Avis Budget Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avis Budget Group Bundle

Avis Budget Group navigates a competitive landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of new entrants. Understanding these forces is crucial for strategic planning and identifying market opportunities.

The complete report reveals the real forces shaping Avis Budget Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Avis Budget Group's primary suppliers are vehicle manufacturers, and their bargaining power is considerable. Given Avis's substantial fleet needs, estimated at around 695,000 vehicles globally in 2024, manufacturers hold sway over pricing and terms. This concentration of purchasing power can lead to manufacturers dictating terms, impacting Avis's operational costs and overall profitability.

Avis Budget Group relies heavily on automotive parts and maintenance providers to keep its extensive fleet operational. The sheer volume of vehicles means strong supplier relationships are essential for consistent parts availability and competitive pricing, directly impacting fleet upkeep costs. In 2024, the automotive aftermarket industry saw continued price increases, with some component costs rising by as much as 15% year-over-year, a trend that directly pressures Avis Budget's maintenance budgets and necessitates careful supplier negotiation.

Fuel represents a significant operating expense for Avis Budget Group, directly influencing its bottom line. In 2024, global oil prices experienced volatility, impacting the cost of gasoline and diesel, which are essential for maintaining a rental fleet. While Avis Budget Group's large fleet size grants it some purchasing power, the company remains susceptible to these external price swings.

The bargaining power of fuel suppliers is considerable because fuel is a critical input with limited substitutes for traditional internal combustion engine vehicles. Avis Budget Group's reliance on these suppliers means that any significant increase in fuel costs, without the ability to fully pass those costs onto consumers, can erode profit margins. For instance, a sustained 10% increase in fuel prices could translate to millions in additional operating costs annually for a company of Avis's scale.

Looking ahead, the increasing adoption of electric vehicles (EVs) within rental fleets is poised to reshape the relationship with traditional fuel suppliers. As Avis Budget Group diversifies its fleet, its dependence on gasoline and diesel will diminish, thereby reducing the bargaining power of oil and gas companies over the long term. This strategic shift aims to mitigate the impact of fuel price volatility.

Technology and Software Providers

Technology and software providers hold significant bargaining power in the car rental sector as digital transformation accelerates. Companies like Avis Budget Group depend heavily on advanced systems for operational efficiency and customer experience.

Avis Budget Group's reliance on cloud-based car rental management software, AI for customer service, and sophisticated fleet tracking highlights this dependence. The seamless integration and timely updates of these technologies are crucial for maintaining a competitive edge. For instance, in 2024, the automotive software market was projected to reach over $50 billion, underscoring the value and influence of these tech partners.

- Increased reliance on specialized software: Car rental operations are becoming increasingly complex, requiring sophisticated software for booking, fleet management, pricing, and customer relationship management.

- Switching costs: Migrating to new software systems can be expensive and disruptive, giving established providers leverage.

- Innovation and differentiation: Providers offering cutting-edge solutions, such as AI-driven analytics or advanced telematics, can command higher prices and exert greater influence.

- Data security and integration expertise: The ability of software providers to ensure data security and seamlessly integrate with existing systems is a critical factor, adding to their bargaining power.

Real Estate and Airport Authorities

The bargaining power of airport authorities and commercial real estate providers is a significant factor for Avis Budget Group. Access to prime rental locations, especially at airports, is essential for their business model. In 2024, airport concession fees can represent a substantial portion of operating costs for car rental companies, directly impacting their ability to compete on price at major travel hubs.

These authorities wield considerable influence through lease agreements, rental fees, and concession terms. For instance, a major international airport might charge a percentage of gross revenue or a fixed monthly fee, which can be quite high. This power allows them to dictate terms that affect Avis Budget's operational footprint and profitability at these critical locations.

- Airport Concession Fees: These fees can range from 10% to 30% or more of gross revenues for car rental companies operating at airports.

- Lease Agreements: Long-term leases with escalating rental costs give landlords significant leverage.

- Limited Alternative Locations: The scarcity of prime airport real estate concentrates bargaining power in the hands of a few authorities.

The bargaining power of vehicle manufacturers remains a key consideration for Avis Budget Group. With a global fleet size in the hundreds of thousands, Avis is a significant customer. However, the automotive industry's consolidation and the high cost of developing new vehicle models mean manufacturers can exert considerable influence on pricing and supply terms.

Avis Budget Group's reliance on a vast number of vehicles means that the terms negotiated with manufacturers directly impact the cost of acquiring and maintaining its fleet. For example, in 2024, the average transaction price for new vehicles continued to be elevated, putting pressure on rental companies to secure favorable fleet purchase agreements.

The bargaining power of suppliers for Avis Budget Group is influenced by several factors, including the concentration of suppliers, the uniqueness of their offerings, and the switching costs for Avis. For instance, while there are multiple automotive manufacturers, the specific models and configurations required by Avis might limit the number of viable suppliers for certain fleet needs.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Avis Budget Group |

|---|---|---|

| Vehicle Manufacturers | Fleet size, manufacturer concentration, switching costs | Pricing of new vehicles, availability of specific models |

| Automotive Parts & Maintenance | Availability of specialized parts, number of service providers | Fleet upkeep costs, vehicle downtime |

| Fuel Suppliers | Global oil prices, limited substitutes for ICE vehicles | Operating expenses, profitability |

| Technology Providers | Software complexity, switching costs, innovation | Operational efficiency, customer experience costs |

| Airport Authorities/Real Estate | Location importance, lease terms, concession fees | Cost of prime rental locations, market access |

What is included in the product

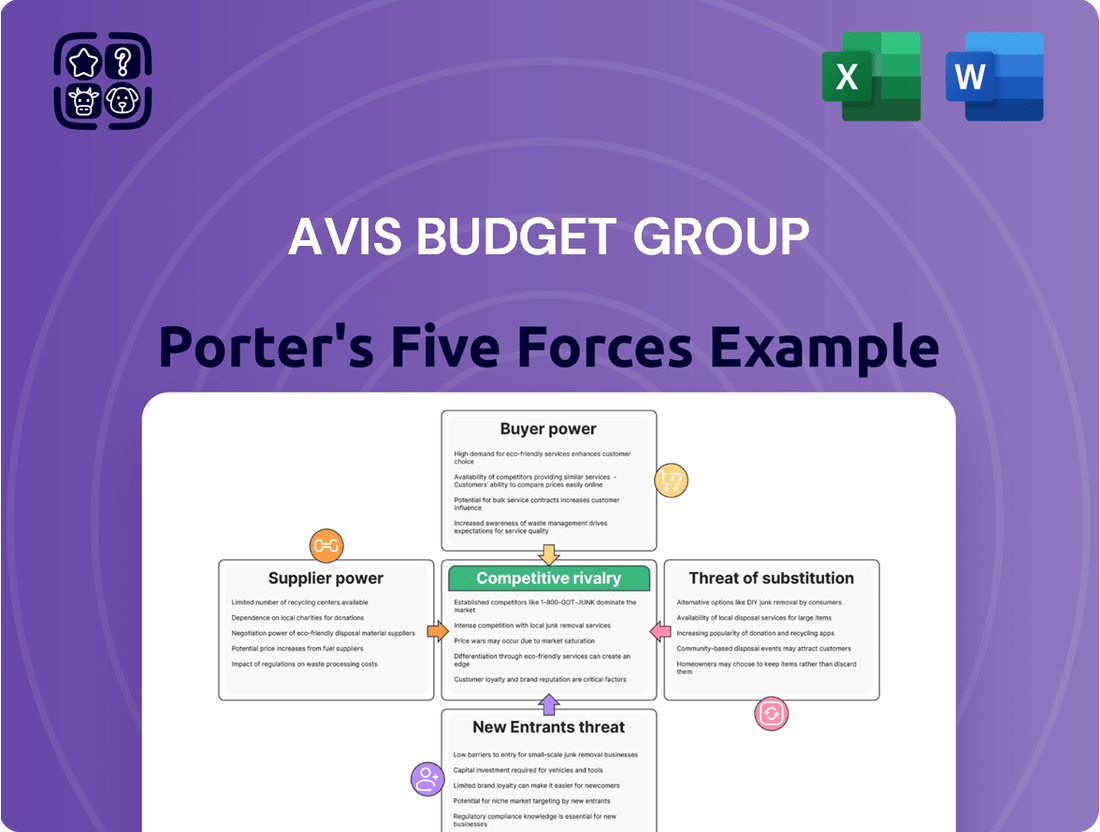

This Porter's Five Forces analysis for Avis Budget Group examines the intensity of competition, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes within the car rental industry.

Effortlessly identify competitive threats and opportunities within the car rental industry, allowing Avis Budget Group to proactively adjust strategies and mitigate risks.

Customers Bargaining Power

Customers in the car rental sector, encompassing both vacationers and business travelers, are notably sensitive to price. This sensitivity is amplified by the proliferation of online comparison platforms and mobile applications. These tools enable consumers to readily assess rental rates from various companies, thereby intensifying competition and pushing providers to offer more competitive pricing.

Customers have significant bargaining power due to the wide array of rental options available. Major competitors like Enterprise Rent-A-Car and Hertz, alongside Avis Budget Group, mean consumers can easily compare prices and services. For instance, in 2024, the car rental market saw robust competition, with several companies vying for market share, further empowering renters.

This abundance of choice, particularly the ability to secure rentals even at short notice, directly enhances the customer's position. They can readily switch to a competitor if Avis Budget Group's pricing or terms are not favorable. The ease of comparison shopping, facilitated by online travel agencies and direct booking platforms, amplifies this power.

The bargaining power of customers is significantly amplified by the digital revolution and the growing demand for contactless services. In 2024, consumers increasingly expect intuitive mobile apps for booking, check-in, and even vehicle access, mirroring trends seen across the travel and retail sectors. Companies like Avis Budget Group must invest in these digital capabilities to meet evolving customer preferences and avoid losing market share to more technologically adept competitors.

Shift to Flexible and Subscription Models

The increasing customer demand for flexible and subscription-based car rental options, including car-sharing, significantly enhances buyer power. This shift provides consumers with a wider array of choices, moving beyond traditional daily or weekly rentals and empowering them to select services that best fit their evolving needs. Avis Budget Group's Zipcar brand is a direct response to this trend, offering a more adaptable rental experience.

This growing preference for flexible models means customers can more easily switch between providers or service types if they find better value or convenience elsewhere. For instance, the rise of peer-to-peer car sharing platforms further diversifies the market, giving customers alternatives that can often be more cost-effective for short-term use. In 2023, the global car-sharing market was valued at approximately $3.8 billion and is projected to grow substantially, indicating a strong customer preference for these flexible arrangements.

- Increased Choice: Customers can opt for hourly, daily, or monthly subscriptions, tailoring rentals to specific usage patterns.

- Cost Sensitivity: Flexible models allow customers to pay only for what they use, increasing price sensitivity and bargaining power.

- Brand Loyalty Erosion: The availability of diverse, adaptable options can reduce customer loyalty to any single rental provider.

- Market Responsiveness: Rental companies must continuously innovate their offerings to meet the demand for flexible and subscription-based services.

Influence of Reviews and Customer Experience

Customer satisfaction and the proliferation of online reviews significantly sway potential renters, directly impacting Avis Budget Group's customer acquisition. A subpar rental experience, amplified through platforms like Google Reviews or Trustpilot, can effectively deter future business, granting customers considerable indirect power through their collective feedback and its influence on brand perception.

For instance, in 2024, companies across the travel sector, including car rental services, saw a marked increase in the weight consumers placed on online sentiment. Avis Budget Group's performance is intrinsically linked to its ability to manage and respond to customer feedback. Negative sentiment can lead to a tangible loss of revenue, as potential customers opt for competitors with better-rated experiences. This dynamic highlights how customer voice translates into market power.

- Customer Satisfaction Metrics: Avis Budget Group's Net Promoter Score (NPS) and customer satisfaction scores are critical indicators of how effectively they are mitigating negative customer experiences.

- Online Review Impact: A significant percentage of travelers, often exceeding 80% in recent surveys, report that online reviews influence their booking decisions.

- Reputation Management Costs: The financial resources dedicated to managing online reputation and addressing customer complaints are a direct cost of customer bargaining power.

- Brand Loyalty Erosion: Negative experiences, if not addressed, can lead to a rapid erosion of brand loyalty, pushing customers towards more responsive competitors.

Customers possess substantial bargaining power in the car rental market due to high price sensitivity and the ease of comparing options online. The availability of numerous competitors and alternative transportation methods, like ride-sharing and public transport, further empowers renters. In 2024, the car rental industry continued to see intense competition, with companies like Avis Budget Group needing to offer competitive pricing and superior service to retain customers.

| Factor | Impact on Avis Budget Group | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Price Sensitivity | High | Travelers frequently use comparison sites, leading to pressure on rental rates. |

| Availability of Substitutes | Significant | Growth in ride-sharing services and car-sharing platforms offers alternatives. |

| Information Availability | High | Online reviews and booking platforms provide extensive information, aiding customer decision-making. |

| Switching Costs | Low | Customers can easily switch between rental companies with minimal effort. |

Full Version Awaits

Avis Budget Group Porter's Five Forces Analysis

This preview shows the exact Avis Budget Group Porter's Five Forces analysis you'll receive immediately after purchase, detailing the intense rivalry among car rental companies, the moderate threat of new entrants due to capital requirements and brand loyalty, and the significant bargaining power of buyers seeking competitive pricing. You'll also gain insights into the low bargaining power of suppliers and the moderate threat of substitutes like ride-sharing services and public transportation, all presented in a fully formatted and ready-to-use document.

Rivalry Among Competitors

The U.S. car rental landscape is a tight race, with giants like Enterprise Holdings, Avis Budget Group, and Hertz Corporation holding significant sway. This oligopoly means competition is fierce, especially for prime locations like airport concessions where demand is consistently high and visibility is crucial for capturing travelers.

Competitive rivalry in the car rental industry, including Avis Budget Group, is intense and often plays out through aggressive pricing strategies. Companies frequently engage in dynamic pricing, adjusting rental rates based on real-time supply and demand, as well as seasonal trends. This can lead to significant price volatility, as firms aim to capture market share and optimize the use of their vehicle fleets.

For instance, during peak travel seasons, prices can surge, while off-peak periods might see substantial discounts. This constant adjustment creates a challenging environment where price wars are common, forcing companies like Avis Budget Group to remain highly competitive on cost to attract and retain customers. In 2024, the industry continued to navigate these pricing pressures, with a strong focus on yield management to balance revenue and utilization.

Competitive rivalry in fleet management is intense, with companies like Avis Budget Group constantly vying for optimal vehicle utilization. This means acquiring the right vehicles, rotating them efficiently, and ensuring they are generating revenue as much as possible. For instance, in 2024, Avis Budget Group continued to invest in fleet modernization, aiming to reduce maintenance costs and improve fuel efficiency, a direct response to competitive pressures.

The battleground is fierce as firms aim to minimize idle time and maximize revenue per vehicle. High vehicle utilization is a critical metric that directly impacts profitability. Avis Budget Group's focus on data analytics to predict demand and adjust fleet deployment is a key strategy to stay ahead in this competitive landscape, especially as rental demand fluctuates throughout the year.

Technological Advancements and Digitalization

Competitive rivalry within the car rental industry, including Avis Budget Group, is significantly intensified by ongoing technological advancements and the pervasive trend of digitalization. This means companies are constantly investing in new tech to stay ahead. For instance, the adoption of AI-powered dynamic pricing strategies, which adjust rental rates in real-time based on demand and other market factors, is becoming a standard practice. Avis Budget Group itself has been investing in digital solutions to enhance customer experience and operational efficiency.

The drive for innovation in areas like contactless rental options, allowing customers to bypass traditional counter services, and sophisticated fleet tracking systems that optimize vehicle utilization and maintenance, directly fuels this rivalry. Companies that successfully implement these digital tools can achieve a notable competitive edge. In 2024, the industry saw continued emphasis on mobile app functionality, with many players aiming to streamline the entire rental process from booking to return through their digital platforms.

- AI-powered pricing: Companies are leveraging AI to optimize rental rates, responding dynamically to market conditions.

- Contactless rentals: Technology enabling self-service pick-up and drop-off is becoming a key differentiator.

- Advanced fleet tracking: Real-time data on vehicle location, usage, and maintenance improves operational efficiency.

- Digital integration: Seamless integration across booking platforms, mobile apps, and in-car technology enhances customer experience.

Brand Recognition and Customer Loyalty

Established brands like Avis and Budget benefit from decades of brand recognition and deeply ingrained customer loyalty. This provides a significant advantage, as customers often default to familiar names they trust for their rental needs.

However, the competitive landscape is dynamic. Rivals are actively investing in marketing and customer relationship management to erode this loyalty. For instance, Hertz has consistently focused on its loyalty program, Hertz Gold Plus Rewards, aiming to incentivize repeat business.

- Brand Equity: Avis and Budget's long history translates into strong brand equity, a valuable intangible asset in the car rental industry.

- Customer Loyalty Programs: Competitors are aggressively enhancing their loyalty programs to capture market share and foster repeat business.

- Marketing Investment: Significant marketing spend by all players aims to build brand awareness and attract new customers, intensifying rivalry.

Competitive rivalry among car rental companies, including Avis Budget Group, is characterized by aggressive pricing and a constant drive for operational efficiency. Companies like Enterprise Holdings and Hertz Corporation are major players, leading to intense competition, particularly at high-demand airport locations.

In 2024, the industry continued to see dynamic pricing strategies, with rental rates fluctuating based on supply, demand, and seasonality. Avis Budget Group, like its competitors, focused heavily on yield management to balance fleet utilization and revenue generation, often engaging in price adjustments to capture market share.

Fleet management also remains a key battleground, with companies striving for optimal vehicle utilization. Avis Budget Group's investments in fleet modernization in 2024 aimed to reduce maintenance costs and improve fuel efficiency, directly addressing competitive pressures to lower operating expenses.

Technological advancements, such as AI-powered dynamic pricing and contactless rental options, further intensified rivalry in 2024. Avis Budget Group's commitment to digital solutions, including enhanced mobile app functionality for a streamlined customer experience, reflects the industry's broader push for innovation to gain a competitive edge.

SSubstitutes Threaten

Ride-sharing services such as Uber and Lyft present a substantial threat to Avis Budget Group. These platforms offer convenient, on-demand transportation, especially for shorter journeys and within urban environments, directly challenging traditional car rental and car-sharing services like Zipcar. The global ride-sharing market was valued at approximately $137.7 billion in 2023 and is expected to expand considerably, signaling a growing consumer preference for these alternatives.

In major metropolitan areas, robust public transportation systems, including extensive bus and rail networks, present a significant threat of substitution for Avis Budget Group. For instance, cities like New York, with its comprehensive subway system, or London, with its iconic Tube, offer convenient and often more cost-effective alternatives for short-to-medium distance travel, reducing the need for rental cars. The increasing adoption of ride-sharing services further intensifies this substitution threat, providing on-demand mobility without the commitment of a rental.

The rise of peer-to-peer car-sharing platforms like Turo and Getaround presents a significant threat to Avis Budget Group. These platforms allow individuals to rent out their personal vehicles, offering a flexible and often more affordable alternative to traditional car rentals, directly competing with Avis's core business.

These independent platforms, including Avis's own Zipcar, are not just niche options anymore; they have become substantial competitors, continually expanding their reach and user base. Turo, for instance, reported a substantial increase in bookings and active hosts in 2023, indicating strong consumer adoption of this model.

Personal Vehicle Ownership

For many, owning a personal vehicle remains the most direct substitute for rental car services. Despite increasing costs associated with purchasing, insuring, and maintaining a car, personal ownership continues to be a primary mobility choice for a substantial portion of the population. For example, in 2023, new vehicle prices averaged over $48,000 in the US, a figure that, while high, doesn't deter millions from making the purchase.

The ongoing costs of vehicle ownership, including fuel, insurance premiums which saw an average increase of 10-15% in many regions during 2023-2024, and routine maintenance, present a trade-off against rental convenience. However, the perceived freedom and constant availability of a personal car often outweigh these expenses for many consumers, making it a persistent competitive threat to Avis Budget Group.

- Personal Vehicle Ownership: Remains a strong substitute due to perceived convenience and freedom.

- Cost Considerations: While vehicle prices and maintenance are high, the total cost of ownership is weighed against rental expenses.

- Market Data: New vehicle prices in the US averaged over $48,000 in 2023, with insurance costs also rising.

Emerging Mobility Solutions

The burgeoning 'mobility-as-a-service' (MaaS) trend poses a significant threat of substitutes for traditional car rentals. This includes the rise of micro-mobility options like e-scooters and shared bicycles, which offer convenient alternatives for short urban trips. For instance, in 2024, cities globally saw continued growth in shared micro-mobility usage, with many reporting millions of rides annually, directly competing for short-distance travel needs.

Furthermore, autonomous vehicle services are emerging as a potent long-term substitute. Avis Budget Group itself has a partnership with Waymo, indicating the industry's recognition of this shift. As these services mature and expand their reach, they could fundamentally alter transportation habits, potentially decreasing reliance on rental cars for both leisure and business travel.

- Micro-mobility growth: Continued expansion of e-scooter and bike-sharing services in urban centers.

- Autonomous vehicle deployment: Increasing availability of self-driving ride-hailing and shuttle services.

- Shifting consumer preferences: Growing adoption of on-demand, flexible transportation solutions over ownership or traditional rentals.

- Partnerships and innovation: Companies like Avis Budget Group actively engaging with new mobility providers to adapt to market changes.

The threat of substitutes for Avis Budget Group is multifaceted, encompassing personal vehicle ownership, ride-sharing, public transit, and emerging mobility solutions. Personal car ownership remains a primary substitute, despite rising costs, as consumers value its constant availability. In 2023, the average price for a new vehicle in the U.S. exceeded $48,000, with insurance costs also seeing significant increases. These factors, however, are weighed against the perceived benefits of having a personal vehicle readily accessible.

Ride-sharing platforms like Uber and Lyft, valued at approximately $137.7 billion globally in 2023, offer convenient, on-demand alternatives, particularly for shorter urban trips. This directly challenges Avis's core rental business. Similarly, robust public transportation networks in major cities, coupled with the growth of peer-to-peer car-sharing services such as Turo, further fragment the market and present viable substitutes for traditional car rentals.

The evolving mobility landscape includes micro-mobility options and the future potential of autonomous vehicles. E-scooters and bike-sharing services provide convenient short-distance travel, while autonomous vehicle services, with which Avis itself is partnering (e.g., Waymo), represent a significant long-term substitute that could reshape transportation habits and reduce the need for rental vehicles.

| Substitute Type | Key Characteristics | Market Relevance (Approx. 2023-2024) | Impact on Avis Budget Group |

| Personal Vehicle Ownership | Constant availability, perceived freedom | New vehicle prices > $48,000 (US); Insurance costs up 10-15% | Persistent, fundamental competitor |

| Ride-Sharing (Uber, Lyft) | On-demand, convenient for short trips | Global market value ~ $137.7 billion (2023) | Direct competitor, especially in urban areas |

| Public Transportation | Cost-effective, extensive networks in cities | High usage in major metropolitan areas (e.g., NYC, London) | Reduces need for rentals for specific travel needs |

| Peer-to-Peer Car-Sharing (Turo) | Flexible, often more affordable rentals | Strong growth in bookings and users | Offers alternative rental options |

| Micro-mobility (E-scooters, bikes) | Convenient for very short urban trips | Millions of rides annually in many cities | Competes for last-mile and short-distance travel |

| Autonomous Vehicles | Future of on-demand, driverless transport | Partnerships emerging (e.g., Avis & Waymo) | Potential long-term disruptive substitute |

Entrants Threaten

The car rental sector demands a massive upfront investment, particularly for acquiring and maintaining a diverse fleet. For instance, Avis Budget Group's fleet size is substantial, and the cost of replacing and expanding this fleet represents a significant barrier. In 2024, the automotive industry continued to see fluctuating prices for new vehicles, making the initial capital outlay for a new entrant even more daunting.

Established brands like Avis and Budget possess a significant advantage due to decades of brand recognition and the creation of powerful network effects. These incumbents have cultivated trust and loyalty over many years, making it difficult for newcomers to gain traction. For instance, Avis Budget Group's global presence, with thousands of rental locations worldwide, represents a substantial barrier to entry that new entrants would find incredibly challenging and costly to replicate.

The car rental industry, including giants like Avis Budget Group, faces a significant barrier to entry due to the sheer complexity of operational logistics and the technology required. Managing a vast, dispersed fleet necessitates intricate systems for maintenance scheduling, vehicle repositioning across locations, and dynamic revenue management to optimize pricing. In 2024, the ongoing investment in fleet modernization and digital platforms, such as AI-powered booking and customer service tools, represents a substantial capital outlay that new entrants must replicate.

Regulatory and Licensing Requirements

The car rental sector faces significant hurdles for newcomers due to stringent regulatory and licensing demands. These include obtaining necessary operating permits, securing comprehensive insurance coverage, and often, navigating complex airport concession agreements. For instance, in 2024, the average cost to secure a new car rental license in a major metropolitan area can range from $5,000 to $20,000, not including ongoing compliance fees.

These requirements act as a substantial barrier, increasing the initial capital outlay and operational complexity for potential entrants. Avis Budget Group, like its peers, must invest heavily in compliance, which can deter smaller players from entering the market and competing directly.

- Licensing and Permits: New entrants must acquire various state and local operating licenses, often involving background checks and proof of financial stability.

- Insurance Mandates: Comprehensive liability and vehicle insurance are non-negotiable, with premiums significantly impacting operational costs. In 2023, the average annual insurance premium for a fleet of 100 rental vehicles exceeded $150,000.

- Airport Concessions: Securing rental car counter space and parking at airports, a critical distribution channel, requires bidding on costly concession agreements, which are typically long-term and exclusive.

Growth of Car-Sharing and Ride-Hailing Startups

The growth of car-sharing and ride-hailing startups presents a nuanced threat to traditional car rental companies like Avis Budget Group. While the capital-intensive nature of owning and maintaining a large fleet acts as a traditional barrier to entry, these new models effectively circumvent many of these hurdles. For instance, platforms like Turo and Getaround connect car owners with renters, shifting the asset ownership burden and leveraging technology to manage transactions and access. This peer-to-peer approach allows them to enter the market with significantly lower overheads.

These new entrants are not necessarily competing head-to-head with Avis Budget Group for every rental occasion, but they are capturing specific market segments. Consider the rise of peer-to-peer car sharing; Turo, for instance, reported a significant increase in bookings in 2023, with user-generated revenue growing substantially. This indicates a growing consumer preference for flexible, often more affordable, and localized transportation solutions. Getaround also saw expansion in key urban markets, further fragmenting the transportation landscape.

- Disruption of Traditional Rental Models: Car-sharing and ride-hailing platforms bypass the need for large physical rental locations and extensive fleet management, lowering initial capital requirements.

- Niche Market Capture: These services appeal to specific consumer needs, such as short-term rentals, unique vehicle types, or convenient urban mobility, thereby segmenting the market.

- Technological Leverage: Startups utilize advanced mobile applications and digital platforms for booking, payment, and vehicle access, offering a seamless user experience that can be difficult for legacy companies to replicate quickly.

- Asset-Light Approach: By connecting existing car owners with renters, these companies operate an asset-light model, reducing the financial risk and operational complexity associated with traditional car rental businesses.

The threat of new entrants in the car rental market, impacting Avis Budget Group, is moderate. While high capital requirements for fleet acquisition and operational complexity serve as significant barriers, innovative, asset-light models are emerging. These new entrants, particularly in the car-sharing and ride-hailing space, can bypass many traditional hurdles.

These alternative models, like Turo and Getaround, leverage technology and peer-to-peer networks, significantly lowering their initial investment compared to traditional rental companies. In 2023, Turo reported a substantial increase in user-generated revenue, demonstrating their growing market presence and appeal to consumers seeking flexible mobility solutions.

Furthermore, the regulatory landscape, while demanding for traditional players, can sometimes be navigated differently by newer, platform-based services. This allows them to enter and scale more rapidly in specific market segments.

| Barrier Type | Impact on New Entrants | Example for Avis Budget Group |

|---|---|---|

| Capital Requirements | High | Acquiring and maintaining a large fleet is expensive. In 2024, new vehicle prices continued to be a major cost factor. |

| Brand Loyalty & Network Effects | Significant | Decades of brand recognition and extensive global locations create strong customer loyalty. Avis Budget Group's thousands of locations worldwide are a major advantage. |

| Operational Complexity | High | Managing fleet logistics, maintenance, and dynamic pricing requires sophisticated systems. 2024 saw continued investment in AI for fleet management. |

| Regulatory & Licensing | Moderate to High | Permits, insurance, and airport concessions are costly and complex. New licenses in major cities can cost $5,000-$20,000 in 2024. |

| Alternative Models (e.g., Car Sharing) | Low to Moderate | Asset-light models like Turo bypass fleet ownership, reducing entry barriers. Turo saw significant booking growth in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Avis Budget Group leverages data from annual reports, SEC filings, and industry-specific market research reports. This blend of company disclosures and expert analysis provides a comprehensive view of competitive intensity and market dynamics.