Bandai Namco Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bandai Namco Holdings Bundle

Bandai Namco Holdings navigates a complex landscape shaped by intense competition, significant buyer power in the gaming and entertainment sectors, and the constant threat of emerging technologies. Understanding these dynamics is crucial for any stakeholder looking to grasp their strategic positioning.

The complete report reveals the real forces shaping Bandai Namco Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bandai Namco Holdings' reliance on intellectual property (IP) for its video games, anime, and merchandise means that key content providers and licensors wield considerable influence. The power of these suppliers is particularly potent when dealing with highly desirable or exclusive licenses, directly impacting Bandai Namco's product pipeline and revenue streams.

For instance, the success of franchises like Elden Ring, which Bandai Namco publishes, underscores the value of strong developer relationships. In 2023, Elden Ring had sold over 25 million units worldwide, demonstrating the significant revenue potential derived from these key IPs, and by extension, the bargaining power of their creators.

Bandai Namco actively works to counterbalance this supplier power by investing in its own content development and by strategically leveraging its vast existing IP portfolio. Iconic franchises such as Pac-Man and Tekken, which are owned and developed internally, provide a degree of control and reduce dependence on external licensors.

Bandai Namco's reliance on technology and software providers, particularly for game engines and development tools, presents a moderate bargaining power for these suppliers. While the gaming industry offers a range of options, the need for specialized or proprietary software, such as console SDKs from Sony and Microsoft, can concentrate power in the hands of a few key players. In 2024, the continued evolution of game development technologies means that companies like Bandai Namco must stay abreast of these advancements, potentially increasing supplier leverage.

Bandai Namco Holdings relies on a global network of manufacturing and production partners for its vast array of toys, figures, and merchandise. The bargaining power of these suppliers is influenced by their production capacity, specialized skills, and cost-effectiveness. For instance, a supplier with unique molding techniques for intricate collectible figures might hold more sway than a general plastics manufacturer.

In 2024, the toy manufacturing sector, particularly in Asia, faced ongoing supply chain challenges, including increased raw material costs and shipping delays. This environment can amplify the bargaining power of established, reliable manufacturers who can consistently deliver high-quality products. Bandai Namco's strategy to mitigate this involves diversifying its manufacturing base across different regions and cultivating robust, long-term partnerships to secure favorable terms and consistent production output.

Talent and Creative Professionals

The entertainment sector, including gaming where Bandai Namco operates, relies heavily on specialized creative professionals such as game developers, animators, and storytellers. These individuals, particularly those with unique skills or established reputations, possess considerable leverage because their contributions are essential for creating compelling content.

In 2023, the global gaming market generated over $184 billion, highlighting the immense value placed on creative output. This underscores the bargaining power of top-tier talent who can significantly influence a game's success.

- High Demand for Specialized Skills: The intricate nature of modern game development requires highly specialized roles, from AI programmers to character artists, leading to a competitive landscape for talent.

- Renowned Creators Command Premiums: Studios or individual creators with a track record of blockbuster hits can negotiate favorable terms, impacting production costs for companies like Bandai Namco.

- Bandai Namco's Talent Strategy: The company's investment in internal development studios and talent acquisition programs directly addresses this by aiming to retain and cultivate creative expertise, thereby mitigating supplier power.

Raw Material Suppliers

Bandai Namco Holdings relies on a variety of raw materials, including plastics, metals, and electronic components, for its extensive toy and merchandise production. The bargaining power of these suppliers is significantly shaped by global commodity price fluctuations and the overall stability of supply chains. For instance, fluctuations in the price of crude oil, a key component in plastic production, directly impact the cost of these essential materials.

The availability of alternative materials and the concentration of suppliers in the market also play a crucial role in determining supplier leverage. If few suppliers can provide a specific, high-quality component, their power increases. Conversely, a market with many alternative suppliers for similar materials tends to reduce this power.

Economic shifts and geopolitical events can further influence the bargaining power of raw material suppliers. Disruptions in global trade, such as tariffs or shipping challenges, can create shortages or price hikes, giving suppliers more leverage over Bandai Namco. For example, in 2024, ongoing supply chain issues stemming from global events continued to put pressure on the availability and cost of certain electronic components vital for interactive toys.

- Plastic Prices: The price of ABS plastic, commonly used in toys, saw an average increase of 5-10% globally in early 2024 compared to the previous year, driven by petrochemical market dynamics.

- Electronic Components: Lead times for certain semiconductor chips essential for Bandai Namco's electronic merchandise remained extended in 2024, averaging 20-30 weeks, thereby increasing supplier leverage.

- Metal Costs: Steel prices, relevant for some toy mechanisms and packaging, experienced moderate volatility in 2024, with some upward pressure due to industrial demand in key manufacturing regions.

Bandai Namco's reliance on external intellectual property (IP) and specialized talent gives suppliers significant bargaining power, particularly for highly sought-after licenses and creative expertise. This is evident in the success of published titles, where creators' contributions are crucial, and in the competitive market for skilled game developers and animators. The company mitigates this by investing in its own IP and talent acquisition.

The company's dependence on technology providers, especially for game engines and console development kits, grants these suppliers moderate leverage. Furthermore, the sourcing of raw materials like plastics and electronic components is susceptible to global price volatility and supply chain disruptions, which can amplify the bargaining power of manufacturers and material providers.

In 2024, the gaming industry continued to see high demand for specialized creative talent, with experienced game directors and lead programmers commanding premium salaries. For instance, the average salary for a senior game programmer in major development hubs saw an increase of 5-8% in 2024. This trend directly impacts Bandai Namco's production costs and talent retention strategies.

| Supplier Type | Impact on Bandai Namco | 2024 Data/Trend |

| IP Licensors/Content Providers | High Bargaining Power (for exclusive/popular IPs) | Continued high demand for established franchises, influencing licensing fees. |

| Creative Talent (Developers, Animators) | High Bargaining Power (for specialized skills) | Average senior game programmer salary increase of 5-8% in 2024. |

| Technology Providers (Game Engines, SDKs) | Moderate Bargaining Power | Ongoing need for advanced development tools and console-specific software. |

| Manufacturing Partners (Toys, Merchandise) | Moderate to High Bargaining Power (depending on specialization/capacity) | Supply chain challenges in 2024 impacting raw material costs and delivery times. |

| Raw Material Suppliers (Plastics, Electronics) | Moderate to High Bargaining Power (due to commodity prices/availability) | Extended lead times (20-30 weeks) for certain electronic components in 2024. |

What is included in the product

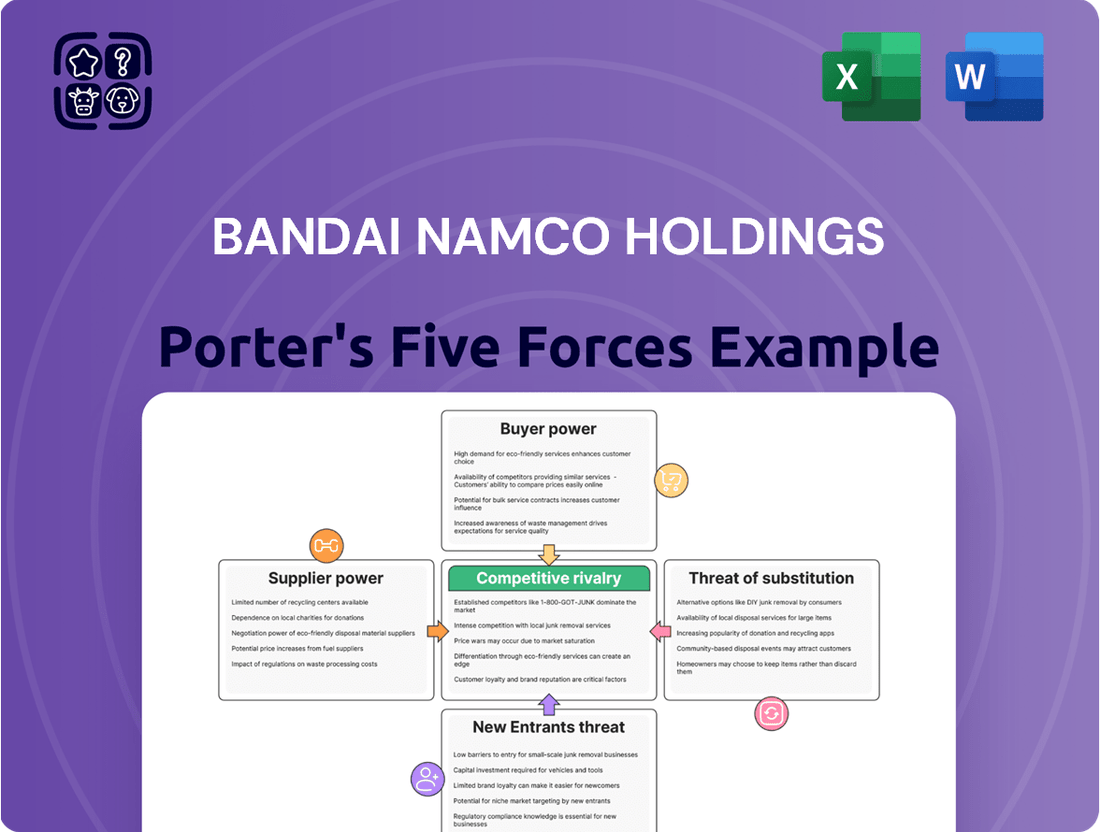

This analysis of Bandai Namco Holdings reveals the intensity of rivalry within the entertainment industry, the bargaining power of its diverse customer base, and the significant barriers to entry for potential competitors.

Visualize the competitive landscape for Bandai Namco Holdings with an intuitive Porter's Five Forces analysis, simplifying complex market dynamics for strategic advantage.

Customers Bargaining Power

Individual consumers, particularly gamers, collectors, and fans, wield considerable bargaining power. This is largely due to the sheer volume of entertainment choices available, making the video game and toy sectors intensely competitive. Their buying habits are shaped by factors like price sensitivity, perceived quality, established brand loyalty, and the anticipation of new product launches.

Bandai Namco strategically cultivates this consumer base by fostering direct connections with fans and leveraging its intellectual property (IP) across diverse segments. For instance, in fiscal year 2024, Bandai Namco reported robust performance in its IP Promotion segment, which includes toys and hobbies, indicating the continued strength of fan engagement. This multi-faceted approach aims to solidify customer retention in a market where switching costs can be relatively low for consumers seeking the next popular item or game.

Large retailers, online marketplaces like Amazon, and digital storefronts such as Steam and PlayStation Store are vital for Bandai Namco's product reach. These intermediaries wield significant bargaining power, influencing everything from product placement and promotional activities to pricing strategies. For instance, a major retailer's decision on shelf space can directly impact a physical game's visibility and sales volume.

The increasing reliance on digital distribution for video games, a core Bandai Namco segment, is reshaping these relationships. While digital platforms offer convenience and potentially lower distribution costs, they also concentrate power in the hands of platform holders. Bandai Namco's own direct-to-consumer initiatives, particularly through its websites and fan communities, aim to mitigate this by building direct relationships and reducing reliance on third-party channels.

Amusement facility patrons, like those visiting Bandai Namco's parks, wield significant bargaining power. This power stems from their ability to choose among various entertainment options and their control over discretionary spending. For instance, in 2023, the global amusement and theme park market was valued at approximately $51.7 billion, indicating a highly competitive landscape where customer preferences heavily influence success.

Customers are swayed by the overall experience, the range of attractions offered, and the price point. Bandai Namco actively addresses this by investing in creating immersive and varied entertainment, aiming to capture and keep their audience. The company's commitment to innovation and customer satisfaction is crucial in a market where a single negative experience can lead patrons to seek alternatives.

Licensing Partners and Collaborators

Companies that license Bandai Namco's intellectual property (IP) wield significant bargaining power. This power stems from their ability to leverage Bandai Namco's popular franchises to reach vast consumer bases and generate substantial revenue. For instance, successful collaborations can unlock new market segments and boost brand visibility for both parties.

Bandai Namco's strategic partnerships underscore this dynamic. Collaborations with major players like Sony, as seen with the expansion of their IP into new gaming experiences, demonstrate a mutual interest in enhancing fan engagement and extending the reach of beloved characters and stories. These alliances are crucial for maximizing the commercial potential of their extensive IP portfolio.

- Licensing partners' revenue potential directly influences their bargaining leverage.

- Strategic alliances, like those with Sony, are key to expanding IP reach and fan engagement.

- Bandai Namco's extensive IP library provides numerous opportunities for mutually beneficial collaborations.

Educational Institutions and Commercial Buyers

In sectors like educational toys and arcade machines, Bandai Namco faces commercial buyers such as schools and entertainment venues. These entities possess significant bargaining power, primarily due to their ability to place large, bulk orders and negotiate long-term supply agreements. This is particularly relevant for educational toys, a growing market segment driven by institutional demand.

The bargaining power of these customers is amplified by several factors:

- Volume Purchases: Educational institutions and large entertainment chains often buy in substantial quantities, giving them leverage to negotiate lower prices per unit. For example, a major school district implementing a new STEM curriculum might require thousands of educational toys.

- Long-Term Contracts: The prospect of securing multi-year contracts for arcade machine leases or toy supplies can incentivize Bandai Namco to offer more favorable terms to these buyers.

- Potential for Switching: While brand loyalty exists, these commercial buyers can switch to alternative suppliers if Bandai Namco's pricing or product offerings are not competitive, especially for standardized educational products.

Individual consumers, particularly gamers and collectors, hold significant bargaining power due to the vast array of entertainment options available. Their purchasing decisions are influenced by price, perceived quality, brand loyalty, and the anticipation of new releases, making consumer engagement crucial for Bandai Namco. The company strategically fosters these connections through its IP promotion segment, which saw strong performance in fiscal year 2024, indicating the continued strength of fan engagement and the need to retain customers in a market with low switching costs.

Large retailers and digital storefronts act as powerful intermediaries, influencing product placement, promotions, and pricing. While digital platforms offer convenience, they also concentrate power with platform holders, prompting Bandai Namco to enhance its direct-to-consumer initiatives to build stronger relationships and reduce reliance on third-party channels. This strategy is vital for maintaining control over brand presentation and customer interaction.

Commercial buyers like schools and entertainment venues possess considerable bargaining power, especially through large, bulk orders and long-term contracts. Their ability to negotiate favorable terms for items like educational toys or arcade machines is amplified by the potential to switch suppliers if Bandai Namco's offerings are not competitive. For instance, a major school district might require thousands of educational toys, providing substantial leverage for price negotiations.

Preview Before You Purchase

Bandai Namco Holdings Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Bandai Namco Holdings, offering a detailed examination of competitive rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. The document you are viewing is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

Bandai Namco operates in a hyper-competitive landscape, facing off against industry giants like Nintendo, Sony with its PlayStation Studios, and Microsoft's Xbox Game Studios. Epic Games also presents a significant challenge, particularly in the PC and digital distribution arenas. This intense rivalry means constant innovation and strategic marketing are crucial for capturing market share.

The battle for consumer attention and top talent is relentless, fueled by a continuous stream of new game releases and ongoing live-service content updates across all platforms. This dynamic environment demands significant investment in research and development, as well as effective community engagement strategies to retain players.

The global video game market is experiencing robust growth, with projections indicating continued expansion through 2025 and beyond. Notably, the mobile gaming segment is the largest contributor to this growth, highlighting a key area where publishers like Bandai Namco must compete effectively to maintain their position.

Toy and collectible manufacturers face intense rivalry, with global players like Hasbro and Mattel competing against a multitude of smaller, specialized firms. This fragmentation means constant pressure on innovation, securing popular licenses, and maintaining strong brand appeal to capture consumer attention.

Competition is fierce, driven by the need for compelling product lines and effective marketing. For instance, the trading card segment, a significant area for collectibles, saw continued robust demand in 2024, with major releases and events driving collector engagement and sales volumes.

Bandai Namco faces intense competition in anime production and distribution. Established Japanese studios like Toei Animation and Sunrise, alongside newer players, vie for talent and market share. The global anime market was valued at approximately $24.2 billion in 2023 and is projected to reach $46.5 billion by 2030, highlighting the lucrative but crowded nature of the industry.

International streaming giants such as Netflix and Crunchyroll are significantly increasing their investment in original anime content and licensing. This influx of capital and production capacity from global players intensifies rivalry, forcing Bandai Namco to innovate and secure exclusive rights to remain competitive. For instance, Netflix announced plans to invest heavily in anime production throughout 2024, aiming to capture a larger share of this growing market.

Amusement and Entertainment Operators

Bandai Namco's amusement facilities face intense competition from a broad spectrum of entertainment providers. This includes not only other amusement parks and arcades but also cinemas, live event venues, and the ever-growing home entertainment sector. The key battleground is the ability to offer compelling and unique experiences that draw consumers away from these alternatives.

The rivalry hinges on several crucial factors: delivering novel attractions, consistently updating offerings to maintain customer interest, and effectively driving foot traffic to physical locations. In 2023, the global amusement and theme park market was valued at approximately $53.4 billion, highlighting the significant scale of this competitive landscape. Companies must continuously innovate to capture a share of this market.

- Diverse Competitors: Bandai Namco's amusement operations contend with a wide array of entertainment choices, from rival theme parks and arcades to movie theaters and digital entertainment platforms.

- Key Differentiators: Success in this segment relies on providing unique, memorable experiences, adapting to evolving consumer preferences, and effectively attracting visitors.

- IP Leverage: Bandai Namco's strategic approach involves utilizing its strong intellectual property portfolio to create distinctive attractions, such as character-themed rides and interactive exhibits, setting them apart from competitors.

Cross-Media Entertainment Conglomerates

Bandai Namco's competitive rivalry is intense, as it operates within the cross-media entertainment sector. Major players like Disney and Warner Bros. Discovery also leverage vast intellectual property portfolios across film, television, gaming, and merchandise, directly competing for consumer attention and discretionary spending. For instance, in 2024, both Disney and Warner Bros. Discovery continued to invest heavily in their streaming services and blockbuster film franchises, creating a crowded landscape where capturing audience engagement is paramount.

These entertainment giants are constantly vying for limited consumer leisure time and dollars. Their strategies often involve cross-promotion of intellectual property across various platforms, a tactic Bandai Namco also employs with its IP axis strategy. The goal is to create a synergistic effect, where success in one medium, like a popular anime or video game, drives demand for related products and experiences in others.

- Broad Competition: Bandai Namco faces rivals like Disney and Warner Bros. Discovery, which also operate across multiple media segments.

- Resource Allocation: Competitors vie for consumer spending on games, movies, merchandise, and live events.

- IP-Driven Strategy: Bandai Namco's IP axis strategy aims to maximize value across its diverse entertainment offerings, mirroring competitor approaches.

- Market Dynamics: The entertainment industry's dynamic nature means constant innovation and adaptation are necessary to maintain market share against these large conglomerates.

Bandai Namco faces formidable competition across its diverse business segments, from gaming giants like Nintendo and Sony to toy manufacturers such as Hasbro and Mattel. The video game market, projected for continued growth through 2025, sees intense rivalry, particularly in the booming mobile sector. Similarly, the anime industry, valued at $24.2 billion in 2023, is crowded with established and emerging players, including streaming services like Netflix that are significantly increasing their anime investments.

In amusement facilities, competition extends beyond theme parks to include cinemas and home entertainment, demanding unique experiences to attract visitors. The broader entertainment sector sees Bandai Namco contending with media conglomerates like Disney and Warner Bros. Discovery, all leveraging extensive intellectual property to capture consumer attention and spending. This means constant innovation and strategic IP utilization are critical for Bandai Namco to maintain its competitive edge.

| Competitor Type | Key Competitors | Market Segment | 2024 Focus/Trend |

| Video Game Publishers | Nintendo, Sony, Microsoft, Epic Games | Console, PC, Mobile Gaming | Live-service content, new IP development, mobile expansion |

| Toy Manufacturers | Hasbro, Mattel | Toys, Collectibles, Trading Cards | Securing popular licenses, brand appeal, trading card market growth |

| Anime Production/Distribution | Toei Animation, Sunrise, Netflix, Crunchyroll | Anime Production, Streaming | Original content investment, global distribution, IP licensing |

| Entertainment Conglomerates | Disney, Warner Bros. Discovery | Film, TV, Gaming, Merchandise, Theme Parks | Streaming service investment, blockbuster franchises, cross-media promotion |

SSubstitutes Threaten

Digital substitutes like Netflix, YouTube, and TikTok are a major threat, constantly vying for consumers' leisure time and attention that could otherwise be spent on Bandai Namco's offerings. In 2024, the global video streaming market alone was projected to reach over $100 billion, highlighting the sheer scale of this competition.

Furthermore, the rise of creator-led content and interactive experiences on platforms like Twitch and TikTok is reshaping entertainment consumption. This shift means consumers are increasingly drawn to dynamic, user-generated content, presenting a challenge to traditional, more passive forms of entertainment that Bandai Namco traditionally excels at.

Traditional physical entertainment options such as books, board games, and engaging in outdoor activities or sports present a considerable threat. These alternatives directly compete for consumer leisure time and discretionary spending, potentially diverting funds that might otherwise be allocated to Bandai Namco's video games, toys, or theme park experiences. For instance, the global board games market was valued at approximately $12.5 billion in 2023 and is projected to grow, indicating a robust alternative entertainment sector.

The toy industry itself, a core segment for Bandai Namco, has experienced notable growth, with a significant portion of this expansion attributed to adult consumers. Adults are increasingly purchasing toys for nostalgia, stress relief, and as collectibles, further intensifying the competitive landscape for physical entertainment. This trend highlights how even within the broader toy market, alternative forms of physical engagement can capture consumer interest and spending.

The threat of piracy and illegitimate content distribution remains a significant concern for Bandai Namco, especially within its video game and anime segments. Illicit channels offering content for free directly compete with legitimate sales, eroding potential revenue streams. For instance, in 2023, the global video game piracy rate was estimated to be around 10-15%, impacting billions in lost sales across the industry, a figure that undoubtedly affects Bandai Namco's bottom line.

Do-It-Yourself (DIY) and Fan-Created Content

The burgeoning DIY culture presents a significant threat of substitutes for Bandai Namco. With accessible game development kits and user-friendly 3D printing technology, consumers can now create their own entertainment, from custom video games to fan-made merchandise. This trend allows individuals to bypass traditional purchasing channels.

For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to grow substantially. This indicates a growing capacity for consumers to produce their own physical goods, potentially including figures and accessories that might otherwise be purchased from Bandai Namco.

However, this DIY movement also offers an avenue for Bandai Namco to foster deeper fan engagement.

- DIY Culture Impact: Consumers creating their own entertainment, like custom games or 3D printed figures, directly substitutes for Bandai Namco's licensed products.

- Market Data: The 3D printing market's significant growth signifies increasing consumer capability to produce their own physical goods.

- Fan Engagement Opportunity: Bandai Namco can leverage fan-created content to build stronger community ties and brand loyalty.

Changing Consumer Preferences and Lifestyle Trends

Shifts in consumer preferences, such as a growing demand for digital entertainment and experiences over physical toys, pose a significant threat. For instance, the global gaming market, a key area for Bandai Namco, was projected to reach over $229 billion in 2023, indicating a strong preference for digital engagement.

Evolving lifestyle trends, including a focus on healthier living and sustainability, could also reduce demand for traditional merchandise. Bandai Namco needs to consider how its product lines align with these broader societal changes. The increasing popularity of STEM-focused educational toys and the robust market for adult collectibles, however, present opportunities for adaptation.

- Digital Shift: The global gaming market's substantial growth signifies a consumer move towards digital experiences.

- Lifestyle Alignment: Bandai Namco must adapt to trends favoring health and sustainability.

- Emerging Markets: Opportunities exist in STEM toys and the growing adult collectibles sector.

The threat of substitutes for Bandai Namco is substantial, encompassing digital entertainment, traditional leisure activities, and even consumer-generated content. Digital platforms like streaming services and social media directly compete for consumer attention, with the global video streaming market alone projected to exceed $100 billion in 2024. Similarly, established physical entertainment such as board games, valued at approximately $12.5 billion in 2023, and outdoor activities offer alternative ways for consumers to spend their leisure time and money.

The rise of creator-led content and the DIY culture further fragment the entertainment landscape. Platforms like Twitch and TikTok showcase user-generated content, drawing audiences away from more traditional media. Moreover, advancements in technology, such as 3D printing, which saw its market reach about $15.1 billion in 2023, empower consumers to create their own entertainment and merchandise, directly substituting for Bandai Namco's offerings.

Piracy remains a persistent threat, particularly impacting Bandai Namco's video game and anime divisions. Illicit content distribution erodes potential revenue, with industry estimates suggesting around 10-15% of video game sales were lost to piracy in 2023. This highlights the constant need for Bandai Namco to innovate and provide compelling value to its customers.

| Threat Category | Key Substitutes | Market Size/Growth Indicator (2023/2024 Data) | Impact on Bandai Namco |

| Digital Entertainment | Streaming Services (Netflix, YouTube), Social Media (TikTok) | Global Video Streaming Market: >$100 billion (2024 proj.) | Diverts consumer leisure time and attention from Bandai Namco's digital and physical products. |

| Traditional Leisure | Board Games, Books, Outdoor Activities | Global Board Games Market: ~$12.5 billion (2023) | Competes for discretionary spending and leisure time, offering alternative entertainment experiences. |

| User-Generated & DIY Content | Creator Platforms (Twitch), 3D Printing | Global 3D Printing Market: ~$15.1 billion (2023) | Empowers consumers to create their own entertainment, bypassing traditional purchases and potentially devaluing licensed products. |

| Content Piracy | Illicit Digital Distribution | Video Game Piracy Rate: 10-15% (2023 est.) | Directly reduces revenue for digital content like video games and anime. |

Entrants Threaten

The digital realm significantly lowers the entry barriers for content creation. Game development tools, animation software, and digital distribution platforms are more accessible than ever, allowing independent creators to emerge. For instance, the global game development software market was valued at approximately $10.5 billion in 2023 and is projected to grow substantially, indicating a vibrant ecosystem for new entrants.

The rapid evolution of technologies like AI for content generation and immersive VR/AR experiences presents a significant threat of new entrants for Bandai Namco. These advancements can lower barriers to entry, allowing agile startups to quickly develop and launch novel entertainment products that challenge established players. For instance, the AI-driven animation sector is projected to grow substantially, potentially enabling new studios to bypass traditional production pipelines and offer unique content.

While certain areas of the entertainment industry might seem accessible, establishing a significant presence akin to Bandai Namco demands considerable financial backing. This includes hefty investments in research and development to create new games and experiences, robust marketing campaigns to reach a global audience, and sophisticated distribution networks. For instance, the development of a major video game title can cost tens of millions of dollars, a significant hurdle for newcomers.

Furthermore, the creation and ongoing nurturing of beloved intellectual properties (IP) such as Pac-Man, Tekken, or Gundam is a long-term, resource-intensive endeavor. These IPs require continuous innovation and marketing to remain relevant and profitable, presenting a formidable barrier to entry for potential competitors who lack the established brand recognition and the financial capacity to sustain such efforts over time.

Brand Loyalty and Established Fan Bases

Bandai Namco Holdings enjoys a significant advantage due to its deeply entrenched brand loyalty and the passionate fan bases built around its beloved franchises. This makes it difficult for new competitors to gain traction, as they must overcome the established trust and emotional connection consumers have with Bandai Namco's properties. For instance, the enduring popularity of franchises like Gundam and Dragon Ball demonstrates the power of these established connections, which are not easily replicated.

The challenge for new entrants lies in replicating the extensive marketing investment and the time required to foster similar levels of consumer engagement and brand recognition. Bandai Namco's 'Connect with Fans' strategy is a prime example of how the company actively nurtures these relationships, further solidifying its market position. This strategy involves various initiatives, from community events to digital engagement platforms, all aimed at deepening the bond with their audience.

- Brand Recognition: Bandai Namco's iconic franchises like Gundam, Dragon Ball, and One Piece have cultivated decades of brand recognition and consumer affinity.

- Fan Base Loyalty: These franchises boast highly dedicated fan bases who actively purchase merchandise, play games, and engage with related media, creating a strong barrier to entry.

- Marketing Investment: New entrants would need substantial marketing budgets to build comparable brand awareness and emotional resonance with consumers.

- Time to Cultivate: Establishing the kind of deep-seated fan loyalty Bandai Namco benefits from is a long-term endeavor, often taking many years and consistent effort.

Regulatory and Licensing Hurdles

Entering specific entertainment sectors, particularly those involving well-known licensed characters or substantial amusement park operations, often necessitates navigating intricate regulatory frameworks and obtaining crucial intellectual property licenses. This can be a significant barrier for potential newcomers.

Bandai Namco Holdings benefits from its deep-seated relationships with licensors and its proactive approach to securing and managing these valuable intellectual properties. For instance, its extensive portfolio of beloved characters from franchises like Gundam and Dragon Ball provides a substantial competitive moat.

The company's ability to secure exclusive rights for popular IPs, such as those in the anime and video game space, makes it challenging for new entrants to replicate its content offerings. In 2023, Bandai Namco reported ¥178.7 billion in net sales for its IP Creation segment, showcasing the financial power of its licensed content.

- Regulatory Complexity: New entrants face significant challenges in obtaining necessary permits and adhering to diverse entertainment industry regulations.

- Intellectual Property Licensing: Securing rights to popular characters and franchises is costly and often exclusive, limiting access for competitors.

- Established Relationships: Bandai Namco's long-standing partnerships with IP holders provide preferential access and terms.

- Capital Investment: The substantial investment required for licensing and regulatory compliance deters many potential new players.

While digital tools lower some entry barriers, the sheer capital required for AAA game development, global marketing, and maintaining beloved IPs like Gundam presents a significant hurdle. New entrants must overcome the substantial costs associated with creating and sustaining these ventures, a barrier Bandai Namco has effectively managed for decades. For example, the average budget for a AAA video game can easily exceed $100 million, a figure that deters many smaller players.

Bandai Namco's established intellectual property and deep fan loyalty are formidable defenses against new entrants. Replicating decades of brand recognition and the emotional connection consumers have with franchises like Dragon Ball requires immense time and investment. The company's 'Connect with Fans' strategy further solidifies this advantage, making it difficult for newcomers to gain significant market share.

Navigating complex licensing agreements and regulatory landscapes for popular IPs and amusement park operations is another substantial barrier. Bandai Namco's strong relationships with licensors and its proactive IP management, evidenced by its IP Creation segment generating ¥178.7 billion in net sales in 2023, create a competitive moat that is hard for new companies to breach.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bandai Namco Holdings is built upon a foundation of verified data, including their annual reports, industry-specific market research from firms like Newzoo and Statista, and public filings from regulatory bodies. This ensures a comprehensive understanding of the competitive landscape.