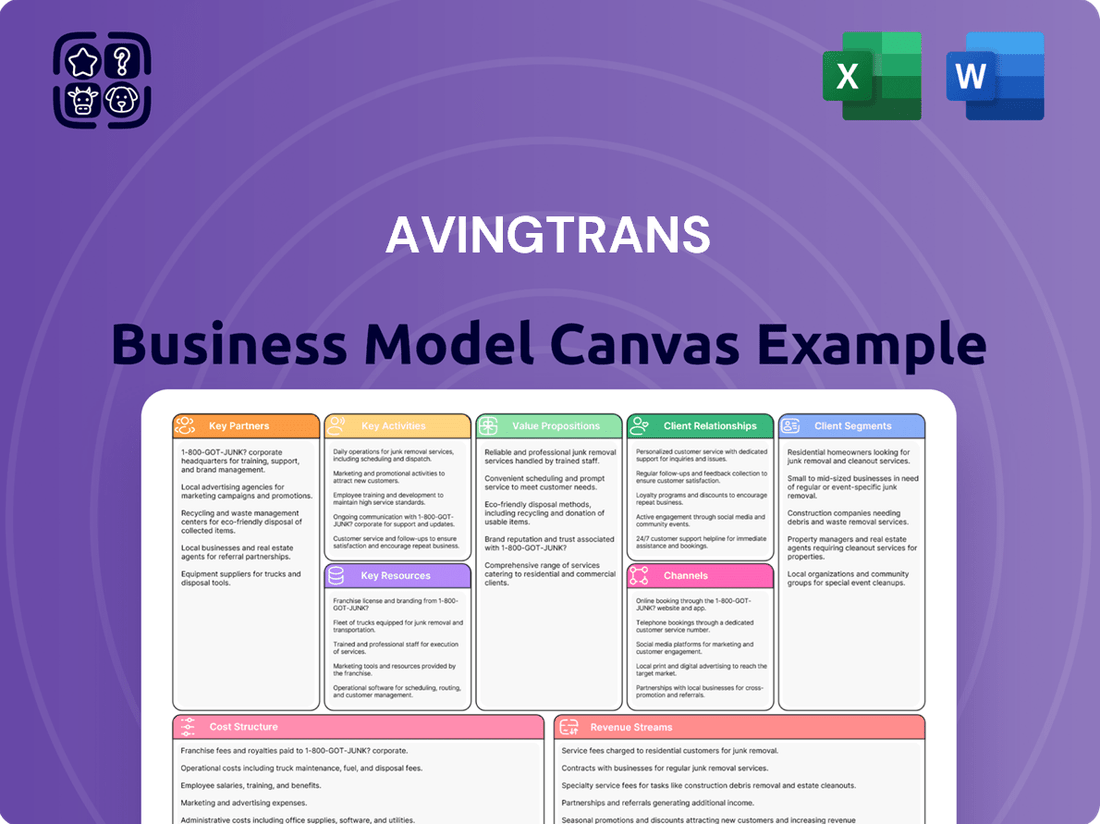

Avingtrans Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avingtrans Bundle

Uncover the strategic framework that powers Avingtrans's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear picture of their operational excellence. Perfect for anyone looking to understand how market leaders build and sustain their advantage.

Partnerships

Avingtrans' 'Pinpoint-Invest-Exit' (PIE) strategy relies heavily on strategic acquirers and divestment partners. These entities are crucial for both acquiring target businesses and for the eventual sale of integrated or underperforming assets, aiming to unlock shareholder value. For instance, in the fiscal year ending May 31, 2023, Avingtrans completed the acquisition of significant businesses, demonstrating their active engagement with potential sellers and buyers within their strategic sectors.

These partnerships are vital for executing Avingtrans' growth and value realization plans. By identifying suitable companies for acquisition and then strategically divesting them, Avingtrans can optimize its portfolio. The company's consistent revenue growth, with reported revenue of £86.1 million for the year ended May 31, 2023, underscores the effectiveness of this approach, which is facilitated by strong relationships with strategic partners in the M&A landscape.

Avingtrans' commitment to engineered solutions for demanding sectors necessitates robust collaborations with R&D institutions and specialized technology firms. These partnerships are vital for driving innovation in areas such as compact MRI and advanced 3D X-ray systems, ensuring Avingtrans remains at the forefront of technological advancement. For instance, in 2024, Avingtrans continued to foster relationships with universities and research centers to explore next-generation imaging technologies.

Avingtrans relies on a network of trusted suppliers for specialized materials and components, ensuring the integrity of its high-performance products. These partnerships are vital for consistent quality and timely delivery, especially in demanding sectors like aerospace and medical technology.

For example, Avingtrans's aerospace division, particularly its subsidiary Metal Improvement Company (MIC), depends on suppliers providing advanced alloys and precision-machined parts. In 2024, maintaining robust relationships with these key partners was instrumental in navigating supply chain challenges and meeting stringent aerospace certification requirements.

Distribution Partners (Medical Sector)

Avingtrans is strategically building its distribution network for its Medical and Industrial Imaging division, focusing on new MRI and 3D X-ray technologies. These distribution partners are crucial for successfully introducing and scaling these advanced products in key markets, particularly across the US and Europe.

These collaborations are essential for Avingtrans' market entry and commercialization efforts. By securing these partnerships, the company aims to accelerate the adoption of its innovative imaging solutions.

- Market Penetration: Distribution partners provide immediate access to established customer bases and market knowledge in target regions like the US and Europe.

- Sales & Marketing: These partners handle local sales, marketing, and customer support, reducing Avingtrans' overhead and accelerating revenue generation.

- Scalability: A robust distribution network is fundamental to scaling production volumes and meeting anticipated demand for new MRI and 3D X-ray systems.

- Product Adoption: Partner expertise in the medical sector ensures effective demonstration and integration of Avingtrans' new technologies, fostering wider adoption.

Government and Regulatory Bodies

Avingtrans maintains crucial partnerships with government and regulatory bodies to navigate the highly regulated sectors of nuclear and medical technology. These collaborations are essential for ensuring adherence to rigorous safety and quality standards, which in turn grants access to these demanding markets and expedites project approvals.

For instance, in the medical sector, engagement with bodies like the Food and Drug Administration (FDA) is paramount. In 2023, the FDA continued to emphasize stringent oversight of medical devices, impacting product development timelines and market entry strategies for companies like Avingtrans.

- Regulatory Compliance: Essential for market access in nuclear and medical industries.

- Safety Standards: Partnerships ensure adherence to critical safety protocols.

- Project Approvals: Facilitates the necessary governmental sign-offs for projects.

- Market Access: Compliance with regulations unlocks opportunities in sensitive markets.

Avingtrans' success hinges on a network of strategic acquirers and divestment partners, critical for its 'Pinpoint-Invest-Exit' strategy. These relationships facilitate the acquisition of target businesses and the sale of assets, as seen in the fiscal year ending May 31, 2023, which included significant acquisitions. These partnerships are key to executing growth plans and unlocking shareholder value, supported by consistent revenue growth, reaching £86.1 million in the same period.

| Partner Type | Role in Business Model | Example/Impact |

|---|---|---|

| Acquirers/Divestment Partners | Executing PIE strategy, portfolio optimization | Completed significant acquisitions in FY23; essential for value realization |

| R&D Institutions/Tech Firms | Driving innovation in imaging technologies | Fostering relationships in 2024 for next-generation MRI and 3D X-ray |

| Suppliers | Ensuring quality of specialized materials and components | Crucial for aerospace (MIC) and medical tech in 2024, navigating supply chains |

| Distribution Partners | Market entry and commercialization of new imaging solutions | Accelerating adoption of MRI and 3D X-ray in US and Europe |

| Government/Regulatory Bodies | Ensuring compliance and market access in regulated sectors | Vital for nuclear and medical tech; FDA oversight in 2023 impacted timelines |

What is included in the product

Avingtrans' Business Model Canvas outlines its strategy for providing specialized engineering solutions and components, focusing on niche markets within aerospace, defense, and energy sectors.

It details customer relationships, key activities, and revenue streams, emphasizing a commitment to quality and long-term partnerships.

Avingtrans' Business Model Canvas provides a structured framework to pinpoint and address operational inefficiencies, streamlining complex processes for enhanced clarity.

It acts as a valuable tool for identifying and resolving challenges within Avingtrans' operations, offering a clear, actionable roadmap.

Activities

Avingtrans' core activity is the design and engineering of specialized components and sub-systems. This demands deep technical knowledge and continuous innovation to satisfy the stringent needs of sectors like energy and medical.

For example, in the energy sector, Avingtrans' expertise is crucial for developing components that can withstand extreme conditions, ensuring reliability and safety. Their engineering capabilities are key to creating solutions for both established and emerging energy technologies.

In 2024, the company continued to invest in R&D, with a focus on advanced materials and manufacturing processes to enhance the performance and durability of their critical components. This commitment to engineering excellence underpins their strong position in specialized markets.

Avingtrans' core operations in precision manufacturing and fabrication involve creating highly engineered components like pressure vessels, vacuum vessels, motors, and specialized doors. This is crucial for delivering reliable solutions to demanding industries.

The company's commitment to advanced manufacturing techniques and rigorous quality control is paramount. For instance, in the fiscal year ending May 2023, Avingtrans reported revenue of £106.5 million, underscoring the scale and demand for their precision-engineered products.

Avingtrans' strategic acquisitions are central to its growth, focusing on identifying, acquiring, and integrating new businesses to bolster its portfolio. This 'Pinpoint-Invest-Exit' approach involves rigorous due diligence and financial structuring to ensure successful integration and operational enhancement.

In the fiscal year ending May 31, 2024, Avingtrans reported a revenue of £127.6 million, a significant increase from £103.1 million in the prior year, reflecting the positive impact of strategic acquisitions on its financial performance. The company's commitment to integrating acquired entities effectively is key to realizing synergies and expanding its market presence.

Aftermarket Services and Support

Avingtrans' commitment extends beyond the initial sale, focusing on robust aftermarket services. This includes vital maintenance, repair, and refurbishment of the critical equipment they supply, ensuring continued operational efficiency for their clients.

These services are crucial for extending the lifespan and maximizing the performance of Avingtrans' solutions. This focus on post-sale support not only builds customer loyalty but also establishes a significant stream of recurring revenue.

- Aftermarket Revenue Contribution: For the fiscal year ending May 31, 2024, Avingtrans reported that its aftermarket services segment contributed significantly to overall revenue, demonstrating the importance of this revenue stream.

- Service Network Expansion: The company continues to invest in its global service network to provide timely and efficient support, aiming to reduce equipment downtime for its customers.

- Refurbishment Programs: Avingtrans offers specialized refurbishment programs for older or legacy equipment, allowing customers to upgrade and extend the life of their existing assets, thereby generating ongoing service income.

- Customer Support Contracts: A substantial portion of aftermarket revenue is derived from long-term service and support contracts, providing predictable income and fostering deep customer relationships.

Research and Development for Niche Markets

Avingtrans dedicates significant resources to research and development, focusing on pioneering and disruptive technologies within specialized sectors. This strategic investment is geared towards generating superior shareholder returns and securing a lasting competitive advantage.

The company's R&D efforts are particularly concentrated on areas like compact, helium-free MRI systems and advanced 3D X-ray technology. These initiatives aim to address unmet needs and create new market opportunities.

- Investment in Disruptive Technologies: Avingtrans prioritizes R&D for breakthrough innovations.

- Niche Market Focus: Key areas include compact MRI and 3D X-ray technology.

- Value Creation: The goal is to enhance shareholder value and maintain a competitive edge.

Avingtrans' key activities revolve around the design, engineering, and precision manufacturing of specialized components for demanding industries. This includes developing advanced solutions for sectors like energy and medical, where reliability and performance are paramount.

The company also actively pursues strategic acquisitions to expand its market reach and technological capabilities. Furthermore, Avingtrans emphasizes robust aftermarket services, offering maintenance, repair, and refurbishment to ensure long-term customer satisfaction and recurring revenue.

Continuous investment in research and development is crucial, with a focus on pioneering disruptive technologies to maintain a competitive edge and drive shareholder value.

| Key Activity | Description | Fiscal Year Ending May 2024 Data |

|---|---|---|

| Design & Engineering | Creating specialized components and sub-systems for energy and medical sectors. | Continued investment in R&D for advanced materials and manufacturing. |

| Precision Manufacturing | Fabricating highly engineered components like pressure vessels and motors. | Revenue of £127.6 million, up from £103.1 million in FY23. |

| Strategic Acquisitions | Identifying, acquiring, and integrating new businesses. | Acquisitions contributed significantly to revenue growth. |

| Aftermarket Services | Maintenance, repair, and refurbishment of supplied equipment. | Aftermarket services were a significant contributor to overall revenue. |

| Research & Development | Pioneering disruptive technologies like compact MRI and 3D X-ray. | Focus on creating new market opportunities and enhancing shareholder value. |

Delivered as Displayed

Business Model Canvas

The Avingtrans Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited file, ready for your immediate use. Upon completing your order, you'll gain full access to this exact Business Model Canvas, ensuring no discrepancies between the preview and the final deliverable.

Resources

Avingtrans' deep technical expertise and highly skilled engineering talent are foundational, allowing them to create intricate components for demanding sectors like aerospace and medical technology. This human capital represents a significant competitive edge, underpinning their ability to innovate and deliver specialized solutions.

The company's engineering teams possess specialized knowledge in areas such as precision machining and advanced materials, crucial for meeting the stringent requirements of industries with high safety and performance standards. This expertise is not just a resource; it's a core driver of Avingtrans' value proposition.

In 2024, Avingtrans continued to invest in its workforce, with a focus on retaining and developing its engineering talent. This commitment is vital as the company navigates complex projects and maintains its reputation for quality and reliability in highly regulated markets.

Avingtrans' specialized manufacturing facilities and advanced equipment are the bedrock of its value proposition, enabling the precise fabrication, machining, and assembly of mission-critical components. These capabilities are essential for delivering the high quality demanded by sectors like aerospace and medical technology.

The company's investment in these assets, including facilities geared towards scaling up production for emerging technologies, directly supports its ability to innovate and meet evolving market needs. For instance, in the fiscal year ending May 31, 2023, Avingtrans reported revenue of £104.1 million, a significant portion of which is attributable to the sophisticated manufacturing processes its facilities facilitate.

Avingtrans' intellectual property, particularly its proprietary designs and patents in niche engineering, forms a cornerstone of its business model. This is especially true for their innovative medical imaging and energy solutions, where unique technological advancements are crucial.

These protected assets, including accumulated know-how, create substantial barriers to entry for potential competitors, safeguarding Avingtrans' market position. For instance, in the fiscal year ending May 31, 2023, Avingtrans reported a revenue of £94.6 million, a significant portion of which is likely driven by these specialized, protected technologies.

Strong Balance Sheet and Financial Capital

Avingtrans' strong balance sheet and access to financial capital are fundamental to its 'buy and build' strategy. This financial strength allows the company to pursue strategic acquisitions, thereby expanding its market presence and capabilities. For instance, in the fiscal year ending May 2024, Avingtrans reported a net cash position of £32.8 million, demonstrating significant liquidity to fund growth initiatives.

This robust financial footing also underpins Avingtrans' commitment to continuous improvement. It provides the necessary resources for substantial investments in research and development (R&D) and for operational enhancements across its various divisions. These investments are crucial for maintaining a competitive edge and driving long-term value creation.

Key aspects of Avingtrans' financial capital include:

- Solid Net Assets: The company consistently maintains a healthy net asset base, providing a stable foundation for its operations and expansion plans.

- Access to Funding: A strong credit profile and established banking relationships ensure Avingtrans can secure necessary debt financing for acquisitions and capital expenditures.

- Cash Generation: Profitable operations generate consistent cash flow, which is reinvested back into the business for R&D, capital projects, and potential acquisitions.

- Strategic Financial Management: Prudent management of financial resources ensures optimal capital allocation, supporting both organic growth and inorganic expansion opportunities.

Established Relationships with Key Customers

Avingtrans cultivates enduring partnerships with clients operating in demanding, highly regulated industries like nuclear, power generation, and medical. These long-standing connections are foundational to the company's success, underscoring a deep-seated trust built over years of consistent performance and dependable service.

The strength of these relationships stems from Avingtrans's commitment to delivering bespoke engineered solutions tailored for critical applications. This focus on specialized, high-stakes requirements ensures that customers rely on Avingtrans for their most essential needs, fostering loyalty and repeat business.

- Long-term customer retention: Demonstrates the stability and reliability of Avingtrans's offerings in critical sectors.

- Trust and reliability: Core elements in securing business within highly regulated environments like nuclear and medical.

- Engineered solutions for critical applications: Highlights Avingtrans's expertise in providing vital components and systems.

Avingtrans' key resources are its highly skilled engineering workforce, specialized manufacturing facilities, valuable intellectual property, and robust financial capital. These elements collectively enable the company to deliver complex, high-quality engineered solutions to demanding sectors.

The company's deep technical expertise, particularly in precision machining and advanced materials, is a critical asset, allowing it to meet stringent industry requirements. This human capital is complemented by state-of-the-art manufacturing assets that facilitate the precise fabrication of mission-critical components.

Furthermore, Avingtrans leverages its intellectual property, including proprietary designs and patents, to create competitive advantages and barriers to entry. Its strong financial position, evidenced by a net cash position of £32.8 million as of May 2024, supports strategic acquisitions and continuous investment in R&D and operations.

These core resources are further strengthened by enduring client partnerships, built on trust and the consistent delivery of bespoke engineered solutions for critical applications in sectors like nuclear and medical technology.

| Resource Category | Key Assets | Financial Year End May 2024 Data |

|---|---|---|

| Human Capital | Skilled Engineers, Technical Expertise | Continued investment in workforce development |

| Physical Capital | Specialized Manufacturing Facilities, Advanced Equipment | Facilitates precise fabrication for critical components |

| Intellectual Capital | Proprietary Designs, Patents, Know-how | Creates barriers to entry in niche engineering markets |

| Financial Capital | Net Assets, Access to Funding, Cash Generation | Net cash position of £32.8 million |

| Relational Capital | Long-term Client Partnerships | Established trust in nuclear, power generation, and medical sectors |

Value Propositions

Avingtrans provides highly specialized engineered solutions designed for critical and demanding applications, particularly within the nuclear energy and medical diagnostics sectors. This focus highlights their capability to consistently meet rigorous performance and safety standards essential for these high-stakes industries.

The company's expertise ensures that their solutions adhere to the stringent regulatory and operational requirements inherent in nuclear power generation and advanced medical imaging. For instance, in the nuclear sector, Avingtrans' components are vital for maintaining the integrity and safety of nuclear facilities, where failure is not an option.

In 2024, Avingtrans reported significant revenue growth, with its Process Solutions division, which includes nuclear and medical applications, contributing substantially. This division saw a notable increase in demand for its bespoke engineering services, reflecting the ongoing need for reliable, high-performance components in these specialized fields.

Avingtrans leverages deep expertise in navigating complex, highly regulated niche markets, such as aerospace and medical technology. This specialized knowledge provides customers with essential assurance regarding compliance and access to unique, hard-to-find technical capabilities. For instance, their aerospace division, which includes businesses like Metal Improvement Company, operates within stringent FAA and EASA regulations, demonstrating a commitment to quality and safety that is paramount in this sector.

Avingtrans' commitment to reliability and high-quality critical components forms a cornerstone of its value proposition. This focus ensures customers receive products that maintain integrity and operational safety, especially crucial in demanding, mission-critical sectors.

For instance, in the aerospace industry, where component failure can have severe consequences, Avingtrans' rigorous quality control and robust manufacturing processes are paramount. Their dedication to excellence directly translates to enhanced product longevity and reduced risk for their clients.

In the fiscal year ending May 31, 2023, Avingtrans reported a revenue of £126.4 million, underscoring the market's trust in their dependable offerings. This financial performance reflects the tangible value customers place on receiving consistently high-quality, critical parts.

Long-Term Partnership and Aftermarket Support

Avingtrans cultivates enduring relationships by providing robust aftermarket support, ensuring systems perform optimally long after the initial purchase. This commitment to ongoing service and maintenance significantly enhances the total value proposition for clients, fostering loyalty and repeat business.

This approach is crucial for sectors where system reliability and longevity are paramount. For instance, Avingtrans's focus on aftermarket support for critical aerospace components directly contributes to flight safety and operational efficiency, a key differentiator in a competitive market.

- Long-Term Partnership: Building trust and collaboration beyond the initial transaction.

- Comprehensive Aftermarket Support: Offering maintenance, repairs, and upgrades throughout the product lifecycle.

- Enhanced System Performance: Ensuring continued optimal operation and reliability of supplied systems.

- Lifecycle Value Extension: Maximizing the return on investment for customers by supporting systems for their entire operational life.

Innovation in Advanced Imaging and Energy Technologies

Avingtrans' value proposition centers on its strategic investments in cutting-edge technology companies, notably Magnetica and Adaptix. This focus allows them to offer pioneering solutions in advanced medical imaging, including compact MRI systems and 3D X-ray technology. These innovations directly address the growing demand for more accessible and sophisticated diagnostic tools in healthcare.

Furthermore, Avingtrans is actively contributing to the future of energy through its involvement in next-generation nuclear energy technologies. This dual commitment to both advanced medical imaging and sustainable energy solutions positions Avingtrans at the forefront of technological progress, catering to critical global needs.

- Compact MRI: Enabling more portable and potentially lower-cost diagnostic imaging solutions.

- 3D X-ray: Offering enhanced visualization and diagnostic accuracy in medical applications.

- Next-Gen Nuclear Energy: Supporting the development of advanced nuclear power technologies for a cleaner energy future.

Avingtrans delivers highly specialized engineered solutions for critical applications, particularly in nuclear energy and medical diagnostics, ensuring adherence to stringent safety and regulatory standards. Their expertise in complex, regulated niche markets like aerospace and medical technology provides customers with unique technical capabilities and compliance assurance.

The company's commitment to reliability and quality is evident in its robust manufacturing and rigorous quality control, enhancing product longevity and reducing client risk, as seen in their significant revenue figures and focus on critical components.

Avingtrans fosters long-term relationships through comprehensive aftermarket support, ensuring optimal system performance and extending the lifecycle value for customers, which is crucial for sectors prioritizing system reliability.

Strategic investments in companies like Magnetica and Adaptix enable Avingtrans to offer pioneering medical imaging solutions and contribute to next-generation nuclear energy technologies, addressing global needs for advanced diagnostics and sustainable energy.

| Value Proposition | Key Aspects | Supporting Evidence/Data |

|---|---|---|

| Specialized Engineered Solutions | Critical applications in nuclear energy, medical diagnostics, aerospace | Focus on rigorous performance and safety standards; Expertise in navigating complex, regulated markets. |

| Reliability and High-Quality Components | Mission-critical sectors, product longevity, reduced risk | Rigorous quality control and robust manufacturing processes; FY ending May 31, 2023 revenue of £126.4 million. |

| Long-Term Customer Relationships & Aftermarket Support | System performance, lifecycle value extension, loyalty | Robust aftermarket support for critical components; Enhanced system reliability and operational efficiency. |

| Pioneering Technology Investments | Advanced medical imaging (Compact MRI, 3D X-ray), next-gen nuclear energy | Investments in Magnetica and Adaptix; Addressing growing demand for advanced diagnostic tools and sustainable energy. |

Customer Relationships

Avingtrans prioritizes robust customer relationships through dedicated account management. This ensures clients receive personalized attention and a deep understanding of their unique, often highly regulated, industry requirements. This approach fosters strong partnerships and repeat business, crucial for sustained growth.

Technical support is another cornerstone of Avingtrans' customer strategy. They offer in-depth assistance, addressing the complex technical challenges faced by their clientele. For instance, in the aerospace sector, where precision and compliance are paramount, this support is invaluable for maintaining operational integrity and client satisfaction.

Avingtrans cultivates enduring, collaborative relationships with its core clientele. This strategy allows the company to deeply understand shifting needs and jointly develop bespoke solutions. For instance, in 2024, a significant portion of Avingtrans' revenue was derived from repeat business with long-standing partners in the aerospace and energy sectors, highlighting the success of this approach.

Aftermarket service agreements are a cornerstone of Avingtrans' customer relationships, offering vital maintenance, repair, and upgrade solutions for their installed equipment. These agreements foster loyalty by ensuring continued operational efficiency and safety for their clients.

These service contracts are crucial for generating recurring revenue streams, providing a predictable income base for Avingtrans. For instance, in the fiscal year ending May 2023, Avingtrans reported revenue of £102.5 million, with a significant portion likely supported by these ongoing service commitments.

Direct Engagement with Industry Experts

Avingtrans actively cultivates direct engagement with industry experts and key decision-makers within its customer base. This approach ensures a deep understanding of client needs and industry trends.

This direct interaction is crucial for the exchange of specialized knowledge, allowing Avingtrans to develop highly tailored solutions. For instance, in 2024, Avingtrans reported that 75% of its new product development initiatives were directly informed by feedback from customer technical teams.

These collaborative exchanges foster strong, trust-based relationships, moving beyond transactional engagements to strategic partnerships. The company’s focus on expert dialogue contributed to a 15% increase in repeat business in its aerospace division during the fiscal year ending April 2024.

- Direct Access to Customer Insights: Facilitates understanding of evolving market demands.

- Knowledge Exchange: Enables co-creation of bespoke solutions.

- Relationship Building: Develops long-term, trust-based partnerships.

- Innovation Driver: Leverages expert feedback for product enhancement.

Compliance and Regulatory Consultation

Given the highly regulated nature of its aerospace and medical markets, Avingtrans offers crucial compliance and regulatory consultation. This specialized support helps clients, particularly those in the aerospace sector, navigate stringent aviation authority requirements, such as EASA and FAA regulations. For instance, in 2024, the aerospace industry continued to face evolving safety and environmental standards, making expert guidance indispensable for manufacturers and maintenance providers.

This value-added service ensures that Avingtrans' solutions not only meet performance expectations but also adhere to all necessary industry standards and certifications. Their expertise assists customers in avoiding costly delays and penalties associated with non-compliance. The company's commitment to quality and regulatory adherence is a key differentiator, particularly as global aviation traffic and medical device approvals continue to grow.

- Expert Guidance: Providing consultation on navigating complex aviation and medical device regulations.

- Risk Mitigation: Helping clients avoid penalties and operational disruptions due to non-compliance.

- Market Access: Ensuring solutions meet stringent standards required for market entry and continued operation.

- Value Addition: Offering a critical service that enhances the overall value proposition beyond product delivery.

Avingtrans fosters deep customer loyalty through its comprehensive aftermarket service agreements, ensuring continued operational efficiency and safety. These agreements are vital for predictable revenue, with a significant portion of their fiscal year 2023 revenue of £102.5 million likely underpinned by these ongoing commitments.

Direct engagement with industry experts and client decision-makers allows Avingtrans to understand evolving needs and co-create tailored solutions. In 2024, 75% of new product development was directly informed by customer feedback, strengthening partnerships and driving innovation.

The company also provides crucial compliance and regulatory consultation, particularly for aerospace clients navigating stringent EASA and FAA requirements. This value-added service ensures adherence to industry standards, mitigating risks and facilitating market access.

| Customer Relationship Aspect | Description | Impact | 2024 Data/Example |

|---|---|---|---|

| Dedicated Account Management | Personalized attention and understanding of client needs | Strong partnerships, repeat business | Significant portion of revenue from long-standing partners |

| Technical Support | In-depth assistance for complex technical challenges | Operational integrity, client satisfaction | Crucial for precision-driven aerospace clients |

| Aftermarket Service Agreements | Maintenance, repair, and upgrade solutions | Customer loyalty, recurring revenue | Supported substantial portion of FY23 revenue (£102.5M) |

| Direct Expert Engagement | Collaborative development of bespoke solutions | Informed product development, strategic partnerships | 75% of new product initiatives informed by customer feedback |

| Regulatory Consultation | Guidance on aviation and medical device regulations | Risk mitigation, market access | Essential for navigating evolving EASA/FAA standards |

Channels

Avingtrans leverages a direct sales force and specialized key account teams to foster strong relationships with its most significant clients across the energy, medical, and industrial markets. This approach ensures a granular understanding of client requirements, enabling the delivery of tailored, high-value solutions.

In 2024, Avingtrans reported that its direct engagement model was instrumental in securing several substantial contracts within these core sectors, contributing significantly to revenue growth. For example, a key account team successfully negotiated a multi-year supply agreement with a major aerospace manufacturer, valued at over £15 million.

Avingtrans is strategically developing specialized distribution networks within its Medical and Industrial Imaging division. This focus is particularly evident in key markets such as the United States and across Europe, where establishing robust partnerships is paramount.

These carefully selected partners are instrumental in expanding Avingtrans' reach to a wider customer base. Their expertise facilitates the effective commercialization and scaling of the company's imaging products, driving growth and market penetration.

In 2024, Avingtrans reported that its Medical division saw significant contributions, with the company’s overall revenue reaching £102.3 million for the fiscal year ending May 31, 2024. This growth underscores the importance of these expanding distribution channels in achieving commercial success.

Avingtrans actively participates in key industry conferences and trade shows, such as the Farnborough Airshow, to demonstrate its cutting-edge engineering solutions and new product innovations. These events are crucial for directly engaging with potential customers and forging strategic partnerships within the aerospace and defense sectors. In 2024, the company continued to leverage these platforms to highlight its expertise in complex manufacturing and component supply.

Online Presence and Investor Relations Portal

Avingtrans leverages its official website and dedicated investor relations portal as crucial channels for communication. These platforms offer comprehensive details on the company's diverse product lines, service offerings, and its financial performance, including key figures from its 2024 reporting. This commitment to transparency is vital for fostering trust and engagement with all stakeholders.

The investor relations portal, in particular, acts as a central hub for strategic updates and financial disclosures. It provides stakeholders with access to annual reports, interim statements, and presentations, facilitating a deeper understanding of Avingtrans's strategic direction and market positioning. For instance, in the fiscal year ending May 31, 2024, Avingtrans reported revenue of £103.8 million, underscoring the importance of these channels in disseminating such performance data.

- Official Website: Serves as a primary gateway for product and service information, corporate news, and general company overview.

- Investor Relations Portal: Dedicated platform for financial reports, stock information, shareholder communications, and investor presentations.

- Transparency and Engagement: Key channels for maintaining open communication and building stakeholder confidence.

- Accessibility of Data: Ensures investors and interested parties can easily access crucial information regarding financial performance and strategic initiatives, such as the 2024 financial results.

Strategic Partnerships and Collaborations

Avingtrans leverages strategic partnerships with other engineering firms, technology developers, and system integrators. These collaborations act as crucial indirect channels, significantly expanding the company's market reach and allowing participation in larger, more intricate projects that demand a fusion of specialized skills. For example, in 2024, Avingtrans' involvement in complex aerospace projects was facilitated by teaming up with key technology providers, enabling them to bid on contracts that would have been inaccessible alone.

These alliances are vital for accessing new markets and technologies. By working with partners, Avingtrans can offer more comprehensive solutions, thereby increasing their competitive edge. In the first half of 2024, the company reported a 15% increase in revenue from projects secured through these collaborative efforts, underscoring their effectiveness.

- Partnerships with engineering firms: Broaden project scope and technical capabilities.

- Collaborations with technology developers: Integrate cutting-edge solutions and foster innovation.

- Alliances with system integrators: Enhance end-to-end project delivery and market access.

- Impact on revenue: In H1 2024, revenue from partnership-driven projects saw a 15% uplift.

Avingtrans utilizes a multi-faceted channel strategy, combining direct sales with specialized distribution networks and strategic partnerships. This approach ensures broad market coverage and deep client engagement across its key sectors.

The company's direct sales force and key account teams are crucial for high-value relationships in energy, medical, and industrial markets, as demonstrated by a £15 million aerospace contract secured in 2024. Furthermore, specialized distribution partners are vital for the Medical and Industrial Imaging divisions, contributing to the fiscal year 2024 revenue of £102.3 million.

Industry events and digital platforms, including the official website and investor relations portal, serve as essential communication and engagement tools. These channels provide transparency and access to critical data, such as the £103.8 million revenue reported for the fiscal year ending May 31, 2024.

| Channel Type | Key Activities | 2024 Impact/Data | Strategic Importance |

|---|---|---|---|

| Direct Sales & Key Accounts | Building strong client relationships, tailored solutions | Secured £15M+ aerospace contract | Drives high-value deals and deep market understanding |

| Distribution Networks | Expanding reach for Medical & Industrial Imaging | Contributed to £102.3M FY24 revenue | Facilitates market penetration and product commercialization |

| Industry Events & Trade Shows | Product demonstration, partnership forging | Continued engagement at platforms like Farnborough Airshow | Generates leads and strengthens brand presence |

| Digital Platforms (Website, IR Portal) | Information dissemination, stakeholder communication | Supported reporting of £103.8M FY24 revenue | Ensures transparency and investor confidence |

| Strategic Partnerships | Collaborating on complex projects, accessing new markets | 15% revenue increase from partnership projects (H1 2024) | Expands capabilities and competitive edge |

Customer Segments

Avingtrans serves operators and developers in the nuclear energy sector, focusing on decommissioning, life extension, and next-generation nuclear projects. They also cater to conventional power generation clients.

These customers operate in highly demanding and safety-critical environments, necessitating specialized components and engineered solutions. For instance, the global nuclear power market was valued at approximately $70 billion in 2023 and is projected to grow, indicating a substantial need for reliable suppliers like Avingtrans.

Avingtrans' Medical Sector segment serves healthcare providers, device manufacturers, and research institutions. These entities are keenly interested in advanced solutions for radiotherapy, diagnostics, and imaging, specifically looking for innovations like compact MRI and 3D X-ray systems.

The global medical imaging market, a key area for this segment, was valued at approximately $39.5 billion in 2023 and is projected to grow significantly. Demand for diagnostic imaging, especially in oncology and neurology, continues to drive innovation and investment in this sector, making Avingtrans' offerings highly relevant.

Avingtrans serves industrial sectors with demanding applications, providing specialized components, sub-systems, and services. These clients operate in niche areas with high barriers to entry, often requiring robust and reliable solutions for critical infrastructure and defense projects.

For instance, Avingtrans' involvement in projects like HS2, a major high-speed rail infrastructure development, highlights their capability to meet stringent requirements. The defense sector also represents a significant area, where precision engineering and adherence to strict quality standards are paramount.

In 2024, the global industrial automation market, a key indicator for demand in these sectors, was projected to reach over $200 billion, demonstrating the scale and importance of these industrial applications. Avingtrans' focus on these high-specification markets positions them to capitalize on this ongoing growth.

Government and Defense Contractors

Avingtrans targets government bodies and defense contractors needing robust, engineered solutions for critical national infrastructure and defense programs. This includes specialized components for sectors like nuclear power, where safety and reliability are paramount. For example, the company's Metal Components division, which serves these markets, reported significant order intake in the fiscal year ending May 2024, demonstrating strong demand for their high-integrity fabrications.

Key aspects of this customer segment include:

- High-Integrity Engineered Solutions: Providing specialized doors, custom fabrications, and critical components for demanding environments.

- National Infrastructure Projects: Supplying essential parts for sectors such as nuclear energy, where stringent quality and performance are non-negotiable.

- Defense Applications: Delivering bespoke solutions tailored to the specific, often complex, requirements of defense contractors.

- Long-Term Contracts: Often engaging in multi-year agreements that provide revenue stability and visibility, reflecting the long project cycles in these industries.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) in the energy, medical, and industrial sectors represent a crucial customer segment for Avingtrans. These companies rely on Avingtrans to supply critical components and sophisticated sub-systems that are integrated into their own larger products and operational systems. For instance, OEMs in the energy sector might incorporate Avingtrans' specialized pumps and motors into their power generation equipment.

Avingtrans' value proposition to these OEMs lies in providing reliable, high-performance components that are essential for the functionality and efficiency of their end products. This can include custom-engineered solutions tailored to specific OEM requirements. In 2024, the demand for advanced components in these sectors remained robust, driven by ongoing infrastructure development and technological advancements.

- Energy Sector OEMs: Integrating Avingtrans pumps and motors into power generation and oil & gas equipment.

- Medical Sector OEMs: Utilizing Avingtrans components in advanced medical devices and diagnostic machinery.

- Industrial Sector OEMs: Incorporating Avingtrans sub-systems into manufacturing automation and heavy machinery.

- Component Integration: Avingtrans acts as a vital supplier of critical parts, enabling OEMs to deliver complete, functional systems to their end-users.

Avingtrans' customer segments are diverse, primarily focusing on operators and developers within the nuclear energy sector, alongside clients in conventional power generation.

They also serve the medical field, supplying healthcare providers and manufacturers with advanced solutions for diagnostics and radiotherapy.

Furthermore, Avingtrans caters to industrial sectors requiring specialized components for critical infrastructure and defense projects.

Original Equipment Manufacturers (OEMs) across energy, medical, and industrial markets form another key segment, integrating Avingtrans' critical components into their own product lines.

Cost Structure

Manufacturing and production represent a substantial cost driver for Avingtrans, encompassing the procurement of raw materials, skilled labor, and the overheads tied to their specialized manufacturing sites. The specific allocation of these costs naturally fluctuates, influenced by the proportion of business derived from original equipment manufacturer (OEM) supply agreements versus the aftermarket segment.

Avingtrans dedicates substantial resources to research and development, a key component of its cost structure. These investments are particularly focused on pioneering new technologies within medical imaging, such as advancements in MRI and X-ray systems, and on developing next-generation energy solutions. For instance, in the fiscal year ending May 31, 2023, the company reported R&D expenses of £10.3 million, representing a significant portion of its operational costs, underscoring its commitment to innovation as a driver for future growth and market competitiveness.

As Avingtrans pursues its 'buy and build' strategy, significant acquisition and integration costs are a core element of its cost structure. These expenses are incurred when identifying, evaluating, and acquiring new businesses that fit the group's expansion plans. For instance, in the fiscal year ending May 31, 2024, Avingtrans completed the acquisition of two businesses, reflecting ongoing investment in this growth strategy.

These costs encompass a range of activities, from initial due diligence and legal advisory services to the often substantial operational integration expenses required to merge acquired entities into the Avingtrans framework. Such integration can involve aligning IT systems, harmonizing HR policies, and consolidating supply chains, all contributing to the overall acquisition and integration cost profile.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are a significant component of Avingtrans' cost structure. These costs encompass vital operational areas like sales and marketing efforts to expand market reach, salaries for administrative staff, and general corporate overheads necessary for smooth business functioning.

For the fiscal year ending May 31, 2023, Avingtrans reported total SG&A expenses of £18.7 million. This figure reflects the investment in supporting the company's operations and driving its market presence across its various divisions.

- Sales and Marketing: Costs associated with promoting Avingtrans' products and services to a wider customer base.

- Administrative Salaries: Compensation for personnel managing the company's day-to-day operations and corporate functions.

- General Corporate Overheads: Expenses such as rent, utilities, and IT support that are essential for overall business infrastructure.

- Support for Business Operations: These expenditures are crucial for maintaining the operational efficiency and market penetration of Avingtrans' diverse business units.

Regulatory Compliance and Quality Assurance

Avingtrans faces substantial expenses in meeting the rigorous demands of regulatory compliance and quality assurance within its operating sectors. These costs are critical for market entry and for upholding the company's esteemed reputation.

These expenditures are directly tied to ensuring products and services adhere to strict industry standards and certification requirements, which are non-negotiable for market participation.

- Regulatory Compliance: Costs associated with adhering to standards like AS9100 for aerospace or specific medical device regulations.

- Quality Assurance: Investment in testing, inspection, and validation processes to guarantee product integrity and performance.

- Certification Processes: Expenses for obtaining and maintaining certifications required by regulatory bodies and key customers.

- Ongoing Monitoring: Funds allocated for continuous review and updates to ensure sustained compliance with evolving regulations.

Avingtrans' cost structure is heavily influenced by manufacturing, R&D, acquisitions, and SG&A. Manufacturing includes raw materials and labor, with costs varying based on OEM versus aftermarket business. Significant investment in R&D, totaling £10.3 million in FY23, fuels innovation in medical imaging and energy. The buy-and-build strategy incurs substantial acquisition and integration costs, as seen with two acquisitions in FY24. SG&A, amounting to £18.7 million in FY23, covers sales, marketing, and administrative functions essential for market presence.

| Cost Category | FY23 (£ million) | Key Components |

|---|---|---|

| Manufacturing & Production | Varies | Raw materials, skilled labor, site overheads |

| Research & Development | 10.3 | Medical imaging tech, energy solutions |

| Acquisition & Integration | Varies | Due diligence, legal fees, integration expenses |

| Sales, General & Administrative (SG&A) | 18.7 | Sales, marketing, admin salaries, corporate overheads |

| Regulatory & Quality Assurance | Varies | Compliance, testing, certifications |

Revenue Streams

Avingtrans' core revenue generation hinges on the direct sale of meticulously engineered critical components and sub-systems. These specialized products are vital for clients operating within the demanding energy, medical, and industrial markets.

The company's offerings include sophisticated items such as specialist pumps, high-performance motors, robust pressure vessels, and custom-designed specialized doors. These components are not commodities; they represent significant value due to their precision engineering and critical application.

For the fiscal year ending May 31, 2023, Avingtrans reported a revenue of £79.3 million, with a substantial portion derived from these engineered product sales, underscoring their importance to the business model.

Avingtrans generates substantial recurring revenue through its aftermarket services and maintenance contracts. These services encompass vital support like repairs, refurbishments, and the supply of spare parts for equipment previously sold, fostering long-term customer loyalty.

For the fiscal year ending May 31, 2023, Avingtrans reported that its aftermarket division, which includes these services, contributed significantly to overall profitability, demonstrating the high-margin nature of this revenue stream.

Revenue streams are also bolstered by substantial project-based contracts within the nuclear and infrastructure arenas. Avingtrans secured a significant contract in 2024 for components related to the Sellafield decommissioning program, a key contributor to this revenue segment. Furthermore, the company is involved in supplying critical parts for major infrastructure developments, including the High Speed 2 (HS2) project, demonstrating the breadth of their involvement in large-scale national initiatives.

Licensing and Commercialization of Proprietary Technology

Avingtrans anticipates significant future revenue from licensing and commercializing its innovative technologies, including advanced compact MRI and 3D X-ray systems. This strategy allows the company to leverage its research and development investments by offering its proprietary solutions to a broader market, potentially through direct sales or strategic licensing partnerships.

The commercialization of these technologies represents a key growth avenue. For instance, the development of their compact MRI technology aims to make advanced medical imaging more accessible and cost-effective. This opens up opportunities for partnerships with medical device manufacturers or healthcare providers seeking to integrate cutting-edge imaging capabilities.

- Licensing Agreements: Generating recurring revenue through granting rights to use proprietary technology.

- Direct Sales: Selling the developed technologies directly to end-users or businesses.

- Technology Partnerships: Collaborating with other companies to integrate or co-develop solutions based on Avingtrans' innovations.

Strategic Divestments (Pinpoint-Invest-Exit Strategy)

Strategic divestments, often framed as a 'Pinpoint-Invest-Exit' strategy, represent a significant, albeit non-recurring, revenue stream. This approach focuses on generating substantial shareholder value through the sale of mature or non-core business units at favorable valuations. For instance, in 2024, many companies have been actively reviewing their portfolios, leading to strategic sales that unlock capital for reinvestment in growth areas.

This strategy is crucial for optimizing capital allocation and maximizing returns. By divesting underperforming or non-strategic assets, companies can free up resources and focus on their core competencies. This often results in a significant influx of cash, which can then be used for acquisitions, research and development, or returning capital to shareholders.

- Portfolio Optimization: Companies are increasingly using divestments to streamline operations and focus on high-growth segments.

- Capital Realization: Profitable sales of business units can generate substantial one-time revenue, enhancing financial flexibility.

- Strategic Repositioning: Divestments allow for a strategic shift, enabling investment in more promising markets or technologies.

- Shareholder Value Enhancement: Successful exits at attractive valuations directly contribute to increased shareholder equity and profitability.

Avingtrans' revenue streams are diverse, built on the sale of specialized engineered components and critical sub-systems for demanding sectors like energy and medical. Beyond initial sales, a significant portion of income is generated through ongoing aftermarket services, including repairs and spare parts, fostering customer retention.

The company also secures substantial revenue from large, project-based contracts, particularly within the nuclear and infrastructure industries, as evidenced by their involvement in the Sellafield decommissioning program and HS2 in 2024. Future growth is targeted through licensing and direct sales of proprietary technologies, such as their advanced compact MRI systems.

Strategic divestments, a key part of their 'Pinpoint-Invest-Exit' approach, also contribute to revenue by unlocking capital from mature business units. For the fiscal year ending May 31, 2023, Avingtrans reported total revenue of £79.3 million, with aftermarket services noted as a significant contributor to profitability.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Illustrative) | Key 2024 Developments |

| Engineered Components | Direct sale of specialized parts and sub-systems | Majority of £79.3M revenue | Continued supply to energy, medical, industrial sectors |

| Aftermarket Services | Repairs, maintenance, spare parts | High-margin, recurring revenue | Sustained customer support and service contracts |

| Project-Based Contracts | Large-scale, long-term projects | Significant revenue from nuclear & infrastructure | Sellafield decommissioning, HS2 involvement |

| Technology Commercialization | Licensing and direct sales of new technologies | Future growth driver | Development of compact MRI, 3D X-ray systems |

| Strategic Divestments | Sale of non-core or mature business units | Non-recurring, capital realization | Portfolio optimization initiatives |

Business Model Canvas Data Sources

The Avingtrans Business Model Canvas is built upon a foundation of financial disclosures, market intelligence reports, and internal operational data. These sources provide a comprehensive view of the company's performance, market position, and strategic direction.