Bain & Company SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bain & Company Bundle

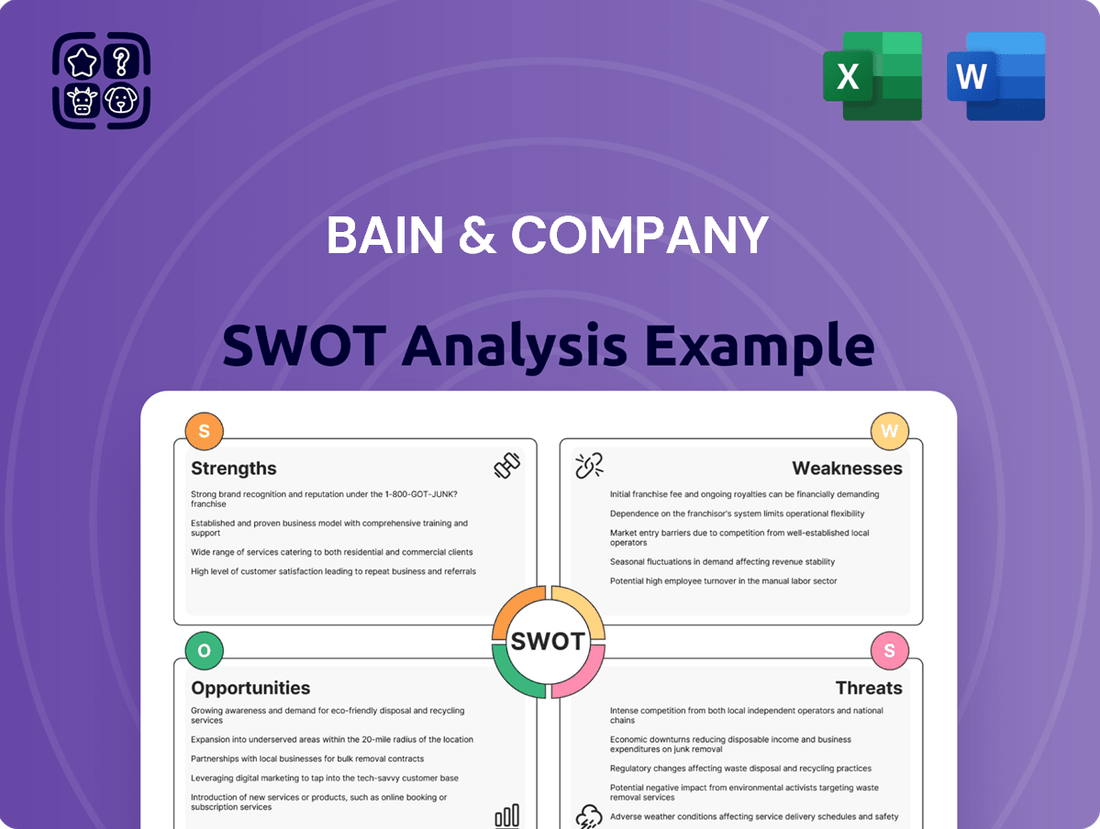

Bain & Company's SWOT analysis reveals a powerful brand and deep industry expertise as key strengths, but also highlights the intense competition and evolving consulting landscape as significant challenges. Understanding these dynamics is crucial for anyone looking to navigate the strategic consulting world.

Want the full story behind Bain's competitive edge, potential vulnerabilities, and strategic direction? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your own strategic planning and market analysis.

Strengths

Bain & Company stands as a titan in the consulting world, consistently ranked among the 'Big Three'. Their impressive reach spans 40 countries with operations in 65 cities, enabling them to tap into diverse global markets and client needs. This expansive network is a significant asset, allowing for unparalleled access to varied business landscapes and insights.

The firm's formidable brand reputation is a cornerstone of its strength, cultivated through decades of delivering impactful client solutions. This reputation is further bolstered by a deeply ingrained client-centric philosophy, which fosters enduring partnerships and a high degree of client loyalty, often leading to substantial repeat business.

Bain & Company's deep industry expertise is a significant strength, particularly in sectors like private equity, healthcare, and technology. Their market leadership in private equity consulting, a key revenue driver, allows them to offer exceptionally precise and actionable advice. This specialization translates into highly customized, data-backed solutions that effectively address intricate client needs.

Bain & Company’s strength lies in its results-oriented and data-driven approach, a hallmark that resonates deeply with its diverse client base. The firm is renowned for its rigorous analytical methods, ensuring strategies are not just theoretical but grounded in measurable outcomes. This commitment to tangible results is a key differentiator in the competitive consulting landscape.

Employing a data-driven methodology, Bain leverages sophisticated tools and industry benchmarks to craft pragmatic and effective strategies. For instance, in 2024, a significant portion of their client engagements focused on digital transformation and performance improvement, where data analytics played a pivotal role in identifying key levers for growth. This analytical rigor translates directly into client success.

The firm’s focus on tangible outcomes empowers clients to enhance performance, foster sustainable growth, and ultimately create enduring value. Bain's track record, often cited in industry reports, highlights consistent client satisfaction driven by demonstrable improvements in areas like revenue growth and cost optimization. Their success is intrinsically linked to the measurable impact they deliver.

Focus on Innovation and Digital Transformation

Bain & Company demonstrates a significant commitment to innovation and digital transformation, a key strength in the current consulting landscape. Their strategic acquisitions of digital marketing and analytics firms underscore this focus, bolstering their capabilities in data-driven client solutions. By integrating advanced technologies, including generative AI, into their service offerings and internal operations, Bain is enhancing efficiency and delivering more sophisticated insights.

This proactive embrace of emerging technologies positions Bain to effectively partner with clients navigating the complexities of digital disruption. For instance, in 2023, Bain reported a substantial increase in digital and analytics revenue, reflecting the growing demand for these specialized services. Their investment in AI capabilities aims to provide clients with predictive analytics and automated solutions, a critical advantage in today's competitive environment.

- Bain's acquisition strategy targets firms with advanced digital marketing and analytics expertise.

- Generative AI is being integrated to improve consulting delivery and internal operational efficiencies.

- This focus directly addresses the evolving needs of clients in a digitally transforming market.

- The firm's revenue growth in digital and analytics services highlights the market's positive reception.

Strong Talent and Culture

Bain & Company consistently ranks as a premier employer, drawing in and keeping top-tier professionals. This strong talent pool is crucial for their client success.

The firm actively cultivates essential skills in its consultants, including sharp problem-solving, effective communication, and robust interpersonal abilities. This focus directly translates into superior client service delivery.

- Top Employer Recognition: Bain was ranked #1 on Fortune's 2024 Best Workplaces in Consulting & Professional Services list, highlighting its ability to attract and retain elite talent.

- Skill Development Focus: The company invests heavily in training programs that enhance consultants' analytical, communication, and client-facing skills, ensuring high-quality project outcomes.

- Collaborative Culture: Bain fosters a culture that emphasizes teamwork and a shared commitment to achieving exceptional results for clients.

Bain's global presence is a significant advantage, with operations in 65 cities across 40 countries as of 2024. This extensive network allows them to leverage diverse market insights and deliver localized solutions effectively. Their strong brand reputation, built on decades of successful client engagements, fosters high client loyalty and repeat business, a testament to their client-centric approach.

The firm's deep expertise, particularly in private equity where they hold a market-leading position, enables them to provide highly specialized and actionable advice. This focus on delivering measurable results through rigorous data analysis is a key differentiator. For example, in 2024, a substantial portion of their work centered on digital transformation and performance improvement, areas where their analytical prowess is paramount.

Bain's commitment to innovation, including strategic acquisitions in digital marketing and analytics, and the integration of generative AI, positions them strongly for the future. Their 2023 revenue growth in digital and analytics services demonstrates market demand for these capabilities. This forward-thinking approach ensures they can effectively guide clients through digital disruption.

Bain's ability to attract and retain top talent is a critical strength, evidenced by their #1 ranking on Fortune's 2024 Best Workplaces in Consulting & Professional Services list. The firm invests heavily in developing consultants' analytical, communication, and interpersonal skills, fostering a collaborative culture that drives exceptional client outcomes.

What is included in the product

Analyzes Bain & Company’s competitive position through key internal and external factors, highlighting its strengths in client relationships and market reputation, while also identifying potential threats from increased competition and evolving client needs.

Offers a structured framework to identify and address critical business challenges efficiently.

Helps pinpoint weaknesses and threats, enabling proactive mitigation strategies.

Weaknesses

As a premier management consulting firm, Bain & Company's premium pricing can be a significant barrier for smaller enterprises or organizations with tighter financial constraints. This high cost of services might lead potential clients to explore more budget-friendly options, particularly when economic conditions tighten.

Bain & Company's reliance on economic stability presents a significant weakness. The demand for management consulting, especially strategic advice, often diminishes when economies falter. For instance, during periods of heightened economic uncertainty, businesses tend to cut discretionary spending, which can directly impact Bain's revenue streams and growth prospects.

Bain & Company faces fierce competition from its direct rivals within the 'Big Three' – McKinsey & Company and Boston Consulting Group – as well as from broader professional services firms like Deloitte and Accenture. This crowded market demands constant innovation and a clear value proposition to stand out.

Potential for Client Over-reliance

Bain & Company's deeply ingrained client-centric model, fostering long-term partnerships, while beneficial, carries a potential weakness: client over-reliance. This can manifest as clients becoming overly dependent on Bain's expertise, potentially slowing their own internal skill development or creating a perceived dependency that some organizations might view unfavorably.

This over-reliance could inadvertently stifle a client's ability to build robust internal capabilities, making them less agile in the long run. For instance, if Bain consistently provides end-to-end solutions, the client might not invest sufficiently in training their own staff for similar tasks.

- Client Dependency: A risk that clients may lean too heavily on Bain for ongoing strategic direction, potentially hindering their own internal strategic planning and execution capabilities.

- Reduced Internal Capacity: Over time, clients might underinvest in developing internal talent and expertise if they consistently outsource critical functions to Bain.

- Perception of Control: Some clients may perceive a high degree of reliance as a loss of internal control, impacting their autonomy and decision-making agility.

Talent Retention Challenges in a Competitive Market

Bain & Company, despite its prestigious reputation, grapples with significant talent retention challenges in the fiercely competitive consulting landscape. The industry's inherent demand for highly skilled professionals creates a persistent talent shortage, forcing firms like Bain to constantly re-evaluate their strategies for attracting and keeping top performers. This is particularly acute given the demanding nature of consulting projects, which can lead to burnout if not managed effectively.

To counter this, Bain must continue its substantial investments in employee development and competitive compensation packages. For instance, in 2023, the consulting industry saw average starting salaries for entry-level consultants rise by approximately 8-10% year-over-year, a trend Bain likely mirrored to remain competitive. Beyond financial incentives, fostering a robust company culture that prioritizes work-life balance and offers clear career progression pathways is crucial for retaining talent.

- Industry-wide attrition rates in consulting can hover between 15-25% annually, necessitating proactive retention efforts.

- Bain's investment in learning and development programs is key, with firms allocating an average of $5,000-$10,000 per employee annually for training and certifications.

- The demand for specialized skills, such as data analytics and digital transformation expertise, further intensifies the competition for talent.

Bain & Company's premium pricing strategy, while reflecting its high-value services, can limit its accessibility for smaller businesses or those operating with tighter budgets. This high cost can steer potential clients toward more economical alternatives, especially during economic downturns.

The firm's profitability is closely tied to economic stability; recessions or periods of economic uncertainty often lead to reduced client spending on strategic consulting, directly impacting Bain's revenue and growth potential.

Intense competition from other major consulting firms like McKinsey and BCG, as well as broader professional services networks, necessitates continuous innovation and a strong, differentiated value proposition to maintain market leadership.

A potential weakness lies in the risk of clients becoming overly dependent on Bain's expertise. This client-centric model, while fostering strong relationships, could inadvertently hinder a client's development of internal strategic capabilities and decision-making autonomy.

Preview Before You Purchase

Bain & Company SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This means you're getting a direct look at the professional, structured, and ready-to-use Bain & Company SWOT analysis. No surprises, just the full, in-depth report.

Opportunities

Bain & Company has a significant opportunity to deepen its reach in high-growth emerging markets and nascent industries. While its global footprint is already substantial, targeted expansion into regions like Southeast Asia or Africa, and sectors such as renewable energy or advanced AI, can unlock substantial new revenue and client opportunities.

For instance, the consulting market in emerging economies is projected to grow at a faster pace than developed ones through 2025. Bain can capitalize on this by tailoring its services to the unique needs of these markets, potentially mirroring its success in established regions but with localized strategies.

Bain & Company can significantly boost its advisory services and operational effectiveness by embracing the swift evolution of AI and automation. This technological wave offers a clear path to improving how they serve clients and streamline internal operations.

By embedding generative AI into critical areas like mergers and acquisitions (M&A) analysis, deep data interpretation, and the creation of bespoke client solutions, Bain can unlock substantial new value. This strategic integration is key to setting themselves apart in a competitive market.

For instance, in 2023, the global AI market was valued at an estimated $200 billion, with projections indicating substantial growth. Bain's ability to leverage these tools can lead to more insightful M&A due diligence, potentially reducing deal completion times by up to 30% and improving accuracy in market forecasting.

Bain anticipates a rebound in Mergers & Acquisitions (M&A) and divestiture consulting throughout 2025. This optimism stems from ongoing technological advancements, evolving profit landscapes, and businesses proactively restructuring to bolster their market positions.

This projected surge in deal-making presents a significant opportunity for Bain & Company, leveraging its established expertise in private equity and M&A advisory services. The firm is well-positioned to capitalize on this renewed market appetite for strategic transactions.

Growing Focus on Sustainability and ESG Consulting

The escalating global demand for sustainability and Environmental, Social, and Governance (ESG) integration presents a significant growth avenue for Bain & Company. Many organizations are actively seeking guidance to navigate complex sustainability targets and regulatory landscapes. Bain's established expertise in social impact and its ongoing research in sustainability position it well to capitalize on this trend by offering specialized consulting services focused on sustainable strategies and green finance.

This burgeoning market is reflected in the substantial growth of ESG investing. For instance, global ESG assets were projected to reach over $53 trillion by 2025, according to Bloomberg Intelligence estimates in 2024. This surge indicates a clear client need for expert advice.

Bain can leverage this opportunity by:

- Expanding its ESG consulting practice: Offering tailored solutions for corporate sustainability reporting, supply chain decarbonization, and circular economy models.

- Developing specialized ESG frameworks: Creating proprietary tools and methodologies to help clients measure, manage, and improve their ESG performance.

- Advising on green investments: Guiding clients on identifying and executing investments in renewable energy, sustainable infrastructure, and impact-focused ventures.

Strategic Partnerships and Acquisitions

Bain & Company can significantly enhance its service offerings by forging strategic partnerships or acquiring specialized firms. This approach allows Bain to rapidly gain expertise in rapidly expanding sectors such as digital transformation, advanced data analytics, and niche technology consulting. For instance, acquiring a firm with proven AI implementation capabilities could immediately bolster Bain's advisory services in this critical area.

This inorganic growth strategy offers a faster route to market penetration and strengthens Bain's competitive edge. By integrating new capabilities, Bain can offer more comprehensive solutions to clients facing complex challenges. Consider the potential impact of acquiring a cybersecurity firm to complement existing digital strategy practices, thereby capturing a larger share of the cybersecurity consulting market, which was projected to reach over $270 billion globally in 2024.

Key opportunities through this strategy include:

- Acquiring niche technology consultancies to expand service lines in areas like cloud migration or IoT solutions.

- Forming alliances with data analytics platforms to offer clients more integrated and powerful insights.

- Targeting firms specializing in sustainability consulting to capitalize on the growing demand for ESG advisory services, a market expected to see significant growth through 2025 and beyond.

- Integrating digital marketing agencies to provide end-to-end customer engagement strategies.

Bain can capitalize on the growing demand for sustainability and ESG integration by expanding its consulting practice and developing specialized frameworks. The firm is well-positioned to advise on green investments, a market projected to see substantial growth through 2025.

The firm can also enhance its offerings through strategic partnerships or acquisitions, particularly in areas like digital transformation and advanced data analytics. Acquiring a cybersecurity firm, for instance, could significantly bolster its competitive edge in a market valued at over $270 billion globally in 2024.

| Opportunity Area | Market Projection (2024/2025) | Bain's Potential Action |

|---|---|---|

| Emerging Markets | Consulting market growth faster than developed economies | Tailored services for Southeast Asia, Africa |

| AI and Automation | Global AI market valued at $200 billion (2023), substantial growth | Integrate generative AI into M&A, data analysis |

| M&A and Divestitures | Anticipated rebound in deal-making through 2025 | Leverage expertise in private equity and M&A advisory |

| Sustainability/ESG | ESG assets projected over $53 trillion by 2025 (Bloomberg Intelligence) | Expand ESG consulting, develop frameworks, advise on green investments |

| Strategic Partnerships/Acquisitions | Cybersecurity market over $270 billion (2024) | Acquire niche tech firms, form data analytics alliances |

Threats

Economic downturns pose a significant threat to Bain & Company. A substantial economic contraction, like the one experienced in early 2020 due to the pandemic, can directly reduce corporate spending on consulting services. For instance, many companies paused or scaled back non-essential projects, impacting demand for external expertise.

During periods of economic instability, clients often prioritize cost-cutting measures. This can lead to a reduction in discretionary spending, including consulting fees, as businesses focus on maintaining core operations and managing cash flow. This trend was evident in the cautious spending patterns observed across various industries in 2023 as inflation persisted.

The rapid evolution of artificial intelligence and automation presents a significant threat if Bain & Company doesn't proactively integrate these tools. The potential for AI to automate routine analytical tasks, which form a core part of traditional consulting, could reduce demand for certain services. For instance, McKinsey reported in 2024 that generative AI could automate up to 30% of current consulting work hours by 2030, necessitating a strategic shift in service offerings and talent development.

Bain & Company faces heightened regulatory scrutiny globally, with governments increasingly focusing on consulting firms' influence and data handling practices. This trend, evident in ongoing investigations and proposed legislation in major markets like the US and EU throughout 2024 and into early 2025, can lead to compliance costs and operational constraints.

National industrial policies and a rise in protectionist measures, exemplified by the continued impact of US-China trade tensions and the EU's strategic autonomy initiatives, create a complex operating environment. These geopolitical shifts directly influence client strategies, particularly concerning supply chain resilience and market access, thereby affecting demand for Bain's advisory services in international M&A and global market entry.

Talent War and Brain Drain

The consulting sector is locked in a perpetual struggle for top-tier talent. For Bain & Company, a misstep in attracting, nurturing, and keeping its high-achievers could directly undermine its service excellence and operational bandwidth.

The intense demands of consulting work, coupled with fierce competition from other sectors and the allure of entrepreneurial paths, create a significant risk of brain drain, where valuable expertise departs the firm.

- Talent Acquisition Challenges: In 2023, the global consulting market continued to see high demand for experienced professionals, with firms like McKinsey, BCG, and Bain actively recruiting from a limited pool of top university graduates and experienced hires.

- Retention Rates: Industry-wide, retention can be a challenge, with some reports indicating that junior consultant turnover can range from 15-25% annually, particularly in high-pressure environments.

- Competitive Compensation: To combat brain drain, leading consulting firms are increasingly offering competitive compensation packages, including substantial bonuses and equity options, to retain their best talent amidst a dynamic job market.

Reputational Risks and Client Data Security

Bain & Company, like all major consulting firms, navigates substantial reputational risks tied to the sensitive client data it handles. A single data breach or a perceived ethical lapse could severely damage its hard-won trust and brand equity, impacting future business acquisition. For instance, the consulting industry as a whole has seen increased scrutiny regarding data privacy, with reports in late 2023 and early 2024 highlighting the growing sophistication of cyber threats targeting professional services firms.

Maintaining the highest standards of confidentiality and integrity is not just a best practice but a fundamental necessity for Bain. The firm's value proposition is intrinsically linked to its ability to safeguard client information and provide unbiased strategic advice. Any compromise in this area could lead to significant financial penalties, loss of client relationships, and a lasting negative impact on its market standing.

- Data Security Incidents: A breach could expose proprietary client strategies, financial data, or personnel information, leading to immediate client attrition and potential legal action.

- Ethical Lapses: Perceived conflicts of interest, insider trading allegations, or misrepresentation in client engagements can erode public and client trust, tarnishing the firm's reputation.

- Failure in Client Deliverables: If client projects do not yield the expected results due to poor advice or execution, it can lead to reputational damage and difficulty securing future engagements.

- Public Perception: Negative media coverage or public backlash related to any of the above can create a ripple effect, impacting Bain's ability to attract top talent and new clients.

The increasing adoption of AI and automation by clients presents a threat, as it could reduce the need for certain traditional consulting services. For instance, a 2024 report by Gartner predicted that AI could automate up to 25% of tasks currently performed by consultants within the next five years, potentially impacting demand for junior-level analytical work.

Intensifying global competition, particularly from specialized boutique firms and in-house consulting arms, challenges Bain's market share. The consulting market is highly fragmented, and while Bain holds a strong position, smaller, agile competitors can sometimes offer more niche or cost-effective solutions, especially in rapidly evolving sectors like digital transformation.

Economic downturns remain a persistent threat, directly impacting client spending on consulting services. As seen in 2023, persistent inflation and interest rate hikes led many corporations to scrutinize discretionary expenditures, including external advisory fees, to manage costs and preserve capital.

Geopolitical instability and rising protectionism create operational complexities and can disrupt cross-border client engagements. Shifting trade policies and nationalistic industrial strategies, such as those observed in the US and EU throughout 2024, can alter market access and M&A landscapes, impacting Bain's international project pipeline.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Context |

|---|---|---|---|

| Technological Disruption | AI/Automation adoption by clients | Reduced demand for certain consulting services | Gartner predicts AI could automate 25% of consultant tasks by 2029. |

| Competitive Landscape | Rise of boutique firms and in-house consulting | Market share erosion, pricing pressure | Increased fragmentation and specialization in the consulting market. |

| Economic Factors | Economic downturns, inflation | Reduced client spending on consulting | Persistent inflation in 2023 led to cautious corporate spending. |

| Geopolitical Factors | Protectionism, trade tensions | Disruption to cross-border projects, altered market access | Evolving national industrial policies in major economies. |

SWOT Analysis Data Sources

This analysis is built on a foundation of robust data, including Bain's own financial statements, comprehensive market research reports, and insights from industry experts and proprietary client engagements.