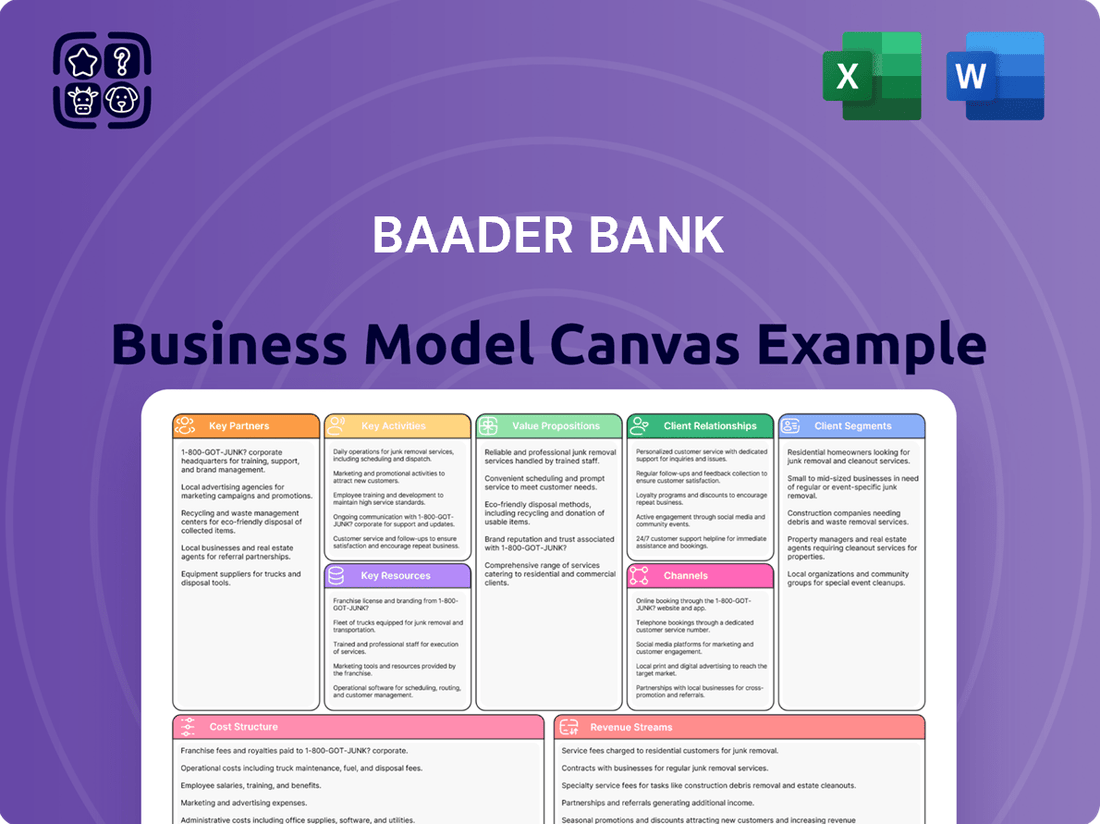

Baader Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baader Bank Bundle

Uncover the strategic framework behind Baader Bank's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for any business strategist. Dive into the specifics of how Baader Bank operates and gain a competitive edge.

Partnerships

Baader Bank actively collaborates with numerous German and international stock exchanges and trading venues. This strategic partnership allows them to function as a market maker, providing essential liquidity across a wide spectrum of financial instruments.

These relationships are fundamental to Baader Bank's ability to facilitate smooth and efficient trading operations. Furthermore, these collaborations are instrumental in broadening their overall market presence and accessibility.

The bank has seen a positive trend in its market share across key stock exchanges and trading platforms, with this growth continuing for three consecutive years, extending through 2024.

Baader Bank is a crucial partner for fintechs and robo-advisors, providing essential account and custody services for a wide range of assets. This allows burgeoning digital investment platforms to tap into Baader Bank's established infrastructure and regulatory know-how, accelerating their development and market entry.

Baader Bank partners with capital management companies, investment consultants, asset managers, and insurers, acting as a crucial outsourcing partner. This collaboration allows them to offer comprehensive support for a wide array of fund products, including UCITS funds, special funds, and offshore funds.

Their expertise extends to managing derivative overlay mandates, demonstrating a deep capability in complex portfolio management. In 2024, Baader Bank continued to solidify its position by facilitating the administration and custody services for numerous asset management clients, with assets under administration growing by 8% year-on-year.

Cooperation Partners (B2B and B2B2C)

Baader Bank actively cultivates B2B and B2B2C cooperation partnerships, a cornerstone for expanding its commission business and client reach. These collaborations are vital for diversifying revenue streams and attracting new customer segments.

Key partners include direct banks, online asset managers, and neobrokers. For instance, in 2024, Baader Bank continued to strengthen its relationships with fintechs, enabling broader access to digital investment platforms.

- Direct Banks: Facilitating white-labeling of trading and custody services.

- Online Asset Managers: Providing the technological backbone for their investment offerings.

- Neobrokers: Enabling access to a wider range of financial instruments and efficient trade execution.

Technology and Infrastructure Providers

Baader Bank's commitment to cutting-edge technology is evident in its strategic investments in IT infrastructure and its partnerships with leading technology providers. These collaborations are crucial for maintaining a high-performing trading platform, expanding the range of financial products available to clients, and bolstering cybersecurity defenses against evolving threats. For example, Baader Bank's partnership with Objectway for their 'Road to Future' program underscores their dedication to implementing a robust and future-proof technological foundation.

These technology partnerships enable Baader Bank to:

- Optimize platform functionality: Ensuring seamless trading execution and efficient client onboarding.

- Expand trading offerings: Integrating new asset classes and sophisticated trading tools.

- Enhance cybersecurity: Protecting client data and financial assets through advanced security measures.

Baader Bank's key partnerships are the bedrock of its diversified service offerings, enabling it to act as a critical intermediary and service provider across the financial ecosystem.

These collaborations extend to stock exchanges, fintechs, capital management companies, and technology providers, allowing Baader Bank to offer robust trading, custody, and outsourcing solutions.

In 2024, Baader Bank saw an 8% year-on-year growth in assets under administration for its asset management clients, highlighting the success of these strategic alliances.

| Partner Type | Role with Baader Bank | Impact/Benefit |

|---|---|---|

| Stock Exchanges & Trading Venues | Market Maker, Liquidity Provider | Facilitates trading, enhances market presence |

| Fintechs & Robo-Advisors | Account & Custody Services Provider | Enables digital platform growth, accelerates market entry |

| Capital Management Companies, Asset Managers | Outsourcing Partner, Fund Administrator | Supports diverse fund products, manages derivative overlays |

| Direct Banks, Online Asset Managers, Neobrokers | White-labeling, Technology Backbone Provider | Expands commission business, broadens client reach |

| Technology Providers | IT Infrastructure Partner | Optimizes platform, expands offerings, enhances cybersecurity |

What is included in the product

A detailed Baader Bank Business Model Canvas that outlines its core offerings, target customer groups, and key partnerships. It provides a clear framework for understanding the bank's operational structure and strategic direction.

Baader Bank's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex financial operations, simplifying understanding and strategic planning.

Activities

Baader Bank actively participates as a market maker on German and international exchanges, supplying crucial liquidity across a wide spectrum of financial products. This involves consistently offering buy and sell prices, facilitating smooth trade execution for numerous securities.

The bank's trading segment demonstrated robust performance, with earnings experiencing a substantial increase in 2024. This growth underscores the effectiveness of their market-making strategies and trading operations in a dynamic financial environment.

Baader Bank offers extensive investment banking services, focusing on structuring and executing both debt and equity capital market transactions for its corporate clients.

A key activity involves acting as a corporate broker, facilitating access for these clients to a broad network of international investors and actively supporting primary market sales initiatives.

In 2024, Baader Bank continued to be a significant player in European capital markets, with its investment banking division contributing substantially to the bank's overall revenue streams through successful deal origination and execution.

Baader Bank actively manages a broad range of assets for a diverse client base, encompassing both institutional and private investors. Their offerings include specialized investment funds and tailored asset management solutions designed to meet specific financial objectives.

The bank provides comprehensive support for the portfolio management of various fund products, ensuring efficient and strategic allocation of capital. This includes the development and distribution of proprietary investment products, further diversifying their asset management capabilities.

In 2024, Baader Bank continued to emphasize its asset management services, with assets under management (AUM) in its fund business showing steady growth. For instance, their mutual funds saw an increase in net inflows, contributing to a robust AUM figure that reflects client trust and market demand.

Brokerage Services

Baader Bank's brokerage services are a cornerstone of its business, providing institutional and private clients with multi-asset trading capabilities. This means clients can buy and sell a broad spectrum of financial instruments, from stocks to bonds and beyond, all within the bank's ecosystem. In 2024, the demand for efficient trading platforms remained high, with many participants seeking seamless execution across global markets.

The bank facilitates access to numerous international exchanges and sophisticated trading platforms, ensuring clients have the tools they need to navigate diverse financial landscapes. This global reach is crucial for investors looking to diversify and capitalize on opportunities worldwide. Baader Bank's commitment to providing comprehensive market access underpins its value proposition in the competitive brokerage space.

- Multi-Asset Trading: Facilitates trading across various asset classes for both institutional and private clients.

- Global Market Access: Provides access to a wide array of international exchanges and trading venues.

- Platform Integration: Offers advanced trading platforms designed for efficient execution and market analysis.

Technology Development and Platform Optimization

Baader Bank's commitment to technology development is a cornerstone of its operations. The bank consistently invests in its IT infrastructure and platform functionality. This focus ensures a secure, automated, and scalable gateway to global capital markets for its diverse client base.

A significant aspect of this activity involves the continuous development of sophisticated trading algorithms. These algorithms are crucial for enhancing efficiency and supporting Baader Bank's expanding digital product offerings, keeping them competitive in the evolving financial landscape.

- IT Infrastructure Investment: Baader Bank prioritizes robust IT systems to guarantee operational stability and security.

- Platform Functionality Enhancement: Ongoing improvements to trading platforms provide users with advanced tools and seamless execution.

- Trading Algorithm Development: The creation and refinement of algorithms aim to optimize trading strategies and offer competitive execution services.

- Digital Product Expansion: Technology development directly supports the launch and enhancement of new digital financial products and services.

Baader Bank's key activities revolve around providing essential financial services. These include acting as a market maker to ensure liquidity across various exchanges, offering comprehensive investment banking services like capital raising, and managing assets for a wide range of clients. Furthermore, the bank facilitates multi-asset trading through advanced platforms and invests heavily in technology to support its digital offerings and algorithmic trading capabilities.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Market Making | Supplying liquidity on exchanges | Contributed to robust trading segment performance with significant earnings increase. |

| Investment Banking | Structuring and executing capital market transactions | Substantially contributed to overall revenue through successful deal origination. |

| Asset Management | Managing assets and developing investment funds | Showed steady growth in Assets Under Management (AUM) with increased net inflows in mutual funds. |

| Brokerage Services | Facilitating multi-asset trading and global market access | Supported high demand for efficient trading platforms and seamless execution. |

| Technology Development | Investing in IT infrastructure and trading algorithms | Ensured operational stability and supported the expansion of digital product offerings. |

Full Document Unlocks After Purchase

Business Model Canvas

The Baader Bank Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means all sections, data, and formatting are identical to the final deliverable, ensuring complete transparency and no surprises. You can confidently assess its quality and relevance, knowing that the complete, editable file will be yours immediately after completing your transaction.

Resources

Baader Bank's operational efficiency hinges on its advanced technology and IT infrastructure. This includes sophisticated trading algorithms and robust systems designed for in-depth data analysis and stringent cybersecurity measures. These technological capabilities are fundamental to their core business activities, such as market making, proprietary trading, and the provision of platform services to clients.

In 2024, Baader Bank continued to invest heavily in its IT infrastructure to maintain a competitive edge. The bank reported that its IT expenditure represented a significant portion of its operating costs, enabling the continuous development and enhancement of its trading platforms and analytical tools. This commitment ensures they can handle high-volume transactions and complex data processing requirements efficiently.

Baader Bank's financial capital and liquidity are foundational to its ability to operate effectively, particularly in managing significant trading volumes and adhering to stringent regulatory demands. A robust capital base ensures stability and the capacity to absorb potential market shocks.

As of December 31, 2024, Baader Bank demonstrated this strength with its equity increasing to EUR 189.4 million. This solid equity position, coupled with total assets amounting to EUR 4.8 billion, underscores the bank's substantial financial resources and its capacity to support extensive trading activities and meet all capital adequacy requirements.

Baader Bank's human capital is a cornerstone of its business model, encompassing a diverse team of seasoned analysts, adept trading specialists, and skilled IT professionals. These individuals are the engine driving the bank's operations and client services.

As of December 31, 2024, the Group's workforce comprised 631 employees, measured in full-time equivalents. This dedicated team possesses critical expertise across various financial domains, including market making, capital markets, brokerage, fund services, and in-depth research.

The collective knowledge and practical experience of these employees are fundamental to Baader Bank's ability to deliver its value proposition. Their proficiency ensures the effective execution of complex financial transactions and the provision of high-quality advisory services.

Regulatory Licenses and Compliance Framework

Baader Bank operates as a fully licensed bank, holding essential regulatory approvals like the MiCAR license, which is crucial for digital asset services. This licensing underpins its ability to offer a broad range of financial products and services. The bank's commitment to a robust compliance framework ensures it meets stringent financial regulations, fostering client confidence.

Adherence to these regulatory standards is paramount for Baader Bank, enabling it to build and maintain trust with its diverse client base, including institutional investors and professional traders. This strong compliance posture is a key resource, differentiating Baader Bank in a competitive financial landscape.

Baader Bank's regulatory licenses and compliance framework are foundational to its business model. For instance, as of the first half of 2024, Baader Bank reported a significant increase in its client assets under custody, a testament to the trust built through its compliant operations. This robust framework allows Baader Bank to:

- Operate with full banking authorization, offering a comprehensive suite of financial services.

- Comply with evolving regulations, such as those pertaining to digital assets under MiCAR.

- Ensure client protection and market integrity, reinforcing its reputation as a reliable financial partner.

Brand Reputation and Market Position

Baader Bank's established brand reputation as a premier European partner for investment and banking services is a cornerstone of its business model. This strong market position, especially in market making, serves as a critical intangible asset, drawing in and retaining a loyal client base and strategic partners.

The bank's reputation directly translates into client acquisition and retention, fostering trust and reliability in a competitive financial landscape. This is particularly evident in its market-making activities, where a solid brand name is essential for counterparties. For instance, in 2024, Baader Bank continued to solidify its presence in key European markets, demonstrating consistent performance and client engagement.

- Brand Reputation: Baader Bank is recognized as a leading European financial institution, fostering trust and attracting high-value clients.

- Market Position: Its strong standing in market making and other specialized financial services provides a competitive edge.

- Client & Partner Attraction: The bank's reputation is a key driver for securing and maintaining relationships with both individual and institutional clients.

Baader Bank's core value proposition is built upon its robust technological infrastructure, significant financial capital, skilled human resources, and a strong regulatory compliance framework. These elements collectively enable the bank to offer specialized financial services, including market making and platform solutions, to a diverse client base.

The bank's commitment to IT investment, exemplified by its 2024 expenditure, ensures operational efficiency and the capacity for complex data processing. Furthermore, its substantial equity of EUR 189.4 million as of December 31, 2024, coupled with total assets of EUR 4.8 billion, highlights its financial stability and ability to meet regulatory demands.

| Key Resource | Description | 2024 Data/Context |

|---|---|---|

| Technology & IT Infrastructure | Advanced trading algorithms, data analysis systems, cybersecurity | Continued heavy investment in IT expenditure for platform development and enhancement. |

| Financial Capital & Liquidity | Equity, total assets, capital adequacy | Equity: EUR 189.4 million; Total Assets: EUR 4.8 billion (as of Dec 31, 2024) |

| Human Capital | Analysts, trading specialists, IT professionals | 631 employees (full-time equivalents) as of Dec 31, 2024, with expertise in capital markets and brokerage. |

| Regulatory Licenses & Compliance | Banking authorization, MiCAR license | Robust compliance framework enabling operation with full banking authorization and digital asset services. |

| Brand Reputation & Market Position | Premier European partner, strong market making presence | Solidified presence in key European markets, demonstrating consistent performance and client engagement in 2024. |

Value Propositions

Baader Bank acts as a crucial market maker, providing robust liquidity for a broad spectrum of securities across numerous exchanges. This active role ensures that institutional and private clients can trade efficiently and without significant disruption, fostering smoother transactions.

By facilitating this high level of liquidity, Baader Bank directly contributes to reduced trading friction and enhanced price discovery. For instance, in 2024, Baader Bank's trading volumes in key European equities demonstrated a consistent ability to absorb significant order flow, underscoring their market-making capabilities.

Baader Bank provides a complete spectrum of capital market services, encompassing trading, investment banking, asset management, and in-depth research. This unified offering streamlines client access to a wide array of financial requirements.

In 2024, Baader Bank reported a significant increase in trading volumes across various asset classes, reflecting strong client engagement with their comprehensive market solutions.

Their integrated model allows clients to efficiently manage diverse financial strategies through a single, reliable platform, enhancing operational effectiveness and market reach.

Baader Bank offers clients access to capital markets through its cutting-edge technology and robust IT infrastructure. This state-of-the-art platform ensures secure, automated, and scalable operations, enhancing the client experience. For instance, in 2023, Baader Bank reported a significant increase in transaction volumes processed through its digital channels, underscoring the efficiency of its technological backbone.

Clients gain a competitive edge with Baader Bank's advanced trading platforms, designed for seamless execution and real-time market data. These sophisticated tools, coupled with highly efficient settlement processes, minimize operational friction and maximize trading opportunities. The bank's continuous investment in technology, with a substantial portion of its 2024 budget allocated to IT upgrades, reflects its commitment to maintaining technological superiority.

Tailored Solutions for Diverse Client Needs

Baader Bank excels at crafting bespoke financial strategies, recognizing that institutional investors, corporate clients, and private individuals each have unique goals. For instance, in 2024, the bank continued to refine its offerings, ensuring that complex hedging needs for large corporations were met with the same precision as personalized wealth growth plans for high-net-worth individuals.

This commitment to tailored solutions is a cornerstone of Baader Bank's business model, translating into financial services that are not only relevant but also highly effective in achieving client objectives. The bank’s approach is built on understanding the nuanced demands of each segment.

- Institutional Investors: Customized trading solutions and market access.

- Corporate Clients: Tailored financing and capital markets services.

- Private Clients: Personalized wealth management and investment advisory.

- Client-Centricity: Focus on specific needs drives service development.

Expertise and Research Insights

Clients leverage Baader Bank's deep market knowledge and comprehensive research reports, crafted by seasoned financial analysts. This access empowers investors to make more astute decisions and gain a distinct advantage in the intricate world of finance.

Baader Bank's commitment to providing cutting-edge research is a cornerstone of its value proposition. For instance, in 2024, the bank's equity research team covered over 200 companies, producing more than 1,000 individual reports, a testament to the depth of their analytical output.

- In-depth Expertise: Access to a team of highly qualified analysts with specialized knowledge across various sectors.

- Valuable Research Insights: Receive timely and actionable research reports, market commentary, and economic analyses.

- Informed Investment Decisions: Utilize data-driven insights to support strategic portfolio allocation and stock selection.

- Competitive Edge: Navigate complex financial landscapes with a clearer understanding of market dynamics and emerging trends.

Baader Bank's value proposition centers on its role as a vital market maker, ensuring consistent liquidity across a wide array of securities. This capability is crucial for enabling efficient and stable trading for both institutional and retail clients. Their extensive market presence in 2024, marked by significant trading volumes in European equities, highlights their capacity to manage substantial order flows and reduce transaction friction.

The bank offers a comprehensive suite of capital market services, integrating trading, investment banking, asset management, and research into a single platform. This holistic approach simplifies financial management for clients, allowing them to pursue diverse strategies seamlessly. In 2024, increased client engagement with these integrated solutions was evident in Baader Bank's reported rise in trading volumes across various asset classes.

Leveraging advanced technology and a robust IT infrastructure, Baader Bank provides clients with secure, automated, and scalable trading operations. This technological backbone, reinforced by substantial IT investment in 2024, ensures efficient transaction processing and an enhanced client experience. Their state-of-the-art platforms offer seamless execution and real-time data, giving clients a distinct competitive advantage.

Baader Bank distinguishes itself by developing bespoke financial strategies tailored to the unique objectives of institutional investors, corporations, and private individuals. This client-centric approach, demonstrated in 2024 through refined offerings for complex hedging needs and personalized wealth growth plans, ensures that services are both relevant and highly effective.

| Value Proposition | Description | 2024/2023 Data Point |

| Market Making & Liquidity | Ensuring efficient trading through robust liquidity provision across various securities. | Consistent absorption of significant order flow in European equities. |

| Integrated Capital Markets Services | Offering a full spectrum of financial services from a single platform. | Significant increase in trading volumes across asset classes due to strong client engagement. |

| Advanced Technology & Infrastructure | Providing secure, automated, and scalable trading platforms. | Substantial IT budget allocation for upgrades; increased transaction volumes via digital channels in 2023. |

| Tailored Financial Strategies | Developing customized solutions to meet specific client needs. | Refined offerings for corporate hedging and private wealth management. |

| In-depth Market Research | Empowering clients with insights from seasoned financial analysts. | Coverage of over 200 companies with more than 1,000 research reports in 2024. |

Customer Relationships

Baader Bank cultivates deep partnerships with institutional clients, including investors, corporations, and asset managers. This commitment is realized through dedicated relationship managers who provide personalized guidance and bespoke financial solutions. For instance, in 2024, Baader Bank reported a significant increase in assets under custody for institutional clients, underscoring the success of these tailored approaches.

Baader Bank enhances customer relationships through robust digital platforms and self-service options, exemplified by its new Baader Trading website. This initiative is crucial for both individual private clients and B2B2C cooperation partners, offering them streamlined access to essential financial services.

These digital tools empower clients by providing convenient access to real-time market information, sophisticated trading functionalities, and efficient account management capabilities. This focus on digital self-service not only improves client experience but also supports scalability in client interactions.

As of 2024, Baader Bank continues to invest in its digital infrastructure, aiming to further personalize client interactions and expand its digital service offerings. The bank's commitment to digital innovation underscores its strategy to foster deeper, more engaged relationships with its diverse client base.

Baader Bank champions a partnership-centric model for its B2B clientele, actively cultivating robust collaborations with fintech innovators, robo-advisory platforms, and a broad array of financial service entities. This deep integration strategy not only embeds Baader Bank's offerings within their partners' ecosystems but also provides crucial support for their unique business architectures, a testament to their success with both direct B2B and B2B2C cooperation frameworks.

Conferences and Investor Events

Baader Bank actively engages in organizing and participating in key investor conferences and forums. A prime example is their own Baader Investment Conference, which serves as a crucial platform for direct interaction.

These events are designed to foster knowledge sharing and create valuable networking opportunities. They connect Baader Bank with its clients and a broader spectrum of market stakeholders, enhancing relationships and facilitating business development.

For instance, the 2023 Baader Investment Conference featured over 150 companies and attracted thousands of participants, highlighting the scale and importance of these gatherings in building and maintaining customer relationships.

- Direct Interaction: Conferences allow for face-to-face meetings, fostering deeper client understanding and trust.

- Knowledge Exchange: These events facilitate the sharing of market insights and strategic perspectives.

- Networking Opportunities: Participants can build connections with industry peers, potential investors, and corporate management.

- Brand Visibility: Active participation in major financial events enhances Baader Bank's profile and reach.

Transparent Communication and Reporting

Baader Bank prioritizes clear and open communication with its shareholders and clients. This includes providing detailed financial reports, timely press releases, and consistent updates on the bank's progress and strategic initiatives.

This dedication to transparency is crucial for fostering trust and ensuring all stakeholders are well-informed about Baader Bank's financial health and future plans. For instance, in 2024, Baader Bank continued its commitment to regular investor relations activities, including conference calls and webcasts to discuss quarterly results.

- Financial Reporting: Baader Bank publishes comprehensive annual and interim financial reports, adhering to strict regulatory standards.

- Press Releases: Key business developments, strategic partnerships, and financial performance updates are disseminated through official press releases.

- Shareholder Communication: Regular updates are provided to shareholders, often including presentations and information packs for annual general meetings.

- Client Information: Clients receive tailored reports and updates relevant to their specific investments and banking relationships.

Baader Bank fosters strong relationships through dedicated relationship managers for institutional clients and robust digital platforms for all. In 2024, the bank saw increased assets under custody, reflecting successful tailored approaches and digital investments aimed at personalization and service expansion.

Channels

Baader Bank leverages its direct online platforms, such as the newly launched Baader Trading website, to offer private investors seamless access to securities trading, real-time market data, and valuable expert commentary. This digital presence is crucial for engaging a broad audience and providing them with the tools needed for informed investment decisions.

In 2024, Baader Bank continued to invest in its digital infrastructure, recognizing the growing demand for self-service investment solutions. The Baader Trading platform, a key component of this strategy, aims to consolidate information and trading capabilities, enhancing user experience and broadening market reach for the bank.

Baader Bank leverages a diverse array of German and international stock exchanges and trading venues as its core channels for executing client orders and fulfilling its role as a market maker. This strategic engagement with multiple liquidity pools is crucial for efficient price discovery and transaction execution.

Key trading venues include established exchanges like the Frankfurt Stock Exchange, alongside increasingly popular electronic platforms such as gettex. In 2024, gettex reported a significant increase in trading volume, underscoring the growing importance of these alternative trading systems for market participants seeking efficient execution.

Baader Bank actively cultivates B2B and B2B2C partnerships, extending its reach through collaborations with direct banks, online asset managers, and neobrokers. This strategy allows the bank to efficiently distribute its diverse range of financial services to a wider clientele.

In 2024, the digital asset sector saw significant growth, with Baader Bank positioning itself to capitalize on this trend through its partnerships. For instance, its involvement in the digital securities market, facilitated by these alliances, offers new avenues for revenue and client acquisition.

Dedicated Sales and Brokerage Teams

Baader Bank leverages dedicated sales and brokerage teams to cultivate direct relationships with institutional investors, corporate clients, and asset managers. These specialized units are crucial for delivering bespoke services and efficiently executing transactions, acting as the primary interface for high-value client interactions.

These teams are instrumental in understanding and responding to the nuanced needs of their clientele, facilitating everything from complex equity trades to structured finance solutions. Their expertise ensures that Baader Bank can offer competitive pricing and seamless execution, a critical factor in today's fast-paced financial markets.

- Client Engagement: Direct interaction with institutional investors, corporate clients, and asset managers.

- Tailored Services: Offering customized solutions and financial products.

- Transaction Facilitation: Efficiently executing trades and managing client portfolios.

- Market Access: Providing clients with access to Baader Bank's extensive trading capabilities and market insights.

Investor Relations and Public Relations

Baader Bank's investor relations and public relations functions are crucial for transparent communication with stakeholders. These departments disseminate financial reports, press releases, and company news to shareholders, analysts, and the media, ensuring a well-informed market. In 2024, Baader Bank continued its commitment to open dialogue, providing regular updates on its financial performance and strategic initiatives.

Key activities include:

- Investor Relations: Engaging directly with shareholders and the financial community through regular earnings calls, investor conferences, and one-on-one meetings to foster trust and provide insights into the bank's strategy and performance.

- Public Relations: Managing media relations and crafting public messaging to enhance Baader Bank's brand reputation and ensure accurate reporting of its business activities and market position.

- Information Dissemination: Publishing quarterly and annual financial reports, press releases on significant corporate events, and updates on business developments, often highlighting key figures such as revenue growth or market share gains. For instance, Baader Bank reported a net profit of €44.2 million for the first nine months of 2024, demonstrating continued operational success.

- Stakeholder Engagement: Building and maintaining strong relationships with all stakeholders, including employees, customers, and regulatory bodies, through consistent and clear communication channels.

Baader Bank utilizes a multi-faceted channel strategy, encompassing direct online platforms like Baader Trading for retail investors, and extensive engagement with various stock exchanges and trading venues for efficient order execution. Furthermore, strategic B2B and B2B2C partnerships extend its reach, while dedicated sales teams cultivate direct relationships with institutional clients. Investor and public relations functions ensure transparent communication with all stakeholders.

Customer Segments

Institutional investors, such as major asset managers and pension funds, represent a core customer segment for Baader Bank. These entities demand high-volume trading capabilities, direct market access, and advanced execution services. In 2024, the global institutional asset management industry managed trillions of dollars, underscoring the significant market opportunity.

Baader Bank serves corporate clients, predominantly within the Germany, Switzerland, and Austria (GSA) region. These companies are actively seeking specialized capital market services to fuel their growth and financial objectives.

Key services offered include facilitating equity capital markets transactions, such as initial public offerings (IPOs) and capital increases, as well as providing debt financing solutions. For instance, in 2024, the European IPO market saw a notable uptick, with Germany being a significant contributor, reflecting the demand for such services.

Furthermore, Baader Bank offers comprehensive corporate brokerage, assisting companies with investor relations, stock exchange listings, and ongoing advisory. This segment is crucial for companies looking to enhance their visibility and liquidity in the public markets.

Baader Bank serves private investors, also known as retail clients, who are actively involved in trading securities. These individuals are looking for a wide selection of financial products and often access them through user-friendly digital platforms or through partnerships Baader Bank has with other firms. This segment is crucial for growth.

The number of managed accounts for private investors has seen substantial growth, reflecting increased engagement in financial markets. For instance, by the end of 2023, Baader Bank reported a significant increase in its client base, with a notable portion attributed to this retail segment, showcasing a strong upward trend in managed accounts.

Asset Managers and FinTechs

Asset managers and FinTechs leverage Baader Bank as a crucial outsourcing partner, utilizing its robust account and fund services, alongside its advanced technological infrastructure. This allows them to streamline operations and focus on their core competencies. For instance, in 2024, many digital asset platforms and wealth management firms continued to integrate with Baader Bank's custody solutions to offer a wider range of investment products.

These partnerships are vital for scaling operations and enhancing product offerings. Baader Bank's infrastructure supports a variety of business models, from traditional fund administration to cutting-edge digital investment platforms. As of early 2025, Baader Bank reported a significant increase in the number of FinTech clients onboarding its white-label trading solutions.

- Core Services: Account administration, custody, fund administration.

- Technological Integration: API access, white-label solutions, digital infrastructure.

- Client Profile: Traditional asset managers, robo-advisors, digital wealth platforms, cryptocurrency custodians.

- Market Trend: Growing demand for outsourcing of non-core banking functions by financial innovators.

Investment Companies and Insurers

Investment companies and insurers are key clients for Baader Bank, requiring robust support for managing diverse fund products. These entities need comprehensive banking services tailored to their substantial investment portfolios, including custody, settlement, and financing solutions. In 2024, the global asset management industry managed an estimated $112 trillion in assets, highlighting the scale of operations these clients undertake.

Baader Bank provides critical infrastructure for these financial institutions, facilitating efficient portfolio management and offering a suite of banking services essential for their operations. This includes access to capital markets, trading execution, and regulatory reporting support, all crucial for navigating complex financial landscapes.

- Portfolio Management Support: Facilitating the administration and oversight of various investment funds, from mutual funds to hedge funds.

- Comprehensive Banking Services: Offering custody, clearing, settlement, and prime brokerage services for institutional investment portfolios.

- Capital Markets Access: Providing seamless integration with global capital markets for trading, issuance, and investment activities.

Baader Bank caters to a broad range of customer segments, from large institutional investors to individual retail clients. This diversification allows the bank to leverage its expertise across various financial needs and market dynamics. The bank's ability to serve these distinct groups underscores its comprehensive service offering and strategic market positioning.

Key client categories include institutional investors like asset managers and pension funds, who rely on Baader Bank for high-volume trading and direct market access. Corporate clients, primarily in the GSA region, utilize the bank for capital market transactions such as IPOs and debt financing. Private investors benefit from accessible trading platforms and a wide array of financial products.

Furthermore, Baader Bank acts as a vital outsourcing partner for asset managers and FinTechs, providing essential account and fund services, along with advanced technological infrastructure. Investment companies and insurers also form a significant client base, requiring specialized support for managing large investment portfolios and diverse fund products.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Institutional Investors | High-volume trading, direct market access, execution services | Global institutional asset management industry managed trillions of dollars in 2024. |

| Corporate Clients (GSA Region) | Capital markets transactions (IPOs, capital increases), debt financing, corporate brokerage | European IPO market saw a notable uptick in 2024, with Germany as a significant contributor. |

| Private Investors | Wide selection of financial products, user-friendly platforms | Significant increase in client base by end of 2023, with strong growth in the retail segment. |

| Asset Managers & FinTechs | Account/fund services, technological infrastructure, outsourcing | Continued integration with Baader Bank's custody solutions by digital asset platforms in 2024. |

| Investment Companies & Insurers | Custody, settlement, financing, portfolio management support | Global asset management industry managed an estimated $112 trillion in assets in 2024. |

Cost Structure

Personnel expenses represent a substantial cost for Baader Bank, encompassing salaries, benefits, and performance-based compensation for its expanding workforce. In 2024, these costs rose to EUR 92.2 million, reflecting investments in talent to support the bank's growth initiatives.

Baader Bank significantly invests in its IT infrastructure and technology to enhance platform capabilities and expand trading services, reflecting a commitment to innovation and market competitiveness.

In 2024, operating expenses reached EUR 97.5 million, a portion of which directly supports these crucial IT upgrades and strategic banking initiatives, demonstrating the financial commitment to technological advancement.

Baader Bank's operating expenses encompass the everyday costs of running its various banking services. These include essential administrative outlays like rent for its offices, utility bills, and marketing efforts to attract and retain clients. In 2024, these other operating expenses totaled EUR 97.5 million, reflecting the investment needed to maintain its operational infrastructure and market presence.

Regulatory and Compliance Costs

Baader Bank, like all financial institutions, incurs significant costs to meet regulatory and compliance obligations. These expenses are essential for maintaining operational integrity and market trust.

These costs cover a range of activities, including the implementation of anti-money laundering (AML) and know-your-customer (KYC) procedures, data protection measures, and adherence to capital adequacy requirements. For instance, in 2023, the global banking sector saw compliance costs rise, with many institutions dedicating substantial budgets to technology and personnel for regulatory adherence.

Key cost drivers within this category include:

- Licensing and Authorization Fees: Costs associated with obtaining and renewing licenses to operate in various jurisdictions and offer specific financial services.

- Compliance Technology: Investment in software and systems for transaction monitoring, risk management, and regulatory reporting.

- Personnel and Training: Salaries for compliance officers, legal experts, and ongoing training for staff on evolving regulations.

- Audits and Reporting: Expenses related to internal and external audits, as well as the preparation and submission of numerous regulatory reports.

Risk Provisions and Pension Expenses

Baader Bank sets aside funds for potential financial risks and employee pension obligations. These risk provisions and pension expenses are a crucial part of managing the bank's financial health and long-term commitments.

In 2024, the bank observed an increase in these provisions. This rise was partly driven by fluctuations in trading income, which can impact the overall risk profile and the necessary capital allocation.

- Risk Provisions: Funds allocated to cover potential losses from various banking activities, including credit and market risks.

- Pension Expenses: Costs associated with providing retirement benefits to employees, reflecting long-term employee commitments.

- 2024 Trend: An increase in these provisions was noted, influenced by factors such as trading income performance.

Baader Bank's cost structure is heavily influenced by its investment in personnel and technology. In 2024, personnel expenses reached EUR 92.2 million, supporting a growing team, while operating expenses, including IT infrastructure upgrades, amounted to EUR 97.5 million. These figures highlight the bank's commitment to innovation and operational efficiency.

| Cost Category | 2024 (EUR Million) |

|---|---|

| Personnel Expenses | 92.2 |

| Operating Expenses (incl. IT) | 97.5 |

Revenue Streams

Baader Bank's commission business is a significant revenue driver, stemming from fees earned on facilitating securities transactions and other brokerage activities. This segment is crucial for their operations.

In 2024, earnings from this commission business saw a notable increase, reaching EUR 102.3 million. This growth is directly attributable to the ongoing expansion of their B2B and B2B2C cooperative ventures, highlighting the success of their partnership strategies.

Baader Bank's trading business generates income through market making, proprietary trading, and providing liquidity on stock exchanges. This diverse approach allows them to capitalize on various market opportunities.

In 2024, the earnings from Baader Bank's trading activities saw a significant increase, reaching EUR 66.7 million. This demonstrates the effectiveness of their trading strategies and their ability to generate substantial revenue in the financial markets.

The interest business is a core revenue stream for Baader Bank, generating earnings from its lending and deposit-taking activities. This segment is particularly sensitive to the prevailing interest rate environment and the overall volume of deposits the bank attracts. In 2024, Baader Bank saw its earnings from this crucial interest business grow significantly, reaching EUR 48.5 million.

Sales and Other Income

Sales and Other Income represents revenue generated from services beyond Baader Bank's core banking activities, along with various miscellaneous income streams. This category captures income that doesn't fit neatly into the bank's primary business segments, providing a broader view of its revenue-generating capabilities.

For the full year 2024, Baader Bank reported total revenue of EUR 247.7 million. This figure encompasses all revenue streams, including the contributions from Sales and Other Income, highlighting the bank's overall financial performance.

The Sales and Other Income segment is crucial for understanding the bank's diversified revenue model. It can include:

- Fees from ancillary services: Revenue derived from services that complement the bank's main offerings, such as administrative fees or charges for specific client requests.

- Commissions on non-core products: Income generated from selling or facilitating transactions related to financial products not central to its primary business lines.

- Miscellaneous income: This can encompass a range of smaller revenue sources, such as gains on the sale of minor assets or other non-operational income.

Asset Management Fees

Baader Bank generates significant revenue through asset management fees, which are earned from overseeing client investments in various financial products and providing wealth management services. These fees are typically calculated as a percentage of the assets under management (AUM), forming a stable and recurring income stream for the bank.

In 2024, the asset management sector continued to be a cornerstone of Baader Bank's financial performance. The bank's commitment to offering specialized investment funds and personalized wealth management solutions directly translates into robust fee income. This segment is crucial for their overall revenue diversification and profitability.

- Asset Management Fees: Income derived from managing investment funds and client portfolios.

- Wealth Management Mandates: Fees charged for personalized financial planning and asset allocation services.

- AUM-Based Revenue: A significant portion of income is tied to the total value of assets Baader Bank manages.

- Fund Services: Fees collected for providing administrative and operational support to investment funds.

Baader Bank's revenue streams are diverse, encompassing commission, trading, interest income, asset management, and other sales. The commission business, driven by securities transactions, brought in EUR 102.3 million in 2024, boosted by B2B and B2B2C partnerships. Trading activities generated EUR 66.7 million in 2024, reflecting successful market making and proprietary trading.

The interest business contributed EUR 48.5 million in 2024, highlighting growth in lending and deposit activities. Asset management fees, derived from managing client investments and wealth, also form a stable income. Overall, Baader Bank reported total revenues of EUR 247.7 million in 2024, showcasing a robust financial performance across its various operations.

| Revenue Stream | 2024 Earnings (EUR Million) | Key Drivers |

|---|---|---|

| Commission Business | 102.3 | Securities transactions, B2B/B2B2C partnerships |

| Trading Business | 66.7 | Market making, proprietary trading, liquidity provision |

| Interest Business | 48.5 | Lending, deposit-taking, interest rate environment |

| Asset Management | N/A (Significant contributor) | AUM, wealth management services, fund administration |

| Sales and Other Income | N/A (Part of total revenue) | Ancillary services, non-core product commissions, miscellaneous income |

| Total Revenue | 247.7 | Combined performance of all segments |

Business Model Canvas Data Sources

The Baader Bank Business Model Canvas is constructed using a blend of proprietary financial data, extensive market research reports, and internal strategic planning documents. These diverse sources ensure a comprehensive and accurate representation of the bank's operations and market position.