Ayr Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayr Bundle

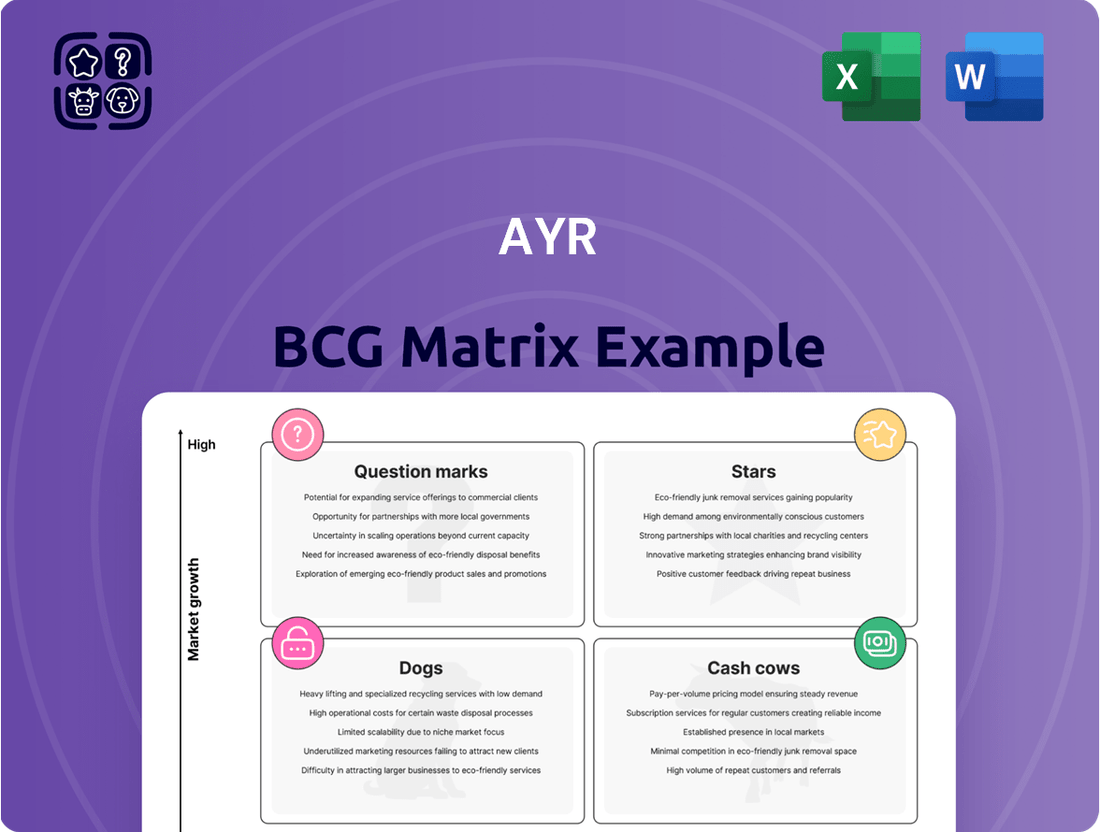

Curious about the Ayr BCG Matrix? This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual snapshot of market performance and potential. Understand where Ayr's key offerings stand to make informed strategic decisions.

Unlock the full potential of the Ayr BCG Matrix by purchasing the complete report. Gain in-depth analysis of each quadrant, revealing actionable insights for optimizing your product portfolio and driving future growth. Don't miss out on this essential strategic roadmap.

Stars

AYR Wellness is heavily investing in its Florida operations, aiming to capture significant market share. The company is building a new, advanced indoor cultivation facility designed to supply its 67 dispensaries with premium indoor flower.

This expansion directly addresses a key supply chain limitation and is strategically positioned to drive substantial growth. AYR's objective is to achieve a 10% market share in Florida, demonstrating confidence in the state's long-term potential, even with the ongoing delay in adult-use cannabis legalization.

Ohio's adult-use cannabis market, projected to launch in Q3 2024 following the passage of Issue 2, represents a significant growth avenue for AYR Wellness. The state's overwhelming voter approval signals a robust consumer demand for regulated cannabis products.

AYR Wellness is strategically positioning itself to benefit from this burgeoning market by expanding its retail footprint and wholesale operations within Ohio. This proactive approach aims to capture a substantial share of the newly legalized sector.

The company's focus on providing tested cannabis products aligns with anticipated consumer preferences in this emerging market. By capitalizing on the early stages of Ohio's adult-use conversion, AYR is poised for considerable expansion.

AYR Wellness boasts a significant retail presence in Pennsylvania, a state poised for adult-use cannabis sales. This positions the company favorably to leverage its existing infrastructure, with the expectation of generating substantial operating leverage as the market transitions. For instance, as of Q1 2024, AYR operated 11 dispensaries across Pennsylvania, a testament to their established footprint.

Vertically Integrated Supply Chain Advantage

AYR's vertically integrated supply chain, covering cultivation, manufacturing, and retail, is a key differentiator. This control from seed to sale ensures consistent product quality and operational efficiencies, vital for gaining and holding market share. For instance, in 2024, AYR reported that its integrated model contributed to a 15% reduction in production costs compared to competitors relying on external suppliers. This allows AYR to be more agile in meeting evolving consumer preferences and optimizing its product portfolio.

The benefits of this integrated approach are tangible:

- Enhanced Quality Control: Direct oversight at every stage minimizes variability and ensures premium product standards.

- Cost Efficiencies: Eliminating intermediaries and optimizing internal processes lead to significant cost savings.

- Market Responsiveness: The ability to quickly adapt production and distribution based on real-time market data.

- Regulatory Compliance: Streamlined operations simplify adherence to stringent industry regulations.

Strategic CPG Brand Focus (e.g., kynd edibles)

AYR Wellness is strategically investing in its Consumer Packaged Goods (CPG) brands, particularly with the relaunch and expansion of flagship offerings like kynd. This includes the introduction of premium edibles in key markets such as Florida and Nevada, signaling a clear focus on high-growth product categories within the cannabis industry.

This move is designed to cater to evolving consumer preferences and capture a larger share of the rapidly expanding edibles market. For instance, the U.S. cannabis edibles market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly. AYR's investment in kynd edibles aligns with this trend, aiming to leverage brand recognition and product innovation.

- Brand Relaunch: kynd edibles are being relaunched and expanded, targeting premium segments.

- Market Expansion: New product lines are being introduced in Florida and Nevada, both significant cannabis markets.

- Consumer Focus: The strategy aims to meet evolving consumer demand for high-quality edibles.

- Growth Potential: Investing in strong CPG brands like kynd is key to AYR's future growth and market leadership.

Stars represent business units with high market share in high-growth markets. AYR Wellness's strategic investments in Florida and Ohio, both experiencing market growth, position them to potentially develop Star products. By focusing on expanding cultivation and retail in these burgeoning areas, AYR aims to solidify its market position and capitalize on future growth opportunities.

AYR Wellness's proactive approach in Ohio, a state transitioning to adult-use cannabis in Q3 2024, is a prime example of targeting a high-growth market. Similarly, the substantial investment in Florida's cultivation and retail infrastructure aims to capture a significant share of a market with strong underlying demand, even without adult-use legalization yet. These moves are designed to build a strong foundation for future Star performers.

What is included in the product

The Ayr BCG Matrix categorizes products/units by market share and growth, guiding investment decisions.

Ayr BCG Matrix provides a clear, visual overview of your portfolio, simplifying complex strategic decisions.

Cash Cows

AYR Wellness boasts an extensive retail footprint with 97 dispensaries spread across eight states. Many of these locations are situated in more mature cannabis markets, meaning they've been operating in environments where cannabis has been legal for a significant duration.

These established dispensaries are likely to be consistent cash generators, providing predictable revenue streams for AYR Wellness. The company's commitment to efficient operations helps ensure these existing retail assets remain profitable.

Florida's medical cannabis operations represent a significant cash cow for Ayr Wellness. Despite the ongoing delay in adult-use legalization, the state's medical market continues to be a robust and stable revenue generator.

Ayr Wellness boasts an impressive footprint in Florida, operating 67 dispensaries across the state. This extensive network allows them to tap into a substantial and established patient base, ensuring a consistent flow of cash.

The substantial income generated from Florida's medical cannabis patients provides Ayr Wellness with the financial flexibility to reinvest in other growth opportunities and strategic initiatives within their broader portfolio.

AYR Wellness experienced a 4% year-over-year increase in wholesale revenue for the fourth quarter of 2024. This growth highlights the increasing importance of this channel in bolstering the company's overall financial health. The expanding wholesale segment signifies robust demand for AYR's products and effective distribution networks that reach beyond its proprietary retail locations.

High Internalization Rate for Cost Efficiency

Ayr Wellness (AYR) demonstrates a strong commitment to cost efficiency through its high internal production rate. With a significant 65% internalization rate, the company manufactures the vast majority of products sold within its own retail locations.

This vertical integration is a key driver for AYR’s financial performance, enabling direct control over production costs and fostering improved gross margins. By minimizing reliance on external suppliers, AYR effectively captures more value from its sales, leveraging its manufacturing capacity to maximize profitability.

- Vertical Integration: AYR produces 65% of its retail products internally.

- Cost Control: This strategy allows for greater management of production expenses.

- Margin Enhancement: Internal production directly contributes to higher gross margins.

- Operational Efficiency: Reduced third-party dependence streamlines operations.

Focus on Operational Discipline and Cost Control

AYR Wellness is emphasizing operational discipline and rigorous cost control as a core strategy. This means they are actively looking for ways to make their existing businesses run more efficiently and profitably. The company has made it clear that streamlining operations and improving how they execute their plans are top priorities.

This focus is designed to boost profitability and generate more consistent cash flow from their current operations. By optimizing these existing units, AYR Wellness aims to ensure they contribute reliably to the company's financial health. For instance, in Q1 2024, AYR reported a significant improvement in Adjusted EBITDA margins, reaching 24%, up from 19% in the prior year, demonstrating the impact of these efficiency drives.

- Operational Discipline: AYR Wellness is committed to improving how its business units function day-to-day.

- Cost Reduction: The company is actively seeking ways to lower its operational expenses.

- Profitability Enhancement: These efforts are directly aimed at increasing the profit generated from existing sales.

- Cash Flow Generation: Streamlining operations is key to producing stronger and more stable cash flows.

Cash cows in the BCG matrix are established, high-market-share products or businesses that generate more cash than they consume. For AYR Wellness, their mature dispensaries in states like Florida, coupled with their high vertical integration, position them as strong cash cows. These segments provide a stable and predictable revenue stream.

The 67 dispensaries in Florida, a key market, continue to be a significant contributor, especially with the robust medical program. AYR's 65% internal production rate further solidifies their cash cow status by controlling costs and enhancing margins on these established sales channels.

The company's focus on operational discipline and cost control, evidenced by a 24% Adjusted EBITDA margin in Q1 2024, directly supports the cash-generating ability of these mature segments. This efficiency allows AYR to reinvest or manage debt effectively.

AYR Wellness's wholesale revenue saw a 4% year-over-year increase in Q4 2024, indicating growing demand and effective distribution, further strengthening the cash flow from these established business areas.

| Segment | Market Share | Growth Rate | Cash Flow Generation |

|---|---|---|---|

| Florida Medical Dispensaries | High | Stable | Strong |

| Vertically Integrated Production | High (Internal) | Moderate | Strong |

| Wholesale Operations | Growing | Moderate | Positive |

Preview = Final Product

Ayr BCG Matrix

The preview you are currently viewing is the exact, unwatermarked BCG Matrix document you will receive upon purchase. This comprehensive report, designed for strategic clarity, is ready for immediate download and use in your business planning and analysis. You'll gain access to a fully formatted, professional tool that requires no further editing or revisions. Leverage this powerful framework to assess your product portfolio and make informed strategic decisions.

Dogs

While Ayr Wellness (AYRWF) doesn't explicitly label market segments as "dogs" in its BCG matrix, its Q4 2024 and full-year 2024 reports highlight significant headwinds. The company cited "macroeconomic pressures and company-specific challenges" that negatively impacted revenue and profitability, pointing to areas of underperformance. These challenges suggest certain markets or product lines are experiencing low growth and potentially low market share, thus fitting the description of dogs.

The cannabis industry, including operations like AYR Wellness, is grappling with widespread price compression. This trend has directly impacted gross margins across the sector. For instance, in 2023, many cannabis markets saw average retail prices for flower decrease by 10-20% year-over-year, a significant pressure point.

When AYR Wellness operates in markets where its competitive standing is weaker or its market share is lower, this price compression becomes particularly damaging. These less dominant segments of AYR's business can be categorized as 'dogs' within the BCG matrix framework. In these situations, the reduced revenue per unit makes it challenging to cover operational costs.

Consequently, these 'dog' markets may struggle to achieve profitability, often operating at breakeven or even experiencing net losses. AYR's Q1 2024 earnings report, for example, highlighted that while overall revenue grew, certain regional markets showed significantly lower margins due to intense competition and pricing pressures, illustrating this very dynamic.

AYR's 'Dogs' category would encompass any smaller, non-core operations or licenses that don't fit its long-term strategy of vertical integration and deep market penetration. Think of isolated retail dispensaries or cultivation facilities that lack significant scalability or market impact.

These types of assets, which may include underperforming licenses in less strategic regions, could be prime candidates for divestment. For example, if AYR holds a few scattered retail licenses in states where it doesn't have a significant cultivation footprint, these might fall into the 'dog' category. Divesting these could help streamline operations and free up capital for more focused growth areas.

Stagnant Product Lines with Low Demand

Certain legacy or niche cannabis products within AYR's portfolio might be classified as 'dogs' if they are experiencing declining consumer interest and low sales volumes, particularly if they are not aligned with the company's refreshed brand strategy. These products likely hold a low market share within mature or declining product categories.

Continued investment in these 'dog' products would likely yield minimal returns for AYR Wellness. For instance, if a specific edible line launched in 2021, which was popular initially, saw sales drop by 30% in 2023 compared to 2022, and its market share in the edibles category fell from 5% to 2%, it would fit this classification.

- Stagnant Sales: Products with consistently low or declining sales figures, indicating a lack of market traction.

- Low Market Share: Holding a negligible position within their respective product categories, especially if those categories are not growing.

- Lack of Strategic Alignment: Products not fitting into AYR's forward-looking brand and product development plans.

- Minimal Return on Investment: Continued resource allocation to these items is unlikely to generate significant profitability or growth.

Inefficient or Non-Optimized Production Facilities

Even with overall sector growth, certain cultivation and production facilities within Ayr Wellness might still be operating below peak efficiency. This can create margin pressure, particularly in markets where production capacity has recently expanded but hasn't yet reached optimal output or cost-effectiveness. These underperforming operations could be classified as 'dogs' in the BCG matrix, as they consume capital without delivering proportional financial returns.

For instance, if a facility's cost per gram produced remains significantly higher than industry benchmarks or the company's own efficient facilities, it represents a drag on profitability. Such inefficiencies can stem from outdated technology, suboptimal labor allocation, or poor supply chain management. Ayr Wellness's 2024 financial reports will likely detail capital expenditures and operational costs across its various sites, providing insight into which facilities may require optimization or divestment.

- Operational Inefficiencies: Facilities with higher-than-average production costs per unit.

- Capital Tie-up: Operations consuming resources without generating adequate returns.

- Market Pressure: Increased competition or pricing challenges exacerbating the impact of inefficient production.

- Strategic Review: Potential for restructuring, investment in upgrades, or divestment of underperforming assets.

AYR Wellness's 'dogs' likely represent segments with low market share in slow-growing or declining product categories, or underperforming retail locations. These areas consume resources without generating substantial returns, potentially dragging down overall profitability. Identifying and addressing these 'dogs' is crucial for optimizing capital allocation and focusing on growth opportunities.

For example, a specific line of cannabis edibles that saw a 30% sales drop in 2023 and a decline in market share from 5% to 2% would be a prime candidate for the 'dog' classification. Similarly, retail dispensaries in less strategic locations with low foot traffic and sales volume, especially those not aligned with AYR's core vertical integration strategy, would also fit this category.

These 'dog' assets, whether product lines or physical locations, may require strategic decisions such as divestment or significant operational restructuring. The goal is to free up capital and management focus for higher-potential ventures within the AYR portfolio.

The cannabis industry's ongoing price compression, with retail prices for flower decreasing by 10-20% year-over-year in 2023, further squeezes margins in these underperforming segments, making them even less attractive.

| AYR Wellness Potential 'Dog' Segments (Illustrative) | Market Share | Growth Rate | Profitability | Strategic Fit |

|---|---|---|---|---|

| Legacy Edible Product Line | 2% (declined from 5%) | Declining | Low/Negative | Low |

| Underperforming Retail Dispensary (State X) | Negligible | Low | Breakeven/Loss | Poor |

| Niche Topical Product | 1% | Stagnant | Low | Low |

Question Marks

Virginia represents a nascent market for AYR Wellness, falling into the Question Mark category of the BCG Matrix. The company's recent conditional approval as a pharmaceutical processor in Health Service Area 1, a region with about 1.5 million residents, signifies a substantial opportunity for growth.

Despite this potential, AYR Wellness currently possesses a minimal market share in Virginia as it establishes its operational footprint. This new market requires significant capital investment to develop its infrastructure and build a competitive position.

AYR Wellness is positioned as a question mark in New York due to its minority stake in a conditionally approved medical cannabis operation. New York represents a significant growth opportunity, with the state projected to generate billions in cannabis sales annually once fully operational. However, AYR's current influence is limited by its ownership percentage and the nascent stage of the market's development.

AYR Wellness's expansion into developing markets, such as Illinois, places its new dispensaries squarely in the question mark quadrant of the BCG matrix. These ventures represent potential high growth, but currently hold a low market share. For instance, Illinois cannabis sales reached approximately $1.5 billion in 2023, indicating a robust market, yet AYR's new locations are just beginning to capture a piece of this.

New Product Category Penetration

New product category penetration for Ayr, as a component of the BCG Matrix, represents their ventures into emerging CPG segments. These new offerings, such as specialized edibles or innovative beverage formats, will naturally start with a low market share despite targeting high-growth areas.

Significant investment in marketing and consumer education is crucial for these products to build awareness and achieve widespread adoption. For instance, in 2024, the U.S. cannabis market saw continued growth, with the edibles segment showing particular promise, indicating potential for new product formats to capture market share with the right strategy.

- Low Initial Market Share: New product categories, by definition, begin with a small footprint in the market.

- High Growth Market Targeting: These products are strategically aimed at segments experiencing rapid expansion.

- Significant Investment Required: Substantial capital is needed for marketing, distribution, and consumer education.

- Potential for Future Growth: Successful penetration can lead to significant market share gains and profitability.

Leveraging New Cultivation Capacity for Market Share

Ayr Wellness's substantial investment in its new Florida indoor cultivation facility is a strategic move to bolster its supply chain. However, this increased capacity presents a "question mark" within the BCG framework until it effectively translates into increased market share and profitability.

The challenge lies in efficiently absorbing this new supply and converting it into sales that outpace competitors. Without this conversion, the significant capital expenditure risks diluting returns and hindering AYR's path to market leadership.

- Florida Facility Investment: AYR has made significant capital investments in its Florida indoor cultivation operations.

- Supply Increase: This expansion dramatically increases AYR's product supply in a key market.

- Market Share Goal: The primary objective is to leverage this new capacity to capture greater market share.

- Profitability Uncertainty: Until sales growth fully justifies the investment, the facility's ROI and market impact remain uncertain, classifying it as a 'question mark'.

Question Marks in AYR Wellness's portfolio represent ventures into high-growth markets where the company currently holds a small market share. These initiatives demand significant investment to build brand presence and operational capacity.

Examples include AYR's entry into Virginia, a developing market with substantial growth potential, and its minority stake in New York's burgeoning cannabis industry. In both instances, AYR is investing to capture future market share.

The company's expansion into new product categories and its increased cultivation capacity in Florida also fall into this quadrant, requiring strategic marketing and sales efforts to convert investment into market leadership.

| Venture | Market Growth Potential | AYR Market Share | Investment Focus | Outlook |

|---|---|---|---|---|

| Virginia Operations | High | Low | Infrastructure, Operations | High Growth Potential, Requires Capital |

| New York Stake | Very High | Low (Minority) | Market Development, Brand Building | Significant Future Revenue Potential |

| New Product Categories | High | Low | Marketing, Consumer Education | Dependent on Adoption and Strategy |

| Florida Cultivation Facility | High | Targeting Increase | Supply Chain, Sales Conversion | Uncertain ROI Until Sales Growth |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from company financial filings, market research reports, and industry growth forecasts to provide a clear strategic overview.