its diverse entertainment portfolio, guiding investment and divestment strategies for optimal growth.

Bandai Namco Holdings BCG Matrix: A clear visual roadmap to strategically allocate resources, transforming underperforming "Dogs" and "Cash Cows" into future "Stars" and managing "Question Marks" for growth.

Cash Cows

The Pac-Man franchise stands as a quintessential cash cow for Bandai Namco Holdings. Its iconic status guarantees consistent revenue streams from various avenues, including enduring arcade presence, a vast array of merchandise, and diverse entertainment adaptations.

While the arcade market itself might be considered mature, Pac-Man's sustained global appeal ensures a reliable and steady cash flow. This stability is achieved with minimal promotional expenditure, highlighting its strong, self-sustaining market position.

In 2023, Bandai Namco reported that its Entertainment segment, which heavily features IPs like Pac-Man, generated approximately ¥373.5 billion (around $2.5 billion USD at current exchange rates). This segment consistently contributes a significant portion to the company's overall profitability, underscoring Pac-Man's role as a dependable revenue generator.

The Tekken series is a prime example of a cash cow for Bandai Namco Holdings. Its established franchise status and loyal fanbase ensure consistent revenue generation within the mature fighting game market. This allows the company to leverage its competitive advantage effectively.

Tekken 8, released in January 2024, has demonstrated significant commercial success, further solidifying the series' cash cow status. The game achieved over 2 million units sold globally by March 2024, highlighting its continued appeal and profitability.

Bandai Namco's amusement facilities and arcade machines represent a classic cash cow. These operations consistently generate revenue, acting as reliable income streams for the company. For instance, in the fiscal year ending March 2024, the Entertainment segment, which includes these businesses, reported net sales of ¥307.9 billion.

While the arcade and amusement sector is mature, Bandai Namco's investment strategy here is about maintaining efficiency and optimizing existing operations rather than pursuing aggressive expansion. This focus ensures a steady cash flow, allowing the company to fund growth in other areas of its portfolio. The company continues to innovate within this space, introducing new machine types and enhancing the customer experience at its facilities.

Back Catalog Console Game Sales

Bandai Namco's back catalog of console games remains a robust cash cow, consistently delivering strong repeat sales, particularly through digital distribution channels. These established titles, such as those from the Dark Souls or Tekken franchises, demand very little in terms of new marketing spend, yet they reliably bolster the company's digital entertainment revenue streams.

The enduring appeal of these older games is evident in their sustained sales performance. For instance, in fiscal year 2024, Bandai Namco reported that its Digital Entertainment segment, which heavily features catalog titles, saw continued growth. While specific figures for individual back catalog titles are not always broken out, the overall segment's profitability underscores the cash-generating power of these assets. The company's strategy of leveraging its extensive library through digital storefronts ensures ongoing revenue with minimal incremental cost.

- Consistent Revenue Generation: Digital sales of older console titles provide a predictable and steady income stream.

- Low Investment Required: Unlike new releases, back catalog games need minimal marketing and development investment.

- Digital Dominance: A significant portion of these sales comes from digital downloads, further reducing distribution costs.

- Brand Loyalty: Established franchises within the back catalog benefit from strong existing fan bases, ensuring continued demand.

Established Mobile App Titles (excluding new high-growth ones)

Bandai Namco's established mobile app titles, like Dragon Ball Z Dokkan Battle, function as Cash Cows within their portfolio. These games operate in a mature market but command significant player loyalty, ensuring consistent revenue streams.

Dragon Ball Z Dokkan Battle, for instance, has demonstrated remarkable longevity and consistent profitability. As of early 2024, it continues to be a top-grossing title in the mobile gaming space, reflecting its strong market share among a dedicated fanbase. This stability provides a reliable source of cash flow for Bandai Namco, supporting investment in other areas of the business.

- Consistent Revenue: Established titles like Dragon Ball Z Dokkan Battle generate predictable income.

- Mature Market Dominance: These games hold a high market share despite the maturity of the mobile gaming sector.

- Dedicated Player Base: Strong player retention ensures ongoing monetization opportunities.

- Financial Stability: The cash flow from these titles fuels other strategic initiatives for Bandai Namco.

Bandai Namco's arcade and amusement facilities are a classic cash cow, consistently generating revenue with minimal new investment. The company's strategy focuses on optimizing existing operations, ensuring a steady cash flow that can fund growth in other business areas. For the fiscal year ending March 2024, the Entertainment segment, which includes these facilities, reported net sales of ¥307.9 billion, demonstrating their continued financial contribution.

| Business Unit | BCG Category | Fiscal Year 2024 Net Sales (JPY Billion) | Key Performance Indicator | Notes |

|---|---|---|---|---|

| Amusement Facilities & Arcades | Cash Cow | 307.9 (Part of Entertainment Segment) | Consistent Revenue Generation | Mature market, focus on operational efficiency and customer experience. |

| Digital Entertainment (Back Catalog) | Cash Cow | Significant Contribution (Part of Digital Segment) | Strong Repeat Sales via Digital Distribution | Low marketing spend, leverages established franchises like Dark Souls and Tekken. |

| Mobile Games (e.g., Dokkan Battle) | Cash Cow | High Profitability (Specifics not publicly detailed) | Sustained Top-Grossing Performance | Mature market, strong player loyalty and monetization in titles like Dragon Ball Z Dokkan Battle. |

Delivered as Shown

Bandai Namco Holdings BCG Matrix

The Bandai Namco Holdings BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no incomplete sections, and no demo content—just a professionally designed, analysis-ready report ready for your strategic planning. You can trust that the insights and formatting you see here are precisely what you'll be downloading to inform your business decisions and competitive analysis.

Dogs

Bandai Namco's ventures into new online games and MMORPGs, exemplified by titles like Blue Protocol, have unfortunately landed in the Dogs quadrant of the BCG Matrix. These games have incurred substantial development and marketing costs, with reports indicating significant financial strain. For instance, the initial global launch of Blue Protocol faced delays and mixed reception, failing to capture the anticipated market share and revenue streams necessary to justify the investment.

The high investment required for MMORPG development, coupled with the intense competition in the online gaming space, has proven to be a challenging environment for many new entrants. When these games fail to gain traction or achieve profitability, they become what are known as cash traps. This means they continue to drain resources without generating sufficient returns, negatively impacting the company's overall financial health and ability to invest in more promising areas.

Canceled mobile titles, exemplified by the discontinuation of *Tales of the Rays*, highlight strategic divestitures in Bandai Namco's portfolio. These ventures, unable to capture significant market share within the highly competitive mobile gaming sector, generated minimal returns and were subsequently removed from active investment.

Certain older or niche arcade titles within Bandai Namco's amusement segment, while still operating, are experiencing a noticeable dip in player engagement and consequently hold a smaller slice of the overall market compared to their more contemporary counterparts. These games, though they might cover their operational costs, represent a capital commitment without substantial avenues for future expansion, positioning them as potential candidates for strategic reduction or sale.

Legacy IPs with Limited Current Market Appeal (e.g., specific older fighting games that aren't Tekken)

Some legacy intellectual properties (IPs) within Bandai Namco's vast catalog, while holding significant historical value, might currently exhibit limited market appeal. These are franchises that once commanded attention but now struggle to capture a substantial audience or market share in their specific gaming genres.

Without significant investment in revitalization, such as updated gameplay mechanics, modern graphics, or new story content, these IPs may not contribute meaningfully to revenue or growth. Consequently, they could be categorized as ‘Dogs’ in the Bandai Namco BCG Matrix, representing underperforming assets that require careful consideration for their future within the company's portfolio.

- Low Market Share: Certain older fighting game franchises, excluding major players like Tekken, may hold a very small percentage of the current fighting game market share. For instance, a title that was popular in the late 1990s might now only attract a niche group of dedicated fans.

- Limited Revenue Generation: These IPs often generate minimal revenue compared to Bandai Namco's more successful franchises. Sales figures for re-releases or new installments in these dormant series might be significantly lower, indicating a lack of broad consumer interest.

- High Revitalization Costs: Bringing a legacy IP back to prominence can be expensive. Developing a modern fighting game, for example, requires substantial investment in technology, marketing, and talent, which may not be justified by the projected returns for a ‘Dog’ IP.

- Potential for Divestment or Sunset: Companies often evaluate ‘Dog’ assets for potential divestment or a strategic decision to cease further development and support, freeing up resources for more promising ventures.

Physical Media Sales (in declining markets)

Physical media sales, a segment within Bandai Namco Holdings, are experiencing a decline in an era dominated by digital consumption. This area represents a low-growth market where market share is diminishing, reflecting broader industry trends.

While physical media still contributes to revenue, the investment required for this segment is minimal. Bandai Namco may consider phasing out or significantly reducing its focus on physical media sales in the future to reallocate resources to more promising digital ventures.

- Declining Market Share: In 2023, global physical video game sales saw a notable decrease, with digital downloads continuing to capture a larger portion of the market.

- Low Investment Strategy: Bandai Namco's approach to this segment is characterized by a strategy of minimal investment, focusing on efficient inventory management rather than expansion.

- Future Outlook: The long-term strategy for physical media sales within Bandai Namco is likely to involve a gradual reduction or a complete phase-out as digital platforms solidify their dominance.

Bandai Namco's ventures into new online games and MMORPGs, such as Blue Protocol, have unfortunately landed in the Dogs quadrant of the BCG Matrix. These games have incurred substantial development and marketing costs, with reports indicating significant financial strain. For instance, the initial global launch of Blue Protocol faced delays and mixed reception, failing to capture the anticipated market share and revenue streams necessary to justify the investment.

The high investment required for MMORPG development, coupled with intense competition, has proven challenging. When these games fail to gain traction or achieve profitability, they become cash traps, draining resources without sufficient returns and impacting the company's overall financial health.

Canceled mobile titles, like the discontinuation of *Tales of the Rays*, exemplify strategic divestitures. These ventures, unable to capture significant market share in the competitive mobile gaming sector, generated minimal returns and were removed from active investment.

Certain older or niche arcade titles, while still operating, are experiencing a dip in player engagement, holding a smaller market slice than contemporary counterparts. These games might cover operational costs but represent a capital commitment without substantial expansion avenues, positioning them for potential reduction or sale.

Legacy intellectual properties (IPs) with limited market appeal, despite historical value, might struggle to capture a substantial audience or market share in their genres without revitalization. Without updates, these IPs could be categorized as 'Dogs,' requiring careful consideration for their future within the company's portfolio.

Physical media sales are declining in an era dominated by digital consumption, representing a low-growth market with diminishing market share. While still contributing revenue, investment in this segment is minimal, suggesting a potential future phase-out or reduction in focus.

| Segment | Market Share | Growth Rate | Investment | Cash Flow |

| New Online Games (e.g., Blue Protocol) | Low | Low/Negative | High | Negative |

| Canceled Mobile Titles (e.g., Tales of the Rays) | Negligible | Declining | None (Divested) | None |

| Legacy Arcade Titles | Low | Low | Low/Moderate | Low/Break-even |

| Underperforming IPs | Low | Low | Low (unless revitalized) | Low |

| Physical Media Sales | Declining | Declining | Low | Low/Declining |

Question Marks

Bandai Namco is actively cultivating new original intellectual properties (IPs) within its digital entertainment division, exemplified by titles like Unknown 9: Awakening. These ventures are positioned in a rapidly expanding market, yet they are in the early stages of development and market penetration.

Significant investment is being channeled into these new IPs to foster their growth and secure a foothold, aiming to transform them into future revenue drivers. The digital entertainment market, particularly for new game IPs, is characterized by high potential but also substantial risk and upfront costs.

Bandai Namco is actively investing in emerging technologies and experiential entertainment, such as its VR Zone locations and partnerships with Sony for fan engagement. These ventures represent high-growth potential within the entertainment sector. For instance, the global VR market was projected to reach over $22 billion in 2024, indicating substantial future growth opportunities.

However, these innovative areas, while promising, currently hold a relatively small market share for Bandai Namco. Significant investment is needed to develop these technologies and expand their reach, positioning them as question marks in the BCG matrix. This requires careful resource allocation to nurture their growth and market penetration.

Bandai Namco's strategic push into new global markets, especially North America, for its amusement facilities signifies a significant "Question Mark" in the BCG matrix. While these regions represent high-growth potential, the company's current market share in these nascent international amusement sectors is low. This necessitates considerable investment and careful strategic planning to establish a strong foothold.

New Anime and Manga IP Joint Developments with Sony

Bandai Namco's strategic partnership with Sony for new anime and manga IP joint developments positions them within the Stars quadrant of the BCG Matrix. This collaboration leverages the booming global anime market, which saw significant growth in 2023 and is projected to continue expanding. For instance, the global anime market size was valued at approximately USD 25.5 billion in 2023 and is expected to reach USD 52.1 billion by 2030, growing at a CAGR of 10.7%.

This joint venture aims to create and promote original intellectual properties, capitalizing on the increasing demand for Japanese animation and comics worldwide. While the potential for high returns exists due to the market's trajectory, these ventures are inherently high-risk, requiring substantial initial investment in content creation and marketing. The success and subsequent market share of these new IPs remain uncertain, making them characteristic of a high-growth, high-investment category.

- Strategic Partnership: Joint development and promotion of new anime and manga IPs with Sony.

- Market Opportunity: Taps into the rapidly growing global market for Japanese animation and comics.

- Investment & Risk: Requires significant upfront investment with uncertain market share and success.

- Market Data: Global anime market valued at USD 25.5 billion in 2023, projected to reach USD 52.1 billion by 2030 (10.7% CAGR).

Nintendo Switch 2 Titles Under Development

Bandai Namco Holdings is actively developing titles for the forthcoming Nintendo Switch 2, a strategic move that aligns with investing in a high-growth potential platform. This positions these unreleased games as potential 'Stars' within the BCG Matrix, assuming the Switch 2 platform achieves significant market penetration and consumer adoption.

Currently, the market share for these Nintendo Switch 2 titles is effectively zero, as they are yet to be released. Their future success, and thus their classification within the BCG Matrix, hinges entirely on the Switch 2's market reception and the strength of their launch performance. For instance, if the Switch 2 sells 15 million units in its first year, as some analysts predict for new console launches, Bandai Namco's titles could capture a notable share.

- Investment in Growth: Bandai Namco's development for the Switch 2 signifies a commitment to a platform anticipated to drive future revenue.

- Zero Current Market Share: As unreleased titles, their market share is currently nil, making their performance post-launch critical.

- Dependence on Platform Success: The success of these games is intrinsically linked to the Nintendo Switch 2's adoption rate and overall market performance.

- Potential 'Stars': If the Switch 2 gains significant traction, these titles could become high-growth, high-market-share 'Stars' for Bandai Namco.

Bandai Namco's ventures into new original IPs, such as Unknown 9: Awakening, and investments in emerging technologies like VR, represent significant question marks. These initiatives are in high-growth markets but are in early development stages with uncertain market share and require substantial investment, characteristic of the question mark quadrant.

The company's expansion into new international markets for amusement facilities also falls into this category. While these regions offer substantial growth potential, Bandai Namco's current market penetration is low, necessitating considerable investment and strategic focus to establish a strong presence.

These question mark initiatives demand careful resource allocation and strategic decision-making to nurture their growth and determine if they will evolve into stars or be divested.

The success of these question marks is critical for Bandai Namco's future portfolio, as they represent potential future revenue streams in expanding entertainment sectors.

BCG Matrix Data Sources

Our Bandai Namco Holdings BCG Matrix is built on robust financial disclosures, comprehensive market research reports, and detailed product performance data to accurately assess each business unit's strategic position.