Baader Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baader Bank Bundle

Navigate the complex external landscape impacting Baader Bank with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are redefining the financial sector, and how these forces specifically influence Baader Bank's strategic direction. Gain a crucial competitive advantage by leveraging these expert-level insights. Download the full version now for actionable intelligence that will empower your decision-making and sharpen your market strategy.

Political factors

Germany's commitment to regulatory stability, bolstered by its membership in the European Union, provides a predictable operating environment for Baader Bank. In 2024, Germany's financial sector continued to adhere to stringent EU directives, including those from the European Banking Authority (EBA), ensuring a consistent framework for capital adequacy and risk management.

Decisions by BaFin, Germany's financial supervisory authority, and the European Central Bank (ECB) significantly shape Baader Bank's operational landscape. For instance, the ECB's monetary policy stance throughout 2024, including interest rate adjustments, directly impacted lending volumes and investment banking activities, influencing Baader Bank's revenue streams.

Fiscal policy also plays a role, with the German government's budget decisions in 2024 affecting overall economic sentiment and the availability of capital for investment. A stable fiscal outlook generally encourages greater market participation, benefiting institutions like Baader Bank.

Geopolitical developments, including international conflicts and trade disputes, introduce considerable uncertainty into financial markets. For a financial institution like Baader Bank, which functions as a market maker, these tensions can manifest as heightened volatility and diminished trading volumes.

Such geopolitical turmoil can disrupt global supply chains, directly affecting Baader Bank's investment banking and asset management operations. BaFin, the German financial supervisory authority, identified geopolitical instability as a significant trend impacting the financial system throughout 2024, underscoring its relevance to banking operations.

Government initiatives aimed at bolstering the financial sector, such as tax incentives for investment or programs designed to spur fintech innovation, could provide a tailwind for Baader Bank. For instance, the German government's commitment to digitalizing its economy, which includes support for financial technology, presents potential avenues for growth and partnership.

Conversely, any increase in financial transaction taxes or the introduction of more stringent regulations on capital requirements or employee benefits could dampen Baader Bank's profitability and operational flexibility. For example, a hypothetical 0.1% financial transaction tax on certain securities trades could directly impact trading volumes and revenue streams for institutions like Baader Bank.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Policies

Baader Bank must navigate increasingly stringent anti-money laundering (AML) and counter-terrorist financing (CTF) policies from German and EU authorities. This necessitates robust compliance frameworks to avoid significant penalties, reputational harm, and operational limitations. For instance, BaFin's July 2024 circulars highlighted high-risk countries, underscoring the need for diligent monitoring to prevent illicit financial activities.

The intensified regulatory scrutiny means that financial institutions like Baader Bank face greater oversight. Non-compliance with AML/CTF directives can result in substantial fines, with some European countries imposing penalties that can reach millions of euros for serious breaches. Beyond financial repercussions, a failure to adhere to these regulations can severely damage a bank's standing with customers and other financial partners.

- Regulatory Landscape: German and EU AML/CTF regulations demand sophisticated compliance systems.

- Risk of Non-Compliance: Penalties can include significant fines, operational restrictions, and reputational damage.

- BaFin Guidance: The July 2024 circulars on high-risk countries emphasize proactive risk management.

- Industry Impact: Stricter enforcement across the financial sector requires continuous adaptation and investment in compliance technology.

Brexit and EU-UK Financial Relations

The ongoing divergence in regulatory frameworks between the UK and the EU post-Brexit continues to shape financial services. For Baader Bank, this means navigating a complex landscape of differing compliance requirements and market access rules, impacting its ability to seamlessly offer services across both regions.

As of early 2024, the UK's financial services sector is still adapting to its new relationship with the EU, with ongoing discussions about regulatory equivalence. This uncertainty directly affects cross-border trade and the operational costs for institutions like Baader Bank, which have significant EU-UK financial dealings.

- Regulatory Divergence: The UK's Financial Services and Markets Act 2023 grants regulators greater flexibility, potentially leading to divergence from EU standards, impacting market access for EU-based firms.

- Market Access Challenges: The loss of automatic passporting rights for UK firms into the EU, and vice versa, necessitates new agreements or adherence to national regimes, increasing complexity for Baader Bank's operations.

- Trade Data: In 2023, the EU's trade surplus in financial services with the UK narrowed, reflecting ongoing adjustments in the sector's cross-border dynamics.

Political stability within Germany and the broader EU region is paramount for Baader Bank's operational continuity. Government policies on taxation and financial regulation, as observed throughout 2024, directly influence profitability and strategic planning. For instance, the German government's continued support for digitalization in finance, including initiatives for fintech integration, presents opportunities for Baader Bank to innovate and expand its service offerings.

What is included in the product

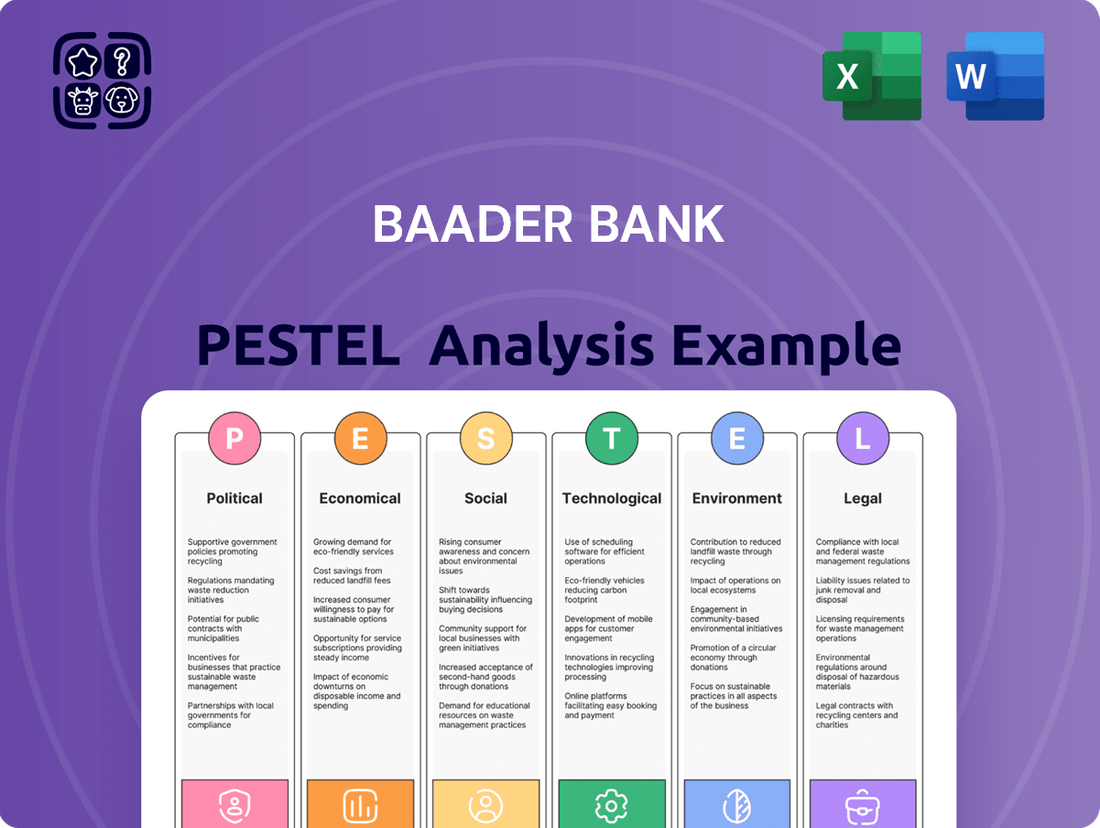

This Baader Bank PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations.

It provides a comprehensive overview of the external landscape, highlighting key trends and their implications for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting Baader Bank.

Helps support discussions on external risk and market positioning during planning sessions, acting as a readily available tool to navigate the complexities faced by Baader Bank.

Economic factors

The current interest rate environment is a critical factor for Baader Bank. While higher rates can benefit net interest margins on certain assets, they also present challenges for fixed-rate loan portfolios and the valuation of securities.

However, the European Central Bank's decision to lower key interest rates starting in mid-2024 is anticipated to provide a stimulus to the broader economy throughout 2025. This shift could lead to increased lending activity and potentially improved market conditions for financial institutions like Baader Bank.

The overall health of the German and global economies significantly impacts investment banking and trading volumes. A sluggish economic environment typically translates to less corporate activity, diminished investor confidence, and a reduced demand for financial services.

Germany's economic outlook for the winter of 2024 suggests a period of stagnation. However, projections indicate a moderate recovery is anticipated throughout 2025, which could provide a more favorable backdrop for financial markets.

Inflation directly impacts Baader Bank's operational costs and the real value of its clients' assets. When prices rise, the money clients have buys less, potentially altering their investment strategies and risk appetite. For instance, if inflation remains elevated, clients might shift towards assets perceived as inflation hedges.

Central banks closely monitor inflation, and persistent price pressures often trigger tighter monetary policies, such as interest rate hikes. This tightening can significantly affect financial markets by increasing borrowing costs and potentially slowing economic growth, impacting Baader Bank's trading volumes and investment banking activities.

Looking ahead, projections suggest consumer price inflation in the euro area will converge towards the European Central Bank's 2% target by the close of 2025. This anticipated stabilization could create a more predictable environment for financial planning and investment, potentially boosting client confidence.

Market Volatility and Trading Volumes

Baader Bank's revenue as a market maker is directly tied to how much the market moves and how much trading is happening. When markets are volatile, there are more chances to profit, but the risks also go up. Conversely, if the market is calm for a long time, trading activity can slow down, impacting earnings.

The bank's performance in the first half of 2025 highlights this relationship. Baader Bank reported that strong trading volumes were a significant factor in their positive financial results during this period.

Key takeaways regarding market volatility and trading volumes for Baader Bank:

- Revenue Dependence: Trading revenue is intrinsically linked to market volatility and trading volumes.

- Volatility Impact: Higher volatility can create profit opportunities but also introduces increased risk.

- Low Volatility Effect: Extended periods of low volatility can lead to reduced trading activity and dampened revenue.

- H1 2025 Performance: Baader Bank's H1 2025 earnings were positively influenced by sustained high trading volumes.

Real Estate Market Developments

Declining real estate prices present a significant risk for financial institutions like Baader Bank. This is primarily due to the impact on their loan portfolios, as property values serve as collateral for mortgages. A downturn can lead to increased non-performing loans if borrowers default and the collateral value is insufficient to cover the outstanding debt.

The German Federal Financial Supervisory Authority (BaFin) has publicly acknowledged these concerns. In response, BaFin has proactively implemented measures to mitigate these risks. One such measure involves the introduction of specific capital buffers designed to absorb potential losses stemming from residential real estate exposures.

These capital buffers are crucial for ensuring the stability of the banking sector. For instance, as of late 2023, BaFin mandated that banks hold additional capital against residential real estate loans, with the exact percentages varying based on risk profiles. This regulatory action reflects a heightened awareness of the interconnectedness between the real estate market and financial system stability.

Key developments include:

- Real estate price trends: German residential property prices experienced a notable decline in 2023, with some reports indicating a year-on-year drop of over 10% in certain metropolitan areas. This trend continued into early 2024, driven by higher interest rates and reduced demand.

- BaFin's capital requirements: BaFin's introduction of capital buffers for residential real estate risks aims to strengthen banks' resilience. These buffers are designed to ensure that banks have sufficient capital to withstand significant price corrections in the property market.

- Impact on collateral: A sustained fall in property values can erode the value of collateral backing real estate loans, potentially increasing the loan-to-value ratios and the risk profile of these assets for banks.

Economic growth in Germany is projected to rebound moderately in 2025 after a period of stagnation in late 2024. This recovery is expected to be supported by easing inflation and a potential uptick in consumer spending, benefiting financial services.

The European Central Bank's anticipated interest rate cuts from mid-2024 onwards will likely stimulate lending and improve market conditions for banks like Baader Bank. However, the transition from higher rates to lower ones presents a mixed bag, impacting net interest margins differently across asset types.

Inflation in the euro area is forecast to return to the ECB's 2% target by the end of 2025, creating a more stable environment for investment. This stabilization could encourage clients to adjust their investment strategies, potentially increasing demand for financial products and services.

| Indicator | 2024 Projection | 2025 Projection | Source |

|---|---|---|---|

| German GDP Growth | 0.3% | 1.2% | Bundesbank (Q4 2024) |

| Euro Area Inflation | 2.5% | 2.0% | ECB (Q4 2024) |

| ECB Main Refinancing Rate | 3.75% (end 2024) | 3.25% (end 2025) | ECB (Q4 2024) |

Preview the Actual Deliverable

Baader Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Baader Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank, offering crucial insights for strategic planning.

You'll gain a detailed understanding of how external forces shape Baader Bank's operations and future prospects. This is the real, ready-to-use file you’ll get upon purchase, providing actionable intelligence.

Sociological factors

German consumers are increasingly embracing digital financial services, with a growing preference for online channels. This shift, while perhaps slower than in some other markets due to privacy concerns, means Baader Bank must continue prioritizing investment in its digital platforms and services to meet evolving client expectations.

Customer behavior is evolving rapidly, with a strong demand for hyper-personalized banking solutions and seamless omnichannel experiences. For instance, a significant portion of digital banking users in Germany, estimated to be over 70% by early 2025, expect instant responses and personalized offers, pushing banks like Baader to innovate their service delivery.

Demographic shifts are profoundly reshaping financial services. As populations age in many developed markets, there's a growing demand for retirement planning, estate management, and income-generating investments. For instance, in Germany, the proportion of individuals aged 65 and over is projected to reach over 30% by 2050, increasing the need for specialized wealth management services that Baader Bank can provide.

Conversely, the rise of younger, affluent demographics, particularly in emerging economies, presents opportunities for wealth accumulation and investment advisory. Baader Bank's strategy must therefore encompass tailored solutions for both the preservation of wealth in aging populations and the growth-oriented needs of a burgeoning younger investor base, adapting its asset management and private banking portfolios accordingly.

Public perception and trust are bedrock for financial institutions like Baader Bank, directly influencing its ability to attract and keep clients. A recent survey in early 2024 indicated that over 60% of retail investors consider an institution's reputation a primary factor in their investment decisions.

Any hint of scandal or ethical lapse within the broader banking industry can quickly spill over, making transparency and robust corporate governance essential for Baader Bank's stability. In 2023, banks facing significant reputational damage saw client outflows increase by an average of 15% compared to those with unblemished records.

Consequently, Baader Bank's commitment to a strong, trustworthy reputation is not just about good practice; it's a critical business imperative for securing both institutional mandates and private wealth, especially as competition intensifies.

Talent Attraction and Retention

Attracting and keeping top talent is crucial in the fast-paced financial sector, and Baader Bank is no exception. This involves understanding what employees want, like flexible work arrangements and a supportive workplace. In 2024, many financial firms are focusing on hybrid models to meet these evolving preferences.

Offering more than just a salary is key. This includes robust training programs and clear career progression paths. For instance, in 2024, many German financial institutions reported increased investment in digital skills training to stay ahead.

The demand for specialists in areas like financial technology (fintech) and cybersecurity continues to surge. Baader Bank's ability to secure professionals with these in-demand skills directly impacts its innovation and security capabilities. The German fintech sector alone saw significant growth in job creation in 2023 and projections for 2024 remain strong.

- Evolving Work Preferences: Financial professionals increasingly seek flexible work arrangements, with hybrid models becoming standard in many German banks as of 2024.

- Corporate Culture: A positive and inclusive corporate culture is vital for retention, with employee satisfaction surveys in the German banking sector showing a correlation between culture and reduced staff turnover.

- Competitive Compensation & Development: Offering competitive salaries, bonuses, and continuous learning opportunities, especially in emerging fields, is essential for attracting and retaining talent.

- Specialized Talent Demand: The need for experts in fintech and cybersecurity is high; for example, cybersecurity roles in the German financial industry experienced a reported 15% increase in demand in late 2023.

ESG Investing Trends and Social Responsibility

Investor demand for ESG-focused products continues to surge, prompting financial institutions like Baader Bank to expand their offerings and integrate sustainability into their core operations. This shift is driven by a growing awareness of the societal impact of investments, pushing companies to adopt more responsible practices.

In Germany, while ESG investing is gaining traction, a segment of investors still harbors skepticism regarding its potential impact on portfolio performance. However, data from 2024 indicates a clear upward trend in ESG assets under management, suggesting that long-term value creation through sustainability is becoming more recognized.

Baader Bank's own financial reporting for 2024 and projections for 2025 explicitly address sustainability, demonstrating a commitment to transparency and aligning with evolving investor expectations. This includes detailing efforts in corporate social responsibility and the integration of ESG criteria into their business model.

- Growing Investor Demand: Global sustainable investment assets reached an estimated $37.8 trillion in early 2024, according to the Global Sustainable Investment Alliance.

- German Market Sentiment: A recent survey in Q1 2024 found that over 60% of German institutional investors consider ESG factors in their decision-making, despite some lingering return concerns.

- Baader Bank's Sustainability Focus: The bank's 2024 annual report highlighted a 15% increase in ESG-compliant financial products offered to clients compared to the previous year.

- Future Outlook: Projections for 2025 anticipate further growth in ESG assets, with regulatory frameworks like the EU Taxonomy expected to drive greater standardization and adoption.

Societal attitudes towards financial institutions are heavily influenced by trust and transparency. In early 2024, over 60% of retail investors cited an institution's reputation as a key decision factor. Reputational damage can lead to significant client outflows, with affected banks experiencing an average 15% increase in client departures in 2023 compared to those with strong reputations.

Technological factors

Baader Bank's commitment to digitalization is evident in its continuous investment in IT infrastructure, aiming to boost efficiency and client satisfaction. This focus on platform optimization is crucial for staying ahead in the competitive financial landscape.

The bank's strategic investments have led to enhanced platform functionality, supporting a seamless user experience. For instance, the recent launch of the new Baader Trading website underscores this dedication to providing intuitive online tools for its clients.

The financial technology (fintech) landscape is evolving at an unprecedented speed, creating both significant opportunities and considerable competitive pressures for established players like Baader Bank. To maintain its market position and offer advanced services, the bank must actively pursue its own innovative developments or forge strategic partnerships with burgeoning fintech firms.

Germany's fintech ecosystem has demonstrated remarkable resilience, notably with a pronounced emphasis on artificial intelligence (AI) applications and the integration of financial services directly into non-financial platforms, often referred to as embedded finance.

The escalating sophistication of cyberattacks presents a substantial challenge for financial institutions like Baader Bank. Staying ahead requires ongoing investment in advanced cybersecurity defenses and stringent data protection measures to safeguard sensitive client information and maintain operational integrity.

German financial regulators, including BaFin, explicitly identify cyberattacks and IT system failures as paramount risks. The economic toll of cyber incidents in Germany is projected for a significant increase by 2025, underscoring the critical need for proactive and resilient cybersecurity strategies within the banking sector.

Artificial Intelligence (AI) and Machine Learning (ML) Adoption

The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) presents significant opportunities for Baader Bank to streamline operations and enhance client services. These technologies can bolster data analysis for sharper investment insights, automate routine tasks, and fortify risk management protocols. For instance, a 2024 report by Statista indicated that AI in financial services is projected to grow substantially, with the market expected to reach over $100 billion globally by 2025, reflecting a strong trend towards AI integration.

German fintechs are actively leveraging AI, pushing banks to develop hyper-personalized financial offerings. Baader Bank can capitalize on this by implementing AI for customized investment advice and tailored product recommendations, thereby improving customer engagement and loyalty. The demand for AI-driven financial tools is escalating, with many institutions reporting efficiency gains of up to 20% in areas like fraud detection through AI implementation.

- AI integration enhances data analysis for investment strategies.

- Automation of processes through ML boosts operational efficiency.

- AI-powered risk management improves accuracy and speed.

- Hyper-personalization of financial services is a key competitive advantage.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are reshaping financial services, offering avenues for novel products and enhanced operational efficiency. These technologies promise greater transparency in capital market transactions.

Germany has proactively addressed the burgeoning crypto market by implementing licensing requirements for crypto custody services, demonstrating a regulatory approach to innovation. This move, alongside the EU's DLT Pilot Regime, signals a concerted effort to cultivate advancements within the DLT ecosystem.

- Increased Efficiency: DLT can streamline post-trade settlement processes, reducing reconciliation efforts and settlement times.

- New Financial Products: Tokenization of assets, such as real estate or art, can unlock liquidity and create new investment opportunities.

- Regulatory Frameworks: Germany's crypto custody licensing and the EU's DLT Pilot Regime aim to provide clarity and foster responsible adoption.

- Transparency: The immutable nature of blockchain records can enhance auditability and reduce the risk of fraud in financial transactions.

Technological advancements are a critical driver for Baader Bank, necessitating continuous investment in digitalization and platform optimization to maintain a competitive edge. The rapidly evolving fintech landscape, particularly in Germany with its focus on AI and embedded finance, presents both opportunities for innovation and competitive challenges.

The bank must navigate the increasing sophistication of cyber threats, a significant risk highlighted by German regulators, requiring robust cybersecurity defenses. Furthermore, the integration of AI and Machine Learning offers substantial potential for Baader Bank to enhance data analysis, automate processes, and deliver hyper-personalized client services, a trend supported by global market growth projections for AI in financial services exceeding $100 billion by 2025.

Blockchain and DLT offer avenues for increased efficiency, new financial products through asset tokenization, and greater transparency, with regulatory frameworks like Germany's crypto custody licensing and the EU's DLT Pilot Regime supporting responsible adoption.

| Technology Area | Impact on Baader Bank | Key Data/Trend (2024-2025) |

|---|---|---|

| Digitalization & Platform Optimization | Enhanced efficiency, client satisfaction, and user experience. | Continued investment in IT infrastructure; launch of new trading platforms. |

| Artificial Intelligence (AI) & Machine Learning (ML) | Improved data analysis, operational automation, hyper-personalization, risk management. | Global AI in financial services market projected to exceed $100 billion by 2025; efficiency gains up to 20% in areas like fraud detection. |

| Blockchain & Distributed Ledger Technology (DLT) | Streamlined settlement, new investment products (tokenization), increased transparency. | Germany's crypto custody licensing; EU's DLT Pilot Regime fostering innovation. |

| Cybersecurity | Mitigation of significant risks, protection of client data, maintenance of operational integrity. | German regulators identify cyberattacks as paramount risks; economic toll of cyber incidents projected to increase. |

Legal factors

Baader Bank navigates a complex regulatory landscape, adhering to key European and German financial market rules like MiFID II and CRD IV/CRR. These directives are crucial for ensuring capital adequacy, promoting transparency, and safeguarding investors.

The bank's commitment to these regulations directly influences its operational framework and financial health. For instance, Baader Bank reported a total regulatory capital ratio of 19.74% in H1 2025, a figure reflecting its compliance with evolving capital requirements, including the new CRR III standards.

Baader Bank's operations are heavily influenced by stringent data protection laws, notably the General Data Protection Regulation (GDPR) and the German Federal Data Protection Act (BDSG). Adherence to these regulations is critical for the secure handling of sensitive client information, with non-compliance potentially resulting in significant financial penalties. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

German data protection authorities have been actively providing guidance on the processing of personal data, especially in the context of emerging technologies like Artificial Intelligence (AI). This focus underscores the importance of robust data governance frameworks to ensure that client data is processed ethically and legally, mitigating risks of substantial fines and reputational damage for institutions like Baader Bank.

Baader Bank's operations are significantly shaped by anti-money laundering (AML) legislation. Staying compliant with these evolving rules is paramount to deterring illicit financial activities and maintaining the bank's integrity. This requires Baader Bank to implement and consistently update strong internal controls and reporting systems to meet regulatory demands.

The German Federal Financial Supervisory Authority (BaFin) actively guides financial institutions in this area. For instance, BaFin has issued specific circulars highlighting countries deemed high-risk for money laundering, thereby directing banks like Baader Bank to exercise heightened scrutiny in their transactions and client onboarding processes, especially in light of global financial crime trends.

Consumer Protection Laws

Consumer protection laws significantly shape Baader Bank's operations, dictating how it engages with clients, manages grievances, and upholds equitable practices. These regulations are crucial for maintaining trust and ensuring transparency in the financial sector.

A key development is BaFin's circular on monitoring and governance of banking products in retail banking, which became effective in May 2024. This mandates stricter oversight and compliance for product offerings.

- Regulatory Compliance: Baader Bank must adhere to evolving consumer protection standards, impacting marketing, product development, and client communication strategies.

- BaFin's Circular: The May 2024 BaFin directive on retail banking product governance requires enhanced internal controls and risk management frameworks.

- Client Trust: Robust adherence to these laws fosters greater consumer confidence and can differentiate Baader Bank in a competitive market.

Sustainable Finance Disclosure Regulation (SFDR) and EU Taxonomy

The Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy are reshaping how financial institutions, including Baader Bank, approach sustainability. These regulations mandate detailed reporting on environmental, social, and governance (ESG) criteria, requiring significant integration into investment strategies and operational processes. Failure to comply can lead to reputational damage and regulatory penalties.

The Corporate Sustainability Reporting Directive (CSRD) further amplifies these disclosure demands, with expanded requirements set to take effect from 2025. This means Baader Bank must prepare for more extensive and standardized sustainability reporting. Germany's Sustainable Finance Beirat has actively contributed to this evolving landscape, recommending specific amendments to both SFDR and CSRD to enhance their effectiveness and clarity.

- SFDR and EU Taxonomy: Impose substantial ESG reporting obligations on financial market participants.

- CSRD Expansion: Will broaden disclosure requirements starting in 2025, necessitating robust data collection and reporting frameworks.

- German Recommendations: Germany's Sustainable Finance Beirat has proposed amendments to SFDR and CSRD, indicating ongoing regulatory refinement.

- Compliance Imperative: Baader Bank must adapt its processes to meet these evolving legal and reporting standards to maintain market trust and regulatory adherence.

Baader Bank operates under a robust legal framework, including directives like MiFID II and CRD IV/CRR, which dictate capital adequacy and investor protection. The bank's reported total regulatory capital ratio of 19.74% in H1 2025 demonstrates its commitment to these evolving capital requirements.

Data protection laws such as GDPR and BDSG are critical, with potential fines up to 4% of global annual turnover for non-compliance, emphasizing the need for secure client data handling. German authorities are actively guiding AI data processing, reinforcing the importance of strong data governance.

Anti-money laundering (AML) legislation requires Baader Bank to implement and update strong internal controls to deter illicit financial activities, with BaFin providing specific guidance on high-risk countries for heightened scrutiny.

Consumer protection laws influence client engagement and grievance management, with BaFin's May 2024 circular on retail banking product governance mandating stricter oversight and compliance.

Environmental factors

Baader Bank must navigate significant climate change risks. Physical risks, such as increased frequency of extreme weather events, could directly impact the bank's physical assets and the financial stability of its clients, potentially leading to loan defaults or reduced investment values. For instance, a severe flood in a key German economic region in 2024 impacted several businesses, highlighting the vulnerability of certain sectors to physical climate events.

Transition risks are equally pertinent. As regulatory frameworks evolve and the global economy shifts towards decarbonization, Baader Bank's investment portfolio may face devaluation if it holds significant assets in carbon-intensive industries. The European Union's ongoing efforts to implement stricter environmental, social, and governance (ESG) regulations, with a particular focus on climate-related disclosures and sustainable finance, will shape investment strategies and potentially impact profitability.

In 2025, BaFin, Germany's financial supervisory authority, has signaled a heightened focus on climate change risk, specifically examining how supervised institutions manage physical risks. This increased scrutiny means Baader Bank will need robust strategies to assess and mitigate these impacts, ensuring compliance and financial resilience in a changing climate landscape.

The growing investor appetite for Environmental, Social, and Governance (ESG) compliant investments is fueling innovation in green finance, leading to a surge in new financial products and services. Baader Bank's strategic positioning to offer and effectively manage these sustainable investment options is paramount for capturing the segment of environmentally conscious clients.

Germany's ESG investing market is on a significant growth trajectory, with projections indicating it could reach substantial revenue figures by 2030, driven by a strong compound annual growth rate (CAGR). This presents a clear opportunity for Baader Bank to expand its sustainable finance offerings.

Regulators are intensifying their focus on green finance, compelling institutions like Baader Bank to proactively assess and reveal their exposure to climate-related risks. This includes embedding sustainability considerations into core risk management strategies.

In Germany, BaFin, the Federal Financial Supervisory Authority, has made it clear that credit institutions must adapt their current processes to effectively manage Environmental, Social, and Governance (ESG) related risks. This adaptation necessitates performing robust quantitative assessments to understand the financial implications of these risks.

Resource Scarcity and Operational Footprint

Baader Bank, like all financial institutions, faces increasing scrutiny regarding resource scarcity, particularly energy and water, which directly impacts operational costs. The bank's own environmental footprint is becoming a key factor in its public image and investor relations. For instance, in 2024, the European Union's proposed Corporate Sustainability Reporting Directive (CSRD) mandates more detailed environmental disclosures, pushing banks to actively manage their resource consumption.

Proactive measures in energy efficiency and responsible resource management are crucial for building a positive environmental profile. This can translate into tangible cost savings; for example, a 10% reduction in energy consumption across a large office portfolio could save hundreds of thousands of Euros annually. Such initiatives not only mitigate risks associated with rising resource prices but also enhance brand reputation among environmentally conscious stakeholders.

- Energy Efficiency Investments: Banks are increasingly investing in energy-efficient technologies for their data centers and office buildings to reduce consumption and associated costs.

- Water Management: Implementing water-saving measures in facilities can lower utility bills and demonstrate a commitment to conservation, especially in water-stressed regions.

- Supply Chain Scrutiny: Financial institutions are also examining the environmental impact of their supply chains, pushing suppliers towards more sustainable practices.

- Regulatory Compliance: Adherence to evolving environmental regulations, such as those related to carbon emissions and waste management, is paramount.

Biodiversity Loss and Ecosystem Services

Biodiversity loss and the decline of essential ecosystem services present a significant, albeit often indirect, threat to economic stability and financial markets. As natural systems degrade, the resources and functions they provide, such as clean water and pollination, become scarcer and more expensive, potentially leading to increased operational costs for businesses and impacting consumer demand. By 2025, BaFin is actively scrutinizing how companies are integrating climate change adaptation and broader environmental risks, including biodiversity, into their strategies, recognizing the potential for systemic financial impacts.

The degradation of ecosystems can manifest in tangible economic consequences. For instance, declining fish stocks impact the fishing industry, and the loss of pollinators threatens agricultural yields, both of which have ripple effects through supply chains and commodity prices. These disruptions can create volatility in sectors reliant on natural resources.

- Economic Impact: The World Economic Forum's 2024 Global Risks Report highlights that biodiversity loss is among the top long-term risks, with potential for significant economic disruption.

- Sectoral Vulnerability: Industries like agriculture, forestry, fisheries, and tourism are directly exposed to biodiversity decline.

- Regulatory Focus: BaFin's 2025 analysis signals an increasing regulatory expectation for transparency and proactive management of these environmental risks by listed companies.

Baader Bank must adapt to evolving environmental regulations and the growing demand for sustainable investments. The bank's commitment to ESG principles is crucial for attracting environmentally conscious clients and capitalizing on the expanding green finance market in Germany, which is projected for significant growth through 2030.

Climate change presents both physical and transition risks, necessitating robust strategies for assessment and mitigation. BaFin's 2025 focus on climate risk management underscores the need for Baader Bank to integrate sustainability into its core operations and risk frameworks.

Resource scarcity, particularly concerning energy and water, directly impacts operational costs and brand reputation. Compliance with directives like the EU's CSRD in 2024 pushes banks to enhance environmental disclosures and manage resource consumption efficiently.

Biodiversity loss poses indirect economic threats, with the World Economic Forum identifying it as a top long-term risk. BaFin's 2025 scrutiny of environmental risk integration highlights the need for proactive management of these broader ecological impacts.

| Environmental Factor | Impact on Baader Bank | Key Data/Trends (2024-2025) |

|---|---|---|

| Climate Change (Physical & Transition Risks) | Loan defaults, investment devaluation, regulatory compliance costs, portfolio adjustments | BaFin's increased scrutiny on climate risk management (2025); EU ESG regulations impacting investment strategies. |

| Green Finance Demand | Opportunity for new products/services, market share growth in sustainable investments | German ESG market CAGR driving substantial revenue by 2030; growing investor preference for ESG-compliant options. |

| Resource Scarcity (Energy, Water) | Increased operational costs, impact on brand reputation | EU CSRD mandates detailed environmental disclosures (2024); potential for significant annual cost savings through energy efficiency. |

| Biodiversity Loss | Indirect economic disruption, supply chain volatility, increased operational costs | World Economic Forum (2024) highlights biodiversity loss as a top long-term risk; BaFin analyzing integration of biodiversity risks (2025). |

PESTLE Analysis Data Sources

Our Baader Bank PESTLE Analysis is built on a robust foundation of official financial reports from regulatory bodies, economic data from leading international organizations like the ECB and Bundesbank, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the financial sector.