Bally's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bally's Bundle

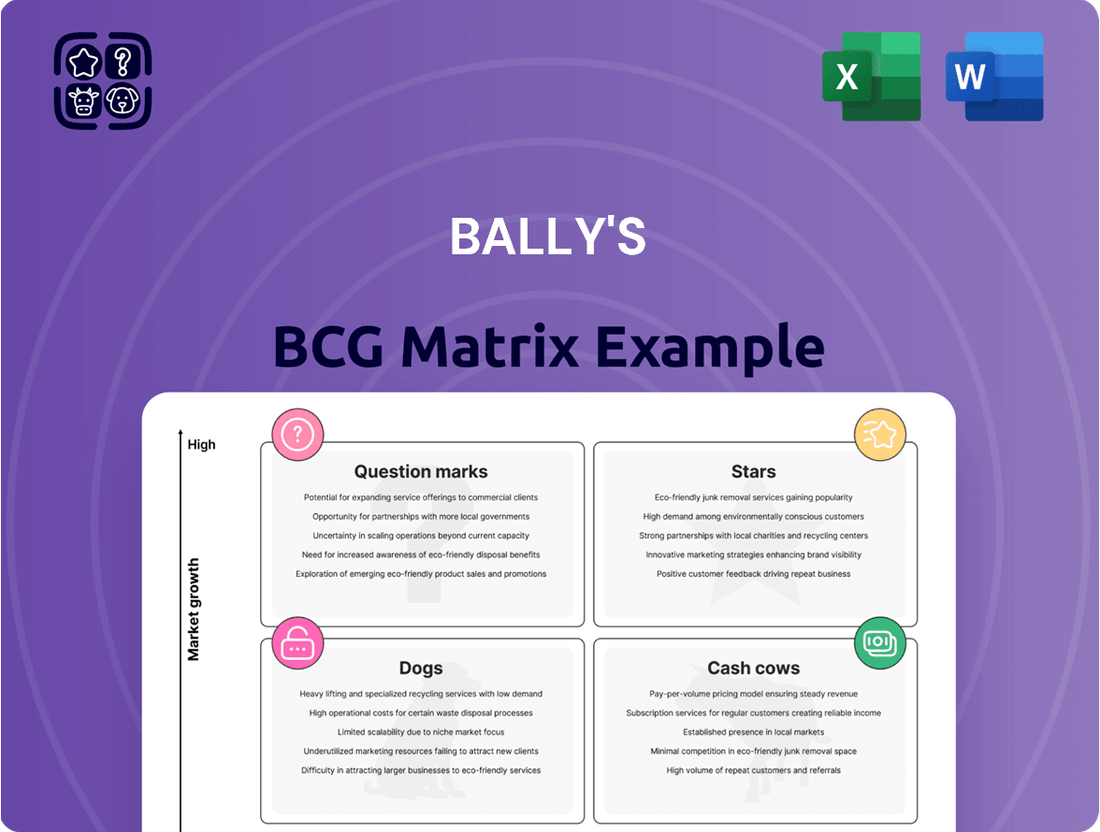

Curious about Bally's product portfolio? Our BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their strategic landscape and unlock actionable insights for growth, dive into the full BCG Matrix. Purchase the complete report for a detailed quadrant breakdown and a clear roadmap to optimizing Bally's product investments.

Stars

Bally's North America Interactive segment, which includes Bally Bet and Bally Casino, is a key growth driver. Revenue saw a substantial 12.5% jump in Q1 2025, building on a remarkable 58% increase for the entirety of 2024.

This expansion is fueled by the company's iGaming presence in states like New Jersey, Pennsylvania, and Rhode Island, alongside its sports betting operations, Bally Bet, now available in 11 states. The strategic focus remains on efficient marketing and cost management within this dynamic, expanding sector.

The four regional gaming properties acquired from Queen Casino & Entertainment in early 2025 are positioned as stars within Bally's BCG Matrix, indicating high growth potential. These newly integrated assets directly contributed to a notable 2.6% year-over-year increase in Bally's Casinos & Resorts revenue during Q1 2025, underscoring their immediate positive impact.

Bally's plans to leverage best operating practices across these acquired locations, aiming to accelerate their growth trajectory and solidify their star status. This strategic move is designed to significantly expand Bally's domestic gaming footprint and enhance its geographic diversification, a key objective for sustained market expansion.

Bally's strategic investment of AUD $200 million in Star Entertainment Group is a bold move into Australia's gaming landscape. This capital injection, structured through a multi-tranche convertible note and subordinated debt, could see Bally's holding roughly 38% of Star Entertainment upon conversion. This significant stake underscores Bally's commitment to expanding its global footprint in regulated international markets, aiming to leverage Star's established presence.

UK Online Operations

Bally's UK online operations are a significant component of its International Interactive segment, showing robust growth. In Q1 2025, revenue increased by 4.9%, building on a strong Q4 2024 performance where it saw an 11.3% rise.

This positive trajectory is attributed to effective player retention strategies and successful revenue optimization efforts. The company's focus is now firmly on regulated European markets, making the UK a crucial area for expansion and continued investment.

- UK Online Revenue Growth: Q1 2025 saw a 4.9% increase, following an 11.3% jump in Q4 2024.

- Growth Drivers: Strong player retention and revenue optimization initiatives are fueling this expansion.

- Strategic Focus: The UK market is a priority within Bally's International Interactive segment, which is concentrating on regulated European markets.

Rhode Island iGaming Monopoly

Bally's holds a unique position in Rhode Island, operating as the sole provider of legal iGaming. This monopoly in a developing market signifies substantial growth potential for the company. The initial performance of iGaming in Rhode Island has been robust, directly contributing to the expansion of Bally's North America Interactive segment.

This exclusive operational right grants Bally's a considerable advantage in securing market share as the acceptance and use of online gaming continues to rise across the region. For context, Rhode Island's iGaming market, launched in March 2024, generated over $17.6 million in gross gaming revenue in its first three months of operation, with Bally's receiving a significant portion of this. This early success underscores the market's promise and Bally's strategic foothold.

- Exclusive Market Access: Bally's is the sole operator of iGaming in Rhode Island.

- Nascent Market Growth: Rhode Island's iGaming sector shows strong early performance and expansion potential.

- Segment Contribution: The Rhode Island iGaming launch positively impacts Bally's North America Interactive segment revenue.

- Market Share Advantage: The monopoly allows Bally's to capture a dominant share as online gaming adoption increases.

The four regional gaming properties acquired from Queen Casino & Entertainment in early 2025 are classified as Stars in Bally's BCG Matrix. These acquisitions represent high-growth potential assets that have already demonstrated immediate positive contributions. Their integration significantly boosted Bally's Casinos & Resorts revenue by 2.6% year-over-year in Q1 2025, highlighting their strong performance and strategic importance.

Bally's is actively working to accelerate the growth of these new properties by implementing best operating practices. This focus is designed to further solidify their position as Stars, driving increased revenue and market share. The expansion of these domestic gaming locations is a key element in Bally's broader strategy for geographic diversification and sustained growth.

| Asset Category | Bally's BCG Matrix Classification | Key Performance Indicators | Strategic Importance |

| Acquired Regional Gaming Properties (Early 2025) | Stars | 2.6% YoY Revenue Increase (Q1 2025) | High growth potential, immediate revenue contribution, geographic expansion |

What is included in the product

Provides a strategic overview of Bally's portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Offers insights on which Bally's business units to invest in, hold, or divest based on market growth and share.

The Bally's BCG Matrix offers a clear, one-page overview, instantly identifying business units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

Cash Cows

Bally's established land-based casinos and resorts, excluding recent additions, form the company's largest segment. This portfolio is a significant cash generator, with Q1 2025 revenue reaching $351.2 million. The segment's overall revenue saw a 2.6% increase year-over-year in the same quarter.

Despite facing tough competition and adverse weather, Bally's legacy properties demonstrated resilience. They actually grew faster than the market in eight of the twelve areas they operate in during Q1 2025. This consistent performance highlights their status as a mature business unit that reliably produces strong cash flow.

Bally's core international interactive operations in regulated European markets represent a significant cash cow. Excluding the divested Asia interactive business, this segment saw revenue climb 7.7% year-over-year in Q1 2025.

These European markets are characterized by strong growth potential and healthy profit margins. This stability translates into a reliable source of consistent cash flow for Bally's overall business.

Bally's strategic partnerships with Gaming and Leisure Properties, Inc. (GLPI) represent a significant cash cow. These involve sale-leaseback deals and funding for development, offering Bally's a steady stream of capital by monetizing its real estate. This financial flexibility is crucial for ongoing operations and growth initiatives.

GLPI's portfolio, which includes Bally's properties, demonstrates robust performance. This strong asset performance ensures that Bally's rental obligations to GLPI are well-covered, providing a stable and predictable financial arrangement. For instance, in 2024, Bally's reported that its rent coverage ratio remained strong, underscoring the reliability of these income streams.

Bally Casino iGaming Platform (New Jersey & Pennsylvania)

Bally's iGaming platform in New Jersey and Pennsylvania is a prime example of a Cash Cow within the company's portfolio. These mature markets have consistently delivered strong revenue, making the platform a significant contributor to the North America Interactive segment's overall success.

The sustained performance is a testament to Bally's focus on enhancing user experience and refining its platform in these established iGaming environments. This strategic approach ensures consistent cash generation, solidifying its position as a reliable revenue stream.

- New Jersey iGaming Revenue: In 2023, New Jersey's online casino market generated over $1.7 billion in gross gaming revenue, with Bally's platform capturing a notable share.

- Pennsylvania iGaming Performance: Pennsylvania's iGaming market also saw substantial growth, exceeding $1.5 billion in revenue in 2023, further highlighting the potential of these established markets for Bally's.

- Segment Contribution: The North America Interactive segment, driven by these successful iGaming operations, is a key pillar supporting Bally's financial stability and growth initiatives.

Long-Standing Regional Casino Operations

Bally's has a proven track record of acquiring and improving underperforming regional casinos. This approach has built a stable base of mature gaming assets. These operations consistently generate revenue and cash flow, providing a solid financial foundation for the company.

- Regional Casino Stability: These established properties contribute significantly to the overall stability of the domestic regional gaming market.

- Consistent Cash Flow: The mature nature of these operations ensures a reliable stream of revenue and cash generation.

- Foundational Business Segment: They represent a core component of Bally's business, underpinning its financial strength.

Bally's legacy land-based casinos and its core international interactive operations in regulated European markets are key cash cows. These segments consistently generate substantial revenue and profit, contributing significantly to the company's financial stability. For example, Bally's Q1 2025 revenue for its established land-based casinos reached $351.2 million, marking a 2.6% year-over-year increase, demonstrating their reliable cash-generating capabilities.

Furthermore, the iGaming platforms in New Jersey and Pennsylvania, along with strategic sale-leaseback deals with Gaming and Leisure Properties, Inc. (GLPI), also function as robust cash cows. These ventures provide predictable income streams and capital flexibility, bolstering Bally's overall financial health. The New Jersey iGaming market alone generated over $1.7 billion in gross gaming revenue in 2023, with Bally's platform capturing a significant portion.

| Segment | Q1 2025 Revenue | Year-over-Year Growth | Key Characteristic |

|---|---|---|---|

| Established Land-Based Casinos | $351.2 million | 2.6% | Mature, resilient, market-outperforming |

| International Interactive (Regulated Europe) | N/A (Segment Growth) | 7.7% | High growth potential, healthy margins |

| iGaming (NJ & PA) | N/A (Market Data) | N/A | Established, consistent revenue generators |

| Strategic Partnerships (GLPI) | N/A (Capital Monetization) | N/A | Provides capital flexibility, stable income |

What You’re Viewing Is Included

Bally's BCG Matrix

The Bally's BCG Matrix preview you are currently viewing is the identical, fully finalized document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content; you get the complete, professionally formatted strategic analysis ready for immediate application. This comprehensive report is designed to provide clear insights into Bally's product portfolio, enabling informed decision-making for resource allocation and strategic planning. You can trust that the detailed breakdown of their Stars, Cash Cows, Question Marks, and Dogs is precisely what you'll utilize to guide your own business strategies.

Dogs

Bally's completed the divestiture of its Asia interactive business in late 2024. This move was a significant strategic decision, impacting overall revenue due to the business's previous contribution.

Prior to the divestiture, these operations saw a substantial performance deterioration and declining revenues. This made them problematic cash traps within the company's portfolio.

The exit from these grey markets was a deliberate choice to refocus efforts and resources on more stable, regulated markets. This aligns with a broader strategy to enhance long-term profitability and reduce regulatory risk.

Bally's temporary Chicago casino, a "question mark" in its BCG matrix, has not met financial expectations. In the first quarter of 2024, the temporary facility reported gross gaming revenue of $28.2 million, falling short of the projected $33.6 million. This underperformance highlights its current status as a resource consumer rather than a significant profit driver.

The facility's revenue, while present, is not yet substantial enough to position it as a strong performer. Its primary role is to maintain a presence in the Chicago market while the permanent $1.7 billion resort is under construction. This strategic necessity means the temporary operation is inherently a stop-gap measure, absorbing capital and operational costs without the scale or amenities to generate robust returns.

While Bally's UK online business has been a bright spot, its broader International Interactive segment experienced a revenue dip. This downturn was largely attributed to persistent struggles in specific non-UK markets.

These underperforming international interactive markets are characterized by low growth potential and minimal market share, acting as cash drains rather than revenue generators. Bally's strategic shift now prioritizes interactive investments in regulated European markets, aiming for more predictable and profitable growth.

Underperforming Legacy Casino Properties in Competitive Markets

Bally's Corporation has identified certain legacy casino properties as underperformers, particularly in competitive markets. These locations often struggle with declining market share due to increased competition or unfavorable economic conditions. For instance, properties in regions experiencing a surge in new supply or facing adverse weather patterns may see reduced foot traffic and gaming revenue.

These underperforming assets can be categorized as 'dogs' within a BCG Matrix framework. They typically exhibit low growth prospects and may only generate enough revenue to cover their operating costs, or even require ongoing investment for maintenance without contributing significantly to overall profitability. Bally's has noted these 'pockets of relative weakness' despite overall segment growth.

- Underperforming Properties: Bally's has acknowledged ongoing weaknesses in several of its casino and resorts portfolio segments.

- Market Challenges: Properties facing increased supply or adverse weather conditions are particularly susceptible to lower market share and growth.

- Financial Impact: Such locations may only break even or consume cash for maintenance, offering minimal returns.

- Strategic Consideration: These 'dog' assets may require strategic review, potentially involving divestment or significant reinvestment to improve performance.

Tropicana Las Vegas Redevelopment Site

The Tropicana Las Vegas redevelopment site, currently a demolished property, represents a significant investment with no immediate revenue generation. This positions it within the BCG Matrix as a potential 'Question Mark' or even a 'Dog' in its current state, as substantial capital is tied up in its transformation into a future stadium and gaming facility.

The project, spearheaded by Bally's Corporation, involves a substantial capital outlay for demolition and site preparation, estimated to be a significant portion of the overall $1.5 billion development cost.

- Current Status: Demolished site, not generating revenue.

- Investment: Capital intensive, with ongoing costs for site preparation.

- Future Potential: Dependent on the successful and timely completion of the new stadium and gaming complex.

- Risk Factor: Until operational, it's a capital sink with uncertain future returns.

Bally's has identified certain legacy casino properties as underperformers, particularly in competitive markets with declining market share. These locations often struggle to generate significant returns and may only cover operating costs, or even require ongoing investment without contributing substantially to overall profitability.

These underperforming assets, characterized by low growth prospects and minimal market share, can be categorized as 'dogs' within the BCG Matrix framework. Bally's has noted these 'pockets of relative weakness' despite overall segment growth, indicating a need for strategic review of these assets.

For example, properties in regions experiencing a surge in new supply or facing adverse economic conditions may see reduced foot traffic and gaming revenue, making them cash drains rather than profit drivers.

These 'dog' assets may require strategic consideration, potentially involving divestment or significant reinvestment to improve their performance and align with Bally's broader strategic goals.

| Asset Type | BCG Category | Performance Indicator | Market Condition | Strategic Consideration |

| Legacy Casino Properties | Dog | Low Growth, Declining Market Share | Increased Competition, Unfavorable Economics | Divestment or Reinvestment |

| Underperforming International Interactive Markets | Dog | Low Growth Potential, Minimal Market Share | Specific Non-UK Market Struggles | Focus on Regulated Markets |

Question Marks

The Bally's Chicago permanent casino development, with its projected $250 million EBITDAR run rate upon its anticipated June 2026 opening, clearly positions it as a significant investment for the company. This substantial capital expenditure for a new, large market venture aligns with the characteristics of a "question mark" in the BCG matrix, signifying high market growth potential but also considerable uncertainty regarding its future success and market share capture.

Bally Bet currently commands a modest 1% of the US sports betting market share, despite its presence in 11 states and ongoing expansion efforts.

The US sports betting landscape is intensely competitive and experiencing rapid growth, presenting both challenges and opportunities for Bally Bet.

To elevate Bally Bet from a Question Mark to a Star within Bally's BCG Matrix, a significant increase in market share is crucial, necessitating substantial investment in marketing and platform enhancements.

Bally's is strategically targeting states like Michigan and West Virginia for iGaming expansion, viewing them as key growth opportunities. These markets, while promising, currently represent areas where Bally's holds minimal to no market share, positioning them as potential 'Question Marks' in a BCG Matrix analysis. Significant capital outlay will be necessary to build brand awareness and capture a meaningful portion of these emerging iGaming landscapes.

Intralot Acquisition (Pending Regulatory Approval)

Bally's is strategically pursuing a significant expansion through its proposed $2.7 billion merger with Intralot, a prominent Greek lottery technology provider. This acquisition aims to fuse Intralot's established business-to-business lottery capabilities with Bally's existing business-to-consumer iGaming operations. The combined entity anticipates gaining access to over 40 international markets, significantly broadening its global footprint.

The Intralot acquisition, while pending necessary regulatory approvals, positions Bally's to achieve greater global scale and diversify its revenue streams away from a primary reliance on U.S. regional markets. The success of this venture in delivering on its promise of global reach and reduced U.S. market dependency is a key factor in its future strategic positioning.

- Transaction Value: $2.7 billion merger with Intralot.

- Strategic Synergy: Combines B2B lottery technology with B2C iGaming strengths.

- Global Reach: Intended access to over 40 international markets.

- Key Condition: Pending regulatory approval for completion.

Bally's New York Casino Project (RFA Process)

Bally's $4 billion casino project in the Bronx, New York, is currently navigating the Request for Applications (RFA) process. This ambitious undertaking signifies a substantial potential market opportunity, tapping into the high-growth prospects of a prime urban location.

- Project Scale: A proposed $4 billion investment for a new casino in New York.

- Regulatory Stage: Currently in the Request for Applications (RFA) phase, indicating early-stage development.

- Market Potential: Represents a significant opportunity in a densely populated urban area with high projected gaming revenue.

- Investment Needs: Requires substantial capital outlay and successful navigation of complex regulatory approvals.

Bally's ventures into new markets and significant strategic acquisitions, like the proposed Intralot merger, represent classic "question mark" scenarios within the BCG matrix. These initiatives demand substantial investment and face considerable uncertainty regarding market acceptance and competitive response, despite their high growth potential.

The company's modest 1% share in the rapidly expanding U.S. sports betting market, coupled with its expansion into states like Michigan and West Virginia where it has minimal presence, highlights further question mark positioning. Success in these areas hinges on aggressive marketing and platform development to gain traction.

Bally's $4 billion casino project in the Bronx is another prime example of a question mark. While the potential revenue from such a prime urban location is immense, the project is still in the early RFA phase, meaning significant regulatory hurdles and considerable investment are required before any return can be realized.

The pending $2.7 billion merger with Intralot, aimed at expanding Bally's global reach into over 40 markets, also falls into the question mark category. Its success depends heavily on regulatory approvals and the effective integration of B2B lottery capabilities with existing B2C operations.

| Initiative | BCG Category | Market Potential | Investment Required | Current Status/Uncertainty |

| Bally's Chicago Casino | Question Mark | High (projected $250M EBITDAR) | Substantial Capital Expenditure | Anticipated June 2026 opening, high uncertainty |

| Bally Bet US Market Share | Question Mark | High (rapidly growing industry) | Significant Marketing & Platform Investment | Currently 1% market share, intense competition |

| iGaming Expansion (MI, WV) | Question Mark | High (emerging markets) | Significant Capital Outlay | Minimal to no market share currently |

| Intralot Merger | Question Mark | High (access to 40+ markets) | $2.7 Billion Transaction Value | Pending regulatory approval, integration uncertainty |

| Bronx Casino Project | Question Mark | Very High (prime urban location) | $4 Billion Investment | Early RFA phase, significant regulatory hurdles |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.