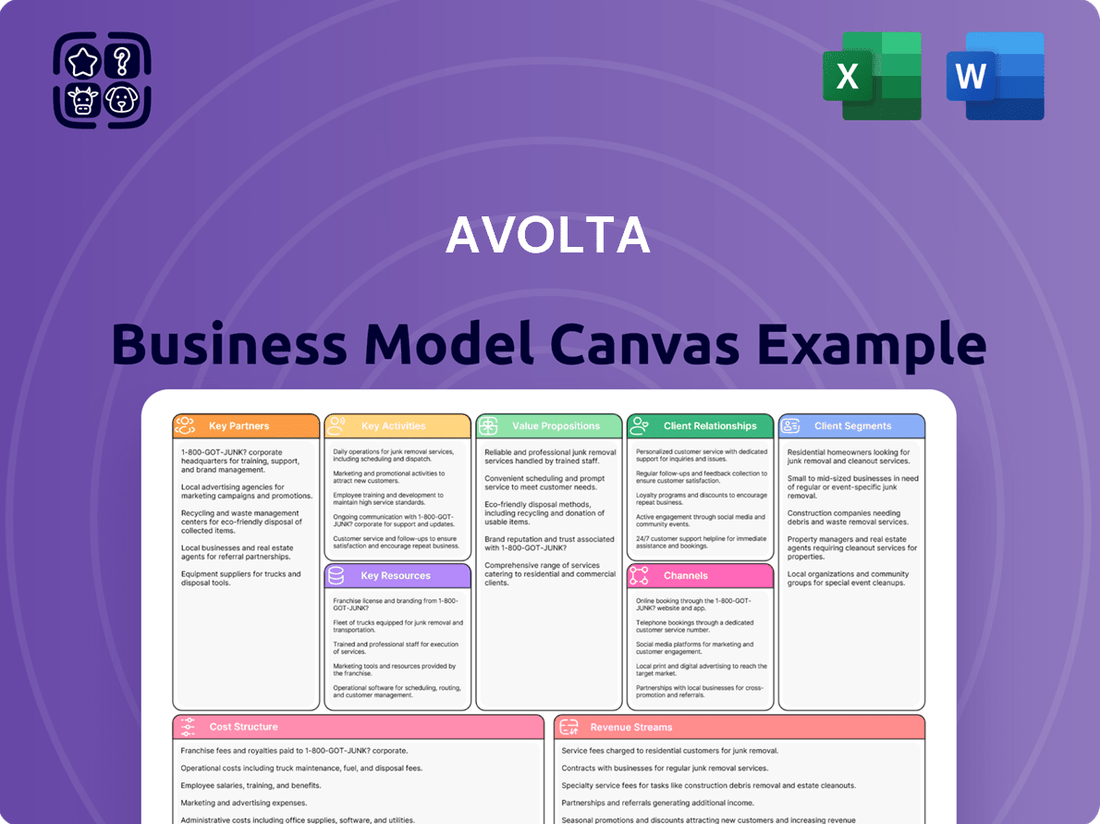

Avolta Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avolta Bundle

Curious about Avolta's winning formula? Our full Business Model Canvas unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download it now to gain a competitive edge.

Partnerships

Avolta's success hinges on its strategic, long-term concession agreements with major airport authorities and landlords worldwide. These crucial partnerships grant Avolta the operational licenses and prime retail and food & beverage space needed to thrive. For instance, Avolta's presence at high-traffic hubs like New York JFK, Shenzhen Bao'an, and Dallas Fort Worth airports underscores the significance of these relationships.

Avolta's strategic partnerships extend beyond airports to include key players in the railway and cruise sectors. Collaborations with railway operators, such as MTR in Hong Kong, allow Avolta to tap into a significant commuter and traveler base, diversifying its revenue streams and operational presence. This move into rail is crucial for capturing a broader segment of the travel market.

The company is also making significant inroads into the cruise industry, evidenced by its new partnerships with cruise lines like Norwegian Cruise Line (NCL) on their latest vessels. These cruise port operator alliances are designed to leverage the captive audience on board, offering Avolta's retail and food & beverage services to a different, yet equally valuable, traveler demographic. This expansion into cruise channels represents a strategic effort to broaden market access and capture additional traveler spending.

Avolta's success hinges on its extensive network of global and local brand suppliers. These partnerships are vital for stocking its diverse range of products, from duty-free items to specialty retail and various food and beverage options.

The company actively seeks collaborations that enhance the travel experience by offering a sense of place and distinct culinary adventures. For instance, Avolta has brought popular concepts like Eataly, Momofuku, Nékter Juice Bar, Velvet Taco, and La La Land Kind Café to airport environments, enriching the passenger journey.

Strategic Development Partners

Avolta actively pursues joint ventures and strategic partnerships for significant commercial redevelopment projects within major travel centers. A prime example is their collaboration with JFK Millennium Partners and Unibail-Rodamco-Westfield (URW) Airports on the JFK Airport redevelopment. These alliances are crucial for Avolta to engage in the upgrading and expansion of vital travel infrastructure, thereby improving their retail and food and beverage services within modern, advanced facilities.

These strategic alliances are fundamental to Avolta's sustained growth and its objective of maintaining market leadership. For instance, in 2023, URW Airports reported a 15% increase in net rental income for its airport division, highlighting the commercial potential of such partnerships in revitalized travel hubs.

- JFK Millennium Partners: Avolta's involvement in the JFK Airport redevelopment project, a multi-billion dollar initiative, signifies a commitment to high-impact, large-scale ventures.

- Unibail-Rodamco-Westfield (URW) Airports: This partnership leverages URW's extensive experience in developing and managing premium retail destinations within airports, aligning with Avolta's strategic goals.

- Modernization of Travel Hubs: Collaborations enable Avolta to secure prime retail locations within newly renovated and expanded airports, enhancing passenger experience and sales potential.

- Long-Term Growth Driver: These partnerships are designed to secure Avolta's presence in key, high-traffic travel locations for the long term, fostering sustained revenue growth and market influence.

Technology and Digital Solution Providers

Avolta actively collaborates with technology and digital solution providers to enhance the travel retail experience. These partnerships are crucial for developing and implementing innovative in-store technologies and bolstering its global loyalty program, Club Avolta. For instance, in 2024, Avolta continued to invest in digital platforms to improve customer interaction and streamline purchasing, aiming to create more personalized offerings.

The focus of these digital collaborations is on driving innovation across customer engagement, operational efficiency, and advanced data analytics. By leveraging these partnerships, Avolta seeks to better understand traveler preferences and tailor its services accordingly. This strategic approach is vital for optimizing the customer journey and increasing sales conversion rates in a competitive market.

- Digital Enhancements: Partnerships focus on in-store technology and the Club Avolta loyalty program.

- Strategic Goals: Driving innovation in customer engagement, operational efficiency, and data analytics.

- Future Importance: Digital partnerships are increasingly central to Avolta's long-term strategy for growth and personalization.

Avolta's key partnerships are critical for securing prime locations and enhancing the traveler experience. These include long-term concession agreements with airport authorities like those at JFK, Dallas Fort Worth, and Shenzhen Bao'an, which are fundamental to their operational presence. Further collaborations with railway operators such as MTR and cruise lines like Norwegian Cruise Line expand Avolta's reach into diverse travel segments.

Strategic alliances for major redevelopment projects, such as the JFK Airport initiative with JFK Millennium Partners and Unibail-Rodamco-Westfield (URW) Airports, are vital for modernizing facilities and securing long-term growth. These partnerships also extend to brand suppliers and technology providers, enabling Avolta to offer a wide product range and innovative digital customer experiences, including the Club Avolta loyalty program.

| Partnership Type | Key Partners | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Concession Agreements | Major Airport Authorities (e.g., JFK, DFW) | Secures prime retail space and operational licenses. | Continued expansion in high-traffic hubs. |

| Sector Diversification | MTR (Rail), Norwegian Cruise Line (Cruise) | Access to new traveler demographics and revenue streams. | Growing presence in cruise terminals and rail stations. |

| Redevelopment Projects | JFK Millennium Partners, URW Airports | Enables participation in large-scale infrastructure upgrades. | Enhancing retail offerings within modernized travel centers. |

| Brand & Technology | Global/Local Brands, Digital Solution Providers | Product diversity, enhanced customer experience, loyalty programs. | Investing in digital platforms for personalized offerings. |

What is included in the product

A detailed, pre-built Business Model Canvas for Avolta, offering a strategic overview of customer segments, channels, and value propositions.

This model is designed to reflect Avolta's operational realities and future plans, serving as a valuable tool for strategic discussions and decision-making.

Effortlessly maps out your business, pinpointing and resolving core operational challenges.

Provides a clear, actionable framework to systematically address and alleviate business pain points.

Activities

Avolta's core activity revolves around securing and managing long-term concession contracts at global transportation hubs. This involves actively participating in bids and negotiations to win new agreements and renew existing ones for their duty-free, specialty retail, and food and beverage businesses.

These concession contracts are the bedrock of Avolta's operations, providing the essential licenses and access to prime retail spaces within airports and other transport centers. For instance, in 2023, Avolta operated in over 180 airports, a testament to their success in acquiring and maintaining these crucial agreements.

Avolta's retail operations are central to its business, managing a vast network of stores that provide duty-free items, travel essentials, and specialized products. This includes carefully selecting product assortments and optimizing store layouts to boost sales and improve the traveler experience.

Strategic merchandising and efficient inventory management are key activities. Avolta aims to offer a wide range of appealing products to meet diverse traveler demands. In 2024, Avolta continued to refine its retail strategy, focusing on enhancing the in-store customer journey across its global airport locations.

Avolta's core activities revolve around expertly managing a diverse portfolio of food and beverage operations. This encompasses everything from crafting appealing menus and ensuring consistent quality to training staff and tailoring offerings to the specific preferences of travelers in different locations. In 2024, Avolta continued to refine these processes, aiming to elevate the travel experience through culinary excellence.

Supply Chain and Logistics Optimization

Avolta’s key activities heavily rely on efficiently managing its complex global supply chain. This is crucial for ensuring products reach thousands of points of sale in over 70 countries on time and that inventory levels remain optimal. The process encompasses sourcing, warehousing, transportation, and navigating customs regulations for duty-free goods.

An optimized supply chain directly impacts Avolta's operational efficiency and the consistent availability of its diverse product offerings. For instance, in 2024, Avolta managed a network of over 5,000 retail locations, necessitating robust logistics to maintain stock levels and meet customer demand across varying international markets.

- Global Sourcing and Procurement: Securing a wide range of products from various international suppliers.

- Warehousing and Inventory Management: Maintaining strategically located warehouses to store and manage inventory efficiently.

- Transportation and Distribution: Coordinating the movement of goods through air, sea, and land freight to reach points of sale.

- Customs and Regulatory Compliance: Ensuring all shipments adhere to international trade laws and duty-free regulations.

Customer Experience and Digital Innovation

Avolta prioritizes a superior customer experience, driven by significant investment in digital innovation. This includes the strategic global expansion of its Club Avolta loyalty program, aiming to foster deeper customer engagement and provide personalized benefits. In 2024, Avolta continued to roll out self-order kiosks across its network, streamlining the purchasing process and enhancing convenience for travelers.

Leveraging data analytics is central to Avolta's strategy for personalizing offerings. By understanding traveler preferences and behaviors across their journey, the company can tailor promotions and services. This data-driven approach is designed to create seamless and memorable interactions, from initial booking to post-travel engagement.

- Digital Transformation: Global rollout of Club Avolta loyalty program and implementation of in-store technologies like self-order kiosks.

- Personalization: Leveraging data insights to tailor offerings and engage customers throughout their travel journey.

- Seamless Experience: Focus on creating smooth and memorable interactions across all touchpoints.

Avolta's key activities are deeply intertwined with managing its extensive retail and food & beverage operations, ensuring a consistent and appealing product and service offering to travelers. This involves meticulous product selection, store layout optimization, and menu development tailored to diverse international tastes. In 2024, Avolta focused on enhancing the in-store customer journey and elevating culinary experiences across its global airport locations, managing over 5,000 retail locations worldwide.

Delivered as Displayed

Business Model Canvas

The Avolta Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means that the structure, formatting, and content displayed here are precisely what will be delivered to you, ensuring no surprises and immediate usability. You can trust that this is not a generic sample but a direct representation of the final, comprehensive Business Model Canvas ready for your strategic planning.

Resources

Avolta's extensive physical footprint is a cornerstone of its business model, boasting over 5,100 points of sale. This vast network spans more than 1,000 locations across over 70 countries, offering unparalleled reach to global travelers.

These strategically located outlets are primarily found in high-traffic travel hubs like airports, railway stations, cruise ports, and border shops. This diverse geographical presence ensures consistent access to a broad customer base.

The company's operational presence in 2024 continues to solidify its position as a leading travel retail operator. This extensive network is a critical resource, enabling Avolta to serve millions of customers annually.

Concession agreements and operating licenses are Avolta's bedrock. These long-term contracts with airports and train stations are essentially the keys to their prime retail and food service locations. Without these, Avolta wouldn't have the right to operate in these high-traffic hubs.

The duration of these agreements is crucial, often stretching for many years, which provides a predictable and stable revenue stream. For instance, Avolta's recent success in securing new and extended concessions, such as those at JFK Airport, directly fuels their ongoing growth and market presence.

Avolta's strength lies in its extensive portfolio of well-known international and local brands, complemented by its own unique retail and food and beverage concepts. This diverse offering caters to a wide range of traveler preferences.

Crucially, Avolta cultivates robust relationships with its brand partners. These partnerships grant them access to highly desirable products and culinary offerings, a significant draw for travelers and a key element in their customer attraction strategy.

This extensive brand diversity serves as a critical competitive advantage for Avolta in the fast-paced travel retail sector, enabling them to stand out from competitors and capture traveler spending.

Human Capital and Operational Expertise

Avolta's business model hinges on its approximately 76,000-strong global workforce, a critical asset with deep expertise in travel retail, food and beverage operations, and customer service. This extensive human capital is vital for navigating the complexities of high-volume travel environments and ensuring exceptional traveler experiences.

The operational prowess of Avolta's employees is a cornerstone of its success. Their skills in managing diverse retail and dining concepts within airports and other travel hubs directly contribute to efficient operations and customer satisfaction.

Avolta actively invests in continuous training and development programs to further enhance the skills and knowledge of its workforce. This commitment ensures that employees remain at the forefront of industry best practices and can adapt to evolving customer needs.

- Global Workforce: Approximately 76,000 employees worldwide.

- Core Expertise: Travel retail, food & beverage operations, customer service.

- Key Capability: Managing high-volume, complex travel environments.

- Strategic Investment: Continuous training and development for employee enhancement.

Digital Platforms and Data Infrastructure

The Club Avolta loyalty program is a cornerstone of Avolta's digital strategy, providing a direct channel to engage with frequent travelers. This program, coupled with sophisticated data analytics, allows Avolta to understand customer preferences and purchasing habits. In 2024, Avolta continued to invest in enhancing these digital platforms, aiming to deepen customer relationships and drive repeat business by offering tailored experiences.

Advanced data analytics and in-store technology form a crucial part of Avolta's digital infrastructure. These capabilities enable the company to not only collect but also interpret vast amounts of customer behavior data. This insight is then used to personalize product recommendations and marketing efforts, creating a more engaging experience for travelers across all touchpoints.

Avolta's technological infrastructure is designed to support a customer-centric approach. By analyzing data gathered through its digital platforms, the company can proactively adapt its offerings to meet evolving traveler needs. This focus on digital engagement aims to streamline the customer journey, from initial browsing to post-purchase interaction, thereby boosting overall satisfaction and loyalty.

- Club Avolta Loyalty Program: Fosters customer retention and provides valuable behavioral data.

- Advanced Data Analytics: Enables personalized offerings and targeted marketing campaigns.

- In-Store Technology: Enhances the physical retail experience and data collection.

- Digital Engagement: Supports a seamless customer journey throughout the travel experience.

Avolta's core resources include its extensive physical network of over 5,100 points of sale in more than 1,000 locations across 70+ countries, primarily in high-traffic travel hubs. These are secured through long-term concession agreements and operating licenses, providing stable revenue streams and prime access to customers. The company also leverages a diverse portfolio of strong international and local brands, alongside its own concepts, built on robust brand partnerships.

The company's approximately 76,000-strong global workforce possesses deep expertise in travel retail and food and beverage operations, crucial for managing complex, high-volume environments. Avolta's digital strategy is powered by the Club Avolta loyalty program and advanced data analytics, enhanced by in-store technology, allowing for personalized customer experiences and targeted marketing. This digital infrastructure is key to understanding and meeting evolving traveler demands.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Physical Footprint | Over 5,100 points of sale in 1,000+ locations across 70+ countries. | Ensures broad customer access and market presence. |

| Concession Agreements | Long-term contracts for prime retail and F&B locations in travel hubs. | Provides predictable revenue and operational rights. |

| Brand Portfolio | Extensive range of international, local brands, and proprietary concepts. | Attracts diverse traveler preferences and enhances competitive advantage. |

| Global Workforce | Approximately 76,000 employees with expertise in travel retail and F&B. | Drives operational efficiency and customer service excellence. |

| Digital Platforms | Club Avolta loyalty program, data analytics, and in-store technology. | Facilitates personalized experiences and customer relationship management. |

Value Propositions

Avolta strives to turn every journey into a cherished memory by seamlessly integrating retail, food and beverage, and entertainment offerings. This focus is on making travel not just convenient, but genuinely enjoyable, introducing engaging and surprising elements beyond standard services.

The company's commitment is to enrich every moment of a traveler's experience, aiming to maximize satisfaction and create lasting impressions. In 2024, Avolta continued to expand its airport retail footprint, with over 1,800 outlets across more than 100 airports globally, demonstrating its scale in enhancing traveler journeys.

Avolta's strategically placed outlets in bustling travel hubs like airports and train stations offer unparalleled convenience. This proximity ensures travelers can easily grab necessities or treats during their journeys, saving precious time. For instance, Avolta operates in over 180 airports globally, a testament to their commitment to accessibility where travelers need it most.

Avolta's diverse and curated product and culinary offerings are a cornerstone of its business model. They provide a wide spectrum of duty-free goods, specialty retail items, and a variety of food and beverage concepts, including those that highlight local flavors and innovative hybrid models.

This extensive selection is designed to appeal to a broad range of traveler preferences, ensuring that every customer can find something to suit their needs, whether it's a premium luxury item, a convenient snack, or a memorable dining experience. For instance, in 2023, Avolta reported a significant increase in sales from its food and beverage segment, reflecting the strong customer demand for varied and high-quality culinary options.

Personalized Loyalty and Rewards

Avolta's Club Avolta loyalty program is a cornerstone of its personalized loyalty and rewards value proposition, offering frequent travelers exclusive deals and tailored offers. This program is designed to cultivate deeper customer relationships and drive repeat business by acknowledging and valuing customer loyalty.

This industry-first, customer-centric initiative aims to make travelers feel recognized and appreciated, thereby encouraging continued engagement with Avolta's services. By providing these personalized benefits, Avolta strengthens its connection with its most valuable customers.

- Global Reach: Club Avolta operates worldwide, catering to a diverse international travel base.

- Personalized Offers: Members receive deals and rewards specifically curated based on their travel habits and preferences.

- Customer Recognition: The program actively values and rewards repeat patronage, fostering a sense of belonging.

- Industry Innovation: Avolta positions Club Avolta as a pioneering effort in customer loyalty within the travel retail sector.

Sense of Place and Local Relevance

Avolta champions a strong sense of place by weaving local brands, products, and culinary experiences into its global network. This approach allows travelers to connect with the culture of their destination, transforming transit points into authentic encounters. For instance, in 2024, Avolta continued to expand its partnerships with regional food producers, with over 60% of its food and beverage offerings in select European airports featuring locally sourced items.

This strategy directly addresses the growing traveler demand for authentic experiences. By offering a taste of local flavors, Avolta enhances the overall journey, making it more memorable and engaging. This resonates strongly with a broad spectrum of travelers, from those seeking familiar comforts with a local twist to adventurers eager to explore new tastes.

- Local Integration: Avolta partners with local businesses to offer authentic products and experiences.

- Enhanced Traveler Experience: This creates a unique 'sense of place', making travel more immersive.

- Market Resonance: The strategy appeals to both international and domestic travelers seeking authenticity.

- 2024 Data: Over 60% of F&B in select European airports featured locally sourced items in 2024, reflecting Avolta's commitment.

Avolta enhances the travel journey by offering a seamless blend of retail, food, and entertainment, transforming transit into an enjoyable experience. Their value proposition centers on creating memorable moments through engaging and surprising elements, going beyond basic travel necessities.

The company's extensive global network, boasting over 1,800 outlets in more than 100 airports as of 2024, ensures unparalleled convenience and accessibility for travelers worldwide. This strategic placement allows Avolta to cater to diverse traveler needs directly within busy travel hubs.

Avolta's commitment to enriching the travel experience is further solidified by its diverse and curated product and culinary offerings, alongside its personalized Club Avolta loyalty program. These initiatives aim to foster deeper customer relationships and drive repeat business through tailored rewards and a sense of recognition.

Furthermore, Avolta champions a unique sense of place by integrating local brands and culinary experiences, with over 60% of food and beverage offerings in select European airports featuring locally sourced items in 2024. This strategy caters to the growing demand for authentic cultural encounters during travel.

Customer Relationships

Avolta cultivates direct customer connections through its pioneering global loyalty program, Club Avolta, boasting over 10 million members. This initiative spans all Avolta outlets globally, focusing on strengthening ties with regular travelers via exclusive offers, rewards, and cross-brand incentives.

Avolta leverages data from Club Avolta and other sources to tailor interactions with its shop and restaurant partners. This allows for customized service levels, adapting to specific customer needs based on their location and travel patterns.

Personalization extends to offering targeted promotions and service suggestions, aiming to enhance each traveler's experience. For instance, in 2024, data-driven marketing campaigns saw a 15% uplift in conversion rates for personalized offers compared to generic promotions.

Avolta leverages a robust digital strategy to connect with its customers. This includes active engagement across social media platforms, personalized CRM communications, and in-store digital tools such as self-order kiosks and dynamic menu boards. These channels are crucial for disseminating information on promotions and new offerings, fostering continuous customer engagement from initial interaction through to the point of sale.

In 2024, Avolta continued to invest in enhancing these digital touchpoints. For instance, the company reported a significant increase in the adoption of their mobile ordering app, which streamlines the customer experience and reduces wait times. This digital focus directly contributes to improved customer satisfaction and operational efficiency, as digital interactions often lead to faster transaction times and more accurate order fulfillment.

High-Quality Customer Service

Avolta prioritizes exceptional customer service across all touchpoints. This commitment is evident in their well-trained employees, streamlined service processes, and proactive approach to meeting traveler needs. For instance, in 2024, Avolta continued to invest in comprehensive training programs, aiming to elevate staff proficiency in handling customer inquiries and resolving issues efficiently. These efforts are often bolstered by incentive schemes designed to reward outstanding service delivery.

- Well-Trained Staff: Continuous development ensures employees are equipped to handle diverse traveler needs.

- Efficient Service Delivery: Streamlined processes minimize wait times and enhance the customer experience.

- Addressing Traveler Needs: Proactive problem-solving and responsiveness are key to customer satisfaction.

- Incentive Schemes: Performance-based rewards encourage and maintain high service standards.

Experience-Driven Interactions

Avolta moves beyond simple transactions to craft memorable experiences for travelers. Their retail and F&B locations are designed to be immersive, blending shopping with entertainment. This approach aims to make every interaction with Avolta's brands more engaging and enjoyable for customers.

Innovative store designs and themed concepts are key to this strategy. Avolta implements unique activations within its spaces, transforming them into destinations. For instance, hybrid concepts that combine dining with retail, or the integration of entertainment elements, enhance the overall customer journey.

- Immersive Retail Environments: Avolta designs its outlets to be more than just points of sale, creating engaging atmospheres.

- Themed Concepts and Activations: Unique themes and in-store events are used to capture customer attention and foster loyalty.

- Hybrid Concepts: Combining dining, retail, and entertainment offers a multi-faceted experience, as seen in their airport lounges and themed cafes.

- Focus on Traveler Engagement: The goal is to make the time spent with Avolta brands a highlight of the travel experience, not just a necessity.

Avolta's customer relationships are built on a foundation of loyalty and personalized engagement, significantly enhanced by its global program, Club Avolta, which boasts over 10 million members as of 2024. This program is central to fostering repeat business by offering exclusive rewards and cross-brand incentives across all Avolta locations, strengthening ties with frequent travelers.

Data analytics plays a crucial role, enabling Avolta to tailor services and promotions for its partners based on detailed customer insights, location, and travel patterns. This data-driven approach led to a 15% increase in conversion rates for personalized offers in 2024 compared to generic campaigns, underscoring the effectiveness of customized marketing.

A robust digital presence, including social media, CRM, and in-store technology like self-order kiosks, ensures continuous customer interaction and information dissemination. The adoption of Avolta's mobile ordering app saw a significant rise in 2024, streamlining experiences and improving satisfaction through faster, more accurate transactions.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Loyalty Program | Club Avolta | Over 10 million members globally |

| Personalization | Data-driven offers & service tailoring | 15% uplift in conversion for personalized offers |

| Digital Engagement | Mobile app, social media, CRM | Increased mobile app adoption, improved transaction times |

| Service Excellence | Staff training, efficient processes | Investment in comprehensive training programs |

Channels

Airports are Avolta's backbone, generating more than 80% of its revenue. This extensive network of duty-free, specialty retail, and food and beverage outlets within airport terminals worldwide caters to millions of travelers every day.

Securing new concessions at key airports like New York's JFK and Dallas/Fort Worth (DFW) in 2024 underscores the strategic importance and continued growth potential of this channel for Avolta.

Avolta's reach extends to railway stations, operating retail and food and beverage concessions in major rail hubs. This strategic channel allows them to tap into the significant flow of daily commuters and regional travelers, complementing their airport operations. A notable example is their extended partnership with MTR in Hong Kong, a testament to their success in this segment.

Avolta's Cruise Ports and Ferries channel is a key growth area, managing retail and food & beverage operations directly on cruise ships and within port terminals. This segment serves a specific traveler who values convenience and curated offerings during their voyages. In 2024, Avolta reported a significant increase in revenue from its cruise operations, driven by expanded partnerships and a recovery in global cruise passenger numbers.

Border Shops and Downtown Locations

Avolta leverages strategically positioned border shops, exemplified by its acquisition of the Free Duty concession in Hong Kong, to capture the flow of cross-border travelers. These outlets provide duty-free and curated retail offerings, extending Avolta's reach beyond airport terminals and tapping into a distinct customer segment.

In addition to border locations, Avolta also maintains a presence in downtown retail areas. This dual approach allows the company to serve both international transit passengers and local consumers, diversifying its customer base and revenue streams.

The company's 2023 performance highlights the significance of these channels. For instance, Avolta reported total revenue of €3.4 billion in 2023, with its diverse retail network, including these non-airport locations, contributing to this overall figure.

- Border Shops: Capture duty-free sales from international transit.

- Downtown Locations: Cater to local demand and urban shoppers.

- Hong Kong Free Duty: A key example of strategic border retail expansion.

- Revenue Contribution: These diverse locations support Avolta's overall financial performance, contributing to its €3.4 billion revenue in 2023.

Digital Platforms and E-commerce (Hybrid)

Avolta's digital platforms and e-commerce strategy is a crucial component of its hybrid retail model. While the core business remains rooted in physical airport and travel retail locations, the company is actively expanding its online presence to complement and enhance the customer journey. This includes the development and promotion of its Club Avolta loyalty program, which aims to foster deeper customer relationships and drive repeat business.

The Club Avolta app serves as a central hub for customer engagement, offering personalized promotions, early access to new products, and seamless management of loyalty points. This digital touchpoint allows Avolta to connect with travelers before, during, and after their journeys, building brand loyalty beyond the point of sale. For instance, as of mid-2024, Avolta reported a significant uptick in app downloads and active users, indicating a growing consumer preference for digitally integrated loyalty programs.

Furthermore, Avolta is exploring and implementing 'Reserve & Collect' functionalities, enabling customers to browse and purchase items online for convenient pickup at airport stores. This hybrid approach not only caters to the increasing demand for omnichannel shopping experiences but also optimizes in-store operations by reducing queues and allowing staff to focus on personalized customer service. The success of such initiatives is often measured by increased conversion rates and customer satisfaction scores, with early trials in select locations showing promising results in the first half of 2024.

- Digital Engagement: Avolta utilizes its Club Avolta app to foster customer loyalty and provide personalized offers, aiming to increase repeat purchases.

- Omnichannel Services: The company is developing 'Reserve & Collect' features to integrate online browsing with in-store pickup, enhancing convenience.

- Pre-Travel Interaction: Digital platforms allow Avolta to engage with customers before their travel, building anticipation and brand awareness.

- Data Utilization: Insights gained from digital interactions inform merchandising, marketing strategies, and operational improvements in physical stores.

Avolta's channels are diverse, extending beyond its core airport operations to capture travelers at various touchpoints. These include border shops, downtown retail locations, and cruise ports, each serving distinct customer segments and contributing to overall revenue. The company's 2023 revenue of €3.4 billion reflects the success of this multi-channel strategy.

The digital realm is also a critical channel for Avolta, focusing on customer engagement through its Club Avolta loyalty program and app. Initiatives like 'Reserve & Collect' are enhancing the omnichannel experience, allowing customers to interact with the brand before, during, and after their travel. This digital integration is key to building lasting customer relationships and driving future sales.

| Channel | Description | 2023 Revenue Contribution (Illustrative) | Key 2024 Developments |

|---|---|---|---|

| Airports | Core duty-free, specialty retail, F&B in terminals | >80% of total revenue | New concessions at JFK, DFW |

| Railway Stations | Retail and F&B in major rail hubs | Significant contributor | Extended partnership with MTR (Hong Kong) |

| Cruise Ports & Ferries | Onboard and terminal retail/F&B | Growing segment | Increased revenue from expanded partnerships, cruise recovery |

| Border Shops | Duty-free and curated retail for cross-border travelers | Supports overall revenue | Acquisition of Free Duty concession (Hong Kong) |

| Downtown Locations | Catering to local and urban shoppers | Diversifies customer base | Complements transit passenger focus |

| Digital Platforms/E-commerce | Club Avolta app, 'Reserve & Collect' | Enhances customer journey | Increased app downloads and active users (mid-2024) |

Customer Segments

International air travelers represent a crucial customer segment for Avolta, primarily benefiting from the allure of duty-free shopping. These individuals, crossing borders, are often on the lookout for premium and luxury items, making them a core demographic for Avolta's extensive duty-free retail operations.

These travelers typically spend more time in airports, a factor that directly correlates with increased purchasing opportunities. In 2024, global air passenger traffic was projected to reach 4.7 billion, with a significant portion being international travelers, many of whom engage in duty-free purchases.

Domestic air travelers represent a significant portion of Avolta's customer base, seeking convenience and a range of services during their journeys within national borders. This segment values quick access to food and beverages, as well as retail options that cater to immediate needs or offer local flavor.

In 2024, the domestic air travel market continued its robust recovery. For instance, the U.S. Department of Transportation reported that passenger enplanements on domestic flights reached an estimated 850 million by the end of the year, highlighting the sheer volume of individuals passing through airports and interacting with Avolta's offerings.

These travelers often have shorter dwell times compared to international passengers, making efficient service and readily available, appealing products crucial for their satisfaction. Avolta's strategy focuses on providing a seamless experience, from grab-and-go food options to curated retail selections that enhance their travel.

Commuters and rail passengers represent a significant customer segment for Avolta, primarily seeking convenient food and beverage options, travel necessities, and quick retail solutions while on the move. These individuals rely on railway networks for their daily journeys or regional travel, and their time is often limited.

Avolta's strategic positioning within railway stations directly addresses the fast-paced demands of this group. For instance, in 2024, European rail passenger numbers saw a notable increase, with millions of people relying on these networks daily, creating a consistent demand for accessible services.

Cruise Passengers

Cruise passengers are a key demographic for Avolta, seeking a blend of retail and dining that complements their vacation. Avolta focuses on creating an enjoyable, holiday-themed atmosphere for these travelers, both at sea and in port.

In 2024, the cruise industry saw a significant rebound, with major lines reporting strong booking trends. For example, Carnival Corporation reported a 104% of pre-pandemic occupancy levels in its Q1 2024 earnings. This indicates a robust demand for leisure travel, directly benefiting Avolta's onboard and destination retail operations.

- Leisure-Oriented Retail: Passengers often look for duty-free shopping, souvenirs, and luxury goods during their voyages.

- Dining Experiences: Avolta provides a variety of food and beverage options, from casual cafes to specialty restaurants, enhancing the cruise experience.

- Port of Call Engagement: The company also caters to passengers visiting popular cruise destinations, offering retail and dining services at these locations.

- Growth Potential: With the cruise sector's continued recovery, Avolta is well-positioned to capture increased spending from this customer segment.

Club Avolta Loyalty Members

Club Avolta Loyalty Members represent a significant customer segment, with over 10 million individuals actively participating in the program. These frequent travelers self-identify their engagement and are keen on receiving personalized offers and rewards.

This highly engaged demographic actively seeks exclusive access and benefits, making them a prime target for tailored marketing initiatives. Their loyalty translates into consistent repeat business for Avolta.

- 10+ Million Members: A substantial base of frequent travelers.

- High Engagement: Actively participate in loyalty program benefits.

- Personalized Offers: Value and seek tailored promotions and rewards.

- Exclusive Access: Desire special privileges and experiences.

Avolta's customer segments are diverse, encompassing international and domestic air travelers, commuters, rail passengers, cruise patrons, and its own loyalty program members. Each group presents unique spending habits and service expectations, driving Avolta's tailored approach to retail and dining.

International travelers, drawn to duty-free luxury, and domestic travelers seeking convenience, form the backbone of airport retail. Commuters and rail passengers prioritize quick service for food and necessities, while cruise passengers expect an integrated holiday shopping and dining experience.

The Club Avolta loyalty members, exceeding 10 million, represent a highly engaged group seeking personalized benefits and exclusive access, ensuring repeat business and valuable customer data.

| Customer Segment | Key Characteristics | 2024 Data/Trends |

|---|---|---|

| International Air Travelers | Seek duty-free, luxury goods; longer dwell times. | Projected 4.7 billion global air passengers; significant portion international. |

| Domestic Air Travelers | Value convenience, immediate needs, local products; shorter dwell times. | Estimated 850 million U.S. domestic passenger enplanements. |

| Commuters & Rail Passengers | Need quick food/beverage, travel essentials; time-sensitive. | Millions rely on European rail daily, showing consistent demand. |

| Cruise Passengers | Desire holiday-themed retail/dining; onboard and port engagement. | Carnival Corp. reported 104% of pre-pandemic occupancy in Q1 2024. |

| Club Avolta Loyalty Members | Over 10 million members; seek personalized offers, exclusive access. | High engagement drives repeat business and loyalty. |

Cost Structure

Avolta's cost structure is heavily influenced by concession fees and rent paid to various partners like airport authorities and railway operators. These payments are crucial for securing operating spaces and can be structured as either a fixed minimum annual guarantee (MAG) or a variable percentage of sales, making them a substantial cost driver.

For instance, in 2023, Avolta reported significant costs related to these agreements. Managing these relationships and optimizing the portfolio is key to controlling this major fixed and variable cost component.

The Cost of Goods Sold (COGS) for Avolta is a major component, encompassing the direct expenses of acquiring the diverse range of products offered in their retail and food and beverage (F&B) locations. This includes everything from duty-free items and unique specialty products to the raw ingredients needed for their F&B operations.

In 2023, Avolta reported a COGS of €3.8 billion, which represented approximately 66% of their total revenue. This highlights the significant impact of product sourcing on their overall profitability. For instance, the cost of acquiring popular luxury brands for duty-free shops, or the fluctuating prices of fresh produce for their cafes, directly influences this figure.

Effectively managing their supply chain and procurement processes is therefore critical for Avolta to maintain competitive pricing and healthy profit margins. Negotiating favorable terms with suppliers and optimizing inventory levels are key strategies to control these direct costs.

Avolta's personnel expenses are a significant cost driver, reflecting its substantial global workforce. With around 76,000 employees worldwide, the company incurs considerable outlays for salaries, wages, and crucial employee benefits.

These costs are further amplified by investments in training and development, essential for maintaining a skilled and adaptable workforce across diverse operational segments. Managing this large, geographically dispersed team necessitates substantial financial commitment to human capital.

Operational and Store Maintenance Costs

Avolta's operational and store maintenance costs are a significant part of its business model, covering the upkeep of its extensive network of travel retail and food & beverage locations. These expenses are crucial for maintaining the high standards travelers expect, impacting brand perception and customer satisfaction. In 2024, Avolta continued to invest in ensuring its store presentation and hygiene remain top-notch, a key differentiator in the competitive travel retail landscape.

These costs encompass a wide range of expenditures necessary for the smooth functioning of Avolta's outlets. This includes essential utilities like electricity and water, regular cleaning services to ensure a pleasant environment, and security measures to protect assets and personnel. Furthermore, general administrative overhead, such as local management and support staff, also falls under this category, contributing to the overall cost structure.

- Utilities: Costs for electricity, water, and gas to operate stores and concessions.

- Cleaning & Hygiene: Expenses for maintaining cleanliness and adhering to strict hygiene standards, particularly vital in F&B operations.

- Security: Investment in security personnel and systems to safeguard inventory and premises.

- General Maintenance: Costs associated with repairs, upkeep of fixtures, and general wear and tear on the physical store environment.

Marketing, Digital, and Innovation Investments

Avolta's cost structure includes significant investments in marketing, digital initiatives, and innovation. These expenditures are vital for attracting and retaining customers and staying ahead in the competitive travel retail landscape.

Marketing campaigns and digital platform development, such as the Club Avolta loyalty program, represent a substantial portion of these costs. The company also invests in technology like self-service kiosks to enhance the customer experience.

Innovation in store concepts and food and beverage offerings further contributes to this cost category. These investments are critical for maintaining Avolta's competitive edge and driving customer engagement.

- Marketing and Digital: Costs associated with advertising, social media, and the development and maintenance of digital platforms like Club Avolta. For example, in 2024, Avolta continued to expand its digital presence and loyalty program to foster deeper customer relationships.

- Technology Implementation: Expenses related to the rollout and upkeep of in-store technologies, such as self-service kiosks and data analytics tools, aimed at improving operational efficiency and customer convenience.

- Innovation Investments: Funds allocated to research and development for new store formats, unique retail experiences, and the introduction of innovative food and beverage selections to differentiate Avolta's offerings.

- Brand Building: Ongoing costs to reinforce brand identity and awareness across various touchpoints, ensuring a consistent and appealing customer proposition in the travel retail market.

Avolta's cost structure is significantly shaped by concession fees and rent, often paid as a minimum annual guarantee or a percentage of sales to airport and railway partners. These agreements are fundamental to securing prime operating locations. Personnel expenses also represent a substantial cost, given Avolta's global workforce of approximately 76,000 employees, encompassing salaries, benefits, and training investments.

The Cost of Goods Sold (COGS) is a major expenditure, representing the direct costs of acquiring the diverse product range sold. In 2023, COGS was €3.8 billion, equating to about 66% of total revenue, underscoring the importance of efficient supply chain management and procurement negotiations.

Operational and store maintenance costs, including utilities, cleaning, security, and general upkeep, are crucial for maintaining brand standards and customer satisfaction. Marketing, digital initiatives, and innovation, such as loyalty programs and new store concepts, are also significant investments aimed at customer engagement and competitive differentiation.

| Cost Category | 2023 Impact | Key Drivers |

| Concession Fees & Rent | Substantial, variable/fixed | MAG, % of Sales, Partner Agreements |

| Cost of Goods Sold (COGS) | €3.8 billion (66% of Revenue in 2023) | Product Sourcing, Supplier Negotiations, Inventory Management |

| Personnel Expenses | Significant | Global Workforce (approx. 76,000), Salaries, Benefits, Training |

| Operational & Maintenance | Ongoing | Utilities, Cleaning, Security, Repairs, General Upkeep |

| Marketing, Digital & Innovation | Strategic Investment | Advertising, Loyalty Programs, Technology, New Concepts |

Revenue Streams

Duty-free sales represent a core revenue engine for Avolta, capitalizing on international travelers’ desire for tax-exempt purchases. This segment thrives in high-traffic locations like airports and border crossings, offering a curated selection of premium products. In 2024, Avolta continued to see robust performance in this area, with duty-free and travel retail contributing a substantial portion of its overall revenue.

Avolta generates significant revenue from its widespread Food & Beverage (F&B) operations. This includes sales from a variety of dining options like quick-service restaurants, casual dining spots, and more upscale bars and cafes located in travel hubs.

In 2023, Avolta's F&B segment demonstrated robust performance, contributing substantially to the company's overall financial results. This segment is a key growth driver, reflecting the company's ability to cater to diverse traveler preferences.

Specialty retail sales represent a significant income source for Avolta, encompassing the sale of a diverse range of products beyond traditional duty-free items. This includes fashion apparel, accessories, electronics, unique local souvenirs, and everyday convenience goods. These offerings are curated to meet the varied needs and desires of both international and domestic travelers.

These sales are particularly crucial as they cater to travelers looking for specific items or those needing to make purchases just before or during their journey. In 2024, Avolta continued to focus on optimizing its product assortment in this segment, aiming to enhance the traveler's shopping experience and capture impulse buys. The company's strategy involves leveraging its prime airport locations to offer a compelling selection that goes beyond basic travel necessities.

Concession Royalties and Minimum Guarantees

Avolta's revenue is significantly boosted by concession royalties and minimum guarantees. These payments, made by Avolta to airport and travel hub authorities, are structured as a percentage of sales or fixed annual amounts, often a combination. While these represent a cost for Avolta, the substantial underlying sales that generate these royalties are a core revenue stream.

In 2023, Avolta reported total revenue of CHF 10.1 billion. A significant portion of this revenue is directly linked to the sales generated within the concessions Avolta operates, which in turn dictate the royalty payments made. The minimum annual guarantees (MAGs) provide a baseline revenue even if sales fall short, ensuring a predictable income floor.

- Concession Royalties: A percentage of gross sales from Avolta's operations within airports and travel hubs.

- Minimum Annual Guarantees (MAGs): Fixed payments made to authorities, providing a baseline revenue.

- Combined Structures: Agreements often blend royalty percentages with MAGs for a hybrid revenue model.

- Underlying Sales as Revenue: The sales generated within concessions are Avolta's primary revenue, with royalties being a cost of securing those sales.

Loyalty Program and Digital Engagement-Driven Sales

Club Avolta, Avolta's loyalty program, and digital engagement efforts are key drivers of increased customer spending and repeat business, rather than direct revenue sources themselves. By fostering stronger customer relationships, these initiatives translate into higher transaction values and more frequent visits across both retail and food and beverage segments.

Personalized offers and promotions are central to this strategy. These tailored incentives encourage customers to spend more per visit and return more often. For instance, by analyzing purchasing habits, Avolta can present targeted deals that resonate with individual preferences, leading to increased cross-selling opportunities.

- Increased Customer Frequency: Loyalty programs are proven to encourage repeat visits.

- Higher Average Spend: Personalized promotions often lead to larger basket sizes.

- Cross-Selling Opportunities: Digital engagement allows for targeted product recommendations.

- Enhanced Customer Lifetime Value: Building loyalty directly impacts long-term revenue potential.

Avolta's revenue streams are multifaceted, primarily driven by its extensive duty-free and travel retail operations, alongside a robust Food & Beverage (F&B) segment. Specialty retail, encompassing fashion, electronics, and souvenirs, further diversifies its income. Additionally, concession royalties and minimum guarantees form a foundational income, ensuring a baseline even with fluctuating sales.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Duty-Free & Travel Retail | Tax-exempt sales of luxury goods, perfumes, cosmetics, and spirits. | Continued strong performance, a primary revenue driver. |

| Food & Beverage (F&B) | Sales from restaurants, cafes, and bars in travel locations. | Demonstrated robust performance in 2023, a key growth area. |

| Specialty Retail | Sales of fashion, electronics, souvenirs, and convenience items. | Optimizing assortment in 2024 to capture traveler needs and impulse buys. |

| Concession Royalties & MAGs | Payments to authorities based on sales percentage or fixed fees. | CHF 10.1 billion total revenue in 2023, with MAGs providing income floor. |

Business Model Canvas Data Sources

The Avolta Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and direct customer feedback. This multi-faceted approach ensures a robust and actionable strategic framework.