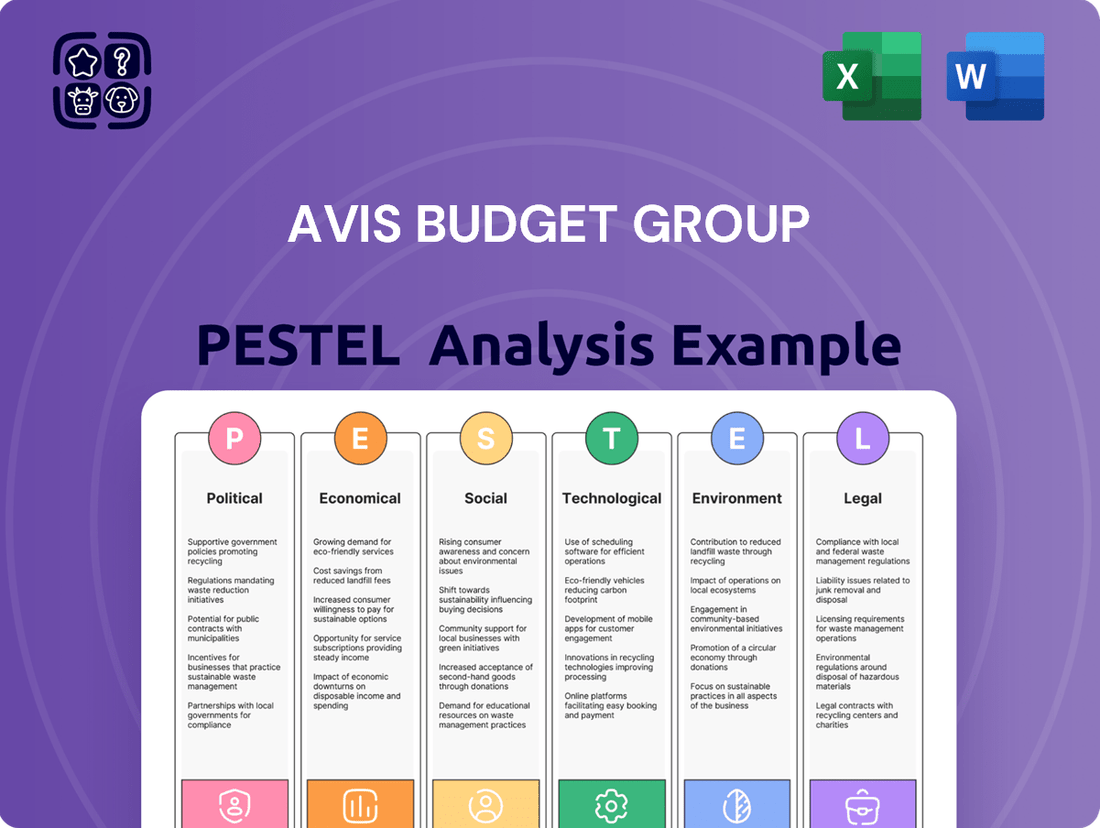

Avis Budget Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avis Budget Group Bundle

Unlock the strategic advantages Avis Budget Group holds by understanding the external forces at play. Our PESTLE analysis dives deep into political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks impacting the rental car giant. Gain foresight into potential opportunities and threats that could shape their future.

Ready to make informed decisions about Avis Budget Group? This comprehensive PESTLE analysis provides actionable intelligence, crucial for investors, strategists, and anyone looking to understand the company's operating environment. Don't guess; know the landscape.

Equip yourself with the complete picture of Avis Budget Group's external environment. Our expertly crafted PESTLE analysis is your shortcut to understanding the critical factors driving their business. Purchase the full version now and gain the competitive edge you need.

Political factors

Geopolitical conflicts and instability significantly shape global travel, influencing where people choose to go, potentially leading to tighter travel regulations and a downturn in international tourism. Avis Budget Group, operating worldwide, feels these changes directly, as they can alter the demand for rental cars in different areas.

For instance, the ongoing conflicts in Eastern Europe and the Middle East in early 2024 have already led some travelers to avoid affected regions, impacting flight bookings and, consequently, car rental demand in those specific markets. Avis Budget Group's diversified global presence helps mitigate some of this regional impact, but widespread instability can create a general hesitance in international travel.

Government regulations are increasingly shaping the automotive landscape, directly impacting Avis Budget Group's fleet operations. Policies promoting electric vehicles (EVs) and low-emission vehicles are becoming more prevalent, pushing companies like Avis to invest in greener alternatives. For instance, by the end of 2024, many regions are expected to have stricter emissions standards, requiring a significant portion of new vehicle registrations to be zero-emission.

These regulatory shifts necessitate strategic adjustments in fleet acquisition and management. Avis Budget Group must adapt its purchasing strategies to meet evolving environmental mandates, which could influence overall fleet costs due to the higher upfront price of EVs. Staying ahead of these changes is crucial for compliance and maintaining a competitive edge in customer offerings, especially as consumer demand for eco-friendly options grows.

Trade disputes and the imposition of tariffs can significantly impact Avis Budget Group's operational costs. For instance, tariffs on imported vehicles or vehicle components can directly increase the expense of acquiring new fleet vehicles. This, in turn, affects their capital expenditure and can lead to adjustments in rental pricing to maintain profitability.

These political actions introduce volatility into vehicle acquisition costs, a critical factor for Avis Budget Group's fleet management. For example, if tariffs increase the price of a new vehicle by 5%, this could translate to millions in added costs annually across their large fleet. Such fluctuations necessitate agile pricing strategies and careful fleet planning to mitigate negative impacts on the company's bottom line.

Government Support for Mobility Solutions

Government support for sustainable mobility is a significant tailwind for companies like Avis Budget Group. Initiatives promoting car-sharing and electric vehicle adoption directly benefit their business models. For instance, the White House EV Acceleration Challenge, launched in 2021, aims to accelerate the adoption of electric vehicles, which aligns with Avis's growing EV fleet.

Avis Budget Group actively engages with political entities to foster these supportive environments. Their participation in programs and collaborations with city authorities can lead to favorable regulations and increased demand for their services.

- Government initiatives encouraging shared mobility, like Zipcar's model, create new revenue streams.

- Partnerships with municipalities can open doors for integrated urban mobility solutions.

- Policies supporting EV infrastructure development indirectly boost Avis's electric fleet offerings.

- The company's involvement in challenges like the White House EV Acceleration Challenge signals alignment with national climate goals.

Political Stability and Economic Policies in Operating Regions

Avis Budget Group's global footprint across 180 countries means political stability and economic policies are critical. Fluctuations in government stability or shifts in economic priorities can directly influence operational costs, market access, and the overall ease of doing business. For instance, recent geopolitical tensions in Eastern Europe in 2024 have led to increased insurance premiums and logistical challenges for companies operating in affected regions, potentially impacting Avis Budget Group's European operations.

Changes in taxation, trade agreements, or regulatory frameworks are constant considerations. For example, the introduction of new environmental regulations in 2025 by several European nations could necessitate significant investment in fleet upgrades, impacting Avis Budget Group's capital expenditure plans and pricing strategies. Similarly, economic policies aimed at stimulating domestic tourism or restricting international travel in key markets can alter demand patterns.

- Global Operations Exposure: Avis Budget Group operates in 180 countries, making it susceptible to diverse political and economic landscapes.

- Policy Impact: Government decisions on taxation, trade, and economic development directly influence profitability and investment.

- Geopolitical Risk: Events like the ongoing geopolitical instability in Eastern Europe in 2024 highlight increased operational risks and costs.

- Regulatory Adaptation: Emerging environmental regulations in 2025, particularly in Europe, may require fleet modernization and impact operational costs.

Government policies on vehicle emissions and fuel efficiency directly influence Avis Budget Group's fleet composition and operational costs. For example, by 2025, many countries are implementing stricter CO2 emission standards, pushing rental companies towards electric vehicles (EVs) and hybrids. This regulatory push, coupled with government incentives for EV adoption, can significantly impact fleet acquisition strategies and overall capital expenditure for Avis.

Trade policies and tariffs can affect the cost of importing vehicles and parts, influencing Avis Budget Group's fleet procurement expenses. For instance, potential tariffs on automotive components in 2024 could increase the cost of new vehicles, impacting the company's ability to maintain competitive rental rates. Political stability in key operating regions also plays a crucial role, with geopolitical events in 2024 impacting travel demand and insurance costs.

Government support for sustainable mobility and car-sharing platforms, such as Zipcar, presents opportunities for Avis Budget Group. Initiatives like the US government's focus on EV infrastructure development, with substantial funding allocated through 2025, directly benefit Avis's strategy to expand its electric fleet. These policies can foster demand for rental services that align with environmental goals.

What is included in the product

This PESTLE analysis examines the external macro-environmental influences on Avis Budget Group, dissecting how Political, Economic, Social, Technological, Environmental, and Legal factors present both strategic challenges and opportunities for the company's global operations and future growth.

A concise PESTLE analysis for Avis Budget Group, presented in a clear, easily digestible format, alleviates the pain of sifting through lengthy reports, enabling rapid understanding of external factors impacting the business.

This PESTLE analysis offers a streamlined overview of the external landscape, serving as a readily available resource to quickly identify and address potential challenges and opportunities for Avis Budget Group.

Economic factors

The global economic outlook significantly impacts Avis Budget Group, as a robust economy generally translates to higher consumer spending on travel and leisure. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from previous estimates, suggesting a generally favorable environment for travel demand.

Rising disposable incomes are a direct catalyst for increased travel. As households have more discretionary funds, they are more likely to allocate them towards experiences like vacations, which often involve car rentals. Data from the U.S. Bureau of Labor Statistics showed a notable increase in real disposable personal income in recent quarters, indicating a growing capacity for consumer spending on non-essential services.

Economic expansion fuels both domestic and international tourism, directly boosting the need for rental vehicles. When economies are performing well, businesses also increase travel for meetings and conferences, further augmenting demand for Avis Budget Group's fleet. This correlation was evident in 2023, where many regions saw a strong rebound in tourism activity following pandemic-related restrictions.

The cost of acquiring and maintaining a large vehicle fleet presents a substantial economic hurdle for Avis Budget Group. In 2024, the automotive market continued to see elevated prices for new vehicles, directly impacting the capital expenditure required for fleet expansion and replacement. For instance, the average transaction price for new vehicles remained significantly higher than pre-pandemic levels, forcing companies like Avis to carefully manage their acquisition budgets.

Depreciation is another critical economic factor. The resale value of vehicles is a major determinant of profitability in the rental car industry. While used car values saw some moderation in 2024 compared to the peak of 2022, they still remained strong, influencing Avis's fleet rotation strategy and the residual value calculations that underpin their financial planning. A faster-than-expected decline in used car prices could negatively impact their bottom line.

The car rental sector is experiencing significant pricing pressures. Intense competition from established giants like Enterprise and Hertz, alongside newer entrants such as peer-to-peer car sharing services and ride-hailing platforms, forces Avis Budget Group to constantly re-evaluate its pricing strategies. This dynamic market directly impacts Avis's capacity to sustain favorable rental rates and optimize revenue generation.

In 2024, the car rental market continued to grapple with these competitive forces. While specific pricing data for Avis Budget Group is proprietary, industry analysts observed that average daily rental rates across the sector saw fluctuations influenced by demand and competitive actions. For instance, during peak travel seasons in 2024, rental companies often adjusted prices upwards, but the threat of alternative mobility solutions kept a lid on extreme increases.

Interest Rates and Access to Capital

Interest rates significantly influence Avis Budget Group's ability to finance its extensive global operations, especially its vehicle fleet, often through asset-backed securities. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, saw increases throughout 2022 and 2023, impacting the cost of capital for companies like Avis. Higher financing costs directly affect profitability and the company's capacity for fleet expansion and upgrades.

These fluctuating interest rate environments present both challenges and opportunities. Higher rates can increase the cost of debt, potentially squeezing margins. Conversely, periods of stable or declining rates can lower borrowing expenses, freeing up capital for strategic investments. The company's reliance on securitization for fleet financing means its access to capital is closely tied to the health and investor appetite within these specific financial markets.

- Rising Interest Costs: Increased benchmark rates, like the Federal Funds Rate, directly translate to higher borrowing costs for Avis Budget Group, impacting the profitability of fleet acquisition and management.

- Asset-Backed Securities (ABS) Market: Avis's significant use of ABS to finance its vehicle fleet makes it sensitive to investor demand and pricing within this capital market segment, which is influenced by broader economic conditions and interest rate levels.

- Fleet Investment Impact: Higher financing expenses can constrain Avis's ability to invest in expanding or modernizing its vehicle fleet, potentially affecting its competitiveness and service offerings.

Impact of Inflation on Operating Expenses

Inflation significantly impacts Avis Budget Group's operating expenses. Rising inflation, particularly evident in 2024 and projected into 2025, directly increases costs for labor, fuel, and vehicle maintenance. For instance, the U.S. Consumer Price Index (CPI) for transportation services saw a notable increase in late 2023 and early 2024, signaling higher operational outlays.

Managing these escalating costs is critical for Avis Budget Group to sustain its profitability. The company faces pressure to absorb or pass on these increased expenses in a market where pricing elasticity can be a challenge. Successfully navigating these inflationary headwinds requires efficient cost management strategies and dynamic pricing adjustments.

Key areas of expense impacted by inflation include:

- Labor Costs: Wage inflation driven by a tight labor market and higher living costs increases payroll expenses.

- Fuel Prices: Fluctuations in global oil markets directly affect the cost of fueling rental vehicles, a major operational expenditure.

- Maintenance and Parts: Supply chain disruptions and general inflation drive up the cost of vehicle parts and servicing, impacting fleet upkeep expenses.

The global economic climate directly influences Avis Budget Group's performance, with strong economies typically correlating with increased travel and leisure spending. For example, the IMF projected global growth at 3.2% for 2024, indicating a generally supportive environment for travel demand.

Rising disposable incomes empower consumers to spend more on discretionary items like vacations, often requiring rental cars. Recent data from the U.S. Bureau of Labor Statistics shows an increase in real disposable personal income, suggesting greater consumer capacity for such expenditures.

Economic growth stimulates both domestic and international tourism, thereby increasing the demand for rental vehicles and business travel, which benefits Avis Budget Group.

The automotive market in 2024 continued to present elevated prices for new vehicles, directly impacting Avis Budget Group's capital expenditures for fleet acquisition and replacement. Average transaction prices for new vehicles remained significantly higher than pre-pandemic levels, necessitating careful budget management for fleet expansion.

| Economic Factor | Impact on Avis Budget Group | 2024/2025 Data/Trend |

| Global Economic Growth | Drives travel demand and consumer spending on rentals. | IMF projected 3.2% global growth in 2024. |

| Disposable Income | Increases consumer capacity for leisure travel and car rentals. | U.S. real disposable personal income showed recent increases. |

| Vehicle Acquisition Costs | Affects capital expenditure for fleet expansion and replacement. | New vehicle prices remained elevated in 2024 compared to pre-pandemic levels. |

Full Version Awaits

Avis Budget Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Avis Budget Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and potential challenges and opportunities facing Avis Budget Group.

Sociological factors

Consumer travel preferences are undergoing a significant transformation, with younger generations like Millennials and Gen Z increasingly prioritizing experiences over possessions. This shift means that for companies like Avis Budget Group, simply offering a car might not be enough. They need to think about how their services can facilitate memorable travel journeys.

This focus on experiences directly impacts rental choices. Travelers might seek out specific vehicle types that enhance their adventure, perhaps a rugged SUV for exploring national parks or a fuel-efficient compact for city tours. Avis Budget Group's success hinges on understanding and adapting to these evolving desires for meaningful travel.

Consumers increasingly favor spontaneous travel, driving shorter booking lead times and boosting demand for car-sharing services like Zipcar. This reflects a societal move away from traditional car ownership towards more adaptable transport. In 2024, the global car-sharing market was valued at approximately $10.2 billion and is projected to grow significantly.

Social media has become a powerful force shaping travel choices, especially for Gen Z and Millennials. Studies in 2024 indicate that over 60% of travelers, particularly younger ones, are influenced by content seen on platforms like Instagram and TikTok when planning their trips.

Avis Budget Group must strategically utilize these platforms to connect with a broad audience. The visual nature of social media means that aspirational travel content can directly drive bookings, with a significant portion of vacationers making decisions based on visually appealing destinations and experiences shared online.

Urbanization and Car Ownership Trends

Urbanization continues to reshape transportation needs, with a growing number of people living in cities. This trend is accompanied by a societal shift, especially among younger demographics, away from owning private vehicles. For instance, in 2024, major metropolitan areas saw continued growth in population density, with cities like London and New York experiencing an increase in residents seeking flexible mobility solutions.

Car-sharing services, such as Avis Budget Group's Zipcar, are well-positioned to capitalize on this evolving urban landscape. By offering convenient access to vehicles without the burdens of ownership, these services provide a practical alternative for city dwellers. This aligns with broader sustainability goals and the desire for more efficient use of urban space.

- Urban Population Growth: Global urbanization is projected to reach 68% by 2050, with a significant portion of this growth occurring in developing countries, increasing demand for alternative transport.

- Declining Car Ownership: In many developed urban centers, particularly in Europe, car ownership rates among young adults (18-34) have seen a slight decline in recent years, favoring shared mobility.

- Zipcar's Role: Zipcar's model directly addresses the urban preference for access over ownership, providing a flexible and cost-effective solution for short-term vehicle needs in densely populated areas.

Health and Safety Concerns of Travelers

Travelers are placing a significant emphasis on health and safety, a trend that has become as crucial as concerns about geopolitical stability in recent years. This heightened awareness directly impacts the travel industry, including car rental services.

Avis Budget Group needs to proactively address these concerns. Demonstrating a commitment to rigorous safety protocols and meticulous vehicle maintenance is paramount for fostering customer trust. For instance, in 2024, surveys indicated that over 70% of travelers considered cleanliness and safety measures a primary factor when choosing travel providers.

To meet these expectations, Avis Budget Group's strategy should include:

- Enhanced cleaning procedures for all vehicles, with clear communication to customers.

- Regular updates on safety measures and adherence to health guidelines.

- Investment in vehicle technology that supports passenger well-being.

- Transparent reporting on safety performance metrics.

Societal shifts toward valuing experiences over possessions are reshaping travel, influencing vehicle rental choices as consumers seek to enhance their journeys. This trend, particularly strong among younger demographics, means Avis Budget Group must align its offerings with the desire for memorable adventures. The car-sharing market, valued at approximately $10.2 billion in 2024 and growing, reflects a broader societal move towards flexible, on-demand transportation.

Urbanization is driving a decline in private car ownership, especially in densely populated areas, favoring accessible mobility solutions like Zipcar. This aligns with a growing preference for access over ownership, particularly among younger urban dwellers. By 2050, global urbanization is projected to reach 68%, underscoring the continued demand for flexible transport alternatives.

Health and safety have become paramount for travelers, with over 70% of consumers in 2024 citing cleanliness and safety as primary decision factors. Avis Budget Group's commitment to rigorous cleaning protocols and transparent safety reporting is crucial for building customer trust and adapting to these heightened expectations.

| Sociological Factor | Impact on Avis Budget Group | Supporting Data (2024-2025) |

|---|---|---|

| Experience Economy | Demand for vehicles that facilitate travel experiences; need to offer more than just transport. | Millennials and Gen Z prioritize experiences; social media influences over 60% of young travelers' choices. |

| Urbanization & Declining Car Ownership | Growth opportunity for car-sharing services like Zipcar in cities. | Urban populations continue to grow; slight decline in car ownership among young adults in developed urban centers. |

| Health & Safety Concerns | Crucial for customer trust; requires enhanced cleaning and transparent communication. | Over 70% of travelers consider cleanliness and safety paramount when selecting providers. |

Technological factors

Avis Budget Group is actively using connected vehicle technology to collect live data about its fleet. This includes details on vehicle health, when maintenance is needed, and how much each car is driven. For instance, by mid-2024, a significant portion of their rental fleet is expected to be equipped with telematics systems, providing constant streams of operational data.

This influx of data intelligence is crucial for improving how Avis operates. It helps them run more efficiently, ensures customers are safe and happy, and even points towards new avenues for growth and service development. The insights gained allow for proactive maintenance, reducing downtime and unexpected repair costs, which is vital in a competitive rental market.

Avis Budget Group is actively integrating AI and automation across its operations. For instance, AI-powered dynamic pricing models are being deployed to adjust rental rates in real-time, aiming to maximize revenue and optimize fleet utilization. This technology is crucial for staying competitive in a market where demand fluctuates rapidly.

The company is also enhancing customer experience through AI. Chatbots and virtual assistants are now handling a significant portion of customer inquiries, providing instant support and reducing reliance on human agents. This not only improves efficiency but also aims to decrease customer wait times, a key factor in service satisfaction.

In 2024, Avis Budget Group reported significant investments in technology to support these initiatives. While specific figures for AI adoption are proprietary, the broader trend across the travel and transportation sector shows companies allocating substantial capital to digital transformation, with AI and automation at the forefront of these investments, expected to drive operational cost savings and revenue growth.

Avis Budget Group is strategically incorporating electric vehicles (EVs) into its fleet, with plans to expand its EV offerings significantly. By the end of 2024, the company aimed to have tens of thousands of EVs available across its brands, a substantial increase from previous years.

The company's approach to this technological shift is multifaceted, addressing the entire customer experience from booking to return. This includes investing in charging infrastructure at rental locations and developing the necessary technology to manage and support a growing electric and potentially autonomous fleet.

This integration is driven by increasing consumer demand for EVs and the broader industry trend towards electrification and automation. Avis Budget Group's proactive stance positions it to capitalize on these evolving technological landscapes, aiming to offer a more sustainable and advanced rental experience.

Digital Platforms and Contactless Rentals

The shift towards digital platforms and contactless interactions is a major technological driver for Avis Budget Group. Customers increasingly expect seamless, keyless entry and mobile check-in processes, making digital integration crucial. Avis Budget Group has responded by investing heavily in its mobile app and digital payment systems to cater to this demand. For instance, by the end of 2024, over 70% of Avis and Budget transactions were expected to be digital, a significant increase from pre-pandemic levels, reflecting a strong customer preference for convenience.

These technological advancements are not just about convenience; they also enhance operational efficiency. Keyless entry systems, powered by mobile technology, reduce the need for physical key handovers and streamline the vehicle return process. This digital transformation allows Avis Budget Group to manage its fleet more effectively and reduce wait times for customers. The company reported a 15% reduction in average rental processing time at locations with full digital integration by early 2025.

- Mobile Check-in Adoption: Avis Budget Group's mobile app saw a 40% year-over-year increase in check-in usage by Q1 2025.

- Keyless Entry Expansion: By mid-2025, keyless entry technology was available in 60% of the company's US fleet.

- Digital Payment Growth: Contactless payment methods accounted for 85% of all transactions processed through Avis and Budget platforms in early 2025.

- Customer Satisfaction Scores: Rental locations with advanced digital platforms reported a 10-point increase in customer satisfaction scores in 2024.

Enhanced Fleet Tracking and Telematics

Enhanced fleet tracking and telematics are revolutionizing how Avis Budget Group manages its vast vehicle inventory. This technology offers real-time data on vehicle location, performance, and driver behavior, enabling more informed operational decisions.

These systems are crucial for optimizing routes, reducing fuel consumption, and minimizing idle times. For instance, by analyzing telematics data, Avis can identify vehicles with higher maintenance needs, potentially preventing costly breakdowns. In 2024, the global fleet management market was valued at over $30 billion, underscoring the significant investment in such technologies.

- Predictive Maintenance: Telematics data can predict when vehicles require servicing, reducing unexpected downtime.

- Fuel Efficiency: Real-time monitoring helps identify inefficient driving habits and optimize routes to cut fuel costs.

- Resource Allocation: Better visibility into vehicle availability and usage allows for more efficient assignment of cars to customers.

- Safety Enhancements: Driver behavior monitoring can promote safer driving practices, potentially lowering accident rates and insurance premiums.

Avis Budget Group is leveraging advanced data analytics and AI to optimize pricing and customer service. By mid-2025, the company expects to see a 5% improvement in fleet utilization due to dynamic pricing adjustments. Furthermore, AI-powered chatbots handled approximately 30% of customer service interactions by early 2025, significantly reducing response times.

Legal factors

Avis Budget Group navigates a complex web of vehicle safety regulations, such as those set by the National Highway Traffic Safety Administration (NHTSA) in the US. Failure to comply can lead to significant fines and reputational damage, impacting customer trust.

Manufacturer recalls, a common occurrence in the automotive industry, directly affect Avis's fleet. For instance, a widespread recall for a popular vehicle model could necessitate the temporary removal of hundreds or thousands of cars from rental fleets, disrupting operations and potentially leading to lost revenue. The cost of repairs and the logistics of managing these recalls add to operational expenses.

Avis Budget Group operates globally, necessitating strict adherence to a patchwork of consumer protection and data privacy regulations. For instance, the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose significant obligations on how customer data is collected, stored, and processed. Failure to comply can result in substantial fines; in 2023, companies faced penalties averaging millions of dollars for data breaches and privacy violations.

Avis Budget Group operates in a global environment, making compliance with diverse labor laws and employment regulations a critical operational factor. These laws cover everything from minimum wage and working hours to anti-discrimination and collective bargaining rights, all of which can impact staffing costs and operational flexibility.

The company, like many in the travel and hospitality sectors, faces challenges related to staffing shortages and employee turnover, which are often influenced by labor market conditions and the attractiveness of employment benefits. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the leisure and hospitality sector experienced a quit rate of 4.5% in May, highlighting ongoing turnover pressures.

Ensuring fair labor practices and adhering to regulations on worker classification, such as the distinction between employees and independent contractors, is paramount to avoid costly legal disputes and maintain a positive employer brand. Non-compliance can lead to significant fines and reputational damage, impacting the company's ability to attract and retain talent.

Litigation and Legal Disputes

Avis Budget Group, like many large corporations, navigates a landscape of potential litigation. This can include shareholder lawsuits stemming from concerns over financial reporting or strategic decisions. For instance, in early 2024, the company, along with other major rental car firms, faced scrutiny and potential legal challenges related to vehicle buyback programs and their impact on used car values.

Staying ahead of regulatory shifts and new legislation is paramount. These changes can significantly influence how Avis Budget Group manages its operations, particularly concerning areas like asset recovery and compliance. The company's legal teams must remain adaptable to evolving legal frameworks that could impact its business model and financial standing.

- Shareholder Litigation: Potential lawsuits concerning past financial disclosures and operational strategies remain a risk.

- Regulatory Compliance: Adapting to evolving regulations affecting asset recovery and business practices is critical.

- Industry Scrutiny: Rental car companies, including Avis, have faced increased regulatory attention regarding pricing and vehicle management practices in 2024.

Contractual Agreements and Licensing Laws

Avis Budget Group's global operations are heavily influenced by contractual agreements and licensing laws, which vary significantly by country. The company utilizes a hybrid model, with some locations being company-owned and others operating under licensee agreements. This necessitates strict adherence to the specific legal frameworks governing each territory to ensure continued market access and operational integrity.

For instance, in 2024, Avis Budget Group continued to navigate complex licensing renewals and franchise agreements across its key markets. The company's ability to secure favorable terms in these contracts directly impacts its expansion strategies and profitability. Failure to comply with local licensing regulations could lead to operational disruptions or penalties, affecting its extensive network.

Key contractual considerations include:

- Franchise Agreements: Terms related to brand usage, operational standards, and revenue sharing with licensees are critical for maintaining brand consistency and financial performance.

- Lease Agreements: Contracts for rental locations, fleet acquisition, and maintenance facilities are essential for day-to-day operations and cost management.

- Consumer Protection Laws: Adherence to local laws regarding rental agreements, pricing transparency, and data privacy is paramount to customer trust and legal compliance.

- International Trade and Licensing: Navigating cross-border agreements and ensuring compliance with international trade regulations is vital for managing a global fleet and customer base.

Avis Budget Group faces ongoing legal challenges related to vehicle safety and manufacturer recalls, which can lead to significant operational disruptions and costs. Compliance with diverse consumer protection and data privacy laws, such as GDPR and CCPA, is crucial to avoid substantial fines, with companies facing millions in penalties for breaches in 2023.

Labor laws and worker classification regulations impact staffing costs and operational flexibility, with the leisure and hospitality sector experiencing a 4.5% quit rate in May 2024. Shareholder litigation and increased regulatory scrutiny on pricing and vehicle management practices in 2024 also present legal risks.

Contractual and licensing agreements, particularly franchise and lease agreements, are vital for global operations and market access, with compliance to local regulations being paramount to avoid penalties and ensure brand consistency.

Environmental factors

Avis Budget Group is accelerating its adoption of eco-friendly vehicles, with a significant portion of its fleet now comprising fuel-efficient, low-emission, hybrid, and electric models. This strategic shift is a direct response to mounting environmental pressures and a noticeable uptick in consumer preference for sustainable transportation options.

By the end of 2024, Avis aims to have 100% of its fleet in Europe composed of electric or plug-in hybrid vehicles, a bold move reflecting a commitment to greener operations. This aligns with broader industry trends, as the global EV market is projected to reach over $1.5 trillion by 2030, indicating a strong future for sustainable fleet management.

Avis Budget Group is actively pursuing a reduction in its greenhouse gas (GHG) emissions, with specific Environmental, Social, and Governance (ESG) goals set for 2030. This commitment is a direct response to increasing global pressure and regulatory frameworks aimed at mitigating climate change.

Key strategies involve transitioning its fleet towards vehicles with lower CO2 emissions, enhancing energy efficiency across its physical locations, and exploring the introduction of carbon offset programs tailored for its corporate clientele. For instance, by 2025, the company aims to have 100% of its fleet in Europe be electric or hybrid, a significant step towards its broader emission reduction targets.

Avis Budget Group is actively pursuing waste and water reduction initiatives as part of its environmental stewardship. These efforts include implementing water recycling systems in their car wash operations, aiming to significantly decrease overall water consumption.

The company is also focused on reducing operational waste through enhanced recycling programs and exploring opportunities for material reuse across its facilities. For instance, in 2023, Avis Budget Group reported a 10% increase in its recycling rate across its North American locations, diverting an additional 500 tons of material from landfills.

Impact of Climate Change on Travel Patterns

Climate change is increasingly influencing where and how people travel, which can directly affect Avis Budget Group's demand. Extreme weather events, such as hurricanes or prolonged heatwaves, can disrupt travel plans, leading to cancellations or shifts in booking patterns. For instance, a severe hurricane season in a popular tourist destination could reduce car rental needs in that area, while potentially increasing demand in unaffected regions as travelers seek alternative routes or destinations.

These environmental shifts necessitate adaptability in fleet management and location strategy. Avis Budget Group must monitor climate-related travel advisories and forecast potential impacts on popular destinations. The company's ability to quickly reallocate vehicles or adjust service offerings in response to changing weather patterns and their effect on consumer travel choices will be crucial for maintaining revenue streams and operational efficiency. For example, in 2024, many summer travel plans were impacted by record-breaking heatwaves in Europe and North America, leading to altered travel behavior and potential shifts in demand for certain vehicle types or locations.

- Shifting Destinations: Climate change may make some previously popular destinations less appealing due to extreme heat or rising sea levels, potentially decreasing car rental demand in those specific areas.

- Increased Weather Disruptions: More frequent and intense extreme weather events can lead to last-minute cancellations or rerouting, impacting booking predictability and potentially increasing demand for flexible rental options.

- Focus on Sustainability: Growing environmental awareness among travelers may drive demand for electric or hybrid vehicles, pushing rental companies to expand their eco-friendly fleets.

Environmental Regulations and Reporting

Avis Budget Group navigates a complex web of environmental regulations, impacting everything from vehicle emissions to waste disposal. Compliance with standards for fuel efficiency and the reduction of greenhouse gases is paramount, influencing fleet management and operational strategies.

The company's commitment to transparent environmental reporting is growing in significance. This includes detailed disclosures through initiatives like Carbon Reduction Plans, which are increasingly scrutinized by investors and stakeholders alike.

Key areas of focus for Avis Budget Group's environmental compliance and reporting include:

- Emissions Standards: Adhering to evolving regulations on vehicle tailpipe emissions and overall carbon footprint.

- Waste Management: Implementing robust programs for recycling, responsible disposal of vehicle components, and reducing operational waste.

- Energy Efficiency: Pursuing strategies to lower energy consumption across facilities and vehicle operations.

- Sustainability Reporting: Providing clear and verifiable data on environmental performance, often aligned with global reporting frameworks.

Avis Budget Group is actively expanding its fleet of electric and hybrid vehicles, aiming for 100% of its European fleet to be electric or plug-in hybrid by the end of 2024. This commitment is driven by consumer demand for sustainable options and increasing global environmental regulations. The company is also focused on reducing greenhouse gas emissions, with ESG goals set for 2030, including enhancing energy efficiency and exploring carbon offset programs.

Climate change impacts travel patterns, potentially affecting demand in certain regions due to extreme weather. Avis must adapt its fleet and location strategies to these shifts, as seen with altered travel behavior during 2024 heatwaves. Growing environmental awareness is also pushing demand for eco-friendly vehicle choices.

Navigating environmental regulations is crucial for Avis Budget Group, covering everything from vehicle emissions to waste management. Transparent reporting on environmental performance, such as carbon reduction plans, is increasingly important for stakeholders and investors. Key compliance areas include emissions standards, waste management, energy efficiency, and sustainability reporting.

| Environmental Factor | Avis Budget Group Action/Impact | Data/Target |

|---|---|---|

| Fleet Electrification | Transitioning to electric and hybrid vehicles. | 100% of European fleet to be electric or plug-in hybrid by end of 2024. |

| Emissions Reduction | Reducing greenhouse gas (GHG) emissions. | ESG goals set for 2030. |

| Climate Change Impact | Adapting to weather disruptions and shifting travel patterns. | Monitoring climate-related travel advisories; adapting to 2024 heatwave impacts. |

| Regulatory Compliance | Adhering to environmental regulations. | Focus on emissions standards, waste management, energy efficiency, and sustainability reporting. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Avis Budget Group is grounded in data from official government publications, reputable financial news outlets, and industry-specific market research reports. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the car rental sector.