Avolta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avolta Bundle

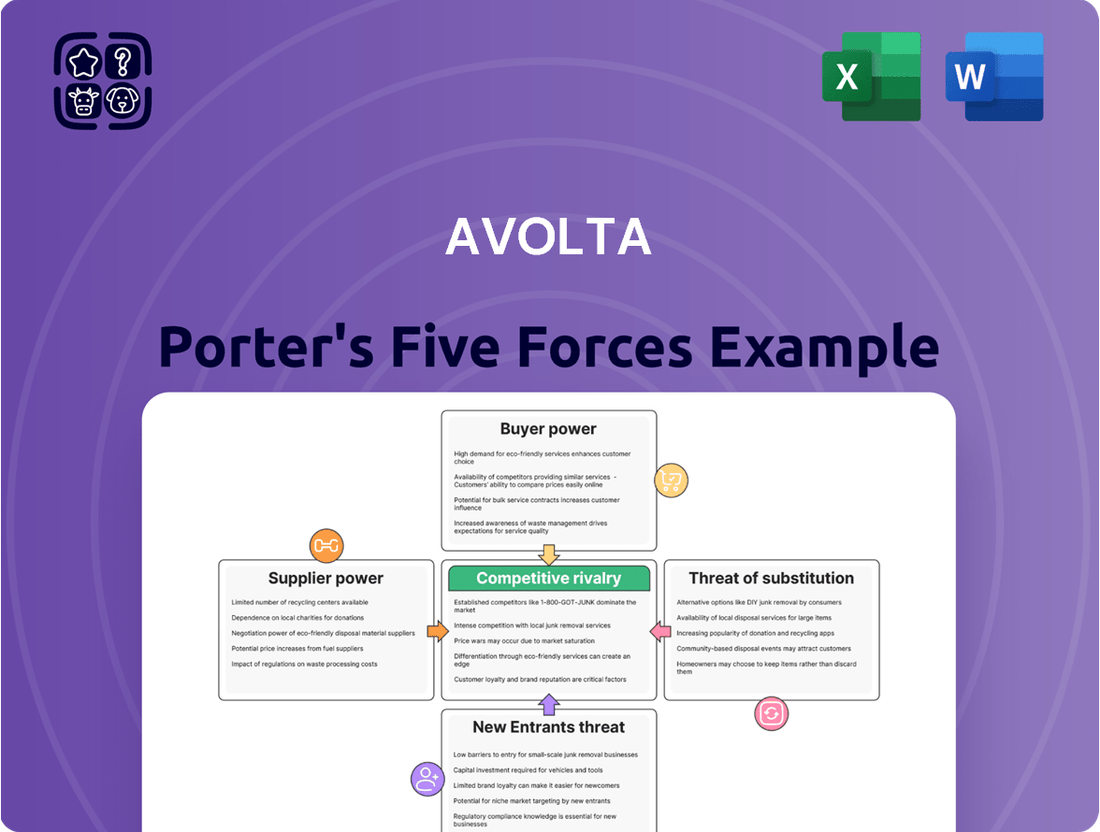

Avolta's competitive landscape is shaped by the interplay of five key forces, revealing crucial insights into its market position. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is vital for strategic planning. This brief overview only scratches the surface of these dynamics.

Unlock the full Porter's Five Forces Analysis to explore Avolta’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with a comprehensive understanding of its industry.

Suppliers Bargaining Power

Avolta's procurement strategy involves sourcing from a wide range of international and local suppliers. The bargaining power of these suppliers can be significant if Avolta depends on a limited number of luxury brands or exclusive product lines, as these suppliers hold unique leverage due to high demand from travelers.

For instance, if a few key premium beverage or confectionery brands are essential to Avolta's offering and have few substitutes, their suppliers can command higher prices. In contrast, for more common items like standard snacks or basic travel accessories, where many suppliers exist, Avolta's purchasing power is stronger, thus reducing supplier leverage.

The bargaining power of suppliers for Avolta is significantly influenced by switching costs. If Avolta has deeply integrated its operations with specific suppliers, such as through long-term contracts or investments in specialized equipment for particular food and beverage concepts, these costs can empower those suppliers. For example, Avolta's reliance on certain branded F&B partners in its airport retail locations means that switching could incur substantial expenses related to rebranding, inventory liquidation, and staff retraining.

Suppliers who provide unique or highly differentiated products, particularly in sectors like luxury goods or specialized food and beverage concepts, wield significant bargaining power. This is especially true in the travel retail industry, where premium and luxury items are a major draw. For instance, a supplier offering an exclusive line of designer fragrances or a novel gourmet snack can command better terms due to the limited availability of alternatives.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward, meaning they start selling directly to travelers and bypass Avolta, significantly boosts their bargaining power. This is particularly relevant in the digital space, where brands can more easily establish direct-to-consumer online channels.

While airport retail concessions are complex and present a high barrier for physical forward integration, the growth of e-commerce means brands could increasingly opt to sell directly to travelers online. This shift could reduce Avolta's role as an intermediary.

Avolta's extensive network of prime locations within airports and travel hubs acts as a strong deterrent against most suppliers attempting forward integration. This established physical presence is a key competitive advantage.

- Forward Integration Threat: Suppliers can increase their bargaining power by selling directly to travelers, bypassing Avolta.

- Online Channels: Direct-to-consumer online models from brands represent a potential long-term threat.

- Avolta's Advantage: Established presence in prime travel locations acts as a significant barrier to supplier forward integration.

Importance of Avolta to Suppliers

The bargaining power of suppliers to Avolta is generally diminished due to Avolta's substantial scale and strategic importance. When a supplier relies heavily on Avolta for a significant portion of its sales, its ability to dictate terms or raise prices is considerably weakened. For example, Avolta's 2023 revenue reached €3.2 billion, indicating its substantial purchasing power across various product categories.

Avolta's expansive global footprint and substantial sales volume position it as a vital distribution channel for numerous brands, especially within the travel retail and duty-free markets. This makes many suppliers dependent on Avolta for market access and revenue generation, thereby reducing their individual bargaining leverage.

- Avolta's extensive global network provides suppliers with access to a vast customer base.

- Significant sales volume translates to substantial orders for suppliers, increasing their reliance on Avolta.

- Dependence on Avolta for market penetration in key travel hubs limits suppliers' ability to negotiate unfavorable terms.

Suppliers' bargaining power is moderated by Avolta's significant scale and its role as a crucial distribution channel for many brands, especially in travel retail. For instance, Avolta's 2023 revenue of €3.2 billion highlights its substantial purchasing volume, making many suppliers reliant on its business for market access and revenue. This dependence limits their ability to impose unfavorable terms.

| Factor | Impact on Supplier Bargaining Power | Avolta's Position |

|---|---|---|

| Supplier Dependence on Avolta | High dependence reduces supplier leverage. | Avolta's €3.2 billion in 2023 revenue signifies its importance to many suppliers. |

| Product Differentiation | Unique products increase supplier power. | Luxury brands and exclusive F&B concepts can command higher prices. |

| Switching Costs | High costs empower suppliers. | Integration with specific F&B partners incurs significant switching costs for Avolta. |

| Forward Integration Threat | Direct sales bypass Avolta, increasing supplier power. | E-commerce poses a threat, though Avolta's prime physical locations are a strong defense. |

What is included in the product

Analyzes the five competitive forces impacting Avolta's industry: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Travelers' price sensitivity is a key factor influencing Avolta's bargaining power of customers. For instance, while a traveler might not haggle over the price of a high-end perfume in a duty-free shop due to the inherent tax savings, they are likely to be much more discerning about the cost of a sandwich or a bottle of water in an airport terminal. This difference highlights how the perceived value and necessity of a product within the travel context directly impact price sensitivity.

The increasing prevalence of online price comparison tools further amplifies customer sensitivity, particularly for non-duty-free items. Travelers can readily check prices for snacks, drinks, or even souvenirs on their smartphones before or during their journey. This easy access to competitive pricing information empowers them to seek out better deals, thereby increasing pressure on Avolta to maintain competitive pricing across its broader retail and food and beverage offerings in travel locations.

Travelers possess significant bargaining power due to the wide array of alternatives available. Within travel hubs like airports, customers can choose from various concessions, comparing prices and offerings. For instance, in 2024, the global airport retail market was valued at over $40 billion, indicating a competitive landscape where consumers have multiple options.

Beyond the immediate travel environment, travelers can access goods and services from a much broader range of sources. Traditional brick-and-mortar retailers, extensive online marketplaces, and local specialty shops all present viable alternatives to airport concessions. This accessibility to diverse purchasing channels amplifies customer leverage, as they are not solely reliant on the limited options within a travel hub.

The perceived value and convenience of purchasing items during travel directly influence how much bargaining power customers wield. If a traveler finds airport prices significantly higher or the selection less appealing than what they can find elsewhere, they are more likely to delay their purchase or seek alternatives, thereby increasing their bargaining power.

Customers today have unprecedented access to information, significantly impacting their bargaining power. With widespread digital connectivity, travelers can easily compare prices and read reviews across numerous platforms, making them highly informed about Avolta's offerings and competitors. This transparency can put pressure on pricing and service levels.

Avolta's Club Avolta loyalty program, boasting over 10 million members as of its latest reports, is a strategic countermeasure. By fostering direct engagement and collecting valuable customer data, Avolta aims to create personalized experiences and exclusive rewards. This can help retain customers by offering greater perceived value than simply comparing external information, thus mitigating the impact of readily available market data.

Switching Costs for Customers

For travelers, the ease of moving between different retailers within a travel hub means switching costs are typically low. This allows customers to readily compare prices and offerings from various vendors.

However, Avolta can cultivate 'soft' switching costs. These arise from factors like the time pressures inherent in travel, the sheer convenience of a one-stop shop, and Avolta's curated product selection, which can make it more appealing to purchase within their environment rather than seeking alternatives.

- Low Direct Switching Costs: Travelers can easily patronize competing retailers in airports or train stations.

- Soft Switching Costs for Avolta: Convenience, time constraints, and unique product assortments can influence customer loyalty.

- Impact on Bargaining Power: While direct switching is easy, these soft costs can mitigate some of the customers' power to demand lower prices.

Volume of Purchases per Customer

Individual travelers, making relatively small purchases, typically wield limited bargaining power on their own. This means that a single person booking a trip doesn't have much sway over Avolta's pricing or service terms.

However, Avolta must consider the aggregate influence of its vast customer base. The collective demand from millions of travelers, particularly those in lucrative segments, significantly shapes Avolta's strategic decisions and pricing structures. For instance, in 2023, Avolta served millions of passengers across its various brands, highlighting the sheer scale of its customer base.

Avolta's strategy to boost spending per passenger is a direct response to this dynamic. By focusing on improving the overall travel experience, Avolta aims to encourage travelers to opt for higher-value services and products, thereby increasing the revenue generated from each individual.

- Low Individual Impact: Most individual travelers make low-volume purchases, limiting their direct bargaining power.

- Collective Influence: The sheer number of travelers, especially high-spending groups, creates significant collective bargaining power.

- Strategic Focus: Avolta aims to increase revenue per passenger by enhancing the overall travel experience and encouraging higher spending.

Customer bargaining power at Avolta is influenced by several factors, including price sensitivity, the availability of alternatives, and switching costs. While individual travelers may have limited power, their collective demand is substantial. Avolta counters this by focusing on enhancing the customer experience and building loyalty.

| Factor | Impact on Bargaining Power | Avolta's Counter-Strategy |

|---|---|---|

| Price Sensitivity | High, especially for non-duty-free items, amplified by online comparisons. | Competitive pricing, loyalty programs (Club Avolta). |

| Availability of Alternatives | High, both within travel hubs and from external retailers. | Curated product selection, convenience, personalized offers. |

| Switching Costs | Low direct switching costs for customers. | Cultivating 'soft' switching costs through convenience and time pressures. |

| Collective Influence | Significant due to the large volume of travelers. | Focus on increasing revenue per passenger through enhanced experience. |

Preview the Actual Deliverable

Avolta Porter's Five Forces Analysis

The preview you see is the exact, comprehensive Avolta Porter's Five Forces Analysis you will receive immediately after purchase. This means you'll gain instant access to the fully formatted document, allowing you to leverage its insights without any delays or unexpected changes. What you're viewing is the complete, ready-to-use analysis, ensuring you get precisely what you need for your strategic planning.

Rivalry Among Competitors

The travel retail and food & beverage landscape is intensely competitive, populated by a mix of large global entities and smaller, specialized regional operators. Avolta, for instance, navigates this complex environment, encountering a varied array of rivals depending on the specific channel it operates within, whether it be airports, railway stations, or cruise terminals.

In 2024, Dufry, which is now Avolta, continued to hold a commanding presence in the global airport retail sector. The company's significant market share, standing at 20.3%, underscores the highly concentrated nature of this segment, even as other players vie for market position across different geographical areas and operational formats.

The global travel retail market is on a strong growth trajectory, with projections indicating a significant increase from 2024 through 2033. Airports, in particular, are a key driver of this expansion. This robust growth environment naturally fuels competitive rivalry as businesses aggressively pursue market share within an expanding industry.

S&P Global Ratings forecasts the travel retail industry to experience a growth rate of 7% to 10% for both 2024 and 2025. Such healthy expansion attracts new entrants and encourages existing players to invest more heavily, intensifying competition for prime locations and customer attention.

Avolta actively differentiates its offerings by providing a broad spectrum of products and services, encompassing duty-free items, specialized retail, and diverse food and beverage options. This strategy aims to enrich the overall traveler experience.

The company is actively merging travel retail and food and beverage segments into hybrid concepts, thereby fostering cross-selling opportunities across different categories to cultivate distinctive and appealing value propositions for its customers.

Exit Barriers

High exit barriers significantly influence competitive rivalry within the travel retail sector. Companies like Avolta face substantial hurdles in divesting operations, primarily due to long-term concession agreements with airports and other transportation hubs. These contracts, often spanning many years, lock businesses into specific locations, making a swift exit financially unviable and potentially leading to substantial penalties or unrecouped investments.

The presence of significant fixed assets and specialized infrastructure further contributes to these exit barriers. Avolta, for instance, has invested heavily in airport retail spaces and the necessary operational setup. Consider their long-standing commitments: a 10-year food and beverage contract at Dallas Fort Worth International Airport and an impressive 18-year agreement for JFK's new terminal. Such long-term commitments mean that exiting these operations before their natural conclusion would be extremely costly, forcing companies to remain and compete vigorously to justify their ongoing presence and recover their capital outlays.

Consequently, these high exit barriers compel companies to compete more intensely to maintain their market share and operational viability. Rather than seeking an easy exit, businesses are incentivized to fight for every sale and customer, driving up the level of rivalry. This dynamic is particularly evident in the travel retail market, where securing and retaining prime airport locations is crucial for long-term success.

- Long-term Concession Contracts: Avolta's extensive contracts, such as the 10-year F&B agreement at DFW and the 18-year contract at JFK's new terminal, create significant commitment.

- Specialized Infrastructure: Investments in airport retail spaces and operational setups are highly specific and difficult to repurpose.

- Financial Lock-in: The inability to easily exit these commitments forces companies to compete fiercely to recoup investments.

- Intensified Rivalry: High exit barriers directly correlate with increased competition as firms strive to maintain market presence and profitability.

Strategic Commitments of Competitors

Competitors' significant investments in innovation and market growth can intensify the competitive landscape for Avolta. For instance, if major players commit substantial capital to developing disruptive technologies or aggressively pursuing new geographic markets, it forces Avolta to respond with its own strategic initiatives to maintain its market position.

Avolta's own strategic commitments, such as its investment in AI tools like Avolta GPT and the expansion of its loyalty program, Club Avolta, are designed to enhance customer personalization and create a distinct competitive advantage. These moves signal Avolta's intent to deepen customer relationships and leverage technology for differentiation.

- Avolta's AI Investment: Avolta is actively integrating artificial intelligence, including its proprietary Avolta GPT, to refine customer interactions and operational efficiencies.

- Loyalty Program Expansion: The growth of Club Avolta aims to foster greater customer loyalty through personalized offers and experiences, a key strategy in a competitive market.

- Industry Trends: The broader travel and tourism industry in 2024 continues to see significant digital transformation efforts, with companies investing heavily in data analytics and personalized customer journeys to capture market share.

Competitive rivalry is a defining characteristic of the travel retail and F&B sectors where Avolta operates. The market is populated by numerous global and regional players, all vying for prime locations and customer spending. This dynamic is amplified by the sector's robust growth projections, with the global travel retail market expected to see significant expansion through 2033, driven largely by airport retail. S&P Global Ratings anticipates a 7% to 10% growth rate for the industry in 2024 and 2025, which naturally attracts investment and intensifies competition.

| Company | 2024 Market Share (Travel Retail) | Key Focus Areas |

|---|---|---|

| Avolta (formerly Dufry) | 20.3% | Airport retail, F&B, hybrid concepts, loyalty programs |

| Dufry (pre-merger) | 20.3% | Global airport retail operations |

| Competitors (various) | Varies by region/channel | Specialized retail, F&B, duty-free, regional strengths |

SSubstitutes Threaten

The most significant threat of substitutes for Avolta's airport retail operations stems from the burgeoning online retail and e-commerce sector. Travelers can easily source many of the same goods, from electronics to fashion, before or after their trips, often at prices that challenge traditional retail models. For instance, global e-commerce sales are projected to reach over $7 trillion in 2024, highlighting the vastness of this alternative channel.

While Avolta's duty-free pricing offers a distinct advantage in certain categories, the sheer convenience and broader product selection available through online platforms present a persistent challenge. Consumers increasingly prioritize ease of access and comparison shopping, which e-commerce excels at providing. This shift in consumer behavior necessitates a robust digital strategy from Avolta.

In response to this competitive pressure, Avolta is actively investing in its digital transformation. This includes enhancing its own e-commerce capabilities to offer a seamless online shopping experience and strengthening its customer loyalty programs. These initiatives aim to retain customer engagement and capture sales that might otherwise be lost to online substitutes, reflecting a strategic pivot towards a more omnichannel approach.

Travelers have numerous alternatives to purchasing within travel retail environments. Local supermarkets, department stores, and specialty shops at their origin or destination offer convenient and often more competitive pricing on many goods. For instance, in 2024, the global retail market, excluding travel retail, is vast, with online sales alone projected to reach trillions of dollars, highlighting the sheer scale of these substitutes.

The threat of substitutes is significant as consumers can easily procure items like confectionery, perfumes, and electronics from non-travel retail channels. This means Avolta must continuously emphasize its unique value proposition. The allure of exclusive travel retail products, such as limited-edition collaborations or specific airport-only brands, alongside the perceived benefit of duty-free pricing, are key differentiators that help Avolta combat this substitution threat.

A significant shift in consumer preferences, moving from tangible goods to intangible experiences, presents a notable threat to Avolta. This trend, particularly pronounced among younger demographics, could diminish demand for traditional retail products, even those integrated into travel experiences.

While Avolta's focus on Food & Beverage (F&B) and experiential retail aims to counter this, a broader societal embrace of minimalism or a prioritization of services over physical goods could still impact revenue streams. For instance, the global travel and tourism market, a key sector for Avolta, saw a significant rebound in 2023, with international tourist arrivals reaching 88% of pre-pandemic levels, indicating a strong appetite for experiences, but this also highlights the potential for substitution if core offerings are perceived as less experiential.

Alternative Food and Beverage Options

Travelers can bypass traditional airport food and beverage outlets by bringing their own snacks and meals, utilizing vending machines for quick bites, or relying on airline-provided catering. These are significant substitutes that can reduce demand for Avolta's services.

Avolta counters this threat by developing a wide array of unique food and beverage concepts, often emphasizing local flavors and culinary experiences. This strategy aims to differentiate their offerings and provide a compelling reason for travelers to choose their outlets over more basic alternatives.

For instance, in 2024, airports globally continued to see a rise in travelers seeking authentic local tastes, a trend Avolta actively capitalizes on. This focus on integration with local culture makes Avolta’s propositions more attractive than generic convenience options.

- Bringing own food: A cost-saving measure for travelers, particularly on shorter flights or for budget-conscious individuals.

- Vending machines: Offer convenience and speed, often stocking a range of snacks and drinks, though typically with less variety than sit-down or quick-service restaurants.

- Airline catering: While often basic, it serves as a default option for many passengers, especially on longer international flights where it's included in the ticket price.

- Avolta's strategy: Diversified F&B concepts and integration of local culinary culture to enhance appeal and customer loyalty.

Regulatory Changes in Duty-Free Allowances

Changes in government regulations, particularly regarding duty-free allowances, can significantly alter the competitive landscape. For instance, an increase in allowances for travelers returning from specific regions can boost the appeal of duty-free purchases in those areas. Avolta, a global travel retail company, saw its revenue increase by 13% to CHF 10.5 billion in 2023, partly due to favorable market conditions and evolving travel retail policies.

Conversely, adverse regulatory shifts worldwide could diminish the attractiveness of duty-free shopping compared to other retail channels. This could lead consumers to opt for substitutes like local retail stores or online platforms that are not subject to the same duty-free limitations. Such changes can influence consumer purchasing decisions, potentially diverting spending away from traditional duty-free operators.

- Regulatory Impact: Tripling duty-free allowances for Chinese travelers returning from Hong Kong or Macau benefited Avolta in the APAC region.

- Global Risk: Adverse global regulatory changes could increase the threat of substitutes by making local or online retail more appealing.

- Financial Implication: Avolta's 2023 revenue growth of 13% to CHF 10.5 billion highlights the sensitivity of travel retail to these regulatory environments.

The threat of substitutes for Avolta is substantial, primarily driven by the pervasive online retail sector. Travelers can easily access a vast array of products, from electronics to fashion, through e-commerce platforms, often at competitive prices. For example, global e-commerce sales are projected to exceed $7 trillion in 2024, underscoring the significant reach of these alternatives.

While Avolta's duty-free pricing offers an advantage, the convenience and extensive selection of online channels present a continuous challenge. Consumers increasingly value ease of access and the ability to compare prices, areas where e-commerce excels. This necessitates a strong digital presence for Avolta to remain competitive.

Furthermore, local retail outlets at a traveler's origin or destination provide readily available substitutes for many goods, including confectionery, perfumes, and electronics. The sheer scale of the global retail market, with online sales alone reaching trillions in 2024, highlights the breadth of these competitive channels.

Avolta counters these threats by emphasizing unique product offerings, such as exclusive travel retail brands and limited-edition collaborations, alongside the inherent benefit of duty-free pricing. The company's strategic investment in its digital transformation and omnichannel approach aims to retain customer engagement and capture sales that might otherwise be lost to substitutes.

Entrants Threaten

Entering the travel retail and food & beverage sector, particularly at lucrative airport and transit points, demands considerable financial outlay. This includes expenses for store construction, stocking merchandise, and obtaining necessary operating permits, creating a formidable barrier for newcomers.

Securing lucrative concession agreements with airport authorities and other travel hub operators presents a significant barrier to entry for new competitors. These agreements are often long-term, demanding established relationships, proven operational expertise, and a solid track record, all of which Avolta has cultivated.

Avolta's strategic advantage is underscored by its long-term contracts, including an 18-year agreement for JFK's new terminal and a 10-year food and beverage contract at Dallas Fort Worth International Airport. These substantial commitments lock in revenue streams and create high switching costs for the airport operators, effectively deterring new entrants who lack Avolta's established presence and operational capacity.

Establishing robust relationships with global brands, especially in the luxury and specialty sectors, is a significant barrier for new entrants in travel retail. These established connections are hard-won and crucial for accessing desirable product assortments.

Newcomers would find it incredibly challenging to replicate the extensive supplier networks and diverse product portfolios that incumbent firms like Avolta have meticulously built over many years. This deep integration into the supply chain creates a substantial competitive moat.

For instance, the top two global travel retailers, including Avolta, benefit from long-standing, preferential supplier relationships, giving them a distinct advantage in sourcing and product exclusivity that new entrants cannot easily overcome.

Operational Complexity and Expertise

The operational complexity inherent in managing Avolta's extensive global network presents a formidable barrier to new entrants. Successfully operating numerous stores and concessions across diverse product categories and geographic regions demands sophisticated logistics, precise inventory control, extensive staff training, and meticulous adherence to a multitude of international regulations. For instance, in 2024, Avolta operates in over 180 locations worldwide, each with unique operational nuances.

Newcomers would confront a steep learning curve, requiring substantial investment in building the necessary infrastructure and acquiring the specialized expertise to navigate these intricate operational challenges. This includes understanding and implementing efficient supply chains, managing perishable goods, and ensuring consistent customer service standards across varied markets.

- Operational Scale: Avolta's presence in over 180 locations globally in 2024 requires immense logistical and management capabilities.

- Product Diversification: Managing a wide array of product categories, from food and beverages to travel retail goods, adds layers of complexity.

- Regulatory Compliance: Navigating diverse international regulations for food safety, labor, and retail operations is a significant hurdle.

- Staff Training and Development: Ensuring a skilled and compliant workforce across numerous sites demands robust training programs.

Customer Loyalty and Brand Recognition

While traveler loyalty to a specific travel retailer might appear lower than in traditional retail sectors, established companies like Avolta leverage significant advantages. Their global loyalty program, Club Avolta, boasts over 10 million members, fostering a dedicated customer base that is difficult for new entrants to replicate. This existing loyalty, coupled with strong brand recognition, presents a substantial barrier.

Building a comparable level of customer trust and a widespread loyalty program from the ground up requires immense investment and time, making it a considerable hurdle for potential new entrants. Avolta's established presence and the inertia of its large member base create a formidable challenge.

- Brand Recognition: Avolta benefits from established brand recognition in the travel retail market.

- Loyalty Program Strength: Club Avolta, with over 10 million members as of recent reports, represents a significant customer retention asset.

- Barriers to Entry: Replicating this scale of customer loyalty and brand equity is a substantial challenge for new competitors.

The threat of new entrants in the travel retail and food & beverage sector is significantly mitigated by Avolta's established scale and operational expertise. High capital requirements for store build-outs and securing prime locations, coupled with the complexity of global operations, create substantial barriers. For example, Avolta's 2024 presence in over 180 locations worldwide highlights the immense logistical and management capabilities required, which are difficult for newcomers to replicate.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from industry-specific market research reports, financial statements of key players, and public filings like SEC reports. This comprehensive approach ensures a thorough understanding of competitive dynamics.