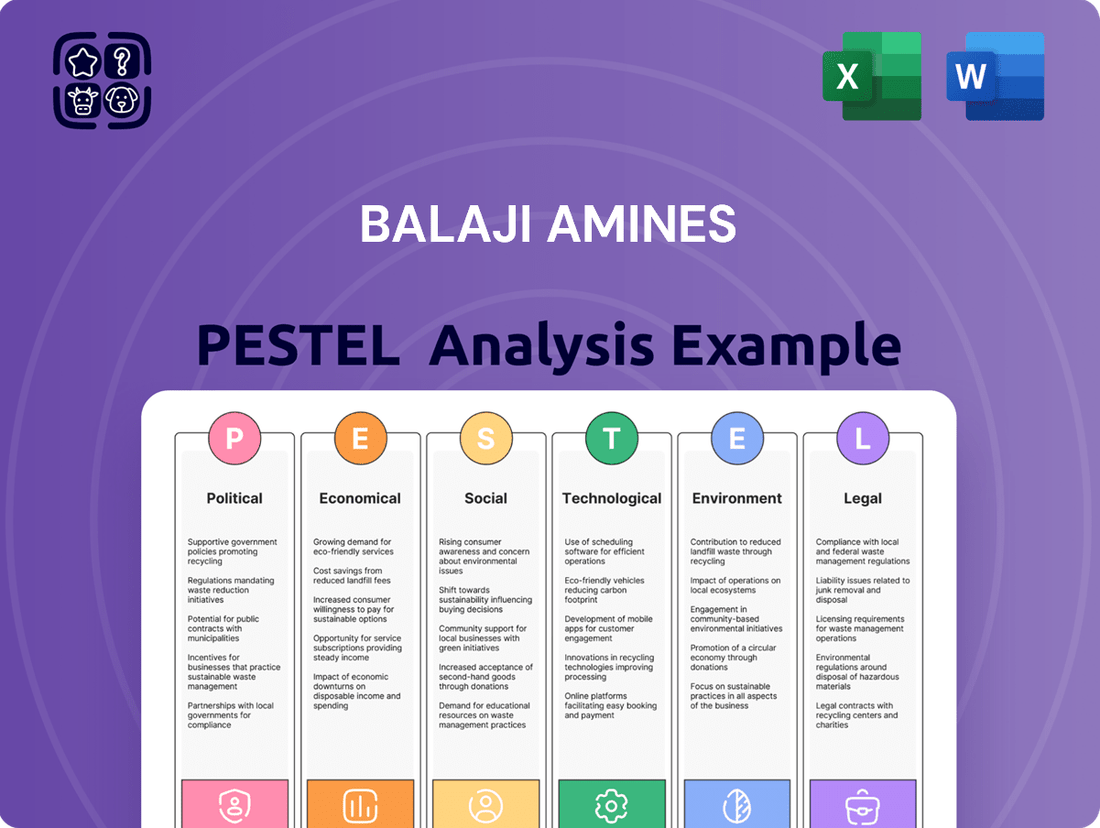

Balaji Amines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balaji Amines Bundle

Balaji Amines operates within a dynamic environment shaped by evolving government regulations, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats.

Our comprehensive PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting Balaji Amines, providing you with the critical intelligence needed to make informed decisions. Gain a competitive edge by downloading the full report and unlocking actionable insights.

Political factors

The Indian government's commitment to boosting the chemical sector is evident through initiatives like 'Make in India' and 'Aatmanirbhar Bharat', directly benefiting companies such as Balaji Amines by promoting domestic manufacturing and attracting investment.

These policies aim to enhance the industry's contribution to India's GDP, with the chemical sector alone projected to reach $300 billion by 2025, underscoring the significant growth potential for domestic players.

Furthermore, the government's consideration of Production Linked Incentive (PLI) schemes for chemicals and petrochemicals signals a strong intent to incentivize both domestic production and export growth, creating a more favorable operating environment for companies like Balaji Amines.

The chemical industry in India is navigating a dynamic regulatory landscape, with the government consistently introducing new rules and enhancing compliance mandates. Balaji Amines, like its peers, must meticulously follow regulations pertaining to the handling of hazardous chemicals, environmental protection measures, and stringent quality standards, including those set by the Bureau of Indian Standards (BIS).

A significant upcoming change is the proposed Chemical (Management and Safety) Rules (CMSR), expected by 2025. This framework, designed to align with the EU's REACH regulations, will require the registration, evaluation, and potential restriction of chemicals identified as high-risk, impacting product development and market access.

Changes in India's trade policies, particularly those aimed at reducing import dependence and boosting exports, directly influence Balaji Amines' operational landscape. For instance, the government's Production Linked Incentive (PLI) schemes, while not directly for amines, signal a broader strategy to enhance domestic manufacturing capabilities, potentially creating a more competitive environment for specialty chemicals.

Navigating global supply chain disruptions remains a key challenge, as evidenced by the volatility in raw material prices experienced throughout 2023 and early 2024. Balaji Amines must effectively manage its sourcing and logistics to counter competition from lower-cost chemical producers, especially those in China, which often benefit from different regulatory and cost structures.

The government's focus on revamping bilateral investment treaties and promoting exports for Micro, Small, and Medium Enterprises (MSMEs) could indirectly benefit larger players like Balaji Amines by fostering a more stable and predictable international trade environment. This could lead to improved access to new markets and potentially more favorable terms for international partnerships.

Geopolitical Stability and International Relations

Geopolitical tensions, like the ongoing Red Sea crisis, significantly impact global supply chains. For the chemical sector, this translates to higher freight costs and potential disruptions, affecting companies like Balaji Amines. In 2024, shipping rates saw considerable volatility due to these events.

Despite global economic uncertainties, India's economic growth remains robust. This stability is crucial for the chemical industry, as its performance is intrinsically linked to the broader economic landscape and international market conditions. India's GDP growth projections for 2024-2025 remain positive, providing a supportive backdrop.

- Red Sea Disruptions: Increased shipping insurance premiums and rerouting of vessels in early 2024 added an estimated 15-20% to freight costs for certain routes.

- India's Economic Resilience: India's economy is projected to grow by over 6.5% in FY2024-25, supporting domestic demand for chemicals.

- Global Chemical Demand: The International Monetary Fund (IMF) forecasts a modest recovery in global manufacturing output in 2024, which will influence demand for chemical intermediates.

Sector-Specific Reforms and Incentives

The Indian government is actively pursuing policy interventions aimed at bolstering the petrochemical and chemical sectors. A key objective is to encourage domestic production, thereby reducing reliance on imports and fostering greater investment in research and development within the industry.

While the Union Budget 2025 did not announce specific Production Linked Incentive (PLI) schemes directly for the chemical industry, it did highlight a strong commitment to overall economic growth and significant investments in infrastructure development. These broader initiatives are expected to create a more favorable operating environment and indirectly benefit chemical companies like Balaji Amines by improving logistics and reducing operational costs.

- Focus on Import Substitution: Government policies are geared towards making India a self-reliant hub for chemicals, a trend that could boost domestic demand for products manufactured by companies like Balaji Amines.

- R&D Investment Push: Encouragement for research and development can lead to innovation and the creation of higher-value chemical products, improving competitiveness.

- Infrastructure Boost: Investments in logistics and transportation infrastructure, as emphasized in the 2025 budget, can lower supply chain costs for chemical manufacturers.

- Indirect Economic Growth: Broader economic expansion supports demand across various end-user industries for chemicals, such as pharmaceuticals, agrochemicals, and automotive.

The Indian government's supportive stance towards the chemical sector, through initiatives like 'Make in India' and 'Aatmanirbhar Bharat', aims to boost domestic manufacturing. The chemical sector is a significant contributor to India's economy, projected to reach $300 billion by 2025, offering substantial growth avenues for companies like Balaji Amines.

The proposed Chemical (Management and Safety) Rules (CMSR), expected by 2025, will align India's chemical regulations with global standards like EU's REACH. This will necessitate rigorous compliance for companies, impacting product development and market access.

Geopolitical events, such as the Red Sea crisis in early 2024, have led to increased freight costs, estimated at 15-20% for certain routes, impacting supply chain economics for chemical manufacturers. India's economic resilience, with projected GDP growth exceeding 6.5% in FY2024-25, provides a stable domestic demand base for the chemical industry.

| Factor | Impact on Balaji Amines | Data/Trend (2024-2025) |

| Government Initiatives | Boosts domestic production and investment | 'Make in India', 'Aatmanirbhar Bharat' driving growth. |

| Regulatory Changes | Requires enhanced compliance and product adaptation | Proposed CMSR by 2025, aligning with EU REACH. |

| Trade Policies & Geopolitics | Affects supply chain costs and market access | Red Sea crisis increased freight costs by 15-20% in early 2024. |

| Economic Environment | Supports domestic demand and operational stability | India's GDP growth projected over 6.5% for FY2024-25. |

What is included in the product

This Balaji Amines PESTLE analysis examines the impact of political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks on the company's operations and strategy.

A concise Balaji Amines PESTLE analysis, presented in a visually segmented format, acts as a pain point reliver by offering quick interpretation of external factors impacting the business, streamlining strategic discussions.

Economic factors

India's economy is set for continued expansion, with real GDP growth anticipated at 6.4% in FY 2025. This strong economic performance directly translates into increased demand for chemicals from crucial sectors like pharmaceuticals, agrochemicals, automotive, and construction, all of which are significant markets for Balaji Amines.

The Indian chemical industry itself is on a robust growth path, projected to reach a market size of $300 billion by 2025. This expansion will not only bolster the national GDP but also create substantial opportunities for companies like Balaji Amines to capitalize on the rising domestic and industrial consumption of chemical products.

The chemical sector, where Balaji Amines operates, faces significant headwinds from fluctuating raw material prices. These price swings directly affect profit margins, making cost management a constant challenge for manufacturers like Balaji Amines.

While recent periods have shown some price stabilization for key inputs, the inherent volatility remains a critical factor. For instance, the price of methanol, a crucial raw material for many amine derivatives, experienced notable fluctuations throughout 2023 and early 2024, impacting production costs for companies in the sector.

The chemical industry saw significant inventory destocking throughout FY2024, which naturally dampened demand. This period was a necessary adjustment for many players in the sector.

By early FY2025, inventory levels have mostly returned to normal. However, the anticipated rebound in demand, particularly within the agrochemical segment, is proving to be a slow process and is currently facing considerable pricing challenges.

Balaji Amines' financial results and operational efficiency are directly tied to these evolving demand-supply conditions. Successfully managing its recently expanded production capacities will be crucial for the company to achieve margin improvements amidst these market pressures.

Investment and Capital Expenditure

Balaji Amines is actively investing in significant capital expenditure projects to bolster its manufacturing capabilities. These initiatives include expanding capacity for existing products and commissioning new plants for specialty chemicals such as electronic-grade DMC, Dimethyl Ether, and N-Methyl Morpholine.

These strategic investments, largely financed through the company's internal accruals, underscore a strong commitment to growth and diversification. For instance, the company has allocated substantial funds towards these expansions, aiming to capture emerging market opportunities. This aligns with a wider industry trend where chemical manufacturers are channeling more resources into both production capacity enhancements and research and development activities.

- Capacity Expansion: Balaji Amines is increasing production volumes for key amines and derivatives.

- New Product Ventures: Significant capital is being deployed for new product lines like electronic-grade DMC and Dimethyl Ether.

- Funding Strategy: The company is primarily utilizing internal accruals to fund these capital expenditure programs.

- Industry Alignment: These investments mirror the broader chemical sector's focus on manufacturing upgrades and R&D.

Competitive Landscape and Pricing Pressure

The Indian chemical industry, including companies like Balaji Amines, is navigating a fiercely competitive environment. This intensity is partly driven by increased supply from China, which often translates into significant pricing pressure. For instance, in FY2024, this competitive dynamic, coupled with pockets of weak demand, directly affected the operating profits and profit margins of key players in the sector.

Maintaining a competitive edge requires more than just participating in the market; it demands strategic differentiation of products and a keen focus on pricing strategies. Companies must find ways to stand out and offer value that justifies their pricing, even amidst market saturation. This ability to adapt and innovate is crucial for sustained financial performance and market share in the evolving chemical landscape.

The pressure on pricing is a recurring theme. For example, reports from FY2024 indicated that the influx of cheaper imports in certain chemical segments put a strain on domestic manufacturers. This underscores the importance of efficient operations and a strong product pipeline for companies like Balaji Amines to absorb such pressures and continue growing.

Key considerations for navigating this competitive landscape include:

- Product Differentiation: Developing unique product offerings or specialized grades that command better pricing.

- Cost Efficiency: Streamlining manufacturing processes to reduce production costs and maintain competitive pricing.

- Market Diversification: Exploring new geographies or end-user industries to reduce reliance on segments facing intense competition.

- Supplier Relationships: Building strong relationships with raw material suppliers to secure favorable pricing and ensure consistent supply.

India's economic trajectory remains positive, with projected GDP growth of 6.4% for FY 2025, fueling demand for chemicals in key sectors like pharmaceuticals and agrochemicals. The Indian chemical industry is on track to reach $300 billion by 2025, presenting significant growth avenues for Balaji Amines.

However, the sector grapples with raw material price volatility, as seen with methanol price fluctuations in 2023-2024, impacting profit margins. While inventory destocking in FY2024 has normalized, demand recovery, particularly in agrochemicals, is slow and faces pricing challenges.

Balaji Amines is strategically expanding its capacity and venturing into new products like electronic-grade DMC, funded by internal accruals, mirroring industry trends in manufacturing upgrades and R&D. This proactive approach is crucial for navigating intense competition, partly driven by Chinese imports, which exerted pricing pressure in FY2024.

| Economic Factor | Impact on Balaji Amines | Data Point/Trend |

| GDP Growth | Increased demand for chemicals | India's real GDP growth projected at 6.4% in FY 2025 |

| Chemical Industry Growth | Market expansion opportunities | Indian chemical industry to reach $300 billion by 2025 |

| Raw Material Price Volatility | Pressure on profit margins | Methanol price fluctuations observed in 2023-2024 |

| Demand Recovery | Slower than anticipated growth in some segments | Agrochemical demand rebound is slow with pricing challenges |

Preview the Actual Deliverable

Balaji Amines PESTLE Analysis

The preview you see here is the exact Balaji Amines PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Balaji Amines. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities for the company.

Sociological factors

Balaji Amines' core business is intrinsically linked to the health and growth of its end-user industries, primarily pharmaceuticals, agrochemicals, and water treatment. These sectors are experiencing robust demand driven by fundamental societal shifts.

For instance, the global population is projected to reach nearly 8.6 billion by 2030, a significant increase from approximately 8 billion in 2023. This demographic expansion directly fuels the need for pharmaceuticals to manage health and agrochemicals to ensure food security. Furthermore, growing awareness about water quality and scarcity, particularly in developing economies, is boosting the demand for water treatment chemicals, a key market for Balaji Amines.

Consumer preferences are increasingly leaning towards eco-friendly and sustainable products, creating a significant demand for greener chemicals globally and within India. This growing awareness directly impacts chemical manufacturers like Balaji Amines, encouraging the adoption of more sustainable practices and the development of cleaner chemical alternatives. For instance, the global market for green chemicals was valued at approximately USD 220 billion in 2023 and is projected to grow substantially, indicating a strong market pull for environmentally conscious products.

The chemical industry, including companies like Balaji Amines, heavily relies on a skilled workforce. In 2024, the demand for specialized chemical engineers and technicians remains high, with reports indicating a persistent talent gap in niche areas. Initiatives focused on upskilling and reskilling are therefore paramount for ensuring operational efficiency and fostering innovation within the sector.

Balaji Amines must prioritize access to adequately trained personnel to support its manufacturing processes and drive technological advancements. As of early 2025, the company's investment in training programs directly impacts its ability to adopt new production techniques and maintain high-quality output, crucial for competitiveness in the global chemical market.

Health and Safety Awareness

Growing public and regulatory focus on health and safety in the chemical industry directly impacts companies like Balaji Amines. This heightened awareness necessitates stricter adherence to safety protocols during the manufacturing and handling of chemicals, influencing operational procedures and investment in safety infrastructure.

For instance, the Directorate General Factory Advice Service & Labour Institutes (DGFASLI) in India, which oversees industrial safety, has been actively promoting enhanced safety standards. In 2023, there was a continued emphasis on process safety management systems within chemical plants, aiming to minimize risks of accidents. This translates to increased compliance costs and the need for continuous training for employees involved in chemical operations.

The potential for chemical accidents, even with robust safety measures, can lead to significant financial and reputational damage. Therefore, companies are increasingly investing in advanced safety technologies and emergency response preparedness. Balaji Amines, like its peers, must factor these evolving health and safety expectations into its strategic planning and operational budgeting to ensure compliance and mitigate risks.

- Increased regulatory scrutiny on chemical handling and manufacturing processes drives higher operational standards.

- Investment in safety infrastructure and training becomes paramount to prevent accidents and ensure worker well-being.

- Compliance with stringent safety norms directly impacts operational costs and necessitates robust risk management strategies.

- Reputational damage and financial penalties are significant risks associated with lapses in health and safety compliance.

Urbanization and Industrialization Trends

India's ongoing urbanization and industrialization are significant drivers for the chemical sector. As more people move to cities and industries expand, the demand for chemicals used in everyday products and infrastructure development naturally rises. This creates a fertile ground for companies like Balaji Amines, whose products are integral to many of these growing sectors.

The increasing urban population fuels demand for consumer goods, many of which rely on specialty chemicals. For instance, the construction boom in urban centers requires chemicals for paints, coatings, and adhesives, while the personal care industry, also seeing robust growth, uses amines in formulations for soaps, detergents, and cosmetics. Balaji Amines' diverse product range, including methylamines, ethylamines, and derivatives, directly caters to these expanding markets.

- Urban Population Growth: India's urban population is projected to reach over 600 million by 2030, a substantial increase that will drive consumption.

- Industrial Output: The manufacturing sector, a key consumer of chemicals, has shown consistent growth, with the Index of Industrial Production (IIP) indicating positive trends in recent years, reflecting increased chemical usage.

- Specialty Chemical Demand: The Indian specialty chemicals market is expected to grow significantly, driven by end-user industries like construction, automotive, and personal care, all of which are beneficiaries of urbanization and industrialization.

Societal trends significantly influence Balaji Amines' market. The growing global population, projected to exceed 8.5 billion by 2030, directly increases demand for pharmaceuticals and agrochemicals, core sectors for the company. Furthermore, heightened environmental consciousness is driving a shift towards sustainable products, with the green chemicals market valued at over USD 220 billion in 2023, creating opportunities for eco-friendly chemical solutions.

The company's reliance on a skilled workforce is critical, with a persistent talent gap in specialized chemical engineering roles noted in 2024. Balaji Amines' investment in training and development directly impacts its ability to adopt new technologies and maintain production quality. Additionally, increasing public and regulatory focus on health and safety necessitates stricter adherence to protocols, as exemplified by DGFASLI's continued emphasis on process safety management in Indian chemical plants since 2023.

India's rapid urbanization, with its urban population expected to surpass 600 million by 2030, is a key growth driver. This trend boosts demand for chemicals used in construction, consumer goods, and personal care products, all areas where Balaji Amines' amines and derivatives find application. The expanding Indian specialty chemicals market, fueled by these urbanizing sectors, underscores the favorable market conditions.

Technological factors

The Indian chemical sector's embrace of automation and smart manufacturing is a significant technological driver. This shift aims to boost operational efficiency, refine quality assurance, and elevate workplace safety standards across the industry.

Balaji Amines is actively participating in this technological evolution by investing in new manufacturing facilities and modernizing its existing plants. These upgrades involve the integration of cutting-edge equipment and advanced technologies designed to expand and enhance its production capacities.

Balaji Amines' commitment to Research and Development (R&D) is a cornerstone of its strategy, driving the creation of novel products and enhancements to existing offerings. This focus extends to developing more environmentally friendly manufacturing processes, a key consideration in today's market.

The company is actively diversifying its product range, with significant new projects like electronic-grade Dimethyl Carbonate (DMC) for electric vehicle (EV) batteries and N-(n-butyl) Thiophosphoric triamide (NBPT) for agricultural applications. These initiatives highlight Balaji Amines' dedication to innovation and its ability to adapt to evolving market needs and technological advancements.

Digitalization and automation are transforming the chemical industry, promising fewer errors, quicker production cycles, and enhanced safety. For companies like Balaji Amines, this means leveraging advanced systems for real-time process monitoring.

Many Indian chemical manufacturers are adopting sophisticated automation to gain immediate insights into production, enabling swift identification of quality deviations and more efficient use of resources. This focus on real-time data can significantly reduce operational downtime and associated costs.

By embracing these technological advancements, Balaji Amines can expect to see improvements in overall plant efficiency and a more robust approach to quality control, directly impacting its bottom line.

Sustainable Technologies and Green Chemistry

The chemical industry is increasingly embracing green chemistry and sustainable technologies. Balaji Amines' commitment to this trend is evident in its strategic investments, such as its solar power plants. These initiatives not only aim to lower operational expenses but also significantly reduce the company's carbon footprint, aligning with global environmental mandates and growing consumer demand for eco-conscious products.

Balaji Amines has been actively investing in renewable energy sources. For instance, the company commissioned a 20 MW solar power plant in Solapur, Maharashtra, which is expected to meet a substantial portion of its energy needs. This move is projected to reduce the company's reliance on conventional grid power, leading to cost savings and a decrease in greenhouse gas emissions. By 2024-2025, such investments are crucial for maintaining competitiveness in an industry where sustainability is becoming a key differentiator.

- Green Chemistry Adoption: The chemical sector is prioritizing environmentally benign processes and materials.

- Solar Power Investment: Balaji Amines' 20 MW solar plant in Solapur demonstrates a commitment to renewable energy.

- Cost Reduction & Emission Control: These sustainable technologies are designed to lower energy costs and reduce carbon emissions.

- Market Competitiveness: Embracing sustainability enhances brand image and meets evolving stakeholder expectations.

Emergence of New Chemical Applications

The emergence of new chemical applications presents significant growth avenues for Balaji Amines. For instance, the demand for electronic-grade Dimethyl Carbonate (DMC) is surging due to its critical role in electric vehicle (EV) battery electrolytes. Balaji Amines is strategically positioning itself to capitalize on this trend.

Furthermore, Dimethyl Ether (DME) is gaining traction as a cleaner alternative to Liquefied Petroleum Gas (LPG), particularly in developing economies seeking to reduce their carbon footprint. This presents another promising market for Balaji Amines' products.

Balaji Amines' proactive engagement with these emerging applications is key to unlocking future revenue streams. The company's focus on innovation in chemical applications is expected to drive sustained growth in the coming years.

- Electronic-grade DMC demand projected to grow significantly with EV market expansion.

- DME adoption as an LPG alternative offers substantial market potential in clean energy initiatives.

- Balaji Amines' R&D efforts are geared towards capturing these high-growth application segments.

Technological advancements are reshaping the chemical industry, emphasizing automation, digitalization, and green chemistry. Balaji Amines is investing in modern manufacturing facilities and R&D to leverage these trends, focusing on efficiency, quality, and sustainability. The company's strategic diversification into high-growth areas like electronic-grade Dimethyl Carbonate for EVs and Dimethyl Ether as a cleaner fuel alternative underscores its commitment to innovation and future market demands.

Legal factors

India's upcoming Chemical (Management and Safety) Rules (CMSR), expected by 2025, will require comprehensive registration, evaluation, and potential restriction of high-risk chemicals, mirroring the EU's REACH system. This new regulatory landscape necessitates that companies like Balaji Amines meticulously assess their product portfolios and supply chains to ensure adherence. Failure to comply could lead to market access issues or penalties, impacting Balaji Amines' operational continuity and market reach within India.

Balaji Amines operates under stringent environmental protection laws, notably the Environment (Protection) Act, 1986, and associated regulations for water and air pollution control. This necessitates obtaining and maintaining consent to operate, adhering to strict emission and effluent discharge standards, and managing hazardous waste responsibly. For instance, in fiscal year 2023, the company reported significant investments in environmental compliance and waste management systems.

The Bureau of Indian Standards (BIS) is increasingly mandating quality certifications for chemicals and petrochemicals in India. This affects both local production and imports, pushing companies to meet stringent national standards. Balaji Amines has proactively secured BIS certification for key products such as Morpholine, showcasing its commitment to quality and regulatory compliance.

Workplace Safety and Hazardous Chemical Rules

Balaji Amines operates under stringent legal frameworks governing workplace safety and hazardous chemical management. The Factories Act, 1948, and the Manufacture, Storage and Import of Hazardous Chemical Rules, 1989, are critical in ensuring compliance. These regulations mandate specific safety protocols, proper handling and storage of hazardous substances, and employee welfare initiatives to mitigate risks and prevent accidents in their manufacturing facilities.

Adherence to these rules is paramount for Balaji Amines to maintain operational integrity and employee well-being. The company must implement robust safety management systems, including regular training, emergency preparedness plans, and the use of appropriate personal protective equipment. For instance, in 2023, the chemical industry in India saw a notable focus on improving safety standards, with increased inspections and a push for better compliance with existing regulations.

- Compliance with The Factories Act, 1948: Ensures safe working conditions and machinery guarding.

- Adherence to MSIHC Rules, 1989: Governs the safe handling, storage, and import of hazardous chemicals.

- Employee Welfare Measures: Mandates provisions for health, sanitation, and accident prevention.

- Risk Mitigation: Focuses on preventing chemical spills, fires, and occupational health hazards.

Product-Specific Regulations and Quality Control Orders (QCOs)

Balaji Amines' operations are significantly influenced by product-specific regulations, particularly Quality Control Orders (QCOs) that govern various chemicals. These mandates dictate stringent manufacturing processes, precise packaging standards, and accurate labeling, all aimed at ensuring product safety and quality. For instance, the Bureau of Indian Standards (BIS) has been increasingly implementing QCOs across a range of chemical products, requiring manufacturers to adhere to specific Indian Standards for their goods to be sold in the domestic market.

These regulations directly impact Balaji Amines by necessitating compliance with evolving quality benchmarks. Failure to meet these prescribed standards can lead to production halts, product recalls, or penalties, affecting market access and profitability. The company must continually invest in process improvements and quality assurance to align with these legal requirements.

- Chemical Sector QCOs: The Indian government has been actively expanding the scope of QCOs to cover a wider array of chemical products, impacting sectors like specialty chemicals and pharmaceuticals where Balaji Amines operates.

- Manufacturing & Packaging Standards: Adherence to specific BIS standards for manufacturing and packaging is crucial, ensuring products are safe for handling, transport, and end-use.

- Labeling Requirements: Precise labeling, including hazard warnings and composition details, is mandated to inform consumers and downstream users, a key compliance area for chemical manufacturers.

- Market Access: Compliance with QCOs is often a prerequisite for market entry and continued sales within India, making it a critical legal factor for Balaji Amines.

India's evolving chemical regulatory landscape, including the anticipated Chemical (Management and Safety) Rules (CMSR) by 2025, presents a significant legal consideration for Balaji Amines. This framework, akin to the EU's REACH, will demand rigorous product assessment and supply chain scrutiny. Furthermore, the Bureau of Indian Standards (BIS) is increasingly mandating quality certifications for chemicals, impacting manufacturing and import processes. Balaji Amines' proactive BIS certification for products like Morpholine underscores its commitment to navigating these evolving legal requirements.

| Regulatory Area | Key Legislation/Rule | Impact on Balaji Amines | Compliance Status/Example |

|---|---|---|---|

| Chemical Management | Chemical (Management and Safety) Rules (CMSR) (Expected 2025) | Requires registration, evaluation, and potential restriction of chemicals. | Proactive assessment of product portfolio and supply chains is necessary. |

| Environmental Protection | Environment (Protection) Act, 1986 | Adherence to emission and effluent standards, hazardous waste management. | Significant investments in environmental compliance reported in FY23. |

| Product Quality | Bureau of Indian Standards (BIS) Certifications | Mandatory for certain chemicals, impacting manufacturing and sales. | BIS certification secured for Morpholine. |

| Workplace Safety | Factories Act, 1948; MSIHC Rules, 1989 | Ensures safe handling of hazardous chemicals and worker welfare. | Focus on robust safety management systems and training. |

Environmental factors

The chemical sector, including companies like Balaji Amines, is under growing pressure to adhere to stricter environmental rules concerning waste management and hazardous emissions. This means significant investment in state-of-the-art pollution control technology and responsible effluent disposal is crucial for compliance and minimizing environmental impact.

For instance, in fiscal year 2023, Balaji Amines reported capital expenditures of ₹206.65 crore, a portion of which is allocated to enhancing environmental infrastructure and compliance measures to meet evolving regulatory demands.

Increasingly stringent government regulations and growing customer demand are compelling chemical manufacturers like Balaji Amines to prioritize water and energy conservation. This trend is evident across the industry as companies face pressure to demonstrate environmental responsibility.

Balaji Amines has proactively addressed these environmental factors by investing significantly in solar power plants, aiming to reduce reliance on conventional energy sources. Their ongoing efforts to optimize manufacturing processes further underscore a commitment to resource efficiency and sustainability, aligning with broader industry goals for reduced environmental impact.

India's ambitious goal of achieving net-zero emissions by 2070 significantly impacts the chemical sector, pushing for substantial carbon emission reductions. This national commitment translates into increased regulatory scrutiny and a growing demand for sustainable practices within companies like Balaji Amines.

Balaji Amines' strategic investment in solar power plants, with a capacity of 32 MW commissioned in FY24, directly addresses this environmental imperative. This move not only reduces the company's reliance on fossil fuels but also demonstrably lowers its carbon footprint, aligning with crucial Environmental, Social, and Governance (ESG) principles and enhancing its appeal to environmentally conscious investors.

Sustainable Sourcing and Raw Material Impact

Balaji Amines, like many chemical manufacturers, faces increasing scrutiny over the environmental impact of its raw material sourcing. The global push for sustainability is driving a demand for ethically and environmentally sound practices throughout the supply chain. This means looking beyond traditional petrochemical feedstocks.

The company is likely exploring cleaner production methods and the potential adoption of bio-based materials. This shift is not just about meeting regulatory expectations, which are becoming more stringent worldwide, but also about responding to growing consumer and business-to-business demand for greener products. For instance, the global bioplastics market, a potential area for bio-based raw materials, was valued at approximately USD 59.4 billion in 2023 and is projected to grow significantly in the coming years.

Key considerations for Balaji Amines include:

- Supply Chain Transparency: Ensuring raw materials are sourced from suppliers with strong environmental credentials.

- Resource Efficiency: Optimizing the use of raw materials to minimize waste and energy consumption during production.

- Alternative Feedstocks: Investigating and potentially integrating bio-based or recycled materials into their manufacturing processes.

- Regulatory Compliance: Staying ahead of evolving environmental regulations related to sourcing and production, such as those concerning carbon emissions and waste management.

Environmental Clearances for Projects

Industrial ventures, particularly those in the chemical industry like Balaji Amines, necessitate rigorous environmental clearances from both central and state regulatory bodies. This process often involves comprehensive Environmental Impact Assessments (EIAs) to gauge and mitigate potential ecological effects. For instance, Balaji Amines' planned greenfield solar power plant and its subsidiary's significant mega project are contingent on securing these crucial environmental approvals, underscoring a commitment to sustainable practices and adherence to regulatory frameworks.

The timeline for obtaining such clearances can vary, but in 2024, projects requiring extensive EIAs might see approval processes extending for several months, impacting project launch schedules. For example, a typical EIA report submission and review cycle can take anywhere from 6 to 18 months, depending on the project's scale and complexity. Balaji Amines' proactive engagement in this process demonstrates foresight in navigating these regulatory hurdles.

- Regulatory Compliance: Obtaining environmental clearances is a mandatory step for all industrial projects, ensuring adherence to national and state environmental protection laws.

- Project Viability: The success and commencement of new projects, such as Balaji Amines' solar plant, are directly tied to the successful acquisition of these environmental permits.

- Sustainability Focus: The EIA process encourages companies to incorporate sustainable design and operational practices, aligning with growing global environmental consciousness.

- Risk Mitigation: Securing clearances helps mitigate environmental risks and potential liabilities, safeguarding the company's reputation and long-term operational stability.

Stricter environmental regulations are a significant factor for Balaji Amines, requiring substantial investment in pollution control and waste management to ensure compliance and minimize ecological impact. The company's capital expenditure in FY23, amounting to ₹206.65 crore, included allocations for enhancing environmental infrastructure.

Balaji Amines is actively pursuing water and energy conservation, exemplified by its investment in solar power plants. In FY24, a 32 MW solar plant was commissioned, reducing reliance on fossil fuels and lowering its carbon footprint, aligning with India's net-zero ambitions by 2070.

The company also faces scrutiny regarding raw material sourcing, with a growing demand for sustainable and ethically sourced materials. Exploring bio-based feedstocks, like those in the expanding bioplastics market (valued at approximately USD 59.4 billion in 2023), is becoming increasingly important.

Securing environmental clearances, including Environmental Impact Assessments (EIAs), is crucial for new projects. The EIA process, which can take 6 to 18 months, is vital for projects like Balaji Amines' planned solar power plant and its subsidiary's mega project, ensuring regulatory adherence and risk mitigation.

| Environmental Factor | Impact on Balaji Amines | Key Actions/Data |

|---|---|---|

| Stricter Regulations | Increased compliance costs, need for advanced pollution control | FY23 Capex: ₹206.65 crore (partly for environmental infra) |

| Climate Change & Net-Zero Goals | Pressure to reduce carbon emissions, adopt renewable energy | FY24: Commissioned 32 MW solar plant; India's 2070 net-zero target |

| Sustainable Sourcing | Demand for ethically sourced raw materials, exploration of alternatives | Global bioplastics market: ~$59.4 billion in 2023 |

| Environmental Clearances | Project timelines dependent on EIA approvals | EIA process: 6-18 months; Crucial for new projects |

PESTLE Analysis Data Sources

Our Balaji Amines PESTLE Analysis is built on a robust foundation of data from official government publications, leading financial news outlets, and reputable industry-specific reports. This ensures all insights into political, economic, social, technological, legal, and environmental factors are current and well-supported.