Banco Bradesco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Bradesco Bundle

Banco Bradesco operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social attitudes. Understanding these external forces is crucial for strategic planning and risk mitigation. Our PESTLE analysis delves deep into these factors, providing you with the actionable intelligence needed to navigate the complexities of the Brazilian financial market. Download the full version now and gain a significant competitive advantage.

Political factors

Brazil's political landscape in late 2024 and early 2025 is characterized by the Lula administration's focus on social programs and economic growth, though fiscal challenges remain a concern. The government's policy direction leans towards increased public spending and social welfare initiatives, which could influence credit demand and regulatory environments for banks like Bradesco. Any shifts towards greater fiscal austerity or significant changes in economic management could impact investor sentiment and the predictability of the financial market.

The Central Bank of Brazil (BCB) and other regulatory bodies significantly influence Bradesco's operations. Recent directives, such as those concerning Basel III implementation, have increased capital requirements, impacting lending capacity. For instance, as of early 2024, Brazilian banks generally maintained capital adequacy ratios well above the minimum regulatory thresholds, reflecting a robust regulatory framework designed to ensure stability.

New regulations focusing on consumer protection and data privacy, like those aligned with LGPD principles, present both compliance challenges and opportunities for enhanced customer trust. The BCB's ongoing efforts to foster financial innovation through initiatives like the Open Finance framework, which Bradesco actively participates in, could unlock new revenue streams and improve service delivery.

Broader geopolitical events and Brazil's international relations significantly influence its financial markets and institutions like Banco Bradesco. For instance, global trade tensions, such as those between major economic powers, can create volatility in commodity prices, a key export for Brazil, impacting corporate earnings and investor sentiment. The ongoing geopolitical shifts can also lead to changes in global capital flows, affecting foreign direct investment into Brazil.

International sanctions imposed on various countries can indirectly impact Brazil by disrupting global supply chains or altering trade patterns. Shifts in major economic alliances, such as the evolving dynamics within BRICS or South American trade blocs, can reshape Brazil's access to international markets and investment opportunities. These external political dynamics directly affect foreign investment, cross-border transactions, and overall economic stability in Brazil, influencing Bradesco's operational environment and profitability.

Corruption and Governance

Brazil continues its efforts to combat corruption, with significant legal and institutional reforms aimed at enhancing transparency and accountability. These initiatives directly impact corporate governance, demanding higher standards of ethical conduct and operational transparency from financial institutions like Banco Bradesco. The success of these anti-corruption measures is crucial for fostering investor confidence and reducing the operational risks associated with doing business in the country.

The perception and reality of corruption can significantly sway investor sentiment, potentially increasing the cost of capital and attracting heightened regulatory scrutiny. In 2023, Brazil's efforts to improve its corruption perception index were noted, though challenges remain. For Bradesco, robust internal governance is paramount; the bank's commitment to compliance and ethical practices is a key determinant of its resilience against these systemic risks.

- Investor Trust: Perceptions of corruption can deter foreign direct investment, impacting capital availability for Brazilian companies.

- Cost of Doing Business: Higher compliance costs and potential fines are associated with operating in environments with weak governance.

- Regulatory Scrutiny: Institutions operating in countries with high corruption risks often face more stringent oversight from both domestic and international regulators.

- Bradesco's Governance: The bank's internal controls and ethical frameworks are vital for navigating Brazil's complex regulatory landscape and maintaining market credibility.

Fiscal Policy and Public Debt

Brazil's fiscal policy, particularly concerning public debt and spending, directly influences Banco Bradesco's operating environment. The government's approach to taxation and expenditure impacts interest rates and inflation, key variables for a financial institution. For instance, a rising public debt burden could necessitate higher interest rates to attract investors, thereby increasing Bradesco's funding costs.

The Brazilian government's fiscal stance in 2024 and projected into 2025 will be critical. As of early 2024, Brazil's public debt-to-GDP ratio remained a focal point, with projections indicating continued pressure. Fiscal consolidation efforts, or a lack thereof, directly affect the Central Bank of Brazil's monetary policy decisions, influencing the Selic rate, which in turn impacts loan demand and credit risk for banks like Bradesco.

- Fiscal Deficit: Brazil's fiscal deficit, a key indicator of government spending versus revenue, directly impacts public debt levels and can influence interest rate expectations.

- Public Debt-to-GDP Ratio: Monitoring the trajectory of Brazil's public debt as a percentage of its Gross Domestic Product provides insight into the government's financial health and its potential need for austerity or borrowing.

- Taxation Policies: Changes in tax laws, whether increasing or decreasing rates, can affect corporate profitability and consumer spending power, both of which are crucial for banking sector performance.

- Government Spending Priorities: Shifts in public spending, such as infrastructure investment or social programs, can stimulate or dampen economic activity, creating opportunities or risks for financial services.

The political stability and policy consistency in Brazil are paramount for Banco Bradesco's long-term outlook. The Lula administration's focus on social spending and economic stimulus, as seen in budget proposals for 2024 and projections for 2025, could boost domestic demand but also raise concerns about fiscal sustainability. Electoral cycles and potential shifts in government policy can introduce uncertainty, affecting investor confidence and the regulatory environment.

Brazil's regulatory framework, overseen by bodies like the Central Bank of Brazil (BCB), continues to evolve. Initiatives such as the ongoing implementation of Basel III standards and the expansion of Open Finance are shaping the banking sector. As of early 2024, Brazilian banks generally maintained strong capital adequacy ratios, exceeding regulatory minimums, indicating a resilient system. However, new regulations on consumer protection and data privacy, aligned with LGPD, necessitate continuous adaptation by institutions like Bradesco.

Geopolitical factors, including global trade dynamics and international relations, indirectly influence Brazil's financial markets and, by extension, Banco Bradesco. For instance, disruptions in global supply chains or shifts in major economic alliances can impact commodity prices, a vital component of Brazil's economy. These external political shifts can affect foreign investment flows and overall economic stability, creating both opportunities and risks for financial institutions.

Brazil's commitment to combating corruption and enhancing governance standards directly impacts its business environment. As of 2023, efforts to improve transparency were ongoing, with significant implications for corporate governance. For Bradesco, adherence to robust internal controls and ethical practices is crucial for maintaining investor trust and navigating potential regulatory scrutiny, especially in light of perceptions of corruption that can influence the cost of capital.

What is included in the product

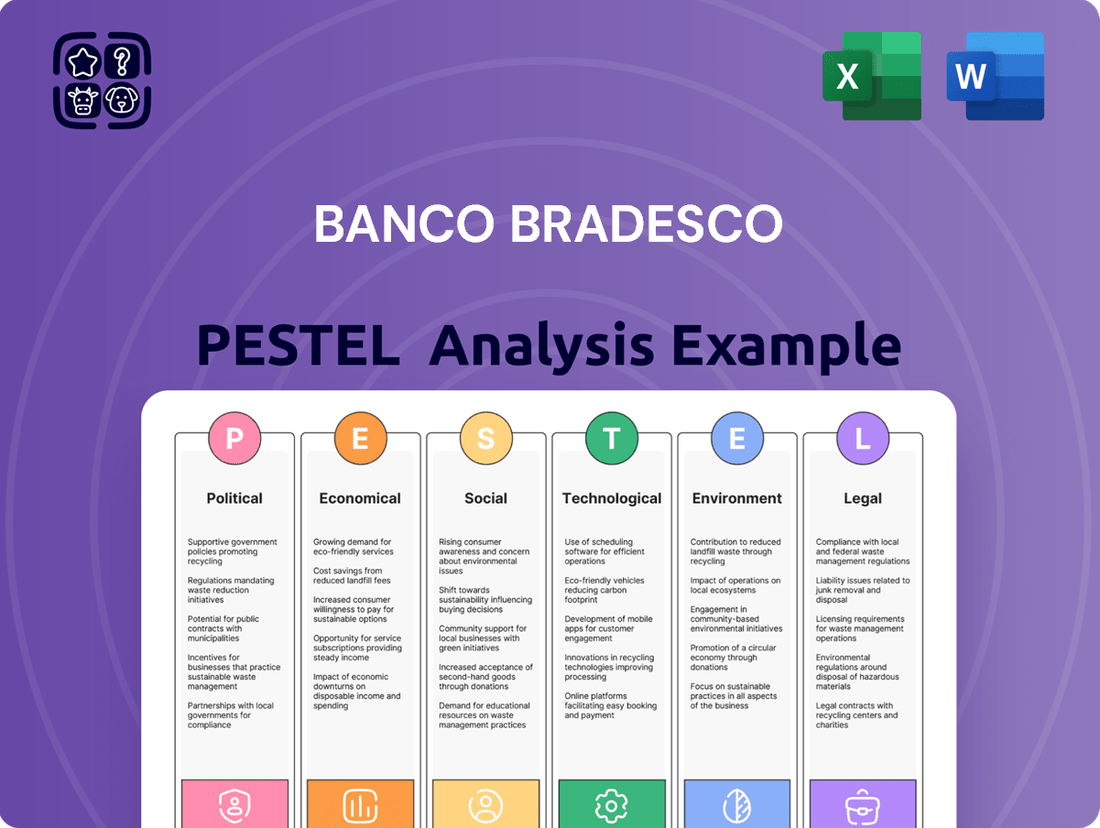

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Banco Bradesco, offering a comprehensive overview of its operating landscape.

A concise PESTLE analysis for Banco Bradesco offers a rapid understanding of external factors, easing the burden of extensive research for strategic planning.

This analysis acts as a pain point reliever by providing a clear, actionable overview of political, economic, social, technological, environmental, and legal influences affecting Bradesco, streamlining decision-making.

Economic factors

Brazil's benchmark Selic rate has seen significant fluctuations, with the Central Bank of Brazil (BCB) actively managing monetary policy. As of mid-2024, the Selic rate is expected to continue its downward trend, aiming to curb inflation. Inflation, while showing signs of moderation, remains a key concern, with projections for 2024 indicating a rate within the target range but still requiring vigilance.

These macroeconomic shifts directly impact Banco Bradesco's financial performance. A declining Selic rate generally compresses net interest margins, as the cost of funding may not fall as quickly as lending rates. However, lower rates can stimulate loan demand, potentially boosting credit volumes. Conversely, persistent inflation could necessitate higher interest rates, increasing borrowing costs for consumers and businesses, which might lead to a rise in non-performing loans and affect asset quality.

The BCB's monetary policy decisions are pivotal. Further rate cuts, if implemented aggressively, could improve loan origination but might pressure profitability. Conversely, any unexpected uptick in inflation could force the BCB to pause or even reverse rate cuts, creating a more challenging environment for Bradesco's lending strategies and overall profitability. For instance, if inflation accelerates beyond expectations in late 2024, the BCB might maintain higher rates for longer, impacting Bradesco's ability to expand its loan portfolio profitably.

Brazil's GDP growth is projected to moderate in 2024 and 2025, following a period of recovery. In 2023, Brazil's GDP grew by an estimated 2.9%. For 2024, forecasts suggest a growth rate closer to 1.5-2.0%, with similar or slightly lower figures anticipated for 2025. This indicates a potential shift towards a more mature phase of the economic cycle, moving away from rapid expansion.

Economic expansion fuels consumer spending and business investment, directly boosting demand for banking services like loans and credit. Conversely, a contraction or slowdown can lead to reduced borrowing, increased defaults, and lower transaction volumes. For Bradesco, this means that a robust growth phase supports loan portfolio expansion and improved credit quality, while a downturn presents challenges to revenue generation in both retail and corporate segments.

The anticipated moderation in GDP growth for 2024-2025 presents a nuanced outlook for Bradesco. While loan growth may slow compared to earlier recovery phases, stable economic activity can still support credit quality. However, any unexpected economic contraction could pressure Bradesco's net interest income and increase provisions for loan losses, impacting profitability across its diverse banking operations.

The Brazilian Real (BRL) has experienced notable volatility against major currencies. For instance, in early 2024, the BRL saw fluctuations against the US Dollar, influenced by global economic trends and domestic policy decisions. This volatility directly affects Banco Bradesco's balance sheet, impacting the value of its foreign currency holdings and obligations.

Fluctuations in the BRL can create both risks and opportunities for Bradesco. A depreciating Real can increase the cost of foreign currency liabilities and reduce the value of foreign assets when translated back into Reals. Conversely, a stronger Real can benefit the bank by lowering its foreign debt burden but may impact the competitiveness of Brazilian exports for its corporate clients.

For Bradesco's corporate clients engaged in international trade, exchange rate volatility poses significant challenges. Companies importing goods face higher costs when the Real weakens, while exporters benefit from a weaker currency. Bradesco's role in providing hedging instruments and managing foreign exchange exposure becomes crucial in mitigating these risks for its clientele.

Unemployment and Income Levels

Unemployment and income levels are critical economic indicators for Banco Bradesco. As of early 2024, Brazil's unemployment rate has shown a downward trend, reaching approximately 7.8% in the first quarter of 2024, a notable decrease from previous periods. This improvement in the labor market directly impacts disposable income, potentially boosting consumer confidence and spending power.

These trends have significant implications for Bradesco's retail banking operations. Lower unemployment and rising disposable incomes generally translate to increased demand for consumer credit, such as personal loans and mortgages. Conversely, higher unemployment and stagnant incomes can lead to increased default rates, directly affecting the bank's asset quality and profitability.

Bradesco's strategies for managing credit risk are therefore closely tied to these economic factors. The bank likely employs robust credit scoring models and risk assessment tools to evaluate borrowers' ability to repay loans, especially in segments more sensitive to economic downturns. Adapting lending criteria and offering flexible repayment options can be crucial for mitigating potential losses.

Key considerations for Bradesco include:

- Impact on Loan Demand: Improved employment figures in 2024 are expected to sustain or increase demand for credit products.

- Credit Default Risk: While unemployment is falling, regional disparities and specific sector vulnerabilities could still present credit risk challenges.

- Retail Segment Performance: The health of the retail banking segment is directly correlated with the general population's purchasing power and ability to service debt.

- Risk Management Strategies: Continuous monitoring of macroeconomic indicators and borrower behavior is essential for proactive credit risk management.

Consumer Spending and Debt Levels

Consumer spending in Brazil has shown resilience, though it's influenced by inflation and interest rates. In early 2024, retail sales data indicated moderate growth, but higher borrowing costs are a key consideration. For instance, the Central Bank of Brazil's Selic rate, while decreasing from its peak, remained at levels that impact discretionary spending and the appetite for credit.

These spending patterns directly influence demand for banking products. As consumers manage their budgets, there's a notable demand for credit cards and personal loans, particularly for managing immediate expenses. Conversely, higher interest rates can temper demand for larger credit facilities like mortgages and auto loans, as seen in the slight slowdown in new loan origination for these segments in late 2023 and early 2024.

Household debt levels are a critical factor for Banco Bradesco. While Brazilians have historically managed debt, sustained periods of high interest rates can increase the risk of defaults. Bradesco, like other major banks, closely monitors debt-to-income ratios and adapts its lending policies by tightening credit criteria or offering more structured repayment plans when economic conditions warrant, aiming to mitigate potential credit losses.

Key data points to consider include:

- Consumer Confidence: Fluctuations in consumer confidence indices, such as those published by FGV, provide insight into future spending intentions.

- Retail Sales Growth: Official statistics from IBGE on retail sales volume and turnover offer a direct measure of consumer purchasing activity.

- Household Indebtedness: Central Bank of Brazil reports on household debt as a percentage of income are crucial for assessing financial health.

- Credit Card Delinquency Rates: Monitoring delinquency rates on credit card portfolios helps Bradesco gauge the immediate impact of economic pressures on consumer repayment capacity.

Brazil's economic landscape in 2024-2025 is characterized by moderating GDP growth, projected between 1.5-2.0% for 2024, and a continued downward trend in the Selic rate, aimed at controlling inflation. While unemployment has decreased to around 7.8% in Q1 2024, consumer spending remains sensitive to interest rates and household debt levels. The Brazilian Real's volatility also presents ongoing challenges for international transactions and foreign currency holdings.

| Economic Factor | 2023 Data (Estimate) | 2024 Projection | 2025 Projection |

|---|---|---|---|

| GDP Growth | 2.9% | 1.5%-2.0% | 1.5%-2.0% (approx.) |

| Selic Rate (Mid-2024) | Declining Trend | Continued Decline Expected | Dependent on Inflation |

| Unemployment Rate (Q1 2024) | ~7.8% | Expected to Remain Stable or Decline | Stable or Slight Decline |

| Brazilian Real Volatility | Notable Fluctuations | Ongoing | Ongoing |

What You See Is What You Get

Banco Bradesco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Banco Bradesco delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. It provides a detailed overview of the external forces shaping the Brazilian banking sector and Bradesco's position within it.

Sociological factors

Brazil's population is projected to reach approximately 219 million by 2025, with a continued trend towards an aging population. This demographic shift means a growing segment of older Brazilians will require specialized financial services, including retirement planning and wealth management. Bradesco must adapt its product offerings and advisory services to cater to this expanding demographic.

Urbanization remains a key driver, with a significant portion of Brazilians residing in cities, increasing the demand for convenient and accessible banking solutions. The bank's strategy needs to balance its physical branch network with robust digital channels to serve these concentrated urban populations effectively, as digital adoption continues to rise rapidly.

Financial inclusion in Brazil is growing, with around 80% of adults having a bank account as of late 2023. However, significant segments of the population, particularly in rural areas and lower-income brackets, remain underbanked or unbanked, presenting a substantial opportunity for institutions like Bradesco.

Bradesco can leverage this by expanding its reach through digital channels and tailored products for these underserved groups. Initiatives focused on financial education are crucial; for instance, programs improving financial literacy can empower individuals to manage their money better, leading to more responsible credit utilization and deeper engagement with formal banking services, ultimately expanding Bradesco's customer base.

Consumer preferences are rapidly shifting towards digital banking solutions, with a growing demand for personalized financial advice and seamless mobile experiences. This evolution necessitates that Banco Bradesco continually innovate its service delivery, focusing on user experience to compete with agile fintechs and digital-first banks.

In Brazil, mobile banking adoption is soaring; by the end of 2024, it's projected that over 70% of banking transactions will occur through mobile channels. Bradesco's investment in its digital platforms, aiming to offer tailored product recommendations and streamlined onboarding processes, directly addresses this trend, ensuring it remains relevant in a landscape increasingly dominated by digital interactions.

Social Inequality and Income Distribution

Social inequality and income distribution significantly shape the Brazilian banking landscape, directly impacting Banco Bradesco's market. High income disparities mean a substantial portion of the population has limited access to formal financial services, influencing demand for basic accounts and credit. Bradesco must therefore develop tailored products for various socioeconomic strata, from low-cost digital solutions for the unbanked to sophisticated wealth management for high-net-worth individuals.

These disparities also affect the uptake of different financial products. For instance, while credit cards and personal loans might be popular among middle-income groups, savings accounts and micro-insurance products are more relevant for lower-income segments. Bradesco's 2024 strategy likely involves expanding its digital platforms to reach underserved populations, aiming to bridge the financial inclusion gap.

Banco Bradesco plays a crucial role in fostering social mobility through financial access. By offering accessible credit, savings products, and financial education, the bank can empower individuals to improve their economic standing. For example, initiatives providing microcredit to small entrepreneurs can stimulate local economies and create opportunities for upward mobility, a key consideration for Bradesco's social responsibility agenda.

- Market Segmentation: Brazil's Gini coefficient, hovering around 0.53 in recent years, highlights significant income inequality, necessitating Bradesco to segment its customer base effectively.

- Product Diversification: The bank needs a broad portfolio, from basic savings accounts for the lower 50% of income earners to investment banking services for the top 1%.

- Financial Inclusion Initiatives: Bradesco's commitment to financial inclusion, evidenced by its digital banking expansion, aims to bring millions of Brazilians into the formal financial system.

- Economic Empowerment: By providing accessible credit and financial literacy programs, Bradesco contributes to economic empowerment, potentially boosting overall economic growth and reducing poverty.

Cultural Attitudes Towards Debt and Savings

Cultural attitudes towards debt and savings in Brazil present a complex landscape for Banco Bradesco. While there's a growing trend towards financial planning, a significant portion of the population still views debt as a necessary tool for consumption and immediate needs, rather than solely for long-term investment. This can influence demand for Bradesco's lending products, with a focus on consumer credit and installment plans.

Savings habits are evolving, with increasing awareness of long-term financial security, yet the propensity to save can be influenced by economic volatility and cultural emphasis on present enjoyment. Bradesco can leverage this by tailoring investment vehicles and insurance offerings that highlight both immediate benefits and future security, aligning with these nuanced cultural norms.

- Debt Perception: A 2024 survey indicated that around 65% of Brazilians consider credit cards essential for managing daily expenses, reflecting a cultural acceptance of revolving debt for immediate needs.

- Savings Goals: While 70% of Brazilians express a desire to save, only 30% consistently manage to set aside funds monthly, often prioritizing immediate consumption over long-term financial planning.

- Financial Literacy: Growing initiatives are improving financial literacy, with a notable increase in online searches for investment and savings advice in 2024, suggesting a cultural shift towards proactive financial management.

- Product Alignment: Bradesco's marketing can emphasize accessible credit solutions for essential purchases and promote savings products with clear, achievable short-term goals to resonate with current cultural priorities.

Brazil's aging population, projected to reach approximately 219 million by 2025, presents a growing demand for specialized financial services like retirement planning and wealth management. Urbanization continues to drive demand for accessible banking, with a majority of Brazilians residing in cities, necessitating a strong digital presence alongside physical branches. Financial inclusion is expanding, with around 80% of adults holding bank accounts by late 2023, yet significant opportunities remain for serving underbanked populations, especially in rural areas.

Consumer preferences are heavily skewed towards digital and mobile banking, with over 70% of transactions expected via mobile channels by the end of 2024, pushing Bradesco to innovate its digital platforms for personalized experiences. Income inequality, evidenced by a Gini coefficient around 0.53, requires Bradesco to segment its market and diversify product offerings, from basic accounts to wealth management. Cultural attitudes show a blend of debt as a consumption tool and a growing interest in financial planning, with 65% of Brazilians deeming credit cards essential for daily expenses, while only 30% consistently save monthly.

| Sociological Factor | Description | Relevance to Bradesco | Data Point (2023/2024) |

|---|---|---|---|

| Demographics | Aging population, growing urban centers | Demand for retirement, wealth management, accessible digital services | Brazil's population ~219 million by 2025; 80% adults banked (late 2023) |

| Consumer Behavior | Shift to digital/mobile banking, debt perception | Need for innovative digital platforms, tailored credit products | >70% banking transactions via mobile by end 2024; 65% see credit cards as essential |

| Social Stratification | Income inequality, financial inclusion gap | Market segmentation, diversified product portfolio, financial literacy programs | Gini coefficient ~0.53; 30% consistently save monthly |

Technological factors

Banco Bradesco is heavily invested in its digital transformation, with a significant focus on expanding its mobile banking capabilities and online services. This strategic push aims to streamline digital customer journeys and enhance user experience in an increasingly digital-first banking landscape. By late 2023, Bradesco reported that over 70% of its transactions were already being conducted through digital channels, highlighting robust customer adoption.

The bank is continuously enhancing its digital platforms to stay competitive, recognizing the need for seamless functionality and intuitive design. This includes ongoing development of its mobile app, which saw a substantial increase in active users throughout 2024, reflecting the growing reliance on digital banking solutions. Bradesco's commitment to innovation in this area is crucial for retaining and attracting customers in the evolving financial sector.

The fintech sector in Brazil is experiencing explosive growth, presenting significant competitive pressure on established institutions like Banco Bradesco. Fintechs are rapidly innovating across various financial services, including payments, credit, and investments, often offering more streamlined and cost-effective solutions.

These agile disruptors are challenging traditional banking models by leveraging technology to enhance customer experience and accessibility. For instance, digital payment solutions and peer-to-peer lending platforms are gaining substantial traction among Brazilian consumers.

In response, Bradesco is actively pursuing strategies such as strategic partnerships with fintechs, targeted acquisitions, and the development of its own digital platforms. This proactive approach aims to integrate innovative solutions and maintain a competitive edge in the evolving financial landscape.

Cybersecurity and data protection are paramount for financial institutions like Banco Bradesco, especially with the escalating sophistication of cyber threats. The bank must continuously invest in advanced security infrastructure to safeguard sensitive customer information and financial transactions from breaches and fraud.

In 2024, the financial sector saw a significant rise in cyberattacks, with data breaches costing companies billions. Bradesco's commitment to compliance with regulations like Brazil's LGPD (Lei Geral de Proteção de Dados) is crucial, as non-compliance can result in substantial fines and severe reputational damage. The bank's ongoing investments in security technologies and employee training are therefore essential to mitigate these growing risks.

Artificial Intelligence (AI) and Machine Learning (ML)

Banco Bradesco is significantly integrating AI and ML across its operations to boost efficiency and customer experience. For instance, AI-powered fraud detection systems are crucial in the financial sector, and Bradesco leverages these to safeguard transactions. Their use of chatbots for personalized customer service aims to provide quicker resolutions and support, a trend seen across major banks in 2024.

These technologies are instrumental in enhancing decision-making processes, particularly in credit scoring and risk management. By analyzing vast datasets, AI/ML models can identify patterns and predict outcomes with greater accuracy, leading to more informed lending decisions and robust risk mitigation strategies. This is vital for maintaining financial stability and profitability.

- Enhanced Fraud Detection: Bradesco utilizes AI to analyze transaction patterns in real-time, reducing fraudulent activities.

- Personalized Customer Service: AI-driven chatbots provide 24/7 support, offering tailored responses and assistance to millions of customers.

- Improved Risk Management: Machine learning algorithms are employed for more precise credit scoring and proactive identification of potential financial risks.

- Process Automation: AI is automating routine tasks, freeing up human resources for more complex strategic initiatives.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) hold significant potential to reshape banking operations. The banking sector is actively exploring DLT for enhanced efficiency and security in areas like payment systems and cross-border transactions. For instance, by 2024, the global blockchain in banking market was projected to reach over $2 billion, highlighting substantial investment and interest.

Bradesco has been actively investigating DLT, particularly for streamlining processes such as trade finance and digital identity management. Their exploration aims to leverage these technologies for faster, more secure, and transparent financial transactions. The long-term implications could include reduced operational costs and improved customer experience through faster settlement times and enhanced data integrity.

- Revolutionizing Payments: DLT can enable near real-time, low-cost payment processing, potentially disrupting traditional correspondent banking models.

- Trade Finance Enhancement: Blockchain platforms can create a shared, immutable record of trade documents, reducing fraud and speeding up the settlement process.

- Digital Identity Solutions: DLT offers secure and verifiable digital identities, crucial for Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance.

- Bradesco's Strategic Interest: The bank's continued research into DLT signifies a commitment to adopting innovative solutions for future operational advantages.

Technological advancements are reshaping Banco Bradesco's operations, with a strong emphasis on digital channels. By late 2023, over 70% of Bradesco's transactions were digital, demonstrating significant customer adoption of mobile and online services.

The bank is actively integrating AI and machine learning for enhanced fraud detection and personalized customer service through chatbots, mirroring trends seen across the financial sector in 2024. Bradesco's investment in cybersecurity is also critical, especially given the rise in cyberattacks throughout 2024, to protect sensitive data and comply with regulations like LGPD.

Furthermore, Bradesco is exploring blockchain and DLT for potential improvements in payment systems and trade finance, aligning with a global market projected to exceed $2 billion in 2024.

Legal factors

Banco Bradesco operates under the stringent oversight of the Central Bank of Brazil (BCB) and other financial regulators, adhering to comprehensive banking regulations. These rules mandate strict compliance with capital adequacy ratios, such as Basel III requirements, ensuring sufficient financial buffers. For instance, as of Q1 2024, Bradesco maintained a robust Tier 1 capital ratio well above regulatory minimums, demonstrating its commitment to financial stability.

Compliance with liquidity management rules, including the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), is critical for Bradesco's day-to-day operations and long-term solvency. The bank must also navigate complex risk management frameworks, covering credit, market, and operational risks, which involve significant investment in technology and personnel. Failure to comply can result in substantial fines and reputational damage, impacting strategic decision-making and operational costs.

The evolving regulatory landscape, including new directives on data privacy and anti-money laundering (AML) in 2024, presents ongoing challenges and costs for Bradesco. Adapting to these changes requires continuous investment in compliance systems and training, influencing the bank's product development and market expansion strategies. These regulatory burdens, while essential for financial system stability, directly impact Bradesco's profitability and competitive positioning.

Banco Bradesco operates within a robust legal framework designed to safeguard consumers in Brazil's financial sector. The Consumer Defense Code (CDC) is central, establishing rights related to transparency, fair contracts, and protection against misleading advertising. For banking services specifically, regulations from the Central Bank of Brazil further dictate practices, ensuring clarity in fees, interest rates, and service offerings.

These legal mandates significantly shape Bradesco's operations. Product design must prioritize clarity and fairness, while marketing campaigns are scrutinized for accuracy and completeness. The bank's complaint handling and dispute resolution mechanisms are also heavily influenced, requiring efficient and consumer-centric processes to address grievances. Non-compliance can lead to substantial fines and severe reputational damage, impacting customer trust and market standing.

Banco Bradesco must meticulously adhere to Brazil's Lei Geral de Proteção de Dados (LGPD), the General Data Protection Law. This legislation mandates stringent protocols for how Bradesco collects, stores, and processes sensitive customer information, impacting everything from account opening to digital banking services.

Key LGPD requirements for Bradesco include obtaining explicit customer consent for data usage, implementing robust security measures to prevent breaches, and establishing clear procedures for notifying authorities and affected individuals in the event of a data incident. For instance, a significant data breach could expose the bank to substantial reputational damage and financial penalties.

Compliance with LGPD involves substantial investment in technology and training to ensure data handling practices align with legal standards. Failure to comply can result in severe penalties, including fines of up to 2% of the company's revenue in Brazil, capped at R$50 million per infraction, as stipulated by the LGPD itself.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF)

Banco Bradesco operates within a rigorous legal framework, particularly concerning Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These rules are critical, both within Brazil and across international jurisdictions where Bradesco has operations. The bank must diligently implement Customer Due Diligence (CDD) processes to verify client identities and understand the nature of their transactions, a core requirement for preventing illicit financial activities.

A significant aspect of Bradesco's legal obligations involves the timely reporting of any suspicious activities (SARs) to the relevant authorities. This necessitates maintaining robust internal controls and compliance programs designed to detect and deter financial crimes. For instance, Brazil's Financial Activities Control Council (COAF) plays a pivotal role in receiving and analyzing these reports, with banks like Bradesco being key contributors to its intelligence gathering.

To ensure effective compliance, Bradesco must continuously invest in advanced technology solutions for transaction monitoring and data analysis. Furthermore, ongoing training for employees is essential to keep them abreast of evolving regulatory requirements and best practices in combating financial crime. These investments are not merely operational costs but are fundamental to maintaining the bank's license to operate and its reputation in the global financial system.

- Regulatory Adherence: Bradesco must comply with Brazil's Law No. 9.613/98 and international standards set by the Financial Action Task Force (FATF).

- Customer Due Diligence (CDD): Implementing thorough Know Your Customer (KYC) procedures for all account openings and significant transactions.

- Suspicious Activity Reporting (SAR): Promptly reporting any transactions or activities that raise red flags to the relevant financial intelligence unit, such as COAF.

- Technology Investment: Allocating resources for sophisticated software to monitor transactions, identify patterns, and manage compliance risks effectively.

Labor Laws and Employment Regulations

Brazilian labor laws significantly shape Banco Bradesco's approach to workforce management. Regulations concerning minimum wage, mandatory benefits like FGTS (Fundo de Garantia por Tempo de Serviço) and INSS (Instituto Nacional do Seguro Social) contributions, and defined working hours directly impact operational expenses. For instance, the average monthly wage for bank tellers in Brazil as of early 2024 hovered around R$2,500, a figure Bradesco must adhere to, alongside other mandated benefits that can add substantially to the total cost of employment.

These legal frameworks also influence Bradesco's HR strategies, dictating hiring practices, termination procedures, and the scope of employee rights, including those related to collective bargaining agreements. The bank's adherence to these rules is crucial for mitigating the risk of labor disputes, which can lead to costly legal battles and operational disruptions. In 2023, Brazil saw a notable number of labor lawsuits filed, underscoring the importance of robust compliance for financial institutions like Bradesco.

- Wage and Benefit Compliance: Bradesco must ensure all employees receive at least the national minimum wage and mandated benefits, impacting payroll costs.

- Working Hours and Overtime: Adherence to the standard 44-hour work week and regulations on overtime pay affects staffing levels and operational efficiency.

- Collective Bargaining: Negotiations with labor unions for collective agreements can influence salary adjustments, benefits, and working conditions, potentially impacting the bank's cost structure.

- Employee Rights and Protections: Legal protections regarding job security, severance pay, and anti-discrimination policies necessitate careful HR management to avoid legal challenges.

Banco Bradesco operates under a complex web of Brazilian legal and regulatory frameworks that significantly influence its operations and strategic decisions. Compliance with consumer protection laws ensures fair dealings, while data privacy regulations like LGPD mandate stringent data handling protocols. The bank's adherence to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws is paramount for maintaining its global standing and preventing illicit financial activities.

Environmental factors

Climate change presents significant risks for Banco Bradesco, including physical impacts like extreme weather events that could damage client assets or disrupt economic activity, affecting loan repayment capabilities. Transition risks also loom, as regulatory shifts and market preferences favoring a low-carbon economy could devalue carbon-intensive assets within Bradesco's loan portfolio. For instance, a drought impacting Brazil's agribusiness sector, a key area for lending, could lead to increased non-performing loans.

Conversely, these challenges create substantial opportunities for Bradesco. The bank can capitalize on the growing demand for green finance by offering sustainable lending products, such as financing for renewable energy projects or eco-friendly infrastructure. In 2024, the global sustainable finance market is projected to continue its robust growth, with Brazil increasingly participating in this trend, offering Bradesco avenues to expand its green bond issuances and climate-related investment funds.

Banco Bradesco is actively embedding sustainable finance and ESG principles across its operations. The bank has committed to expanding its portfolio of green financial products, aiming to channel more resources towards environmentally responsible projects.

This strategic focus includes rigorous assessment of ESG risks within its lending and investment activities, ensuring that environmental and social considerations are integral to credit and investment decisions. Bradesco reported that its sustainable portfolio reached R$192.8 billion by the end of 2023, demonstrating a tangible commitment to this area.

Furthermore, Bradesco is dedicated to transparent reporting on its sustainability performance, providing stakeholders with detailed insights into its progress and impact. The bank's 2024 sustainability report will likely offer updated figures on its ESG initiatives and portfolio growth.

Banco Bradesco is actively working to shrink its environmental footprint, focusing on energy, water, and waste across its vast network. In 2023, the bank reported a 10.4% reduction in energy consumption per employee compared to 2019, a testament to efficiency upgrades in its branches and data centers. Sustainable office practices, like paperless initiatives and responsible waste management, are key components of this strategy, aiming for a more resource-efficient operational model.

Regulatory Pressure and Environmental Compliance

Banco Bradesco faces mounting regulatory pressure to disclose and manage its environmental risks and impacts. New regulations, such as those requiring enhanced climate-related financial disclosures, are becoming standard. For instance, by the end of 2024, major Brazilian financial institutions were expected to further integrate ESG (Environmental, Social, and Governance) factors into their risk management and strategic planning, aligning with global trends and investor expectations.

These evolving legal and regulatory shifts directly influence how Bradesco approaches risk management. The bank must adapt its frameworks to account for physical climate risks, transition risks associated with a low-carbon economy, and increasing demands for transparency in its public disclosures regarding sustainability performance.

- Increased Scrutiny: Regulators are demanding more granular data on environmental impact and climate risk exposure.

- Compliance Costs: Adhering to new reporting requirements and environmental standards can incur significant operational costs.

- Reputational Impact: Non-compliance or perceived inaction on environmental issues can damage Bradesco's reputation and investor confidence.

- Strategic Integration: Environmental compliance is no longer a separate function but a core component of overall business strategy and risk mitigation.

Stakeholder Expectations and Reputation

Stakeholder expectations for environmental responsibility are significantly shaping Banco Bradesco's operations. Investors increasingly scrutinize ESG (Environmental, Social, and Governance) performance, with socially conscious capital flows reaching record highs in 2024. Bradesco's commitment to sustainability, as evidenced by its 2024 climate action plan which aims to reduce financed emissions by 40% by 2030, directly impacts its brand reputation and ability to attract these investors. Similarly, customers are demonstrating a preference for banks with strong environmental credentials, viewing sustainability as a key differentiator.

Bradesco's environmental initiatives are crucial for maintaining and enhancing its reputation. For instance, its investments in renewable energy financing, which saw a 15% increase in portfolio value in the first half of 2024, are positively perceived by the market. This focus on green finance not only attracts environmentally aware customers but also strengthens employee morale and loyalty, as staff increasingly seek to work for organizations aligned with their values. A strong environmental record can translate into tangible business benefits.

Conversely, environmental controversies pose significant reputational risks for Bradesco. Negative publicity stemming from perceived inaction or missteps in environmental stewardship can alienate stakeholders and lead to a decline in customer trust and investor confidence. For example, a hypothetical instance of financing a project with significant environmental impact, if not managed transparently, could lead to boycotts or divestment campaigns, impacting the bank's valuation and market position.

- Growing ESG Investment: Global ESG assets under management are projected to exceed $50 trillion by 2025, highlighting investor demand for sustainable practices.

- Customer Loyalty: Studies in 2024 indicate that over 60% of consumers are more likely to choose brands with strong sustainability commitments.

- Reputational Risk Mitigation: Proactive environmental management and transparent reporting are key to avoiding negative public perception and maintaining stakeholder trust.

- Employee Engagement: Companies with robust environmental programs report higher employee satisfaction and retention rates, a trend observed in Bradesco's internal surveys.

Banco Bradesco's environmental strategy is increasingly shaped by climate change impacts, particularly in Brazil's vital agribusiness sector, where drought can directly affect loan repayment capacity. The bank is actively expanding its green finance offerings, a market segment that saw significant growth globally in 2024, to capitalize on the transition to a low-carbon economy.

Bradesco reported its sustainable portfolio reached R$192.8 billion by the end of 2023, underscoring its commitment to channeling funds towards environmentally sound projects. The bank also achieved a 10.4% reduction in energy consumption per employee in 2023 compared to 2019, demonstrating operational efficiency improvements.

Regulatory pressures are mounting, with Brazilian financial institutions expected by the end of 2024 to further integrate ESG factors into risk management, aligning with global trends and investor demands for transparency in climate-related financial disclosures.

Stakeholder expectations, especially from investors whose ESG assets under management are projected to exceed $50 trillion by 2025, are driving Bradesco's sustainability initiatives. Over 60% of consumers in 2024 indicated a preference for brands with strong sustainability commitments, reinforcing the importance of Bradesco's environmental actions for brand reputation and customer loyalty.

| Metric | 2023 Value | Target/Trend | Source |

| Sustainable Portfolio Value | R$192.8 billion | Growth Trend | Bradesco Reports |

| Energy Consumption Reduction (per employee vs. 2019) | 10.4% | Efficiency Improvement | Bradesco Reports |

| Financed Emissions Reduction Target | 40% by 2030 | Climate Action Plan | Bradesco Reports |

| Global ESG Assets Under Management | Projected >$50 trillion by 2025 | Investor Demand | Industry Projections |

| Consumer Preference for Sustainable Brands | >60% (2024) | Market Trend | Consumer Surveys |

PESTLE Analysis Data Sources

Our Banco Bradesco PESTLE Analysis is meticulously constructed using data from official Brazilian government agencies, the Central Bank of Brazil, and reputable financial news outlets. We incorporate economic indicators from institutions like the IMF and World Bank, alongside reports on technological advancements and social trends.