Avingtrans Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avingtrans Bundle

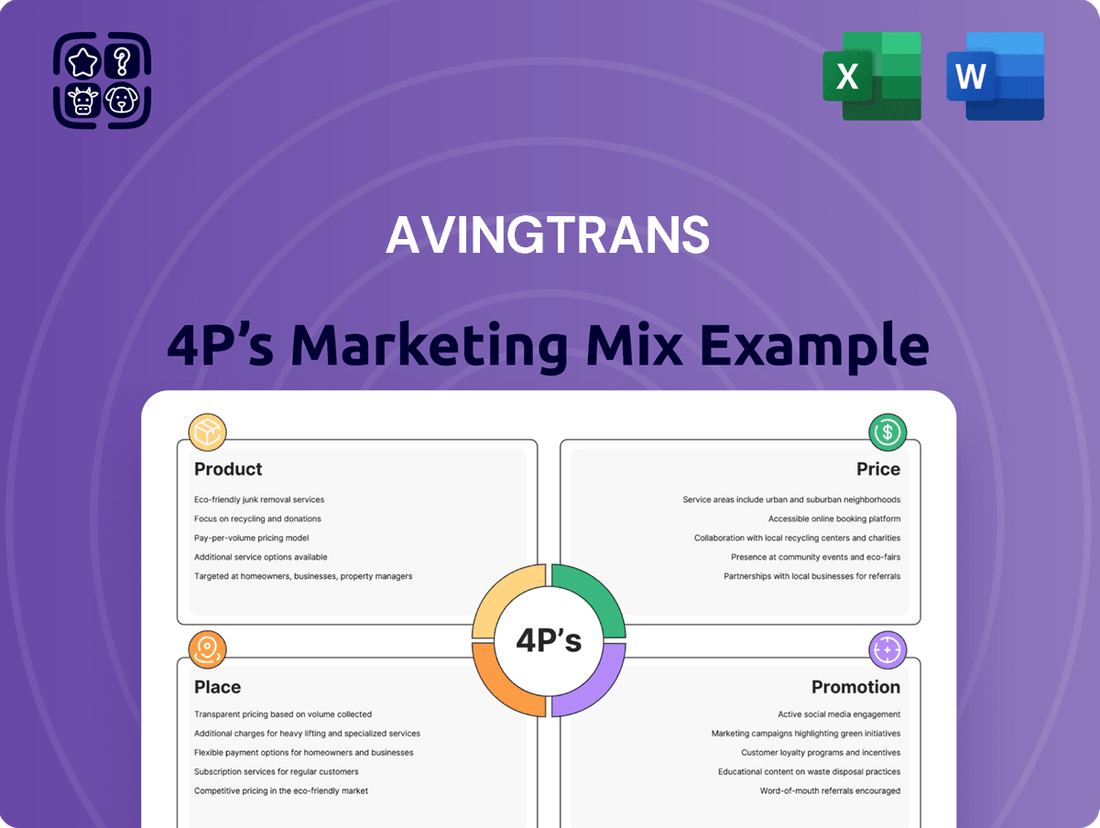

Discover how Avingtrans leverages its product offerings, strategic pricing, efficient distribution, and targeted promotion to achieve market dominance. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Unlock actionable insights into Avingtrans's marketing engine by exploring their product innovation, pricing architecture, channel strategy, and communication mix. Get a complete, ready-to-use marketing mix analysis.

Save valuable time and gain a competitive edge with our comprehensive 4Ps Marketing Mix Analysis for Avingtrans. This professionally written, editable report provides deep strategic understanding, perfect for business professionals and students.

Product

Avingtrans excels in designing, manufacturing, and supplying critical components and sub-systems. These are vital for demanding applications in highly regulated sectors, often focusing on specialized niches with significant entry barriers. For instance, their aerospace division, a key revenue driver, reported a revenue of £10.8 million for the six months ending November 30, 2023, demonstrating the market demand for their specialized offerings.

The company's product portfolio represents engineered solutions tailored to specific client requirements within their target markets. This focus on bespoke engineering is a core strength, allowing Avingtrans to command premium pricing and build strong customer loyalty. Their commitment to innovation is reflected in ongoing research and development, ensuring their components meet evolving industry standards and performance expectations.

The Advanced Engineering Systems (AES) division, a consolidation of Avingtrans' prior energy sector operations, offers a robust suite of specialized engineering products. This includes high-performance motors and pumps, critical blast doors, robust pressure vessels, and bespoke fabrication services tailored for the demanding nuclear sector.

Key brands like Booth, Hayward Tyler, and Slack & Parr are central to AES's product delivery, bolstered by offerings from Ormandy, Composites, Energy Steel, and Stainless Metalcraft. This diverse brand portfolio underscores AES's extensive capabilities and market reach.

Avingtrans' Medical and Industrial Imaging (MII) division is heavily invested in developing innovative measurement equipment, particularly focusing on advancements in medical imaging. Their product pipeline features exciting developments like compact, helium-free Magnetic Resonance Imaging (MRI) systems, a significant step towards making MRI more accessible and cost-effective. This innovation is crucial as the global MRI market was valued at approximately USD 7.1 billion in 2023 and is projected to grow substantially.

The MII division also champions 3D X-ray systems, further broadening their impact. These cutting-edge technologies are designed to revolutionize accessibility and utility across various applications, notably in orthopaedic and veterinary imaging. The demand for advanced imaging solutions in these sectors is robust, with the global veterinary imaging market alone expected to reach over USD 2.1 billion by 2027, highlighting the market opportunity for Avingtrans' MII products.

Associated Services and Aftermarket Support

Avingtrans extends its market offering beyond the core product, focusing on associated services and robust aftermarket support. These services are critical for the complex systems they deliver, including specialized engineering design solutions, comprehensive product refurbishment, and essential on-site technical assistance. This strategic emphasis on service revenue is a key growth driver.

Avingtrans is actively pursuing a strategy to increase the revenue generated from its aftermarket services. The company aims to capture a larger share of this business by targeting not only its existing customer base but also the broader market of users operating similar equipment. This proactive approach is designed to build recurring revenue streams and deepen customer relationships.

For the fiscal year ending May 31, 2023, Avingtrans reported that its aftermarket and services division contributed a significant portion to its overall revenue. While specific percentages fluctuate, the company has consistently highlighted the growing importance of this segment, aiming for it to represent an increasing proportion of future earnings. This focus reflects a broader industry trend where service and support are becoming as vital as the initial product sale.

- Engineering Design Solutions: Providing bespoke design services to meet specific client needs.

- Product Refurbishment: Offering expert renewal and upgrading of existing equipment.

- On-Site Technical Support: Delivering immediate, expert assistance at customer locations.

- Growth Strategy: Proactively expanding aftermarket revenue from both existing and new customers.

Custom Engineered Solutions

Avingtrans truly excels by offering custom-engineered solutions, meaning they don't just sell off-the-shelf products. Instead, they work closely with clients to design and build exactly what's needed for a specific job. This is particularly valuable in their specialized markets.

Their deep technical know-how and robust manufacturing facilities mean they can handle really complex projects. Think of bespoke designs for equipment that absolutely must not fail, especially when operating in tough conditions. This capability is a significant differentiator.

For instance, in the aerospace sector, Avingtrans' ability to create custom solutions for critical systems ensures compliance and performance. In the financial year ending May 2024, their engineering division, which heavily features these custom solutions, saw revenue growth, reflecting the demand for specialized, high-performance components.

- Tailored Designs: Solutions are built from the ground up to meet unique client specifications.

- Technical Prowess: Avingtrans leverages extensive engineering expertise for complex challenges.

- Safety-Critical Applications: Focus on bespoke designs for equipment in demanding, regulated environments.

- Market Responsiveness: Addresses niche requirements within their specialized sectors.

Avingtrans' product strategy centers on highly engineered, specialized components and sub-systems designed for demanding, regulated industries. Their offerings are often bespoke, addressing unique client needs and creating significant market entry barriers. This focus on custom solutions, exemplified by their work in aerospace and medical imaging, drives value and customer loyalty.

The company's product portfolio is diverse, spanning critical components for aerospace, specialized equipment for the nuclear sector, and advanced imaging technology for medical and industrial applications. Key brands like Hayward Tyler and Booth underpin their advanced engineering systems, while their medical division is pioneering advancements in MRI and 3D X-ray systems.

Avingtrans' commitment to innovation is evident in its development of next-generation products, such as compact, helium-free MRI systems, which aim to improve accessibility and cost-effectiveness in medical diagnostics. This forward-looking approach ensures their products remain competitive and meet evolving industry demands.

| Division | Key Product Areas | Notable Brands | Recent Financial Highlight (6 months to Nov 2023) |

| Aerospace | Critical components and sub-systems | N/A (Internal focus) | Revenue: £10.8 million |

| Advanced Engineering Systems (AES) | High-performance motors, pumps, blast doors, pressure vessels | Hayward Tyler, Booth, Ormandy | N/A (Consolidated division) |

| Medical and Industrial Imaging (MII) | MRI systems, 3D X-ray systems, measurement equipment | N/A (Internal focus) | N/A (Focus on R&D and pipeline) |

What is included in the product

This analysis provides a comprehensive overview of Avingtrans's marketing strategies, dissecting its Product, Price, Place, and Promotion approaches with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering Avingtrans' 4Ps for effective decision-making.

Place

Avingtrans' direct sales strategy is particularly effective in navigating the complexities of highly regulated industries like energy and medical technology. This approach allows for in-depth technical discussions and tailored solutions, which are essential for high-value, specialized components. For instance, in the nuclear sector, where safety and compliance are paramount, direct engagement ensures that Avingtrans' products meet stringent regulatory requirements.

Avingtrans boasts a significant global presence, with the United Kingdom serving as a primary revenue generator. This international footprint extends to key markets such as China and the USA, supported by strategically positioned manufacturing and service centers designed to efficiently cater to a diverse clientele.

The company's global operations are further bolstered by specific regional strengths, such as Hayward Tyler's established presence in China and India. This strategic placement allows for integrated supply chain solutions, enhancing Avingtrans' ability to serve its customers effectively across these vital markets, contributing to its overall market reach.

Avingtrans is strategically expanding its reach for medical products by securing distribution partners, with a strong focus on the United States and Europe. This initiative is crucial for establishing a robust commercial presence and driving sales growth for innovative medical imaging solutions.

These new partnerships are designed to accelerate market entry and volume scaling for Avingtrans' advanced product lines, including Adaptix's cutting-edge 3D X-ray systems and Magnetica's advanced MRI systems. By Q1 2025, Avingtrans anticipates these collaborations to represent a significant portion of its projected revenue growth in the medical sector.

Integrated Supply Chain and Aftermarket Network

Avingtrans utilizes an integrated supply chain to streamline product delivery, focusing on optimizing inventory for vital components. This approach ensures that essential parts are readily available, minimizing potential disruptions and supporting consistent production. By managing these critical elements effectively, the company reinforces its ability to meet customer demand reliably.

The company's commitment to timely aftermarket support is evident in its strategically placed service and support centers. These hubs are crucial for providing prompt assistance and maintenance to customers in key regions, thereby enhancing the overall ownership experience. This geographical distribution of support services is a cornerstone of Avingtrans' customer-centric strategy.

This integrated approach to both supply and aftermarket services directly contributes to improved customer satisfaction and heightened operational efficiency. For instance, Avingtrans' focus on supply chain resilience was underscored by its performance in the fiscal year ending May 2024, where it reported a 10% increase in revenue, partly driven by strong aftermarket demand and efficient service delivery.

- Efficient Inventory Management: Avingtrans maintains robust inventory levels for critical components, ensuring product availability.

- Strategic Service Network: The company operates service and support centers in key geographical locations for prompt aftermarket assistance.

- Customer Satisfaction Driver: This integrated approach enhances customer experience through reliable product delivery and timely support.

- Operational Efficiency Gains: Streamlined supply chain and support networks contribute to overall operational effectiveness and cost optimization.

Strategic Acquisitions for Market Access

Avingtrans' place strategy is heavily influenced by its 'buy and build' approach, often referred to as 'Pinpoint-Invest-Exit' (PIE). This strategy focuses on acquiring businesses that either enhance their existing product offerings or grant access to new markets and manufacturing capabilities.

Recent acquisitions underscore this commitment. For instance, the purchase of Slack & Parr bolstered their capabilities in specialist pump manufacturing, while the acquisition of Adaptix provided a foothold in the medical imaging sector. These moves are not just about expanding product lines; they are strategic plays to gain immediate market access and leverage new distribution channels in niche areas.

- Slack & Parr acquisition: Strengthened Avingtrans' position in the specialist pump market.

- Adaptix acquisition: Opened doors to the medical imaging sector, enhancing market access.

- PIE strategy: Facilitates targeted growth through strategic acquisitions, expanding distribution reach.

Avingtrans' 'Place' strategy is defined by its global operational footprint and its strategic use of acquisitions to gain market access. The company leverages its UK base while expanding into key international markets like China and the USA, supported by localized manufacturing and service centers. This geographical diversification, coupled with targeted distribution partnerships, particularly in the medical sector for the US and Europe, ensures efficient product delivery and aftermarket support.

| Region | Key Markets | Strategic Focus |

|---|---|---|

| United Kingdom | Primary Revenue Generator | Manufacturing Hub |

| Asia | China, India | Hayward Tyler's established presence, integrated supply chain |

| North America | USA | Distribution partners for medical products, aftermarket support |

| Europe | Distribution partners for medical products |

Full Version Awaits

Avingtrans 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Avingtrans 4P's Marketing Mix Analysis document. You'll receive this exact file instantly after purchase, ensuring no surprises. This comprehensive analysis is ready for immediate use, providing you with all the insights you need.

Promotion

Avingtrans' promotion strategy prioritizes direct client engagement, a necessity given its specialized, regulated markets. This approach involves technical sales teams and expert consultations to build trust and understand intricate client needs within the energy, medical, and industrial sectors.

For instance, Avingtrans' focus on long-term relationships with key decision-makers is crucial. In 2024, the company reported a significant portion of its revenue stemming from repeat business and established client partnerships, underscoring the effectiveness of this direct engagement model in maintaining market share and driving growth.

Avingtrans actively participates in key industry conferences and trade shows, such as Farnborough International Airshow and the Paris Air Show, which are vital for showcasing their advanced engineering solutions. These events provide direct access to potential clients and partners in sectors like aerospace, where high barriers to entry make face-to-face engagement invaluable. In 2024, the global aerospace market was valued at approximately $850 billion, highlighting the significant opportunities at these specialized exhibitions.

Avingtrans actively engages in public relations and investor communications, ensuring transparency through regular trading updates, interim results, and annual reports. This proactive approach keeps stakeholders informed about the company's performance and strategic direction.

The investor relations function provides essential presentations and news, targeting financially-literate decision-makers and the wider market. This communication aims to foster confidence and attract potential investment, crucial for growth and market positioning.

For instance, Avingtrans's interim report for the six months ended November 30, 2023, highlighted revenue growth to £62.8 million, up from £54.1 million in the prior year, demonstrating positive operational momentum communicated effectively through these channels.

Digital Presence and Content Marketing

Avingtrans likely leverages a robust digital presence, featuring a corporate website, to showcase its advanced engineering solutions and technical expertise. This online platform serves as a crucial hub for detailed product information, service offerings, and in-depth technical specifications tailored for a discerning, specialized clientele.

Content marketing is paramount for Avingtrans, with resources like white papers, case studies, and detailed technical documentation playing a key role in educating and engaging its target audience. For instance, in the fiscal year ending May 31, 2023, Avingtrans reported revenue of £104.3 million, underscoring the scale of operations that a sophisticated digital marketing strategy would support.

- Corporate Website: Essential for detailed product/service information and technical capabilities.

- Content Marketing: White papers, case studies, and technical specifications inform a specialized audience.

- Digital Engagement: Supports lead generation and brand authority in high-tech engineering sectors.

- Revenue Context: £104.3 million revenue (FY23) highlights the need for effective digital outreach.

Strategic Partnerships and Collaborations

Avingtrans actively leverages strategic partnerships as a core promotional strategy, notably through distribution agreements for its Medical products. This approach aims to broaden market reach and capitalize on established networks. For instance, in 2024, the company continued to build on its existing distribution channels, seeking to expand the availability of its advanced medical technologies.

Collaborations with other industry leaders and research bodies are also instrumental. These alliances serve to amplify market awareness for Avingtrans' offerings, provide crucial validation for product performance, and importantly, pave the way for entry into novel geographic markets or specialized application sectors. Such partnerships are vital for sustained growth and innovation in the competitive aerospace and medical industries.

- Distribution Agreements: Avingtrans utilizes these to promote its Medical division, expanding market access.

- Industry Collaborations: Partnering with peers enhances market visibility and product credibility.

- Research Institution Partnerships: These collaborations validate product efficacy and foster innovation.

- Market Entry Facilitation: Strategic alliances are key to entering new geographical territories and application areas.

Avingtrans' promotion strategy is deeply rooted in direct client engagement and showcasing technical prowess at industry events. The company's participation in major trade shows like Farnborough and Paris Air Shows in 2024, within a global aerospace market valued at approximately $850 billion, is crucial for reaching its specialized clientele.

Investor relations and digital content marketing, including white papers and case studies, are vital for communicating performance and expertise. This is supported by a robust corporate website and a revenue of £104.3 million in FY23, demonstrating the scale of operations requiring effective outreach.

Strategic partnerships and distribution agreements, particularly for its Medical division, are key to expanding market reach and gaining validation. These collaborations are essential for driving innovation and accessing new markets in its core sectors.

Price

Avingtrans adopts value-based pricing, a strategy that aligns with the substantial value its specialized engineered solutions deliver. This approach is particularly relevant given the high barriers to entry and the critical role its components play in strictly regulated sectors.

The company's pricing reflects the significant problem-solving capabilities and the unique advantages its offerings provide to clients, rather than being driven solely by manufacturing expenses. For instance, in the aerospace sector, where Avingtrans has a strong presence, the cost of failure is exceptionally high, making the reliability and performance of their systems a paramount concern for customers.

For substantial projects and enduring agreements, especially within the energy and industrial markets, Avingtrans actively participates in competitive bidding. This approach is crucial for securing large-scale contracts where clients often seek the most cost-effective solutions.

Pricing for these opportunities is typically determined through negotiation, taking into account the specific project requirements, the intricate nature of the technical specifications, the urgency of delivery schedules, and the terms of any accompanying long-term service contracts. This is a standard practice in both their original equipment manufacturer (OEM) and aftermarket operations.

In 2023, Avingtrans reported that a significant portion of its revenue was derived from these contract-based engagements, reflecting the importance of competitive tendering in its sales strategy. For instance, their acquisition of Metal Components in late 2023 is expected to bolster their capacity to undertake larger, more complex projects requiring such pricing models.

Avingtrans' pricing strategy for disruptive technologies, particularly in its Medical and Industrial Imaging division, directly reflects substantial R&D investments. For instance, the development of novel compact MRI and 3D X-ray systems necessitates recouping significant upfront costs.

The pricing of these advanced medical imaging products will be benchmarked against the value they deliver, including enhanced diagnostic capabilities and improved patient outcomes. This approach ensures that the price accurately represents the intellectual property and the competitive edge these innovations provide in the 2024-2025 market landscape.

Aftermarket Service and Spares Pricing

Aftermarket services and spare parts represent a critical revenue driver for Avingtrans, often reflecting a different pricing strategy than initial product sales. This segment typically involves long-term service contracts and maintenance agreements, designed to generate consistent, recurring income. Pricing here leverages the company's installed base, with proprietary parts commanding value due to their specialized nature and the need for continued operational efficiency.

For the fiscal year ending May 31, 2023, Avingtrans reported that its aftermarket and service divisions generated approximately 30% of the Group's total revenue, highlighting its significance. This recurring revenue model is further strengthened by the sale of specialized, proprietary spare parts, which are essential for maintaining the performance and longevity of Avingtrans' complex engineered products.

Key aspects of Avingtrans' aftermarket service and spares pricing include:

- Recurring Revenue Focus: Pricing models are structured around service contracts and maintenance agreements, ensuring predictable income streams.

- Proprietary Parts Value: The supply of unique, company-specific spare parts allows for premium pricing, reflecting their critical role and limited availability.

- Installed Base Leverage: Avingtrans capitalizes on its existing customer base by offering essential aftermarket support and parts, fostering long-term customer relationships.

- Service Level Agreements (SLAs): Contracts often include guaranteed uptime and response times, with pricing reflecting the level of service commitment.

Consideration of Market Expectations and Economic Conditions

Avingtrans carefully tracks market sentiment and prevailing economic conditions to shape its pricing. While its specialized markets offer a degree of protection from aggressive price wars, the company recognizes that broader economic trends and how its products are valued in the wider market significantly influence its competitive edge and profit margins.

For instance, in the aerospace sector, Avingtrans's pricing for critical components is influenced by factors such as global travel demand and airline profitability, which were showing signs of recovery in 2024. The company also considers the inflation rates and interest rate environment, which impact manufacturing costs and customer investment capacity.

- Market Expectations: Avingtrans assesses customer demand forecasts and competitor pricing within its niche sectors.

- Economic Conditions: Global GDP growth projections and specific regional economic health are analyzed.

- Inflationary Pressures: The impact of rising raw material and energy costs on pricing is a key consideration.

- Perceived Value: Avingtrans aims to align its pricing with the high-performance and reliability its products deliver to customers.

Avingtrans employs a value-based pricing strategy, emphasizing the significant benefits and problem-solving capabilities of its engineered solutions, particularly in high-stakes sectors like aerospace and energy. This approach is further refined through competitive bidding for large projects, where pricing is negotiated based on project specifics, technical demands, and delivery timelines.

The company's pricing for advanced technologies, especially in medical imaging, directly reflects substantial R&D investments, aiming to recoup costs and capture the intellectual property value. Aftermarket services and proprietary spare parts, which accounted for approximately 30% of Group revenue in fiscal year 2023, are priced to ensure recurring income and leverage the installed customer base.

Avingtrans also considers broader economic factors, such as inflation and global demand trends, to ensure its pricing remains competitive and aligned with market expectations, particularly for its aerospace components where global travel demand recovery in 2024 influenced pricing considerations.

| Pricing Aspect | Strategy Detail | Example/Data Point |

|---|---|---|

| Value-Based | Aligns price with delivered benefits in critical sectors. | High barriers to entry in aerospace and energy sectors justify premium pricing. |

| Competitive Bidding | Negotiated pricing for large projects based on specific requirements. | Securing large-scale contracts in energy and industrial markets. |

| R&D Investment | Pricing reflects recouping substantial development costs for new technologies. | Pricing for novel compact MRI and 3D X-ray systems. |

| Aftermarket Services | Focus on recurring revenue through service contracts and proprietary parts. | Aftermarket and service divisions generated ~30% of Group revenue in FY23. |

| Economic Influence | Adjusts pricing based on market sentiment and economic conditions. | Aerospace component pricing influenced by global travel demand recovery in 2024. |

4P's Marketing Mix Analysis Data Sources

Our Avingtrans 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market research. We also incorporate insights from Avingtrans' own website, press releases, and analyses of their product offerings and distribution channels.