Avolta Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avolta Bundle

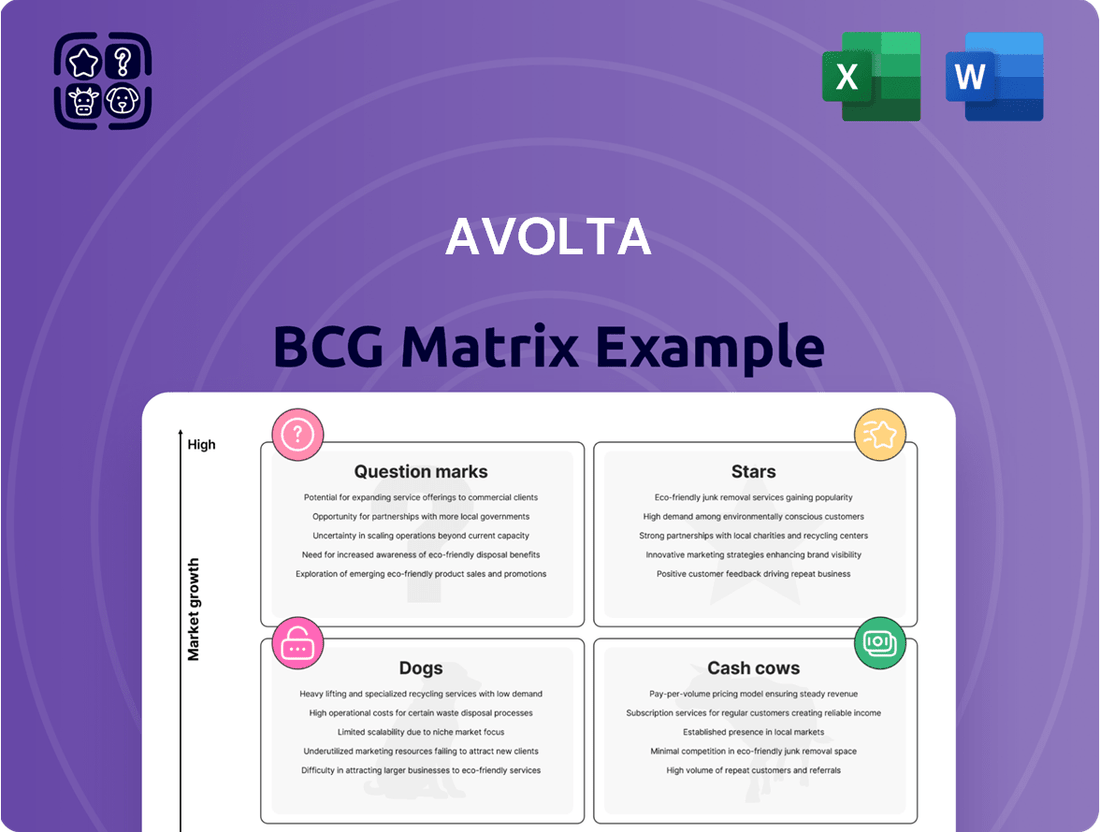

Is your product portfolio a well-oiled machine or a collection of underperformers? The Avolta BCG Matrix provides a powerful framework to categorize your offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a vital snapshot of market share and growth potential. Don't settle for a partial understanding; unlock the full strategic advantage.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Avolta's EMEA region is a significant contributor to its overall success, showcasing impressive growth. In 2024, turnover in this area reached CHF 6.93 billion, marking a substantial 9.4% increase. This performance underscores EMEA's role as a key engine for Avolta's expansion.

The robust growth in EMEA is fueled by a strong recovery in international travel and Avolta's strategic initiatives, especially within the Middle East. This region benefits from established markets like the UK and Spain, alongside strategic new ventures such as operations in Saudi Arabia.

These factors combine to position EMEA as a high-growth, high-market-share segment within Avolta's portfolio. The strategic expansion into new territories, coupled with sustained performance in mature markets, solidifies EMEA's importance for the company's future trajectory.

Avolta is at the forefront of blending travel retail with food and beverage offerings, creating innovative hybrid concepts. In 2024 alone, they launched over 20 of these integrated locations, demonstrating a strong commitment to this evolving market. This approach is yielding significant results, with the hybrid segment experiencing growth beyond initial projections.

The success of these hybrid models is evident as they are expected to capture 10-20% of the total market in the near future. Concepts like 'The Corner by Real Madrid' exemplify this strategy by enriching the customer journey and promoting complementary sales, thereby reinforcing Avolta's dominant position in this dynamic retail landscape.

North America is a shining star for Avolta, demonstrating impressive growth. The company secured an 18-year contract at New York's JFK Airport, covering duty-free, convenience, and specialty retail. This significant win reinforces Avolta's leading position in the US travel retail market, where it already holds an estimated 33% market share.

Club Avolta Global Loyalty Program

Club Avolta, Avolta's innovative global loyalty program, represents a significant growth driver and a key differentiator in the travel retail and F&B sector. Its rapid expansion highlights its strong market appeal and effectiveness in building customer relationships.

By the close of 2024, Club Avolta achieved a remarkable milestone, boasting over 10 million members. This substantial membership base translated into a tangible financial impact, contributing more than 5% to Avolta's overall revenue, a figure that surpassed initial projections.

- Industry-First Innovation: Club Avolta is recognized as a pioneering loyalty program within the travel retail and F&B industry.

- Rapid Membership Growth: By the end of 2024, the program had successfully enrolled over 10 million members.

- Significant Revenue Contribution: The loyalty program accounted for more than 5% of Avolta's revenue in 2024, exceeding expectations.

- Enhanced Customer Engagement: Club Avolta drives personalization and deeper engagement across Avolta's global network of locations.

Strategic 'Travel Experience Revolution'

Avolta's 'Destination 2027' strategy, aiming for a 'travel experience revolution,' is a clear star in its portfolio. This ambitious plan centers on seamlessly integrating retail, food and beverage, and digital touchpoints to redefine the traveler's journey.

This strategic focus is backed by impressive financial momentum. In 2024, Avolta achieved 6.3% organic growth, and forecasts anticipate continued annual organic growth between 5% and 7%. These figures underscore the market's positive reception to their innovative approach.

Avolta is actively fueling this revolution through significant investments. Resources are being channeled into business development initiatives, comprehensive digital transformation projects, and targeted operational enhancements. These investments are designed to solidify Avolta's position as a market leader and innovator.

- Strategic Vision Avolta's 'Destination 2027' strategy champions a 'travel experience revolution'.

- Financial Performance Achieved 6.3% organic growth in 2024, with projections of 5-7% annual growth.

- Investment Focus Key investments are directed towards business development, digital transformation, and operational improvements.

- Market Positioning This strategy positions Avolta as an innovator and leader in the travel retail sector.

Stars represent Avolta's highest-performing business segments, characterized by strong growth and substantial market share. These areas are crucial for driving overall company expansion and profitability.

Key examples of Avolta's Stars include its robust EMEA operations, which saw a 9.4% turnover increase to CHF 6.93 billion in 2024, and its North American ventures, highlighted by an 18-year contract at JFK Airport. The innovative 'Destination 2027' strategy, targeting a travel experience revolution, also falls into this category, supported by 6.3% organic growth in 2024.

Furthermore, Avolta's pioneering hybrid retail and F&B concepts, with over 20 launches in 2024, are positioned as Stars due to their strong growth exceeding initial projections. The Club Avolta loyalty program, surpassing 10 million members and contributing over 5% to revenue in 2024, also demonstrates Star-like qualities.

| Segment | 2024 Turnover (CHF Billions) | 2024 Growth (%) | Market Share/Position | Key Initiatives |

|---|---|---|---|---|

| EMEA | 6.93 | 9.4 | High Market Share | UK, Spain, Saudi Arabia expansion |

| North America | N/A | Significant Growth | 33% US Market Share | JFK Airport contract |

| Hybrid Concepts | N/A | Exceeding Projections | 10-20% Market Capture Expected | 20+ launches in 2024 |

| Club Avolta | N/A | N/A | 10M+ Members | Loyalty Program Growth |

| 'Destination 2027' Strategy | N/A | 6.3% Organic Growth | Market Leader | Digital transformation, operational enhancements |

What is included in the product

The Avolta BCG Matrix offers a strategic framework for categorizing business units based on market share and growth, guiding investment decisions.

A clear, visual representation of your portfolio's strengths and weaknesses, simplifying complex strategic decisions.

Cash Cows

Avolta's position as the number one global travel retailer, with 2023 sales solidifying its dominance, places it squarely in the Cash Cows quadrant of the BCG Matrix. This leadership is built on a substantial global footprint of around 5,100 shops, ensuring a steady and predictable revenue stream from a mature market.

The sheer scale of Avolta's operations generates significant and consistent cash flow. This financial strength allows for substantial reinvestment into growth initiatives or direct returns to shareholders, a hallmark of a successful Cash Cow.

Avolta's core food and beverage concessions in travel hubs are prime examples of Cash Cows. This segment boasts a high market share within the mature travel F&B industry, generating consistent and substantial revenue. For instance, in 2023, Avolta reported a strong performance in its travel experience division, which includes these concessions, demonstrating their reliable contribution to overall profitability.

Avolta's successful integration of Autogrill delivered CHF 85 million in business combination synergies in 2024, exceeding expectations by completing a year ahead of schedule. This achievement directly translates into enhanced profitability and a robust, predictable cash flow stream for the company. The operational efficiencies gained provide a stronger financial foundation.

Diversified Global Presence

Avolta's strategically diversified global presence, spanning over 70 countries and multiple travel channels like airports, railway stations, and cruise ports, underpins its position as a cash cow. This extensive reach significantly reduces dependence on any single market or region, fostering a stable and consistent revenue stream.

This broad geographical and channel diversification is a key strength, ensuring predictable performance even amidst fluctuating economic conditions worldwide. For instance, in 2023, Avolta operated in 75 countries, demonstrating its commitment to a wide operational footprint.

- Global Reach: Operates in 75 countries as of 2023, minimizing single-market risk.

- Channel Diversification: Presence across airports, railway stations, and cruise ports provides multiple revenue streams.

- Resilient Business Model: Diversification leads to predictable and constant performance across varied economic cycles.

- Stable Cash Flow: Reduced reliance on any one segment ensures a reliable source of cash generation.

Established Duty-Paid and Convenience Stores

Beyond its prominent duty-free operations, Avolta's extensive network of duty-paid and travel convenience stores, notably through its Hudson brand, represents a significant pillar of its business. These outlets are strategically positioned to serve a wide array of travelers, offering everyday necessities and impulse purchases. This segment is characterized by its high market share within established travel hubs and mature markets, ensuring a consistent and reliable revenue stream.

These convenience stores function as classic Cash Cows within Avolta's portfolio. They benefit from established brand recognition and customer loyalty, allowing them to command strong market positions. While growth prospects are typically modest due to market maturity, their consistent profitability and strong cash generation capabilities are vital for funding other business initiatives and shareholder returns. For instance, in 2024, Avolta reported continued strength in its North American retail segment, which includes many of these convenience-focused locations, contributing significantly to overall profitability.

- High Market Share: Dominant presence in mature travel retail environments.

- Stable Cash Flows: Consistent revenue generation due to essential product offerings.

- Lower Growth Expectations: Mature markets limit rapid expansion potential.

- Brand Strength: Brands like Hudson benefit from established traveler recognition.

Avolta's established brands and extensive network of travel retail locations, particularly in mature markets, solidify its Cash Cow status. These operations consistently generate substantial and predictable cash flow, a direct result of high market share and customer loyalty. This financial stability is crucial for funding other business areas and shareholder returns.

| Business Segment | Market Share | Cash Flow Generation | Growth Potential |

| Duty-Free Operations | Dominant | High & Stable | Moderate |

| Food & Beverage Concessions | High | Consistent | Low to Moderate |

| Travel Convenience Stores (e.g., Hudson) | High | Reliable | Low |

Preview = Final Product

Avolta BCG Matrix

The preview you are currently viewing is the definitive Avolta BCG Matrix document you will receive immediately after completing your purchase. This ensures you get the exact, unwatermarked, and fully functional strategic tool designed for insightful business analysis. You can trust that this preview accurately represents the complete, ready-to-deploy Avolta BCG Matrix, enabling you to make informed decisions without delay.

Dogs

The Latin America region faced a challenging year in 2024, with like-for-like sales decreasing by 4.7%. This downturn was particularly pronounced in the fourth quarter, which saw a significant contraction of 9.6%.

This performance is largely due to external economic headwinds and difficult year-over-year comparisons, especially in Argentina, which had posted strong results previously. Such a trend suggests a segment that is not growing and may even be shrinking, necessitating a close look at how resources are being deployed.

Certain European markets, particularly the Nordics, have experienced sales headwinds due to geopolitical events. For instance, war-related air routing restrictions have directly impacted airport operations like Helsinki, leading to reduced passenger traffic and, consequently, lower sales for travel retail operators.

These localized challenges translate into a low growth environment and a shrinking market share for Avolta's operations within these specific areas. In 2023, the Nordics region, while not explicitly detailed for geopolitical impact alone, generally saw slower growth compared to other European segments, with some individual airport concessions underperforming due to broader economic and connectivity issues.

Consequently, these underperforming segments may become resource drains, consuming capital and management attention without generating sufficient returns. This profile aligns with the 'dog' category in the BCG matrix, signifying units with low market share in low-growth markets, requiring careful consideration for resource allocation or divestment.

Legacy outdated retail concepts within Avolta, while not explicitly labeled, represent traditional formats that haven't kept pace with traveler demands for experiential or digitally enhanced shopping. These may include older airport shop layouts or limited product assortments that fail to engage contemporary travelers.

Such concepts likely exhibit low market share and stagnant growth, struggling to compete against more innovative retail offerings. For instance, if a significant portion of Avolta's retail footprint still relies on purely transactional models without incorporating digital engagement or unique product experiences, it could be classified here.

These legacy formats can become cash traps, consuming resources for operations and maintenance without generating substantial returns. Avolta's 2024 financial reports, which would detail segment performance, would be crucial in identifying which retail channels are underperforming and potentially draining profitability.

High-Cost, Low-Return Operations

Within Avolta's diverse operations, certain units might be characterized as high-cost, low-return assets. These could be legacy product lines or specific service divisions that, despite efforts to optimize, struggle to generate sufficient profit. For instance, if a particular segment of Avolta's business experienced a revenue decline of 15% in 2024 while its operational costs increased by 10%, it would fall into this category.

Avolta's strategic approach involves rigorous portfolio review. Areas consistently underperforming and failing to meet profitability targets are prime candidates for strategic reassessment. This could lead to decisions regarding divestiture or significant operational overhaul. For example, if a business unit consistently shows a profit margin below 3% and has not improved over the last two fiscal years, it would be flagged for such review.

- High Cost Structure: Units with operational expenses exceeding 75% of their revenue.

- Low Profitability: Segments consistently generating net profit margins below industry averages or internal benchmarks.

- Lack of Growth Potential: Areas with stagnant or declining market share and limited prospects for future revenue increases.

- Strategic Misalignment: Operations that no longer fit Avolta's core business strategy or future growth ambitions.

Non-Strategic or Underperforming Concessions

Avolta, with its extensive global presence, may operate concessions that have drifted from its core strategic objectives or consistently fail to meet performance benchmarks. These might include smaller, geographically dispersed sites or specific product categories that consume resources without significantly boosting market share or overall profitability. For example, in 2024, a review might reveal that certain airport retail outlets in less-trafficked secondary hubs are exhibiting declining revenue per square foot, potentially falling below the company's target of 5% year-over-year growth for established locations.

Active portfolio management is crucial for identifying these non-strategic or underperforming assets. These could be prime candidates for divestment or restructuring to free up capital and management attention for more promising ventures. In 2024, Avolta's strategic review process, which analyzes factors like return on invested capital (ROIC) and alignment with emerging travel trends, would likely flag such concessions. For instance, if a particular food and beverage concession in a European train station saw its ROIC drop to 6% in 2023, well below the company's 15% target, it would be a strong candidate for optimization or sale.

- Underperforming Assets: Concessions showing declining revenue or profitability metrics.

- Strategic Misalignment: Operations that no longer fit Avolta's growth pillars or target markets.

- Resource Drain: Operations consuming capital and management focus without commensurate returns.

- Optimization/Exit Candidates: Assets identified for potential sale, restructuring, or closure to improve portfolio efficiency.

The 'Dogs' in Avolta's portfolio represent business segments or concessions that are experiencing low growth and hold a low market share. These units often require significant resources but yield minimal returns, acting as potential drains on the company's overall performance.

For instance, the Latin America region's 4.7% like-for-like sales decrease in 2024, particularly the 9.6% contraction in Q4, highlights a challenging environment. Similarly, specific European markets like the Nordics, impacted by geopolitical events affecting air travel, demonstrate low growth and shrinking market share.

These underperforming areas, such as legacy retail concepts that haven't adapted to modern traveler demands, are prime candidates for strategic reassessment, potentially leading to divestment or significant restructuring to optimize capital allocation.

Avolta's rigorous portfolio review process, which would analyze metrics like a 3% profit margin or a 6% ROIC in 2023, aims to identify and address these 'dog' assets to improve overall portfolio efficiency.

| Segment Example | 2024 Performance Indicator | BCG Classification Rationale |

| Latin America Sales | -4.7% Like-for-Like Sales (2024) | Low growth, potentially low market share due to economic headwinds. |

| Nordics Airport Retail | Impacted by geopolitical events, reduced passenger traffic | Low growth, shrinking market share in specific locations. |

| Legacy Retail Concepts | Struggling to compete with innovative offerings | Low market share, stagnant growth, potential cash traps. |

| Underperforming Concessions (e.g., ROIC < 15%) | ROIC drop to 6% (2023) in a specific concession | Resource drain, strategic misalignment, candidates for optimization/exit. |

Question Marks

Avolta's strategic entry into Saudi Arabia, marked by its presence at Riyadh's King Khalid International Airport in 2024, positions it in a market with substantial growth prospects. This move is crucial for building brand recognition and market share from the ground up in a region experiencing significant economic development and infrastructure investment.

The planned expansion into Tunisia's five largest airports in 2025 further underscores Avolta's ambition in emerging markets. These new ventures, while demanding considerable upfront capital and focused execution, are designed to capitalize on nascent demand and establish a strong competitive foothold for long-term profitability.

Avolta's launch of Avolta NEXT, its innovation hub focused on travel retail and F&B tech, alongside AI tools like Avolta GPT for customer insights, represents a significant push into high-growth digital areas. These initiatives are designed to transform the traveler experience, but their ultimate market impact and commercial success are still in the early stages of development.

As such, these digital advancements are categorized as question marks within the BCG matrix, indicating substantial potential but also requiring ongoing investment and strategic focus to mature. For example, in 2024, Avolta continued to invest in its digital capabilities, aiming to leverage AI for personalized offers and operational efficiencies, though specific revenue contributions from these new ventures are yet to be fully realized.

Avolta's strategic expansion into new food and beverage concepts, like its inaugural F&B presence in the Latin America cruise channel and its first location at São Paulo/Congonhas Airport in early 2025, signals a bold move into high-potential, yet nascent markets. These ventures are categorized as question marks within the BCG matrix, indicating substantial growth prospects coupled with a currently limited market share.

These pioneering initiatives are designed to unlock new revenue streams and establish Avolta's footprint in previously untapped segments. For instance, the São Paulo/Congonhas Airport venture aims to capture a significant share of the airport's passenger traffic, a demographic known for its disposable income and willingness to spend on convenience and quality F&B offerings.

The success of these question mark strategies hinges on significant investment to build brand recognition, optimize operations, and scale effectively. Avolta's commitment to these new channels reflects a long-term vision to transform these initial footholds into market-leading positions, mirroring the growth trajectory of successful ventures in other sectors.

Specialized Experiential Retail Concepts

Avolta is actively exploring specialized experiential retail concepts, such as The Corner by Real Madrid, which blend retail with unique customer experiences. These initiatives are designed to capture niche markets and foster deep customer engagement, potentially driving significant growth.

While these innovative formats show promise for high engagement and targeted customer acquisition, their current contribution to Avolta's overall revenue is likely minimal. For instance, as of early 2024, the travel retail sector, Avolta's primary domain, saw continued recovery, but specialized concepts are still in nascent stages of market penetration.

- Targeted Customer Engagement: Concepts like The Corner by Real Madrid are crafted to resonate with specific fan bases, enhancing loyalty and spending.

- Potential for High Growth: These experiential models, if successful, can command premium pricing and attract repeat business, offering a higher growth trajectory than traditional retail.

- Strategic Investment Focus: Avolta's challenge lies in identifying which of these specialized concepts possess the scalability and broad market appeal to warrant significant investment for wider rollout.

- Market Share Uncertainty: Currently, these specialized concepts represent a small fraction of Avolta's total market share, underscoring the need for data-driven decisions on future resource allocation.

Digital Personalization and Omni-Channel Initiatives

Avolta's focus on digital personalization, particularly through its Club Avolta loyalty program, is a key driver for future growth. This initiative aims to move beyond initial adoption to deeper engagement, offering tailored experiences to members. The ongoing rollout of these advanced digital strategies is considered a high-growth area for the company.

The company is also heavily invested in broader omni-channel integration, ensuring a seamless customer journey across all touchpoints. While Club Avolta has already attracted members, the full potential for market share capture and revenue optimization from these comprehensive digital efforts is still being realized. This necessitates continued investment and ongoing refinement of their digital platforms.

- Digital Personalization: Enhancing Club Avolta loyalty program for deeper customer engagement.

- Omni-Channel Integration: Creating a seamless customer experience across all platforms.

- Growth Potential: These initiatives represent high-growth areas for Avolta.

- Evolving Strategy: Full market capture and revenue optimization are still in progress, requiring ongoing investment.

Question marks represent Avolta's ventures with high growth potential but currently low market share. These include new market entries like Saudi Arabia, expansion into Tunisia, and innovative F&B concepts in São Paulo. These initiatives require substantial investment to build brand awareness and scale operations effectively. Their ultimate success is uncertain, necessitating careful monitoring and strategic resource allocation to convert them into stars.

BCG Matrix Data Sources

Our BCG Matrix is informed by comprehensive market data, including sales figures, competitor analysis, and industry growth projections, ensuring a data-driven strategic view.