Balaji Amines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balaji Amines Bundle

Curious about Balaji Amines' market performance? This glimpse into their BCG Matrix highlights key product segments, offering a strategic overview of their growth potential and resource allocation.

To truly unlock actionable insights and understand which of Balaji Amines' products are poised for future success or require careful management, dive into the complete BCG Matrix. Purchase the full report for a detailed quadrant breakdown and strategic recommendations to guide your investment decisions.

Stars

Balaji Amines is a dominant player in the Indian aliphatic amines market, with methylamines and ethylamines being core products. These chemicals are crucial for the pharmaceutical and agrochemical sectors, both of which are experiencing robust growth. For instance, the Indian pharmaceutical market was valued at approximately USD 50 billion in 2023 and is expected to grow at a CAGR of over 10% through 2027, presenting a substantial opportunity for Balaji Amines.

The company's strong market share in these high-growth industries, particularly in methylamines and ethylamines which are vital intermediates, positions them as significant revenue generators. Their established presence ensures they are well-placed to capitalize on the increasing demand driven by India's expanding healthcare and agricultural needs.

Balaji Amines' derivatives for the pharma sector are a strong contender, leveraging their expertise in amines to serve a rapidly growing market. India's pharmaceutical industry is projected to reach $130 billion by 2030, creating significant demand for specialized chemical intermediates.

This segment capitalizes on the increasing global and domestic healthcare needs, particularly for generic and specialty drugs where Balaji Amines' products are crucial. The company's focus on niche derivatives positions it well within this expanding pharmaceutical landscape.

Balaji Amines' derivatives are crucial for the agrochemical sector, mirroring their strength in pharmaceuticals. This segment benefits from India's burgeoning agrochemical market, driven by increased demand for crop protection and advanced farming techniques. In 2023, the Indian agrochemical market was valued at approximately USD 4.5 billion, with projections indicating continued robust growth.

Electronic Grade Dimethyl Carbonate (DMC)

Balaji Amines' Electronic Grade Dimethyl Carbonate (DMC) product is a prime example of a Star in the BCG Matrix. As the only Indian manufacturer of this crucial component for EV batteries, the company holds a commanding position in a sector experiencing explosive growth. The plant commenced operations in May 2025, positioning Balaji Amines to capitalize immediately on this high-potential market.

The demand for Electronic Grade DMC is directly tied to the rapid expansion of the electric vehicle market. In 2024, global EV sales surpassed 13 million units, a significant increase from previous years. This trend is expected to continue, driving substantial demand for battery materials like DMC.

- Market Dominance: Balaji Amines is the sole domestic producer of Electronic Grade DMC, securing a near-monopoly in a critical niche.

- High Growth Sector: The product serves the burgeoning electric vehicle battery industry, a sector projected for substantial CAGR in the coming years.

- Recent Commissioning: The plant's operational start in May 2025 means it is poised to capture immediate market share and revenue.

- Strategic Importance: Electronic Grade DMC is a key electrolyte solvent for lithium-ion batteries, making it indispensable for the clean energy transition.

Key Speciality Chemicals

Balaji Amines' key specialty chemicals, such as morpholine, are strong contenders in the BCG matrix. Morpholine, a versatile chemical used in pharmaceuticals, agrochemicals, and rubber processing, has secured Bureau of Indian Standards (BIS) certification, a testament to its quality and adherence to industry standards. This certification likely bolsters its market position.

These established specialty chemicals and derivatives often cater to niche, high-growth application areas where Balaji Amines possesses significant technical expertise. This specialized demand, coupled with the company's deep understanding and manufacturing capabilities, allows them to maintain a dominant market share in these segments. For instance, in 2023, the Indian specialty chemicals market was valued at approximately $22 billion and is projected to grow at a CAGR of 10-12% through 2028, indicating a robust environment for these products.

- Morpholine's BIS certification highlights product quality and market acceptance.

- Specialty chemicals benefit from targeted demand and Balaji Amines' domain expertise.

- These products contribute significantly to the company's market leadership in specific high-growth sectors.

- The Indian specialty chemicals market's strong growth trajectory supports the performance of these offerings.

Balaji Amines' Electronic Grade Dimethyl Carbonate (DMC) is a quintessential Star product. As the sole Indian manufacturer of this critical component for EV batteries, the company has a commanding position in an exploding market. The plant's commissioning in May 2025 ensures immediate leverage of this high-potential opportunity.

The demand for Electronic Grade DMC is inextricably linked to the rapid expansion of the electric vehicle market. Global EV sales surpassed 13 million units in 2024, a testament to this sector's momentum. This upward trend is expected to continue, fueling significant demand for essential battery materials like DMC.

Balaji Amines' other specialty chemicals, such as morpholine, also exhibit Star-like qualities. Morpholine's BIS certification underscores its quality and market acceptance, particularly in pharmaceuticals, agrochemicals, and rubber processing. The Indian specialty chemicals market, valued at approximately $22 billion in 2023 and projected for 10-12% CAGR through 2028, provides a fertile ground for these high-value products.

These specialized offerings capitalize on niche, high-growth applications where Balaji Amines possesses strong technical expertise, allowing for market leadership.

| Product | Market Position | Growth Potential | Key Driver |

|---|---|---|---|

| Electronic Grade DMC | Sole Indian Manufacturer | Very High (EV Sector) | Global EV Sales (13M+ units in 2024) |

| Morpholine | Strong Domestic Presence | High (Pharma, Agrochem) | Specialty Chemicals Market Growth (10-12% CAGR) |

What is included in the product

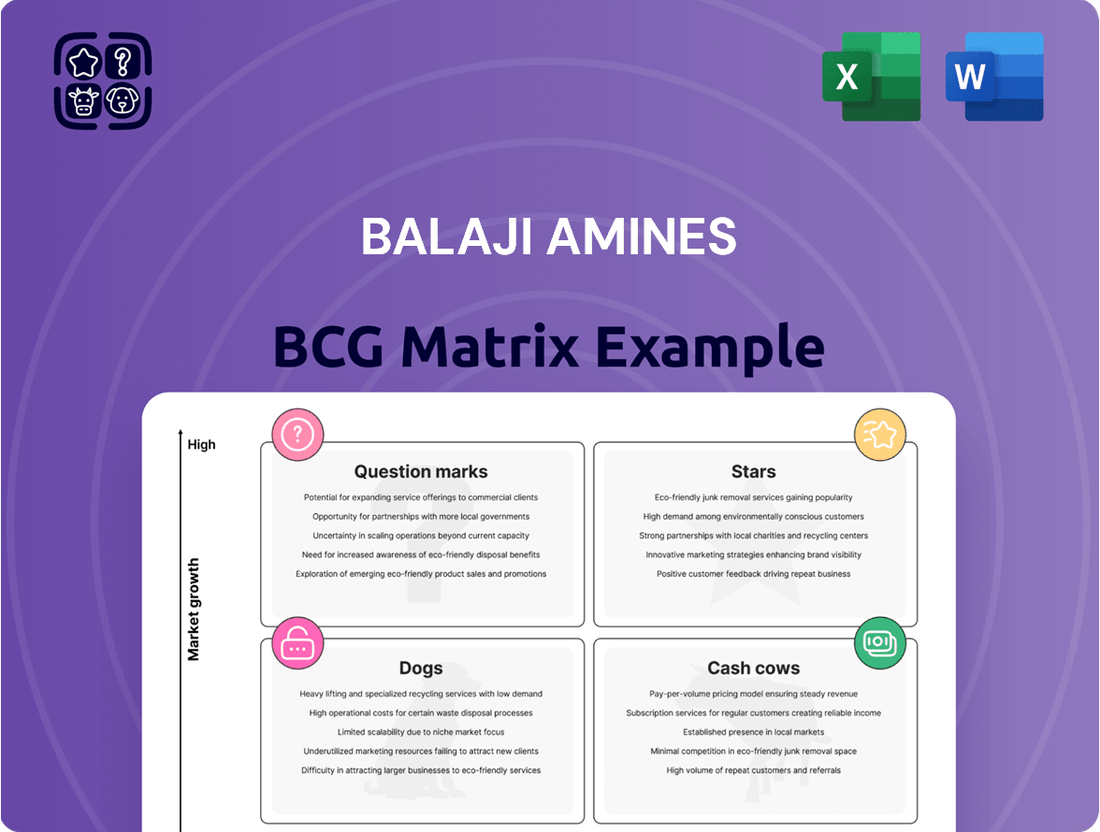

This BCG Matrix overview provides a tailored analysis of Balaji Amines' product portfolio, categorizing its business units.

It offers clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within Balaji Amines' market position.

The Balaji Amines BCG Matrix offers a clear, one-page overview, simplifying strategic decisions by categorizing business units.

This optimized layout provides a distraction-free view for C-level executives, aiding in efficient resource allocation.

Cash Cows

Certain mature amines production units within Balaji Amines, while part of a broader Star category, might represent Cash Cows. These units operate in more established markets with lower growth potential but hold a significant market share.

These operations are characterized by high operational efficiency and a loyal customer base, allowing them to generate substantial and consistent cash flow with minimal incremental investment. For instance, in the fiscal year 2024, Balaji Amines reported robust revenue growth, and a portion of this stability can be attributed to these mature, high-volume product lines.

The financial stability provided by these Cash Cow units is crucial. It allows Balaji Amines to fund investments in its high-growth Star and Question Mark segments, thereby supporting the company's overall strategic objectives and future expansion plans.

Established General Specialty Chemicals within Balaji Amines' portfolio represent mature products that have carved out a stable market niche. These are not necessarily tied to the latest high-growth trends but have demonstrated consistent demand and profitability over time.

These established chemicals have secured a strong competitive advantage, leading to healthy profit margins. Consequently, they generate substantial cash flow for the company without requiring significant ongoing investment in marketing or new product development. Balaji Amines' financial reports for 2024 indicate a steady contribution from these segments, underscoring their role as reliable cash generators.

Balaji Amines' by-products and co-products, particularly those serving mature, high-demand markets, function as cash cows. These offerings capitalize on existing manufacturing capabilities, leading to minimal additional investment for significant revenue generation. For instance, products like Di-Methyl Amine (DMA) and Tri-Methyl Amine (TMA), often generated as co-products in amine production, have established demand in sectors like pharmaceuticals and agrochemicals, contributing steadily to the company's profitability.

Infrastructure-backed Production

Balaji Amines' infrastructure-backed production, particularly its established product lines, are positioned as cash cows. Investments in supporting infrastructure, such as the solar power plant commissioned in early 2024, directly contribute to this status. This plant is expected to significantly reduce electricity costs for their manufacturing facilities, thereby lowering operational expenses for mature production units.

By decreasing the cost of production for existing, stable products, Balaji Amines enhances their ability to generate substantial cash flows. Even with modest market growth, these efficiency gains translate into higher profitability. This strategic focus on cost optimization through infrastructure development solidifies these products' role as reliable cash generators for the company.

- Infrastructure Investment: Commissioning of a solar power plant in early 2024 to reduce energy costs.

- Cost Reduction: Expected to lower operational expenses for mature production lines.

- Cash Flow Enhancement: Improved efficiency and lower costs boost cash generation from established products.

- Strategic Positioning: Reinforces the cash cow status of these production units.

Diversified Customer Base

Balaji Amines' diversified customer base is a cornerstone of its Cash Cow strategy. The company serves a wide array of industries, including pharmaceuticals, agrochemicals, and water treatment, with its established amine products. This broad reach ensures consistent demand, acting as a buffer against sector-specific downturns.

This diversification is crucial for maintaining stable revenue streams, even when certain industries experience slower growth. For instance, in 2023, Balaji Amines reported strong performance across its key product segments, underscoring the resilience provided by its varied customer portfolio. The company's ability to cater to multiple sectors means its mature products continue to generate reliable cash flow, a hallmark of a Cash Cow.

- Diverse Industry Penetration: Balaji Amines supplies essential chemicals to pharmaceuticals, agrochemicals, and water treatment sectors, among others.

- Revenue Stability: A broad customer base across these industries mitigates risks and ensures consistent demand for established products.

- Resilience in Growth Phases: Even in lower-growth phases for specific industries, the overall diversification allows for dependable cash generation.

- Mitigation of Sector-Specific Risks: Reliance on a single industry is reduced, enhancing the stability of cash flows from mature product lines.

Balaji Amines' established product lines, particularly those with significant market share in mature segments like certain specialty amines, function as its Cash Cows. These products benefit from economies of scale and established customer relationships, leading to consistent profitability with minimal need for further investment.

In fiscal year 2024, Balaji Amines saw its revenue grow, and a substantial portion of this stability stems from these mature, high-volume products. Their reliable cash generation supports the company's strategic initiatives, including expansion into newer, higher-growth areas.

The company's focus on operational efficiency, exemplified by infrastructure investments like its solar power plant commissioned in early 2024, further strengthens the Cash Cow status of these segments by reducing production costs.

This strategic approach ensures that Balaji Amines can fund its growth ambitions by leveraging the consistent cash flows generated by its well-entrenched products.

| Segment | Market Growth | Market Share | Cash Flow Generation |

|---|---|---|---|

| Specialty Amines (Mature) | Low | High | High & Stable |

| General Amines (Established) | Low to Moderate | High | High & Stable |

| Co-products (e.g., DMA, TMA) | Moderate | Significant | Consistent |

What You’re Viewing Is Included

Balaji Amines BCG Matrix

The Balaji Amines BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase, offering a comprehensive strategic overview without any watermarks or demo content. This document has been meticulously prepared to provide actionable insights into Balaji Amines' product portfolio, categorizing each business unit to guide future investment and resource allocation decisions. You can trust that the analysis presented here is the complete and final version, ready for immediate integration into your strategic planning processes. This preview serves as a testament to the quality and detail contained within the purchased report, ensuring you get precisely what you need for informed decision-making.

Dogs

Balaji Amines' older products facing significant price erosion and low market share in slow-growth segments could be categorized as Dogs in the BCG Matrix. For instance, products like Methylamines, which have seen increased competition and pricing pressure, especially from Chinese manufacturers, might fit this description if their market share and growth prospects are limited. In 2023, the specialty chemicals sector, which includes amines, experienced global growth rates of around 4-5%, but individual product lines within established companies can diverge significantly based on competitive intensity.

Balaji Amines' legacy facilities often represent older manufacturing units or product lines that struggle with efficiency and higher operational costs. These assets might be producing chemicals facing declining demand or intense price competition, making them less profitable.

These older facilities can become cash traps, demanding significant investment for maintenance or upgrades without delivering competitive returns. For instance, in 2023, the specialty chemicals sector, where Balaji Amines operates, saw varying performance, with some commoditized products facing margin pressures due to global supply chain dynamics and increased input costs.

Products categorized as Dogs in Balaji Amines' BCG Matrix would likely be specific chemical intermediates or derivatives catering to industries experiencing a significant downturn or those that have actively transitioned to alternative raw materials. For instance, if Balaji Amines holds a low market share in niche segments supplying chemicals to, say, the declining photographic film industry, these products would firmly fit the 'Dog' profile. Their growth prospects are inherently minimal, and they contribute little to the company's overall market position.

Unsuccessful Turnaround Initiatives

Balaji Amines has faced challenges with certain product lines where significant investment in revitalization efforts did not translate into improved market standing or profitability. These initiatives, aimed at turning around underperforming segments, have unfortunately not yielded the anticipated growth.

When a company invests heavily in trying to boost a struggling product or business unit, but it doesn't gain market share or become more profitable, that product essentially stays in the 'Dog' category of the BCG Matrix. These costly turnaround plans frequently fall short of their objectives.

- Unsuccessful Revitalization: Balaji Amines' attempts to revive certain low-performing product segments have not achieved the desired market share gains or profitability improvements.

- Costly Turnaround Failures: Significant capital allocated to these turnaround initiatives has not delivered the expected positive financial outcomes.

- Continued Underperformance: Products or business units that undergo these expensive, failed revitalization efforts remain classified as 'Dogs' within the BCG Matrix framework.

Non-strategic or Divested Assets

Non-strategic or divested assets within Balaji Amines' portfolio would represent business segments or product lines that no longer align with the company's core growth objectives. These are typically characterized by a low market share in industries experiencing minimal growth or stagnation.

Such assets might include older chemical formulations or smaller subsidiaries that, while perhaps profitable, do not offer significant future expansion potential. Divesting these can free up capital and management bandwidth for more promising ventures. For instance, if a particular amine derivative product line saw its market demand plateau and its growth rate fall below industry averages, it could be considered for divestment.

Balaji Amines, as of its latest financial reporting periods leading up to July 2025, would likely assess its product portfolio against strategic growth pillars. Any segment contributing minimally to overall revenue growth and requiring disproportionate resources would be a candidate for review. The company's focus remains on high-growth specialty chemicals and derivatives, meaning older or less differentiated products are prime candidates for divestment if they don't fit this strategy.

- Low Market Share: Products or units with a small percentage of their respective market.

- Stagnant Market Growth: Industries or product categories experiencing little to no expansion.

- Resource Drain: Assets that consume management time and financial investment without substantial returns.

- Strategic Misalignment: Business units that do not fit with the company's long-term vision or core competencies.

Products in the Dogs category for Balaji Amines are those with low market share in slow-growing industries, often facing intense competition and price erosion. These could be older, commoditized chemicals where the company lacks a competitive edge. For example, certain basic amines or derivatives catering to mature industries might fall into this classification if their growth prospects are minimal and market share is not dominant.

Balaji Amines' legacy product lines, particularly those manufactured in older facilities with potentially higher operational costs, are prime candidates for the Dog quadrant. These products might be struggling to compete on price or efficiency against newer, more advanced offerings or lower-cost global producers. In 2023, while the broader specialty chemicals market showed resilience, specific segments within it experienced margin pressures due to input cost volatility and oversupply from certain regions.

These 'Dog' products represent a drain on resources, consuming capital and management attention without generating substantial returns or contributing meaningfully to the company's strategic growth. Attempts to revitalize these segments have historically been costly and often unsuccessful in shifting their market position. The company's strategic focus on high-growth specialty chemicals means these underperforming assets are often candidates for divestment or careful rationalization to free up resources for more promising ventures.

| BCG Category | Balaji Amines Product Examples (Hypothetical) | Market Characteristics | Strategic Implications |

|---|---|---|---|

| Dogs | Older amine derivatives for declining industries (e.g., certain agrochemical intermediates with limited demand) | Low market share, low growth rate, high competition, price sensitivity | Potential divestment, focus on cost reduction, minimal investment |

| Dogs | Commoditized basic chemicals facing significant price pressure from imports | Low market share, stagnant or declining growth, intense price competition | Rationalize production, explore niche applications, or consider exiting |

Question Marks

Balaji Amines' Dimethyl Ether (DME) project, with a planned capacity of 100,000 tonnes per annum, positions the company to enter India's nascent DME market. This venture aims to cater to the aerosol industry and serve as a cleaner alternative to LPG, tapping into a sector projected for substantial expansion.

The project, slated for commissioning around March 2025 or in FY26, represents a strategic move into a high-growth segment. While the market potential is significant, Balaji Amines currently holds a minimal market share in DME, reflecting its early stage in this specific product category.

Balaji Amines' N-Methyl Morpholine (NMM) production, with a planned capacity of 3,000-5,000 tonnes per annum (TPA), is set to commence operations by the end of FY 2024-25 or FY26E. This new venture enters a market experiencing robust growth, positioning NMM as a potential Star in the BCG matrix.

Initially, Balaji Amines is expected to hold a modest market share in the NMM segment. Significant investment in marketing and sales efforts will be crucial to build brand recognition and secure a larger portion of the expanding demand. This strategic push is designed to propel NMM from its current low market share to a more dominant position.

Balaji Amines' N-(n-butyl) Thiophosphoric triamide (NBPT) project, with a planned production capacity of 2,500 TPA, is slated for operation by the end of FY 2024-25. This positions NBPT within a potentially high-growth market segment.

The company will likely face significant investment requirements to build market share and demonstrate the product's commercial success. This strategic move suggests Balaji Amines is targeting a segment with strong future demand, though initial market penetration will be key.

Isopropylamine (MIPA/DIPA)

Balaji Amines is strategically entering the isopropylamine (MIPA/DIPA) market by modifying an existing ethylamines plant, aiming for a capacity of 20-21 MT/day. This move positions isopropylamine as a potential 'Question Mark' in their BCG matrix, given its status as a new product line with an anticipated low initial market share in a high-growth sector. The company's focus will be on aggressive market penetration to quickly move this product towards a 'Star' position.

The chemical intermediates market, where isopropylamine operates, has demonstrated robust growth, with projections indicating continued expansion driven by demand from pharmaceuticals, agrochemicals, and specialty chemicals. For instance, the global isopropylamine market was valued at approximately USD 850 million in 2023 and is expected to grow at a CAGR of around 5.5% through 2030, according to industry reports from early 2024. This growth trajectory provides a favorable environment for Balaji Amines to capture market share.

- Strategic Diversification: Isopropylamine represents a new product category for Balaji Amines, requiring significant investment and market development.

- Market Potential: The high-growth nature of the chemical intermediates sector offers substantial opportunities for market share expansion.

- Capacity Target: The planned capacity of 20-21 MT/day signifies a serious commitment to establishing a meaningful presence.

- Growth Objective: The primary goal is to rapidly increase market share from a low starting point to achieve star status.

New Products from Balaji Speciality Chemicals Mega Project

Balaji Speciality Chemicals' mega project, a Rs. 750 crore investment, is set to introduce products like Hydrogen Cyanide and Sodium Cyanide. This ambitious expansion is slated for completion by the end of FY 2025-26.

These new offerings are critical inputs for various industries, suggesting significant market potential. However, Balaji Amines is expected to enter these markets with a nascent market share, requiring substantial capital to build a dominant position.

- Mega Project Investment: Rs. 750 crores

- Key New Products: Hydrogen Cyanide, Sodium Cyanide, EDTA

- Expected Completion: End of FY 2025-26

- Market Entry Strategy: Low initial market share, requiring investment for growth

Isopropylamine (MIPA/DIPA) represents a new product line for Balaji Amines, entering a high-growth sector with an anticipated low initial market share. The company's strategy involves aggressive market penetration to quickly elevate this product from a 'Question Mark' to a 'Star' in the BCG matrix.

The global isopropylamine market was valued at approximately USD 850 million in 2023, with projections indicating a compound annual growth rate of around 5.5% through 2030. This expansion, driven by demand in pharmaceuticals and agrochemicals, offers a favorable environment for Balaji Amines to build its market presence.

Balaji Amines' planned capacity of 20-21 MT/day for isopropylamine signifies a substantial commitment to establishing a meaningful footprint. The success of this venture hinges on effectively capturing market share from a low starting point.

The company's mega project, involving a Rs. 750 crore investment for products like Hydrogen Cyanide and Sodium Cyanide, also positions these as 'Question Marks'. These critical inputs for various industries have significant market potential but require substantial capital for market dominance, with completion expected by the end of FY 2025-26.

| Product | BCG Category | Planned Capacity | Market Entry Status | Growth Outlook |

|---|---|---|---|---|

| Isopropylamine (MIPA/DIPA) | Question Mark | 20-21 MT/day | Low initial market share | High (5.5% CAGR projected) |

| Hydrogen Cyanide | Question Mark | N/A | Nascent market share | High (critical input) |

| Sodium Cyanide | Question Mark | N/A | Nascent market share | High (critical input) |

BCG Matrix Data Sources

Our Balaji Amines BCG Matrix is constructed using comprehensive financial statements, detailed industry reports, and up-to-date market research to provide a clear strategic overview.