Ayr Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayr Bundle

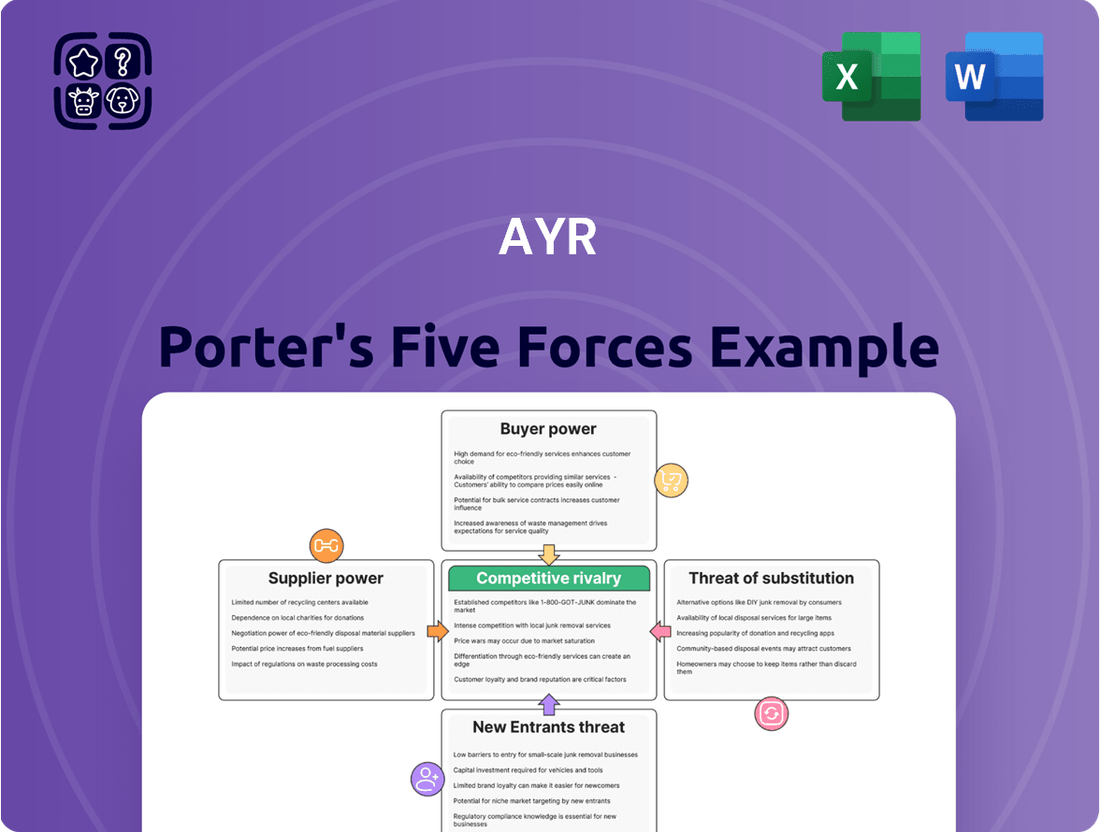

Understanding the competitive landscape is crucial for any business, and Porter's Five Forces Analysis provides a powerful framework. For Ayr, this means dissecting the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the danger posed by substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ayr’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of specialized cultivation technology, including advanced climate control, lighting, and sensor systems, exert moderate bargaining power. These technologies are crucial for AYR Wellness to achieve optimal cannabis yields and consistent quality, creating a degree of reliance on these niche providers.

AYR Wellness's commitment to high-quality cannabis production directly translates to a need for these specialized, often proprietary, cultivation tools. The development of innovations such as automated grow boxes and sophisticated sensor arrays, while boosting efficiency, can also foster dependence on particular suppliers, thereby influencing their power.

Suppliers of unique or high-demand cannabis genetics, like seeds and clones, hold considerable sway. This is particularly true if they have exclusive strains or can consistently deliver superior genetics that result in higher potency or sought-after cannabinoid profiles. For a company like AYR Wellness, which emphasizes vertical integration and plant quality, securing consistent access to these premium genetics is crucial for product differentiation.

Suppliers of specialized cannabis packaging, particularly child-resistant and compliance-focused options, and manufacturing equipment for edibles, concentrates, and vapes, hold moderate bargaining power. This power is influenced by the degree of customization required and the stringency of regulatory mandates.

While basic packaging materials might be easily sourced from multiple vendors, unique or highly compliant packaging solutions can significantly enhance a supplier's leverage. AYR's operational continuity hinges on a steady influx of these critical materials and dependable manufacturing machinery.

Compliance and Seed-to-Sale Software

Providers of seed-to-sale tracking and compliance software wield significant influence in the cannabis sector. Their solutions are indispensable for navigating the complex web of regulations, making them a crucial component for any operator like AYR Wellness. The intricate nature of integrating and migrating these systems presents substantial switching costs, effectively locking in customers and reinforcing supplier power.

These software platforms are vital for comprehensive inventory management, sales tracking, and state-specific reporting, ensuring operational integrity and regulatory compliance. For instance, in 2024, the cannabis industry continued to face evolving compliance mandates across numerous states, increasing the reliance on robust and adaptable software solutions.

- Regulatory Dependence: The cannabis industry's highly regulated nature makes compliance software non-negotiable, granting suppliers considerable leverage.

- High Switching Costs: Implementing and transitioning between seed-to-sale systems involves significant time, resources, and potential disruption, creating a barrier for companies to change providers.

- Essential Operational Functionality: These software solutions are critical for day-to-day operations, managing everything from cultivation tracking to point-of-sale transactions.

Financial and Legal Services

The bargaining power of suppliers in financial and legal services for cannabis companies like AYR Wellness is significantly elevated due to the ongoing federal illegality of cannabis in the United States. This creates a niche market where specialized financial institutions and legal firms possess unique expertise and are in high demand.

These specialized service providers are essential for cannabis businesses navigating a complex and often shifting regulatory environment, which limits the pool of available and qualified partners. For instance, in 2024, many cannabis companies continued to struggle with accessing traditional banking services, forcing them to rely on a smaller number of cannabis-friendly banks and credit unions.

- Limited Banking Access: As of 2024, many traditional banks still avoid the cannabis industry due to federal prohibition, concentrating business with a few specialized financial institutions.

- Specialized Legal Expertise: Legal counsel experienced in cannabis regulations is scarce, granting these firms considerable leverage in negotiating fees and terms.

- Increased Costs: This limited access to essential financial and legal services can translate into higher operational costs for companies like AYR Wellness, impacting profitability.

- Operational Challenges: Dependence on a small number of providers can create vulnerabilities and operational hurdles for cannabis businesses needing consistent support.

Suppliers of critical inputs, such as specialized cultivation technology, unique genetics, and compliance software, hold significant bargaining power over AYR Wellness. This is amplified by the cannabis industry's unique regulatory landscape and the specialized nature of many of these resources, leading to higher costs and potential operational dependencies.

In 2024, the continued federal prohibition of cannabis in the U.S. meant that companies like AYR Wellness faced limited options for financial and legal services. This scarcity of specialized providers, particularly in banking, allowed these firms to command higher fees and dictate terms, directly impacting AYR's operational expenses.

The reliance on seed-to-sale tracking software further illustrates supplier leverage. These systems are essential for regulatory compliance, and the high costs associated with switching platforms in 2024 locked many companies into existing contracts, reinforcing supplier power.

| Supplier Category | Bargaining Power Level | Key Factors Influencing Power (2024) |

|---|---|---|

| Cultivation Technology | Moderate | Niche, proprietary systems; crucial for yield and quality. |

| Cannabis Genetics | Considerable | Exclusive strains, high demand, impact on product differentiation. |

| Packaging & Manufacturing Equipment | Moderate | Customization needs, regulatory stringency. |

| Compliance Software | Significant | Indispensable for regulations, high switching costs. |

| Financial & Legal Services | Significantly Elevated | Federal illegality, scarce specialized expertise, limited banking access. |

What is included in the product

Ayr's Five Forces Analysis dissects the competitive intensity of its markets, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals to inform strategic decisions.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force with a dynamic, interactive dashboard.

Customers Bargaining Power

The cannabis market is seeing a significant surge in product diversity, offering consumers everything from traditional flower and potent edibles to convenient vapes and innovative beverages. This expanding array of choices, coupled with a growing number of dispensaries in states with legal cannabis, directly empowers the customer.

With more dispensaries opening, particularly in key markets like Florida and Massachusetts, consumers face lower switching costs. For instance, in 2024, states like Illinois saw continued growth in dispensary licenses, making it easier for customers to explore different retailers and product offerings without significant effort or expense.

This increased competition among dispensaries, including AYR Wellness, means customers can readily find comparable products or better deals elsewhere. If a customer isn't satisfied with a particular dispensary's selection or pricing, they have ample alternatives available, thereby strengthening their negotiating position.

Customers in the cannabis market, particularly in established adult-use states, are increasingly sensitive to price. This heightened price sensitivity contributes to market compression, forcing companies like AYR Wellness to prioritize cost management and competitive pricing strategies to protect their market share.

The average price of cannabis flower has experienced substantial decreases in several key states. For example, in some markets, the price per ounce has fallen by over 30% year-over-year, directly impacting retail profit margins and underscoring the intense pressure on businesses to operate efficiently.

AYR Wellness strives to cultivate strong customer loyalty by focusing on product quality and a positive brand experience. However, the cannabis market's fragmentation and varying regional product availability can hinder the development of deep, unwavering brand loyalty.

Customers often prioritize convenience and the immediate availability of specific products or strains at their local dispensaries over brand allegiance. For instance, in 2023, the U.S. cannabis market saw significant regional disparities in product offerings, influencing consumer purchasing decisions.

Consumer Demand for Specific Product Attributes

Consumer demand for specific product attributes significantly influences the bargaining power of customers in the cannabis industry. As preferences evolve, for instance, towards low-dose edibles or wellness-focused products like those containing CBD and CBN, or even specific high-THC strains, customers gain leverage. This forces companies like AYR Wellness to adapt their product development and inventory management strategies to stay competitive.

The market is clearly showing a diversification in consumption methods, moving beyond traditional cannabis flower. This shift means that companies must innovate and offer a wider range of products, from vapes and edibles to tinctures and topicals, to cater to varied consumer needs and preferences. For example, in 2024, sales of cannabis edibles and beverages saw substantial growth, indicating a strong consumer interest in alternative consumption formats.

- Shifting Consumer Preferences: Demand for low-dose edibles, CBD/CBN-infused products, and specific terpene profiles is increasing.

- Product Innovation: AYR Wellness must continually innovate its product line to meet evolving consumer desires for diverse consumption methods and specific attributes.

- Market Diversification: The growth in non-flower product categories, such as vapes and edibles, highlights the expanding customer base seeking alternatives to traditional smoking.

- Competitive Landscape: Companies that fail to adapt to these changing demands risk losing market share to more agile competitors.

Influence of Online Reviews and Information

The rise of online review platforms and social media has significantly amplified the bargaining power of customers. These digital spaces allow for the instant sharing of experiences, product quality assessments, and price comparisons. For instance, in 2024, platforms like Yelp and Google Reviews continue to be major influencers, with millions of user-generated reviews shaping consumer choices across various industries.

This increased transparency empowers consumers to make more informed decisions, directly impacting a company's sales and reputation. A study in early 2024 indicated that over 90% of consumers read online reviews before making a purchase decision, highlighting the critical role of customer feedback.

- Customer Empowerment: Online platforms provide readily accessible information on product quality and pricing.

- Reputation Impact: Positive reviews and word-of-mouth are vital for customer acquisition and retention.

- Informed Decisions: Consumers leverage reviews to compare offerings and make educated choices.

- Market Transparency: The ease of sharing information creates a more transparent marketplace.

The bargaining power of customers in the cannabis market is substantial, driven by increasing product variety, a growing number of dispensaries, and heightened price sensitivity. Consumers can easily switch between providers due to low switching costs, and online platforms amplify their ability to compare prices and product quality, forcing companies to remain competitive.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Product Diversity | Increases options, empowering consumers | Significant growth in edibles, beverages, and vapes |

| Number of Dispensaries | Lowers switching costs, increases choices | Continued dispensary license growth in key states |

| Price Sensitivity | Drives demand for lower prices | Average price per ounce down over 30% in some markets |

| Online Reviews/Social Media | Enhances transparency and information access | Over 90% of consumers read reviews before purchasing |

Preview the Actual Deliverable

Ayr Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis you'll receive immediately after purchase. You're looking at the actual document, complete with detailed insights into competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The U.S. cannabis industry is intensely competitive, with a significant number of Multi-State Operators (MSOs) like AYR Wellness actively seeking market share. Leading players such as Curaleaf and Trulieve have established substantial market positions, fueling aggressive expansion and product development strategies. This dynamic landscape necessitates continuous innovation and operational efficiency for companies to thrive.

Established cannabis markets are increasingly feeling the pinch of saturation. This means more businesses are vying for the same customers, often leading to aggressive price wars and a dip in revenue per sales point. For instance, in Oklahoma, a state that rapidly legalized cannabis, the sheer number of dispensaries has driven down average sales per location.

This intense competition forces companies like AYR Wellness to focus on operational efficiency and unique product strategies to stand out. AYR Wellness navigates a landscape where some markets are already quite mature and crowded, while others are still developing, presenting a mixed challenge.

The cannabis industry faces significant competitive rivalry due to regulatory complexity and state-level fragmentation. This means companies must navigate a confusing patchwork of laws and licensing requirements that differ from one state to another. For instance, in 2024, the number of states with some form of legal cannabis continued to grow, but each introduced unique operational hurdles and compliance costs.

This state-by-state approach naturally limits the ability of companies to achieve economies of scale that are common in less regulated industries. Building a consistent national brand becomes incredibly challenging when product offerings, marketing, and even packaging must adhere to vastly different rules in each market. This creates distinct competitive arenas, often favoring well-capitalized firms capable of managing diverse compliance strategies.

Pricing Pressures and Margin Squeeze

Competitive rivalry within the cannabis industry, particularly impacting AYR Wellness, is characterized by intense price pressures. This compression directly squeezes profit margins for all participants, necessitating a sharp focus on operational discipline.

Companies are actively pursuing cost reductions, streamlining operations, and enhancing manufacturing efficiencies to defend their profitability. This strategic imperative to manage price compression is a critical operational priority for 2025.

- Intense Price Compression: The cannabis market is experiencing significant downward pressure on prices, impacting the revenue streams of all operators, including AYR Wellness.

- Margin Squeeze: This pricing environment directly leads to reduced profit margins, making it challenging for companies to maintain healthy financial performance.

- Focus on Efficiency: To counteract margin erosion, businesses are prioritizing disciplined cost management, operational streamlining, and manufacturing improvements.

- 2025 Operational Priority: Supporting and navigating price compression is a key strategic and operational focus for companies in the sector heading into 2025.

Strategic Expansion and Vertical Integration

Competitors are aggressively expanding their retail footprints and enhancing vertical integration to control the supply chain from cultivation to sale. This heightened competition puts pressure on pricing and market share. For instance, in 2024, MSO (Multi-State Operator) competitors continued to consolidate, with several major players announcing significant acquisitions to bolster their cultivation and retail presence across key states.

AYR Wellness itself is a vertically integrated operator, opening new dispensaries and investing in cultivation facilities to strengthen its position and achieve cost efficiencies. This strategy aims to secure supply and improve product consistency. In the first quarter of 2024, AYR Wellness reported expanding its cultivation capacity in Pennsylvania, aiming to support its growing retail network.

- Aggressive Retail Expansion: Competitors are rapidly increasing the number of dispensaries, intensifying the battle for customer access and loyalty.

- Vertical Integration Focus: Companies are investing heavily in cultivation, processing, and manufacturing to gain control over their supply chains.

- Cost Efficiencies: Vertical integration allows for better cost management, from raw materials to finished products, enhancing profit margins.

- Product Consistency: Controlling the entire process ensures higher and more consistent product quality, a key differentiator in a crowded market.

Competitive rivalry in the U.S. cannabis sector is fierce, driven by a growing number of multi-state operators (MSOs) and increasing market saturation in established states. This intense competition translates into significant price compression, squeezing profit margins for all players, including AYR Wellness. Companies are responding by prioritizing operational efficiency, cost reductions, and vertical integration to maintain profitability and secure market share.

The pursuit of economies of scale is hampered by state-by-state regulatory fragmentation, forcing companies to navigate diverse compliance landscapes. This creates distinct competitive arenas, often favoring well-capitalized firms adept at managing complex legal and operational requirements. For example, in 2024, the ongoing expansion of legal cannabis to new states, while offering growth opportunities, also introduced varied operational hurdles and compliance costs, further fragmenting the competitive environment.

Competitors are actively expanding their retail footprints and deepening vertical integration, from cultivation to sale, to control supply chains and enhance product consistency. This strategic push aims to differentiate in a crowded market and improve cost management. In the first quarter of 2024, AYR Wellness reported expanding cultivation capacity in Pennsylvania to support its retail network, a common strategy among MSOs seeking to bolster their market position.

| Metric | AYR Wellness (Q1 2024 Est.) | Industry Average (2024 Est.) | Key Competitor (e.g., Curaleaf Q1 2024) |

|---|---|---|---|

| Retail Footprint (Dispensaries) | ~80-90 | Varies by state, MSOs average 50+ | ~200+ |

| Cultivation Capacity (sq ft) | ~500,000-600,000 | Varies, MSOs investing heavily | ~1,000,000+ |

| Average Revenue per Dispensary | $500K-$700K/month | $400K-$800K/month (state dependent) | $600K-$900K/month |

| Gross Margin | ~40-45% | ~35-50% | ~45-55% |

SSubstitutes Threaten

Even with growing legalization, the illicit cannabis market continues to be a formidable substitute for legal options like those offered by AYR Wellness. This is especially true in markets where taxes and regulations drive up the price of legal cannabis, making unregulated sources more appealing to price-sensitive consumers.

For instance, in some states, the price difference between legal and illicit cannabis can be substantial, encouraging a portion of the market to bypass regulated channels. While authorities are implementing strategies to curb this, the persistent availability of cheaper, albeit unregulated, cannabis remains a constant threat to the profitability and market share of legal operators.

The burgeoning market for alternative wellness products, such as CBD-infused items and non-intoxicating cannabinoid blends, presents a significant threat of substitutes for traditional cannabis operators like Ayr Wellness. Consumers increasingly seek health and wellness benefits without the psychoactive properties of THC, diverting demand towards these alternatives. For instance, the global CBD market was valued at approximately $5.2 billion in 2023 and is projected to grow substantially, indicating a strong consumer preference for these less regulated, often more accessible options.

For individuals managing conditions such as anxiety, chronic pain, or insomnia, conventional pharmaceuticals and readily available over-the-counter medications represent significant substitutes for medical cannabis. As research increasingly validates the therapeutic potential of cannabis, it presents a more direct competitive alternative to these long-standing treatments.

The growing body of clinical studies, with notable advancements in understanding cannabinoid efficacy for pain management and neurological disorders, is steadily enhancing the perceived legitimacy and accessibility of cannabis as a medical option. For instance, by mid-2024, over 500 clinical trials related to cannabis were registered globally, indicating a substantial increase in scientific investigation.

Emergence of Hemp-Derived Cannabinoids

The emergence of hemp-derived cannabinoids, such as Delta-8 and Delta-10 THC, represents a significant threat of substitutes for traditional cannabis markets. These compounds offer alternative psychoactive experiences and are often available in jurisdictions where traditional cannabis remains illegal or heavily regulated, broadening consumer access. The market for these products has seen substantial growth, with projections indicating continued expansion.

This expanding segment offers consumers legal pathways to explore cannabis-like effects, directly impacting demand for products from licensed dispensaries. For instance, the U.S. hemp-derived cannabinoid market was estimated to be worth billions in 2023 and is expected to grow further. This rapid development means consumers have more choices, potentially diverting sales from established players.

- Growing Availability: Hemp-derived cannabinoids are increasingly found in convenience stores and online, bypassing traditional dispensary channels.

- Legal Arbitrage: Their legality, often based on the 2018 Farm Bill, allows for wider distribution than state-legal cannabis.

- Product Diversification: This sector offers a broad array of products, including edibles, vapes, and tinctures, mirroring traditional cannabis offerings.

- Consumer Appeal: Consumers seeking alternatives due to cost, legality, or preference are increasingly turning to these hemp-derived options.

Alcohol and Tobacco Industries

The threat of substitutes for traditional cannabis operators is intensifying as established industries, particularly alcohol and tobacco, make significant inroads into the cannabis market. Companies in these sectors are leveraging their vast resources, distribution channels, and marketing acumen to introduce cannabis-infused beverages and products, directly competing with existing cannabis businesses. This strategic expansion is a clear indicator of a growing substitution threat.

These well-capitalized entrants can significantly alter the competitive landscape. For example, in 2024, major beverage companies continued to explore and invest in cannabis-adjacent products, seeking to capture a share of the burgeoning market. This trend is expected to accelerate, leading to increased market consolidation as these larger players acquire or partner with smaller cannabis firms.

- Established Alcohol and Tobacco Companies Entering Cannabis: Major players are investing, forming partnerships, or developing their own cannabis-infused products, such as beverages.

- Leveraging Existing Infrastructure: These companies can utilize their established distribution networks and sophisticated marketing expertise, giving them a competitive edge.

- Long-Term Substitution Threat: The financial and operational strength of these traditional industries poses a significant long-term challenge to independent cannabis operators.

- Market Consolidation Expected: The trend points towards further consolidation within the cannabis sector as larger, established companies acquire or integrate existing cannabis businesses.

The threat of substitutes for companies like AYR Wellness is multifaceted, ranging from illicit markets and alternative wellness products to established industries entering the cannabis space. The availability of cheaper, unregulated cannabis continues to siphon off price-sensitive consumers, especially in high-tax states. Furthermore, the growing popularity of CBD and hemp-derived cannabinoids, such as Delta-8 THC, offers consumers legal avenues for cannabis-like experiences, diverting demand from traditional THC products. By mid-2024, over 500 clinical trials related to cannabis were registered globally, highlighting increased scientific validation that could also position cannabis as a substitute for traditional pharmaceuticals.

| Substitute Category | Key Characteristics | Impact on AYR Wellness | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Illicit Market | Lower prices, unregulated | Reduces market share, pressures pricing | Price differences can be substantial in some states. |

| Alternative Wellness Products (CBD, etc.) | Non-psychoactive, broad wellness appeal | Diverts consumers seeking health benefits without THC | Global CBD market valued at ~$5.2 billion in 2023. |

| Hemp-Derived Cannabinoids (Delta-8/10) | Legal in many areas, similar effects | Offers alternative access to cannabis-like experiences | U.S. hemp-derived cannabinoid market worth billions in 2023. |

| Traditional Pharmaceuticals | Established treatments for medical conditions | Competes for patients seeking relief for anxiety, pain, etc. | Increased clinical trials for cannabis efficacy. |

| Alcohol & Tobacco Companies | Established infrastructure, marketing power | Introduces cannabis-infused products, potential market consolidation | Major beverage companies exploring cannabis-adjacent products in 2024. |

Entrants Threaten

The vertically integrated cannabis industry, where companies control everything from cultivation to retail, requires immense capital. Newcomers need significant funds for state-of-the-art cultivation facilities, processing and manufacturing equipment, and establishing a network of retail dispensaries. For instance, setting up a single cultivation facility can easily cost tens of millions of dollars, not to mention the ongoing operational expenses.

Compounding this financial hurdle is the ongoing federal prohibition of cannabis in the United States. This means the industry largely lacks access to traditional banking services, making it difficult to secure loans or attract mainstream investment. Established players like AYR Wellness, having navigated these challenges and built scale, possess a distinct advantage, creating a substantial barrier for emerging businesses seeking to enter the market.

The cannabis industry's highly regulated nature presents a significant threat of new entrants due to complex and costly licensing processes. Navigating state-by-state requirements for cultivation, manufacturing, and retail licenses involves lengthy applications, substantial fees, and stringent compliance measures. For instance, in 2024, states like New York are still refining their licensing frameworks, with initial application fees for dispensaries reportedly ranging from $5,000 to $25,000, alongside significant capital investment requirements. AYR Wellness has successfully managed these barriers, demonstrating the capital and operational expertise needed to establish a multi-state presence.

The threat of new entrants in the cannabis industry is significantly amplified by regulatory uncertainty. The ongoing debate around federal legalization in the United States, coupled with frequently changing state-level laws, creates a highly unpredictable operating environment. This volatility acts as a substantial barrier, discouraging many potential investors and entrepreneurs from entering the market.

Businesses already operating, and any new ones considering entry, must constantly adapt to new rules, varying tax structures, and evolving compliance requirements. For instance, in 2024, states continue to refine their cannabis tax frameworks, impacting profitability and operational costs. This continuous need for adaptation increases operational risk and capital expenditure, making the sector less attractive for newcomers.

This dynamic regulatory landscape presents a formidable challenge. The sheer complexity and the constant need for legal and compliance adjustments mean that only well-resourced and agile companies can effectively navigate the terrain, thereby limiting the influx of new competitors.

Need for Specialized Expertise and Infrastructure

The cannabis industry demands highly specialized knowledge in cultivation, processing, distribution, and retail. Newcomers often struggle to acquire this expertise and build the necessary operational infrastructure. Established players like AYR Wellness have cultivated these capabilities over years, creating a significant barrier for potential entrants.

Building efficient supply chains and securing experienced teams takes considerable time and investment. New entrants typically lack the established networks and operational efficiencies that vertically integrated companies have already perfected. This difficulty in replicating existing expertise and infrastructure acts as a strong deterrent.

- Cultivation Expertise: Requires deep understanding of plant science, pest management, and environmental controls.

- Processing & Manufacturing: Demands knowledge of extraction techniques, product formulation, and quality assurance.

- Distribution & Logistics: Needs compliance with strict regulations and efficient cold chain management.

- Retail Operations: Involves customer service, inventory management, and adherence to state-specific sales laws.

Brand Recognition and Customer Acquisition

Established multi-state operators (MSOs) in the cannabis industry have cultivated significant brand recognition and loyal customer bases. For instance, by early 2024, companies like Curaleaf and Green Thumb Industries had already secured substantial market share in key states through years of operation and targeted marketing efforts.

New entrants must contend with this established loyalty, necessitating considerable investment in marketing and customer acquisition strategies to carve out their niche. The sheer volume of dispensaries and the wide array of product choices available mean that emerging brands must offer compelling differentiation to attract and retain customers.

- Brand Loyalty: Existing MSOs benefit from repeat business due to established trust and product familiarity.

- Marketing Costs: New entrants face high customer acquisition costs, estimated to be upwards of $50-$100 per new customer in competitive markets as of late 2023.

- Market Saturation: The increasing number of licensed dispensaries in many states intensifies competition for consumer attention.

- Differentiation Imperative: Unique product offerings, innovative branding, or superior customer experience are crucial for new players to stand out.

The threat of new entrants in the cannabis sector is significantly mitigated by the substantial capital requirements. Establishing a vertically integrated operation, from cultivation to retail, demands millions in upfront investment for facilities, equipment, and licensing. For example, securing cultivation licenses alone can cost hundreds of thousands of dollars in some states, with additional millions needed for infrastructure.

The highly regulated nature of the industry also acts as a considerable barrier. Navigating the complex, state-specific licensing processes, which often involve extensive background checks, security protocols, and application fees, deters many potential newcomers. In 2024, states continue to refine these regulations, with application fees for cultivation licenses sometimes exceeding $25,000, alongside rigorous compliance demands.

Furthermore, the ongoing federal prohibition in the United States limits access to traditional banking and financing, forcing companies to rely on more expensive capital sources. This financial constraint, coupled with the need for specialized operational expertise and established brand loyalty, creates a formidable challenge for new businesses seeking to enter the market.

| Barrier | Description | Example (2024) |

|---|---|---|

| Capital Requirements | High upfront investment for facilities, equipment, and licensing. | Cultivation facility setup can cost $10M-$50M+; licensing fees vary by state, e.g., $25,000+ for cultivation licenses. |

| Regulatory Complexity | Navigating state-specific licensing, compliance, and evolving laws. | Lengthy application processes, stringent security requirements, and ongoing compliance audits. |

| Limited Access to Capital | Federal prohibition restricts access to traditional banking and financing. | Reliance on private equity, venture capital, and debt financing with higher interest rates. |

| Operational Expertise | Need for specialized knowledge in cultivation, processing, and retail. | Years of experience required to optimize yields, manage supply chains, and ensure product quality. |

| Brand Loyalty & Market Saturation | Established brands and numerous dispensaries make customer acquisition difficult. | High customer acquisition costs; need for significant marketing investment to differentiate. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, financial statements of key players, and publicly available company filings. We also incorporate insights from trade associations and economic indicators to capture the broader competitive landscape.