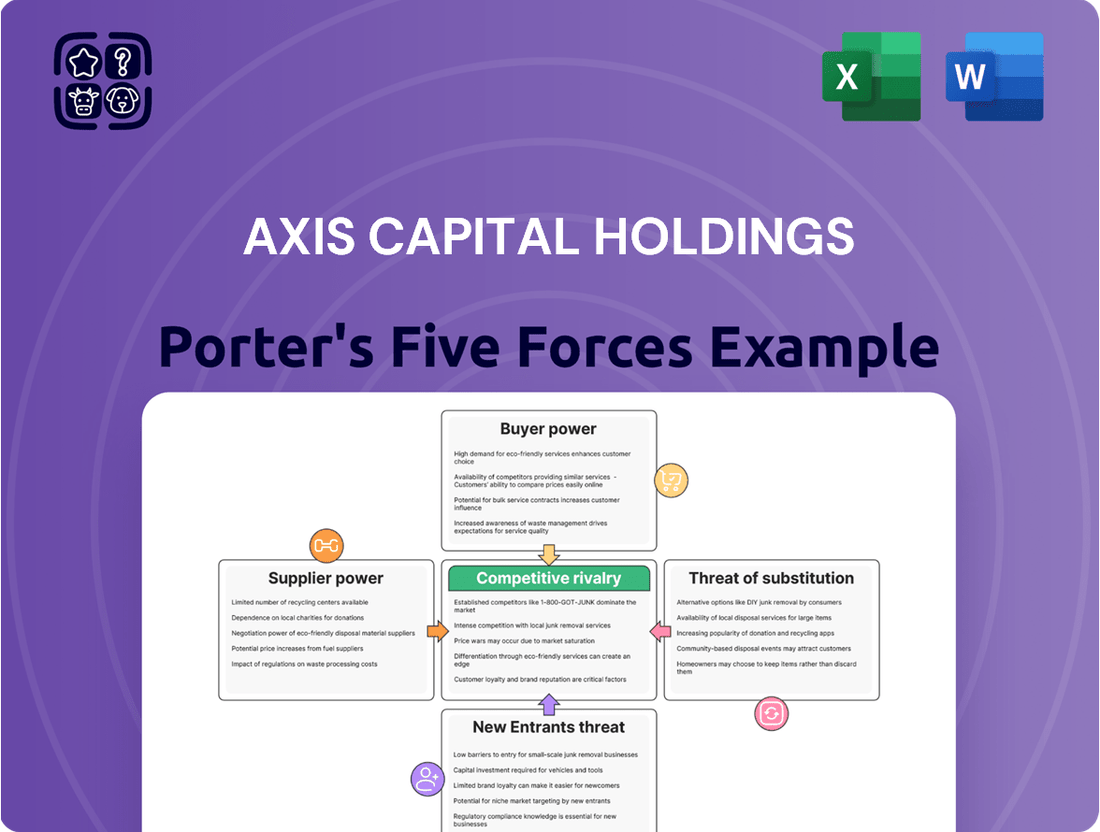

Axis Capital Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

Axis Capital Holdings operates in a market characterized by moderate buyer power and significant threat of substitutes, as our initial Porter's Five Forces analysis reveals. Understanding the intensity of these forces is crucial for navigating the competitive landscape. Unlock the full Porter's Five Forces Analysis to explore Axis Capital Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The global reinsurance market is expected to maintain stability through 2024 and 2025, bolstered by healthy operating profits and strong capital reserves. This stability is a key factor in understanding supplier power.

In 2024, the reinsurance sector saw record levels of capital. This surge was fueled by retained earnings and a significant increase in catastrophe bond issuances, indicating a plentiful supply of capital available to reinsurers.

With abundant capital readily available, the bargaining power of reinsurance suppliers is likely to be constrained. This ample supply suggests that reinsurers, like Axis Capital Holdings, may face less pressure from individual reinsurers seeking to dictate terms.

Axis Capital Holdings, like many in the insurance sector, is heavily investing in advanced analytics and artificial intelligence. This technological shift means a growing dependence on specialized data providers and AI tool developers. For instance, in 2024, the global AI in insurance market was projected to reach over $10 billion, highlighting the significant investment and reliance on these external technological capabilities.

This increasing reliance on sophisticated AI and data analytics platforms can bolster the bargaining power of the suppliers providing these crucial technologies. If Axis Capital finds itself dependent on a few key vendors for essential AI-driven underwriting or risk assessment tools, these suppliers could command higher prices or more favorable terms. For example, a vendor offering proprietary machine learning algorithms for fraud detection might hold significant leverage.

However, Axis Capital can mitigate this supplier power through strategic initiatives. By investing in internal AI development capabilities and fostering strategic partnerships with a diverse range of technology providers, the company can reduce its dependence on any single supplier. This approach allows for greater flexibility and negotiation strength when sourcing essential technological components, ensuring that the company’s operational efficiency is not unduly constrained by supplier leverage.

The availability of reinsurance capacity significantly influences supplier power. While property reinsurance rates are experiencing a softening trend, casualty reinsurance is projected to see substantial price hikes, potentially in the double digits for 2025. This divergence is largely attributed to persistent concerns surrounding social inflation and escalating litigation costs, directly impacting the pricing power of casualty reinsurers.

This dynamic pricing environment highlights how supplier power isn't uniform across all reinsurance lines. The overall reinsurance market, while stabilizing, is doing so at elevated levels compared to previous years. This suggests that reinsurers, as suppliers to primary insurers like Axis Capital, maintain a considerable, though perhaps not extreme, degree of bargaining power, especially in lines facing heightened risk and claims volatility.

Scarcity of Niche Expertise

The insurance sector, including companies like Axis Capital, is grappling with a significant talent deficit, especially for seasoned professionals adept at specialty underwriting and complex risk management. This scarcity directly fuels the bargaining power of niche experts.

Highly skilled underwriters, actuaries, and claims specialists command greater leverage due to the limited supply of individuals with their specialized knowledge. For instance, a 2024 report indicated that demand for experienced actuaries in specialized fields outstripped supply by over 20%.

- Scarcity of Senior Talent: The insurance industry faces a pronounced shortage of senior-level professionals with deep expertise in niche areas.

- Increased Underwriter Leverage: This talent gap empowers highly skilled underwriters and risk managers, allowing them to negotiate more favorable terms.

- Strategic Imperative for Axis Capital: Axis Capital must prioritize talent acquisition, development, and retention to secure essential specialized personnel.

- Impact on Costs: The need to attract and retain these scarce skills can lead to higher compensation costs, impacting profitability.

Broker Concentration and Influence

The concentration of brokers in the specialty insurance market significantly impacts Axis Capital's bargaining power. Large brokerage firms, by aggregating a substantial client base and possessing deep market insights, can exert considerable influence. This consolidation trend means a smaller number of major brokers manage a significant share of premium placements.

This concentration directly translates into increased bargaining power for these brokers. They become crucial suppliers of distribution services, and their ability to steer business towards or away from specific insurers like Axis Capital gives them leverage. For instance, in 2024, the top five global insurance brokers were projected to handle over 60% of commercial lines premiums, a figure underscoring their market dominance and ability to negotiate favorable terms.

- Broker Consolidation: The specialty insurance brokerage sector has seen significant mergers and acquisitions, leading to fewer, larger players.

- Aggregated Client Base: Large brokers represent a vast number of clients, giving them substantial volume and negotiation power.

- Market Knowledge: Their extensive experience and data provide them with critical insights into market pricing and conditions.

- Distribution Leverage: Brokers act as the gateway to customers, making their distribution services a key factor in an insurer's success.

The bargaining power of suppliers for Axis Capital Holdings is influenced by several factors, including the availability of reinsurance capital, the concentration of brokers, and the scarcity of specialized talent. While abundant capital in the reinsurance market in 2024 generally limits supplier power, the increasing reliance on specialized AI and data analytics providers presents a potential shift, as these tech vendors could hold significant leverage.

The concentration of brokers in the specialty insurance market, where the top five global brokers were projected to handle over 60% of commercial lines premiums in 2024, grants them substantial negotiation power. Furthermore, a talent deficit in the insurance sector, with demand for experienced actuaries in specialized fields outstripping supply by over 20% in 2024, empowers niche experts and increases compensation costs for companies like Axis Capital.

| Factor | Impact on Supplier Power | 2024/2025 Data/Trend |

|---|---|---|

| Reinsurance Capital Availability | Constrained Supplier Power | Record levels of capital in 2024; stable market outlook. |

| AI & Data Analytics Providers | Potentially Increased Supplier Power | Global AI in insurance market projected over $10 billion; growing reliance on specialized vendors. |

| Broker Concentration | Increased Supplier Power | Top 5 global brokers handling >60% of commercial lines premiums in 2024. |

| Talent Scarcity (Specialized Roles) | Increased Supplier Power | Demand for experienced actuaries outstripped supply by >20% in 2024. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Axis Capital Holdings's position in the reinsurance market.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, enabling proactive strategic adjustments.

Customers Bargaining Power

Axis Capital Holdings, as a provider of specialty insurance and reinsurance, faces significant bargaining power from its large clients. These clients, including major corporations, insurance companies, and government bodies, are sophisticated buyers who often possess substantial risk management expertise.

Their sheer size and the volume of business they represent give these large clients considerable leverage. For instance, in 2023, major insurance markets saw increased competition, allowing large buyers to demand more favorable pricing and terms from reinsurers like Axis Capital.

This negotiation power translates into pressure on profitability for Axis Capital, as these clients can often secure better rates or more tailored coverage by leveraging their market position and seeking multiple quotes.

Primary insurers, as key clients of Axis Capital's reinsurance arm, hold significant market knowledge. This allows them to effectively compare offerings and negotiate terms, particularly in a market where reinsurance capacity has grown and certain property catastrophe rates have eased.

With increased reinsurance capacity in 2024, primary insurers have more options, strengthening their bargaining position. For instance, in the property catastrophe reinsurance market, a softening of pricing in some segments means insurers can secure more favorable terms, directly impacting the profitability of reinsurers like Axis Capital.

Brokers are increasingly acting as a powerful conduit, aggregating demand from numerous clients and presenting it to specialty insurers and reinsurers. This collective voice significantly amplifies the bargaining power of the end customer. For instance, in 2024, the global insurance broker market was valued at approximately $75 billion, highlighting the substantial influence these intermediaries wield in shaping market dynamics and client negotiations.

By offering clients access to a wider array of options and fostering greater transparency in pricing and coverage, brokers empower individuals and businesses to negotiate more favorable terms. This increased choice directly challenges individual carriers, like Axis Capital Holdings, as customers can readily compare and switch providers based on broker-provided insights and aggregated market intelligence.

Demand for Customized Risk Solutions

Customers in the specialty insurance market are increasingly demanding highly customized and flexible risk management solutions that go beyond standard offerings. This trend is particularly evident in rapidly evolving risk areas such as cyber threats, where businesses require very specific coverage tailored to their unique exposures.

This growing need for bespoke products shifts considerable power to the customer. They can dictate the precise terms and conditions of coverage, forcing insurers to adapt their product development and underwriting processes to meet these specific requirements. For instance, in 2024, the global cyber insurance market saw continued growth, with many clients actively negotiating specialized clauses for ransomware or data breach response services.

- Demand for tailored coverage in emerging risks like cyber is a key driver of customer power.

- Insurers must adapt product offerings to meet specific client needs in specialty markets.

- Customers dictating terms for customized solutions strengthens their bargaining position.

Rise of Alternative Risk Transfer

The increasing adoption of Alternative Risk Transfer (ART) solutions, like captive insurance and parametric policies, gives customers more choices beyond traditional insurance providers. This trend in 2024 means businesses can explore options that allow them to retain risk more directly or negotiate better terms with conventional insurers.

For instance, the global alternative risk transfer market was valued at approximately $60 billion in 2023 and is projected to grow steadily. This expansion directly enhances customer bargaining power by providing viable alternatives.

- Increased Leverage: Customers can use ART options to negotiate lower premiums or more favorable coverage terms from traditional insurers.

- Risk Retention: Captives and other ART structures allow companies to self-insure specific risks, reducing reliance on the broader insurance market.

- Customized Solutions: ART often offers more tailored risk management solutions than standardized traditional policies.

- Market Competition: The availability of ART fuels competition, driving down costs and improving service levels across the insurance landscape.

The bargaining power of customers for Axis Capital Holdings is substantial, driven by the sophistication and scale of its client base. Large corporations and primary insurers, acting as sophisticated buyers, leverage their market knowledge and the volume of business they represent to negotiate favorable pricing and terms. This is particularly evident in 2024, where increased reinsurance capacity in certain segments like property catastrophe has given primary insurers more options, enhancing their ability to secure better rates.

| Factor | Impact on Axis Capital | Supporting Data (2023-2024) |

|---|---|---|

| Client Size & Volume | Increased leverage for favorable pricing and terms | Major corporations and primary insurers represent significant business volume. |

| Market Sophistication | Clients can effectively compare offerings and negotiate tailored coverage. | Primary insurers possess deep market knowledge, especially in evolving risk areas. |

| Alternative Risk Transfer (ART) | Provides clients with choices beyond traditional insurers, increasing negotiation power. | Global ART market valued at ~$60 billion in 2023, showing growing client options. |

| Broker Influence | Aggregated demand amplifies customer voice, fostering transparency and competition. | Global insurance broker market valued at ~$75 billion in 2024, indicating significant intermediary power. |

What You See Is What You Get

Axis Capital Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Axis Capital Holdings, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain in-depth insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

Axis Capital Holdings faces fierce rivalry from a multitude of global reinsurers and specialized underwriters within its niche markets. For instance, the global reinsurance market size was estimated to be around $650 billion in 2023, indicating a highly competitive environment.

The specialty insurance brokerage sector, a key area for Axis, is experiencing significant consolidation. This trend, seen throughout 2024, is creating larger entities with greater market power, intensifying the competitive pressure on companies like Axis.

The reinsurance market shows a split in pricing trends, with property reinsurance rates softening. This suggests increased competition in that specific area.

Conversely, casualty reinsurance prices are projected to climb by double digits in 2025, indicating robust demand and potentially less intense price competition in that segment. This divergence highlights how rivalry can manifest differently across various lines of business within the industry.

Axis Capital Holdings and its peers are locked in a fierce competition where the primary goal is underwriting profitability. This means companies are striving to earn more from premiums than they pay out in claims and expenses, aiming for a combined ratio below 100%.

In 2023, the insurance industry, including specialty insurers like Axis Capital, saw a significant focus on achieving this profitability. For instance, many carriers reported combined ratios that, while improving, still reflected the ongoing need for disciplined pricing and risk selection to ensure a profit from the core insurance business.

This intense drive for underwriting profit directly translates into competitive pressure. Insurers must constantly refine their risk assessment models and operational efficiencies to offer competitive pricing while still safeguarding their bottom line, making profitable growth a key differentiator.

Technology-Driven Competition

Axis Capital Holdings faces intense rivalry driven by rapid technological advancements. Companies are pouring resources into AI, machine learning, and sophisticated underwriting systems to sharpen their analytical capabilities and boost operational efficiency. This technological arms race is a key factor in the competitive landscape.

These innovations allow insurers to refine risk assessment, automate processes, and deliver quicker, more customer-centric services. For instance, the global insurtech market was valued at approximately $11.1 billion in 2023 and is projected to grow significantly, underscoring the widespread adoption of technology in the sector.

- AI and Machine Learning Adoption: Leading insurers are integrating AI to improve fraud detection and personalize customer experiences, with some reporting significant reductions in claims processing times.

- Advanced Underwriting Platforms: Investments in data analytics and predictive modeling are enabling more accurate pricing and risk selection, creating a competitive advantage for those who adopt them early.

- Digital Transformation Initiatives: Companies are focusing on digital channels and customer interfaces, aiming to capture market share by offering seamless online experiences.

Global Footprint and Diversified Portfolios

Axis Capital Holdings operates within a competitive landscape where rivals frequently boast extensive global networks and highly diversified product offerings. Many competitors maintain significant operations across property, casualty, and specialized insurance sectors, mirroring Axis Capital's own strategic approach. This broad diversification enables them to offset underwriting or investment losses in one line of business with profits from another, thereby bolstering their resilience against market volatility and sharpening the competitive intensity across numerous insurance segments.

For instance, in 2024, major global insurers reported varied performance across their diverse portfolios. Companies like Chubb, with its expansive international presence and broad product suite, demonstrated strong capital positions. This allows such diversified players to absorb localized market downturns or unexpected claims events more effectively than less diversified entities. The ability to leverage scale and cross-sell across different insurance lines also presents a significant competitive advantage.

- Global Reach: Competitors often operate in numerous countries, providing access to a wider customer base and diverse risk pools.

- Portfolio Diversification: Insurers spread risk across property, casualty, specialty lines, and sometimes even life insurance, cushioning the impact of sector-specific downturns.

- Financial Resilience: Diversified revenue streams and robust capital reserves allow competitors to absorb losses and maintain competitive pricing.

- Cross-Selling Opportunities: A broad product offering enables competitors to offer bundled solutions, increasing customer loyalty and market share.

Axis Capital Holdings contends with intense rivalry from global reinsurers and specialized underwriters, a dynamic underscored by the estimated $650 billion global reinsurance market size in 2023.

The specialty insurance brokerage sector, crucial for Axis, is seeing consolidation in 2024, creating larger, more powerful competitors. This trend intensifies the competitive pressure on Axis Capital.

While property reinsurance rates are softening, indicating increased competition in that area, casualty reinsurance prices are projected to rise by double digits in 2025, suggesting less intense price rivalry in that segment.

Axis and its rivals are focused on underwriting profitability, aiming for combined ratios below 100%, a pursuit that drives disciplined pricing and risk selection.

| Key Competitive Factor | Impact on Axis Capital | Industry Trend/Data (2023-2025) |

| Global Reinsurance Market Size | High competitive intensity due to large market size | Estimated $650 billion in 2023 |

| Specialty Insurance Consolidation | Increased market power of rivals | Significant consolidation observed in 2024 |

| Pricing Divergence (Property vs. Casualty) | Varying competitive pressures across lines | Property reinsurance rates softening; Casualty reinsurance prices projected to rise double digits in 2025 |

| Focus on Underwriting Profitability | Need for efficient operations and risk selection | Industry-wide focus on achieving combined ratios below 100% |

SSubstitutes Threaten

Alternative Risk Transfer (ART) solutions, including structured programs, parametric insurance, and captive insurance, are increasingly seen as direct substitutes for traditional insurance and reinsurance. These options are particularly attractive to clients facing difficult-to-insure risks and can offer greater flexibility and potential cost savings compared to conventional policies.

The demand for ART has been steadily climbing. For instance, in 2024, the global captive insurance market continued its robust growth, with many companies establishing or expanding their own insurance entities to manage specific risks, thereby bypassing traditional reinsurers.

Large corporations and governments are increasingly able to handle more of their own risks. This is because they're getting better at managing these risks internally. For example, in 2024, many large companies are setting up substantial captive insurance companies to underwrite their own liabilities, reducing their need for traditional insurance products.

This trend of self-insurance directly challenges traditional insurers and reinsurers like Axis Capital Holdings. When a major entity decides to self-insure, it means a significant chunk of potential premium revenue is lost. This can impact market share and pricing power for external providers, especially for common or predictable risks.

Investments in advanced risk prevention technologies, like predictive analytics for natural disasters or robust cybersecurity, can significantly lower the likelihood and impact of financial losses. For instance, in 2024, companies are increasingly leveraging AI to forecast weather patterns, potentially reducing insured losses from events like hurricanes by a projected 10-15% in affected regions.

By effectively preventing or mitigating risks internally, businesses might find they require less traditional insurance coverage for certain perils. This development creates a threat of substitutes, as sophisticated in-house risk management can act as an alternative to purchasing specific insurance products, thereby impacting demand for traditional risk transfer services.

Direct Access to Capital Markets

Direct access to capital markets, through instruments like catastrophe bonds and other insurance-linked securities (ILS), presents a significant threat of substitution for traditional reinsurance. These markets allow entities to directly access risk financing, bypassing intermediaries like Axis Capital Holdings.

The ILS market has seen substantial growth, with total market capacity reaching approximately $100 billion by the end of 2023, demonstrating its increasing role as an alternative risk transfer mechanism. This trend is expected to continue, as sophisticated investors seek yield and diversification, directly competing for risk capital that might otherwise flow through reinsurers.

- ILS market capacity: Approximately $100 billion by end of 2023.

- Alternative risk transfer: ILS bypass traditional reinsurance.

- Investor demand: Driven by yield and diversification seeking.

Emergence of Public-Private Partnerships

The emergence of public-private partnerships (PPPs) can act as a substitute for traditional insurance. For systemic or catastrophic risks, governments and industries may collaborate to create coverage programs. These collective mechanisms can offer an alternative to individual commercial insurance or reinsurance, particularly for risks deemed uninsurable by the private market alone.

These PPPs can significantly impact the demand for private insurance. For instance, in 2024, the US federal government's National Flood Insurance Program (NFIP) continues to be a primary source of flood coverage for millions, acting as a substitute for private flood insurance in many high-risk areas. Similarly, terrorism risk insurance facilities, often government-backed, provide coverage that might otherwise be unavailable or prohibitively expensive from private insurers.

- Government-backed programs like the NFIP can absorb risks that private insurers find too volatile.

- Industry-specific initiatives may pool resources to cover unique or large-scale liabilities, reducing reliance on commercial policies.

- Catastrophe bonds, while a risk transfer mechanism, can also be seen as a substitute for traditional reinsurance capacity by providing alternative capital for extreme events.

- The **availability and terms of these public-private solutions** directly influence the market share and pricing power of private insurers offering similar coverage.

Alternative Risk Transfer (ART) solutions, such as parametric insurance and captives, are increasingly substituting traditional insurance. These options offer flexibility and potential cost savings, particularly for difficult-to-insure risks. The captive insurance market, for example, saw robust growth in 2024, with many companies forming their own entities to manage risks, thereby reducing reliance on traditional reinsurers.

Large corporations are increasingly self-insuring, establishing substantial captive insurance companies in 2024 to underwrite their own liabilities. This trend directly challenges reinsurers like Axis Capital Holdings by capturing premium revenue that would otherwise be purchased externally, impacting market share and pricing power.

Direct access to capital markets via insurance-linked securities (ILS) is a significant substitute for traditional reinsurance. The ILS market capacity reached approximately $100 billion by the end of 2023, indicating its growing role in risk financing and directly competing for risk capital.

Public-private partnerships (PPPs) also act as substitutes, especially for systemic risks. Government-backed programs like the US National Flood Insurance Program (NFIP) provide coverage that might otherwise be sought from private insurers, impacting demand for commercial policies.

| Substitute Type | Description | 2024 Trend/Data Point |

|---|---|---|

| Alternative Risk Transfer (ART) | Includes captives, parametric insurance. | Continued robust growth in captive insurance market. |

| Self-Insurance/Captives | Companies underwriting own liabilities. | Many large corporations establishing significant captive entities. |

| Insurance-Linked Securities (ILS) | Direct capital market access for risk financing. | Market capacity ~$100 billion by end of 2023; growing investor demand. |

| Public-Private Partnerships (PPPs) | Government and industry collaboration on coverage. | Programs like NFIP acting as primary flood coverage for millions. |

Entrants Threaten

Entering the specialty insurance and reinsurance market, where Axis Capital Holdings operates, demands significant capital. This is necessary to underwrite complex risks effectively and comply with stringent solvency regulations. For instance, in 2023, the global insurance industry saw substantial capital inflows, yet the specialized nature of reinsurance still presents a high hurdle.

These considerable capital requirements act as a potent deterrent for many prospective competitors. Establishing the financial foundation needed to absorb potential large-scale claims and maintain regulatory compliance is a formidable undertaking, limiting the ease with which new players can enter this sector.

The global insurance and reinsurance sectors are characterized by a dense web of regulations. For instance, Solvency II in Europe, a comprehensive framework for capital requirements, risk management, and supervision, demands significant investment in compliance infrastructure and expertise from any new entrant. This strict oversight, encompassing licensing, solvency margins, and ongoing reporting, acts as a substantial deterrent.

The demand for niche underwriting expertise presents a significant barrier to new entrants in the specialty insurance and reinsurance markets. These sectors thrive on the ability to accurately assess and price unique, complex risks, a skill honed over years of experience and specialized training. For instance, in 2024, the cyber insurance market continued to see a surge in demand for underwriters with deep understanding of evolving digital threats, a skillset not easily replicated.

Developing a team possessing this specialized domain knowledge and a proven track record is both time-consuming and expensive. New companies struggle to attract and retain top talent, as established players often offer more competitive compensation and a clearer career path. This talent acquisition hurdle makes it challenging for newcomers to quickly build the necessary credibility to compete effectively against seasoned incumbents like Axis Capital.

Importance of Established Reputation

In the insurance and reinsurance industry, an established reputation is a significant hurdle for new entrants. Trust is the bedrock of this sector, with clients prioritizing carriers known for reliable claims payment and consistent service. This makes it difficult for newcomers to attract business, as customers are often hesitant to switch from insurers with a proven track record.

Building this level of trust takes considerable time and investment. New companies must demonstrate financial stability and a commitment to customer satisfaction, which is a lengthy process. For instance, in 2024, the global insurance market continued to value financial strength, with ratings agencies like AM Best maintaining rigorous standards for assessing insurer solvency and operational performance. Axis Capital Holdings, as an established player, benefits from its long-standing reputation, which translates into customer loyalty and a competitive advantage against nascent firms.

The barrier to entry is further amplified by the need for new entrants to match the financial strength of incumbents.

- Reputation as a Key Differentiator: Insureds and reinsureds prioritize carriers with a history of fulfilling obligations, making reputation a critical competitive factor.

- Time and Investment in Trust Building: New entrants must invest heavily in marketing and demonstrating reliability to gain market confidence, a process that can take years.

- Client Preference for Stability: In 2024, market volatility underscored the importance of financial stability, leading clients to favor well-established insurers with strong balance sheets.

High Investment in Technology and AI

The considerable capital outlay needed for cutting-edge technology, particularly in areas like artificial intelligence and advanced data analytics, presents a significant hurdle for potential new entrants into the insurance sector. Established players like Axis Capital Holdings are already investing heavily in these areas to enhance underwriting precision and operational efficiency.

For instance, the global spending on AI in insurance was projected to reach over $20 billion by 2024, indicating the scale of investment required. New companies must match these substantial technological commitments to develop sophisticated underwriting platforms and data-driven insights, which are crucial for competing effectively in today's market.

- High Capital Requirements: Significant upfront investment is necessary for advanced technology infrastructure, including AI and data analytics platforms.

- Competitive Parity: New entrants must invest heavily to achieve a level of technological capability comparable to established firms undergoing digital transformation.

- Barriers to Entry: The cost of acquiring and implementing modern underwriting and data processing tools can deter smaller or less-funded new players.

The threat of new entrants in the specialty insurance and reinsurance market, where Axis Capital Holdings operates, is significantly mitigated by the substantial capital requirements necessary to underwrite complex risks and meet stringent solvency regulations. For example, the global insurance industry saw robust capital inflows in 2023, but the specialized nature of reinsurance still presents a high barrier to entry, demanding considerable financial foundation to absorb potential large claims.

Regulatory complexity, such as Solvency II in Europe, mandates significant investment in compliance infrastructure and expertise, acting as a substantial deterrent for newcomers. Furthermore, the demand for niche underwriting expertise, exemplified by the 2024 surge in demand for cyber insurance underwriters with deep understanding of evolving digital threats, creates a talent acquisition hurdle that new companies struggle to overcome against established players.

An established reputation built on trust and reliable claims payment is a critical differentiator, making it difficult for newcomers to attract business. Building this trust takes considerable time and investment, with clients in 2024 continuing to favor insurers with strong balance sheets and a proven track record, as highlighted by rigorous standards from rating agencies like AM Best.

The need to match incumbents' financial strength and invest heavily in cutting-edge technology, such as AI and advanced data analytics, further amplifies entry barriers. The projected over $20 billion global spending on AI in insurance by 2024 underscores the scale of investment required for new entrants to achieve competitive parity.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Axis Capital Holdings is built upon a foundation of comprehensive data, including Axis Capital's annual reports and SEC filings, alongside industry-specific research from leading financial data providers and market intelligence firms.