Bally's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bally's Bundle

Bally's faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being particularly influential forces. Understanding these dynamics is crucial for navigating the complex casino and hospitality landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bally's’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts the bargaining power of suppliers for companies like Bally's in the gaming and hospitality sector. The reliance on specialized providers for crucial elements such as gaming technology, digital content, and operational infrastructure means that if this supplier base is narrow and highly specialized, these entities can wield considerable influence. This leverage can translate into increased costs or less favorable contractual agreements for Bally's when acquiring essential goods and services.

For instance, a limited number of dominant manufacturers for electronic gaming machines or proprietary online casino platforms can dictate terms. In 2024, the global gaming machine market is dominated by a few key players, with companies like Aristocrat Leisure and Light & Wonder holding substantial market share, suggesting a degree of supplier concentration that could empower them in negotiations with operators like Bally's.

The cost and complexity Bally's faces when switching from one major supplier to another significantly impact supplier power. High switching costs, like the expense of integrating new software systems or retraining employees on different equipment, make it harder for Bally's to change providers. This inertia gives existing suppliers more leverage.

For instance, if Bally's relies on a proprietary gaming software system from a specific supplier, the cost and time to migrate to a new platform could be substantial. This would empower the current supplier, as Bally's would be hesitant to incur those significant switching expenses, potentially leading to higher prices or less favorable terms.

The uniqueness of Bally's supplier offerings significantly impacts supplier power. When suppliers provide highly differentiated or proprietary technology and content, such as exclusive casino games or specialized sports betting platforms, they gain considerable leverage. This is particularly true if Bally's relies heavily on these unique elements to draw and keep its customer base.

For instance, if a key software provider for Bally's develops a groundbreaking slot machine game that becomes a major draw, that supplier can likely demand higher licensing fees or more favorable contract terms. In 2023, the online gaming market saw continued innovation, with companies investing heavily in proprietary content to stand out. This trend suggests that suppliers with unique digital assets are in a strong position to negotiate with operators like Bally's.

Threat of Forward Integration by Suppliers

Suppliers in the gaming and hospitality sector might pose a threat if they can credibly integrate forward, essentially becoming direct competitors to Bally's. This capability would grant them considerable negotiation power, as Bally's would be keen to prevent the emergence of a new rival in its core markets. For instance, a major slot machine manufacturer could potentially acquire or develop its own casino operations.

However, the significant capital requirements for establishing and running casinos often act as a substantial barrier, limiting the practical ability of most suppliers to pursue forward integration. The cost of acquiring licenses, real estate, and operational infrastructure is immense. In 2023, the average cost to develop a new casino resort in the US could range from hundreds of millions to over a billion dollars, a figure that deters many smaller or less capitalized suppliers.

- Limited Forward Integration Risk: The high capital intensity of casino operations generally restricts suppliers' ability to integrate forward and compete directly with Bally's.

- Supplier Leverage: If a supplier *could* credibly integrate forward, they would gain significant leverage in price and term negotiations with Bally's.

- Industry Capitalization: The substantial investment needed to enter the casino market, often exceeding $500 million for a new property, makes this threat less prevalent for most suppliers.

Importance of Bally's to Suppliers

The proportion of a supplier's revenue derived from Bally's significantly influences the supplier's bargaining power. If Bally's represents a substantial portion of a supplier's business, the supplier is more likely to offer competitive pricing and favorable terms to retain Bally's as a key client. For instance, if a supplier's sales to Bally's constitute over 10% of their total revenue, their dependence on Bally's increases, thus diminishing their leverage.

Conversely, if Bally's is a minor customer for a supplier, the supplier holds greater bargaining power. In such scenarios, the supplier can afford to dictate terms, potentially leading to higher prices or less favorable contract conditions for Bally's. This dynamic is particularly relevant for specialized suppliers whose products or services are in high demand across multiple industries.

- Supplier Dependence: A supplier's reliance on Bally's revenue directly correlates with their bargaining power.

- Customer Concentration: Bally's status as a major or minor customer for a supplier dictates the supplier's willingness to negotiate.

- Market Position: Suppliers with strong market positions and diversified customer bases generally have more leverage.

- Bally's Purchasing Volume: The sheer volume of goods or services Bally's procures from a supplier can shift the balance of power.

The bargaining power of suppliers for Bally's is influenced by the availability of substitute products or services. If alternative suppliers or solutions exist that can fulfill similar needs, Bally's can leverage this competition to negotiate better terms. However, the gaming industry often involves specialized technology and unique content, which can limit viable substitutes.

For instance, if a proprietary slot machine software offers a unique player experience not easily replicated, the supplier holds considerable power. In 2024, the demand for innovative and engaging digital gaming content continues to rise, making it harder for Bally's to find direct substitutes for highly successful proprietary offerings.

The bargaining power of suppliers is also shaped by the importance of the supplier's product or service to Bally's overall operations and profitability. If a supplier provides a critical component or service that directly impacts Bally's revenue generation, that supplier will likely have more leverage. For example, a supplier of a highly popular exclusive online slot game would have significant power.

The cost of switching suppliers is a major factor influencing supplier bargaining power. High switching costs, such as the expense of integrating new software, retraining staff, or potential disruption to operations, empower existing suppliers. Bally's faces substantial costs if it needs to replace its core gaming platform providers, giving those suppliers an advantage in negotiations.

| Factor | Impact on Bally's Supplier Bargaining Power | Example/Data (2024) |

|---|---|---|

| Availability of Substitutes | Low power if few substitutes exist for specialized tech/content. | High demand for unique digital gaming content limits viable alternatives. |

| Importance of Supplier's Offering | High power if offering is critical to Bally's revenue. | Exclusive, popular slot games can command premium terms. |

| Switching Costs | High power if switching is costly and complex. | Significant expenses for integrating new gaming platforms. |

What is included in the product

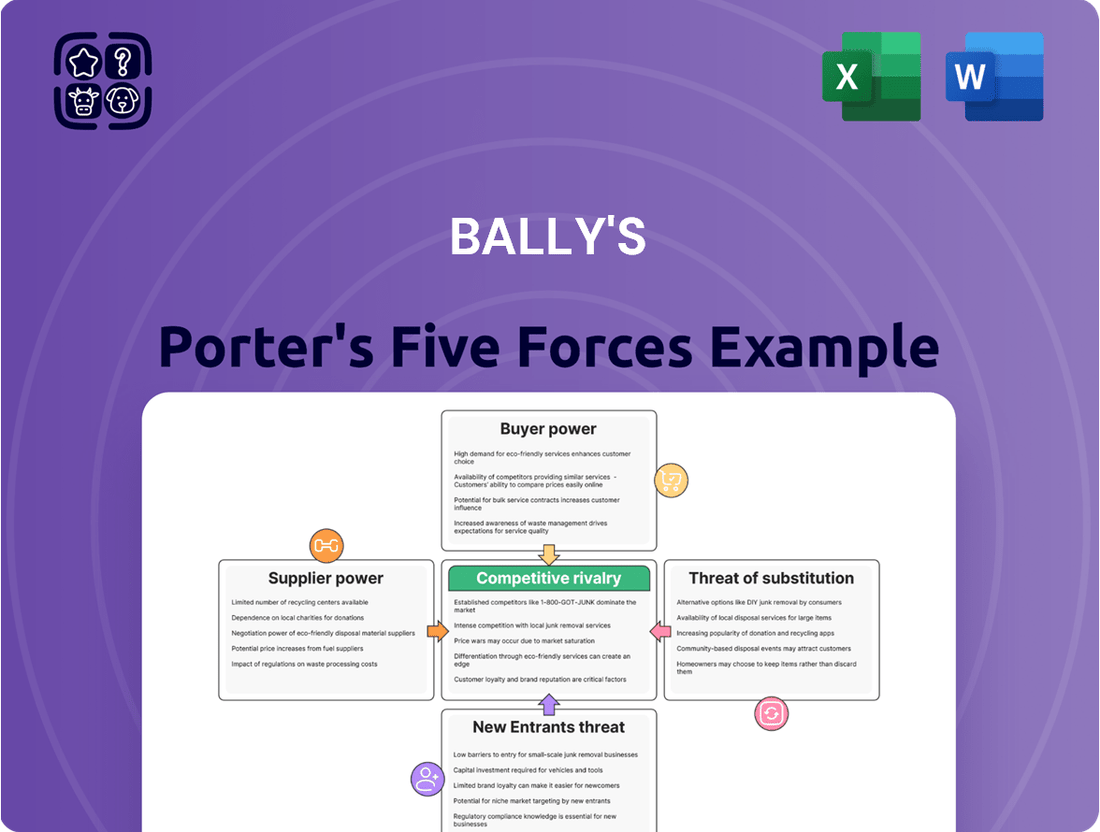

Tailored exclusively for Bally's, this analysis dissects the five competitive forces shaping its industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly visualize competitive intensity with a dynamic force field diagram, highlighting key threats and opportunities.

Customers Bargaining Power

Bally's operates with a widely dispersed customer base across its land-based casinos and online platforms. This broad reach means that customer concentration is inherently low.

Consequently, no single customer or a small cluster of customers represents a substantial portion of Bally's overall revenue. This lack of reliance on a few key individuals significantly diminishes the bargaining power that any individual customer might wield over the company.

Customers in the gaming and entertainment industry have a wide array of choices, from traditional brick-and-mortar casinos to burgeoning online gaming sites and a diverse range of other leisure pursuits. This abundance of alternatives significantly enhances customer bargaining power.

Should Bally's pricing or offerings fail to meet customer expectations, consumers can readily shift their patronage to competitors, a dynamic that intensifies if substitute options are perceived as equally or more appealing. For instance, the online gambling market saw substantial growth, with global revenue projected to reach over $100 billion by 2025, indicating a strong competitive landscape readily accessible to consumers.

Customers in the gaming industry, especially those who play casually, can be quite sensitive to price. This means that things like special offers, bonuses, and even the odds offered in sports betting really matter when they decide where to play. Bally's has to be smart about its pricing to keep people coming back.

For instance, in 2024, the online sports betting market saw intense competition, with many operators offering aggressive sign-up bonuses and promotional wagers to attract new customers. This environment directly impacts Bally's ability to set prices and maintain margins, as players can easily switch to a competitor offering a better deal.

Customer Information and Transparency

The bargaining power of customers in the gaming industry, particularly for companies like Bally's, is significantly amplified by increased information access. Online platforms and review sites have made pricing, odds, and competitor experiences readily available. This transparency allows customers to easily compare offerings, driving down prices and demanding better value, thus strengthening their position.

This heightened customer awareness is a crucial factor. For instance, in 2024, the online gambling market saw continued growth, with players actively seeking the most advantageous deals. This trend means companies must offer competitive odds and attractive promotions to retain customers.

- Information Accessibility: Customers can readily access pricing, odds, and reviews across multiple gaming providers via online platforms.

- Price Sensitivity: Increased transparency leads to greater price sensitivity among customers, who actively seek the best value.

- Switching Costs: Low switching costs in the digital gaming space further empower customers to move to competitors offering better terms.

- Brand Loyalty Erosion: The ease of comparison can erode brand loyalty if competitors consistently offer superior value propositions.

Low Switching Costs for Customers

For online gaming, the bargaining power of customers is significantly amplified by low switching costs. It's often as simple as creating a new account on a different platform, a process that takes mere minutes.

While Bally's and other land-based casinos offer loyalty programs, the digital landscape allows players to easily sample multiple competitors. This ease of access means customers can readily compare offerings and move to a platform with better bonuses or a wider game selection, exerting considerable pressure on existing providers.

- Low Friction Entry: Signing up for a new online casino account is typically a quick and straightforward process, often completed within minutes.

- Competitive Offers: Customers can easily compare welcome bonuses, ongoing promotions, and game libraries across various online platforms.

- Minimal Financial Commitment: Unlike some industries where switching involves substantial financial outlay, online gaming often requires only a small initial deposit to try a new service.

- Information Accessibility: Online reviews and comparison sites make it easy for customers to research and identify the best available options.

Bally's customers possess considerable bargaining power due to the vast number of gaming and entertainment options available. The ease with which consumers can switch between land-based casinos, online platforms, and other leisure activities means Bally's must constantly offer competitive value. For instance, the global online gambling market was projected to exceed $100 billion by 2025, highlighting the intense competition and the readily available alternatives for consumers.

Price sensitivity is another key factor. Customers, especially casual gamers, are highly responsive to promotions, bonuses, and favorable odds. In 2024, the online sports betting sector saw aggressive promotional campaigns, including sign-up bonuses, directly influencing Bally's pricing strategies and profitability.

Furthermore, increased information accessibility empowers customers. Online reviews and comparison sites allow players to easily research and compare pricing, odds, and overall customer experience across numerous providers. This transparency forces companies like Bally's to maintain competitive offers to retain their customer base, as switching costs for online platforms are minimal.

What You See Is What You Get

Bally's Porter's Five Forces Analysis

This preview displays the complete Bally's Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the casino and hospitality industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing you with actionable insights into Bally's market position and strategic considerations.

Rivalry Among Competitors

The gaming, hospitality, and entertainment sector is intensely competitive, featuring major established companies such as Caesars Entertainment, PENN Entertainment, and MGM Resorts International, alongside a growing number of online-focused businesses. This broad spectrum of competitors, from large integrated resorts to digital-first platforms, means Bally's faces rivalry across multiple fronts.

In 2023, for instance, Caesars Entertainment reported total revenue of $11.5 billion, while PENN Entertainment generated $6.1 billion. These figures highlight the significant scale of some key rivals, indicating Bally's must compete with entities possessing substantial financial resources and market presence.

The U.S. commercial gaming industry is experiencing growth, especially in online gaming and mobile sports betting. However, this expansion fuels intense competition, making it difficult for companies like Bally's to achieve profitable growth.

Bally's reported a slight dip in consolidated revenue for Q1 2025, partly due to a divestiture. Despite this, its Casinos & Resorts and North America Interactive divisions showed revenue increases, indicating pockets of strength amidst the competitive landscape.

Companies in the gaming and hospitality sector vie for customer attention by offering unique gaming experiences, robust loyalty programs, diverse entertainment options, and cutting-edge technology. This differentiation is crucial for attracting and retaining patrons in a crowded market.

Bally's aims to stand out by leveraging its diverse portfolio of casinos and resorts, each offering distinct amenities and atmospheres. Furthermore, its strategic expansion into an omni-channel presence, encompassing sports betting and iGaming platforms, allows it to connect with customers across various touchpoints, extending engagement beyond the traditional casino floor.

In 2023, Bally's reported net revenue of $2.3 billion, with a significant portion driven by its retail casino operations. The company's investment in its digital segment, including sports betting and iGaming, is a key part of its differentiation strategy to capture a broader market share.

Exit Barriers

Bally's faces significant exit barriers, a key factor in its competitive landscape. The company's substantial investments in physical assets, such as casinos and resorts, represent a major hurdle to leaving the market. For instance, Bally's operates numerous properties across the United States, requiring considerable capital to build and maintain.

These high fixed costs, coupled with long-term leases and a large workforce, mean that exiting the industry would incur substantial penalties and unrecoverable expenses. This situation often forces companies like Bally's to continue operating even when market conditions are unfavorable, leading to intensified competition as they strive to cover their ongoing costs.

- Significant Fixed Assets: Bally's owns and operates multiple casino properties, representing billions in capital investment.

- Long-Term Commitments: The company is bound by leases and employment contracts that increase the cost and complexity of exiting.

- Employee Base: A large, often unionized, workforce presents severance and contractual obligations upon closure.

Strategic Stakes

The strategic importance of market leadership and securing key regional presences significantly fuels competitive rivalry for Bally's. Companies are willing to invest heavily, even with aggressive pricing and marketing tactics, to establish or defend their positions. This is particularly evident in the rapidly evolving online gaming sector and in strategically vital markets like Chicago, where Bally's is investing in a substantial permanent casino development.

This intense focus on strategic locations and market share can lead to a heightened level of competition. For instance, Bally's Chicago project, estimated to cost around $1.7 billion, highlights the substantial investments being made to capture a significant portion of this lucrative market. Competitors are likely to respond with their own strategic moves to counter Bally's advantage.

- Market Leadership Aspiration: Companies like Bally's are driven to be leaders in their chosen markets, leading to aggressive competition.

- Regional Strategic Importance: Key locations, such as Chicago, become battlegrounds for market share, increasing rivalry.

- Investment in Growth: The significant capital outlay for projects like the Bally's Chicago casino signals a commitment to gaining a competitive edge.

- Aggressive Tactics: Expect pricing and marketing wars as firms vie for dominance in newly regulated or high-potential markets.

The competitive rivalry for Bally's is fierce, driven by numerous large, well-established players like Caesars Entertainment and MGM Resorts, as well as emerging online-focused entities. This broad competitive landscape means Bally's must constantly innovate and differentiate itself to capture and retain market share across its diverse offerings. The sector's growth, particularly in online gaming, intensifies this rivalry, demanding significant investment in customer acquisition and retention strategies.

Companies are actively vying for market leadership through substantial investments and aggressive tactics, especially in key strategic regions. Bally's $1.7 billion investment in its Chicago casino development exemplifies this, signaling a commitment to securing a dominant position in a lucrative market, which will undoubtedly provoke strategic responses from competitors.

| Competitor | 2023 Revenue (Billions USD) | Key Focus Areas |

|---|---|---|

| Caesars Entertainment | 11.5 | Integrated resorts, online gaming |

| PENN Entertainment | 6.1 | Retail casinos, sports betting integration |

| MGM Resorts International | 15.2 | Luxury hospitality, entertainment, growing digital presence |

SSubstitutes Threaten

Consumers today have an incredibly diverse range of entertainment choices that compete with Bally's core offerings. Beyond the casino floor or online gaming platforms, people can spend their leisure time and money on anything from attending live concerts and major sporting events to enjoying a meal at a new restaurant or going to the movies. This broad spectrum of alternatives means Bally's faces significant pressure from substitutes.

These substitutes directly threaten Bally's ability to capture consumer discretionary spending. For instance, the global live music industry, a significant substitute, saw revenues rebound strongly in 2023, with major festivals and tours attracting hundreds of thousands of attendees, indicating a strong consumer appetite for experiences outside of traditional gambling. Similarly, the box office for major film releases in 2023 surpassed $9 billion in the US alone, showcasing the enduring appeal of cinematic entertainment.

The accessibility and variety of these alternative entertainment options mean that consumers can easily shift their spending away from casinos. If a compelling concert or a highly anticipated sporting event is happening, it can divert funds that might otherwise have been allocated to gambling or casino-related activities. This constant competition for leisure dollars underscores the substantial threat posed by substitutes to Bally's market position.

Illicit or unregulated gaming operations, both online and offline, present a substantial threat to regulated entities like Bally's. These underground markets bypass the costs associated with taxes and compliance, allowing them to offer potentially more attractive pricing or incentives. The American Gaming Association actively works to combat these illegal ventures, highlighting the ongoing challenge they pose to the legitimate industry.

Beyond traditional casinos and sports betting, other forms of legal gambling present a competitive threat to Bally's. State lotteries, horse racing, and the rapidly growing fantasy sports sector offer alternative entertainment and potential for winnings. In 2023, U.S. state and territory lotteries generated over $115 billion in sales, demonstrating a significant market where consumers allocate discretionary spending.

These substitutes can attract customers by offering different accessibility, varying risk-reward profiles, or unique engagement models. For instance, the convenience of a state lottery ticket or the skill-based element of fantasy sports might appeal to consumers who are not drawn to the traditional casino experience, thereby diverting potential revenue streams from Bally's core offerings.

Growth of Home Entertainment and Digital Media

The increasing sophistication and accessibility of home entertainment, including video games, streaming services, and virtual reality, present a significant threat of substitutes for traditional casino entertainment. These options compete directly for consumers' leisure time and entertainment budgets, offering immersive and engaging experiences. For example, the global video game market was projected to reach over $200 billion in 2024, highlighting the substantial consumer spending shifting towards digital entertainment.

These digital alternatives provide convenience and a wide variety of content, often at a lower cost than a trip to a physical casino. Bally's must acknowledge that consumers can now access high-quality entertainment from their living rooms, reducing the necessity of visiting a brick-and-mortar establishment. The growth in subscription-based streaming services alone, with platforms like Netflix and Disney+ boasting hundreds of millions of subscribers globally, demonstrates this shift in consumer preference.

- Video Game Market Growth: Projected to exceed $200 billion in 2024, indicating a significant portion of entertainment spending.

- Streaming Service Dominance: Platforms like Netflix and Disney+ have hundreds of millions of global subscribers, showcasing a preference for at-home entertainment.

- Virtual Reality Advancements: VR technology offers increasingly immersive experiences that can rival the engagement of physical entertainment venues.

- Cost-Effectiveness: Home entertainment options are often perceived as more budget-friendly compared to travel and admission costs associated with traditional casinos.

Changing Consumer Preferences

Evolving consumer preferences present a significant threat of substitutes for Bally's. A growing segment of consumers, particularly younger demographics, may favor interactive or skill-based gaming over traditional slot machines and table games. For instance, the rise of esports and social casino gaming platforms demonstrates a shift in how people engage with entertainment, potentially diverting spending away from brick-and-mortar casinos. In 2024, the online gaming market continued its robust growth, with projections indicating further expansion as technology advances and accessibility increases.

Furthermore, a preference for alternative forms of entertainment at integrated resorts, such as live music, fine dining, or unique attractions, can also act as a substitute for traditional gambling. Bally's resorts must innovate to capture attention. The industry is actively adapting by blending sports betting, live entertainment, and diverse gaming options to appeal to a broader audience. This strategic pivot aims to counter the threat posed by substitutes by offering a more comprehensive entertainment experience.

- Shifting Entertainment Focus: Consumers might opt for concerts, dining, or other non-gaming activities offered at resorts.

- Rise of Digital Gaming: Social casino games and skill-based video games offer alternative entertainment avenues.

- Demographic Preferences: Younger generations may be less inclined towards traditional casino gambling.

- Industry Adaptation: Bally's and competitors are integrating sports, entertainment, and gaming to attract diverse customer bases.

The threat of substitutes for Bally's is substantial, encompassing a wide array of entertainment options that compete for consumer leisure time and spending. From live events and dining to digital entertainment like video games and streaming services, consumers have numerous alternatives. For instance, the U.S. box office generated over $9 billion in 2023, and the global video game market was projected to exceed $200 billion in 2024, highlighting significant spending in these substitute sectors.

Furthermore, other legal gambling avenues such as state lotteries and fantasy sports also siphon potential revenue. In 2023, U.S. state and territory lotteries alone saw over $115 billion in sales. These substitutes offer different forms of engagement, convenience, and risk-reward profiles, drawing consumers away from traditional casino offerings.

The increasing accessibility and appeal of home entertainment, including immersive video games and convenient streaming services with hundreds of millions of global subscribers, further intensifies this threat. Bally's must acknowledge that these digital alternatives offer compelling experiences, often at a lower cost and with greater convenience than visiting a physical casino.

The evolving entertainment landscape, with a growing preference for interactive and skill-based gaming, poses a direct challenge. Esports and social casino platforms are gaining traction, indicating a shift in consumer engagement. Bally's resorts are adapting by integrating diverse offerings like sports betting and live entertainment to counter this trend and capture a broader audience.

| Substitute Category | 2023/2024 Data Point | Implication for Bally's |

|---|---|---|

| Live Events & Entertainment | U.S. Box Office: >$9 Billion (2023) | Direct competition for discretionary spending on leisure activities. |

| Digital Entertainment | Global Video Game Market: >$200 Billion (2024 Projection) | Captures significant leisure time and entertainment budgets, offering convenience and immersion. |

| Other Gambling Forms | U.S. Lottery Sales: >$115 Billion (2023) | Offers alternative, often more accessible, gambling experiences. |

| Home Entertainment | Streaming Subscribers: Hundreds of Millions Globally | Provides cost-effective, high-quality entertainment accessible from home. |

Entrants Threaten

The capital required to enter the integrated resort and online gaming sector is immense. Bally's itself faces this barrier, as evidenced by its significant investment in new developments. For instance, the company is undertaking a substantial project in Chicago, which involves considerable upfront costs for land, construction, and licensing.

Developing new integrated resorts or acquiring existing ones demands a massive financial commitment. Bally's Chicago project alone is projected to cost around $1.7 billion, highlighting the substantial capital requirements that deter potential new entrants. This high barrier to entry means only well-capitalized companies can even consider competing.

The gaming industry is a minefield of regulatory complexity. Newcomers must navigate a labyrinth of state-specific laws and licensing procedures, which are not only intricate but also incredibly expensive. For instance, obtaining a gaming license in a major market like Nevada can cost millions of dollars and take years to process, presenting a formidable barrier to entry.

Established players like Bally's, with existing licenses across multiple jurisdictions, possess a significant advantage. This established infrastructure and familiarity with compliance requirements mean they can adapt more quickly and efficiently to market changes, while new entrants are bogged down by the sheer weight of legal and regulatory hurdles. In 2024, the ongoing expansion of sports betting into new US states continues to highlight these licensing challenges, with each new market requiring a separate, costly approval process.

Established brands like Bally's have cultivated significant customer loyalty, making it challenging for newcomers to gain traction. For instance, in the competitive online casino space, brand recognition plays a pivotal role in player acquisition.

New entrants face substantial hurdles, requiring significant investment in marketing and promotional activities to attract and retain customers. These customer acquisition costs can be particularly high in digital environments where building trust and visibility is paramount, impacting profitability for new players entering the market.

Access to Distribution Channels

For Bally's, access to distribution channels presents a significant barrier to new entrants, especially in the highly regulated casino and online gaming sectors. In land-based operations, acquiring prime real estate in desirable locations is a major hurdle, often requiring substantial capital investment and navigating complex zoning laws. For online gaming, gaining market access necessitates securing licenses in each state where operations are permitted and establishing partnerships for platform distribution, which can be a lengthy and costly process.

Bally's benefits from its existing infrastructure and market presence. The company operates a diverse portfolio of casinos across the United States, providing established physical distribution points. Furthermore, Bally's holds online sports betting licenses in multiple jurisdictions, demonstrating its ability to navigate the regulatory landscape and secure online distribution channels. For instance, as of early 2024, Bally's operates in states like New Jersey, Pennsylvania, and New York for its online offerings, requiring individual state-by-state approvals.

- Land-Based Operations: Securing prime real estate locations is a critical barrier for new entrants in the casino industry, demanding significant capital and regulatory navigation.

- Online Gaming Access: Gaining market access requires state-by-state legalization and securing distribution on online platforms, a complex and resource-intensive endeavor.

- Bally's Advantage: Bally's possesses an established portfolio of physical casinos and holds online sports betting licenses in multiple states, providing existing distribution networks.

- Market Presence: Bally's operates in key online gaming markets such as New Jersey and Pennsylvania, underscoring its established distribution capabilities.

Proprietary Technology and Expertise

Developing and maintaining advanced gaming platforms, iGaming solutions, and sports betting technology demands substantial investment in research and development, along with specialized expertise. Bally's has strategically invested in its proprietary technology stack and made key acquisitions, such as Gamesys Group, to enhance its digital capabilities. This focus on internal development and strategic integration creates a significant hurdle for potential new entrants seeking to compete effectively in the digital gaming space.

The threat of new entrants concerning proprietary technology and expertise for Bally's is moderately high. The iGaming sector, while capital-intensive, has seen a steady influx of new operators. For instance, in 2024, several new online casinos and sportsbooks launched in various regulated markets, often leveraging white-label solutions or partnering with established platform providers. However, Bally's commitment to building its own technology, as evidenced by its acquisition of Gamesys for $2 billion in 2021, provides a competitive edge. This investment in a robust and integrated technology infrastructure, including its own customer relationship management (CRM) and player account management (PAM) systems, makes it more challenging for newcomers to replicate the seamless user experience and operational efficiency Bally's offers.

- Significant R&D Investment: Bally's commitment to proprietary technology requires ongoing substantial investment in research and development to stay ahead in a rapidly evolving digital landscape.

- Acquisition of Digital Capabilities: The acquisition of Gamesys Group in 2021 for approximately $2 billion significantly bolstered Bally's digital gaming and sports betting technology stack, creating a formidable barrier to entry.

- Integrated Technology Infrastructure: Bally's focus on developing its own CRM and PAM systems allows for greater control over customer experience and operational efficiency, differentiating it from competitors relying on third-party solutions.

- Expertise Barrier: The need for specialized talent in areas like data science, cybersecurity, and platform development for sophisticated gaming operations presents a challenge for new entrants lacking established teams and expertise.

The threat of new entrants for Bally's is moderated by significant capital requirements, regulatory hurdles, and established brand loyalty. For example, the Bally's Chicago project, costing approximately $1.7 billion, exemplifies the immense financial commitment needed. Navigating complex, costly licensing processes, such as those in Nevada costing millions, further deters new players.

Bally's existing infrastructure and brand recognition provide a competitive edge. In 2024, the ongoing expansion of online sports betting into new US states means each market requires separate, costly approvals, a barrier new entrants find challenging. Customer acquisition costs are also high, especially in the digital space, impacting profitability for newcomers.

| Barrier Type | Description | Bally's Advantage | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High upfront investment for integrated resorts and online platforms. | Existing financial resources from operations. | Bally's Chicago project estimated at $1.7 billion. |

| Regulatory Hurdles | Complex and costly state-specific licensing and compliance. | Established licenses and familiarity with regulations. | Nevada gaming licenses can cost millions and take years. |

| Brand Loyalty & Customer Acquisition | Building trust and attracting customers is expensive. | Established brand recognition and customer base. | High marketing costs in competitive online gaming. |

| Technology & Expertise | Need for advanced gaming platforms and specialized talent. | Investment in proprietary technology and acquisitions. | Gamesys acquisition for $2 billion in 2021. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bally's leverages data from their annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and competitor financial disclosures to provide a comprehensive view of the competitive landscape.