Ayr PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayr Bundle

Uncover the critical external forces shaping Ayr's journey with our comprehensive PESTLE analysis. From evolving political landscapes to shifting social trends, understand the opportunities and threats that lie ahead. Equip yourself with actionable intelligence to refine your strategy and secure a competitive advantage. Download the full PESTLE analysis now and gain the foresight you need to thrive.

Political factors

The U.S. Department of Justice's May 2024 proposal to reclassify cannabis from Schedule I to Schedule III under the Controlled Substances Act represents a major political shift. This move could significantly impact companies like AYR Wellness by easing the constraints of IRS Code Section 280E.

If enacted, the Schedule III reclassification would allow cannabis businesses to claim standard business deductions, a privilege currently denied to them. This could free up substantial capital, as companies like AYR Wellness would no longer be subject to the punitive tax treatment that has historically limited reinvestment in operations and expansion.

The Secure and Fair Enforcement (SAFE) Banking Act continues to be a critical political factor for the cannabis industry. Its primary goal is to offer federal protections to financial institutions that serve state-legal cannabis businesses, thereby easing the burden of cash-heavy operations. This act has seen repeated passage in the House of Representatives.

However, as of May 2025, the SAFE Banking Act has not yet cleared the Senate. Despite this legislative hurdle, there is a notable level of bipartisan support, coupled with increasing pressure from multi-state cannabis operators. This combination suggests potential for significant advancement in the near future, which could reshape the financial landscape for cannabis companies.

The ongoing expansion of state-level cannabis legalization continues to be a significant political factor for AYR Wellness. As of June 2025, 24 states and the District of Columbia have legalized recreational cannabis, with 40 states permitting medical use. This broadens AYR's potential market access and operational footprint across the United States.

Legislative developments remain dynamic. States like Nebraska are actively considering medical marijuana, while Pennsylvania and Hawaii are engaged in discussions regarding recreational legalization. These evolving regulations create both opportunities for market entry and challenges in navigating diverse legal frameworks.

Governmental Stance and Administrative Priorities

The political landscape significantly shapes the cannabis industry's trajectory. The Biden administration's move to initiate cannabis rescheduling, a process that could reclassify marijuana from Schedule I to Schedule III under the Controlled Substances Act, signals a potential shift in federal policy. This reclassification, if finalized, could ease research barriers and potentially impact banking access for cannabis businesses.

Looking ahead, the incoming administration's priorities will be crucial. While Donald Trump has previously voiced support for states' rights in cannabis regulation and the SAFE Banking Act, which aims to protect financial institutions that serve state-legal cannabis businesses, it's unclear if federal cannabis reform will be a central focus of Project 2025. This initiative outlines a broad agenda for a potential Republican administration.

The differing approaches highlight the ongoing debate between federal prohibition and state-level legalization. As of early 2025, 24 states, plus Washington D.C. and several U.S. territories, have legalized adult-use cannabis, while 38 states permit medical use. This patchwork of regulations creates complexities for businesses operating across state lines and navigating federal banking restrictions.

- Federal Rescheduling: Biden administration's initiation of the rescheduling process from Schedule I to Schedule III could reduce regulatory burdens.

- SAFE Banking Act: Support for this act could improve access to financial services for state-legal cannabis businesses, which currently face significant hurdles.

- State-Level Progress: As of early 2025, 24 states have legalized adult-use cannabis, demonstrating continued momentum at the sub-federal level.

- Project 2025: The focus of a potential future administration on cannabis reform remains a key variable, with potential shifts in policy direction.

Regulatory and Compliance Oversight

AYR Wellness, as a vertically integrated cannabis operator, navigates a complex patchwork of state-specific regulations covering cultivation, manufacturing, and retail sales. This intricate web of rules, which varies significantly from state to state, demands a highly adaptable internal compliance strategy to manage frequent policy shifts. For instance, in 2024, states like Pennsylvania and New Jersey continued to refine their cannabis regulations, impacting licensing, product testing, and advertising for operators like AYR.

The fragmented nature of cannabis laws across the United States means AYR Wellness must maintain robust compliance frameworks to ensure adherence to each jurisdiction's unique requirements. This constant need for adaptation can directly influence operational efficiency and the pace of market expansion. Failure to comply can result in significant penalties, underscoring the critical importance of staying ahead of legislative changes and enforcement trends.

- State-Specific Regulations: AYR operates under diverse state laws for cultivation, manufacturing, and retail.

- Compliance Burden: Fragmentation necessitates strong internal compliance and adaptability to policy updates.

- Operational Impact: Evolving regulations can affect efficiency and market expansion strategies.

- 2024 Focus: States like Pennsylvania and New Jersey saw regulatory refinements impacting cannabis businesses.

The U.S. Department of Justice's May 2024 proposal to reclassify cannabis from Schedule I to Schedule III under the Controlled Substances Act is a pivotal political development. This potential change could alleviate the tax burdens imposed by IRS Code Section 280E on companies like AYR Wellness, allowing for standard business deductions and freeing up capital for reinvestment.

The SAFE Banking Act remains a critical legislative focus. While it has passed the House multiple times, its Senate passage by May 2025 is still pending. Bipartisan support and pressure from multi-state operators suggest a strong possibility of its enactment, which would significantly improve financial access for cannabis businesses.

State-level legalization continues to expand AYR's market opportunities. As of June 2025, 24 states and D.C. have legalized recreational cannabis, with 40 permitting medical use, creating a complex but growing operational landscape. States like Pennsylvania and New Jersey are actively refining their regulations, impacting how AYR operates.

The political environment is dynamic, with ongoing debates about federal versus state control. Project 2025's stance on cannabis reform under a potential Republican administration will be a key factor to monitor, potentially influencing future federal policy directions.

What is included in the product

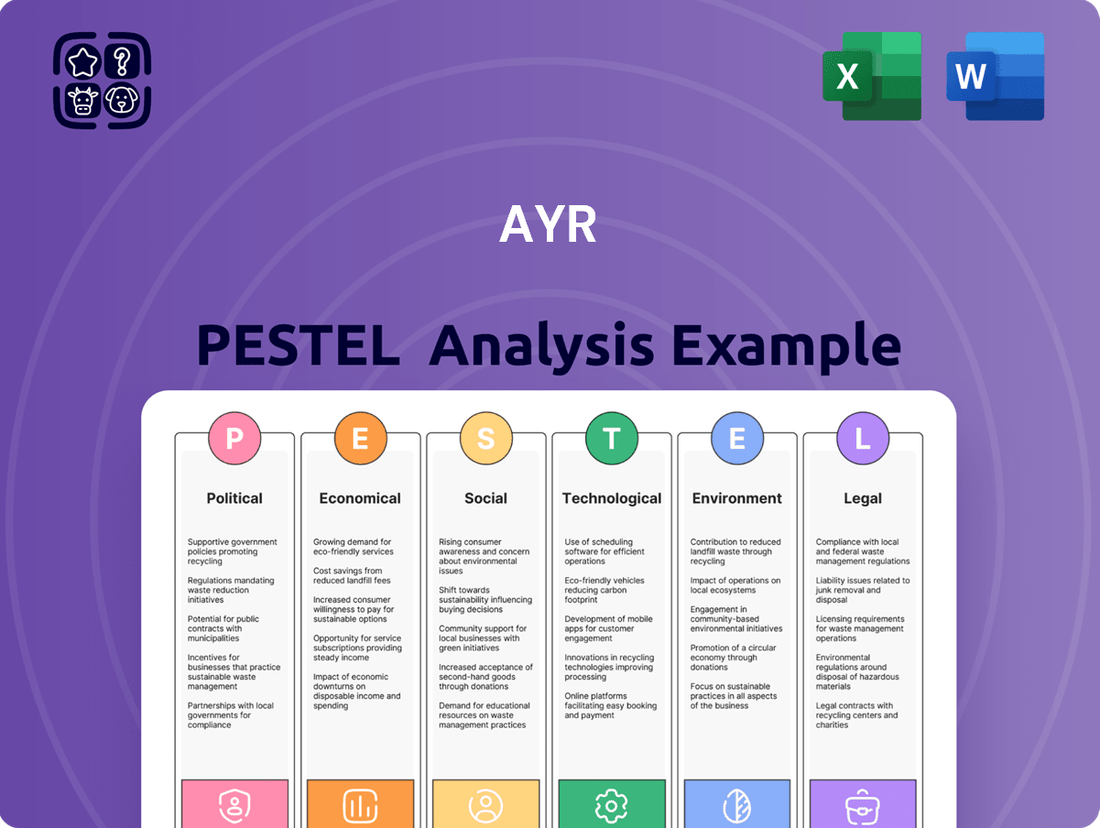

The Ayr PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the business, providing a strategic overview of the external landscape.

The Ayr PESTLE analysis provides a clear, summarized version of the full analysis, relieving the pain point of sifting through extensive data for quick referencing during meetings or presentations.

Economic factors

The U.S. cannabis market is poised for significant expansion, with combined medical and recreational sales anticipated to hit roughly $34 billion by the close of 2025.

This growth trajectory is further bolstered by projections suggesting the market could reach upwards of $53.5 billion by 2027.

Such robust market growth, fueled by increasing consumer acceptance and ongoing product innovation, presents a substantial revenue opportunity for AYR Wellness.

Current federal tax law, specifically IRS Code Section 280E, is a significant hurdle for cannabis companies like AYR Wellness. This law prevents businesses involved in the sale of Schedule I controlled substances from claiming standard business deductions, resulting in substantially higher effective tax rates compared to other industries. For example, in 2023, many cannabis businesses faced effective tax rates exceeding 70% or even 80% due to these limitations.

A potential reclassification of cannabis from Schedule I to Schedule III under federal law could dramatically alleviate this financial burden. Such a change, which has seen increasing bipartisan support and legislative movement in 2024, would allow cannabis companies to access normal business deductions, similar to other industries. This could potentially lower effective tax rates for AYR Wellness to a more manageable range, perhaps closer to the corporate average of 21%, freeing up substantial capital for reinvestment into operations, expansion, and research and development.

Despite cannabis being legal in many states, its federal prohibition significantly restricts AYR Wellness's access to traditional banking. This forces many cannabis businesses, including AYR, to operate largely with cash, which introduces security risks and operational inefficiencies.

The potential passage of the SAFE Banking Act in 2024 or 2025 could be a game-changer for AYR. It would allow financial institutions to serve state-legal cannabis businesses without fear of federal reprisal, opening doors to crucial services like commercial loans, payroll processing, and credit lines. This access could reduce AYR's cost of capital and mitigate the risks associated with cash-heavy operations.

Market Consolidation and Competition

The cannabis sector is experiencing significant market consolidation. Larger, financially robust companies are actively acquiring smaller players, reshaping the competitive landscape. This ongoing consolidation means that companies like AYR Wellness must focus on strategic brand building, optimizing operational efficiency, and driving innovation to secure and grow their market presence.

This trend is evident in the increasing number of mergers and acquisitions within the industry. For instance, in 2023, the U.S. cannabis M&A market saw a notable uptick in deal volume, indicating a strong drive towards consolidation. AYR Wellness, to thrive amidst this, needs to leverage its strengths.

- Increased M&A Activity: Larger cannabis companies are acquiring smaller, often regional, operators to expand their footprint and product portfolios.

- Brand Differentiation: AYR Wellness must invest in its brands to stand out in a crowded market, focusing on quality, consumer trust, and unique product offerings.

- Operational Excellence: Streamlining operations and achieving cost efficiencies are crucial for maintaining profitability and competitiveness against larger, more integrated rivals.

- Innovation Pipeline: Continuous development of new products and delivery methods will be key to capturing evolving consumer preferences and staying ahead of the competition.

Operational Cost Management

AYR Wellness is navigating a landscape where operational costs are on the rise, impacting areas like labor, energy consumption, and the ever-present expenses tied to regulatory compliance. These increases directly affect the company's bottom line and its ability to achieve robust profitability.

Looking ahead to 2025, AYR Wellness has outlined a clear strategy centered on disciplined cost management. This involves a concerted effort to streamline internal processes and elevate the efficiency of their execution across all operations. The goal is to unlock greater profitability by optimizing their current business structure.

- Labor Costs: In the U.S., average hourly wages for retail and wholesale trade workers, which can include cannabis industry roles, saw a notable increase, with some sectors experiencing over 5% year-over-year growth in compensation as of late 2023 and into 2024, driven by labor shortages and inflation.

- Energy Expenses: The cost of electricity, a significant component of operational expenses for cultivation and retail facilities, has seen volatility. For instance, industrial electricity prices in some regions experienced a jump of around 10-15% between 2022 and 2024, depending on the state and energy market conditions.

- Compliance Costs: The cannabis industry, in particular, faces substantial compliance burdens. These can range from licensing fees, which can be tens of thousands of dollars annually per state, to the costs associated with rigorous security measures and detailed record-keeping mandated by state and local governments.

The U.S. cannabis market's projected growth to $34 billion by the end of 2025 highlights a significant economic opportunity. However, federal prohibition and IRS Code Section 280E impose substantial tax burdens, with effective rates often exceeding 70% for cannabis companies. The SAFE Banking Act, potentially passed in 2024 or 2025, could normalize financial access, reducing operational risks and costs.

Rising operational costs, including labor and energy, are impacting profitability, with average hourly wages seeing increases and industrial electricity prices experiencing volatility. AYR Wellness is focusing on cost management and operational efficiency to navigate these economic pressures and enhance profitability.

| Economic Factor | Impact on AYR Wellness | Data Point/Projection |

|---|---|---|

| Market Growth | Increased revenue potential | U.S. cannabis sales projected at $34 billion by end of 2025 |

| Taxation (280E) | Substantially higher effective tax rates | Effective tax rates can exceed 70% |

| Banking Access | Operational inefficiencies and security risks due to cash reliance | SAFE Banking Act could provide access to traditional financial services |

| Operational Costs | Pressure on profitability | Labor costs up ~5%+ YoY; Electricity costs volatile (up 10-15% in some regions 2022-2024) |

What You See Is What You Get

Ayr PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ayr PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the region, providing valuable insights for strategic planning.

Sociological factors

Public acceptance of cannabis is a significant driver for AYR Wellness. As of early 2024, a remarkable 88% of Americans support cannabis legalization, and close to half have tried marijuana. This widespread acceptance is actively normalizing cannabis use and dismantling long-standing stigma.

This evolving social landscape directly benefits AYR Wellness by fostering a more receptive market for its retail operations and diverse product portfolio. The reduced social stigma translates into a more favorable environment for consumers to engage with legal cannabis products.

Consumer preferences are demonstrably shifting, with a notable uptick in demand for products centered around health and wellness. This includes a growing interest in cannabis-infused beverages, a category projected to see significant expansion. Furthermore, convenience remains a key driver, boosting the appeal of items like pre-rolls.

AYR Wellness is well-positioned to leverage these evolving tastes by strategically broadening its product offerings. By developing items specifically designed for relaxation, stress reduction, and improved sleep, the company can directly address these burgeoning consumer needs and capture market share in these high-growth segments.

Societal trends are significantly shaping the cannabis industry. The global medical cannabis market is anticipated to hit $21.04 billion by 2025, fueled by evolving laws and increasing recognition of its benefits for conditions such as chronic pain and anxiety.

AYR Wellness is well-positioned to leverage this growth. By concentrating on diverse cannabis experiences, the company can expand its reach within this burgeoning sector by developing specialized medical and wellness-focused products.

Demographic Shifts in Cannabis Consumption

Millennials represent a substantial segment of the current cannabis market, but Gen Z is quickly becoming the most rapidly expanding consumer group. For AYR Wellness, grasping the evolving consumption patterns and preferences of these younger demographics is paramount for refining marketing, product innovation, and in-store customer engagement.

Recent data from 2024 highlights this trend, with reports indicating that individuals aged 21-34 constitute over 60% of cannabis consumers. Furthermore, market analysis from early 2025 projects that Gen Z, typically defined as those born between 1997 and 2012, will drive a significant portion of future market growth, with their spending projected to increase by an average of 15% annually over the next five years.

- Millennial Dominance: Individuals aged 21-34 are currently the largest consumer group, accounting for a significant majority of sales.

- Gen Z Growth: Those born between 1997 and 2012 are the fastest-growing demographic, showing increasing interest and spending in the cannabis sector.

- Future Market Drivers: Understanding Gen Z's preferences is critical for AYR Wellness to capture future market share and adapt product offerings.

- Shifting Preferences: Younger consumers often favor different product formats, such as edibles and vapes, over traditional flower, influencing product development strategies.

Social Equity and Community Impact

The cannabis industry is increasingly focusing on social equity, aiming to broaden access to licenses, funding, and education for communities historically disadvantaged by the war on drugs. AYR Wellness, for instance, can play a vital role in community development by championing local growers and establishing policies that deter market concentration, thereby cultivating a more equitable sector.

This commitment translates into tangible benefits. For example, in 2023, states with established social equity programs saw a notable increase in participation from individuals from underrepresented backgrounds in cannabis licensing. AYR's initiatives could involve partnerships with community organizations, providing job training and mentorship programs specifically designed for residents in areas disproportionately affected by past prohibition policies.

- Expanding Access: AYR can support social equity applicants through dedicated funding streams and simplified licensing processes.

- Community Investment: Investing in local infrastructure and supporting small businesses within underserved communities demonstrates a commitment to broader economic uplift.

- Preventing Monopolization: Implementing fair competition practices ensures that smaller, community-focused operators can thrive alongside larger entities.

- Education and Training: Providing resources for cannabis cultivation, business management, and regulatory compliance empowers marginalized individuals to succeed in the industry.

Societal attitudes towards cannabis continue to evolve, with a significant majority of Americans now supporting legalization. This widespread acceptance is normalizing cannabis use, creating a more receptive market for AYR Wellness. Consumer preferences are also shifting, with a growing demand for wellness-focused products and convenient formats like pre-rolls.

Younger demographics, particularly Gen Z, are emerging as key growth drivers in the cannabis market. AYR Wellness must understand their evolving consumption patterns to refine marketing and product innovation. The industry's increasing focus on social equity presents opportunities for AYR to invest in community development and promote fair competition.

| Sociological Factor | 2024/2025 Data Point | Impact on AYR Wellness |

|---|---|---|

| Public Acceptance | 88% of Americans support cannabis legalization (early 2024) | Normalizes use, expands customer base |

| Consumer Preferences | Growing demand for wellness products and convenience (2024) | Opportunity for product diversification and innovation |

| Demographic Shifts | Gen Z projected to drive significant future market growth (early 2025) | Requires targeted marketing and product development for younger consumers |

| Social Equity Focus | States with social equity programs saw increased participation (2023) | Potential for community investment and brand reputation enhancement |

Technological factors

Technological innovations are significantly reshaping cannabis cultivation. AI-driven systems, precision agriculture, and automated climate control are key advancements, leading to optimized yields and lower operational costs. For instance, smart sensors can monitor everything from nutrient levels to light intensity, ensuring ideal growing conditions.

AYR Wellness can capitalize on these technological leaps, incorporating smart sensors and vertical farming techniques. These methods are crucial for maintaining optimal growing environments, which directly impacts product quality and overall operational efficiency. By adopting these technologies, AYR can expect to see improvements in consistency and a reduction in resource waste.

Cannabis extraction technology is rapidly advancing, with solvent-free methods and sophisticated machinery now capable of producing exceptionally pure and potent products. This technological leap allows companies like Ayr Wellness to significantly enhance their manufacturing processes, ensuring a high degree of product consistency and catering to the growing consumer preference for premium concentrates and edibles.

In 2024, the global cannabis extraction market was valued at approximately $3.5 billion, with projections indicating substantial growth driven by these technological improvements. Ayr Wellness can leverage these innovations to optimize its production of distillates and isolates, meeting stringent quality standards and expanding its market share in the high-value cannabis product segments.

Blockchain technology is significantly enhancing cannabis supply chain management, offering unparalleled transparency from cultivation to consumer purchase. This traceability is crucial for AYR Wellness, as it allows consumers to verify product origins, fostering trust and ensuring compliance with regulations.

In 2024, the global cannabis market is projected to reach over $100 billion, with transparency becoming a key differentiator for brands. AYR Wellness’s commitment to seed-to-sale tracking via blockchain directly addresses this growing consumer demand for verifiable product information and quality assurance within their vertically integrated model.

E-commerce and Digital Retail Innovations

E-commerce is rapidly becoming a standard in the cannabis sector, with many dispensaries now providing online ordering and convenient in-store pickup. This shift reflects a broader trend towards digital integration within the retail landscape, making it easier for consumers to access products.

AYR Wellness can significantly elevate its customer engagement by leveraging digital platforms. Imagine AI-powered chatbots that can instantly answer customer queries or personalized recommendation engines that suggest products based on individual preferences, creating a more tailored and efficient shopping experience. This digital enhancement can also streamline inventory management processes.

The growth of online cannabis sales is substantial. For instance, in 2023, the U.S. legal cannabis market was valued at approximately $32 billion, with e-commerce playing an increasingly vital role in reaching consumers. By 2025, projections suggest this market could reach upwards of $57 billion, highlighting the immense potential for digital strategies.

- E-commerce Normalization: Online ordering and pickup are becoming standard in cannabis retail.

- Digital Enhancement Opportunities: AYR Wellness can integrate AI chatbots and personalized recommendations.

- Market Growth: The U.S. legal cannabis market was valued around $32 billion in 2023 and is projected to grow significantly.

- Customer Experience Improvement: Digital tools offer enhanced customer service and inventory control.

Research and Product Development

AYR Wellness's commitment to ongoing research and development is paramount for driving product innovation, particularly in the creation of new cannabis strains and specialized product lines. This focus allows AYR to stay ahead of shifting consumer demands, such as the growing interest in wellness-oriented products and cannabis-infused beverages.

Investing in R&D is key for AYR to differentiate itself in a crowded marketplace. For instance, in 2023, the company reported significant progress in its product development pipeline, with several new formulations and delivery methods under active exploration. This proactive approach to innovation is crucial for capturing market share as consumer preferences continue to evolve.

- Product Diversification: AYR is exploring new product categories beyond traditional flower and edibles, including advanced vape technologies and topical formulations.

- Strain Development: The company is investing in genetic research to develop proprietary strains with unique cannabinoid and terpene profiles, aiming to cater to specific wellness needs and recreational preferences.

- Consumer Insights: AYR utilizes market research and data analytics to understand emerging trends, such as the demand for low-dose edibles and non-inhalation consumption methods, guiding its R&D efforts.

Technological advancements are revolutionizing cannabis cultivation and processing. AI, automation, and advanced extraction techniques are optimizing yields, enhancing product purity, and reducing costs. Blockchain technology is also crucial for supply chain transparency, building consumer trust and ensuring regulatory compliance.

AYR Wellness can leverage these innovations to improve operational efficiency and product quality. By embracing digital platforms for e-commerce and customer engagement, AYR can also tap into the rapidly growing online cannabis market, projected to reach over $57 billion by 2025.

The company's investment in R&D is vital for developing new strains and product lines, differentiating AYR in a competitive landscape. This focus on innovation allows AYR to adapt to evolving consumer preferences, such as the increasing demand for wellness-oriented products and diverse consumption methods.

| Technology Area | Impact on AYR Wellness | Market Data/Projection |

|---|---|---|

| Precision Agriculture & AI | Optimized yields, reduced operational costs, improved consistency | Global cannabis market projected to exceed $100 billion by 2024 |

| Advanced Extraction | Higher purity products, catering to premium concentrate demand | Global cannabis extraction market valued at $3.5 billion in 2024 |

| Blockchain | Enhanced supply chain transparency, increased consumer trust | Transparency a key differentiator in a market valued at $32 billion in 2023 |

| E-commerce & Digital Platforms | Improved customer engagement, streamlined operations, access to online market | U.S. legal cannabis market projected to reach $57 billion by 2025 |

| Research & Development | Product innovation, new strain development, adaptation to consumer trends | Company reported significant progress in product development pipeline in 2023 |

Legal factors

The Drug Enforcement Administration's (DEA) review of cannabis rescheduling from Schedule I to Schedule III remains a pivotal legal factor for AYR Wellness. While hearings have seen delays, the potential reclassification is closely watched. This shift, if enacted, would not equate to federal legalization of recreational use, but it carries significant implications for tax treatment under section 280E, which currently restricts deductions for cannabis businesses. For AYR Wellness, this could mean a substantial reduction in their effective tax rate, potentially improving profitability. Furthermore, a Schedule III status could ease regulatory hurdles for research and development, opening new avenues for product innovation.

AYR Wellness faces a dynamic legal landscape, with each state implementing unique rules for cannabis operations. For instance, as of early 2024, states like New Jersey have established robust adult-use markets with specific licensing tiers, while others, like Pennsylvania, continue to focus primarily on medical cannabis programs. This fragmentation necessitates constant adaptation to varying possession limits, cultivation quotas, and product safety standards across AYR's operational footprint.

The federal prohibition on cannabis continues to present substantial legal and regulatory hurdles for traditional banking services, even as numerous states have moved toward legalization. This creates a challenging environment for companies like AYR Wellness, which must navigate these conflicting legal landscapes.

The potential passage of the SAFE Banking Act in 2024 or 2025 is a critical development for AYR Wellness. This legislation would allow cannabis businesses to access standard financial services, significantly reducing the risks associated with cash-heavy operations and enhancing their ability to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Taxation and Revenue Laws

Cannabis businesses, including AYR Wellness, are significantly impacted by tax laws, especially IRS Section 280E. This federal provision prevents cannabis companies from deducting ordinary business expenses, effectively leading to much higher tax burdens compared to other industries. For instance, in 2023, AYR Wellness reported a net loss, partly due to these tax implications, which limit their ability to reinvest profits and expand operations.

Any federal rescheduling of cannabis or legislative reform addressing Section 280E would be a game-changer for AYR Wellness. Such changes could unlock substantial financial benefits, allowing the company to deduct costs like rent, payroll, and marketing. This would directly translate into improved profitability and increased capital for strategic growth initiatives.

The current tax environment presents a major hurdle. For example, a report analyzing the cannabis industry in 2024 highlighted that effective tax rates for compliant businesses can exceed 70% due to 280E, significantly impacting cash flow and investment capacity.

- IRS Section 280E: Prohibits standard business expense deductions for cannabis companies.

- Tax Burden Impact: Leads to significantly higher effective tax rates, reducing reinvestment capital.

- Potential for Reform: Federal rescheduling or legislative changes could drastically improve AYR Wellness's financial health.

- Industry Data (2024): Effective tax rates can reach over 70% for cannabis businesses due to 280E.

Interstate Commerce Restrictions

The federal prohibition of cannabis continues to be a significant hurdle, effectively barring interstate commerce. This means that cannabis products manufactured or grown in one state where it is legal cannot be freely shipped and sold in another legal state. For companies like AYR Wellness, this forces a fragmented operational model.

This restriction necessitates that AYR Wellness maintain distinct and separate supply chains and operational infrastructure in each state where it operates. This fragmentation inherently increases both the complexity of managing these dispersed operations and the overall cost of doing business, as economies of scale across states are largely unattainable.

- Federal Illegality: Cannabis remains a Schedule I controlled substance federally, preventing interstate commerce.

- Operational Fragmentation: AYR Wellness must operate independent supply chains in each state, increasing logistical costs.

- Cost Implications: The inability to move inventory across state lines leads to higher operational expenditures for AYR.

- Market Access Limitations: Companies cannot leverage production capacity in one state to meet demand in another, limiting market reach.

The legal landscape for AYR Wellness is largely defined by the federal prohibition of cannabis, which prevents interstate commerce and necessitates separate operational infrastructures in each state. This fragmentation, coupled with the impact of IRS Section 280E, which disallows standard business expense deductions, significantly increases operating costs and tax burdens. For instance, effective tax rates for compliant cannabis businesses in 2024 could exceed 70%. The potential rescheduling of cannabis to Schedule III or the passage of the SAFE Banking Act in 2024/2025 could offer substantial financial relief and operational improvements for AYR Wellness.

| Legal Factor | Impact on AYR Wellness | Data/Context (2024/2025) |

|---|---|---|

| Federal Prohibition & Interstate Commerce | Prevents cross-state sales, forcing fragmented operations and higher logistics costs. | Companies must maintain separate supply chains in each state, limiting economies of scale. |

| IRS Section 280E | Disallows ordinary business expense deductions, leading to significantly higher effective tax rates. | Effective tax rates can exceed 70% for cannabis businesses, impacting profitability and reinvestment. |

| DEA Rescheduling Review (Schedule I to III) | Potential to reduce tax burden and ease R&D regulations. | While delays have occurred, a Schedule III reclassification would be a major financial benefit. |

| SAFE Banking Act | Would grant access to traditional financial services, reducing cash-handling risks. | Passage in 2024 or 2025 would improve compliance and operational efficiency. |

Environmental factors

Indoor cannabis cultivation, a core operation for companies like AYR Wellness, is notoriously energy-hungry. This demand stems largely from the constant need for powerful lighting and sophisticated HVAC systems to maintain optimal growing conditions, leading to a substantial carbon footprint. For instance, a 2023 report indicated that indoor cannabis cultivation can account for up to 1% of total electricity consumption in some states, a figure that is expected to grow.

AYR Wellness, like its industry peers, is under increasing pressure to mitigate this environmental impact and control operational costs. This involves a strategic shift towards energy-efficient technologies. Implementing advanced LED lighting solutions, which can reduce energy usage by up to 50% compared to traditional high-pressure sodium lamps, and adopting automated climate control systems are key strategies. Furthermore, exploring renewable energy sources, such as solar or wind power, presents a significant opportunity to lower both energy expenses and the company's environmental liability.

Water usage in cannabis cultivation presents a significant environmental challenge, particularly in drought-prone areas. AYR Wellness must prioritize efficient water management to ensure sustainability. For instance, in 2023, California, a key market for AYR, experienced moderate to severe drought conditions across much of the state, impacting agricultural water availability.

Implementing advanced water conservation techniques is crucial for AYR. This includes adopting smart irrigation systems that precisely deliver water to plants, reducing waste. Furthermore, exploring water reclamation technologies to reuse water within cultivation facilities and selecting cannabis strains known for their lower water requirements can significantly mitigate environmental impact.

Minimizing waste and adopting sustainable packaging are critical for environmentally conscious cannabis operations, particularly as the sector grapples with the proliferation of single-use plastics. AYR Wellness can significantly reduce its ecological footprint by implementing practices such as utilizing recyclable or reusable consumer packaging and actively exploring biodegradable material alternatives. This approach not only addresses environmental concerns but also resonates with a growing segment of eco-conscious consumers, potentially boosting brand loyalty and market share.

Carbon Footprint of Operations

The carbon footprint associated with cannabis production, especially for indoor cultivation, presents a substantial environmental challenge. For AYR Wellness, this means a focus on minimizing energy consumption is crucial.

Optimizing cultivation techniques, such as adopting more efficient lighting and HVAC systems, can directly lower energy demands. Investing in energy-efficient infrastructure, like LED lighting and advanced climate control, is a key strategy. Furthermore, exploring hybrid greenhouse models that maximize natural sunlight can significantly reduce reliance on artificial lighting, thereby cutting down on emissions.

- Energy Consumption: Indoor cannabis cultivation can be highly energy-intensive, with lighting, HVAC, and dehumidification systems being major contributors to electricity use.

- Renewable Energy Adoption: Companies like AYR Wellness are increasingly looking at sourcing renewable energy or installing on-site solar to offset their operational carbon footprint.

- Water Usage: Efficient water management and recycling systems are also vital environmental considerations in cultivation.

Adoption of Sustainable Cultivation Methods

The cannabis industry is increasingly focused on sustainable cultivation. This includes practices like organic living soil, regenerative farming, and integrated pest management. These methods not only benefit the environment by improving soil health and biodiversity but also reduce the need for chemical pesticides and fertilizers.

AYR Wellness can leverage these sustainable approaches to enhance its brand image and appeal to environmentally conscious consumers. For instance, adopting organic practices can lead to higher quality products and potentially lower operational costs in the long run due to reduced input expenses. As of early 2025, several leading cannabis cultivators have reported a 10-15% reduction in water usage and a 20% decrease in waste generation by implementing regenerative farming techniques.

- Growing Consumer Demand: A significant portion of consumers, particularly in the 2024-2025 period, express a preference for cannabis products cultivated using eco-friendly methods.

- Regulatory Tailwinds: Emerging environmental regulations in key markets are beginning to favor or mandate sustainable practices in agriculture, including cannabis cultivation.

- Operational Efficiency: Implementing integrated pest management and water conservation strategies can lead to a reduction in operational costs for cultivators like AYR Wellness.

- Brand Differentiation: Demonstrating a commitment to sustainability can be a powerful differentiator in a competitive market, attracting a loyal customer base.

Environmental factors significantly impact AYR Wellness's operations, particularly concerning energy and water consumption. Indoor cultivation's high energy demand, driven by lighting and HVAC, contributes to a substantial carbon footprint, with some states seeing cannabis cultivation account for up to 1% of electricity use by 2023. Water scarcity, especially in drought-prone regions like California, necessitates efficient water management and conservation techniques.

The company is actively pursuing energy efficiency through LED lighting and advanced climate control, aiming to reduce energy usage by up to 50%. Exploring renewable energy sources is also a key strategy to lower costs and environmental impact. Water conservation efforts include smart irrigation and water reclamation, crucial for sustainability in water-stressed markets.

Minimizing waste and adopting sustainable packaging are essential, with a growing consumer preference for eco-friendly products. Regenerative farming practices, adopted by leading cultivators, have shown significant reductions in water usage and waste generation, offering both environmental benefits and operational cost savings.

AYR Wellness faces increasing pressure to adopt sustainable practices due to growing consumer demand and emerging environmental regulations. By implementing efficient cultivation techniques, such as hybrid greenhouses and integrated pest management, the company can reduce its environmental footprint and enhance brand differentiation.

PESTLE Analysis Data Sources

Our Ayr PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, international economic bodies, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.