Axis Capital Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

Uncover the critical political, economic, and technological forces shaping Axis Capital Holdings's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and anticipate future challenges. Download the full version now for a strategic advantage.

Political factors

AXIS Capital navigates a complex web of regulations across key operating regions like Bermuda, the US, and the UK. These jurisdictions, overseen by bodies such as the Bermuda Monetary Authority and various US state insurance commissioners, mandate distinct compliance standards that directly influence business operations.

The financial impact of these regulatory demands is substantial, with AXIS Capital incurring significant annual international regulatory compliance costs. These expenses, estimated to be in the tens of millions of dollars annually, necessitate careful strategic planning and directly affect the company's bottom line and capital allocation decisions.

AXIS Capital Holdings, operating globally, faces significant geopolitical risk exposure, impacting its underwriting and the broader political risk premium. Instability in key operational regions necessitates constant vigilance and adaptable strategies.

The ongoing conflict in the Middle East and the protracted war in Ukraine are explicitly identified by AXIS as potential drivers of unforeseen losses, underscoring the direct financial implications of these geopolitical events on the company's performance.

Governmental support is a significant driver for the energy transition, directly influencing the renewable energy sector where Axis Capital Holdings operates. Policies like tax credits, subsidies, and favorable regulations for renewable energy projects are crucial for sustained growth and risk mitigation. For instance, the Inflation Reduction Act in the United States, enacted in 2022, provides substantial incentives for clean energy development, projecting billions in new investment through 2030.

The level of this backing is essential for expanding renewable energy technologies and addressing climate-related risks. In 2024, global investment in the energy transition reached an estimated $2 trillion, with a significant portion driven by government initiatives and policy frameworks aimed at decarbonization and energy security.

Taxation Policy Changes

Changes in corporate income tax rates significantly impact Axis Capital Holdings' profitability. For example, Bermuda's introduction of a 15% corporate income tax rate, effective January 1, 2025, will directly influence the company's overall effective tax rate. These policy shifts require careful financial planning and can affect strategic investment decisions.

The company must adapt its financial strategies to account for varying tax landscapes across its global operations. This includes optimizing its tax structure to mitigate potential negative impacts from new or revised tax legislation in key markets.

- Bermuda's 15% corporate income tax rate effective January 1, 2025

- Impact on Axis Capital's effective tax rate

- Necessity for adjusted financial planning

- Potential influence on investment decisions

Trade Tensions and Market Volatility

Escalating trade tensions, particularly between major economies, can significantly disrupt global supply chains and currency markets, creating economic headwinds that directly impact the insurance industry. This political factor contributes to heightened market uncertainty, potentially tempering premium growth as businesses scale back investments or face increased operational costs. For instance, the ongoing trade disputes have led to increased volatility in commodity prices, affecting insured values and claims costs for property and casualty insurers.

These trade-related uncertainties can temper premium growth, requiring insurers like AXIS Capital to navigate a more complex and potentially less predictable business environment. The International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected a slowdown in global growth, partly attributing it to persistent trade frictions. This environment necessitates robust risk management strategies to mitigate the impact of sudden market shifts on underwriting and investment portfolios.

- Tariff Impact: Increased tariffs on goods can lead to higher replacement costs for insured assets, potentially increasing claims payouts for property and casualty lines.

- Currency Fluctuations: Trade disputes often trigger currency volatility, impacting the value of international investments and the cost of reinsurance sourced from overseas markets.

- Reduced Global Trade: A slowdown in international trade can decrease demand for trade credit insurance and marine insurance products.

- Economic Uncertainty: Heightened geopolitical risk associated with trade tensions can lead to a general "risk-off" sentiment among investors, affecting the performance of insurers' investment portfolios.

Governmental support significantly bolsters the renewable energy sector, a key area for Axis Capital Holdings. Policies like the Inflation Reduction Act in the US, enacted in 2022, are projected to drive billions in clean energy investment through 2030. In 2024, global energy transition investments reached approximately $2 trillion, with government initiatives playing a crucial role in decarbonization efforts.

Changes in corporate tax rates directly impact Axis Capital's profitability. Bermuda's introduction of a 15% corporate income tax, effective January 1, 2025, will alter the company's effective tax rate, necessitating adjustments in financial planning and potentially influencing investment strategies.

Escalating trade tensions create economic headwinds by disrupting supply chains and currency markets, impacting the insurance industry. The IMF's October 2024 World Economic Outlook cited persistent trade frictions as a factor in projected global growth slowdown, underscoring the need for robust risk management.

| Political Factor | Impact on Axis Capital | Supporting Data/Example |

|---|---|---|

| Governmental Support for Renewables | Drives investment and growth in the renewable energy sector. | US Inflation Reduction Act (2022) projecting billions in clean energy investment through 2030. Global energy transition investment reached ~$2 trillion in 2024. |

| Corporate Tax Rate Changes | Affects profitability and influences financial planning. | Bermuda's 15% corporate income tax effective January 1, 2025. |

| Trade Tensions | Increases economic uncertainty, disrupts supply chains, and affects currency markets. | IMF's October 2024 WEO cited trade frictions impacting global growth. |

What is included in the product

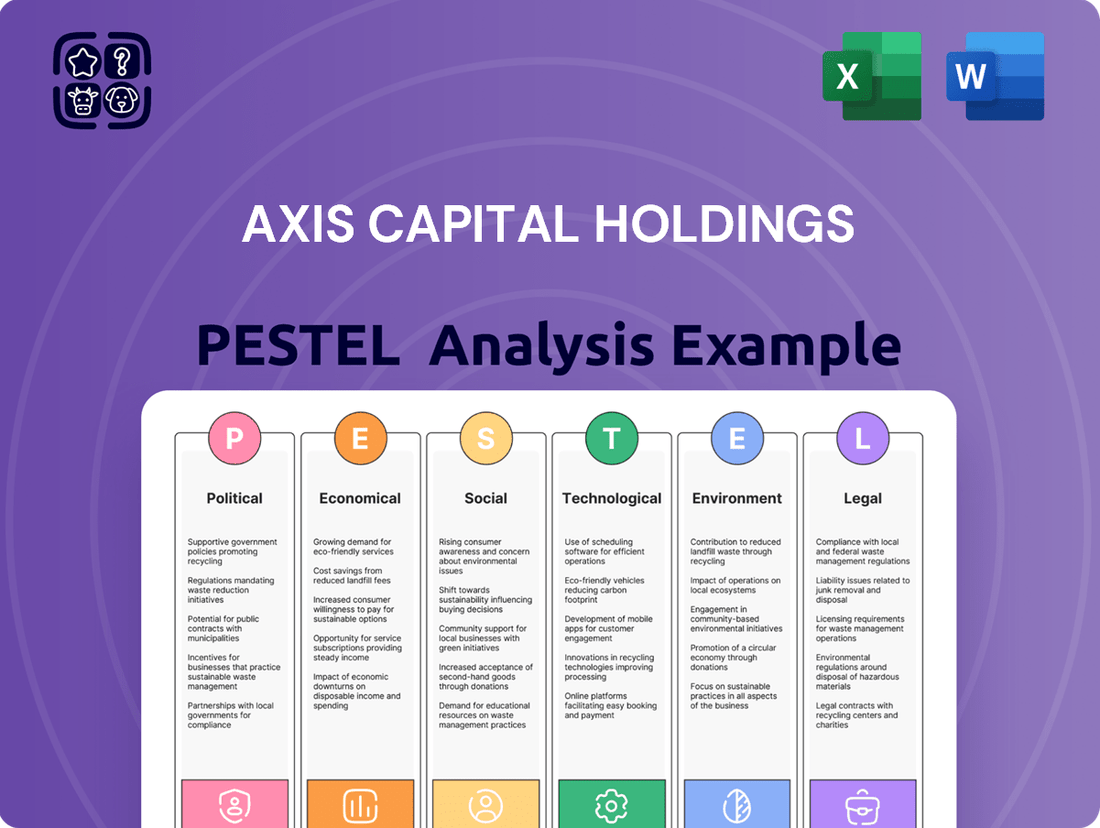

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Axis Capital Holdings, providing a comprehensive understanding of its operating landscape.

It offers actionable insights to navigate external challenges and leverage emerging opportunities for strategic advantage.

Axis Capital Holdings' PESTLE analysis offers a structured framework to identify and mitigate external threats, acting as a pain point reliever by providing proactive insights for strategic decision-making.

Economic factors

Axis Capital Holdings' financial health is intrinsically linked to the ebb and flow of global economic cycles. Periods of financial market volatility can significantly impact the company's revenue streams and net income, as investment income plays a crucial role in its overall profitability. For instance, during 2024, a notable slowdown in fixed-income markets, with the Bloomberg U.S. Aggregate Bond Index seeing a modest gain of approximately 3.5% year-to-date as of mid-year, could present challenges.

However, Axis Capital's strategy of diversifying into alternative investments offers a potential buffer. Stronger performance in these alternative asset classes, which often exhibit lower correlation to traditional markets, can help offset any downturns in fixed maturity income. This strategic allocation is designed to provide a more resilient financial performance, even amidst broader market uncertainties prevalent in the 2024-2025 economic outlook.

Elevated interest rates present a dual-edged sword for insurers like Axis Capital Holdings. While higher rates can significantly boost investment yields, particularly on their substantial fixed maturity portfolios, they can also impact the valuation of existing bond holdings. For Axis Capital, this means a closer look at their net investment income, which directly benefits from increased yields on new and maturing investments.

In the current economic climate, the book yield and market yield on Axis Capital's fixed maturities are critical metrics. As of the first quarter of 2024, the average yield on Axis Capital's fixed maturity portfolio has shown an upward trend, reflecting the higher interest rate environment. This trend is a positive indicator for the company's investment performance, directly contributing to its overall profitability.

Social inflation, driven by increased jury awards and broader definitions of liability, is significantly impacting casualty reinsurance. This trend has led to substantial, often double-digit, rate increases across various casualty lines. For instance, in 2024, casualty reinsurance rates saw significant upward pressure, particularly in sectors like directors and officers (D&O) liability and auto liability, reflecting the escalating claims costs.

The rise in litigation frequency and severity necessitates a close watch on evolving legal precedents and claimant behaviors. Insurers and reinsurers must proactively implement strategies to manage these growing claims costs. This includes refining underwriting practices and exploring coverage enhancements to better address the financial implications of social inflation, which has been a persistent factor in the market throughout 2024 and into early 2025.

Capacity and Pricing Trends in Reinsurance Market

The reinsurance market in 2024 and early 2025 is characterized by a divergence in pricing. Property catastrophe reinsurance is experiencing rate softening, a direct result of substantial available capacity from reinsurers. This oversupply puts downward pressure on prices for property-related risks.

Conversely, casualty reinsurance continues to see upward price momentum. This trend is driven by ongoing concerns regarding social inflation, increased litigation costs, and the persistent need for reinsurers to build adequate reserves for long-tail liabilities. For a company like AXIS Capital, which operates in both insurance and reinsurance, navigating these contrasting market forces is crucial.

- Property Reinsurance: Rates are declining due to ample capacity.

- Casualty Reinsurance: Prices are rising, influenced by social inflation and litigation trends.

- AXIS Capital's Strategy: Requires tailored underwriting approaches for each segment to ensure profitability amidst these differing dynamics.

Demand for Specialty Insurance

The demand for specialty insurance is surging, with the market showing stronger growth than traditional insurance sectors. This expansion is fueled by increasing needs for sophisticated risk management and the rise of new industries with unique exposure profiles.

AXIS Capital is well-positioned to capitalize on this trend, aiming to broaden its offerings in specialized areas. Key growth drivers include addressing risks associated with cyber threats and the escalating impacts of climate change, both of which require tailored insurance solutions.

- Specialty insurance market growth: Projections indicate the global specialty insurance market will continue its upward trajectory, with some segments expected to grow at a compound annual growth rate (CAGR) of over 7% through 2025.

- Cyber insurance demand: The cyber insurance market alone is anticipated to reach premiums of $20 billion by 2025, reflecting a significant increase driven by rising cyberattack frequency and severity.

- Climate-related risks: Insurers are increasingly developing products for climate-related perils, such as parametric insurance for extreme weather events, demonstrating a clear market shift towards specialized coverage.

Economic factors significantly shape Axis Capital Holdings' performance, with interest rate movements and market volatility being key drivers. Elevated interest rates, as seen in early 2024, boost investment yields on new fixed-income assets, positively impacting net investment income. However, this environment also presents challenges in managing the valuation of existing bond portfolios.

The divergence in reinsurance pricing between property and casualty lines is a critical economic consideration. Property catastrophe reinsurance rates are softening due to ample capacity, while casualty reinsurance rates are rising, driven by social inflation and litigation trends. This creates a complex operating landscape for Axis Capital.

The demand for specialty insurance is outperforming traditional sectors, offering growth opportunities. AXIS Capital's strategic focus on areas like cyber and climate-related risks aligns with this trend, as these specialized markets are projected for robust growth through 2025.

| Economic Factor | Impact on Axis Capital | Relevant Data (2024-2025 Outlook) |

|---|---|---|

| Interest Rate Environment | Boosts investment yields on new fixed-income assets; potential pressure on existing bond valuations. | Average yield on fixed maturities showing upward trend in Q1 2024. |

| Market Volatility | Affects revenue streams and net income, particularly investment income. | Bloomberg U.S. Aggregate Bond Index saw modest gains in early 2024. |

| Reinsurance Pricing Trends | Property catastrophe rates softening; casualty rates increasing due to social inflation. | Casualty reinsurance rates saw significant upward pressure in 2024 across various lines. |

| Specialty Insurance Demand | Growing demand for sophisticated risk management solutions. | Global specialty insurance market projected to grow at over 7% CAGR through 2025; Cyber insurance market to reach $20 billion by 2025. |

Preview the Actual Deliverable

Axis Capital Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Axis Capital Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping Axis Capital Holdings' operations and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element, offering a robust framework for understanding the company's business environment.

Sociological factors

The specialty accident and health insurance market is significantly shaped by evolving workforce dynamics and the relentless rise in healthcare costs. As companies grapple with providing competitive benefits, there's a growing need for flexible and supplementary coverage options.

In 2024 and projected into 2025, the trend of employers seeking to offload some healthcare cost burden continues. This dynamic creates opportunities for insurers like AXIS Capital to offer tailored accident and health products that complement traditional employer-sponsored plans, addressing gaps in coverage and providing financial protection against unexpected medical expenses.

Customers increasingly expect insurance policies that precisely match their unique risks, moving away from one-size-fits-all approaches. This shift is particularly evident in specialty insurance, where clients need coverage for emerging or niche sectors.

AXIS Capital must therefore provide highly customized solutions. For instance, offering specialized policies for the burgeoning cannabis industry, which faced significant underwriting challenges and evolving regulations through 2024, or for the rapidly expanding renewable energy sector, requiring coverage for complex project risks and supply chain disruptions, is crucial for retaining market share.

Societies are increasingly aware of intricate risks like cybersecurity breaches and the escalating impact of climate change. This heightened consciousness directly fuels a demand for specialized insurance solutions that can effectively cover these emerging threats.

AXIS Capital, with its strategic emphasis on specialty insurance, is well-positioned to capitalize on this trend. The company can develop and offer tailored products designed to address the complexities of these evolving risk landscapes.

For instance, the global cyber insurance market was projected to reach $10.5 billion in 2023 and is expected to grow significantly. Similarly, insured losses from natural catastrophes in 2024 are anticipated to remain elevated, underscoring the need for sophisticated risk transfer mechanisms that AXIS Capital provides.

Social Inflation and Litigation Trends

Social inflation, a phenomenon characterized by rising insurance claim costs driven by societal shifts like increased litigation and larger jury verdicts, presents a significant challenge for the casualty insurance sector. AXIS Capital, especially within its reinsurance operations, must meticulously factor these evolving trends into its underwriting strategies and the establishment of adequate reserves.

The impact of social inflation is evident in the growing size of jury awards. For instance, median jury awards in large commercial liability cases have shown an upward trend. While specific 2024/2025 data is still emerging, historical patterns indicate continued pressure. This necessitates a proactive approach from reinsurers like AXIS to manage potential volatility.

- Increased Litigation Frequency: A greater propensity for lawsuits across various sectors, including product liability and general liability, fuels higher claim volumes.

- Larger Jury Awards: Juries are awarding larger sums, particularly in cases involving catastrophic injuries or perceived corporate negligence, driving up the cost per claim.

- Expanded Definitions of Damages: There's a trend towards broader interpretations of what constitutes compensable damages, including emotional distress and punitive damages.

- Social Media Influence: Public perception and sentiment, often amplified by social media, can influence jury decisions and settlement negotiations.

Mental Health and Well-being in the Workplace

Axis Capital Holdings recognizes the increasing societal emphasis on mental health and well-being, a trend reflected in initiatives like the AXIS/Harris Poll Mental Health in Insurance Survey. This heightened awareness directly impacts how companies attract and retain talent, as employees increasingly prioritize supportive work environments.

The growing importance of mental well-being in the workplace presents both challenges and opportunities for Axis Capital. Companies that actively foster a mentally healthy culture are better positioned to attract top talent and reduce employee turnover, which can lead to significant cost savings and improved productivity.

- Societal Shift: A growing public discourse around mental health means employers are increasingly scrutinized for their support systems.

- Talent Attraction: Companies with robust mental health programs are more appealing to a wider pool of potential employees.

- Retention Impact: High employee well-being correlates with lower attrition rates, saving companies on recruitment and training costs.

- Industry Benchmarking: Participation in surveys like the AXIS/Harris Poll indicates a move towards industry-wide best practices in employee care.

Societal awareness of emerging risks, such as cybersecurity and climate change, directly drives demand for specialized insurance. AXIS Capital is positioned to offer tailored products for these evolving threats, with the global cyber insurance market projected for significant growth and elevated natural catastrophe losses anticipated through 2025.

Social inflation, marked by increased litigation and larger jury awards, significantly impacts casualty insurance. AXIS Capital's reinsurance operations must account for these trends, as median jury awards in large commercial liability cases have historically shown an upward trajectory, necessitating proactive risk management.

The growing emphasis on mental health and well-being influences corporate culture and talent management. Companies prioritizing employee well-being, as highlighted by initiatives like the AXIS/Harris Poll Mental Health in Insurance Survey, are better positioned for talent attraction and retention, impacting operational costs and productivity.

Technological factors

Axis Capital Holdings is significantly investing in AI and emerging technologies as a core component of its strategy to boost operational efficiency and profitable growth. These technological advancements are central to their 'How We Work' program, which aims to refine processes and reduce overheads, such as general and administrative expense ratios.

The company's proactive adoption of AI is geared towards enhancing underwriting capabilities and streamlining overall business operations. This strategic technological push is designed to yield tangible benefits in efficiency and cost management, contributing to a stronger financial performance in the competitive insurance landscape.

The specialty insurance sector is increasingly prioritizing data-driven underwriting and expanding its digital footprint through sophisticated e-trade platforms. This technological shift allows insurers to refine risk assessments and broaden customer access.

AXIS Capital is well-positioned to capitalize on these trends, enhancing its digital distribution capabilities for swifter market penetration. The company can also harness these advancements to bolster its underwriting intelligence, leading to more informed and efficient decision-making.

For instance, in 2024, the global insurtech market was projected to reach over $100 billion, with a significant portion dedicated to AI and data analytics for underwriting. This underscores the substantial opportunity for companies like AXIS to gain a competitive edge through technology.

The escalating frequency and sophistication of cyberattacks are a primary catalyst for the specialty insurance sector, fueling a surge in demand for cyber insurance and coverage for technology-related risks. AXIS Capital, operating as a specialty insurer, is strategically situated to leverage this burgeoning market opportunity.

The global cyber insurance market, projected to reach $34.2 billion by 2026, highlights the substantial growth driven by these evolving threats. For instance, ransomware attacks alone cost businesses an estimated $20 billion in 2023, underscoring the critical need for robust protection.

Modernization of Underwriting Platforms

The insurance industry is rapidly moving beyond older, less flexible systems to adopt Delegated Underwriting Platforms (DUPs). These modern platforms are designed for greater agility and scalability, which is essential for keeping pace with market demands. AXIS Capital's commitment to modernizing its underwriting processes is a key strategic move in this technological shift.

By integrating emerging technologies, AXIS Capital enhances its ability to manage vast amounts of data, ensure regulatory compliance, and implement real-time, data-driven pricing strategies. This modernization directly impacts operational efficiency and competitive positioning. For instance, in 2024, the global insurtech market was valued at approximately $11.4 billion, with a significant portion driven by advancements in underwriting technology.

Key benefits of this modernization include:

- Improved Data Handling: Advanced platforms can process and analyze data more efficiently, leading to better risk assessment.

- Enhanced Compliance: Modern systems are built with regulatory requirements in mind, simplifying adherence.

- Real-time Pricing: Leveraging data analytics allows for dynamic and accurate pricing, crucial in fluctuating markets.

- Scalability: DUPs offer the flexibility to scale operations up or down as business needs change.

Data Analytics for Risk Assessment

Advanced data analytics and sophisticated modeling are becoming indispensable for precise risk assessment within the specialty insurance and reinsurance sectors. AXIS Capital's capacity to process and interpret extensive datasets allows for a more nuanced understanding and accurate pricing of intricate risks, especially those stemming from evolving climate patterns and novel, unforeseen threats.

The integration of these analytical capabilities directly impacts underwriting profitability and capital allocation. For instance, the specialty insurance market saw a significant increase in data-driven underwriting adoption throughout 2024, with many firms reporting improved loss ratios by up to 5% through enhanced predictive modeling.

- Enhanced Risk Modeling: Leveraging AI and machine learning to identify and quantify emerging risks, such as cyber threats and parametric insurance triggers.

- Climate Change Impact: Analyzing vast datasets to better predict and price the financial implications of extreme weather events, a growing concern for insurers.

- Underwriting Efficiency: Streamlining the risk assessment process, leading to faster quote generation and more competitive pricing for complex commercial policies.

Axis Capital Holdings is actively embracing technological advancements, particularly in AI and data analytics, to enhance its underwriting precision and operational efficiency. This focus is evident in their investment in modern Delegated Underwriting Platforms (DUPs), which are crucial for agility and scalability in the dynamic specialty insurance market.

The company's strategic adoption of these technologies aims to improve data handling, ensure regulatory compliance, and enable real-time, data-driven pricing. For example, the global insurtech market, projected to exceed $100 billion in 2024, highlights the significant opportunities in AI-driven underwriting.

The increasing frequency of cyberattacks is a major driver for specialty insurance, fueling demand for cyber coverage. Axis Capital is positioned to capitalize on this trend, with the global cyber insurance market expected to reach $34.2 billion by 2026, demonstrating the critical need for advanced risk assessment technologies.

By integrating sophisticated modeling, Axis Capital can better assess complex risks, including those related to climate change and emerging threats. This data-driven approach is key to improving underwriting profitability, with firms in 2024 reporting up to a 5% improvement in loss ratios through enhanced predictive modeling.

| Technology Focus | Market Projection (2024/2025) | Axis Capital Impact |

|---|---|---|

| AI & Data Analytics | Global Insurtech Market: >$100 Billion | Enhanced underwriting, operational efficiency |

| Cybersecurity | Global Cyber Insurance Market: ~$30 Billion (2025 est.) | Increased demand for specialized coverage |

| Delegated Underwriting Platforms (DUPs) | N/A (Industry Shift) | Improved agility, scalability, and real-time pricing |

Legal factors

Axis Capital Holdings, like many global insurers, navigates a labyrinth of international regulatory frameworks. Key examples include Solvency II in the European Union, which dictates capital requirements and risk management, and the Dodd-Frank Act in the United States, impacting financial stability and consumer protection.

Adherence to these diverse and often evolving regulations imposes substantial compliance costs, estimated to be in the tens of millions annually for large global insurers. These costs directly influence operational strategies, requiring significant investment in technology, personnel, and internal controls across Axis Capital's worldwide operations.

The complexity of these frameworks can also impact product development and market entry strategies, as each jurisdiction may have unique requirements for insurance products and services. For instance, data privacy regulations like GDPR in Europe add another layer of compliance that affects how Axis Capital handles customer information globally.

The evolving legal landscape, particularly shifts in tort law and litigation trends, directly impacts AXIS Capital's exposure to claims and the adequacy of its reserves, especially within its casualty insurance lines. For instance, a rise in social inflation, which can lead to larger jury awards and increased settlement demands, presents a significant challenge. AXIS Capital actively monitors these developments, as seen in their financial reporting where they discuss reserve adequacy in light of changing legal environments.

Axis Capital Holdings, like all financial institutions, faces a complex web of data privacy and cybersecurity regulations globally. As technology adoption accelerates, particularly in areas like AI-driven underwriting and digital client onboarding, the company must navigate evolving laws such as the EU's General Data Protection Regulation (GDPR) and various state-level privacy acts in the US. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Maintaining robust cybersecurity measures is paramount to protect sensitive client data, including financial details and personal information. The increasing sophistication of cyber threats means Axis Capital must continuously invest in advanced security protocols and employee training to prevent breaches. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the substantial financial and reputational risks associated with inadequate cybersecurity defenses.

Tax Law Changes in Operating Jurisdictions

Changes in tax laws within operating jurisdictions, such as Bermuda's introduction of a 0% corporate income tax rate effective from January 1, 2024, directly influence AXIS Capital Holdings' effective tax rate and overall profitability. This new tax regime requires the company to continually assess and adapt its financial and operational strategies to ensure ongoing compliance and to maintain an optimized tax position. For instance, while Bermuda itself has a 0% rate, other key operating locations might see adjustments. The company's ability to navigate these evolving tax landscapes is crucial for sustained financial performance.

AXIS Capital must remain agile in its financial planning to account for potential shifts in global tax regulations. For example, ongoing discussions around international tax harmonization, particularly concerning digital services taxes or minimum corporate tax rates, could present future challenges or opportunities. The company's proactive approach to tax management, including strategic structuring and diligent compliance, is paramount. This includes staying abreast of legislative developments that could affect its tax liabilities across its diverse portfolio of operations.

- Bermuda's 0% Corporate Income Tax Rate: Implemented January 1, 2024, this significantly impacts AXIS Capital’s tax structure in its home jurisdiction.

- Global Tax Reform Scrutiny: Continued international focus on tax fairness and minimum global tax rates could lead to future regulatory adjustments affecting multinational insurers.

- Jurisdictional Tax Rate Variations: AXIS Capital operates in numerous countries, each with its own unique and potentially changing tax laws, necessitating constant monitoring and adaptation.

- Impact on Effective Tax Rate: Changes in any key operating jurisdiction’s tax laws can directly alter AXIS Capital's consolidated effective tax rate, influencing net income and shareholder returns.

Insurance Holding Company Laws and Regulations

As an insurance holding company, AXIS Capital's U.S. subsidiaries operate under a complex web of state-specific insurance holding company laws. These regulations are designed to protect policyholders by ensuring the financial soundness and proper management of insurance groups. For instance, in 2024, states like New York and California continued to enforce stringent registration requirements for insurance holding companies, mandating the disclosure of material transactions and significant changes in control.

These laws typically necessitate the filing of detailed financial statements, business plans, and information about the ultimate controlling person with domestic state insurance departments. This oversight allows regulators to assess the potential impact of transactions within the holding company structure on the solvency and operational integrity of the insurance entities. AXIS Capital, like its peers, must navigate these varying state requirements, which can include pre-approval for certain intercompany transactions and examinations of the holding company’s financial condition.

Key aspects of these regulations often include:

- Registration Requirements: Holding companies must register with the insurance department in the state where their principal insurance subsidiaries are domiciled.

- Filing Obligations: Regular filings of financial statements, annual reports, and disclosures of material transactions are mandatory.

- Regulatory Oversight: State insurance departments have the authority to review and approve or disapprove significant transactions that could affect an insurer's financial stability.

- Group Supervision: These laws enable regulators to supervise the entire insurance group, not just individual entities, to ensure overall financial health.

Axis Capital Holdings operates within a dynamic legal environment, subject to evolving insurance regulations globally. For instance, Solvency II in the EU and Dodd-Frank in the US impose strict capital and risk management requirements, driving significant annual compliance costs, often in the tens of millions for large insurers.

Data privacy laws like GDPR and various US state privacy acts necessitate robust cybersecurity measures, with GDPR fines potentially reaching 4% of global annual revenue. The projected $10.5 trillion global cost of cybercrime by 2025 underscores the critical need for investment in security protocols and training.

Changes in tax laws, such as Bermuda's 0% corporate income tax rate effective January 1, 2024, directly impact Axis Capital's effective tax rate and profitability, requiring continuous strategic adaptation.

Furthermore, state-specific insurance holding company laws in the US mandate detailed filings and regulatory oversight, influencing intercompany transactions and overall group financial health, with states like New York and California enforcing stringent registration requirements in 2024.

Environmental factors

Climate change is a major concern for Axis Capital, as it directly correlates with a rise in both the frequency and intensity of natural disasters. This trend poses a significant challenge to the company's risk management and underwriting processes.

Axis Capital has openly acknowledged its vulnerability to escalating natural catastrophe losses. The unpredictable nature of these events, from hurricanes to wildfires, necessitates constant adaptation of their reinsurance strategies to mitigate potential financial impacts.

For instance, the insurance industry, including players like Axis Capital, experienced substantial insured losses from natural catastrophes in 2023, estimated to be around $110 billion globally, according to Swiss Re. This figure underscores the growing financial exposure driven by climate-related events.

Axis Capital Holdings is actively participating in the global shift towards cleaner energy sources. The company offers specialized insurance products designed to cover the unique risks involved in renewable energy projects, such as wind farms and solar installations. This strategic focus supports the development of a low-carbon economy.

Demonstrating this commitment, Axis Capital underwrites through initiatives like AXIS Energy Transition Syndicate 2050. This syndicate specifically targets risks associated with emerging energy technologies and lower-carbon alternatives, reflecting a proactive approach to the evolving energy landscape.

Climate-related weather events present a significant risk to AXIS Capital's physical assets, directly impacting the properties they insure and reinsure. These events also indirectly disrupt broader business operations, creating a dual threat to the company's stability.

AXIS Capital has experienced substantial pre-tax losses stemming from catastrophe and weather-related incidents. For instance, in the first quarter of 2024, the company reported net unfavorable prior period development of $10 million, with catastrophe losses of $25 million, a portion of which was attributed to weather events.

ESG Investment Considerations

Axis Capital Holdings actively incorporates sustainability and environmental factors into its investment due diligence. This approach is demonstrated by their significant investments, particularly in the energy transition and infrastructure sectors, aligning with broader Environmental, Social, and Governance (ESG) principles.

The company's commitment to ESG is further evidenced by its strategic allocation of capital. For instance, in 2024, Axis Capital announced plans to invest $500 million in renewable energy projects, aiming to support decarbonization efforts and capitalize on the growing green economy. This focus reflects a recognition of both the environmental imperative and the financial opportunities presented by sustainable development.

- Energy Transition Focus: Axis Capital is channeling substantial capital into projects that facilitate the shift towards cleaner energy sources.

- Infrastructure Development: Investments extend to infrastructure crucial for supporting sustainable practices and technologies.

- ESG Integration: Sustainability considerations are a core component of their investment evaluation and decision-making processes.

- Financial Commitment: The company has made concrete financial commitments, such as the $500 million allocation to renewable energy in 2024, underscoring their dedication to environmental objectives.

Greenhouse Gas Emissions Reduction Targets

Axis Capital Holdings is actively addressing climate change by setting ambitious greenhouse gas (GHG) emissions reduction targets. The company has committed to a science-based target of a 50% absolute reduction in Scope 1 and 2 GHG emissions by 2030, measured against a 2019 baseline. This significant commitment underscores Axis Capital's dedication to minimizing its environmental impact across its global operations.

This proactive stance is crucial in the current financial landscape, where environmental, social, and governance (ESG) factors are increasingly influencing investment decisions and regulatory frameworks. By setting these targets, Axis Capital is aligning itself with global efforts to combat climate change and demonstrates a forward-thinking approach to sustainability.

- Science-Based Target: 50% absolute reduction of Scope 1 and 2 GHG emissions by 2030.

- Baseline Year: 2019.

- Scope: Global operations.

Axis Capital's environmental strategy is deeply intertwined with managing climate-related risks and capitalizing on the energy transition. The company's underwriting and investment decisions increasingly reflect a commitment to sustainability, aiming to mitigate exposure to natural catastrophes while supporting the growth of green industries.

The financial impact of climate events is significant, with global insured losses from natural catastrophes reaching approximately $110 billion in 2023. Axis Capital's proactive approach includes underwriting specialized insurance for renewable energy projects and investing in sustainable infrastructure, demonstrating a clear alignment with ESG principles.

Furthermore, Axis Capital has set ambitious targets to reduce its own environmental footprint, committing to a 50% absolute reduction in Scope 1 and 2 GHG emissions by 2030 against a 2019 baseline. This commitment highlights a dedication to operational sustainability alongside its business strategy.

| Environmental Factor | Impact on Axis Capital | Key Initiatives/Data |

|---|---|---|

| Climate Change & Natural Catastrophes | Increased risk of insured losses, necessitating adaptive reinsurance strategies. | Global insured losses from natural catastrophes estimated at $110 billion in 2023. |

| Energy Transition | Opportunity to underwrite new risks in renewable energy and invest in green infrastructure. | Underwriting through AXIS Energy Transition Syndicate 2050; $500 million investment planned for renewable energy projects in 2024. |

| Greenhouse Gas Emissions | Need to reduce operational environmental impact. | Commitment to a 50% absolute reduction in Scope 1 & 2 GHG emissions by 2030 (vs. 2019 baseline). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Axis Capital Holdings is built on a robust foundation of data from reputable financial news outlets, regulatory filings, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the global insurance and reinsurance market.