Banco Bradesco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Bradesco Bundle

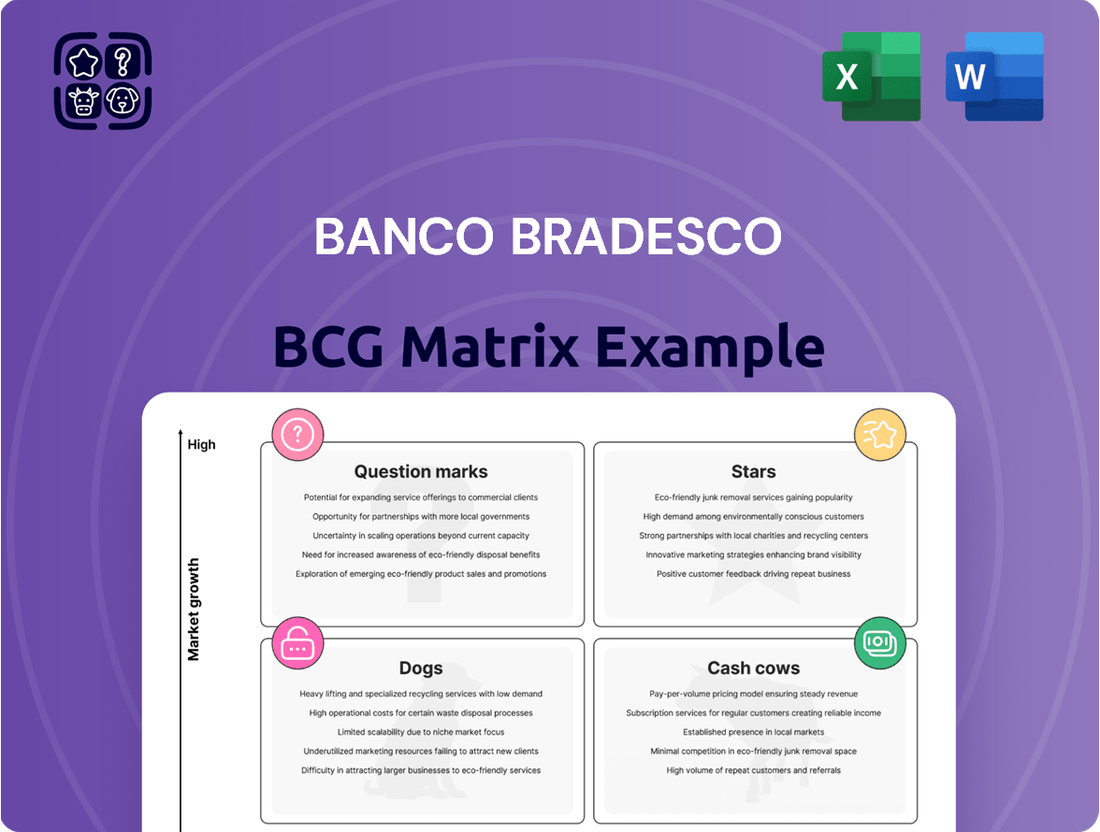

Unlock the strategic potential of Banco Bradesco's product portfolio with our comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders, which are generating steady cash flow, and which require careful consideration for future investment.

This preview offers a glimpse into the powerful insights contained within the full Banco Bradesco BCG Matrix. Gain a clear understanding of their market positioning and identify key areas for growth and resource allocation.

Don't miss out on the opportunity to make informed decisions. Purchase the full BCG Matrix report today to receive detailed quadrant placements, actionable strategic recommendations, and a roadmap to optimize Banco Bradesco's market performance.

Stars

Banco Bradesco is making significant strides in Generative AI, notably through its platforms like Bridge and its virtual assistant BIA. This investment is a key driver for improving customer interactions and streamlining internal operations.

The bank's commitment to AI is translating into tangible benefits, with high efficiency gains and a notable boost in productivity. This positions Bradesco favorably within the fast-growing AI technology sector.

The implementation of generative AI has demonstrably enhanced BIA's ability to resolve customer queries, evidenced by an increase in its resolution rate. Furthermore, BIA's application has broadened across various departments within the organization.

Banco Bradesco's AI-driven lending for SMEs and individuals is a key growth area. In 2024, the bank saw its loan portfolio for Micro, Small, and Medium-Sized Enterprises (MSMEs) surge by an impressive 28.0% year-over-year. Individual loans also experienced a healthy increase of 13.3% during the same period.

The bank is actively employing artificial intelligence to refine credit origination processes and enhance risk management within these rapidly expanding segments of the Brazilian market. This strategic application of AI, coupled with a focus on secured credit lines and a reduction in delinquency ratios, is solidifying Bradesco's competitive standing.

Banco Bradesco has achieved remarkable digital penetration, with a staggering 99% of its total transactions now happening online. This digital-first approach is heavily skewed towards mobile and internet banking, which account for 95% of these digital transactions, highlighting a significant shift in customer behavior and Bradesco's success in meeting these demands. This trend is further bolstered by the company's strategic move to migrate its digital channels to the cloud, ensuring scalability and enhanced user experience in Brazil's booming digital finance landscape.

Blockchain-based Solutions

Bradesco is investing in blockchain technology, aiming to launch a digital identity solution by 2025. This move places them within the rapidly expanding blockchain sector, a market projected to reach $3.1 trillion by 2030 according to some estimates. The bank is also exploring stablecoins for international payments, signaling a commitment to modernizing financial infrastructure.

These blockchain initiatives are crucial for Bradesco's future growth. They are designed to enhance customer data management and streamline cross-border transactions, tapping into a market segment with significant potential. This strategic focus on emerging technologies is key to maintaining a competitive edge.

- Digital Identity Solution: Targeted for 2025 launch, enhancing customer security and data management.

- Stablecoin Exploration: Partnering to investigate stablecoins for more efficient cross-border payments.

- Market Position: Positioning Bradesco as an innovator in the high-growth blockchain financial technology space.

ESG-aligned Financial Products

Banco Bradesco, through Bradesco Seguros, is actively developing ESG-aligned financial products, recognizing the growing investor preference for sustainable options. This strategic focus positions Bradesco within a high-demand market segment.

- Pioneering ESG Pension Products: Bradesco Seguros has taken a leading role in offering pension products that adhere to Environmental, Social, and Governance (ESG) principles.

- Significant ESG Fund Growth: By December 2024, the company's portfolio of ESG-principled funds reached over BRL 688 million in investments, demonstrating substantial market traction.

- Meeting Market Demand: This expansion into ESG products directly addresses the escalating global and domestic demand for sustainable finance solutions, attracting a growing base of environmentally and socially conscious investors.

- Expanding Accessibility: Bradesco is committed to broadening the reach of these products by increasing its presence in regions outside of major urban centers, making sustainable investment opportunities more accessible.

Banco Bradesco's AI-driven lending for SMEs and individuals, with a 28.0% year-over-year surge in MSME loans and a 13.3% increase in individual loans in 2024, represents a significant Star in its BCG Matrix. The bank's robust digital penetration, with 99% of transactions online, further fuels the growth of these segments. This strategic focus on AI-enhanced credit origination and risk management in high-growth areas solidifies their leading position.

| Business Segment | BCG Matrix Category | Key Growth Drivers | 2024 Performance Indicators | Strategic Focus |

|---|---|---|---|---|

| AI-Driven Lending (SMEs & Individuals) | Star | AI for credit origination, risk management, digital channels | MSME Loans: +28.0% YoY; Individual Loans: +13.3% YoY | Expand AI capabilities, reduce delinquency, focus on secured credit |

| Generative AI Platforms (Bridge, BIA) | Star | Improved customer interaction, operational efficiency, productivity gains | Increased BIA query resolution rate, broad departmental application | Enhance AI features, drive further efficiency |

| Digital Banking & Cloud Migration | Star | 99% online transactions, 95% mobile/internet banking | Successful migration to cloud for scalability and user experience | Maintain digital leadership, optimize cloud infrastructure |

What is included in the product

This BCG Matrix overview for Banco Bradesco focuses on strategic insights for each quadrant, guiding investment and divestment decisions.

The Banco Bradesco BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis by placing each business unit in its appropriate quadrant.

Cash Cows

Bradesco Seguros is a classic cash cow for Banco Bradesco. It commands a substantial 5.9% market share in the Brazilian insurance sector as of Q1 2024, and this dominance extends to over 20% by September 2024. This strong market position in a mature industry allows it to generate consistent profits.

The insurance arm consistently delivers impressive financial results, with a net income of R$9.1 billion reported for the full year 2024 and R$2.2 billion in Q2 2024 alone. These figures highlight its robust cash-generating capabilities, making it a stable and significant contributor to the bank's overall financial health.

Bradesco's traditional retail banking services are a strong Cash Cow, boasting a 9.5% customer market share in Brazil as of September 2024. These core offerings, including checking accounts and payment processing, consistently generate significant fee income and a stable deposit base, underpinning the bank's robust financial performance in a mature market.

Bradesco Asset Management (BRAM) is a significant player in the financial services sector, managing over US$100 billion in assets. This substantial AUM underscores its robust market presence and extensive experience in providing diverse investment solutions.

BRAM acts as a cash cow for Banco Bradesco, consistently delivering strong fee and commission income. This revenue stream is reliable and requires less capital investment compared to the bank's core lending activities, making it a highly profitable segment.

With over four decades of operational history in the Latin American market, BRAM benefits from deep-seated expertise and a well-established reputation. This long-standing presence allows them to navigate market complexities effectively and maintain a competitive edge.

Secured Loan Portfolios

Secured loan portfolios represent a significant cash cow for Banco Bradesco, reflecting a strategic emphasis on lower-risk lending. This focus is evident in the substantial portion of their overall loan book dedicated to collateralized products.

Bradesco's commitment to secured lending, encompassing areas like rural financing, real estate, and payroll-deductible loans, yields more consistent net interest income. This stability is further bolstered by lower delinquency rates compared to unsecured offerings, enhancing the cash-generating capabilities of these segments.

The quality of new loans within these secured portfolios is also improving, directly contributing to their efficiency as cash cows. For instance, in the first quarter of 2024, Bradesco reported a consolidated net income of R$5.9 billion, with its credit portfolio showing resilience.

- Focus on Secured Lending: Rural, real estate, and payroll-deductible loans form a high percentage of Bradesco's portfolio.

- Predictable Income: Collateralized lending leads to more stable net interest income.

- Reduced Risk: Secured loans exhibit lower delinquency rates, enhancing cash flow predictability.

- Improved Vintage Quality: Newer loans in these portfolios are of higher quality, boosting cash generation.

Established Corporate Banking Operations

Banco Bradesco's established corporate banking operations are a clear Cash Cow within its BCG Matrix. This division, focused on large corporations, is a bedrock of stability and profitability for the bank.

Leveraging deep, long-standing relationships with its corporate clients and offering a full spectrum of financial products and services, this segment consistently bolsters Bradesco's net interest income and fee-based revenues. Its presence in a mature market is already well-established, ensuring reliable performance.

- Profitability Driver: Corporate banking consistently generates significant net interest income and fee revenues for Bradesco.

- Market Position: Operates in a mature market where Bradesco holds a strong, entrenched position.

- Client Relationships: Benefits from long-standing, stable relationships with large corporate clients.

- Revenue Streams: Contributes reliably through a comprehensive suite of financial products and services.

Bradesco Seguros is a cornerstone cash cow, holding a significant 5.9% market share in the Brazilian insurance sector by Q1 2024, growing to over 20% by September 2024. This mature market dominance translates into consistent profits, with a reported net income of R$9.1 billion for the full year 2024, demonstrating its robust cash-generating ability.

Traditional retail banking services are another key cash cow, serving 9.5% of Brazilian customers as of September 2024. These core offerings, like checking accounts and payment processing, reliably generate substantial fee income and a stable deposit base, solidifying their role as a consistent profit generator.

Bradesco Asset Management (BRAM), managing over US$100 billion in assets, acts as a predictable revenue generator through strong fee and commission income. With over four decades of experience in Latin America, BRAM's established market presence requires minimal new capital investment, making it highly profitable.

Secured loan portfolios, including rural financing and real estate, are vital cash cows due to their lower risk and consistent net interest income. These segments, showing improved loan quality in Q1 2024, contribute to enhanced cash flow predictability with lower delinquency rates.

Established corporate banking operations are a bedrock cash cow, leveraging long-standing client relationships to drive net interest income and fee revenues in a mature market. This segment consistently contributes to Bradesco's profitability through a comprehensive suite of financial products.

Full Transparency, Always

Banco Bradesco BCG Matrix

The Banco Bradesco BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This ensures complete transparency, as you'll be acquiring the exact strategic analysis without any watermarks or sample content. The report is designed for immediate use, empowering you to integrate its insights into your business planning and decision-making processes without delay.

Dogs

Banco Bradesco has been actively resizing its physical branch network, a move driven by the significant shift in customer behavior towards digital banking. This strategic adjustment includes closing branches that are no longer profitable, reflecting the declining reliance on traditional brick-and-mortar locations.

This extensive physical infrastructure, a historical asset, is now viewed as a high-cost, low-growth component. With diminishing returns, it presents itself as a prime candidate for divestiture or a substantial reduction in its footprint. Bradesco is indeed accelerating the optimization of this network.

For instance, in 2023, Bradesco announced plans to close approximately 1,000 branches, a significant portion of its then-existing network of over 4,000 branches, as part of its efficiency drive and digital transformation strategy.

Outdated IT systems represent a significant challenge for Banco Bradesco, even amidst its digital transformation efforts. While the bank is investing heavily in new technologies, the continued maintenance and eventual overhaul of these legacy systems are substantial cost drivers. In 2023, IT spending for Brazilian banks generally saw an increase, with many focusing on cloud migration and cybersecurity, suggesting Bradesco's modernization efforts align with industry trends but also highlight the ongoing expense of managing older infrastructure.

In late 2022 and throughout 2023, Banco Bradesco strategically reduced its involvement in specific high-risk lending areas. This move was a direct response to increasing default rates and a noticeable dip in profitability within these segments. For instance, by the end of Q3 2023, Bradesco's non-performing loans (NPLs) ratio stood at 3.07%, a slight increase from 3.01% in Q3 2022, highlighting the challenges in managing riskier credit exposures.

These particular credit portfolios were not performing as expected, leading to substantial provisions for potential loan losses. Instead of generating cash, they were consuming resources, effectively acting as cash traps for the bank. This situation necessitated a proactive approach to portfolio management and risk mitigation, addressing the lingering issues from past performance in these segments.

Traditional Over-the-Counter Transactions

Traditional over-the-counter transactions at Banco Bradesco, while a small fraction of its overall volume, represent a segment with limited growth potential and lower operational efficiency. With an overwhelming 99% of Bradesco's transactions now occurring digitally, these in-person interactions likely consume a disproportionate amount of resources, including staff and physical branch infrastructure, offering minimal strategic advantage in the bank's evolving digital-first strategy.

This focus on digital channels effectively reduces the bank's dependence on cash handling and traditional transfer methods, streamlining operations and improving cost-effectiveness.

- Low Growth Segment: The diminishing reliance on physical transactions indicates a mature or declining market for these specific services.

- High Resource Consumption: Maintaining branches and personnel for these transactions incurs significant operational costs relative to their strategic contribution.

- Reduced Cash Dependency: The shift to digital minimizes exposure to cash management risks and associated expenses.

- Strategic Reallocation: Resources previously tied to traditional transactions can be redirected to more innovative and high-growth digital initiatives.

Declining Market Share in Certain Retail Segments

Banco Bradesco, despite its significant presence in the Brazilian financial landscape, is experiencing a decline in market share within specific retail banking segments. This shift is largely attributed to the escalating competition from agile digital-first institutions and burgeoning fintech companies that are rapidly capturing market share in the broader retail banking space. For instance, while Bradesco holds a notable 9.5% market share, challenger Nubank commands a larger 20.3%.

In particular, sub-segments where digital innovation is rapidly reshaping customer preferences, Bradesco's established, more traditional product offerings are showing signs of market share erosion. This trend is occurring within a context of generally low growth for these particular retail banking areas, underscoring the urgent need for a strategic reassessment of Bradesco's approach to these competitive digital frontiers.

- Market Share Comparison: Bradesco (9.5%) vs. Nubank (20.3%) in the broader retail banking market.

- Competitive Landscape: Intense rivalry from digital banks and fintechs.

- Segment Vulnerability: Traditional offerings facing pressure in digitally advancing sub-segments.

- Growth Context: Declining share occurring in low-growth retail banking areas.

Banco Bradesco's physical branch network and traditional over-the-counter transactions represent its "Dogs" in the BCG matrix. These segments are characterized by low growth and high resource consumption, with digital channels now handling the vast majority of transactions. The bank is actively shrinking its branch footprint and reallocating resources from these less efficient areas to more promising digital initiatives.

The declining reliance on physical interactions, with 99% of transactions now digital, highlights the low growth potential of these traditional services. Maintaining this infrastructure is costly, consuming resources that could be better invested in innovation. This strategic shift aims to streamline operations and improve cost-effectiveness by minimizing cash handling and traditional transfer methods.

Bradesco's market share erosion in certain retail banking segments, particularly those rapidly advancing digitally, further solidifies these areas as "Dogs." Intense competition from agile digital-first institutions and fintechs, such as Nubank's 20.3% market share compared to Bradesco's 9.5%, underscores the challenges in these mature or declining retail banking areas.

The bank's strategic reduction in high-risk lending areas also aligns with the "Dog" classification, as these portfolios were not performing as expected and acted as cash traps. By addressing these underperforming segments, Bradesco frees up capital and management focus for more strategic growth opportunities.

Question Marks

Banco Bradesco's new digital product launches, like Max Prêmios Livelo and micro-entrepreneur insurance in 2024, are positioned in rapidly evolving, competitive digital spaces. These initiatives aim for significant growth, but their market penetration is currently limited, demanding substantial investment in marketing and user acquisition to avoid stagnation.

The strategic focus for these nascent digital offerings is on driving market adoption. For instance, the Max Prêmios Livelo program, launched in 2024, aims to capture a share of the growing loyalty program market, a segment that saw significant activity with major players enhancing their offerings throughout the year.

Banco Bradesco is heavily investing in agentic AI, a sophisticated form of artificial intelligence capable of independent planning, decision-making, and task execution. This strategic move positions Bradesco at the forefront of a nascent but rapidly evolving technological frontier.

While the full market impact and Bradesco's eventual market share in agentic AI remain uncertain, these early-stage initiatives represent significant cash outlays with substantial, high-growth potential. The bank's commitment underscores a belief in AI's transformative power for future financial services.

Banco Bradesco's exploration into emerging fintech partnerships, like its collaboration with Parfin to test stablecoin applications for international transactions, positions it within the Question Marks quadrant of the BCG Matrix. These ventures into innovative areas are crucial for future growth, but they are currently in nascent stages.

The pilot with Parfin aims to demonstrate the potential of stablecoins to transform payment systems, a high-potential but unproven market. Success hinges on significant investment and effective implementation to shift these initiatives from low market share to leadership positions.

International Digital Expansion (e.g., My Account)

Banco Bradesco's international digital expansion, exemplified by services like 'My Account', aims to tap into high-growth markets beyond Brazil. This strategy positions these initiatives as potential Stars or Question Marks in the BCG Matrix, depending on their current market share and growth trajectory in new territories.

The challenge lies in navigating varied international competitive landscapes and regulatory frameworks, which demand significant and adaptable investment. For instance, in 2024, digital banking adoption rates varied significantly across regions, with some Latin American countries showing rapid growth while others presented more mature, albeit competitive, markets. This often translates to high initial demands but potentially lower, or even negative, initial returns as market share is built.

- Digitalization Investment: Bradesco's commitment to digital services saw substantial investment in 2024, with a focus on enhancing user experience and cross-border functionalities for platforms like 'My Account'.

- Market Penetration Goals: The bank aims to establish a strong foothold in key international markets, targeting segments with high digital banking adoption potential.

- Competitive Environment: Success hinges on differentiating its digital offerings from established local and international fintech players in diverse regulatory and economic conditions.

- Return on Investment: Initial phases of international digital expansion are characterized by high upfront costs and user acquisition expenses, impacting short-term profitability.

Niche Digital Lending Innovations

Banco Bradesco is actively exploring niche digital lending innovations, focusing on specialized segments within its broader loan offerings. These ventures, characterized by their nascent market share and high growth potential, are classified as question marks within the BCG matrix. The bank is channeling resources into these areas to solidify its position and capitalize on emerging opportunities.

These niche digital lending products are designed to address specific customer needs not fully met by traditional banking services. Bradesco's strategy involves enhancing collection processes and developing innovative credit models tailored for these segments. For instance, by mid-2024, the bank reported a significant increase in digital loan origination, with a notable portion attributed to these specialized platforms.

- Targeted Digital Lending: Bradesco is launching digital platforms for specific underserved markets, such as small businesses in the e-commerce sector or individuals seeking specialized financing for green initiatives.

- Investment in Growth: These initiatives require substantial investment to build market share, develop robust digital infrastructure, and refine credit scoring models for niche customer profiles.

- Data-Driven Credit Models: The bank is leveraging advanced analytics and artificial intelligence to improve risk assessment and collection efficiency for these new digital lending products.

- Market Validation: Success hinges on gaining traction in these new markets, with ongoing evaluation to determine future investment levels and strategic direction.

Banco Bradesco's ventures into stablecoins with Parfin and international digital expansion through 'My Account' represent significant investments in high-growth, but currently uncertain, markets. These initiatives, while promising, require substantial capital and strategic focus to gain market share and achieve profitability, placing them firmly in the Question Marks quadrant of the BCG Matrix.

The bank is channeling resources into these nascent digital frontiers, acknowledging the high potential rewards alongside the inherent risks. Success in these areas will depend on navigating complex regulatory environments and outmaneuvering competitors, with significant investment needed to transition from low market share to leadership positions.

For example, the pilot with Parfin in 2024 aimed to showcase stablecoins' potential to revolutionize payments, a market still in its early stages. Similarly, the international digital expansion targets regions with varied digital banking adoption rates, requiring adaptable investment strategies to build presence.

These question mark initiatives are critical for Bradesco's long-term growth strategy, aiming to tap into emerging technological trends and new geographic markets. The bank's commitment underscores a belief in the future of digital finance, even as these ventures demand significant upfront investment and careful market cultivation.

BCG Matrix Data Sources

Our Banco Bradesco BCG Matrix is constructed using a blend of internal financial statements, comprehensive market research reports, and analyses of industry growth trends to provide a clear strategic overview.