Bain & Company Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bain & Company Bundle

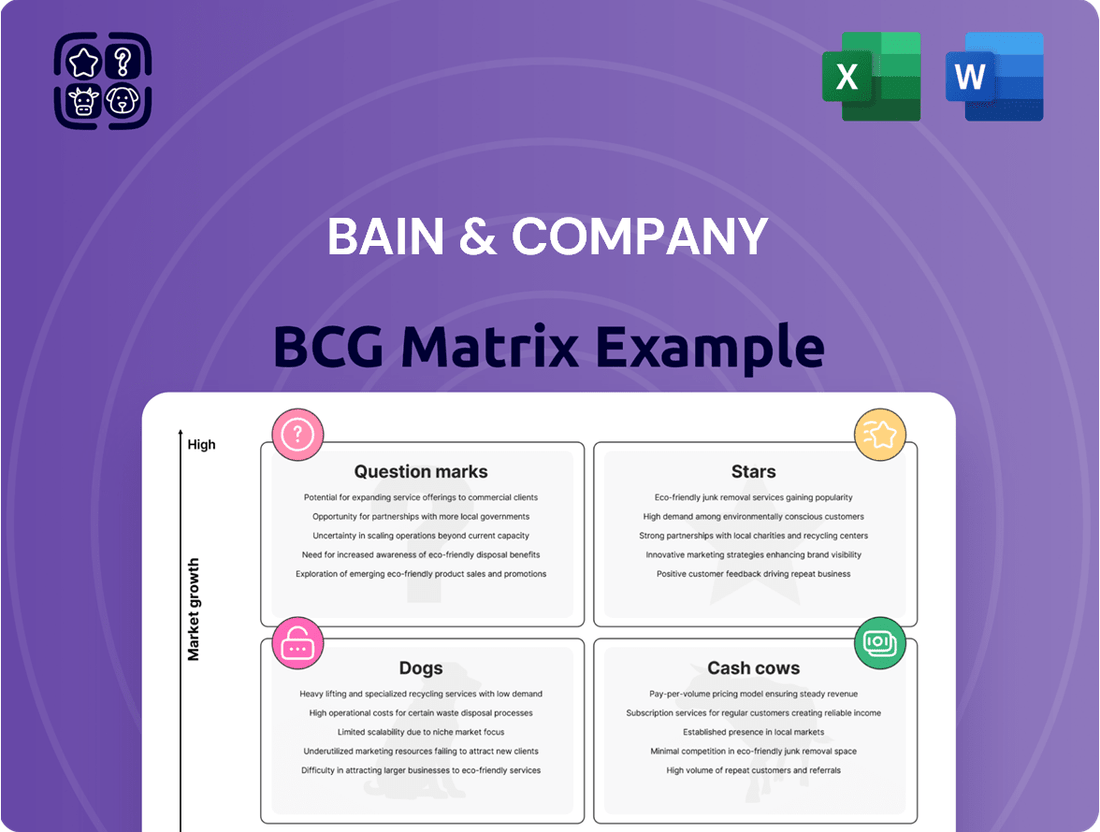

Understand the strategic positioning of a company's product portfolio with the BCG Matrix, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This preview offers a glimpse into these vital classifications, but the full report provides the actionable insights needed to make informed investment and resource allocation decisions.

Unlock the complete strategic potential of your business by purchasing the full BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, enabling you to identify opportunities for growth and divestment. Don't miss out on the detailed analysis and tailored recommendations that will drive your company forward.

Stars

AI and Generative AI Consulting is a burgeoning "Star" for Bain & Company, reflecting substantial client demand and significant firm investment. Bain's strategic partnerships with industry pioneers like OpenAI and Microsoft underscore their commitment to delivering cutting-edge AI solutions.

These collaborations allow Bain to guide clients in leveraging AI for enhanced operational efficiency, improved customer loyalty, and accelerated product launches. By equipping its consultants with generative AI tools, Bain aims to streamline research and foster innovation, solidifying its leadership in this rapidly advancing field.

Bain & Company's digital transformation services are a clear standout, earning them a 'Leader' position in the Forrester Wave™: Digital Transformation Services report for Q4 2023. This recognition highlights their significant impact and expertise in a rapidly evolving market. Their global reach is amplified by their proprietary digital delivery platform, Vector, which underpins thousands of digital projects worldwide, demonstrating a robust operational capacity.

The core of Bain's offering in this space involves developing and implementing advanced technology solutions, alongside modernizing existing IT systems. This strategic focus aligns perfectly with the current market demand for digital innovation and efficiency. The digital transformation market itself is experiencing robust growth, fueled by businesses seeking to enhance customer experiences, streamline operations, and gain a competitive edge through technology adoption.

Bain & Company shines brightly in private equity consulting, a sector representing about a quarter of its overall business. This area has experienced impressive expansion, with Bain advising on over half of all global buyout deals exceeding $500 million since the year 2000.

With the private equity market anticipated to rebound strongly in 2025, Bain's commanding presence in this dynamic and growing field is a key strength. This strategic advantage positions them well to capitalize on future market opportunities.

M&A Advisory with AI Integration

Bain & Company's M&A advisory is poised for significant growth as the M&A market anticipates a rebound in 2025. Their integration of generative AI is a key differentiator, promising to streamline critical deal-making processes.

Generative AI is expected to revolutionize M&A by accelerating tasks such as drafting integration plans and evaluating synergy opportunities. This technological advancement allows Bain to offer enhanced diligence and drive stronger portfolio outcomes for clients in a strengthening market.

- AI-Accelerated Deal Process: Bain leverages generative AI to speed up key M&A activities, including integration planning and synergy assessment.

- Market Rebound Anticipation: With the M&A market projected to recover in 2025, Bain's AI-enhanced advisory services are strategically positioned for increased demand.

- Sharper Diligence and Performance: The application of AI enables more thorough due diligence and aims to improve post-merger portfolio performance for clients.

Sustainability and ESG Consulting

Sustainability and ESG consulting is a rapidly growing area, with companies worldwide prioritizing environmental, social, and governance factors. This trend is driving significant investment in ESG initiatives, creating a robust market for specialized consulting services.

Bain & Company has strategically positioned itself within this expanding sector. The firm has invested heavily in upskilling its entire consultant base in ESG competencies. This commitment is underscored by their impressive portfolio of over 2,100 sustainability projects completed between 2022 and 2023.

Bain's focus areas, including climate change, decarbonization, the circular economy, and sustainable finance, align directly with the critical needs of businesses navigating the evolving landscape of sustainability. This strategic emphasis allows Bain to capture significant market share in a sector that is both expanding rapidly and holds immense importance for the future of global business.

- Market Growth: The global sustainability consulting market is experiencing robust expansion as companies integrate ESG principles.

- Bain's Investment: Bain & Company has upskilled all its consultants in ESG and completed over 2,100 sustainability projects from 2022-2023.

- Key Focus Areas: Bain concentrates on climate change, decarbonization, circular economy, and sustainable finance.

- Strategic Positioning: This focus enables Bain to capitalize on a critical and fast-growing sector.

Bain & Company's expertise in AI and Generative AI consulting is a prime example of a "Star" in their BCG matrix. Client demand for these advanced solutions is exceptionally high, driving significant firm investment and strategic partnerships with leaders like OpenAI. This focus allows Bain to guide businesses in leveraging AI for tangible improvements in efficiency and customer engagement.

Digital transformation services represent another "Star" for Bain, evidenced by their "Leader" status in Forrester's Q4 2023 Digital Transformation Services report. Their proprietary platform, Vector, supports thousands of global digital projects, showcasing their robust capabilities in modernizing IT and implementing advanced technology solutions.

Private equity consulting is a significant "Star" for Bain, accounting for roughly 25% of their business and showing impressive growth. They have advised on over half of all global buyout deals exceeding $500 million since 2000, positioning them strongly for the anticipated private equity market rebound in 2025.

M&A advisory is also a "Star" for Bain, especially with the projected market recovery in 2025. Their integration of generative AI is a key differentiator, accelerating crucial deal-making processes like integration planning and synergy evaluation, leading to sharper diligence and better client outcomes.

Sustainability and ESG consulting is a rapidly growing "Star" for Bain. The firm has invested in upskilling its consultants and completed over 2,100 sustainability projects between 2022 and 2023, focusing on critical areas like climate change and decarbonization.

| Bain & Company's "Stars" | Key Differentiator | Market Context | Bain's Investment/Activity |

| AI & Generative AI Consulting | Strategic partnerships (OpenAI, Microsoft) | High client demand, rapid advancement | Firm investment, consultant upskilling |

| Digital Transformation Services | Proprietary platform (Vector) | Market growth, need for efficiency | Forrester Leader, thousands of projects |

| Private Equity Consulting | Dominant market share in large deals | Anticipated market rebound in 2025 | Advises on >50% of global buyouts >$500M (since 2000) |

| M&A Advisory | AI-accelerated deal processes | Projected M&A market recovery in 2025 | Generative AI integration for diligence |

| Sustainability & ESG Consulting | Focus on critical ESG areas | Rapidly expanding market, corporate prioritization | 2,100+ sustainability projects (2022-2023) |

What is included in the product

The BCG Matrix categorizes business units by market growth and share, guiding strategic decisions.

The Bain & Company BCG Matrix offers a clear, visual snapshot of your portfolio, instantly relieving the pain of complex strategic analysis.

Cash Cows

Bain & Company's core corporate strategy consulting is a significant cash cow, representing the firm's foundational expertise. This traditional service focuses on guiding Fortune 500 CEOs through critical decisions concerning overall business direction, growth, and market positioning.

These established client relationships, built on a reputation for delivering impactful strategic advice, generate a consistent and high-margin revenue stream for Bain. In 2024, the global management consulting market, where corporate strategy plays a pivotal role, was projected to reach over $300 billion, with strategy consulting being a substantial component.

Bain & Company's operations and performance improvement services are a bedrock of their business, acting as reliable cash cows. These offerings are designed to help clients run their operations more smoothly and efficiently, a need that never really goes away for businesses. Think of it as fine-tuning a well-oiled machine to squeeze out every last drop of performance.

The demand for these services remains consistent because companies are always looking for ways to cut costs and boost productivity. For instance, in 2024, many businesses focused on supply chain resilience and digital transformation to enhance operational efficiency, directly leveraging Bain's expertise in these areas. This continuous need translates into a steady stream of revenue, even if the growth rates aren't as explosive as in other consulting areas.

Bain & Company's established financial services consulting arm is a prime example of a Cash Cow within the BCG matrix. This segment consistently delivers robust revenue streams by advising major players in banking, insurance, and asset management on critical areas like strategic planning, risk mitigation, and in-depth market intelligence.

The mature landscape of financial institutions often leads to engagements focused on optimizing established operations, ensuring predictable and stable profitability. For instance, in 2024, the global financial services consulting market was valued at over $100 billion, with firms like Bain capturing a significant share through these high-margin advisory services.

Customer Experience and Loyalty Programs

Bain & Company's deep expertise in customer experience and loyalty programs solidifies its position as a cash cow within its service offerings. This area has been a cornerstone of their advisory work for years, reflecting a consistent demand from clients across diverse sectors seeking to cultivate stronger customer relationships.

Bain's ability to demonstrably improve customer satisfaction and foster enduring loyalty translates into highly valued services. These engagements frequently result in repeat business and predictable revenue streams, underscoring the enduring significance of customer retention strategies in today's competitive landscape.

For instance, a 2024 report indicated that companies with robust loyalty programs saw an average increase of 10% in customer lifetime value compared to those without. Bain's strategic guidance in this domain directly contributes to such tangible financial benefits for their clients.

- Bain's long-standing focus on customer experience and loyalty.

- Services consistently valued across industries for enhancing customer satisfaction.

- Contribution to stable, recurring revenue streams through strong client relationships.

- Impact on client profitability, with loyalty programs boosting customer lifetime value by up to 10% in 2024.

Post-Merger Integration and Value Creation

Post-merger integration (PMI) is where M&A advisory truly becomes a cash cow for firms like Bain & Company. While the initial deal-making is crucial, the real value creation, and thus consistent revenue, comes from ensuring the merged entity performs optimally.

Bain's extensive track record in PMI, focusing on identifying and capturing synergies, streamlining operations, and driving cultural alignment, translates into high-value, recurring engagements. This is essential for clients who have invested heavily in acquisitions and need to see tangible returns.

For instance, in 2024, the global M&A market saw significant activity, with deal values reaching substantial figures. Successful integration is paramount to realizing the projected benefits of these transactions. Bain's expertise in this area ensures clients don't just close a deal, but unlock its full potential, leading to sustained client relationships and revenue streams.

- Post-merger integration is a critical cash cow for M&A advisory services.

- Bain's expertise in synergy identification and performance improvement drives consistent, high-value engagements.

- Successful integration is vital for clients to realize acquisition benefits and maximize returns.

- The 2024 M&A landscape underscores the importance of robust PMI strategies for value creation.

Bain & Company's expertise in digital transformation advisory acts as a significant cash cow, addressing the ongoing need for businesses to modernize and adapt. This service helps clients navigate complex technological shifts, optimize digital operations, and leverage new platforms for growth.

The consistent demand for digital upskilling and efficiency gains ensures a steady revenue stream. In 2024, the global digital transformation market was estimated to be worth over $2 trillion, with consulting services forming a substantial portion of this value, highlighting the enduring relevance of Bain's offerings in this space.

Bain's deep understanding of organizational design and change management also functions as a reliable cash cow. Companies frequently require assistance in restructuring their operations, adapting to new market dynamics, or implementing large-scale organizational changes to improve efficiency and effectiveness.

These services are sought after by mature organizations looking to optimize their existing structures rather than pursue rapid, high-risk growth. For instance, in 2024, many established corporations focused on agile methodologies and workforce redesign to enhance operational agility, directly benefiting from Bain's strategic guidance.

| Bain Service Area | BCG Matrix Category | 2024 Market Context | Key Value Proposition |

|---|---|---|---|

| Digital Transformation | Cash Cow | Global market > $2 trillion; high demand for modernization | Helps clients adapt, optimize, and leverage technology for sustained growth. |

| Organizational Design & Change Management | Cash Cow | Focus on operational efficiency and workforce redesign in mature organizations | Assists companies in restructuring and adapting for improved effectiveness. |

Delivered as Shown

Bain & Company BCG Matrix

The preview you are currently viewing is the exact Bain & Company BCG Matrix document you will receive upon purchase. This means no watermarks, no demo content, and no altered formatting—just the complete, professionally designed strategic tool ready for your immediate use. You can be confident that what you see is precisely what you'll download, enabling you to seamlessly integrate this powerful analysis into your business planning and decision-making processes.

Dogs

Highly Transactional, Undifferentiated Project Work represents engagements that are commoditized and lack strategic depth. These projects, often involving routine tasks, might not fully utilize Bain's core consulting strengths, potentially leading to lower profit margins.

For instance, a project focused solely on data entry or basic market research without deeper analysis would fall into this category. In 2024, consulting firms like Bain are increasingly looking to automate or outsource such low-value activities to focus on higher-impact strategic advisory.

Consulting engagements focused purely on maintaining or making minor upgrades to old IT systems, without a plan for a complete digital overhaul, often fall into the 'Dog' category. This type of work typically offers limited growth prospects and risks becoming less valuable as businesses increasingly demand cutting-edge digital solutions. For example, a significant portion of IT spending in 2024, estimated to be in the hundreds of billions globally, is still allocated to maintaining legacy systems, but the strategic imperative is shifting rapidly towards modernization.

Bain & Company, like many leading consultancies, generally steers clients towards modernizing their IT infrastructure to align with broader strategic objectives. This approach recognizes that while maintaining existing systems is necessary, it doesn't drive the competitive advantage or innovation that digital transformation promises. Companies that delay this transformation may find themselves at a disadvantage, as competitors leverage newer technologies to improve efficiency and customer experience.

Standalone cost-cutting engagements, devoid of a larger strategic vision or a clear path to sustainable value, can be categorized as a 'Dog' within a consulting firm's portfolio. While cost reduction is a common element in many projects, focusing solely on this without fostering competitive advantage or long-term client growth presents a less appealing proposition for a premier strategy consultancy.

For instance, a client seeking only to trim operational expenses by 5% without addressing underlying market shifts or innovation needs might not yield the transformative results expected from a top-tier firm. In 2024, many companies are looking beyond simple cost efficiencies, with a significant portion of C-suite executives prioritizing growth strategies and digital transformation over pure cost reduction, as indicated by various industry surveys.

Small-Scale, Non-Repeatable Operational Fixes

Projects focused on minor, isolated operational improvements, rather than systemic changes, often end up in the 'Dog' quadrant of the BCG Matrix. These are typically one-off fixes that don't offer a pathway for widespread adoption or significant organizational learning. For instance, a consultancy might spend considerable time optimizing a single department's workflow, but if that process is unique and cannot be applied elsewhere, its long-term value is limited.

These types of engagements can become resource drains, consuming billable hours without generating substantial, repeatable revenue for the consulting firm. In 2024, many firms are prioritizing projects with clear scalability and a demonstrable return on investment across multiple business units. A study by McKinsey in late 2024 indicated that clients were increasingly seeking strategic partners capable of driving transformation, not just tactical adjustments. Projects that don't align with this demand risk being categorized as 'Dogs'.

- Limited Scalability: Engagements that target unique, non-transferable problems.

- Low Strategic Impact: Fixes that don't contribute to the client's overall competitive advantage.

- Resource Inefficiency: Projects consuming time and budget without significant future revenue potential for the consultancy.

- Lack of Differentiation: Such work doesn't showcase the firm's core capabilities or strategic foresight.

Advisory for Stagnant, Non-Disruptive Industries

Consulting for industries in deep, structural decline or resistant to innovation, where strategic input has limited long-term impact, can be viewed as a less optimal fit for firms like Bain & Company. These environments don't align with their core strength of driving growth and navigating change.

For instance, in 2024, industries like traditional print media and certain segments of brick-and-mortar retail continue to face significant headwinds. Print advertising revenue in the US, for example, has been on a downward trend for years, with many publications struggling to adapt to digital alternatives.

Bain's strategic value is most pronounced when clients can leverage innovation and market shifts. In stagnant sectors, the potential for transformative growth, a key consulting objective, is inherently constrained.

- Limited Growth Potential: Industries with low or negative growth rates offer fewer opportunities for consultants to implement strategies that yield substantial, long-term client value.

- Resistance to Disruption: Sectors that actively resist digital transformation or new business models present challenges for consultants focused on innovation-led growth.

- Focus on Efficiency vs. Transformation: While consultants can advise on operational efficiencies, the core value proposition often lies in enabling significant market share gains or entirely new revenue streams, which are difficult in declining markets.

Dogs represent engagements with low market share and low growth potential, offering limited profitability and strategic value. These projects often involve commoditized services or clients in declining industries, consuming resources without driving significant future revenue or showcasing the firm's core strategic capabilities.

In 2024, consulting firms like Bain are actively seeking to minimize their exposure to such engagements, focusing instead on high-growth, high-impact strategic advisory. This shift reflects a broader industry trend towards value-added services that leverage deep expertise and drive transformative change for clients.

For instance, a consulting project focused solely on maintaining legacy IT systems without a digital transformation roadmap falls into this category. Global IT spending in 2024, while substantial, shows a clear trend towards modernization, with legacy maintenance becoming a less strategic allocation of resources.

Similarly, standalone cost-cutting initiatives, absent a broader growth or innovation strategy, are often classified as Dogs. While cost efficiency is important, the strategic imperative for clients in 2024, as highlighted by numerous C-suite surveys, is increasingly centered on growth and digital advancement.

| Engagement Type | Market Share | Market Growth | Profitability | Strategic Value |

|---|---|---|---|---|

| Legacy IT Maintenance | Low | Declining | Low | Low |

| Isolated Cost Reduction | Low | Low | Low | Low |

| Commoditized Project Work | Low | Low | Low | Low |

| Consulting in Declining Industries | Low | Negative | Low | Low |

Question Marks

Emerging hyper-niche AI applications, like highly specialized agentic AI or nascent AI-driven business models, fall into the question mark category of the BCG matrix. These areas are characterized by significant investment from firms like Bain, but their market adoption and ultimate impact remain unproven, presenting a high-risk, high-reward profile.

Expanding into challenging geographic markets, like certain regions in Sub-Saharan Africa or parts of Southeast Asia, can be considered a ‘Question Mark’ for consulting firms such as Bain & Company. These areas often present unique hurdles, including underdeveloped infrastructure, regulatory complexities, and a less established professional services ecosystem. For instance, in 2024, consulting spending in some emerging African markets was projected to grow, but the fragmented nature of the market and the need for deep local expertise meant significant upfront investment was necessary for any firm aiming for substantial penetration.

Bain's internal venture initiatives, like those emerging from its 'Founder's Studio,' represent significant strategic investments. For instance, ESG Flo, an AI-powered platform designed to streamline ESG data management, exemplifies these high-potential, yet nascent, ventures. Such projects require substantial capital for research, development, and market penetration.

These ventures are positioned as potential 'stars' within a BCG-like framework. While they currently consume resources, their aim is to capture significant market share in rapidly growing sectors, such as the burgeoning ESG technology market. The success of these initiatives hinges on their ability to scale effectively and achieve profitability in the coming years.

Highly Specialized, Unproven Sustainability Sub-Domains

Highly specialized, unproven sustainability sub-domains, like intricate carbon credit verification or nascent circular economy frameworks, can be viewed as Question Marks in a BCG matrix. These areas represent potential future growth but currently demand significant investment in research and development, with uncertain market adoption. For instance, the voluntary carbon market, while expanding, still grapples with standardization challenges, impacting the scalability of specific methodologies.

Bain & Company is actively investigating these emerging frontiers, recognizing their long-term strategic importance. However, the path to establishing these as dominant service offerings requires substantial market education and the development of proven business models. The complexity and lack of established precedents mean that these sub-domains are currently characterized by high risk and potentially high reward, awaiting further market validation and standardization.

- Emerging Markets: Areas like advanced bio-material sourcing or novel waste-to-energy technologies are in early stages, requiring extensive R&D.

- Limited Precedents: Niche circular economy models, such as those for specific industrial waste streams, lack established case studies and proven scalability.

- High Investment Needs: Developing robust methodologies for complex carbon accounting or validating new sustainable material certifications demands significant capital outlay.

- Market Uncertainty: Client adoption rates for highly specialized sustainability solutions remain uncertain, making revenue projections challenging.

Disruptive Consulting Business Models

Disruptive consulting models are shaking up the industry by moving beyond the traditional project-based fee structure. Think of subscription services offering ongoing strategic guidance or productized solutions that package expertise into repeatable offerings. These innovative approaches aim for higher scalability and recurring revenue, though they demand substantial upfront investment in development and market validation.

The potential for growth is significant, but the path to profitability isn't always straightforward. Early adopters are experimenting with these models, and data from 2024 suggests a growing interest. For instance, a significant portion of companies surveyed in late 2023 indicated a willingness to explore alternative advisory fee structures, hinting at a market ripe for disruption.

- Subscription-based advisory: Offering continuous support and access to expertise for a recurring fee, potentially lowering client costs for ongoing needs.

- Productized consulting: Developing standardized, repeatable solutions for specific business problems, allowing for faster delivery and predictable pricing.

- Outcome-based pricing: Tying consultant fees directly to measurable client results, aligning incentives and demonstrating clear value.

- Technology-enabled services: Leveraging AI and digital platforms to deliver consulting insights and solutions more efficiently and at scale.

Question Marks in the BCG matrix represent new ventures or market segments with low market share but high growth potential. These are areas where significant investment is required, but the outcome is uncertain, making them high-risk, high-reward propositions. For example, Bain & Company's exploration into highly specialized AI applications, like agentic AI, or nascent AI-driven business models, fits this category due to the substantial investment needed and the unproven market adoption.

Expanding into challenging geographic markets, such as certain regions in Sub-Saharan Africa or parts of Southeast Asia, also embodies the Question Mark characteristic for consulting firms like Bain. These markets present unique hurdles like underdeveloped infrastructure and regulatory complexities. In 2024, while consulting spending in some emerging African markets was projected to grow, the fragmented nature and need for deep local expertise meant substantial upfront investment was necessary for any firm aiming for significant penetration.

Bain's internal venture initiatives, like ESG Flo, an AI-powered platform for ESG data management, are prime examples of Question Marks. These ventures require considerable capital for R&D and market penetration, aiming to become future stars in rapidly growing sectors like ESG technology. Their success hinges on effective scaling and achieving profitability, a process that involves navigating market uncertainty and developing proven business models.

| Category | Description | Examples | Investment Need | Market Uncertainty |

|---|---|---|---|---|

| Question Mark | Low market share, high market growth potential. Requires significant investment, uncertain outcome. | Emerging hyper-niche AI applications, challenging geographic markets, internal venture initiatives, unproven sustainability sub-domains, disruptive consulting models. | High | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry analyses, and growth projections, to provide accurate strategic guidance.