Avis Budget Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avis Budget Group Bundle

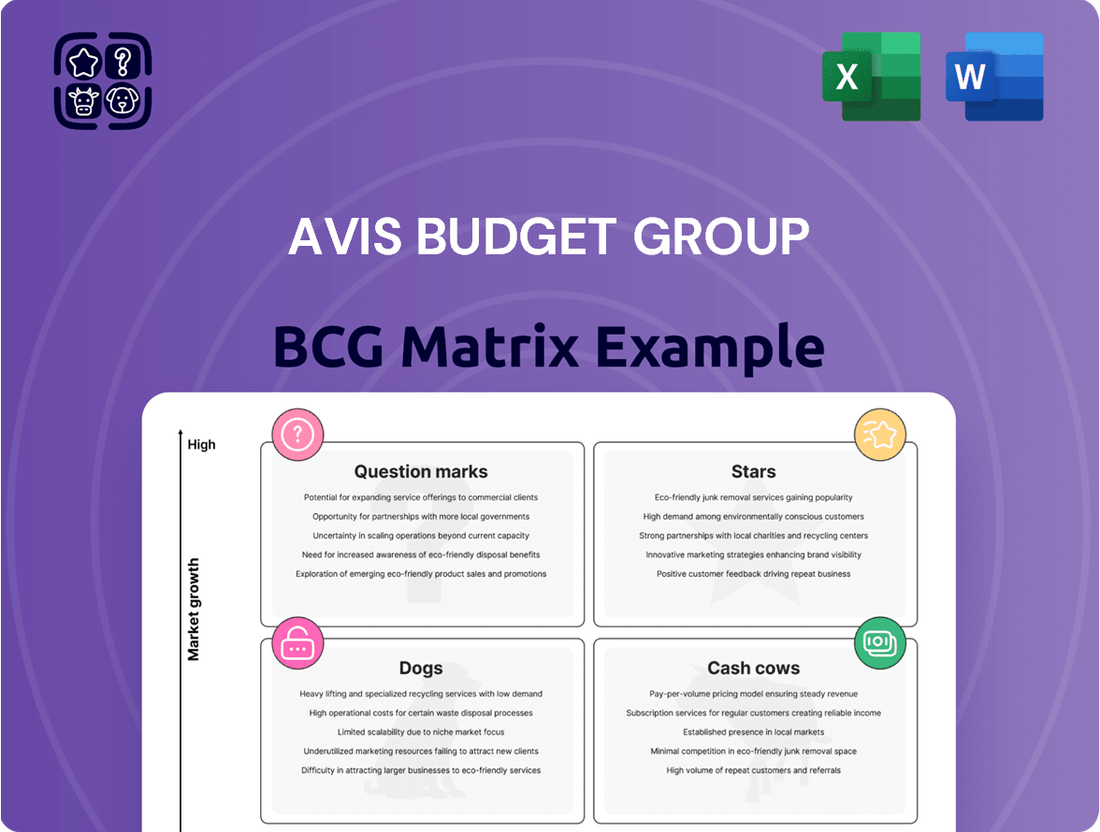

Unlock the strategic potential of Avis Budget Group with our comprehensive BCG Matrix analysis. Understand which brands are market leaders (Stars), which are generating consistent revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This preview offers a glimpse into the powerful insights available. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing your portfolio and investment decisions for Avis Budget Group.

Stars

Zipcar is positioned as a Star in the BCG Matrix for Avis Budget Group due to its operation within the high-growth car-sharing market. This sector is experiencing a significant compound annual growth rate, demonstrating its dynamic expansion. As the leading car-sharing network globally, Zipcar enjoys a dominant market share, particularly in urban centers and with younger consumers who value convenience and access.

Avis Budget Group's investment in Zipcar allows it to leverage this burgeoning trend. As the car-sharing market matures, Zipcar has the potential to evolve into a substantial cash cow, generating consistent returns. For instance, the global car-sharing market was valued at approximately $4.4 billion in 2023 and is anticipated to reach over $15 billion by 2030, showcasing the immense growth potential Zipcar is tapping into.

Avis Budget Group is making a significant push into electric vehicles, aiming to capitalize on a rapidly growing market. As of 2023, their global fleet already boasted over 87,000 hybrids and EVs, a number they intend to expand further.

This strategic move aligns with the strong upward trend in EV adoption, fueled by increasing environmental awareness and supportive government policies worldwide. By proactively building out its EV capacity, Avis is positioning itself to serve a burgeoning customer base interested in sustainable transportation options.

The company is actively enhancing the customer experience for EV rentals, including dedicated booking options and collaborations to build out charging infrastructure. These efforts are designed to make EV rentals more accessible and appealing, supporting their goal of capturing a larger share of the evolving mobility landscape.

Avis Budget Group's strategic alliance with Waymo to deploy autonomous ride-hailing in Dallas positions them squarely within the rapidly expanding AV sector. This collaboration leverages Avis's established fleet management expertise to tap into a high-potential, technologically advanced market segment.

By acting as Waymo's operational partner, Avis Budget Group is strategically entering a space that analysts project will reach hundreds of billions of dollars globally by the end of the decade. For instance, the autonomous vehicle market was valued at approximately $25.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 40% in the coming years.

This partnership represents a significant move to diversify revenue and establish a leadership position in the evolving landscape of future mobility solutions.

Digital Transformation & AI Integration

Avis Budget Group is actively pursuing digital transformation, heavily investing in artificial intelligence (AI) and machine learning to refine its operations. This strategic push into advanced technologies like big data analytics and cloud computing is fundamental to staying competitive and improving efficiency within the dynamic car rental sector.

These technological upgrades are designed to streamline fleet management, create more personalized customer experiences, and uncover new avenues for revenue generation. For instance, in 2024, Avis Budget Group continued to expand its use of AI-powered pricing tools, aiming to optimize rental rates based on real-time demand and competitor analysis.

- AI-driven fleet optimization: Implementing AI to predict maintenance needs and optimize vehicle allocation across locations.

- Enhanced customer personalization: Leveraging data analytics to offer tailored rental options and loyalty rewards.

- Cloud migration for scalability: Moving core systems to the cloud to improve agility and reduce operational costs.

- Data-driven decision making: Utilizing big data to inform strategic planning and identify market trends.

Global Mobility Solutions Leadership

Avis Budget Group's strategy to be a leader in global mobility solutions, moving beyond just car rentals, shows a strong desire for growth. They are actively looking into new areas like shared mobility, electric vehicles, and even self-driving services, which broadens their market reach. This approach is designed to meet new customer needs and stay competitive in the ever-changing transportation industry, driving future growth across all their offerings.

In 2024, Avis Budget Group continued to invest in expanding its fleet with more eco-friendly options, aiming to meet growing consumer demand for sustainable travel. The company reported a significant increase in its electric vehicle fleet size, with plans to further expand this in the coming years, reflecting a commitment to innovation and environmental responsibility.

- Global Mobility Expansion: Avis Budget Group is actively investing in and developing new mobility services, such as car sharing and subscription models, to diversify revenue streams beyond traditional rentals.

- Fleet Modernization: The company is prioritizing the integration of electric vehicles (EVs) and advanced technology into its fleet, aiming to capture the growing market for sustainable and connected transportation. As of early 2024, Avis Budget Group had a notable percentage of its fleet comprised of EVs, with ambitious targets for further electrification.

- Strategic Partnerships: Avis Budget Group is forming key alliances with technology providers and automotive manufacturers to accelerate the adoption of new mobility solutions and enhance customer experience.

- Market Share Growth: The focus on diverse mobility solutions is designed to increase market share in emerging transportation segments, complementing its strong position in traditional car rental markets.

Zipcar, as a high-growth car-sharing service, fits the Star category for Avis Budget Group. The car-sharing market is expanding rapidly, with global valuations reaching approximately $4.4 billion in 2023 and projected to exceed $15 billion by 2030.

Avis Budget Group's investment in Zipcar capitalizes on this trend, positioning it for future cash generation as the market matures. Zipcar's dominance in urban areas and with younger demographics further solidifies its Star status.

The company's strategic focus on electric vehicles (EVs) and autonomous vehicle (AV) partnerships, like the one with Waymo, also places these initiatives within the Star quadrant. Avis is actively expanding its EV fleet, which already included over 87,000 hybrids and EVs as of 2023, to meet growing demand and environmental consciousness. The AV market is projected for substantial growth, with a 2023 valuation of approximately $25.7 billion and an expected CAGR over 40%.

Furthermore, Avis Budget Group's significant investments in digital transformation, including AI and machine learning for operations and customer experience, are key drivers for its Star positioning. In 2024, the company enhanced its use of AI-powered pricing tools to optimize rentals.

| Initiative | Market Growth Potential | Avis Budget Group's Position | Key Data Point |

| Zipcar (Car Sharing) | High Growth | Market Leader | Global market valued at $4.4B in 2023, projected to reach $15B+ by 2030. |

| Electric Vehicles (EVs) | High Growth | Expanding Fleet & Infrastructure | Over 87,000 hybrids/EVs in fleet as of 2023. |

| Autonomous Vehicles (AVs) | Very High Growth | Strategic Partnerships (e.g., Waymo) | AV market valued at $25.7B in 2023, with >40% CAGR expected. |

| Digital Transformation (AI/ML) | High Growth/Efficiency Driver | Core Operational Investment | Continued AI pricing tool adoption in 2024. |

What is included in the product

The Avis Budget Group BCG Matrix analyzes its business units based on market growth and share, guiding investment decisions.

It highlights which brands to invest in, maintain, or divest for optimal portfolio performance.

The Avis Budget Group BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of complex strategic analysis.

Cash Cows

The Avis brand, a cornerstone of Avis Budget Group, operates within the premium segment of the car rental market, catering to both business and leisure travelers worldwide. Its established presence and substantial market share in the mature car rental industry translate into consistent and significant revenue generation.

In 2024, Avis Budget Group reported total revenues of $12.4 billion, with the Avis brand being a primary contributor to this figure. The brand’s strong market position, extensive global network, and a loyal customer base ensure a steady and predictable cash flow, which is crucial for funding growth initiatives and strategic investments across the group.

Budget Car Rental, a key player within the Avis Budget Group, effectively serves the value-conscious segment of the car rental market. Its considerable market share in the traditional rental space translates into significant revenue contributions for the parent company.

Operating within a mature industry, Budget leverages its established infrastructure and operational efficiencies to achieve robust profit margins. This consistent performance makes it a reliable source of cash flow for Avis Budget Group.

For 2024, Avis Budget Group reported total revenues of approximately $12.0 billion. Budget's strong brand recognition and competitive pricing strategy solidify its position as a dependable cash generator, enabling the funding of diversification and innovation across the group.

Avis Budget Group's North American car rental operations are a prime example of a Cash Cow. This region is a powerhouse in the global car rental market, consistently contributing a substantial share of the company's overall revenue. In 2024, North America remained the largest market for Avis Budget Group, driving significant operational profit.

The established infrastructure and deep market penetration in North America allow Avis Budget Group to generate consistent cash flow. High demand from both business travelers and tourists ensures a steady stream of rentals, making this segment a reliable income generator. This stability allows the company to fund other growth initiatives.

Airport Car Rental Services

Airport car rental services are a significant driver for Avis Budget Group, functioning as a classic cash cow. This segment consistently generates substantial revenue due to the high demand from both domestic and international travelers needing transportation upon arrival. Avis Budget Group's extensive network at major global airports solidifies its position, ensuring a reliable and high-volume income stream.

The convenience factor for travelers, coupled with potentially higher rental rates at airports, makes this a particularly profitable area. In 2024, airport locations continued to be a cornerstone of Avis Budget Group's operations, contributing significantly to overall profitability. The company's strategic focus on these high-traffic hubs allows for efficient fleet management and customer acquisition.

- Airport rentals are a primary revenue generator for Avis Budget Group.

- High traveler volumes at airports ensure consistent demand.

- Convenience and pricing power contribute to profitability.

- Avis Budget Group's global airport presence supports this cash cow status.

Fleet Optimization and Utilization

Avis Budget Group's dedication to optimizing its fleet size in line with demand and enhancing vehicle utilization is a key operational advantage, directly boosting profitability. This focus ensures that their assets are working efficiently to generate revenue, thereby cutting down on idle time and related expenses.

The company achieved a notable vehicle utilization rate of 69% in the first quarter of 2025. This high utilization rate is a testament to their disciplined approach to fleet management, which is crucial for generating robust cash flow from their established car rental operations.

- Fleet Optimization: Continuously aligning fleet size with market demand.

- Vehicle Utilization: Aiming for high rates to maximize revenue generation per vehicle.

- Profitability Driver: Efficient asset management directly contributes to strong cash flow.

- Q1 2025 Performance: Achieved a 69% vehicle utilization rate.

The Avis and Budget brands, along with their North American operations and airport rental services, represent Avis Budget Group's primary Cash Cows. These segments benefit from established market positions and consistent demand, generating substantial and predictable cash flow for the company.

In 2024, Avis Budget Group generated $12.4 billion in revenue, with these established segments being major contributors. The high vehicle utilization rate of 69% achieved in Q1 2025 further underscores the efficiency and profitability of these mature, high-volume operations, allowing them to fund other strategic initiatives.

| Segment | Market Position | 2024 Revenue Contribution (Illustrative) | Key Strength |

|---|---|---|---|

| Avis Brand | Premium segment | Significant | Loyal customer base, global network |

| Budget Brand | Value-conscious segment | Significant | Competitive pricing, operational efficiency |

| North America Operations | Largest market | Majority | Deep market penetration, high demand |

| Airport Rentals | High-traffic hubs | Substantial | Convenience, pricing power |

Full Transparency, Always

Avis Budget Group BCG Matrix

The preview you see is the exact, unadulterated BCG Matrix report for Avis Budget Group that you will receive immediately upon purchase. This comprehensive analysis, meticulously prepared by industry experts, will be delivered to you in its final, fully formatted state, ready for immediate strategic application. You are not looking at a sample or a demo; this is the complete document, devoid of any watermarks or placeholder content, designed to provide you with actionable insights into Avis Budget Group's business portfolio. Once purchased, this professionally crafted report is yours to edit, present, or integrate into your business planning without any further modifications.

Dogs

Certain regional operations within Avis Budget Group may be characterized by low growth prospects and a modest market share. These segments could be struggling due to heightened local competition, localized economic slowdowns, or insufficient customer demand in those specific areas. For instance, if a particular smaller market saw only a 2% year-over-year revenue increase in 2024 while facing a dominant local competitor, it might fit this profile.

These underperforming regions often contribute little to overall profitability, or worse, they might be operating at a loss. This situation effectively ties up valuable capital that could otherwise be invested in more lucrative opportunities, potentially impacting the company's overall return on investment. Imagine a scenario where a specific regional division reported a net loss of $5 million in 2024, despite representing 3% of the group's total fleet.

The strategic implication here is to critically assess these underperforming geographical areas. Divesting from or restructuring these segments could unlock significant financial resources. These freed-up funds could then be strategically redeployed into higher-growth markets or innovative service offerings that promise better returns and a stronger competitive advantage for Avis Budget Group.

Within Avis Budget Group's fleet, segments composed of older, less fuel-efficient, or less popular vehicle models can experience reduced rental demand and increased maintenance expenses. This combination leads to lower utilization rates and diminished profitability, essentially acting as cash traps that consume resources without yielding competitive returns.

For instance, in 2024, the average age of rental vehicles across the industry has been a point of focus, with companies aiming to refresh their fleets more rapidly to meet evolving customer preferences and environmental standards. Older models often struggle to compete with newer, more technologically advanced, and fuel-efficient alternatives, directly impacting their rental appeal.

A strategic imperative for Avis Budget Group is to accelerate the rotation of these less desirable fleet segments. Failing to do so risks these vehicles becoming a significant drain on financial resources, diverting capital that could be invested in more profitable and in-demand vehicle categories, thereby hindering overall fleet performance and shareholder value.

Niche ancillary services with low adoption represent potential question marks for Avis Budget Group. These might include specialized insurance add-ons or unique vehicle accessories that haven't resonated widely with renters. For instance, if a service like premium roadside assistance beyond basic needs sees less than 5% uptake across the fleet, it could fall into this category.

These services, while potentially offering incremental revenue, might also drain resources if customer demand is minimal. Avis Budget Group's focus in 2024 would be on assessing if the marketing spend and operational complexity of these low-adoption services outweigh their contribution. If a particular ancillary service, like satellite navigation rentals in an era of ubiquitous smartphone GPS, consistently shows low utilization, it warrants re-evaluation.

Inefficient Legacy IT Infrastructure (Pre-Digital Transformation)

Before its significant digital transformation, Avis Budget Group likely operated with legacy IT infrastructure that presented considerable challenges. These older systems were often costly to maintain, with reports indicating that IT modernization can consume up to 70% of an IT budget, leaving little for innovation. Such fragmentation hindered operational agility and customer experience, representing a potential drag on growth.

These legacy systems, while being actively addressed, could be considered Dogs within the BCG matrix framework. They are characterized by low market share and low growth prospects, often requiring substantial investment simply to keep them operational without yielding proportional returns.

- High Maintenance Costs: Legacy systems often incur disproportionately high maintenance expenses compared to modern, integrated solutions.

- Operational Inefficiencies: Fragmented IT can lead to manual workarounds, data silos, and slower processing times, impacting overall productivity.

- Limited Scalability: Older infrastructure may struggle to adapt to growing business needs or integrate new technologies efficiently.

- Resource Drain: Maintaining these systems diverts capital and skilled personnel away from strategic growth initiatives.

Specific Licensee Operations with Poor Performance

While Avis Budget Group manages many operations directly, it also utilizes licensing agreements in various international markets. These licensed operations, particularly those struggling with local market challenges, poor management, or insufficient investment, can be viewed as underperformers within the company's overall portfolio.

Such underperforming licensees may generate minimal royalty income and potentially harm brand reputation due to a lack of direct oversight and control. For instance, in 2024, while Avis Budget Group reported strong overall performance, specific regional licensees faced headwinds. This highlights the inherent risks in a licensing model where brand standards and operational quality are not directly managed.

- Low Royalty Generation: Underperforming licensees contribute less royalty revenue, impacting overall group profitability.

- Brand Dilution Risk: Inconsistent service quality or negative customer experiences at licensed locations can damage the Avis or Budget brand's reputation globally.

- Limited Control: The group has less direct influence over operational decisions and investment strategies of licensees compared to wholly-owned subsidiaries.

- Strategic Review: These underperforming units might necessitate a strategic review, potentially leading to restructuring, renegotiation of terms, or even termination of licensing agreements.

Segments within Avis Budget Group that exhibit low growth and a small market share are categorized as Dogs in the BCG matrix. These could be specific regional operations experiencing economic slowdowns or facing intense local competition, potentially generating minimal profits or even losses. For example, a region with only a 2% revenue increase in 2024 against a dominant competitor might fit this profile.

These underperforming areas tie up capital that could be better utilized elsewhere. Consider a scenario where a particular regional division reported a $5 million net loss in 2024, despite representing 3% of the group's total fleet, illustrating the drain on resources.

Strategically, divesting from or restructuring these underperforming segments can free up capital. This capital can then be reinvested in higher-growth markets or innovative services, enhancing Avis Budget Group's overall competitive position and financial returns.

Older, less fuel-efficient, or less popular vehicle models within Avis Budget Group's fleet can also be classified as Dogs. These vehicles often face reduced rental demand and higher maintenance costs, leading to lower utilization rates and profitability. In 2024, the industry focus on fleet modernization highlights how older models struggle against newer, more appealing alternatives.

Question Marks

Budget Truck Rental, while dominant in the US, faces a significant opportunity in the international arena. The global truck rental market is projected for strong growth, with Compound Annual Growth Rates (CAGRs) estimated between 7.52% and 9.6% through 2029. This positions international expansion for Budget Truck Rental as a classic ‘Question Mark’ in the BCG matrix – a high-growth market where Avis Budget Group currently holds a low share.

A strategic push into these burgeoning international markets would necessitate substantial investment. This capital would be crucial for establishing brand recognition, building out rental fleets, and developing localized operational capabilities to compete effectively. The aim would be to transform Budget Truck Rental from a low-share player into a market leader in these high-potential regions.

Avis Budget Group is actively exploring new Mobility-as-a-Service (MaaS) avenues, moving beyond traditional car rentals and car-sharing. This includes initiatives like integrating with public transportation networks and developing subscription-based mobility packages. These ventures tap into a burgeoning market with substantial growth prospects.

While these new MaaS offerings represent significant future potential, Avis Budget Group's current market penetration in these developing segments is likely minimal. For instance, the global MaaS market was projected to reach $1.5 trillion by 2030, indicating the scale of opportunity. Avis's position in this vast, emerging landscape is still in its early stages.

Transforming these nascent MaaS segments into future market leaders, or Stars in the BCG matrix, will necessitate considerable investment. This capital will be directed towards pilot programs, advanced technology development, and strategic partnerships. For example, companies investing heavily in digital platforms and data analytics are better positioned to capture market share in MaaS.

Avis Budget Group is actively exploring advanced predictive analytics to fine-tune fleet operations and revenue. This strategic push aims to anticipate customer demand and position vehicles optimally, promising significant gains in efficiency. However, the full realization of these capabilities is still in its nascent stages, positioning this area as a Question Mark within their growth strategy.

Strategic Ventures in Emerging Markets

Avis Budget Group's strategic ventures into emerging markets would likely position them as Stars or Question Marks within the BCG matrix. These markets, characterized by high growth potential, would necessitate significant investment to build brand recognition and operational infrastructure. For instance, as of early 2024, many Southeast Asian economies are experiencing robust GDP growth, often exceeding 5%, creating fertile ground for increased car rental demand as tourism and local economies expand.

These new initiatives would likely begin with a relatively low market share, as Avis Budget Group establishes its presence against local competitors or other international players. The high growth rate of these emerging economies, however, offers substantial upside. Avis Budget Group would need to carefully manage capital allocation, balancing the need for aggressive expansion with the inherent risks of unfamiliar operating environments.

- Emerging Market Entry: Focus on regions with high projected GDP growth and increasing disposable incomes, such as parts of India or Africa, where mobility needs are rapidly evolving.

- Investment Requirements: Significant capital will be needed for fleet acquisition, technology integration, and building a localized brand presence, potentially mirroring initial investments made in other high-growth regions in the past.

- Market Share Dynamics: Expect an initial low market share, with the objective of capturing a substantial portion of the high market growth rate over the next 5-10 years.

- Strategic Maneuvering: Partnerships with local entities or acquisitions may be crucial to navigate regulatory landscapes and consumer preferences effectively, a strategy successfully employed by competitors in similar markets.

Partnerships for Integrated Travel Experiences

Avis Budget Group is likely pursuing strategic partnerships to create more comprehensive travel packages. This involves integrating its car rental services with other travel components like flights and accommodations, aiming for a seamless customer journey.

These collaborations place Avis Budget Group within the high-growth travel technology sector. While direct market share on these integrated platforms might be nascent, the potential for customer acquisition and market expansion is substantial.

These alliances are pivotal for broadening Avis Budget Group's reach and tapping into new customer demographics. Such strategic moves could elevate these ventures into the 'Star' category within the BCG matrix, signifying strong market growth and position.

- Partnerships: Integration with travel aggregators, airlines, and hospitality providers.

- Market Position: High-growth area in travel tech, with potentially low initial direct market share.

- Strategic Goal: Expand reach, acquire new customers, and transition ventures to 'Stars'.

Avis Budget Group's ventures into emerging markets and new Mobility-as-a-Service (MaaS) offerings represent significant growth opportunities. These areas are characterized by high potential but currently low market share for Avis, fitting the 'Question Mark' profile in the BCG matrix. Substantial investment is required to build brand presence and operational capabilities in these dynamic sectors.

The global MaaS market, projected to reach $1.5 trillion by 2030, and the international truck rental market, with CAGRs between 7.52% and 9.6% through 2029, highlight the growth potential. Avis's strategic partnerships in travel tech also fall into this category, aiming to integrate services and expand customer reach in a high-growth sector.

These 'Question Marks' require careful capital allocation to transform into 'Stars' by capturing market share. Success hinges on strategic maneuvering, such as local partnerships, technology investment, and adapting to evolving consumer needs in these rapidly developing segments.

| Initiative | Market Growth Potential | Current Market Share (Avis) | Strategic Focus |

|---|---|---|---|

| International Truck Rental Expansion | High (7.52%-9.6% CAGR through 2029) | Low | Investment in brand, fleet, localization |

| Mobility-as-a-Service (MaaS) Development | Very High ($1.5 trillion by 2030) | Nascent/Minimal | Pilot programs, technology, partnerships |

| Travel Tech Partnerships | High (Travel Technology Sector) | Low (on integrated platforms) | Customer acquisition, market expansion |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Avis Budget Group's financial data, industry research, and official reports to ensure reliable, high-impact insights.