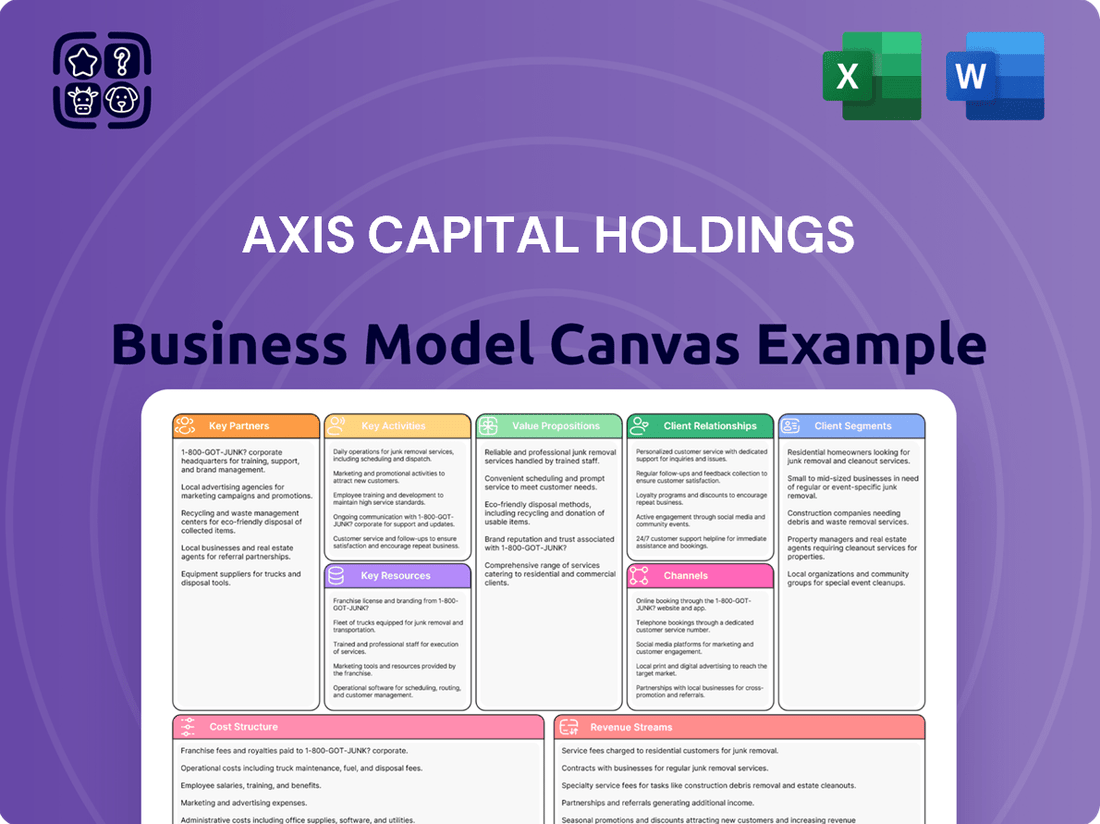

Axis Capital Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

Unlock the strategic blueprint behind Axis Capital Holdings's success with our comprehensive Business Model Canvas. Discover how they create and deliver value, manage key relationships, and generate revenue in the competitive financial services landscape. This detailed analysis is essential for anyone looking to understand their operational framework.

Partnerships

Axis Capital Holdings cultivates a robust network of reinsurance partners. These relationships are fundamental to their ability to underwrite substantial and intricate risks, thereby diversifying their own risk portfolio and bolstering their capacity across specialized insurance segments.

A prime illustration of this strategy is the loss portfolio transfer reinsurance agreement finalized with Enstar in Q2 2025. This transaction involved retroceding net reserves for losses and loss expenses amounting to approximately $2 billion, underscoring the scale and importance of these reinsurance collaborations.

Axis Capital Holdings heavily relies on its insurance brokers and extensive distribution networks to reach its global client base. These crucial partners, acting as intermediaries, are instrumental in placing specialty insurance and reinsurance solutions, providing Axis with broad market access and efficient client acquisition.

Axis Capital Holdings actively cultivates relationships with third-party capital providers and institutional investors. These collaborations, frequently structured as insurance-linked securities (ILS), are crucial for amplifying Axis's underwriting capabilities and optimizing its capital base.

These strategic alliances enable Axis to deploy more capital, thereby expanding its market reach and capacity. The firm has demonstrated a clear commitment to growing these partnerships, with notable increases in fee income from third-party capital partners projected for both 2024 and 2025.

Technology and AI Solution Providers

Axis Capital Holdings collaborates with technology and AI solution providers to boost operational efficiency and refine risk assessment processes. These partnerships are crucial for developing advanced data analytics capabilities and digital infrastructure, enabling the delivery of tailored insurance products and solidifying their competitive position in the specialty insurance sector. For instance, in 2024, Axis Capital continued its strategic investments in AI-driven underwriting tools, aiming to reduce claims processing time by an estimated 15% by year-end.

These alliances are fundamental to Axis Capital's 'How We Work' initiative, which emphasizes digital transformation and data-informed decision-making. By integrating cutting-edge technologies, the company enhances its ability to analyze complex risks and offer innovative solutions to clients. Their commitment to digital advancement is reflected in a significant portion of their 2024 operational budget being allocated to technology upgrades and AI integration projects.

- AI-powered underwriting: Enhancing risk selection and pricing accuracy.

- Data analytics platforms: Improving claims management and fraud detection.

- Cloud infrastructure: Facilitating scalability and operational agility.

- Cybersecurity solutions: Protecting sensitive client data and company assets.

Industry Associations and Regulatory Bodies

Axis Capital Holdings actively collaborates with key industry associations to stay ahead of market shifts and advocate for favorable operating conditions. For instance, in 2024, participation in forums hosted by organizations like the Investment Company Institute (ICI) provided insights into evolving investor preferences and regulatory proposals impacting asset management.

Engagement with regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, is crucial for ensuring compliance and shaping a predictable financial landscape. Axis Capital's proactive dialogue in 2024 contributed to discussions around new disclosure requirements and capital adequacy rules, aiming to foster market stability.

- Industry Associations: Facilitate knowledge sharing and best practice adoption, crucial for navigating the dynamic financial services sector.

- Regulatory Bodies: Ensure adherence to compliance standards and provide input on policy development, fostering a secure operating environment.

- Market Trend Analysis: Partnerships offer early access to data and expert opinions on emerging trends, informing strategic decisions.

Axis Capital Holdings leverages strategic alliances with reinsurance partners to expand its underwriting capacity and manage risk effectively. These collaborations, including significant loss portfolio transfer agreements, are vital for their operations. Furthermore, their network of insurance brokers and distributors ensures broad market access and efficient client engagement.

Axis Capital also actively partners with third-party capital providers and institutional investors, often through insurance-linked securities, to enhance its capital base and underwriting capabilities. These partnerships are projected to drive increased fee income in 2024 and 2025. Additionally, collaborations with technology and AI providers are crucial for operational efficiency and advanced risk assessment, with significant investments in AI-driven tools planned for 2024.

| Key Partnership Type | Strategic Role | 2024/2025 Impact/Focus |

| Reinsurance Partners | Risk diversification, capacity enhancement | Loss portfolio transfer with Enstar (Q2 2025) for ~$2B reserves |

| Insurance Brokers & Distributors | Market access, client acquisition | Facilitating placement of specialty insurance and reinsurance |

| Third-Party Capital Providers | Capital amplification, ILS structuring | Projected increase in fee income; growing partnerships |

| Technology & AI Providers | Operational efficiency, risk assessment | AI underwriting tools; 15% claims processing time reduction target (2024) |

What is included in the product

Axis Capital Holdings' Business Model Canvas outlines its strategy for providing specialized insurance and reinsurance solutions, focusing on diverse customer segments like corporations and insurers, delivered through multiple channels including brokers and direct sales, all while emphasizing a strong value proposition of risk management and financial security.

Axis Capital Holdings' Business Model Canvas offers a streamlined approach to dissecting complex financial strategies, alleviating the pain of scattered information and lengthy documentation.

It provides a clear, visual roadmap of their operations, simplifying the identification of key drivers and potential areas for improvement, thus reducing the burden of strategic planning.

Activities

Axis Capital Holdings' core activity centers on the disciplined underwriting of a wide array of specialty insurance products. This involves careful risk selection, accurate pricing, and the efficient issuance of policies across diverse sectors like property, casualty, professional liability, and environmental risks, all aimed at ensuring profitability and robust risk management.

The company's insurance segment demonstrated robust financial health, reporting an impressive combined ratio of 85.3% in the second quarter of 2025. This figure highlights the effectiveness of their underwriting strategies in managing claims and expenses relative to premiums earned.

Axis Capital Holdings is a significant player in providing reinsurance solutions, acting as an insurer for other insurance companies. This core activity involves taking on a portion of their clients' risk, which is crucial for managing capital and limiting exposure. This diversified revenue stream proved resilient, with the reinsurance segment reporting steady positive results in the second quarter of 2025.

Axis Capital Holdings actively manages a substantial investment portfolio to generate consistent investment income. This core activity involves the strategic allocation of capital across various asset classes, including fixed maturities, alternative investments, and other financial instruments. The primary objective is to optimize returns while diligently managing liquidity and inherent risks.

For the second quarter of 2025, Axis Capital Holdings reported a net investment income of $187 million. This figure underscores the success of their investment management strategies in driving profitability through effective asset deployment and risk mitigation.

Risk Management and Analytics

Axis Capital Holdings' key activities include robust risk management and sophisticated data analytics. These functions are critical for evaluating, modeling, and reducing a wide array of risks, ensuring sound underwriting and portfolio optimization. This focus allows Axis to effectively navigate evolving threats, such as those posed by catastrophic events and weather patterns.

In 2024, Axis Capital demonstrated its commitment to these areas by investing approximately $50 million in enhancing its data analytics infrastructure. This investment underscores the importance of leveraging advanced analytics to inform strategic decisions and maintain a competitive edge in the insurance market.

- Risk Assessment: Utilizing advanced analytics to identify and quantify potential exposures.

- Portfolio Optimization: Employing data-driven insights to balance risk and return across the company's holdings.

- Underwriting Excellence: Informing pricing and coverage decisions through comprehensive risk modeling.

- Emerging Threat Mitigation: Developing strategies to address new and evolving risks, including climate-related events.

Client Relationship Management

Axis Capital Holdings places significant emphasis on building and nurturing robust relationships with its clients, brokers, and strategic partners. This ongoing effort is fundamental to their business model, focusing on delivering superior service and customized solutions.

The company's commitment to client satisfaction and long-term partnerships is evident in its impressive 2024 performance, achieving a client retention rate of 92%. This high retention underscores the effectiveness of their relationship management strategies.

- Client Engagement: Proactively engaging with clients to understand evolving needs and provide proactive support.

- Partnership Development: Cultivating strong alliances with brokers and other financial institutions to expand service offerings and reach.

- Service Excellence: Consistently delivering high-quality service and tailored financial solutions to meet diverse client objectives.

- Retention Focus: Implementing strategies aimed at ensuring client loyalty and maximizing long-term value, as demonstrated by their 92% retention rate in 2024.

Axis Capital Holdings' key activities revolve around disciplined underwriting across various specialty insurance lines and providing vital reinsurance solutions to other insurers. They also focus on astute investment portfolio management to generate income and robust risk management, heavily leveraging data analytics to inform decisions and mitigate emerging threats. Cultivating strong client and broker relationships is also paramount for service delivery and retention.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Specialty Insurance Underwriting | Disciplined risk selection and pricing for diverse insurance products. | 85.3% combined ratio (Q2 2025) |

| Reinsurance | Assuming risk from other insurers to manage capital and exposure. | Steady positive results (Q2 2025) |

| Investment Management | Strategic allocation of capital to optimize returns and manage risk. | $187 million net investment income (Q2 2025) |

| Risk Management & Data Analytics | Evaluating, modeling, and reducing risks, with significant investment in infrastructure. | $50 million invested in data analytics infrastructure (2024) |

| Relationship Management | Building and nurturing strong ties with clients, brokers, and partners. | 92% client retention rate (2024) |

Delivered as Displayed

Business Model Canvas

The Axis Capital Holdings Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing a direct, unedited representation of the comprehensive analysis that will be yours to utilize. When you complete your transaction, you will gain full access to this identical, professionally structured Business Model Canvas, ready for immediate application to your strategic planning.

Resources

Axis Capital Holdings relies heavily on its underwriting expertise, a core resource built by highly skilled professionals with deep knowledge in specialty insurance and reinsurance. These individuals are crucial for accurately assessing complex risks and crafting tailored coverage solutions, which directly translates into a significant competitive edge in the market. For instance, in 2024, the company continued to emphasize its commitment to developing this talent, recognizing that specialized underwriting acumen is key to navigating and profiting from niche insurance markets.

Financial capital and reserves are the bedrock of Axis Capital's ability to underwrite risk and maintain stability. A robust capital base allows the company to absorb unexpected losses and meet its commitments to policyholders and reinsured parties.

Demonstrating this strength, Axis Capital reported shareholders' equity of $5.3 billion as of December 31, 2023. By the close of 2024, their total capital had grown to an impressive $7.4 billion, underscoring a significant increase in their financial capacity.

Axis Capital's proprietary data and analytics platforms are a cornerstone of its business model. These sophisticated systems are built upon an advanced data analytics infrastructure, allowing for deep dives into market trends and customer behavior. This forms a crucial part of their intellectual capital.

Central to these platforms are proprietary risk modeling tools. These are not off-the-shelf solutions; Axis Capital has developed them internally to precisely assess risk, ensuring accurate pricing for their insurance products and optimizing their investment portfolios. This precision directly impacts profitability and stability.

In 2024, Axis Capital demonstrated a significant commitment to these digital assets by allocating $85 million towards enhancing its digital capabilities. This investment fuels the continuous improvement of their data analytics and risk modeling, ensuring they remain at the forefront of informed decision-making in a dynamic financial landscape.

Global Operating Licenses and Network

Axis Capital Holdings leverages its global operating licenses and extensive network to facilitate international business operations and serve a diverse clientele across various jurisdictions. This infrastructure is fundamental to its ability to underwrite a broad range of insurance and reinsurance products worldwide.

The company maintains a significant presence in key global markets, with office locations strategically positioned to support its international reach. These locations include Bermuda, the United States, Europe, Singapore, and Canada, underscoring its commitment to a global operational footprint.

- Global Licensing: Possesses necessary operating licenses in major insurance and reinsurance hubs, enabling seamless cross-border transactions.

- Worldwide Office Network: Established offices in Bermuda, the USA, Europe, Singapore, and Canada facilitate local market access and client servicing.

- Market Access: This network allows Axis Capital to effectively underwrite and manage risks in a variety of international territories.

- Client Diversification: The global presence supports engagement with a broad spectrum of clients, from multinational corporations to regional businesses.

Brand Reputation and Relationships

Axis Capital Holdings' brand reputation is a cornerstone of its business model, built on a foundation of underwriting excellence and financial stability. This strong reputation translates into trust among clients and partners, ensuring a consistent flow of business. For instance, Axis was recognized as the E&S Insurer's 2025 Carrier of the Year, a testament to its superior performance and industry standing.

The company cultivates deep, long-standing relationships with a wide network of brokers, clients, and other key industry players. These relationships are vital for maintaining market share and driving new business opportunities. Such strong connections foster loyalty and provide valuable feedback, enabling Axis to adapt and thrive in a competitive landscape.

- Brand Reputation: Underwriting excellence, financial strength, and reliable claims handling are key intangible assets.

- Industry Recognition: Awarded E&S Insurer's 2025 Carrier of the Year, highlighting operational success.

- Stakeholder Relationships: Long-standing connections with brokers, clients, and industry stakeholders are critical for sustained business.

- Market Standing: These relationships ensure continued business flow and a robust market position.

Axis Capital's key resources are its specialized underwriting talent, substantial financial capital, proprietary data and analytics, and its global operational infrastructure. These elements collectively enable the company to effectively assess and price complex risks, maintain financial stability, and serve a diverse international client base.

The company's financial strength is a critical resource, allowing it to absorb potential losses and meet its obligations. This is evident in its shareholders' equity, which grew significantly from $5.3 billion at the end of 2023 to $7.4 billion by the close of 2024, demonstrating a robust increase in its capital base.

Furthermore, Axis Capital's investment in proprietary data and analytics, including $85 million allocated in 2024 for digital enhancements, underscores its commitment to leveraging advanced technology for risk modeling and informed decision-making. This technological edge is crucial for its competitive positioning.

| Key Resource | Description | 2024 Data/Significance |

|---|---|---|

| Underwriting Expertise | Highly skilled professionals with deep knowledge in specialty insurance and reinsurance. | Crucial for accurate risk assessment and tailored solutions. |

| Financial Capital & Reserves | The company's capital base and reserves. | Shareholders' equity grew from $5.3 billion (Dec 2023) to $7.4 billion (Dec 2024). |

| Proprietary Data & Analytics | Advanced data analytics infrastructure and proprietary risk modeling tools. | $85 million invested in 2024 to enhance digital capabilities and risk assessment. |

| Global Operating Licenses & Network | Necessary licenses and strategically located offices worldwide. | Facilitates international business and client servicing in key markets. |

Value Propositions

Axis Capital Holdings excels in offering highly specialized insurance and reinsurance for intricate, unique risks that standard insurers often overlook. This focus allows them to craft bespoke solutions for niche markets and evolving exposures, a key differentiator in the complex insurance landscape.

In 2024, Axis Capital demonstrated its commitment to specialty lines by reporting a robust underwriting profit in segments like property catastrophe and aviation, underscoring the value of their tailored risk management approach. Their expertise in these areas allows them to capture premiums for risks that others deem too difficult or specialized to underwrite.

Axis Capital Holdings offers clients the advantage of its extensive global network, complemented by deep-seated local market understanding. This dual strength ensures that services are not only consistent worldwide but also tailored to the specific nuances of each region, a key benefit derived from its international operating subsidiaries.

With strategic offices located in Bermuda, the United States, Europe, Singapore, and Canada, Axis Capital Holdings effectively bridges global capabilities with localized expertise. This geographic spread, as of early 2024, allows the company to navigate diverse regulatory environments and market dynamics, providing clients with relevant and effective solutions across these key international markets.

Axis Capital Holdings' financial strength and stability are cornerstones of its value proposition. The company's robust financial health, underscored by strong credit ratings, assures clients and partners of its capacity to meet claims and fulfill obligations. This instills significant confidence in the long-term security of their insurance coverage.

As of year-end 2024, Axis Capital reported total assets amounting to $32.5 billion and total capital of $7.4 billion. These figures demonstrate a solid foundation, enabling the company to navigate market fluctuations and maintain its commitment to policyholders and stakeholders.

Underwriting Discipline and Claims Efficiency

Axis Capital Holdings prioritizes rigorous underwriting to build a resilient and profitable portfolio. This focus ensures that risks are carefully assessed and priced, contributing to the company's financial stability. For instance, in the second quarter of 2025, Axis Capital reported a combined ratio of 88.9%, a key indicator of underwriting profitability.

Complementing its underwriting strength, Axis Capital excels in claims efficiency. The company is committed to handling claims fairly and promptly, offering clients dependable support when they experience losses. This streamlined claims process enhances customer satisfaction and reinforces the company's reputation for reliability.

- Disciplined Underwriting: Focus on careful risk selection and pricing.

- Claims Efficiency: Timely and fair resolution of client claims.

- Portfolio Stability: Underwriting practices contribute to a stable financial base.

- Client Support: Reliable assistance during loss events.

Innovative Risk Management and Data Insights

Axis Capital Holdings distinguishes its offerings through advanced data analytics and cutting-edge technology, providing clients with unparalleled insights into their risk profiles. This allows for the development of sophisticated, proactive risk management strategies tailored to optimize insurance programs and mitigate potential exposures.

The company's commitment to technological advancement is evident in its substantial investments in AI and data science capabilities. For instance, in 2024, Axis Capital continued to allocate significant resources towards enhancing its proprietary analytics platforms, aiming to deliver more predictive and actionable intelligence to its clientele.

- Enhanced Risk Identification: Utilizing AI to analyze vast datasets, identifying emerging risks and trends earlier than traditional methods.

- Optimized Program Design: Data-driven insights enable the creation of more efficient and cost-effective insurance solutions.

- Proactive Exposure Management: Empowering clients with real-time data to actively manage their exposures and reduce volatility.

- Technological Investment: Continued focus on R&D in AI and machine learning to refine risk modeling and client services.

Axis Capital Holdings provides specialized insurance and reinsurance for complex, unique risks, offering tailored solutions for niche markets. Their 2024 performance highlighted strong underwriting profits in areas like property catastrophe, demonstrating the value of their specialized approach.

The company leverages a global network combined with deep local market understanding, ensuring consistent service worldwide while adapting to regional nuances. This international presence, with offices in key locations like Bermuda and Europe as of early 2024, allows for effective navigation of diverse regulatory and market conditions.

Axis Capital's financial strength, evidenced by strong credit ratings and substantial capital, provides clients with confidence in their ability to meet obligations. By year-end 2024, the company reported total assets of $32.5 billion and total capital of $7.4 billion, underscoring its stability.

Advanced data analytics and technology are central to Axis Capital's value proposition, enabling sophisticated risk management strategies. Investments in AI and data science in 2024 enhance risk identification and program optimization for clients.

| Value Proposition | Description | Key Metric/Data Point (as of 2024/early 2025) |

|---|---|---|

| Specialized Risk Solutions | Underwriting unique and complex risks overlooked by standard insurers. | Strong underwriting profit in specialty lines (e.g., property catastrophe). |

| Global Reach, Local Expertise | Combining a worldwide network with in-depth understanding of local markets. | Offices in Bermuda, US, Europe, Singapore, Canada. |

| Financial Strength & Stability | Assurance of claims-paying ability and long-term security through robust financial health. | Total Assets: $32.5 billion; Total Capital: $7.4 billion (Year-end 2024). |

| Technological Advancement | Utilizing AI and data analytics for enhanced risk assessment and management. | Continued investment in proprietary analytics platforms for predictive intelligence. |

Customer Relationships

Axis Capital Holdings cultivates robust relationships with its intermediary partners, particularly brokers, through a model of dedicated underwriters and account managers. This direct engagement ensures a granular understanding of broker needs and the specific requirements of their clients.

These dedicated professionals facilitate the creation of tailored insurance solutions, moving beyond standardized offerings to address unique risks and opportunities. This personalized approach is central to Axis Capital's strategy for fostering loyalty and driving business growth.

In 2024, Axis Capital reported gross premiums written of $5.4 billion, underscoring the volume of business generated through these strong broker and client partnerships. This figure highlights the tangible impact of their relationship-centric approach on their financial performance.

Axis Capital Holdings cultivates enduring, trust-based relationships with clients and distribution partners by prioritizing consistent engagement and proactive communication. This long-term partnership approach focuses on mutual success over fleeting transactions, a strategy reflected in their impressive 92% client retention rate for 2024.

Axis Capital Holdings prioritizes claims service excellence as a cornerstone of its customer relationships. In 2024, the company focused on enhancing responsiveness and efficiency in its claims handling, aiming to build lasting trust.

A streamlined claims process is vital. Axis Capital aims to ensure clients experience transparency and receive timely support, leading to fair settlements and greater overall satisfaction, reinforcing their commitment to policyholder needs.

Technology-Enabled Interactions

Axis Capital Holdings leverages digital platforms and advanced technology to foster stronger customer connections. By offering online portals, customers can efficiently manage policies, submit claims, and access valuable risk insights, creating a more streamlined and self-service experience.

This commitment to technology is evident in Axis Capital's strategic investments. For instance, in 2024, the company continued to prioritize enhancements to its digital infrastructure, aiming to improve operational efficiency and customer engagement across all service touchpoints.

- Digital Portals: Providing customers with 24/7 access to policy information and claims processing.

- AI Integration: Utilizing artificial intelligence to personalize customer interactions and offer predictive risk management advice.

- Streamlined Processes: Reducing friction in customer journeys, from onboarding to claim resolution.

- Enhanced Communication: Implementing digital channels for proactive updates and support.

Thought Leadership and Market Insights

Axis Capital Holdings actively cultivates its customer relationships by sharing valuable market insights and thought leadership. This approach positions the company as a trusted expert, going beyond transactional interactions to build lasting connections.

Through special reports and participation in industry discussions, Axis Capital demonstrates its deep understanding and commitment to the sectors it serves. For instance, their Axis Global Energy Special Report in 2024 provided critical analysis on the impact of severe weather events on solar technology, offering actionable intelligence to stakeholders.

- Thought Leadership: Axis Capital disseminates expert analysis and forecasts to inform clients and the market.

- Special Reports: Publications like the Axis Global Energy Special Report offer in-depth looks at critical industry trends.

- Industry Engagement: Active participation in discussions solidifies Axis Capital's reputation as an industry authority.

- Value Proposition: This strategy enhances client loyalty by providing essential, data-driven resources.

Axis Capital Holdings fosters strong customer relationships through a multi-faceted approach, emphasizing dedicated service, digital accessibility, and expert insights. Their commitment to a high client retention rate, noted at 92% in 2024, highlights the success of these strategies.

The company's focus on claims service excellence, coupled with investments in digital platforms for policy management and claims processing, ensures a streamlined and transparent customer experience. This dedication to efficient support builds lasting trust.

Axis Capital also positions itself as a valuable partner by sharing market insights and thought leadership, such as their 2024 Axis Global Energy Special Report. This proactive engagement demonstrates a deep commitment to client success beyond mere transactions.

| Relationship Aspect | 2024 Data/Focus | Impact |

|---|---|---|

| Client Retention | 92% | Demonstrates strong loyalty and satisfaction. |

| Gross Premiums Written | $5.4 billion | Reflects business growth driven by partnerships. |

| Digital Investment | Continued infrastructure enhancements | Improves customer engagement and efficiency. |

Channels

Axis Capital's insurance segment primarily leverages a robust global network of independent insurance brokers and agents. These vital intermediaries act as the crucial link to a diverse customer base, ranging from small businesses to large corporations.

These brokers and agents are instrumental in placing policies and providing essential client advisory services, ensuring Axis Capital reaches a broad spectrum of the market. For instance, in 2023, Axis Capital's insurance segment generated approximately $4.2 billion in gross written premiums, a testament to the effectiveness of this channel.

Axis Capital Holdings leverages reinsurance brokers as a core channel for its reinsurance segment. These intermediaries are crucial for connecting Axis with a diverse pool of insurance companies looking to offload risk. In 2024, the reinsurance market continued to show robust activity, with brokers playing a pivotal role in facilitating these complex transactions and ensuring broad market access for Axis.

While Axis Capital Holdings primarily operates through brokers, they cultivate direct relationships with a select group of very large clients, such as major corporations and government bodies. This approach is reserved for situations requiring highly customized or intricate risk management solutions.

These direct engagements allow for in-depth consultation, enabling Axis Capital to directly understand client needs and meticulously design programs that precisely address complex risks. This personalized service is crucial for securing and managing substantial accounts.

For instance, in 2024, Axis Capital's direct client engagement strategy was instrumental in securing several multi-year, high-value contracts within the energy and infrastructure sectors, underscoring the strategic importance of these tailored relationships for their large-scale business.

Digital Platforms and Online Portals

Axis Capital Holdings is increasingly leveraging digital platforms and online portals to bolster existing client relationships and attract new business. These digital touchpoints are crucial for providing seamless access to policy details, claims processing, and valuable risk management tools, thereby elevating the overall client experience.

Axis is actively investing in and enhancing its digital capabilities to meet evolving customer expectations. For instance, in 2024, the company continued to roll out upgraded client portals offering more self-service options and personalized content.

- Enhanced Client Experience: Digital platforms provide 24/7 access to policy information and claims status, improving convenience.

- New Business Acquisition: Online portals can streamline the onboarding process for new clients, making it easier to engage with Axis.

- Digital Investment: Axis is committed to digital transformation, with significant resources allocated in 2024 to upgrade its online infrastructure and user interfaces.

- Data-Driven Insights: These platforms enable Axis to gather valuable data on client behavior, informing future service enhancements and product development.

Underwriting Teams and Regional Offices

Axis Capital's underwriting teams and regional offices are crucial channels for direct engagement. These physical locations in key markets like Bermuda, the US, Europe, Singapore, and Canada allow for personalized service and localized expertise, fostering strong relationships with brokers, clients, and partners.

This network facilitates a deeper understanding of regional market dynamics and client needs. For instance, in 2024, Axis continued to leverage these offices to underwrite a diverse portfolio, with a significant portion of its gross written premiums originating from its international operations.

- Physical Presence: Offices in Bermuda, US, Europe, Singapore, Canada.

- Relationship Building: Direct engagement with brokers, clients, and partners.

- Localized Expertise: Tailored service and market understanding.

- Revenue Generation: International operations contributed significantly to gross written premiums in 2024.

Axis Capital Holdings effectively utilizes a multi-channel approach to reach its diverse customer base. The primary channels include a global network of independent insurance and reinsurance brokers, direct relationships with large corporate clients, and increasingly, digital platforms and online portals. Additionally, their physical presence through underwriting teams and regional offices in key markets like Bermuda, the US, Europe, Singapore, and Canada facilitates localized expertise and direct engagement.

| Channel | Primary Use | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Independent Brokers & Agents | Insurance Placement & Client Advisory | Broad Market Access & Client Reach | $4.2 billion in gross written premiums (Insurance Segment, 2023) |

| Reinsurance Brokers | Risk Transfer Facilitation | Access to Diverse Insurer Pool | Pivotal role in robust 2024 reinsurance market activity |

| Direct Client Engagement | Customized Risk Solutions for Large Clients | Deep Client Understanding & Tailored Programs | Secured multi-year, high-value contracts in energy/infrastructure (2024) |

| Digital Platforms/Online Portals | Client Relationship Enhancement & New Business | Seamless Access, Self-Service Options, Data Insights | Continued rollout of upgraded client portals (2024) |

| Underwriting Teams & Regional Offices | Direct Engagement & Localized Expertise | Personalized Service & Market Understanding | Significant portion of gross written premiums from international operations (2024) |

Customer Segments

Axis Capital Holdings caters to large corporations and multinational businesses needing sophisticated insurance solutions for their worldwide operations and intricate risk exposures. These clients typically span various sectors and operate across multiple countries.

For instance, in 2024, the global commercial insurance market saw significant demand from large enterprises seeking to mitigate risks associated with supply chain disruptions and cyber threats, with premiums for specialized coverages often running into millions of dollars per policy.

Other insurance companies are a cornerstone of Axis Capital's reinsurance operations. These entities, ranging from large global insurers to smaller regional players, rely on reinsurance to offload a portion of their risk, thereby stabilizing their financial results and enhancing their capacity to write new business. For instance, in 2023, Axis reported strong growth in its Reinsurance segment, with gross premiums written increasing by 11% year-over-year to $4.9 billion, underscoring the significant demand from this customer base.

Governmental entities, such as state and local governments, represent a significant customer segment for specialized insurance and reinsurance. These entities often require coverage for public infrastructure projects, ensuring resilience against damage or disruption. For instance, in 2024, infrastructure spending by governments globally is projected to continue its upward trend, creating a growing need for risk management solutions.

Furthermore, governmental bodies need protection for public services, including healthcare systems and educational institutions, against various liabilities and operational risks. Unique governmental risks, like political instability or specific regulatory exposures, also drive demand for tailored insurance products. The global insurance market for public sector risks is substantial, with many governments actively seeking robust financial protection mechanisms.

Small and Medium-Sized Enterprises (SMEs) with Specialty Needs

Axis Capital Holdings also recognizes the distinct requirements of Small and Medium-sized Enterprises (SMEs) that possess unique or niche risk exposures. These businesses often require specialized insurance products that are not readily available from mainstream insurers, presenting an opportunity for Axis to leverage its expertise in specialty lines.

For instance, in 2024, the global specialty insurance market, which includes coverages for niche risks, was projected to continue its growth trajectory, driven by increasing complexity in business operations and emerging threats. SMEs in sectors like advanced manufacturing, technology startups, or those with significant intellectual property assets frequently fall into this category.

- Niche Risk Exposure: SMEs in sectors such as cyber security, renewable energy projects, or those involved in complex supply chains often need tailored coverage.

- Specialized Product Demand: Axis can offer bespoke policies addressing unique liabilities, property damage scenarios, or business interruption risks specific to these SMEs.

- Market Gap: General insurers may overlook or underwrite these specialized risks inadequately, creating a clear market opening for Axis Capital.

Niche Industry Sectors

Axis Capital Holdings strategically focuses on niche industry sectors that present distinct risk profiles and opportunities for specialized expertise. These include rapidly evolving areas like renewable energy, life sciences, and cyber technology, allowing for the development of highly tailored insurance and financial solutions.

The company's commitment to deep specialization within these sectors enables them to offer clients precisely what they need. For instance, Axis boasts a dedicated renewable energy team, actively engaging with the energy transition market. This focus allows them to understand the unique challenges and potential of emerging green technologies and infrastructure.

- Renewable Energy Focus: Axis Capital Holdings actively participates in the growing renewable energy market, demonstrating a strategic commitment to the energy transition.

- Life Sciences Specialization: The company provides specialized solutions for the life sciences sector, acknowledging its unique risk landscape and innovation cycles.

- Cyber Technology Expertise: Axis targets the cyber technology industry, offering tailored coverage for the evolving threats and opportunities in the digital realm.

Axis Capital Holdings serves a diverse clientele, including large corporations, multinational businesses, and governmental entities requiring sophisticated insurance for complex global risks. Additionally, other insurance companies are a key segment, relying on Axis for reinsurance to manage their own risk portfolios.

The company also targets Small and Medium-sized Enterprises (SMEs) with unique or niche risk exposures that mainstream insurers may not adequately cover. This strategic focus allows Axis to leverage its expertise in specialty lines, addressing gaps in the market.

Axis Capital Holdings actively engages with niche industry sectors, such as renewable energy, life sciences, and cyber technology, where specialized knowledge is crucial for developing tailored insurance solutions. This specialization caters to evolving business landscapes and emerging threats.

| Customer Segment | Key Needs | Axis Capital's Offering |

|---|---|---|

| Large Corporations & Multinationals | Global risk mitigation, complex exposures | Sophisticated worldwide insurance solutions |

| Other Insurance Companies | Risk offloading, financial stabilization | Reinsurance capacity and support |

| SMEs with Niche Risks | Tailored coverage for unique exposures | Bespoke policies addressing specialized liabilities |

| Niche Industry Sectors (e.g., Renewables, Cyber) | Deep understanding of sector-specific risks | Highly specialized insurance and financial solutions |

Cost Structure

The most substantial cost for Axis Capital Holdings stems from paying out claims and the expenses tied to adjusting those losses. These outflows are a direct consequence of the underwriting risks the company takes on.

For instance, in 2024, Axis Capital reported significant impacts from catastrophe and weather-related events, which directly inflated these claim and loss adjustment expenses, underscoring their importance in the cost structure.

Axis Capital Holdings incurs significant underwriting and acquisition costs, which are crucial for securing new business. These expenses encompass commissions paid to brokers and agents, as well as the costs associated with underwriting, policy issuance, and thorough risk assessment. In the second quarter of 2025, Axis reported an acquisition ratio of 19.8%, indicating the efficiency of their strategy in bringing in new policies.

General and Administrative Expenses (G&A) are the backbone of operational overheads, encompassing salaries for essential personnel, rent for office spaces, utilities, and other day-to-day administrative costs at Axis Capital Holdings. These are crucial for keeping the business running smoothly.

Axis Capital Holdings is actively working to optimize its G&A by focusing on its 'How We Work' program. This initiative is specifically designed to streamline operations and identify opportunities for cost reduction, aiming for greater efficiency.

For instance, in 2024, a significant portion of Axis's operating expenses would typically be allocated to G&A. While specific figures for 2024 are still being finalized, similar companies in the financial services sector often see G&A represent 15-25% of their total operating expenses, reflecting the investment in talent and infrastructure.

Technology and Data Infrastructure Investments

Axis Capital Holdings makes substantial investments in its technology and data infrastructure. These investments are crucial for boosting how efficiently they operate, refining their risk assessment models, and driving their digital transformation efforts. In 2024 alone, Axis dedicated $85 million to bolster these digital capabilities, underscoring the strategic importance of this cost center.

These technology and data infrastructure expenditures are essential for maintaining a competitive edge and ensuring robust operational performance.

- Technology & Data Infrastructure: Significant capital is allocated to advanced technological solutions and data analytics platforms.

- Operational Efficiency: Investments aim to streamline processes, reduce manual intervention, and improve overall business productivity.

- Risk Modeling: Enhanced data infrastructure supports more sophisticated and accurate risk assessment and management.

- Digital Transformation: Funding is directed towards modernizing systems and developing new digital services to meet evolving market demands.

Reinsurance Ceded Premiums

Reinsurance ceded premiums are a crucial cost for Axis Capital, reflecting the significant expense of transferring a portion of its underwriting risk to other insurers. This practice is fundamental to managing capital requirements and limiting exposure to large or catastrophic losses. For instance, in the first quarter of 2024, Axis Capital reported net premiums written of $1,325.5 million, with a substantial portion of this being ceded to reinsurers, illustrating the scale of this cost.

This cost directly impacts profitability by reducing the net premium retained by Axis. However, it is a necessary investment to maintain financial stability and the ability to underwrite a diverse portfolio of risks. The strategic use of reinsurance allows Axis to participate in larger risks than it could manage alone, thereby expanding its market reach and earning potential.

Axis Capital actively manages its reinsurance arrangements to optimize cost and coverage. A notable example of this strategy is their completion of a loss portfolio transfer reinsurance agreement with Enstar in the second quarter of 2025. This type of agreement typically involves transferring the liabilities of a specific book of business, along with the associated unearned premiums and reserves, to a reinsurer, thereby removing the risk and capital requirements from Axis's balance sheet.

The financial impact of ceded premiums is significant:

- Reduced Net Premiums Earned: Ceded premiums directly decrease the amount of premium revenue Axis retains.

- Capital Management: It allows Axis to operate with a more efficient capital base by offloading potential large losses.

- Risk Mitigation: Essential for protecting against unexpected volatility in claims, especially in catastrophe-prone lines.

- Strategic Agreements: Transactions like the loss portfolio transfer with Enstar demonstrate proactive risk management and balance sheet optimization.

Axis Capital Holdings' cost structure is heavily influenced by claims and loss adjustment expenses, which are direct results of the underwriting risks taken. For instance, in 2024, catastrophe events significantly impacted these costs. Additionally, underwriting and acquisition costs, including broker commissions, are substantial for securing new business, with an acquisition ratio of 19.8% reported in Q2 2025. General and administrative expenses, covering salaries and operations, are managed through programs like 'How We Work' for efficiency, with G&A typically representing 15-25% of operating expenses in the sector.

| Cost Category | Description | 2024/2025 Data Point | Impact |

|---|---|---|---|

| Claims & Loss Adjustment Expenses | Paying out claims and associated administrative costs. | Inflated by catastrophe events in 2024. | Directly tied to underwriting risk. |

| Underwriting & Acquisition Costs | Commissions, policy issuance, and risk assessment. | Acquisition ratio of 19.8% in Q2 2025. | Essential for new business generation. |

| General & Administrative (G&A) | Salaries, rent, utilities, operational overheads. | Targeted for reduction via 'How We Work' program. | Supports smooth business operations. |

| Technology & Data Infrastructure | Investments in systems, analytics, and digital transformation. | $85 million invested in 2024 for digital capabilities. | Enhances efficiency and risk modeling. |

| Reinsurance Ceded Premiums | Cost of transferring risk to other insurers. | Q1 2024 net premiums written: $1,325.5 million (portion ceded). | Manages capital and limits exposure. |

Revenue Streams

Axis Capital's insurance segment generates its primary revenue through gross premiums written on specialty insurance policies. This figure reflects the total amount of premiums collected before any portion is passed on to reinsurers.

In the second quarter of 2025, Axis Capital reported a healthy 7% increase in gross premiums written within its insurance segment, indicating strong demand for its specialized offerings.

Axis Capital's reinsurance segment earns revenue through gross premiums written on contracts with other insurers. This represents the total amount of premiums collected before deducting any reinsurance ceded to other reinsurers.

In the second quarter of 2025, gross premiums written in this segment saw a decrease of 7%. This decline was attributed to the timing of renewal negotiations and other market-related factors.

Axis Capital Holdings generates substantial revenue through its net investment income. This income is derived from the performance of the company's diverse investment portfolio, encompassing interest, dividends, and gains from alternative investments. In the second quarter of 2025, Axis Capital Holdings reported net investment income of $187 million, highlighting its effectiveness in managing and growing its invested assets.

Underwriting Fees and Other Income

Axis Capital Holdings generates revenue through underwriting fees for various insurance and reinsurance products. This also encompasses income derived from risk consulting and other specialized insurance services. In 2024, Axis Capital reported a notable increase in fee income from its third-party capital partners, reflecting successful strategic capital alliances.

Further diversification of revenue streams comes from income generated via strategic capital partnerships. These collaborations allow Axis Capital to leverage external capital, enhancing its underwriting capacity and profitability. The growth in third-party capital partner fee income continued into 2025, demonstrating the ongoing success of these strategic ventures.

- Underwriting Fees: Charges for services related to the issuance of insurance policies and reinsurance contracts.

- Risk Consulting: Fees earned for providing expert advice on risk management and mitigation strategies.

- Other Income: Revenue from miscellaneous insurance-related activities and services.

- Third-Party Capital Partner Income: Fees received from entities providing capital for underwriting activities, which saw an increase in 2024 and 2025.

Net Realized Investment Gains/Losses

Net realized investment gains or losses represent profits or deficits from selling assets within Axis Capital Holdings' investment portfolio. While these can be a significant revenue source, they are inherently more volatile than other income streams, directly impacted by market fluctuations and the effectiveness of the company's investment strategies.

For instance, in 2024, the broader market experienced significant swings. Companies that actively managed their portfolios and timed sales effectively could have realized substantial gains. Conversely, unfavorable market conditions could lead to realized losses, directly reducing overall revenue for the period.

- Market Volatility Impact: In 2024, sharp increases in interest rates and geopolitical uncertainties created a challenging environment, leading to potential realized losses for less defensively positioned portfolios.

- Strategic Realizations: Axis Capital's ability to strategically exit positions at opportune moments in 2024 would have directly translated into realized gains, contributing positively to revenue.

- Portfolio Composition: The specific mix of assets held by Axis Capital in 2024, whether equities, fixed income, or alternatives, would have dictated the magnitude of potential gains or losses upon sale.

Axis Capital's revenue streams are primarily built upon the premiums collected from its insurance and reinsurance businesses. Beyond direct premiums, the company also generates significant income from its investment portfolio and various fee-based services.

The company's strategic capital partnerships are a growing revenue driver, with fees from these alliances showing continued strength into 2025. This diversification highlights Axis Capital's ability to leverage external capital for enhanced profitability and underwriting capacity.

Axis Capital also earns income through underwriting fees, risk consulting, and other specialized insurance services. In 2024, fee income from third-party capital partners saw a notable increase, underscoring the success of these strategic collaborations.

| Revenue Stream | Q2 2025 (Estimate/Trend) | 2024 (Actual/Trend) |

|---|---|---|

| Gross Premiums Written (Insurance) | +7% | Strong Growth |

| Gross Premiums Written (Reinsurance) | -7% | Market Influenced |

| Net Investment Income | $187 million (Q2 2025) | Consistent Growth |

| Fee Income (incl. Third-Party Capital) | Continued Growth | Notable Increase |

Business Model Canvas Data Sources

The Axis Capital Holdings Business Model Canvas is informed by a robust combination of financial disclosures, industry analysis, and internal strategic planning documents. These sources provide a comprehensive view of the company's operations, market position, and future direction.