Avingtrans Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avingtrans Bundle

Avingtrans operates within a competitive landscape shaped by several key forces, including the bargaining power of buyers and the intensity of rivalry. Understanding these dynamics is crucial for anyone looking to grasp their market position. This brief overview only scratches the surface of the intricate competitive forces at play.

Unlock the full Porter's Five Forces Analysis to explore Avingtrans’s competitive dynamics, market pressures, and strategic advantages in detail. Gain actionable insights to drive smarter decision-making and understand the true forces shaping their industry.

Suppliers Bargaining Power

Avingtrans' reliance on specialized materials and components means assessing the number of available suppliers is crucial. If only a handful of companies can provide critical inputs, their leverage over Avingtrans increases significantly. This concentration of suppliers can lead to higher costs and potential disruptions, impacting the company's operational efficiency and profitability.

The uniqueness of inputs is a key factor in supplier bargaining power. If Avingtrans relies on highly specialized components or technologies that are not readily available from multiple sources, its suppliers gain significant leverage. For instance, if a supplier holds patents for critical materials used in Avingtrans' aerospace or medical equipment sectors, they can dictate terms more effectively.

Avingtrans faces significant switching costs when changing suppliers, particularly for its specialized aerospace and medical components. These costs can include the lengthy and expensive requalification processes required to ensure new suppliers meet stringent industry standards, potentially taking months and substantial investment. For instance, in the aerospace sector, a supplier change might necessitate re-testing and re-certification of components, adding considerable time and expense to production cycles.

Threat of forward integration by suppliers

The threat of forward integration by Avingtrans' suppliers presents a notable challenge. If suppliers have the technical expertise and financial capacity, they could begin manufacturing components or assembling sub-systems that Avingtrans currently produces. This would directly pit them against Avingtrans, potentially leading to increased competition and reduced margins for Avingtrans.

For instance, a key supplier of specialized aerospace components, if seeing strong demand and profitability in Avingtrans' end-products, might invest in its own assembly lines. This could disrupt Avingtrans' supply chain and force it to contend with a competitor that already controls the raw materials or intermediate stages of production. In 2024, the aerospace sector saw continued consolidation, with some tier-1 suppliers expanding their capabilities, making this a relevant concern.

- Supplier Capability: Assess if suppliers possess the necessary manufacturing technology and skilled labor to produce Avingtrans' finished components or sub-systems.

- Market Opportunity: Evaluate if the profit margins and market share Avingtrans holds are attractive enough to incentivize suppliers to enter the market directly.

- Competitive Landscape: Consider how Avingtrans' existing competitors might react to a supplier's forward integration, potentially creating new strategic alliances or competitive pressures.

- Avingtrans' Defenses: Explore Avingtrans' strategies to mitigate this threat, such as securing long-term supply agreements, developing proprietary technologies, or diversifying its supplier base.

Importance of Avingtrans to suppliers

The bargaining power of suppliers to Avingtrans is influenced by how much of a supplier's business Avingtrans constitutes. If Avingtrans is a significant customer for a supplier, that supplier will likely be more accommodating to maintain the relationship and favorable terms, thereby reducing their bargaining power.

For instance, if a key component supplier derives 25% of its annual revenue from Avingtrans, it has less leverage than a supplier for whom Avingtrans represents only 2% of its sales. This dynamic means Avingtrans can often negotiate better pricing and terms, especially for critical inputs.

- Supplier Dependence: If Avingtrans accounts for a large portion of a supplier's revenue, the supplier's ability to dictate terms is diminished.

- Customer Concentration: Avingtrans's position as a substantial buyer can lead to preferential treatment and more competitive pricing from its suppliers.

- Industry Benchmarks: While specific figures for Avingtrans's supplier revenue proportions are not publicly detailed, general industry analysis suggests that customers with significant purchasing volumes often benefit from reduced supplier bargaining power.

The bargaining power of Avingtrans' suppliers is moderately high due to the specialized nature of its components and the significant switching costs involved. A concentration of suppliers for critical inputs, such as those in the aerospace and medical sectors, can lead to increased costs and potential supply chain disruptions. For example, in 2024, the aerospace industry continued to see supply chain pressures, impacting lead times and component availability for manufacturers like Avingtrans.

The threat of forward integration by suppliers is a relevant concern, particularly as some tier-1 suppliers in the aerospace sector expanded their capabilities in 2024. This means Avingtrans must remain vigilant about suppliers potentially moving into direct competition. Avingtrans's ability to negotiate favorable terms is also influenced by its relative importance as a customer to its suppliers; being a large buyer can reduce supplier leverage.

| Factor | Impact on Avingtrans | Supporting Data/Observation |

| Supplier Concentration | Increases bargaining power | Specialized components often have fewer qualified suppliers. |

| Switching Costs | Increases bargaining power | Re-qualification processes in aerospace/medical sectors are time-consuming and expensive. |

| Threat of Forward Integration | Increases bargaining power | Consolidation in aerospace supply chains in 2024 saw suppliers expanding capabilities. |

| Customer Dependence (Avingtrans's role) | Decreases bargaining power | Avingtrans's significant purchasing volume can lead to better terms. |

What is included in the product

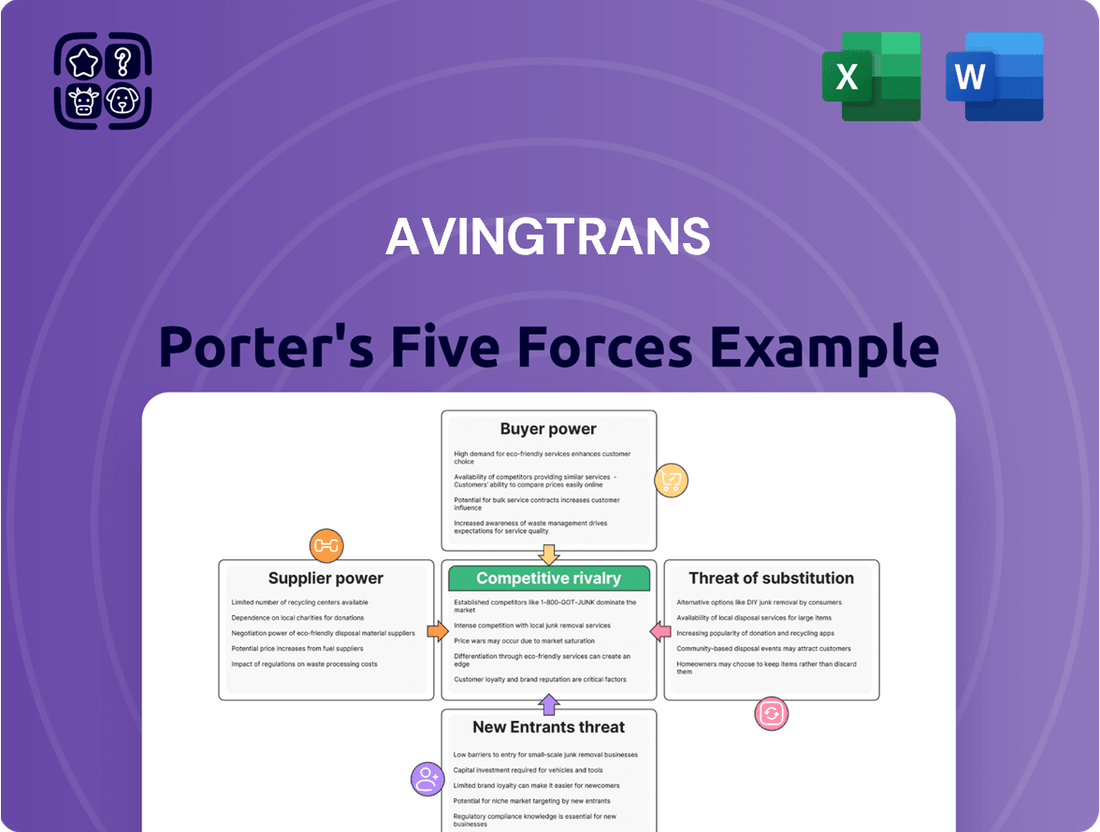

Avingtrans' Porter's Five Forces Analysis dissects the competitive intensity within its operating sectors, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Easily identify critical industry pressures and competitive threats with a visually intuitive Porter's Five Forces analysis, streamlining strategic planning.

Customers Bargaining Power

Avingtrans' customer concentration, particularly in specialized sectors like nuclear and medical, is a key factor in understanding customer bargaining power. For instance, if a few major clients in these highly regulated industries account for a significant portion of Avingtrans' revenue, these large customers can exert substantial influence. This leverage might translate into demands for reduced pricing or more advantageous contract conditions, directly impacting Avingtrans' profitability.

Switching from Avingtrans involves significant hurdles for customers. These include the costs and time associated with re-qualifying new suppliers, ensuring performance consistency, and managing the complexities of integrating new systems into their existing infrastructure. For instance, in sectors like aerospace or defense where Avingtrans operates, recertification processes alone can take months and cost hundreds of thousands of dollars, significantly raising switching barriers.

Avingtrans customers in sectors like aerospace and defense exhibit low price sensitivity. This is driven by the critical nature of components where performance, reliability, and adherence to strict regulatory standards are non-negotiable. For instance, in 2024, the global aerospace market, a key sector for Avingtrans, continued to demand high-specification parts, with safety and certification often outweighing minor price variations.

Threat of backward integration by customers

The threat of backward integration by Avingtrans' customers is generally low. This is because the design and manufacturing of critical components and sub-systems require substantial technical expertise, specialized production facilities, and navigating complex regulatory environments. For instance, in the aerospace sector, where Avingtrans operates, developing in-house capabilities for highly engineered parts can take years and significant capital investment, often exceeding what many customers can readily commit.

This inherent complexity limits the bargaining power of customers who might otherwise consider bringing production in-house. Avingtrans' established track record and specialized knowledge in areas like high-precision machining and complex assembly provide a significant barrier to entry for potential customer integration. For example, in 2023, Avingtrans reported revenue of £145.5 million, demonstrating its scale and established position within its niche markets, which further deters customer integration efforts.

- Low Likelihood of In-House Production: Customers typically lack the specialized technical expertise and advanced manufacturing capabilities required to replicate Avingtrans' core competencies.

- High Capital Investment Required: Establishing the necessary infrastructure and R&D for backward integration would demand substantial financial resources, making it economically unviable for most customers.

- Regulatory Hurdles: Many of Avingtrans' target industries, such as aerospace and defense, involve stringent regulatory approvals for component manufacturing, posing a significant challenge for new entrants.

- Focus on Core Competencies: Customers often prefer to concentrate on their primary business activities, outsourcing specialized manufacturing to experts like Avingtrans to maintain efficiency and focus.

Availability of alternative suppliers

The availability of alternative suppliers significantly influences the bargaining power of Avingtrans' customers. If numerous credible suppliers can offer similar complex, niche engineered solutions that meet Avingtrans' stringent market requirements, customers gain leverage. This increased competition among suppliers means customers can more easily switch providers if Avingtrans' pricing or terms are unfavorable.

However, Avingtrans operates in markets characterized by high barriers to entry. These barriers, such as specialized technical expertise, significant capital investment, and regulatory compliance, inherently limit the number of alternative suppliers. Consequently, the pool of credible competitors capable of matching Avingtrans' offerings is likely restricted, which in turn reduces the bargaining power of its customers.

- Limited Credible Alternatives: The niche nature of Avingtrans' engineered solutions means few suppliers can replicate their capabilities, thereby diminishing customer choice.

- High Barriers to Entry: Factors like specialized R&D, intellectual property, and established supply chains create significant hurdles for new entrants, protecting Avingtrans from intense competition.

- Reduced Customer Leverage: With fewer viable alternatives, customers have less power to negotiate lower prices or demand more favorable terms from Avingtrans.

Avingtrans' customers possess moderate bargaining power, primarily influenced by the specialized nature of its products and the high switching costs involved. While some customers are concentrated, the technical complexity and regulatory requirements in sectors like aerospace and medical limit their ability to easily substitute Avingtrans' offerings or integrate production themselves. This balance means customers can negotiate, but Avingtrans retains significant leverage due to its expertise and the barriers to entry for competitors.

The bargaining power of Avingtrans' customers is somewhat constrained by the scarcity of alternative suppliers capable of meeting their stringent technical and regulatory demands. In 2024, the aerospace sector, a key market, continued to prioritize reliability and certification, making price a secondary concern for critical components. This scenario reduces the leverage customers have to push for lower prices or more favorable terms, as finding equivalent suppliers is challenging and costly.

| Factor | Impact on Customer Bargaining Power | Avingtrans' Position |

|---|---|---|

| Customer Concentration | Moderate to High (for specific large clients) | Mitigated by specialization and switching costs |

| Switching Costs | High (technical qualification, integration) | Strong deterrent to customer switching |

| Price Sensitivity | Low (in critical sectors like aerospace) | Allows for premium pricing based on value and reliability |

| Threat of Backward Integration | Low (due to technical expertise and capital requirements) | Protects Avingtrans from in-house production by customers |

| Availability of Alternatives | Low (due to high barriers to entry and specialization) | Limits customer negotiation power and choice |

Same Document Delivered

Avingtrans Porter's Five Forces Analysis

This preview showcases the comprehensive Avingtrans Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. You're not just seeing a sample; you're viewing the complete, professionally formatted analysis, ready for your strategic planning. This detailed report will equip you with a thorough understanding of the competitive landscape impacting Avingtrans, enabling informed decision-making.

Rivalry Among Competitors

Avingtrans operates within specialized engineering sectors, facing competition from both niche players and larger, diversified engineering conglomerates. While specific niches might limit the sheer number of direct rivals, the presence of substantial, multi-sector engineering groups capable of undertaking large-scale projects means the competitive intensity can be significant. For instance, in the energy sector, Avingtrans might contend with established players like Doosan Babcock or GE Power for critical component supply contracts, even if their primary focus differs.

Avingtrans operates in markets characterized by varying growth rates, with some sectors experiencing slower expansion due to their mature and highly regulated nature. For instance, the aerospace and defense sector, a key area for Avingtrans, typically sees more measured growth compared to rapidly evolving tech industries. This slower pace can indeed intensify competitive rivalry as established players vie more fiercely for existing market share.

Avingtrans operates in niche markets, meaning exiting these sectors can be costly. Competitors might face substantial financial losses if they have heavily invested in specialized machinery or facilities specific to these industries. For instance, in the aerospace sector, the cost of decommissioning or repurposing highly specialized manufacturing equipment can be prohibitive.

Long-term contracts and commitments also act as significant exit barriers. Companies deeply embedded in supply chains for sectors like rail or defense often have multi-year agreements that are difficult and expensive to break. Avingtrans' involvement in supplying critical components for long-life assets means competitors are similarly tied into these extended relationships, making a swift exit improbable.

Furthermore, the specialized nature of Avingtrans' markets means that assets are not easily transferable or sellable to other industries. This illiquidity of assets, coupled with potential reputational damage from a disorderly exit, discourages firms from leaving, even if they are underperforming. This can lead to prolonged periods of intense competition as less profitable entities remain active.

Product differentiation

Avingtrans' competitive rivalry is significantly influenced by product differentiation, particularly in its engineered solutions. The company leverages superior technical expertise and proprietary technologies to distinguish its offerings. This focus on specialized capabilities, such as advanced materials science and precision engineering, allows Avingtrans to command a premium and reduces the emphasis on price-based competition.

The extent of Avingtrans' differentiation is evident in its ability to cater to niche markets requiring highly specialized components. For instance, in the aerospace sector, where safety and performance are paramount, Avingtrans' bespoke solutions, developed through extensive R&D, create a strong barrier to entry for less specialized competitors. This allows for a rivalry centered on innovation and the delivery of enhanced value rather than solely on cost.

- Technical Expertise: Avingtrans invests heavily in its engineering talent, fostering a culture of innovation that underpins its product differentiation.

- Proprietary Technologies: The company holds patents and utilizes unique manufacturing processes that are difficult for competitors to replicate, enhancing its market position.

- Niche Market Focus: By concentrating on high-specification engineered solutions, Avingtrans avoids direct competition with mass-produced alternatives, thereby strengthening its differentiation.

- Value-Based Rivalry: Differentiation shifts the competitive landscape from price wars to a focus on performance, reliability, and customized solutions, which Avingtrans excels at providing.

Intensity of competition based on quality and innovation

In sectors where Avingtrans operates, such as aerospace and energy, competition is fierce, but it's often driven by factors beyond just cost. Companies vie for dominance through the consistent delivery of high-quality products, unwavering reliability, and adherence to stringent regulatory standards. Continuous innovation is also a critical battleground, as firms strive to develop cutting-edge solutions that meet evolving industry demands.

Avingtrans' stated emphasis on serving demanding applications and leveraging its deep technical expertise strongly indicates that it faces this type of intense rivalry. This focus allows the company to command premium pricing, reflecting the specialized nature and high performance requirements of its offerings.

- Quality and Reliability: In 2024, the aerospace sector, a key market for Avingtrans, saw continued emphasis on supply chain resilience and product integrity following past disruptions. Companies demonstrating superior quality control and a proven track record of reliability are better positioned to secure long-term contracts.

- Innovation in Specialized Markets: For instance, advancements in materials science and manufacturing techniques are crucial in the energy sector, particularly for components used in extreme environments. Companies investing in R&D for these areas, like Avingtrans' work with high-temperature alloys, gain a competitive edge.

- Regulatory Compliance: Adherence to strict safety and performance regulations, such as those from EASA for aerospace or relevant bodies for energy infrastructure, is non-negotiable. Failure to comply can lead to significant penalties and loss of market access, making compliance a key differentiator.

Competitive rivalry for Avingtrans is characterized by a blend of specialized niche players and larger, diversified engineering firms. While its focus on high-specification engineered solutions differentiates it, the company still contends with rivals who compete on quality, reliability, and innovation, particularly in sectors like aerospace and energy. The mature nature of some of these markets intensifies competition for existing market share.

Avingtrans' competitive landscape is shaped by the need to consistently deliver high-quality, reliable products that meet stringent regulatory standards. For example, in 2024, the aerospace sector continued to prioritize supply chain resilience, benefiting companies with proven quality control. Similarly, innovation in materials science and manufacturing is crucial for energy sector components, where Avingtrans' work with high-temperature alloys provides an edge.

The intense rivalry in Avingtrans' markets often centers on value-based factors rather than pure price competition. Its technical expertise and proprietary technologies allow it to command premium pricing, as seen in its bespoke solutions for demanding aerospace applications. This differentiation strategy means competitors are often judged on performance, reliability, and the ability to provide customized, high-value offerings.

| Competitive Factor | Avingtrans' Position | Key Competitor Examples (Illustrative) | 2024 Market Trend Impact |

|---|---|---|---|

| Technical Expertise & Differentiation | Strong, leveraging proprietary technologies and niche focus. | Rolls-Royce (aerospace), Siemens Energy (energy) | Continued demand for specialized, high-performance components. |

| Quality & Reliability | High, essential for aerospace and energy sectors. | Safran (aerospace), Baker Hughes (energy) | Increased focus on supply chain resilience and product integrity post-disruptions. |

| Innovation | Key differentiator, especially in materials science and advanced manufacturing. | GE Aerospace (aerospace), Mitsubishi Heavy Industries (energy) | R&D investment crucial for meeting evolving demands in extreme environments. |

| Regulatory Compliance | Non-negotiable, adherence to strict standards (e.g., EASA). | All major players in regulated sectors. | Compliance remains a critical barrier to entry and a mark of quality. |

SSubstitutes Threaten

The threat of substitutes for Avingtrans' offerings, particularly in the aerospace and defence sectors, is generally moderate. While there are alternative components and systems available, the stringent certification requirements and long qualification processes in these industries create significant barriers to switching. For example, a new braking system for an aircraft must undergo extensive testing and regulatory approval, a process that can take years and cost millions, making direct substitution for established components a substantial undertaking.

However, the potential for disruption exists. Advances in materials science could lead to lighter, more durable, or cost-effective alternatives to current metal alloys used in Avingtrans' products. Similarly, the increasing integration of software and AI in control systems might offer new ways to achieve functionalities currently reliant on proprietary mechanical or hydraulic sub-systems. For instance, a shift towards more sophisticated electronic flight control systems could reduce reliance on certain traditional hydraulic components, though the integration challenges remain significant.

In the broader industrial sectors Avingtrans serves, the threat of substitutes can be higher. For less regulated applications, such as components for specialist industrial machinery, customers may have a wider array of choices from different manufacturers or even entirely different technological approaches. The availability of off-the-shelf components or modular designs from competitors could present a more direct substitute threat, especially if they offer a compelling cost or performance advantage without the extensive qualification hurdles faced in aerospace.

The relative price and performance of substitutes are critical. If alternative solutions offer similar or better functionality at a lower cost, a company's pricing power diminishes significantly. For instance, in the aerospace sector where Avingtrans operates, the stringent safety and performance requirements mean that cheaper, less reliable substitutes are rarely a viable option, limiting the threat.

Customer propensity to substitute for Avingtrans' products is generally low, particularly in its core markets like aerospace and energy. The complex nature of these applications, which often involve long design cycles, extensive testing, and stringent regulatory approvals, makes customers hesitant to adopt unproven alternatives. For instance, in the aerospace sector, a single component failure can have catastrophic consequences, leading to a strong preference for established, reliable suppliers with proven track records.

Switching costs for customers to adopt substitutes

The threat of substitutes for Avingtrans's products, particularly in sectors like aerospace and medical, is mitigated by high switching costs for customers. These costs can be substantial, involving significant financial and operational outlays to transition to alternative technologies. For instance, re-engineering existing aircraft systems or medical equipment to accommodate a new supplier's components can run into millions of pounds, alongside extensive re-certification processes that can take years.

These transition expenses are a major deterrent. Consider the aerospace industry where a single aircraft model might have hundreds of Avingtrans components. Replacing these would necessitate not just the purchase of new parts but also rigorous testing and validation to ensure safety and compliance with aviation regulations. In 2024, the cost of recertifying a single aircraft component can easily exceed £500,000, making customers hesitant to switch unless absolutely necessary.

- Financial Costs: Re-tooling, new hardware integration, and potential software upgrades represent significant capital expenditure for customers.

- Operational Costs: Retraining specialized staff, adapting manufacturing processes, and managing the disruption of a transition period add to the overall expense.

- Regulatory and Certification Hurdles: For Avingtrans's key markets, obtaining new certifications for substitute products can be a lengthy and costly process, often taking 2-3 years and millions in testing.

- Performance Integration: Ensuring seamless integration and maintaining the high performance standards expected in aerospace and medical applications requires extensive validation, further increasing switching costs.

Regulatory hurdles for substitutes

The threat of substitutes for Avingtrans's products is significantly mitigated by regulatory hurdles, particularly in sectors like nuclear and aerospace. New technologies or alternative solutions aiming to replace existing components in these highly regulated industries face stringent approval processes and substantial compliance costs. For example, in the nuclear sector, any new material or component must undergo rigorous testing and certification to meet safety standards, a process that can take years and cost millions. This lengthy and expensive pathway effectively deters many potential substitutes from entering the market, thereby protecting Avingtrans's market position.

Consider the medical technology sector, another area where Avingtrans has a presence. The U.S. Food and Drug Administration (FDA) approval process for new medical devices or components can be exceptionally demanding. In 2024, the average time for FDA clearance of a 510(k) device was approximately 6.1 months, while premarket approval (PMA) applications, which are for higher-risk devices, averaged around 2.5 years. These significant time and financial commitments act as a powerful barrier, making it difficult for substitute offerings to gain traction against established, certified products.

- Nuclear Sector Compliance: New materials and components require extensive safety certifications, often spanning multiple years and incurring millions in testing expenses.

- Medical Device Approvals: FDA 510(k) clearance averaged 6.1 months in 2024, while PMA applications took approximately 2.5 years, highlighting significant time barriers for substitutes.

- Aerospace Certification: Aviation authorities like the FAA impose rigorous certification requirements for all aircraft parts, demanding thorough validation of performance and safety, which is costly and time-consuming for new entrants.

The threat of substitutes for Avingtrans's products is generally low to moderate, primarily due to high switching costs and stringent regulatory environments in its core markets. In aerospace, for example, the extensive certification processes for new components, which can cost millions and take years, make direct substitution a significant undertaking. This is compounded by the critical safety requirements where proven reliability is paramount, discouraging the adoption of unproven alternatives.

In less regulated industrial sectors, the threat can be more pronounced if substitutes offer a clear cost or performance advantage. However, even here, Avingtrans's established relationships and customized solutions often create a degree of customer stickiness. The key differentiator remains the substantial investment required for customers to transition to alternatives, encompassing financial, operational, and regulatory considerations.

| Factor | Impact on Threat of Substitutes | Supporting Data/Example (2024) |

| Switching Costs (Aerospace) | High | Recertification of a single aircraft component can exceed £500,000. |

| Regulatory Hurdles (Medical) | High | FDA PMA applications averaged 2.5 years for approval in 2024. |

| Customer Propensity to Substitute | Low | Catastrophic failure consequences in aerospace favor established suppliers. |

| Performance Integration Needs | High | Seamless integration requires extensive validation, increasing costs. |

Entrants Threaten

Entering Avingtrans' specialized sectors, such as aerospace and defence or medical, demands significant upfront capital. Newcomers must invest heavily in state-of-the-art manufacturing facilities and specialized machinery, often costing millions. For instance, setting up a precision engineering facility comparable to Avingtrans' capabilities could easily require an initial investment exceeding £50 million, creating a formidable barrier.

Beyond physical assets, substantial funding is needed for research and development to match Avingtrans' established technological expertise. Companies must also account for the costs associated with regulatory compliance and certifications, which are particularly stringent in Avingtrans' core markets. These high capital requirements act as a robust deterrent, effectively limiting the number of potential new entrants capable of competing effectively.

Avingtrans operates in sectors with substantial regulatory barriers, such as aerospace and medical technology. Navigating the intricate web of approvals, certifications, and stringent ongoing compliance standards, like those for nuclear safety or medical device regulations, presents a formidable challenge for potential new entrants. These extensive requirements are both time-consuming and costly, effectively deterring many from entering the market.

The deep technical expertise and specialized knowledge needed to design and manufacture critical components for demanding sectors like aerospace and medical devices represent a formidable barrier to new entrants. Companies like Avingtrans invest heavily in accumulating this intellectual capital over many years, making it incredibly difficult for newcomers to replicate.

For instance, Avingtrans’s subsidiary, Metal Components, holds certifications like AS9100 for aerospace, signifying a rigorous commitment to quality and specialized processes. This deep engineering know-how, essential for producing high-reliability parts, requires significant upfront investment in training and development, deterring many potential competitors.

Access to distribution channels and customer relationships

Newcomers face significant hurdles in building the trusted relationships and securing access to established distribution channels and customer networks, particularly within highly regulated sectors. Existing players often leverage long-standing trust and a proven track record, cemented by enduring contracts, to maintain their market position, making it a formidable challenge for new entrants to penetrate these established ecosystems.

For instance, in the aerospace sector, where Avingtrans operates, securing contracts with major airlines or defense contractors requires extensive vetting and a history of reliable performance. In 2024, the lead times for such approvals can extend over several years, demonstrating the entrenched nature of existing relationships.

- Established Trust: New entrants struggle to replicate the decades of proven reliability and safety records that incumbent firms possess.

- Contractual Lock-ins: Existing long-term supply agreements and customer contracts create significant barriers to entry.

- Regulatory Hurdles: Navigating complex and stringent regulatory approvals for new suppliers in sectors like aerospace adds considerable time and cost.

- Distribution Control: Incumbents often control key distribution channels, limiting access for new players.

Economies of scale and experience curve benefits

Avingtrans likely benefits from significant economies of scale in its specialized manufacturing sectors. For instance, in its aerospace division, achieving high production volumes can drastically reduce the per-unit cost of complex components, a benefit new entrants would struggle to match initially. This scale allows Avingtrans to absorb fixed costs over a larger output, leading to lower overhead per item.

The experience curve also plays a crucial role. As Avingtrans has produced components over time, its workforce and processes have become more efficient, reducing waste and improving production speed. For example, in 2024, Avingtrans reported revenue of £152.8 million, indicating a substantial operational base. New competitors would need considerable time and investment to replicate this accumulated know-how, facing a steep learning curve that translates to higher initial costs and potentially lower quality.

- Economies of Scale: Avingtrans' established production volumes in aerospace and medical sectors lead to lower per-unit manufacturing costs compared to potential new entrants.

- Experience Curve Benefits: Accumulated operational knowledge and process efficiencies gained over years of specialized manufacturing give Avingtrans a competitive edge in cost and quality.

- Cost Disadvantage for New Entrants: New companies would face higher initial production costs and a longer period to achieve comparable efficiencies, making price competition challenging.

- Investment Barrier: Reaching Avingtrans' current level of operational scale and experience requires substantial upfront capital and time, acting as a deterrent to new market participants.

The threat of new entrants for Avingtrans is generally low due to substantial barriers. High capital requirements for specialized equipment and R&D, coupled with stringent regulatory approvals in aerospace and medical sectors, deter many potential competitors. Furthermore, Avingtrans' established reputation, deep technical expertise, and existing customer relationships, cultivated over years of operation, create significant hurdles for newcomers seeking to gain market access and trust.

| Barrier Category | Specific Avingtrans Example | Impact on New Entrants | 2024 Relevance |

| Capital Requirements | £50M+ for precision engineering facility | High initial investment needed | Ongoing high cost of advanced machinery |

| Technical Expertise | AS9100 certification, deep engineering know-how | Difficult to replicate specialized skills | Continuous need for skilled workforce training |

| Regulatory Hurdles | Aerospace & Medical certifications | Time-consuming and costly compliance | Lead times for approvals can exceed several years |

| Customer Relationships | Long-standing contracts with major clients | Challenging to penetrate established networks | Vetting processes remain rigorous and lengthy |

| Economies of Scale/Experience | Substantial operational base (£152.8M revenue in 2024) | New entrants face higher initial costs | Reaching comparable efficiency takes significant time |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Avingtrans leverages data from company annual reports, investor presentations, and industry-specific trade publications. We also incorporate market research reports and financial databases to provide a comprehensive view of the competitive landscape.