Bain & Company PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bain & Company Bundle

Unlock the strategic advantages Bain & Company holds by understanding the intricate web of political, economic, social, technological, legal, and environmental factors influencing its operations. Our meticulously researched PESTLE analysis provides a clear roadmap to navigating these external forces, empowering you to anticipate market shifts and capitalize on emerging opportunities. Don't just react to change; lead it. Download the full Bain & Company PESTLE analysis now and gain the foresight needed for decisive action.

Political factors

Government policy and regulation shifts significantly influence Bain & Company's operating environment. For instance, changes in corporate tax rates, as seen with potential adjustments in the US federal corporate tax rate which has remained at 21% since 2018, can affect client budgets and investment in consulting services. New regulations impacting specific industries Bain serves, such as data privacy laws like GDPR or CCPA, can create both challenges and demand for advisory services in compliance and digital transformation.

Moreover, government initiatives promoting digital transformation or sustainability can open new avenues for Bain's expertise. For example, the EU's Green Deal aims to boost sustainable investments, potentially increasing demand for consulting in environmental, social, and governance (ESG) strategies. Bain must remain agile, adapting its service offerings and strategic advice to navigate these evolving regulatory landscapes across its global operations.

Geopolitical stability is a critical factor for Bain & Company. For instance, ongoing trade tensions, such as those between the US and China, can disrupt global supply chains and investment flows, directly impacting the advice Bain provides to its clients navigating these complexities. The firm's global operations mean it must constantly assess how shifts in international alliances or regional conflicts, like the protracted war in Ukraine, affect market access and economic outlooks for its diverse client base.

Political stability in key markets directly influences Bain & Company's operations and client confidence. For instance, the ongoing political developments in Europe, a significant region for consulting, could affect investment decisions and the demand for strategic advice. Bain's ability to secure long-term engagements hinges on navigating these geopolitical landscapes effectively.

Uncertainty stemming from political shifts, such as upcoming elections in major economies like the United States in late 2024, can create policy vacuums and economic hesitations. This directly impacts clients' willingness to commit to large-scale strategic projects, potentially altering the scope and profitability of Bain's consulting work in those regions.

Bain must continuously monitor geopolitical risks, considering that a decline in political stability in a key market, like parts of Asia experiencing regional tensions, could lead to economic slowdowns. This necessitates a proactive approach to risk assessment to safeguard project viability and maintain strong client relationships amidst fluctuating global conditions.

Public Sector Spending Priorities

Government budgets and spending priorities significantly shape opportunities for management consulting firms like Bain & Company. Increased investment in areas such as digital infrastructure, sustainable energy, and healthcare modernization, for instance, directly translates into demand for strategic advisory services.

Bain & Company actively engages with public sector clients, offering expertise in strategic planning and operational efficiency. For example, in 2024, many governments are focusing on post-pandemic recovery and resilience, leading to substantial spending in public health systems and digital transformation initiatives. This presents a clear avenue for consulting firms to leverage their capabilities.

- Infrastructure Investment: Many nations are earmarking significant funds for infrastructure upgrades, with global spending projected to reach trillions by 2025, creating demand for consulting on project management and financing.

- Digital Transformation: Public sector adoption of digital technologies is accelerating, with governments investing in e-governance and cybersecurity solutions, areas where Bain has strong expertise.

- Healthcare Spending: Increased focus on public health and healthcare system reforms in 2024-2025 is driving demand for consulting on efficiency improvements and technological integration.

- Defense Budgets: Several countries are increasing defense spending, creating opportunities for consulting on strategic modernization and procurement processes.

Nationalization and Foreign Investment Policies

Nationalization trends and evolving foreign investment policies directly influence Bain & Company's advisory services for clients pursuing international growth. For instance, in 2024, several emerging markets tightened regulations on foreign ownership in sectors like telecommunications and natural resources, potentially limiting client acquisition targets or market entry strategies. Bain needs to navigate these shifting legal landscapes to guide clients effectively through cross-border transactions and market penetration.

These policy shifts can significantly alter the competitive environment for Bain's clients. Restrictions on foreign direct investment (FDI) might lead to increased domestic competition or create opportunities for local players to gain market share, impacting client valuations and strategic planning. Bain's expertise in understanding these dynamics is crucial for advising on market entry, mergers, and acquisitions in diverse global settings.

Staying abreast of these legal frameworks is paramount for Bain. For example, as of early 2025, countries like Vietnam and Indonesia continue to review and update their FDI screening mechanisms, impacting sectors from technology to manufacturing. Bain's ability to provide sound advice on international expansion and investment strategies hinges on its proactive monitoring and interpretation of these nationalization and foreign investment policies.

- Increased Scrutiny on FDI: Many nations are enhancing their review processes for foreign investments, particularly in strategic sectors.

- Sector-Specific Restrictions: Policies often target specific industries, such as technology, defense, and critical infrastructure, imposing ownership caps or outright bans.

- Impact on M&A: Nationalization risks and FDI limitations can complicate due diligence and deal structuring for cross-border mergers and acquisitions.

- Geopolitical Influence: Global geopolitical tensions are increasingly shaping national investment policies, adding another layer of complexity for international businesses.

Government policy and regulation are crucial for Bain & Company, influencing everything from client spending to the firm's own operational strategies. For instance, shifts in corporate tax rates, with the US federal rate stable at 21% since 2018, directly impact client investment capacity. Emerging data privacy laws, like GDPR and CCPA, create both compliance challenges and opportunities for consulting in digital transformation.

Geopolitical stability is a significant concern, as trade tensions and regional conflicts, such as the ongoing war in Ukraine, can disrupt global markets and client operations. Bain must navigate these complexities to advise clients effectively on international strategy and risk management.

Government spending priorities offer substantial opportunities for Bain. In 2024-2025, increased public sector investment in digital infrastructure, sustainable energy, and healthcare modernization directly fuels demand for consulting services in these growth areas.

| Government Focus Area | Projected Impact on Consulting Demand (2024-2025) | Example of Bain's Role |

|---|---|---|

| Digital Transformation (Public Sector) | High Demand | Advising on e-governance and cybersecurity upgrades. |

| Sustainable Infrastructure | Growing Demand | Consulting on project management and financing for green initiatives. |

| Healthcare System Modernization | Sustained Demand | Improving efficiency and integrating technology in public health systems. |

| Defense Modernization | Increasing Demand | Strategic planning for procurement and technological advancements. |

What is included in the product

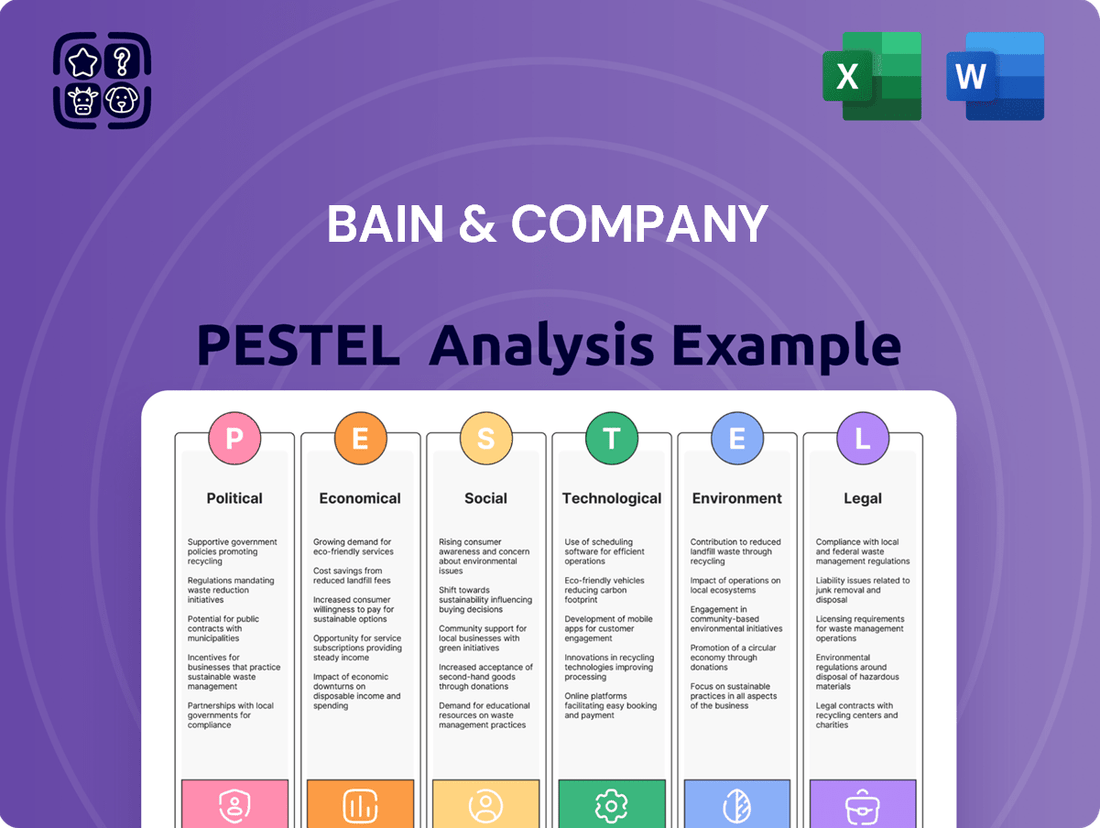

This PESTLE analysis examines the external macro-environmental forces—Political, Economic, Social, Technological, Environmental, and Legal—that impact Bain & Company's operations and strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

The global economy's trajectory significantly impacts demand for management consulting. In 2024, while growth is projected to moderate, many economies are expected to avoid outright recession, with the IMF forecasting 3.2% global growth for 2024. This environment fuels corporate investment in strategic initiatives, creating opportunities for firms like Bain & Company.

Periods of economic expansion typically see increased spending on growth strategies, digital transformation, and M&A, directly boosting demand for consulting services. For instance, the global consulting market size was valued at approximately $350 billion in 2023 and is projected to grow, reflecting this trend. Bain & Company can capitalize on this by offering services that support expansion and innovation.

Conversely, economic downturns, though potentially less severe in 2024 than initially feared, shift consulting needs towards cost optimization, restructuring, and risk management. Even in challenging times, companies require expert advice to navigate uncertainty and build resilience, maintaining a baseline demand for consulting. Bain & Company's ability to adapt its service portfolio to address these evolving priorities is crucial for sustained success.

Rising inflation, with the US experiencing a Consumer Price Index (CPI) increase of 3.4% year-over-year as of April 2024, directly impacts Bain's clients by increasing their operating costs and potentially eroding profit margins. Fluctuating interest rates, such as the Federal Reserve's target range for the federal funds rate remaining between 5.25% and 5.50% in early 2024, influence clients' cost of capital, making borrowing more expensive and thus affecting investment decisions and the feasibility of large projects.

These economic shifts significantly alter consumer spending power; for instance, persistent inflation can reduce disposable income, leading clients to adjust their strategic focus towards value offerings or cost containment. Bain & Company must analyze these dynamic economic factors to provide clients with tailored strategies that navigate increased costs and shifting consumer behavior, ensuring their advice remains relevant and impactful for profitability and growth.

Currency exchange rate volatility presents a significant challenge for global firms like Bain & Company. Fluctuations in exchange rates directly impact the reported value of international revenues and profits, as well as the cost of doing business in different countries. For instance, a stronger US dollar can make Bain's services more expensive for clients in countries with weaker currencies, potentially affecting demand.

This volatility also influences the financial health and strategic choices of Bain's multinational clients. When a client's overseas earnings translate into fewer domestic currency units due to unfavorable exchange rate movements, it can temper their appetite for international expansion or cross-border investments. This necessitates careful risk assessment and hedging strategies when advising on such ventures.

In 2024 and heading into 2025, major currency pairs like the EUR/USD and USD/JPY have experienced notable swings. For example, the Euro saw periods of weakness against the dollar in late 2023 and early 2024, impacting the profitability of European operations for globally diversified companies. Bain must integrate these currency dynamics into its valuation models and strategic recommendations for clients navigating international markets.

Industry-Specific Economic Trends

Economic trends within specific industries significantly shape Bain & Company's client base and the demand for its consulting services. For instance, the robust growth in the technology sector, with global IT spending projected to reach $5 trillion in 2024 according to Gartner, contrasts with ongoing challenges in traditional manufacturing. Bain's ability to specialize in diverse sectors, understanding their unique economic drivers like the projected 5% growth in the global retail e-commerce market for 2024, is crucial for delivering relevant and effective strategies.

Bain's deep expertise in sector-specific economic nuances allows them to offer tailored solutions. This is vital as industries experience varied economic cycles; for example, the automotive sector is navigating both supply chain recovery and the transition to electric vehicles, a complex economic landscape. By understanding these distinct realities, Bain can provide strategic advice that directly addresses the particular economic headwinds and tailwinds each industry faces, enhancing their value proposition.

- Technology Sector Growth: Global IT spending forecast to hit $5 trillion in 2024, driving demand for digital transformation consulting.

- Manufacturing Shifts: Traditional manufacturing faces economic pressures, requiring strategic adaptation and efficiency improvements.

- Consumer Goods Dynamics: The global retail e-commerce market is expected to grow by 5% in 2024, presenting opportunities and challenges.

- Automotive Industry Transition: The sector grapples with supply chain issues and the economic implications of EV adoption.

Client Budget Constraints and Spending Patterns

Client budget constraints and spending patterns are a critical factor for consulting firms like Bain & Company. The financial health of their clients directly impacts the demand for consulting services, with economic downturns often leading to tighter budgets and a focus on cost-saving initiatives. For instance, a recent survey indicated that 70% of businesses planned to scrutinize their spending more closely in 2024, potentially affecting discretionary project budgets.

These constraints can manifest in several ways. Clients might opt for shorter, more targeted engagements rather than large-scale, long-term projects. There's also an increased emphasis on demonstrating a clear and rapid return on investment (ROI) for any consulting expenditure. Bain needs to articulate the tangible value and financial benefits of its services to secure and retain business.

- Reduced Project Scope: Clients may scale back the size or duration of consulting projects due to budget limitations.

- Increased ROI Scrutiny: A greater demand for quantifiable results and a clear payback period on consulting investments.

- Shift in Priorities: Clients might reallocate funds from strategic growth projects to immediate cost-optimization or efficiency drives.

- Demand for Flexible Pricing: Potential for clients to seek more flexible fee structures or performance-based pricing models.

Global economic growth is projected to moderate in 2024, with the IMF forecasting 3.2% expansion, influencing corporate investment in strategic initiatives. Periods of economic expansion typically boost demand for consulting services, with the global consulting market valued at approximately $350 billion in 2023. Conversely, economic downturns shift consulting needs towards cost optimization and risk management, maintaining a baseline demand.

Same Document Delivered

Bain & Company PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Bain & Company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bain & Company.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic decision-making regarding Bain & Company's operations and future growth.

Sociological factors

Bain & Company's success hinges on accessing a skilled and varied talent pool. In 2024, the global consulting market is projected to reach over $300 billion, underscoring the demand for expert knowledge. A diverse workforce brings varied perspectives, crucial for tackling complex client challenges.

Demographic shifts significantly impact recruitment. For instance, the increasing proportion of Gen Z entering the workforce by 2025 brings digital fluency but may require different engagement and development approaches compared to experienced professionals. Conversely, an aging workforce in some developed economies presents opportunities for retaining valuable experience while also necessitating succession planning.

Bain's strategy must adapt to these demographic trends to attract, nurture, and keep its consultants. This includes offering flexible work arrangements and continuous learning opportunities to appeal to a broad spectrum of talent. For example, by 2025, many firms are expected to have over 25% of their workforce comprised of digital natives, requiring updated HR practices.

Employee expectations have dramatically shifted, with a strong emphasis on work-life balance and flexible work arrangements. Surveys from 2024 indicate that over 70% of professionals now prioritize flexibility when considering new job opportunities.

Furthermore, diversity, equity, and inclusion (DEI) initiatives are no longer optional; they are core expectations for a positive workplace. Companies that demonstrate a genuine commitment to DEI, as evidenced by increased representation in leadership roles, are seeing higher employee retention rates, with some reporting a 15% improvement in the past year.

The desire for purpose-driven employment is also on the rise. A significant portion of the workforce, particularly younger generations, seeks to align their work with their values, looking for organizations that contribute positively to society. This trend directly influences how Bain & Company attracts and retains top talent, as well as the advice it provides to clients on human capital strategies.

Consumer preferences are rapidly shifting, with a growing emphasis on sustainability and ethical sourcing. For instance, a 2024 Nielsen report indicated that 60% of consumers are willing to pay more for products from environmentally conscious brands. This directly influences how Bain & Company advises clients in the consumer goods sector, pushing them towards greener supply chains and transparent marketing.

Lifestyle changes, such as the increasing adoption of remote work and a focus on health and wellness, are reshaping purchasing habits. Bain's clients in retail are seeing a surge in demand for home-based goods and services, alongside a continued interest in fitness and mental well-being products. This necessitates strategic pivots in product development and distribution channels.

The digital native generation's influence on purchasing decisions is also a significant sociological factor. Younger consumers, born after 1997, prioritize online convenience, social media recommendations, and authentic brand interactions. Bain's insights into this demographic are crucial for clients aiming to capture market share through effective digital engagement strategies.

Societal Values and Corporate Social Responsibility

Societal values are increasingly shaping business operations, with a growing demand for ethical practices and sustainability. This trend directly impacts how consulting firms like Bain & Company advise clients, as companies are prioritizing strategies that align with Environmental, Social, and Governance (ESG) principles. For instance, a 2024 survey by Deloitte found that 70% of consumers consider a company's ESG performance when making purchasing decisions, highlighting the critical need for businesses to integrate these values into their core strategies.

This shift presents significant opportunities for Bain to leverage its expertise in ESG consulting, helping clients navigate complex regulatory landscapes and enhance their brand reputation. Bain's own commitment to CSR, including its "Bain Cares" initiative which focuses on pro bono work and community engagement, also strengthens its appeal to both clients and top talent. In 2023, Bain reported that over 85% of its employees felt proud to work for the firm due to its social impact efforts, demonstrating the link between societal values and organizational success.

- Growing Consumer Demand for Ethical Brands: A 2024 Nielsen report indicated that 62% of consumers are willing to pay more for sustainable products, influencing corporate strategy and consulting needs.

- Investor Focus on ESG: Global ESG assets under management are projected to reach $33.9 trillion by 2026, according to Bloomberg Intelligence, underscoring the financial imperative for companies to adopt responsible practices.

- Talent Attraction and Retention: Studies in 2024 show that a significant majority of millennials and Gen Z prioritize working for companies with strong social and environmental commitments.

- Regulatory Influence: Governments worldwide are implementing stricter regulations related to environmental impact and corporate governance, compelling businesses to seek expert guidance on compliance and strategic adaptation.

Urbanization and Population Shifts

Global urbanization continues to reshape market landscapes, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This trend directly impacts Bain & Company's clients by altering consumer bases, labor pools, and infrastructure demands. For instance, the growth of megacities presents both opportunities for service expansion and challenges in managing complex supply chains and real estate investments.

These population shifts necessitate strategic adjustments for businesses. Consider the increasing demand for housing and public services in rapidly growing urban centers, creating new markets for construction, utilities, and technology solutions. Bain must guide clients in navigating these evolving demographics to identify lucrative investment areas and optimize operational footprints.

- Urban Growth: By 2050, 68% of the global population is expected to reside in urban areas, a significant increase from 56% in 2021.

- Economic Concentration: Major urban centers often concentrate economic activity, leading to higher per capita GDP and increased consumer spending power in these regions.

- Infrastructure Demands: Rapid urbanization strains existing infrastructure, creating opportunities in areas like smart city technologies, public transportation, and sustainable development.

- Labor Mobility: Population movements towards urban hubs influence labor markets, impacting talent acquisition and wage expectations for businesses.

Societal values are increasingly shaping business operations, with a growing demand for ethical practices and sustainability. This trend directly impacts how consulting firms like Bain & Company advise clients, as companies are prioritizing strategies that align with Environmental, Social, and Governance (ESG) principles. For instance, a 2024 survey by Deloitte found that 70% of consumers consider a company's ESG performance when making purchasing decisions, highlighting the critical need for businesses to integrate these values into their core strategies.

This shift presents significant opportunities for Bain to leverage its expertise in ESG consulting, helping clients navigate complex regulatory landscapes and enhance their brand reputation. Bain's own commitment to CSR, including its "Bain Cares" initiative which focuses on pro bono work and community engagement, also strengthens its appeal to both clients and top talent. In 2023, Bain reported that over 85% of its employees felt proud to work for the firm due to its social impact efforts, demonstrating the link between societal values and organizational success.

The desire for purpose-driven employment is also on the rise, with a significant portion of the workforce, particularly younger generations, seeking to align their work with their values. This trend directly influences how Bain & Company attracts and retains top talent, as well as the advice it provides to clients on human capital strategies.

Employee expectations have dramatically shifted, with a strong emphasis on work-life balance and flexible work arrangements. Surveys from 2024 indicate that over 70% of professionals now prioritize flexibility when considering new job opportunities, impacting talent acquisition and retention strategies.

| Sociological Factor | 2024/2025 Data Point | Impact on Bain & Company |

|---|---|---|

| Consumer Demand for Ethics/Sustainability | 60-70% of consumers willing to pay more for sustainable products (Nielsen, Deloitte 2024) | Drives demand for ESG consulting and sustainable supply chain strategies. |

| Investor Focus on ESG | Global ESG AUM projected to reach $33.9T by 2026 (Bloomberg Intelligence) | Increases client need for ESG integration and reporting. |

| Talent Expectations (Flexibility, Purpose) | >70% of professionals prioritize flexibility (2024 surveys); high employee pride in firms with social impact (Bain 2023) | Requires adaptable HR policies and emphasis on CSR for talent attraction/retention. |

| Demographic Shifts (Gen Z, Aging Workforce) | Gen Z entering workforce by 2025; aging workforce in developed economies | Necessitates tailored engagement and development strategies for diverse talent pools. |

Technological factors

The pervasive digital transformation continues to reshape industries, offering Bain & Company a dual challenge and opportunity. Clients are increasingly focused on integrating cloud, AI, and automation to boost efficiency and develop innovative business models. For instance, a 2024 survey indicated that over 70% of businesses are prioritizing digital transformation initiatives, with cloud adoption being a key driver.

To maintain its advisory leadership, Bain must actively expand its expertise in digital strategy, implementation, and change management. The demand for digital transformation consulting services is projected to grow significantly, with the global market expected to reach over $2 trillion by 2025, according to recent industry reports.

The accelerating integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping how businesses operate, make decisions, and interact with customers. Bain & Company leverages these technologies internally for advanced research and analysis, while also guiding clients on AI strategy, implementation, and responsible usage.

Bain's capacity to embed AI-powered insights into its consulting frameworks and assist clients in harnessing these advancements is a critical differentiator. For instance, a 2024 report indicated that 70% of companies were exploring or actively implementing AI solutions to improve efficiency.

Cybersecurity threats are escalating, with global costs projected to reach $10.5 trillion annually by 2025, a significant jump from previous years. This evolving landscape, coupled with stricter data privacy mandates like GDPR and CCPA, presents substantial operational and reputational risks for consulting firms like Bain & Company. Protecting sensitive client information and proprietary data is paramount, necessitating continuous investment in advanced security protocols and employee training.

Bain & Company's role extends beyond internal defense; it actively guides clients through these complexities. By developing comprehensive cybersecurity strategies and ensuring adherence to evolving data privacy regulations, Bain helps its clients mitigate risks and build trust in an increasingly digital world. This advisory function is critical as businesses grapple with the financial and legal implications of data breaches and non-compliance.

Automation and Future of Work Technologies

The increasing adoption of automation, including robotics and intelligent process automation (IPA), is fundamentally reshaping how businesses operate and the very definition of jobs. This trend offers significant avenues for Bain to guide clients in streamlining operations, cutting expenses, and upskilling their employees for evolving roles. For instance, a McKinsey Global Institute report in 2023 estimated that automation could boost global productivity growth by 0.8 to 1.4 percent annually.

Internally, Bain can leverage automation to boost its own efficiency, particularly in research and data analysis. This allows consultants to dedicate more time to strategic problem-solving and client engagement, rather than getting bogged down in repetitive tasks. The World Economic Forum’s Future of Jobs Report 2023 highlighted that by 2027, 47% of businesses expect to automate tasks currently performed by humans.

- Automation Impact: Automation and IPA are transforming traditional business processes and the nature of work across industries.

- Client Opportunities: Bain can help clients optimize operations, reduce costs, and reskill their workforces in response to these technological shifts.

- Internal Efficiency: Automation enhances Bain's internal research and data processing, freeing consultants for higher-value strategic thinking.

- Job Market Evolution: By 2027, a significant portion of businesses anticipate automating tasks previously done by humans, necessitating workforce adaptation.

Emerging Technologies and Innovation Ecosystems

Bain & Company must continuously monitor and understand rapidly evolving technologies such as blockchain, quantum computing, the Internet of Things (IoT), and extended reality (XR). This vigilance is essential for anticipating future market dynamics and evolving client demands. For instance, the global AI market, a significant driver of technological change, was valued at approximately $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, highlighting the immense potential and disruption these advancements bring.

Engaging with innovation ecosystems, including a dynamic network of startups and venture capital firms, is a core strategy for Bain to remain at the cutting edge of technological progress. Venture capital investment in technology startups globally reached an estimated $300 billion in 2024, underscoring the robust activity and the flow of innovation Bain can tap into.

This proactive engagement enables Bain to effectively advise clients on harnessing disruptive technologies. By understanding these advancements, Bain helps businesses leverage them for a sustainable competitive edge and to pioneer new market opportunities. For example, companies adopting advanced analytics and AI saw an average revenue increase of 5-10% in 2024, demonstrating the tangible benefits of technological integration.

- Blockchain Adoption: Global blockchain spending is expected to exceed $13 billion in 2024, with significant growth in supply chain management and financial services.

- IoT Growth: The number of connected IoT devices is projected to surpass 29 billion by 2025, creating vast data streams and new service opportunities.

- XR Market Expansion: The XR market, encompassing virtual and augmented reality, is forecast to grow to over $300 billion by 2027, transforming industries from entertainment to training.

- AI Integration: Over 70% of companies reported using AI in at least one business function by the end of 2024, a substantial increase from previous years.

Technological advancements are rapidly reshaping business landscapes, demanding continuous adaptation from firms like Bain & Company. The pervasive digital transformation, driven by cloud computing, AI, and automation, presents both significant opportunities and challenges for advisory services.

Bain's ability to integrate cutting-edge technologies like AI and automation into its client solutions is crucial for maintaining its competitive edge. For instance, by the end of 2024, over 70% of companies were exploring or implementing AI solutions to enhance operational efficiency, a trend Bain is well-positioned to capitalize on.

The firm must also navigate escalating cybersecurity threats, with global costs projected to reach $10.5 trillion annually by 2025, while guiding clients through evolving data privacy regulations.

Emerging technologies such as blockchain, IoT, and XR are creating new market dynamics, with global blockchain spending expected to exceed $13 billion in 2024 and the number of connected IoT devices projected to surpass 29 billion by 2025.

| Technology Area | 2024/2025 Projection | Impact on Bain & Company |

|---|---|---|

| AI & Machine Learning | 70% of companies exploring/implementing AI (2024) | Enhance client advisory, internal research, and operational efficiency. |

| Cybersecurity | $10.5 trillion annual global costs (by 2025) | Mitigate risks, guide clients on data privacy and security strategies. |

| Automation & IPA | 47% of businesses expect to automate tasks (by 2027) | Streamline operations for clients, upskill workforces, improve internal research. |

| Blockchain | >$13 billion global spending (2024) | Advise clients on supply chain, financial services applications. |

| IoT | >29 billion connected devices (by 2025) | Leverage data streams for client insights and new service opportunities. |

Legal factors

Data privacy and protection regulations, like Europe's GDPR and California's CCPA, are increasingly stringent, directly affecting how Bain & Company manages client information and research. Bain must meticulously adhere to these laws for data collection, storage, and use, ensuring robust compliance. For instance, as of early 2024, fines for GDPR violations can reach up to €20 million or 4% of global annual turnover, a significant financial risk for non-compliance.

Bain actively assists its clients in navigating this intricate regulatory environment. By providing expert guidance on data privacy, the firm helps businesses avoid substantial legal penalties and preserve crucial customer trust. This advisory role is critical as data breaches and privacy missteps can lead to severe reputational damage and loss of market share.

Anti-trust and competition laws are critical for Bain & Company as they directly impact client strategies involving mergers, acquisitions, and market entry. These regulations, enforced by bodies like the US Federal Trade Commission (FTC) and the European Commission, aim to prevent monopolies and ensure fair market practices. For instance, in 2023, the FTC continued its aggressive stance on tech mergers, scrutinizing several large deals to assess their competitive impact.

Bain's advisory role necessitates a deep understanding of these varying legal frameworks across different countries to guide clients through complex approvals and compliance. Failure to adhere to these laws can result in significant fines and blocked transactions. For example, the European Union's merger control regime, which reviewed over 300 transactions in 2023, often requires detailed analysis of market share and potential consumer harm.

Bain & Company, as a global employer, must meticulously adhere to a complex web of labor and employment laws in each jurisdiction it operates within. These regulations govern everything from initial hiring and contract specifics to daily working conditions, remuneration structures, and the procedures for employee separation.

Failure to comply with these diverse legal frameworks can lead to significant repercussions, including costly legal battles, damage to the company's reputation, and disruption to its operations. For instance, in 2024, the International Labour Organization reported a global increase in labor disputes, highlighting the critical need for robust compliance strategies.

Maintaining a positive and fair work environment for its international workforce is paramount, and this is directly linked to consistent adherence to these employment standards. Ensuring equitable compensation and safe working conditions, as mandated by laws in countries like Germany or France, is not just a legal obligation but a strategic imperative for talent retention.

Intellectual Property Rights and Protection

Protecting its intellectual property, such as proprietary consulting methodologies and research, is paramount for Bain & Company's sustained competitive edge. The firm's ability to safeguard its unique frameworks and data through robust internal processes and client contracts is essential. This focus on IP protection is mirrored in Bain's advisory services, where guiding clients on patent, trademark, and copyright strategies is increasingly vital, especially in rapidly evolving, technology-centric sectors. For instance, the global IP market saw significant growth, with patent filings alone reaching over 3.4 million in 2023, highlighting the increasing value placed on innovation.

Bain & Company's engagement with intellectual property extends to advising clients on navigating complex IP landscapes. This includes:

- Developing robust IP protection strategies: Assisting businesses in securing patents, trademarks, and copyrights for their innovations and brand identities.

- Managing IP portfolios: Helping clients optimize the value and protection of their intellectual assets through strategic management.

- Addressing IP-related disputes: Providing guidance on infringement issues and litigation, particularly in technology and life sciences sectors.

- Leveraging IP for competitive advantage: Advising on how to use IP as a strategic tool for market differentiation and revenue generation.

Professional Liability and Contract Law

Bain & Company operates under stringent professional liability regulations, meaning any faulty advice or service can lead to significant legal repercussions. For instance, in 2023, the consulting industry saw continued scrutiny regarding the impact of advice on client financial performance, with several high-profile cases highlighting the importance of due diligence. This accountability underscores the need for meticulous service delivery and risk management.

Contract law forms the bedrock of Bain's client relationships, with each engagement governed by comprehensive agreements. These contracts detail project scope, expected outcomes, payment terms, and crucially, liability limitations. In 2024, the trend towards more complex, multi-year contracts with performance-based clauses is evident, requiring robust legal review to ensure clarity and enforceability.

- Professional Liability: Bain's exposure to claims for negligence or errors in its consulting advice.

- Contractual Agreements: The legal framework governing client engagements, including scope, fees, and deliverables.

- Risk Management: Proactive measures to mitigate legal risks through careful contract drafting and service execution.

- Regulatory Compliance: Adherence to evolving legal standards impacting the consulting profession.

Bain & Company must navigate a complex web of legal and regulatory requirements globally. Data privacy laws like GDPR and CCPA, with potential fines up to €20 million or 4% of global annual turnover as of early 2024, necessitate meticulous data handling. Antitrust regulations, actively enforced by bodies like the FTC and European Commission, scrutinize mergers and market practices, with the EU reviewing over 300 transactions in 2023 alone.

Labor laws across jurisdictions dictate hiring, working conditions, and separation procedures, with global labor disputes on the rise according to the ILO in 2024. Intellectual property protection is crucial, with patent filings exceeding 3.4 million globally in 2023, impacting Bain's proprietary methodologies and client advisory. Professional liability and contract law, including performance-based clauses in 2024's complex agreements, underscore the need for robust risk management and service execution.

Environmental factors

Global climate change regulations and ESG mandates are escalating, directly influencing Bain & Company's diverse client base across all industries. These evolving requirements, focusing on carbon emissions and broader sustainability, present substantial opportunities for Bain to guide clients in developing robust sustainability strategies and decarbonization plans.

For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully operational in 2026, will significantly impact trade and necessitate emissions reporting for many sectors. This regulatory shift underscores the growing demand for expert advisory services in navigating complex environmental compliance, a core area for Bain.

Bain & Company itself faces increasing scrutiny regarding its own environmental footprint, prompting greater focus on sustainable business practices and reporting within the firm. This internal alignment with external ESG expectations is crucial for maintaining credibility and leadership in the sustainability advisory space.

Growing concerns over resource scarcity, including water, critical minerals like lithium and cobalt, and energy, are significantly impacting global supply chains. Extreme weather events, exacerbated by climate change, further disrupt operations. For instance, the International Energy Agency reported in early 2024 that disruptions in key energy-producing regions due to geopolitical instability and weather events led to price volatility throughout 2023 and into 2024.

Bain & Company guides businesses to build more resilient supply chains by optimizing resource use and diversifying sourcing. This strategic shift aims to mitigate environmental risks and ensure business continuity, becoming a crucial element in long-term planning. Companies are increasingly investing in circular economy models and exploring alternative materials to reduce dependence on scarce resources.

Stakeholder pressure for corporate environmental responsibility is escalating. Investors, consumers, and employees are demanding greater transparency and action on environmental issues. For instance, a 2024 report indicated that over 70% of institutional investors consider ESG factors, including environmental performance, when making investment decisions.

Bain & Company assists clients in building strong environmental management systems and setting ambitious sustainability goals. They also help ensure accurate reporting of environmental performance, a critical component in meeting stakeholder expectations.

Bain itself is committed to reducing its environmental footprint. This commitment is driven by the company's core values and the increasing expectations from its clients for sustainable business practices.

Sustainable Business Models and Green Innovation

The global push for sustainability is fundamentally reshaping business. Companies are increasingly adopting green business models, driven by both consumer demand and regulatory pressures. This shift fosters a fertile ground for green innovation, creating new markets and competitive advantages.

Bain & Company actively partners with businesses to navigate this transition. They help clients identify and implement circular economy principles, integrate renewable energy sources, and develop eco-friendly products. For instance, in 2024, investments in renewable energy are projected to reach $2 trillion globally, highlighting the immense market potential.

- Circular Economy Initiatives: Bain advises on strategies to reduce waste and maximize resource utilization, a critical component as the global waste management market is expected to grow significantly by 2030.

- Renewable Energy Adoption: Assisting companies in transitioning to cleaner energy sources, aligning with the increasing corporate commitments to net-zero emissions.

- Eco-Friendly Product Development: Guiding the creation of sustainable products that meet evolving consumer preferences and environmental standards.

- Market Entry Strategies: Developing plans for businesses to successfully enter and compete within the rapidly expanding green market.

Natural Disasters and Extreme Weather Events

The escalating frequency and severity of natural disasters and extreme weather events present significant operational and financial risks for businesses worldwide. For instance, the World Meteorological Organization reported that weather, climate, and water-related disasters caused over $170 billion in economic losses in 2023 alone, a stark increase from previous years.

Bain & Company assists clients in evaluating their susceptibility to climate-related risks. This involves developing robust climate adaptation strategies and implementing effective business continuity plans. A key focus is advising on strategic site selection, enhancing infrastructure resilience, and exploring risk transfer mechanisms to protect vital assets and ongoing operations.

- Increased Frequency of Extreme Events: 2023 saw record-breaking heatwaves, widespread flooding, and intense storms, impacting supply chains and business continuity across multiple sectors.

- Economic Impact: Global economic losses from natural catastrophes are projected to rise, with insurance industry estimates suggesting insured losses from natural catastrophes in 2023 alone exceeded $100 billion.

- Adaptation and Resilience: Businesses are increasingly investing in climate resilience measures, with a growing market for climate risk assessment and adaptation consulting services, estimated to reach tens of billions of dollars annually by 2025.

Environmental factors are increasingly shaping business strategy, with climate change regulations and resource scarcity driving significant shifts. For example, the European Union's Carbon Border Adjustment Mechanism, fully operational in 2026, will mandate emissions reporting for many industries, impacting global trade. This trend highlights a growing demand for expert guidance in navigating complex environmental compliance and building resilient supply chains, a core offering for Bain & Company.

| Environmental Factor | Impact on Businesses | Bain & Company's Role |

|---|---|---|

| Climate Change Regulations & ESG Mandates | Increased compliance costs, opportunities for green innovation, supply chain disruption risks. | Advising on sustainability strategies, decarbonization plans, and ESG reporting. |

| Resource Scarcity (Water, Minerals, Energy) | Supply chain vulnerabilities, price volatility, need for circular economy models. | Guiding clients in optimizing resource use, diversifying sourcing, and implementing circularity. |

| Extreme Weather Events | Operational disruptions, increased insurance costs, need for business continuity planning. | Assisting in climate risk assessment, developing adaptation strategies, and enhancing infrastructure resilience. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of primary and secondary data, encompassing official government publications, reputable market research firms, and leading economic institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape.