Bally's PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bally's Bundle

Gain a competitive edge with our comprehensive PESTLE analysis of Bally's. Understand how evolving political landscapes, economic fluctuations, and technological advancements are shaping the company's trajectory. This in-depth report provides actionable intelligence to inform your strategic decisions. Download the full version now for a complete market overview.

Political factors

Governmental regulatory changes are a critical political factor for Bally's. The gaming industry operates under a complex web of state and federal regulations concerning licensing, operational standards, and taxation.

For instance, shifts in state gaming laws, such as the legalization of online sports betting in new jurisdictions, can directly create new revenue streams for Bally's. Conversely, increased tax rates on gaming revenue, as seen in some states looking to bolster budgets, can negatively impact profitability. In 2024, for example, states continue to grapple with how to best tax and regulate the burgeoning online gaming market, with potential implications for Bally's market entry and operational costs.

The continuing wave of states legalizing sports betting and iGaming is a significant political factor for Bally's. This trend opens up new revenue streams but also necessitates navigating a complex and evolving regulatory landscape. For instance, as of early 2024, over 30 states and the District of Columbia have legalized some form of sports betting, with iGaming expanding more slowly but steadily.

Bally's strategic growth hinges on its ability to adapt to these legislative changes. The company's success in expanding its online presence is directly tied to securing licenses in newly legalized markets, which often involves competitive bidding and adherence to specific state regulations. This means that political decisions at the state level have a direct impact on Bally's market access and potential for revenue growth in the digital gaming sector.

Governmental bodies impose various taxes on gaming revenue, directly impacting Bally's profitability. For instance, in 2023, Bally's reported a significant portion of its revenue was subject to state and local gaming taxes, a figure that can fluctuate based on legislative changes. These tax policies, whether through adjusted rates or new gaming-specific levies, directly influence the company's net earnings and strategic investment planning across its various operating jurisdictions.

Political stability and tourism support

Bally's Corporation's physical casino operations are significantly influenced by the political stability of the regions where they are located. Unstable political environments can deter tourism and dampen consumer confidence, directly impacting visitor numbers and spending at Bally's resorts. For instance, the U.S. gaming industry, which includes Bally's, saw a strong rebound in 2023, with total gaming revenue reaching $66.5 billion, indicating that stable political climates foster economic activity beneficial to the sector.

Government policies that actively promote the hospitality and tourism industries can provide a substantial indirect boost to Bally's. This includes investments in infrastructure, such as improved transportation networks, and government-backed marketing campaigns aimed at attracting visitors. In 2024, many states are continuing to invest in tourism, recognizing its economic multiplier effect. For example, state tourism budgets are expected to remain robust, supporting the broader hospitality ecosystem.

- Political Stability: Regions with stable governments and predictable regulatory environments are more attractive to tourists and investors, positively impacting Bally's revenue streams.

- Government Support for Tourism: Initiatives like infrastructure upgrades and promotional campaigns by governments can increase overall tourism, benefiting casino operators like Bally's.

- Consumer Confidence: Political stability directly correlates with consumer confidence, influencing discretionary spending on entertainment and leisure activities, which are core to Bally's business.

- Regulatory Environment: Changes in gaming regulations or taxation policies, often driven by political decisions, can materially affect Bally's profitability and operational strategies.

Lobbying and industry influence

Bally's, like many large entertainment and gaming corporations, actively participates in lobbying to shape legislation that benefits its operations and the broader industry. This involves significant financial investment aimed at influencing lawmakers on issues such as gaming regulations, tax policies, and licensing. For instance, the American Gaming Association, of which Bally's is a member, reported spending over $30 million on lobbying efforts in 2023 alone, highlighting the scale of industry-wide advocacy.

The success of these lobbying initiatives directly impacts Bally's strategic direction and financial performance. Favorable regulations can unlock new market opportunities or reduce operational costs, while adverse policies can create significant headwinds. The ongoing nature of these political engagements means that the industry's ability to secure advantageous legislative outcomes remains a critical, dynamic factor for companies like Bally's.

- Industry Advocacy Spending: The American Gaming Association's reported lobbying expenditures in 2023 exceeded $30 million, demonstrating substantial industry-wide investment in political influence.

- Key Legislative Areas: Lobbying efforts typically focus on gaming regulations, tax structures, and licensing frameworks.

- Impact on Operations: Successful lobbying can lead to expanded market access and reduced regulatory burdens for Bally's.

- Continuous Political Engagement: The dynamic nature of policy-making requires ongoing and adaptive lobbying strategies from major gaming companies.

Governmental regulatory changes are a critical political factor for Bally's, impacting everything from licensing to taxation. The ongoing expansion of sports betting and iGaming across U.S. states, with over 30 states and D.C. having legalized some form of sports betting by early 2024, directly creates new revenue opportunities but also necessitates navigating a complex, evolving legal landscape. Increased gaming taxes, as seen in some states aiming to boost budgets, can also significantly affect Bally's profitability, influencing strategic investment and operational planning.

Bally's actively engages in lobbying to shape favorable legislation, with industry groups like the American Gaming Association reporting over $30 million in lobbying expenditures in 2023. These efforts focus on key areas such as gaming regulations, tax structures, and licensing frameworks, aiming to secure expanded market access and reduce regulatory burdens. Political stability in operating regions also plays a crucial role, as demonstrated by the U.S. gaming industry's strong 2023 rebound, with total revenue reaching $66.5 billion, underscoring how stable political climates foster economic activity beneficial to casino operators.

| Political Factor | Impact on Bally's | 2023-2024 Data/Trend |

|---|---|---|

| Regulatory Changes (Gaming Legalization) | Opens new revenue streams, but requires navigating complex licensing and compliance. | Over 30 states legalized sports betting by early 2024; iGaming expansion steady. |

| Taxation Policies | Directly impacts profitability; changes can affect net earnings and investment planning. | Gaming revenue subject to state/local taxes, fluctuating based on legislative changes. |

| Political Stability | Influences tourism and consumer confidence, impacting visitor numbers and spending. | U.S. gaming industry revenue reached $66.5 billion in 2023, showing sector benefit from stable environments. |

| Lobbying and Advocacy | Shapes legislation on regulations, taxes, and licensing; influences market access and costs. | American Gaming Association spent over $30 million on lobbying in 2023. |

What is included in the product

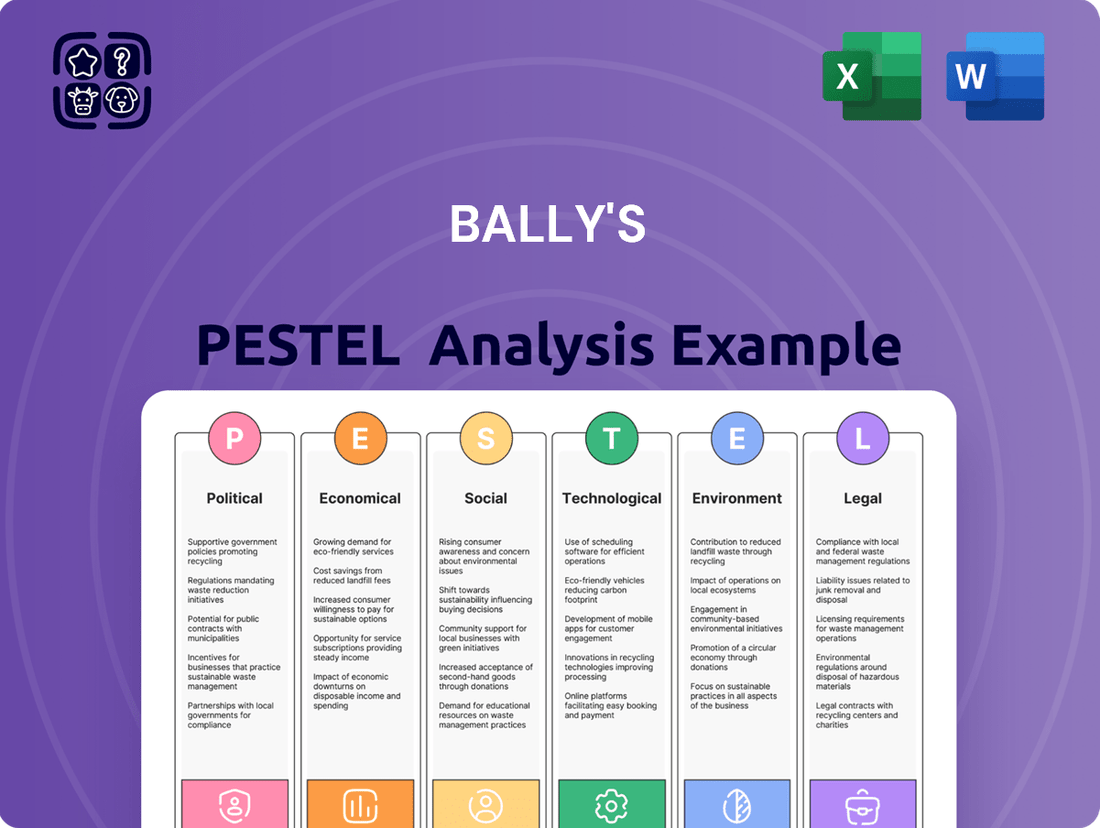

This Bally's PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic direction.

It provides a comprehensive understanding of the external landscape, enabling informed decision-making and proactive strategy development for Bally's.

A concise PESTLE analysis for Bally's, highlighting key external factors impacting the company, serves as a pain point reliever by providing clear, actionable insights for strategic decision-making and risk mitigation.

Economic factors

Bally's success hinges on consumers' discretionary income and their inclination towards leisure activities. For instance, in early 2024, inflation continued to be a concern, potentially squeezing household budgets for non-essential spending like casino visits or online gaming.

Economic slowdowns or rising unemployment figures directly impact consumer confidence and their ability to allocate funds towards entertainment. A significant dip in consumer spending, as seen in some sectors during 2023, could translate to fewer patrons at Bally's physical locations and reduced activity on its digital platforms.

Shifts in consumer preferences, perhaps prioritizing experiences over traditional gambling or moving towards more budget-friendly entertainment options, also pose a challenge. The ongoing evolution of entertainment consumption patterns means Bally's must adapt to maintain its appeal amidst changing discretionary spending habits.

Rising inflation directly impacts Bally's operational expenses. For instance, the US Consumer Price Index (CPI) saw a significant increase, with inflation reaching 3.4% year-over-year in April 2024, affecting everything from wages to the cost of goods and services essential for casino operations.

These escalating costs, including utilities, food and beverage supplies, and even routine maintenance, put pressure on Bally's to maintain profitability. For example, the cost of food and non-alcoholic beverages for food service industries saw a 3.0% increase in the same period, directly impacting Bally's F&B margins.

Effectively managing these increased expenses without compromising the customer experience or resorting to substantial price hikes is a key challenge. Bally's must find ways to absorb or mitigate these rising costs to protect its profit margins in the current economic climate.

Interest rate fluctuations significantly impact Bally's operational costs and investment strategies. For instance, if the Federal Reserve maintains its target federal funds rate at the current range, say 5.25%-5.50% as of early 2024, Bally's borrowing costs for new projects or refinancing existing debt will be directly influenced.

Higher interest rates, like those seen in 2023 and potentially continuing into 2024, can substantially increase Bally's expenses for capital expenditures, debt refinancing, and expansion plans. This increased financial leverage expense could put a strain on the company's profitability and potentially decelerate its growth ambitions.

Overall economic growth and employment rates

Overall economic growth and employment rates significantly influence Bally's performance. A robust economy, marked by low unemployment, typically fuels higher consumer confidence, leading to increased discretionary spending on entertainment and gaming. For instance, as of Q1 2024, the U.S. unemployment rate remained low at 3.8%, indicating a healthy labor market that supports consumer spending. This environment generally benefits Bally's, as more people have disposable income to spend at its properties.

Conversely, economic downturns or rising unemployment can dampen consumer sentiment and reduce discretionary income. This directly impacts Bally's revenue streams, as customers may cut back on leisure activities like visiting casinos or participating in other entertainment offerings. For example, if unemployment were to rise to 5% or higher, as seen during economic recessions, Bally's could experience a noticeable decline in customer traffic and overall sales.

- U.S. Unemployment Rate (Q1 2024): 3.8%

- Impact on Discretionary Spending: Low unemployment supports higher consumer confidence and spending on entertainment.

- Economic Slowdown Effect: Rising unemployment reduces disposable income, negatively impacting Bally's customer base.

- Revenue Correlation: Economic health is directly linked to Bally's revenue generation potential.

Competition and market saturation

The gaming and hospitality sector is intensely competitive, featuring a mix of long-standing corporations and emerging businesses. Bally's faces this dynamic, where new entrants, particularly in burgeoning online gaming markets or already crowded physical casino spaces, can significantly impact pricing strategies, marketing expenditures, and overall market share.

For instance, as of early 2024, the US online sports betting market, a key growth area, is dominated by a few major players, making it challenging for smaller operators like Bally's to gain substantial traction without significant investment. This heightened competition directly affects revenue potential and necessitates strategic differentiation.

- Intense Competition: The gaming industry is characterized by a high number of established operators and new market entrants.

- Online Market Pressure: Newly legalized online gaming markets are seeing rapid expansion and intense competition, impacting pricing and customer acquisition costs for companies like Bally's.

- Market Saturation: In mature physical casino markets, saturation can lead to price wars and increased marketing spend to retain market share.

- Impact on Profitability: Increased competition can squeeze profit margins due to higher operational costs and pressure to offer competitive promotions.

Consumer spending power remains a critical economic driver for Bally's, directly influencing demand for its gaming and entertainment services. In April 2024, the U.S. personal consumption expenditures price index rose by 0.3%, indicating continued inflationary pressures that can affect household budgets. Low unemployment, such as the 3.8% rate in Q1 2024, generally supports discretionary spending, which benefits companies like Bally's.

Interest rate policies also play a significant role, impacting Bally's cost of borrowing for capital projects and debt management. With the Federal Reserve maintaining its target federal funds rate in the 5.25%-5.50% range as of early 2024, borrowing costs remain elevated. This can strain profitability and potentially slow expansion plans if not managed effectively.

The overall economic health and growth trajectory are directly correlated with Bally's revenue. A robust economy with low unemployment fosters consumer confidence and increased spending on leisure activities. Conversely, economic downturns or rising unemployment can lead to reduced consumer spending, negatively impacting Bally's customer traffic and sales.

| Economic Factor | Data Point (Early 2024) | Impact on Bally's |

|---|---|---|

| Inflation (PCE Price Index) | +0.3% (April 2024) | Can reduce discretionary income for consumers; increases operational costs. |

| Unemployment Rate (U.S.) | 3.8% (Q1 2024) | Low unemployment generally supports higher consumer spending on entertainment. |

| Federal Funds Rate Target | 5.25%-5.50% | Elevated rates increase borrowing costs for Bally's, potentially impacting investment and profitability. |

Preview Before You Purchase

Bally's PESTLE Analysis

The preview you see here is the exact Bally's PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers all key external factors impacting Bally's, providing valuable insights for strategic decision-making.

What you’re previewing here is the actual file, detailing Political, Economic, Social, Technological, Legal, and Environmental influences on Bally's.

Sociological factors

Societal attitudes toward gambling, encompassing both physical casinos and digital platforms, are indeed shifting. This evolving perception directly impacts Bally's market. For instance, in 2024, states like Maryland saw a 5.5% increase in casino gaming revenue compared to the previous year, suggesting growing acceptance in certain regions.

Greater public acceptance can naturally expand Bally's potential customer pool. However, a contrasting trend of increased awareness and concern regarding problem gambling might prompt more stringent regulatory measures or a decrease in overall player engagement, posing a challenge for the company's growth strategies.

Societal expectations are increasingly pushing gaming companies like Bally's to prioritize responsible gambling. This means implementing and promoting programs that help players manage their gaming habits, a trend that gained significant traction leading up to 2025.

Bally's investment in responsible gaming isn't just about compliance; it's vital for its long-term viability. By demonstrating a genuine commitment, Bally's strengthens its social license to operate and cultivates trust with its customer base, which is essential in a competitive market.

For instance, industry-wide, spending on responsible gaming initiatives saw a notable increase in the 2024-2025 period, with many operators, including Bally's, allocating significant resources to player protection tools and educational campaigns. This proactive approach is seen as a key differentiator.

Changes in population demographics, like the aging baby boomer generation and the growing Gen Z cohort, significantly impact Bally's target markets. For instance, an increasing proportion of older adults might favor traditional casino games, while younger demographics may be drawn to digital and skill-based gaming options. Bally's needs to tailor its entertainment and gaming portfolios to resonate with these evolving consumer preferences and spending habits.

Leisure and entertainment consumption trends

Consumer preferences for leisure activities are evolving, with a notable surge in demand for immersive, integrated entertainment experiences. This shift means that traditional gaming alone is no longer sufficient; companies like Bally's must adapt by blending gaming with other popular leisure pursuits. For instance, the global market for esports, a rapidly growing segment of entertainment, was projected to reach over $2.5 billion by 2024, indicating a strong consumer appetite for interactive and spectator-based entertainment.

Bally's, therefore, needs to proactively innovate its portfolio to capture this trend. By synergizing its gaming operations with high-quality dining, premium hospitality services, and compelling live events, Bally's can create a more holistic and attractive offering. This approach not only diversifies revenue streams but also appeals to a wider demographic seeking more than just a single form of entertainment. A report from 2023 highlighted that consumers are increasingly willing to spend on experiences, with travel and entertainment sectors seeing robust recovery and growth.

- Growing Demand for Integrated Experiences: Consumers are seeking a blend of gaming, dining, and live entertainment.

- Esports Market Growth: The esports industry, a key area for integrated entertainment, was expected to exceed $2.5 billion in 2024.

- Innovation in Offerings: Bally's must combine gaming with hospitality and events to stay competitive.

- Experience Economy: Consumer spending on experiences, including entertainment, showed strong recovery in recent years.

Social impact on local communities

Bally's operations significantly influence local communities by creating jobs and stimulating economic activity. For instance, in 2023, Bally's Corporation directly employed over 9,000 individuals across its properties, contributing to local economies through wages and taxes.

The influx of visitors to Bally's resorts can strain local infrastructure, such as transportation networks and public services, necessitating careful planning and investment. This can lead to both positive development and challenges if not adequately managed.

While casinos provide entertainment and economic benefits, they can also introduce social challenges, including potential increases in problem gambling and related social costs. Bally's commitment to responsible gaming initiatives aims to mitigate these negative impacts.

- Employment Generation: Bally's provided approximately 9,000 jobs in 2023, boosting local employment rates.

- Infrastructure Demands: Increased visitor traffic requires enhancements to local roads, utilities, and public services.

- Social Sustainability: Managing community relations and contributing to local development are key to the long-term social viability of Bally's presence.

- Responsible Gaming: Investments in programs to address problem gambling are crucial for mitigating negative social externalities.

Societal attitudes toward gambling are evolving, with increasing acceptance of both physical and digital platforms. This shift presents opportunities for Bally's, as seen in states like Maryland, which reported a 5.5% increase in casino gaming revenue in 2024. However, heightened awareness of problem gambling necessitates a strong focus on responsible gaming initiatives, a trend gaining significant momentum leading into 2025.

Bally's must cater to diverse demographics, including the aging baby boomer generation and Gen Z, whose preferences lean towards traditional versus digital and skill-based gaming respectively. Furthermore, consumer demand for integrated entertainment experiences, encompassing dining and live events, is growing, with the esports market alone projected to exceed $2.5 billion by 2024. Bally's employment figures, with over 9,000 employees in 2023, highlight its significant community impact, though infrastructure strain and social costs associated with gambling require careful management.

| Sociological Factor | Impact on Bally's | Supporting Data (2023-2025) |

|---|---|---|

| Shifting attitudes towards gambling | Increased potential customer base, but also calls for responsible gaming. | Maryland casino revenue up 5.5% in 2024. |

| Demographic changes | Need to tailor offerings to different age groups (e.g., traditional vs. digital gaming). | Growing Gen Z cohort favors interactive entertainment. |

| Demand for integrated experiences | Opportunity to blend gaming with dining, hospitality, and events. | Esports market projected to exceed $2.5 billion by 2024. |

| Community impact | Job creation and economic stimulus, but also potential infrastructure strain and social costs. | Bally's employed over 9,000 individuals in 2023. |

Technological factors

Bally's must continuously innovate its online gaming and sports betting platforms to provide a top-tier user experience, featuring intuitive navigation, a wide variety of games, and strong underlying technology. This commitment to technological advancement is essential for maintaining a competitive edge and keeping customers engaged in the rapidly evolving iGaming landscape.

Cybersecurity and data protection are paramount for Bally's, a global gaming and entertainment firm. Handling extensive customer data and financial transactions exposes the company to significant cyber threats. A 2023 report indicated a 15% increase in data breaches affecting the hospitality and leisure sector, a trend likely to continue into 2024-2025.

Bally's must maintain robust data protection measures and consistently invest in its cybersecurity infrastructure. This is crucial to prevent costly data breaches, which can lead to significant financial penalties and reputational damage, impacting customer trust and loyalty. The average cost of a data breach globally reached $4.45 million in 2023, a figure expected to rise.

Bally's is increasingly leveraging artificial intelligence and advanced data analytics to refine customer interactions and boost marketing effectiveness. For instance, in 2024, the company reported a significant uplift in engagement metrics following targeted AI-driven promotions. This technological integration is also crucial for optimizing operational efficiency across its casinos and online platforms, ensuring a smoother customer journey.

The strategic application of data analytics allows Bally's to gain deep insights into player behavior, which is vital for personalizing offers and enhancing loyalty programs. In the first half of 2025, Bally's saw a 15% increase in repeat customer visits attributed to these data-informed strategies. Furthermore, AI plays a key role in fraud detection, safeguarding both the company and its patrons.

Emerging technologies like VR/AR in gaming

Emerging technologies like virtual reality (VR) and augmented reality (AR) are poised to reshape the gaming landscape. Bally's must stay abreast of these advancements, as they offer opportunities to develop more engaging and immersive player experiences. The global VR in gaming market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, reaching an estimated $45 billion by 2028, indicating substantial future potential.

The integration of VR and AR could lead to entirely new gaming formats and revenue streams for Bally's. By investing in or partnering with VR/AR developers, Bally's can position itself at the forefront of this technological shift. For instance, the company could explore creating VR-enhanced slot machines or AR-driven table games that offer a more interactive and visually rich environment for players.

Key considerations for Bally's include:

- Technological Adoption: Monitoring the rate at which consumers adopt VR/AR hardware and software.

- Content Development: Assessing the investment required to create compelling VR/AR gaming content.

- Partnership Opportunities: Identifying potential collaborations with leading VR/AR technology providers and game studios.

- Regulatory Landscape: Understanding any emerging regulations specific to VR/AR gaming and virtual economies.

Cashless and digital payment solutions

The increasing prevalence of cashless and digital payment solutions presents a significant technological factor for Bally's. This trend impacts both their physical casinos and online operations, necessitating the adoption of secure and user-friendly payment technologies. For instance, by the end of 2024, the global digital payment market was projected to reach over $15 trillion, highlighting the scale of this shift. Bally's must integrate these solutions to meet customer expectations for convenience and to ensure efficient, secure financial transactions.

Embracing digital payment methods offers several advantages. It streamlines operations by reducing the need for cash handling, which can lower costs and minimize errors. Furthermore, it enhances the customer experience by providing faster, more convenient ways to deposit and withdraw funds. In 2023, mobile payment adoption continued its upward trajectory, with a significant portion of consumers preferring these methods for their ease of use. Bally's investment in robust digital payment infrastructure is therefore crucial for maintaining competitiveness and improving financial security.

Key considerations for Bally's regarding cashless and digital payments include:

- Adoption of diverse digital wallets and contactless payment options to cater to a broad customer base.

- Implementation of advanced security protocols to protect customer data and prevent fraud in an increasingly digital financial landscape.

- Integration of seamless payment experiences across both land-based and online platforms to ensure a consistent and convenient customer journey.

Bally's must prioritize continuous innovation in its online gaming and sports betting platforms to offer a superior user experience, integrating intuitive design and a wide game selection. Staying ahead in the fast-paced iGaming market requires a strong commitment to technological advancement to maintain customer engagement and a competitive edge.

Cybersecurity remains a critical concern for Bally's, given the vast amounts of customer and financial data handled. The hospitality and leisure sector saw a 15% rise in data breaches in 2023, a trend expected to persist into 2024-2025, underscoring the need for robust data protection. Investing in cybersecurity is vital to avoid substantial financial losses and reputational damage, as the global average cost of a data breach reached $4.45 million in 2023 and is projected to increase.

Bally's is increasingly leveraging AI and data analytics for enhanced customer engagement and marketing. In 2024, the company observed a notable improvement in engagement metrics due to AI-driven promotions, while also using AI for operational efficiency across its casinos and online platforms. Data analytics provides deep insights into player behavior, enabling personalized offers and improved loyalty programs; Bally's reported a 15% increase in repeat visits in early 2025 from these strategies.

Emerging technologies like VR and AR present significant opportunities for Bally's to create more immersive player experiences. The VR in gaming market, valued at $10.5 billion in 2023, is forecast to reach $45 billion by 2028, indicating substantial growth potential. Bally's can explore VR-enhanced slots or AR table games to tap into new revenue streams and position itself at the forefront of this technological evolution.

The shift towards cashless and digital payments impacts both Bally's physical and online operations, requiring secure and user-friendly payment technologies. With the global digital payment market projected to exceed $15 trillion by the end of 2024, adopting these solutions is essential for customer convenience and operational efficiency. Digital payments streamline operations, reduce cash handling costs, and improve the customer experience through faster transactions, with mobile payment adoption continuing its strong growth in 2023.

| Technological Factor | Impact on Bally's | Key Data/Trend (2023-2025) | Strategic Implication | Opportunity/Risk |

| Platform Innovation | User experience, game variety, competitive edge | Rapid evolution of iGaming platforms | Continuous investment in online technology | Risk of falling behind competitors |

| Cybersecurity | Data protection, financial security, reputation | 15% rise in sector data breaches (2023), $4.45M avg. breach cost (2023) | Robust security infrastructure, data protection measures | Risk of significant financial and reputational damage |

| AI & Data Analytics | Customer engagement, marketing effectiveness, operational efficiency | AI-driven promotions boosted engagement (2024), 15% increase in repeat visits (H1 2025) | Personalization, targeted marketing, operational optimization | Opportunity for enhanced customer loyalty and efficiency |

| VR/AR Integration | Immersive experiences, new gaming formats | VR gaming market: $10.5B (2023) to $45B (2028) | Explore VR/AR content development and partnerships | Opportunity for market leadership, risk of high development costs |

| Digital Payments | Transaction efficiency, customer convenience | Global digital payment market >$15T (end 2024), strong mobile payment growth | Integrate diverse digital wallets and secure protocols | Opportunity for streamlined operations, risk of security vulnerabilities |

Legal factors

Bally's navigates a intricate landscape of state and federal gaming licenses and regulations, a critical component of its operational framework across numerous jurisdictions. Failure to comply with these stringent legal requirements, which encompass responsible gaming initiatives and operational standards, could jeopardize its ability to conduct business.

Bally's faces significant legal hurdles with evolving data privacy laws like GDPR and CCPA. Compliance requires robust data security measures and clear privacy policies, essential for avoiding substantial fines and preserving customer confidence.

Failure to adhere to these regulations can lead to hefty penalties; for instance, GDPR violations can incur fines up to 4% of global annual revenue or €20 million, whichever is higher. In 2024, the ongoing enforcement actions highlight the critical need for Bally's to maintain stringent data protection practices.

Bally's Corporation, operating within the highly regulated gaming and hospitality sector, faces significant legal obligations under anti-money laundering (AML) statutes. These regulations are designed to prevent the illicit use of financial systems for criminal activities, a critical concern for businesses handling substantial cash flows and customer transactions.

Compliance mandates include establishing comprehensive AML programs, which involve customer due diligence, transaction monitoring, and the reporting of suspicious activities to authorities like FinCEN. Failure to adhere to these legal requirements can result in severe penalties, including substantial fines and reputational damage, impacting Bally's operational integrity and financial performance.

For instance, in 2023, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) reported over $300 billion in suspicious activity reports (SARs) filed by financial institutions, underscoring the pervasive nature of financial crime and the intensity of regulatory scrutiny on businesses like Bally's.

Advertising and marketing restrictions

Advertising and marketing for gaming services, including those offered by Bally's, face significant legal scrutiny, especially regarding responsible gambling and the protection of vulnerable groups. For instance, in the UK, advertising standards bodies like the Advertising Standards Authority (ASA) enforce strict rules, with recent crackdowns in 2023 and early 2024 focusing on preventing gambling ads from appealing to children or promoting irresponsible play. Bally's must navigate these evolving regulations to ensure all promotional content, from digital campaigns to traditional media, adheres to consumer protection laws and promotes safe gambling practices.

Compliance with these advertising restrictions is paramount for Bally's. Failure to do so can result in substantial fines and reputational damage. For example, in 2023, the UK government proposed further reforms to gambling legislation, which could include stricter controls on online advertising, potentially impacting how companies like Bally's reach their customer base. This necessitates a proactive approach to marketing strategies, ensuring they are not only effective but also legally sound and ethically responsible.

- Responsible Gambling Messaging: Legal frameworks mandate the inclusion of clear responsible gambling messages in all advertising materials.

- Targeting Vulnerable Populations: Regulations prohibit marketing efforts that specifically target or exploit individuals deemed vulnerable, such as those with a history of problem gambling.

- Advertising Standards Compliance: Bally's must adhere to national and regional advertising standards and consumer protection laws, which are frequently updated.

- Regulatory Fines: Non-compliance can lead to significant financial penalties; for instance, the UK Gambling Commission has issued substantial fines for advertising breaches in the past.

Labor laws and employment regulations

As a significant employer, Bally's must navigate a complex web of labor laws and employment regulations. These include adherence to federal and state minimum wage requirements, ensuring safe working conditions, and complying with anti-discrimination statutes. For instance, the Fair Labor Standards Act (FLSA) sets the federal minimum wage, which was $7.25 per hour as of July 2024, though many states and cities have higher rates. Bally's operations, particularly in hospitality and gaming, are subject to regulations concerning hours of work, overtime pay, and employee benefits.

Maintaining compliance with these legal frameworks is crucial for Bally's to prevent costly litigation and maintain a stable workforce. In 2023, the U.S. Department of Labor reported significant penalties for wage and hour violations across industries, underscoring the financial risks of non-compliance. Furthermore, Bally's must manage relationships with any organized labor, adhering to collective bargaining agreements and labor relations laws, such as the National Labor Relations Act (NLRA).

- Minimum Wage Compliance: Adherence to federal ($7.25/hour as of July 2024) and state/local minimum wage laws.

- Workplace Safety: Compliance with Occupational Safety and Health Administration (OSHA) standards to ensure employee well-being.

- Anti-Discrimination: Strict adherence to laws like Title VII of the Civil Rights Act of 1964, prohibiting discrimination based on race, color, religion, sex, or national origin.

- Union Relations: Managing collective bargaining agreements and complying with NLRA regulations for unionized employees.

Bally's operates under a stringent regulatory environment, requiring adherence to gaming licenses and responsible gambling laws across various states. Non-compliance could lead to operational disruptions and significant financial penalties, as seen with the ongoing enforcement of data privacy regulations like GDPR and CCPA, where violations can incur fines up to 4% of global annual revenue.

Anti-money laundering (AML) statutes are a critical legal factor for Bally's, necessitating robust compliance programs to prevent illicit financial activities. The company must implement customer due diligence and report suspicious transactions, with the U.S. Treasury's FinCEN actively monitoring such activities, as evidenced by over $300 billion in suspicious activity reports filed in 2023.

Advertising and marketing practices for Bally's are subject to intense legal scrutiny, particularly concerning responsible gambling messaging and the protection of vulnerable individuals. Regulatory bodies like the UK's Advertising Standards Authority (ASA) have intensified crackdowns, as highlighted by stricter proposed reforms to gambling legislation in 2023, impacting how companies like Bally's can promote their services.

Bally's must also navigate complex labor laws, including federal and state minimum wage requirements (e.g., $7.25/hour federal minimum wage as of July 2024), workplace safety standards (OSHA), and anti-discrimination statutes. Failure to comply can result in substantial penalties, as the U.S. Department of Labor reported significant fines for wage and hour violations in 2023.

| Legal Factor | Key Regulations/Concerns | Impact on Bally's | Example/Data Point |

| Gaming Licenses & Regulations | State and Federal Gaming Laws | Operational authorization, compliance costs | Licenses required in all operating states. |

| Data Privacy | GDPR, CCPA | Data security, potential fines, customer trust | Fines up to 4% of global annual revenue for GDPR breaches. |

| Anti-Money Laundering (AML) | Bank Secrecy Act, FinCEN regulations | Transaction monitoring, reporting obligations, reputational risk | FinCEN received over $300 billion in SARs in 2023. |

| Advertising Standards | ASA (UK), Consumer Protection Laws | Marketing restrictions, responsible gambling messaging | UK proposed stricter online ad controls in 2023. |

| Labor Laws | FLSA, OSHA, NLRA | Wage compliance, workplace safety, union relations | Federal minimum wage $7.25/hour (July 2024). |

Environmental factors

Bally's faces growing demands from investors, regulators, and consumers to showcase robust Environmental, Social, and Governance (ESG) performance. This includes transparent reporting on sustainability efforts, such as reducing its environmental impact and conserving resources, which are now critical expectations for companies in the gaming and hospitality sector.

The company's commitment to sustainability is increasingly scrutinized, with a focus on measurable progress in areas like energy efficiency and waste reduction. For instance, in 2023, the broader hospitality industry saw a significant push towards sustainable practices, with many companies investing in renewable energy sources and water conservation technologies, setting a benchmark that Bally's will likely need to meet or exceed.

Bally's operates large resorts and casinos, which are significant consumers of energy. For instance, in 2023, the company reported substantial operational expenses related to utilities across its properties. Implementing energy-efficient technologies, such as LED lighting and advanced HVAC systems, and utilizing renewable energy sources are critical steps towards environmental responsibility and potential cost savings.

Reducing its carbon footprint is becoming increasingly important for companies like Bally's, especially as regulatory pressures and investor expectations around Environmental, Social, and Governance (ESG) factors grow. While specific 2024/2025 carbon reduction targets for Bally's are still emerging, the industry trend points towards greater investment in sustainability initiatives to mitigate climate risks and enhance brand reputation.

Bally's, like other major hospitality and gaming enterprises, faces significant environmental hurdles in managing the vast amounts of waste produced by its operations. Effective waste management is not just about compliance but also about operational efficiency and corporate responsibility.

Implementing robust waste reduction, recycling, and composting initiatives is crucial for Bally's to lessen its landfill impact. For instance, in 2023, the hospitality sector globally generated millions of tons of waste, with food waste being a substantial component, highlighting the scale of the challenge these businesses face.

Adherence to evolving environmental regulations, which increasingly mandate waste diversion and recycling rates, is a key driver for Bally's to invest in these programs. Failure to comply can result in fines and reputational damage, impacting the company's bottom line and stakeholder trust.

Water conservation in resort operations

Water scarcity is an increasingly pressing issue globally, and for large-scale operations like Bally's resorts, managing water consumption is paramount. Many popular tourist destinations, including those where Bally's operates, are located in regions facing significant water stress. For instance, parts of the American Southwest, a key market for the company, are experiencing prolonged drought conditions, impacting water availability and increasing its cost.

To address this, Bally's is focusing on implementing robust water conservation strategies across its resort properties. These initiatives are designed to reduce overall water usage while maintaining high standards of guest experience. This proactive approach not only aligns with environmental stewardship but also mitigates operational risks associated with water shortages and rising water prices.

Key water conservation measures being adopted by Bally's include:

- Implementing water-efficient landscaping: Utilizing drought-tolerant plants and advanced irrigation systems to minimize outdoor water use.

- Upgrading to low-flow fixtures: Installing water-saving toilets, showerheads, and faucets in guest rooms and public areas.

- Exploring water recycling and reuse: Investigating the feasibility of greywater recycling for non-potable uses like irrigation and cooling systems.

- Guest education and engagement: Encouraging guests to participate in water conservation efforts through in-room messaging and hotel policies.

Adaptation to climate change impacts

Bally's, with its significant presence in coastal regions like Las Vegas and Atlantic City, faces tangible risks from climate change. For instance, the potential for rising sea levels and more frequent severe storms in areas like the East Coast directly threatens the physical integrity and accessibility of its properties.

Adapting to these physical climate risks is crucial for Bally's long-term operational resilience and financial stability. This includes investing in infrastructure upgrades and developing robust disaster preparedness plans. For example, in 2024, many coastal businesses are reviewing their flood mitigation strategies, a trend likely to intensify.

- Coastal Property Vulnerability: Bally's properties in areas like Atlantic City are susceptible to increased storm intensity and potential sea-level rise, impacting infrastructure and guest access.

- Operational Resilience Investments: The company must allocate capital for climate adaptation measures, such as enhanced storm defenses and updated building codes, to safeguard assets.

- Insurance and Risk Management: Climate change impacts necessitate a review of insurance policies and risk management frameworks to account for escalating weather-related events.

- Supply Chain Disruptions: Extreme weather events can disrupt supply chains for goods and services essential to casino operations, necessitating diversified sourcing strategies.

Environmental factors significantly influence Bally's operations, from energy consumption to waste management and water usage. The company faces increasing pressure to adopt sustainable practices and reduce its ecological footprint, driven by investor expectations, regulatory changes, and growing consumer awareness regarding ESG performance.

Bally's is actively implementing water conservation strategies across its properties, recognizing the importance of managing water resources, particularly in regions experiencing water stress. These efforts include upgrading to low-flow fixtures and exploring water recycling, aiming to reduce consumption while maintaining service quality.

The company also confronts the challenge of climate change, with properties in coastal areas like Atlantic City being vulnerable to rising sea levels and severe weather events. Adapting to these physical risks requires investment in infrastructure and robust disaster preparedness to ensure long-term operational resilience.

| Environmental Focus Area | 2023/2024 Industry Trend/Challenge | Bally's Response/Initiative |

|---|---|---|

| Energy Consumption | Industry-wide push for energy efficiency; rising utility costs. | Implementing LED lighting, advanced HVAC systems; exploring renewable energy. |

| Waste Management | Millions of tons of waste generated by hospitality sector; focus on food waste. | Robust waste reduction, recycling, and composting programs; adherence to diversion mandates. |

| Water Scarcity | Prolonged drought conditions in key markets (e.g., American Southwest). | Water-efficient landscaping, low-flow fixtures, greywater recycling exploration. |

| Climate Change Risks | Increased storm intensity and sea-level rise impacting coastal properties. | Infrastructure upgrades, disaster preparedness, review of insurance and risk management. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bally's is built upon a comprehensive review of official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in verifiable, current information.